Professional Documents

Culture Documents

Qhicfsheet 12

Qhicfsheet 12

Uploaded by

Shahid HamidCopyright:

Available Formats

You might also like

- Internal HR Processes and Procedures Audit PDFDocument5 pagesInternal HR Processes and Procedures Audit PDFDiverseHR100% (7)

- My Bank Account StatementDocument4 pagesMy Bank Account StatementIseay100% (1)

- Payroll Accounting 2015 1st Edition Landin Solutions Manual DownloadDocument42 pagesPayroll Accounting 2015 1st Edition Landin Solutions Manual DownloadTommie Clemens100% (21)

- Offer Letter - LokeshwaranDocument3 pagesOffer Letter - LokeshwaranPazhamalairajan Kaliyaperumal100% (1)

- Swaminathan Offer Letter PDFDocument3 pagesSwaminathan Offer Letter PDFElakkiyaNo ratings yet

- Dr. Reddy's Laboratories Limited: June, 2016 Payslip For The MonthDocument1 pageDr. Reddy's Laboratories Limited: June, 2016 Payslip For The Monthrohitjain444No ratings yet

- Pag-IBIG MULTI-PURPOSE LOAN APPLICATION FORMDocument2 pagesPag-IBIG MULTI-PURPOSE LOAN APPLICATION FORMalexcastillo91% (114)

- Staff Handbook 2011Document35 pagesStaff Handbook 2011mohdfazel100% (1)

- PRC-2018 Proposals - STU T.SDocument34 pagesPRC-2018 Proposals - STU T.SNagaraju DanamNo ratings yet

- Payslips 00437165 20230816Document2 pagesPayslips 00437165 20230816Nathaniel MasonNo ratings yet

- Thirakannam NagarajaachariDocument2 pagesThirakannam NagarajaachariNaga RajNo ratings yet

- UP Cost Proposal 2Document4 pagesUP Cost Proposal 2Noggie Espina LorenzoNo ratings yet

- Maternity Benefit GuideDocument4 pagesMaternity Benefit GuidehrtfcorpNo ratings yet

- TakeHome Activity No 2Document10 pagesTakeHome Activity No 2Shai Rendon CandaoNo ratings yet

- Fungsionak L Awal Nopember 2020Document7 pagesFungsionak L Awal Nopember 2020rasyidNo ratings yet

- This Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesDocument7 pagesThis Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesJose AlexanderNo ratings yet

- Small Business Enterprise Loan: Ermel O. TagardaDocument18 pagesSmall Business Enterprise Loan: Ermel O. Tagardaboa1315No ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Ax 16jul15Document3 pagesAx 16jul15Liz YobalNo ratings yet

- FWD: Offer Letter For Meenu Singh: 1 MessageDocument3 pagesFWD: Offer Letter For Meenu Singh: 1 Messagerajprince26460No ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNawaz AhmedNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Rizaholic rizaNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Rizaholic rizaNo ratings yet

- Ledger For The Period April 2017 To March 2018Document1 pageLedger For The Period April 2017 To March 2018boiler maintenanceNo ratings yet

- Pemerintah Kabupaten Indragiri Hulu Surat Pengesahan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja)Document5 pagesPemerintah Kabupaten Indragiri Hulu Surat Pengesahan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja)Firda YunaidiNo ratings yet

- E Liwag 01312007 OLDDocument2 pagesE Liwag 01312007 OLDdaqs06No ratings yet

- Sales ProjectionDocument20 pagesSales ProjectionjenissegemcamangonNo ratings yet

- Job Ads July 2009Document10 pagesJob Ads July 2009peter_martin9335100% (2)

- (Answers) R1 20200924153547prl3 - Final - ExamDocument21 pages(Answers) R1 20200924153547prl3 - Final - ExamArslan HafeezNo ratings yet

- MDI Landscape PayslipDocument1 pageMDI Landscape PayslipGerry Boy BailonNo ratings yet

- Last Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountDocument3 pagesLast Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountpankajNo ratings yet

- Appointment LetterDocument7 pagesAppointment LetterArun Mohanty100% (1)

