Professional Documents

Culture Documents

338 339 Editorial Gros

338 339 Editorial Gros

Uploaded by

longchempaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

338 339 Editorial Gros

338 339 Editorial Gros

Uploaded by

longchempaCopyright:

Available Formats

DOI: 10.

1007/s10272-010-0354-3

Editorial

Currency Wars?

War is not merely a political act, but also a political instrument, a continuation of political relations, a carrying out of the same by other means. This working definition of

war by the 19th century Prussian military historian Clausewitz is widely accepted even

today. If the notion that quantitative easing is a continuation of monetary policy by other

means is added to this, the use of the term currency wars becomes understandable.

Who started this war? The easy answer is the USA. With short-term interest rates already at zero and fiscal policy possibly paralysed by a divided government, the Federal

Reserve recently opted for a programme of buying $600 billion of medium-term Treasury

bills with the aim of stimulating demand via lower interest rates.

Why did it chose to do so and will this policy work?

The why is clear. Part of the mandate of the Fed is to aim for high employment. This

is why it feels that it has to do something, or rather anything, to stimulate demand in

order to reduce unemployment, which is at a politically unacceptable level (9.5%). It is

interesting to note that growth has recovered more strongly in the USA than in the euro

zone this year (to over 3% in Q3), but still the Federal Reserve maintains that it has to engage in quantitative easing because it considers the present unemployment rate unacceptable. By contrast, the ECB has recently even been talking about withdrawing some

stimulus although the growth rate in the euro area, at below 2%, is considerably below

that of the USA, and the euro area unemployment rate is still above 10%, and thus higher

than the US rate. This shows the extent to which the acceptability of unemployment differs on both sides of the Atlantic.

Will it work? The essence of quantitative easing is that buying massive amounts of Tbills should lower medium- and long-term interest rates, which should increase asset

prices and lower the borrowing costs of enterprises and families. In this sense quantitative easing is really just a continuation of normal monetary policy by moving up

the yield curve and should have similar effects. But there are reasons to doubt that the

usual elements of the monetary transmission mechanism will work under present circumstances.

US corporations are already sitting on an enormous pile of cash. Lower interest rates will

not lead them to invest more. Lowering borrowing costs for families should help sustain

house prices and consumption. But again, under current circumstances, the effect will

be very limited because there are so few new home buyers. The usual transmission

mechanism would be massive refinancing of existing mortgages, but this is now impossible because many are under water (the value of the house is lower than the mortgage). Higher stock prices should give another boost to demand, but this is likely to be

limited as one cannot really say by how much quantitative easing will boost stock prices

and only a very small part of any increase in stock prices stimulated by temporarily depressed medium-term bond yields will be consumed. The only channel which should

work as usual thus remains the exchange rate.

Most observers thus agree that the new round of quantitative easing (QE II) should have

a rather limited impact on the economy, but the standard models suggest that it should

certainly be positive. However, this line of argument overlooks the fact that lower interest rates also mean lower incomes for investors, like insurance companies and ordinary

people who have saved for their retirement. These rentiers will now have to reduce consumption because their income has gone down along with interest rates. The upshot is

338

Intereconomics 2010 | 6

Editorial

that one cannot exclude the case that the net effect of QE II might be to reduce demand

in the USA.

This explains why the reaction to the new round of quantitative easing has been so hostile outside the USA: normally the impact of an easing of monetary policy on the rest

of the world should be neutral as income in the USA goes up, the rest of the world

can export more to the USA. At the same time, the US dollar might depreciate, but the

two effects could easily be of similar size, thus cancelling each other out. However, the

emerging markets and countries whose economies are in a healthy state now perceive

that QE II will only have a negative impact because it does not stimulate demand in the

USA but will foster asset price bubbles everywhere else. Moreover, emerging markets

have already left the recession behind and they do not need a further monetary stimulus.