- Offer Letter - Mohammed MohidDocument3 pagesOffer Letter - Mohammed MohidNARESH UNo ratings yet

- Appoinment LetterDocument3 pagesAppoinment LetterPrashant KumarNo ratings yet

- 10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Document1 page10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Kuldeep KushwahaNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Dede DetianaNo ratings yet

- HADOX - Jrhjejdr JJDDocument4 pagesHADOX - Jrhjejdr JJDSunair SunuNo ratings yet

- Understanding Offset #1Document2 pagesUnderstanding Offset #1WCCO - CBS MinnesotaNo ratings yet

- Job Ads December 2009Document10 pagesJob Ads December 2009peter_martin9335No ratings yet

- Return of Contributions Employees' State Insurance Corporation Form 5Document3 pagesReturn of Contributions Employees' State Insurance Corporation Form 5Md ZakariaNo ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- TMP Q196839Document2 pagesTMP Q196839Dimitar AtanasovNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Flexible LoanDocument5 pagesFlexible LoanDicksonNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- PT Thiess Contractors Indonesia: @@R550185 - TI0014 - SENAKIN - 200320 - 150320@@Document3 pagesPT Thiess Contractors Indonesia: @@R550185 - TI0014 - SENAKIN - 200320 - 150320@@Adi SukmaNo ratings yet

- Payslip 202003Document3 pagesPayslip 202003muhammad adisukmaNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Vhiita Riska SarieNo ratings yet

- Conne QTDocument4 pagesConne QThariomsingh.karnisenaNo ratings yet

- HRMS & PayrollDocument27 pagesHRMS & PayrollDede KurniawanNo ratings yet

- Payment Schedule Options For Current Term Assessment: Option I (Cash Basis)Document1 pagePayment Schedule Options For Current Term Assessment: Option I (Cash Basis)Aj PotXzs ÜNo ratings yet

- 1135-Know Your Service Condition - 2015 Canara Bank New - MailDocument42 pages1135-Know Your Service Condition - 2015 Canara Bank New - Mailraju vermaNo ratings yet

- PayAdvice 18547 230521Document1 pagePayAdvice 18547 230521singh gopalNo ratings yet

- I PSF 202223Document5 pagesI PSF 202223shyamcaclassesNo ratings yet

- CandidateDocument13 pagesCandidateravi lingamNo ratings yet

- New Adb Plans Wef Nov-2012Document4 pagesNew Adb Plans Wef Nov-2012B.S. RawatNo ratings yet

- Biplab - PDF Offer LetterDocument3 pagesBiplab - PDF Offer Letterbiplabsuroj48No ratings yet

- Appointment Letter - Mahesh ShuklaDocument4 pagesAppointment Letter - Mahesh ShuklaRamesh GiriNo ratings yet

- Archana Tarle Software EngineerDocument5 pagesArchana Tarle Software EngineerSamad MirzaNo ratings yet

- Amit JanaDocument1 pageAmit JanaPravin ThoratNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- In Small Independent Businesses: Women Are Like Cats—Men Are Like DogsFrom EverandIn Small Independent Businesses: Women Are Like Cats—Men Are Like DogsNo ratings yet

- Ranjeet Kumar Padhi: Summary ProfileDocument4 pagesRanjeet Kumar Padhi: Summary ProfilepraveenNo ratings yet

- Manufacturing Company Payroll RegisterDocument4 pagesManufacturing Company Payroll RegisterSurendran LakshmanNo ratings yet

- Payroll In-ChargeDocument2 pagesPayroll In-ChargeCherryNo ratings yet

- 0 Periksa ScoreDocument46 pages0 Periksa ScorescribdNo ratings yet

- Moule6-HR in ERPDocument39 pagesMoule6-HR in ERPrelaxing playlistNo ratings yet

- Assistant Controller TemplateDocument5 pagesAssistant Controller TemplateNeilNo ratings yet

- Seven-Year Financial Pro Jection: ProblemDocument10 pagesSeven-Year Financial Pro Jection: Problemnyashadzashe munyatiNo ratings yet

- Chapter 12 FinalDocument19 pagesChapter 12 FinalMichael Hu100% (1)

- P 58Document1 pageP 58penelopegerhardNo ratings yet

- Payroll Management System: Main ObjectivesDocument3 pagesPayroll Management System: Main Objectivespandeypintu57No ratings yet

- Auditing PayrollDocument45 pagesAuditing PayrollRowena AlidonNo ratings yet

- Gatorade Gym Budget One-Time CostsDocument2 pagesGatorade Gym Budget One-Time CostsBrian Ng'enoNo ratings yet

- Payroll Management SystemDocument23 pagesPayroll Management Systemchucha ayanaNo ratings yet

- Tally Gold & AMCDocument6 pagesTally Gold & AMCFinance HIMSRNo ratings yet

- Appendix I: Payroll AccountingDocument22 pagesAppendix I: Payroll AccountingDerian WijayaNo ratings yet

- 5 Tax Reduction Secrets Every Business Owner Must KnowDocument12 pages5 Tax Reduction Secrets Every Business Owner Must Knowalyssa israelNo ratings yet

- Supplemental Form 7 BISDocument4 pagesSupplemental Form 7 BISROSELY BIYOCNo ratings yet

- Cima P3 DumpsDocument6 pagesCima P3 DumpsKatty Steve100% (1)

- R12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10Document3 pagesR12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10lava.cupidNo ratings yet

- Government of PunjabDocument1 pageGovernment of PunjabPunjab Drainage Department0% (1)

- 9) Chapter 8 (Internal Control System)Document42 pages9) Chapter 8 (Internal Control System)azone accounts & audit firmNo ratings yet

- My Consignment Agreement PDFDocument3 pagesMy Consignment Agreement PDFtamara_arifNo ratings yet

- PCC ConfigDocument345 pagesPCC ConfigVamsi SuriNo ratings yet

- School Operational Work Plan: Name of The School: Heroes High School - Bahati YEAR 2020-2021Document2 pagesSchool Operational Work Plan: Name of The School: Heroes High School - Bahati YEAR 2020-2021Cate100% (3)

- Chart of Accounts TemplateDocument8 pagesChart of Accounts TemplateGeorge GonzalesNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

Qhicfsheet 12

Qhicfsheet 12

Uploaded by

Shahid HamidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qhicfsheet 12

Qhicfsheet 12

Uploaded by

Shahid HamidCopyright:

Available Formats

Queensland Health Implementation of Continuity (QHIC) Project

Implementing the new payroll and rostering systems (SAP HR and Workbrain) to support

Queensland Health business.

Factsheet Payslip

March 2010 - Issue 12

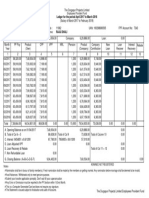

Your New Look Payslip

You will receive your first pay from the new payroll and rostering systems on 24 March 2010. While your new payslip

will look different, there are no changes to when you receive your pay or how you will receive your payslip.

What will remain the same?

• There is no change to the pay day and pay fortnights.

• Payslip distribution points stay the same and your payslip will be sent to you in exactly the same way it is now.

• Any concerns regarding the pay amounts displayed on your payslip, please direct your question to your local

Payroll and Establishment QHSSP contact, as you do now.

What has changed?

This section details the menu fields, layout and terminology that will be on your new payslip. Number references are

provided as a guide to the sample payslip attached to this update.

Length of Payslips

Payslips will generally be one page long, however if you have retrospective adjustments, these will appear on a

second page. Concurrent employees will receive a separate payslip for each different engagement they hold.

(1) A message box in the top right hand corner of your new payslip will display any adjustments that have been made

to your pay along with a brief explanation of the reason for the adjustment. General messages will also appear here.

(2) Person ID Number

Your payslip will contain your Person ID Number on the right hand side under Private and Confidential, and is the

same number as your current Employee ID. Your Person ID Number differentiates you as an individual.