The only area that might actually benefit from QE II is the euro area, because the depressed yields from US Treasuries are likely to stimulate the search for yields and the

risk appetite of investors everywhere. These days the US Treasury can borrow at rockbottom interest rates. The interest rate on inflation-protected bonds has actually now

become minus 0.5% for a five-year maturity! The US government is thus essentially being paid in real terms by investors to take their resources. This implies that investors

have to look for any alternative that has at least a positive real yield. With Irish, Greek

and other bonds now trading at yields around 8%, investors might be tempted to take

the plunge, trusting that in the case of trouble Europe would be ready to bail them out.

Will the emerging economies be able to isolate themselves from the wave of liquidity

which the Federal Reserve is unleashing? Germany discovered how difficult this is during the 1960s and 1970s and resisted the trend of the Deutschmark first to appreciate

and then to become an international reserve currency because it felt that the exportoriented German economy would suffer from the wide swings in the exchange rate that

are the norm for global reserve currencies. Given the weakness of the other European

currencies, however, and Germanys desire to keep markets open, there was very little

that its authorities could do. As the Deutschmark became a major international reserve

currency during the 1980s and 1990s, large gyrations in the dollar exchange rate thus at

times had a rather large impact on the German economy. However, in the end the German economy adjusted and the country was able to preserve relative price stability even

when inflation took off in the rest of the world.

Today the emerging markets, especially China, have taken the place of Germany (and

Japan) in the 1960s and 1970s as the major emerging exporting nations but with one

difference: China manages its exchange rate tightly using pervasive capital controls and

massive interventions. Given that China is the only major economy with widespread

capital controls, China has created its own exorbitant privilege: it can determine its

exchange rate because all the other big nations do not have capital controls. A number

of other, smaller, emerging economies are also toying half-heartedly with partial capital

controls to keep their economies from appreciating. However, as in the case of Germany

about 40 years ago, this is unlikely to be effective as partial controls in otherwise open

financial markets cannot prevent a flood of hot money, as it used to be called.

What is called currency wars is thus really a zero-sum game for the worlds export markets, a continuation of monetary policy by other means. In the long run the winners may

be those who do not try to fight the markets and resist the strength of their currencies

even if this may mean a painful adjustment in their export sector in the short run.

Daniel Gros

Director CEPS, Brussels, Belguim

Intereconomics 2010 | 6

339

You might also like

- Topic 1 - Review Q&A (Pearson)Document2 pagesTopic 1 - Review Q&A (Pearson)$t@r0867% (3)

- Great Investments For Times of InflationDocument28 pagesGreat Investments For Times of InflationCanadianValue100% (1)

- Banking Report ThesisDocument20 pagesBanking Report Thesisroshaun007100% (6)

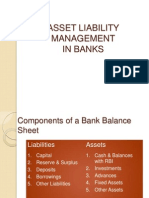

- Asset Liability ManagementDocument18 pagesAsset Liability Managementmahesh19689No ratings yet

- TVM Question 55Document8 pagesTVM Question 55jaiNo ratings yet

- Basic Accounting AssignmentDocument8 pagesBasic Accounting AssignmentRj Bengil70% (20)

- Chap 10 The Financial Plan by Shepherd Hisrich, PetersDocument28 pagesChap 10 The Financial Plan by Shepherd Hisrich, PetersamitgehiNo ratings yet

- High Price of Easy MoneyDocument2 pagesHigh Price of Easy MoneyRobert IronsNo ratings yet

- The Austerity Delusion (Krugman)Document11 pagesThe Austerity Delusion (Krugman)phdpolitics1No ratings yet

- 11-14-11 What's Driving GoldDocument4 pages11-14-11 What's Driving GoldThe Gold SpeculatorNo ratings yet

- Fear Returns: World EconomyDocument6 pagesFear Returns: World EconomymuradgwaduriNo ratings yet

- Is Greece The Next LehmansDocument2 pagesIs Greece The Next LehmansBilal RajaNo ratings yet

- "This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsDocument12 pages"This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsJohnPapaspanosNo ratings yet