(3) Personnel Assignment Number

An eight digit Personnel Assignment Number (PAN) will appear as “Assignment No” on the left hand side under the

Employer Name, and distinguishes your individual engagements within Queensland Health.

Employees who have a single position (engagement), including those employees with aggregated employment

arrangements, will have one PAN, and this will be the same as your Person ID Number, with zeros added to the front

of the number to expand it to eight digits. Employees who have a concurrent employment arrangement will have a

separate PAN for each engagement, allowing them to distinguish between the different engagements they hold.

Note: The PAN is required on all leave forms and when reporting roster changes, claiming short term leave or claiming

allowances via the Attendance Variation and Allowance Claim form (AVAC) to Payroll and Establishment Services,

QHSSP. Therefore, you must ensure the correct Personnel Assignment Number is used for the relevant engagement.

Queensland Health Enterprise Solutions Transition (QHEST)

Queensland Health Implementation of Continuity (QHIC) Project

Implementing the new payroll and rostering systems (SAP HR and Workbrain) to support

Queensland Health business.

Details of Your Position

There are changes to the way your position classification and classification level will appear on your payslip. Your

current payslip shows your pay Classification (e.g. Nurse-RN, then level within that Classification NRG5(07)).

(4) On the new payslip, your classficiation will be shown as your Sub Position (ie. Substantive Position) Nurse-RN

NRG5(07).

(5) If you are being paid higher duties, an additional HD Position (ie. Higher Duties) will be shown below your your

Sub Position.

A substantive position is the position(s) against which an employee has been appointed (other than for relief or

higher duties purposes) regardless of the status of the employee, eg. Permanent Full time, Permanent Part time,

Temporary Full time, Temporary Part time or Casual. Higher Duties refers to the temporary appointment of an existing

employee to perform the duties of another position to which a higher rate of remuneration applies.

(6) Earnings Window

This area provides a breakdown of hours worked and associated allowances paid over the two-week pay period.

Each day in the current pay cycle has its own box with the days hours detailed below. The units, rate of pay received

and the amount details of each line of the earnings are displayed.

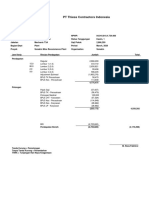

Retrospective Adjustments

The new payroll and rostering systems are date driven, allowing for retrospective date adjustments to be made. A

retrospective adjustment refers to any adjustment made after the event has occurred and the pay period it was in

has been completed. Where you have a retrospective adjustment, details of the adjustment will appear on a second

page of your payslip.

In the front message box, a description of the retrospective adjustment will be displayed, as well as the date that the

adjustment occurred.

(7) The total adjustment figure will be displayed, and will also appear as “brought forward” on the first page of the

payslip above the total gross figure.

(8) Leave Balances (Hrs)

Up to 6 leave type balances will be displayed in the middle column at the bottom of your payslip. Leave types will

include Professional Development Leave (PDL) and Long Service Leave balances (LSL) (where entitled).

Please visit the QHEST website (http://qheps.health.qld.gov.au/qhest/qhicproject/home.htm). The website

contains all past Line Manager Updates and Factsheets.

If you have any questions please send an email to: QHEST_info@health.qld.gov.au.

Queensland Health Enterprise Solutions Transition (QHEST) 2

Queensland Health Implementation of Continuity (QHIC) Project

Sample Payslip

This payslip is a guide only. You will receive an official copy of the payslip in the first pay period after go-live.

Messages

Distribution Point: REEU

Citizen Sara

XYZ Health Unit

C/- Caboolture Hospital 1

“McKean Street, Caboolture” 4510

Pay Advice Private and Confidential

Pay Date 24.03.2010 Employee Name Sara Citizen

Employer ABN 66329169412 2 Person ID 111111

Employer Name QUEENSLAND HEALTH 4 Sub Position Nurse-RN NRG5(07)

3 Assignment No 00111111

5

6 Type Week 1 Week 2 Hrs/ Rate Amount

Units

Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat Sun

08/03 09/03 10/03 11/03 12/03 13/03 14/03 15/03 16/03 17/03 18/03 19/03 20/03 21/03

Fortnightly

Salary 7.60 7.60 7.60 7.60 7.60 7.60 7.60 7.60 7.60 7.60 76.00 32.5276 2,472.10

APNurseOffCont

Edu Credent 80.39

Shift - Afternoon

Penalty 12.5% 8.00 8.00 8.00 8.00 8.00 40.00 4.1982 167.95

Shift - Night

Penalty 20% 8.00 8.00 1.00 17.00 114.20

Shift - Sat

Loading 50% 7.00 7.00 117.55

RDO - Accrual

0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 4.00

Total Gross 2,952.19

7

Deductions Bank Disbursements

Full Income Tax 476.00 014-010 999999999 610.00

MBF 112.12

638-012 999999999 1,056.64

RemServPreTax 646.38

ESAC Sal Sacrifice Cont. 51.05

Deductions 1,285.55

Net Income 1,666.64

Employer Super Contribution 8 Leave Balances (Hrs) Year to Date

ESAC Employer Cont 265.70 PDL - Nursing 48.00 PDE Accrual LTD Balance 459.92

Banked RDO 148.79 Full Taxable Gross 27,057.12

22.92% Leave Loading 79.66 Full Income Tax 5,712.00

Recreation Leave 79.66

Sick Leave 193.22

LSL Balance 360.58

Page - 1

Queensland Health Enterprise Solutions Transition (QHEST) 3

You might also like

- Internal HR Processes and Procedures Audit PDFDocument5 pagesInternal HR Processes and Procedures Audit PDFDiverseHR100% (7)

- My Bank Account StatementDocument4 pagesMy Bank Account StatementIseay100% (1)

- Payroll Accounting 2015 1st Edition Landin Solutions Manual DownloadDocument42 pagesPayroll Accounting 2015 1st Edition Landin Solutions Manual DownloadTommie Clemens100% (21)

- Offer Letter - LokeshwaranDocument3 pagesOffer Letter - LokeshwaranPazhamalairajan Kaliyaperumal100% (1)

- Swaminathan Offer Letter PDFDocument3 pagesSwaminathan Offer Letter PDFElakkiyaNo ratings yet

- Dr. Reddy's Laboratories Limited: June, 2016 Payslip For The MonthDocument1 pageDr. Reddy's Laboratories Limited: June, 2016 Payslip For The Monthrohitjain444No ratings yet

- Pag-IBIG MULTI-PURPOSE LOAN APPLICATION FORMDocument2 pagesPag-IBIG MULTI-PURPOSE LOAN APPLICATION FORMalexcastillo91% (114)

- Staff Handbook 2011Document35 pagesStaff Handbook 2011mohdfazel100% (1)

- PRC-2018 Proposals - STU T.SDocument34 pagesPRC-2018 Proposals - STU T.SNagaraju DanamNo ratings yet

- Payslips 00437165 20230816Document2 pagesPayslips 00437165 20230816Nathaniel MasonNo ratings yet

- Thirakannam NagarajaachariDocument2 pagesThirakannam NagarajaachariNaga RajNo ratings yet

- UP Cost Proposal 2Document4 pagesUP Cost Proposal 2Noggie Espina LorenzoNo ratings yet

- Maternity Benefit GuideDocument4 pagesMaternity Benefit GuidehrtfcorpNo ratings yet

- TakeHome Activity No 2Document10 pagesTakeHome Activity No 2Shai Rendon CandaoNo ratings yet

- Fungsionak L Awal Nopember 2020Document7 pagesFungsionak L Awal Nopember 2020rasyidNo ratings yet

- This Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesDocument7 pagesThis Is An Example of What Some of The Upfront Costs May Be. Be Sure To Plan For These in Your Budget, As Well As Ongoing ExpensesJose AlexanderNo ratings yet

- Small Business Enterprise Loan: Ermel O. TagardaDocument18 pagesSmall Business Enterprise Loan: Ermel O. Tagardaboa1315No ratings yet

- TurboTax Print Preview 02-14-2013T20.10.08.460Document13 pagesTurboTax Print Preview 02-14-2013T20.10.08.460glenncannon1973No ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Ax 16jul15Document3 pagesAx 16jul15Liz YobalNo ratings yet