- Volume 2.4 Still Bullish Apr 13 2010Document12 pagesVolume 2.4 Still Bullish Apr 13 2010Denis OuelletNo ratings yet

- Calm Before The Storm: Thursday, 23 May 2013Document11 pagesCalm Before The Storm: Thursday, 23 May 2013Marius MuresanNo ratings yet

- Euro ZoneDocument4 pagesEuro ZoneDurgesh KesarkarNo ratings yet

- Fixing The CrisisDocument8 pagesFixing The Crisisckarsharma1989No ratings yet

- The Currency Puzzle (29!10!2010)Document21 pagesThe Currency Puzzle (29!10!2010)adhirajrNo ratings yet

- Yield Curve - The Economist - 1998Document3 pagesYield Curve - The Economist - 1998Nico NovoaNo ratings yet

- JPF The G-20 and The Currency War 01Document3 pagesJPF The G-20 and The Currency War 01BruegelNo ratings yet

- BIS LeverageRootToTheCrisisDocument5 pagesBIS LeverageRootToTheCrisisHector Perez SaizNo ratings yet

- SIN20130510Document11 pagesSIN20130510riedavniueNo ratings yet

- Bob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011Document4 pagesBob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011sankaratNo ratings yet

- On Target: Martin Spring's Private Newsletter On Global StrategyDocument13 pagesOn Target: Martin Spring's Private Newsletter On Global StrategydiannebNo ratings yet

- g20 Monitor Ma g20 Conflicts Now Need To Be Resolved Not Papered OverDocument3 pagesg20 Monitor Ma g20 Conflicts Now Need To Be Resolved Not Papered OverBruegelNo ratings yet

- Sumner Gold Report May2015Document3 pagesSumner Gold Report May2015mercosurNo ratings yet

- Whither The Great Recessio - Reading The Tea Leaves - 30 Aug 2009Document2 pagesWhither The Great Recessio - Reading The Tea Leaves - 30 Aug 2009api-26869162No ratings yet

- The Immoderate World Economy: Maurice ObstfeldDocument23 pagesThe Immoderate World Economy: Maurice ObstfeldDmitry PreobrazhenskyNo ratings yet

- Economic and Market: A U.S. Recession?Document16 pagesEconomic and Market: A U.S. Recession?dpbasicNo ratings yet

- The Economic and Financial Outlook - 22!07!11!16!02Document12 pagesThe Economic and Financial Outlook - 22!07!11!16!02BerezaNo ratings yet

- The World Economy After The Pandemic, Will Inflation Return?Document3 pagesThe World Economy After The Pandemic, Will Inflation Return?Rishabh Kumar PG22No ratings yet

- Barclays 2 Capital David Newton Memorial Bursary 2006 MartDocument2 pagesBarclays 2 Capital David Newton Memorial Bursary 2006 MartgasepyNo ratings yet

- Nvestment Ompass: Quarterly CommentaryDocument4 pagesNvestment Ompass: Quarterly CommentaryPacifica Partners Capital ManagementNo ratings yet

- Eclectica 08-09Document4 pagesEclectica 08-09ArcturusCapitalNo ratings yet

- Rethinking Globalization - NotesDocument13 pagesRethinking Globalization - NotesLana HNo ratings yet

- China's Reflation Experiment:: Short Term Gain / Long Term Pain?Document11 pagesChina's Reflation Experiment:: Short Term Gain / Long Term Pain?rlinskiNo ratings yet

- 2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonDocument2 pages2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonPranjayNo ratings yet

- US FinPolicy 2019Document6 pagesUS FinPolicy 2019Ankur ShardaNo ratings yet

- Currency WarsDocument25 pagesCurrency Warsdivrastogi100% (2)

- Deutsche Bank ResearchDocument3 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Equicapita September 2013 Briefing - Central Bankers Start To See The Outline of The Corner and The PaintDocument6 pagesEquicapita September 2013 Briefing - Central Bankers Start To See The Outline of The Corner and The PaintEquicapita Income TrustNo ratings yet

- Bob Chapman Fiscal Debt and