- FWD: Offer Letter For Meenu Singh: 1 MessageDocument3 pagesFWD: Offer Letter For Meenu Singh: 1 Messagerajprince26460No ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNawaz AhmedNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Rizaholic rizaNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document2 pagesRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Rizaholic rizaNo ratings yet

- Ledger For The Period April 2017 To March 2018Document1 pageLedger For The Period April 2017 To March 2018boiler maintenanceNo ratings yet

- Pemerintah Kabupaten Indragiri Hulu Surat Pengesahan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja)Document5 pagesPemerintah Kabupaten Indragiri Hulu Surat Pengesahan Pertanggungjawaban Bendahara Pengeluaran (SPJ Belanja)Firda YunaidiNo ratings yet

- E Liwag 01312007 OLDDocument2 pagesE Liwag 01312007 OLDdaqs06No ratings yet

- Sales ProjectionDocument20 pagesSales ProjectionjenissegemcamangonNo ratings yet

- Job Ads July 2009Document10 pagesJob Ads July 2009peter_martin9335100% (2)

- (Answers) R1 20200924153547prl3 - Final - ExamDocument21 pages(Answers) R1 20200924153547prl3 - Final - ExamArslan HafeezNo ratings yet

- MDI Landscape PayslipDocument1 pageMDI Landscape PayslipGerry Boy BailonNo ratings yet

- Last Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountDocument3 pagesLast Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountpankajNo ratings yet

- Appointment LetterDocument7 pagesAppointment LetterArun Mohanty100% (1)

- Offer Letter - Mohammed MohidDocument3 pagesOffer Letter - Mohammed MohidNARESH UNo ratings yet

- Appoinment LetterDocument3 pagesAppoinment LetterPrashant KumarNo ratings yet

- 10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Document1 page10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Kuldeep KushwahaNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Dede DetianaNo ratings yet

- HADOX - Jrhjejdr JJDDocument4 pagesHADOX - Jrhjejdr JJDSunair SunuNo ratings yet

- Understanding Offset #1Document2 pagesUnderstanding Offset #1WCCO - CBS MinnesotaNo ratings yet

- Job Ads December 2009Document10 pagesJob Ads December 2009peter_martin9335No ratings yet

- Return of Contributions Employees' State Insurance Corporation Form 5Document3 pagesReturn of Contributions Employees' State Insurance Corporation Form 5Md ZakariaNo ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- TMP Q196839Document2 pagesTMP Q196839Dimitar AtanasovNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Flexible LoanDocument5 pagesFlexible LoanDicksonNo ratings yet

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- PT Thiess Contractors Indonesia: @@R550185 - TI0014 - SENAKIN - 200320 - 150320@@Document3 pagesPT Thiess Contractors Indonesia: @@R550185 - TI0014 - SENAKIN - 200320 - 150320@@Adi SukmaNo ratings yet

- Payslip 202003Document3 pagesPayslip 202003muhammad adisukmaNo ratings yet

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Document1 pageRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Vhiita Riska SarieNo ratings yet

- Conne QTDocument4 pagesConne QThariomsingh.karnisenaNo ratings yet

- HRMS & PayrollDocument27 pagesHRMS & PayrollDede KurniawanNo ratings yet

- Payment Schedule Options For Current Term Assessment: Option I (Cash Basis)Document1 pagePayment Schedule Options For Current Term Assessment: Option I (Cash Basis)Aj PotXzs ÜNo ratings yet

- 1135-Know Your Service Condition - 2015 Canara Bank New - MailDocument42 pages1135-Know Your Service Condition - 2015 Canara Bank New - Mailraju vermaNo ratings yet

- PayAdvice 18547 230521Document1 pagePayAdvice 18547 230521singh gopalNo ratings yet

- I PSF 202223Document5 pagesI PSF 202223shyamcaclassesNo ratings yet

- CandidateDocument13 pagesCandidateravi lingamNo ratings yet

- New Adb Plans Wef Nov-2012Document4 pagesNew Adb Plans Wef Nov-2012B.S. RawatNo ratings yet

- Biplab - PDF Offer LetterDocument3 pagesBiplab - PDF Offer Letterbiplabsuroj48No ratings yet

- Appointment Letter - Mahesh ShuklaDocument4 pagesAppointment Letter - Mahesh ShuklaRamesh GiriNo ratings yet

- Archana Tarle Software EngineerDocument5 pagesArchana Tarle Software EngineerSamad MirzaNo ratings yet

- Amit JanaDocument1 pageAmit JanaPravin ThoratNo ratings yet

- Salary StackDocument3 pagesSalary StackAMIT SINGHNo ratings yet

- In Small Independent Businesses: Women Are Like Cats—Men Are Like DogsFrom EverandIn Small Independent Businesses: Women Are Like Cats—Men Are Like DogsNo ratings yet

- Ranjeet Kumar Padhi: Summary ProfileDocument4 pagesRanjeet Kumar Padhi: Summary ProfilepraveenNo ratings yet

- Manufacturing Company Payroll RegisterDocument4 pagesManufacturing Company Payroll RegisterSurendran LakshmanNo ratings yet

- Payroll In-ChargeDocument2 pagesPayroll In-ChargeCherryNo ratings yet

- 0 Periksa ScoreDocument46 pages0 Periksa ScorescribdNo ratings yet

- Moule6-HR in ERPDocument39 pagesMoule6-HR in ERPrelaxing playlistNo ratings yet

- Assistant Controller TemplateDocument5 pagesAssistant Controller TemplateNeilNo ratings yet

- Seven-Year Financial Pro Jection: ProblemDocument10 pagesSeven-Year Financial Pro Jection: Problemnyashadzashe munyatiNo ratings yet

- Chapter 12 FinalDocument19 pagesChapter 12 FinalMichael Hu100% (1)

- P 58Document1 pageP 58penelopegerhardNo ratings yet

- Payroll Management System: Main ObjectivesDocument3 pagesPayroll Management System: Main Objectivespandeypintu57No ratings yet

- Auditing PayrollDocument45 pagesAuditing PayrollRowena AlidonNo ratings yet

- Gatorade Gym Budget One-Time CostsDocument2 pagesGatorade Gym Budget One-Time CostsBrian Ng'enoNo ratings yet

- Payroll Management SystemDocument23 pagesPayroll Management Systemchucha ayanaNo ratings yet

- Tally Gold & AMCDocument6 pagesTally Gold & AMCFinance HIMSRNo ratings yet

- Appendix I: Payroll AccountingDocument22 pagesAppendix I: Payroll AccountingDerian WijayaNo ratings yet

- 5 Tax Reduction Secrets Every Business Owner Must KnowDocument12 pages5 Tax Reduction Secrets Every Business Owner Must Knowalyssa israelNo ratings yet

- Supplemental Form 7 BISDocument4 pagesSupplemental Form 7 BISROSELY BIYOCNo ratings yet

- Cima P3 DumpsDocument6 pagesCima P3 DumpsKatty Steve100% (1)

- R12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10Document3 pagesR12x Oracle Payroll Fundamentals Configuration (Global) - D60571GC10lava.cupidNo ratings yet

- Government of PunjabDocument1 pageGovernment of PunjabPunjab Drainage Department0% (1)

- 9) Chapter 8 (Internal Control System)Document42 pages9) Chapter 8 (Internal Control System)azone accounts & audit firmNo ratings yet

- My Consignment Agreement PDFDocument3 pagesMy Consignment Agreement PDFtamara_arifNo ratings yet

- PCC ConfigDocument345 pagesPCC ConfigVamsi SuriNo ratings yet

- School Operational Work Plan: Name of The School: Heroes High School - Bahati YEAR 2020-2021Document2 pagesSchool Operational Work Plan: Name of The School: Heroes High School - Bahati YEAR 2020-2021Cate100% (3)

- Chart of Accounts TemplateDocument8 pagesChart of Accounts TemplateGeorge GonzalesNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet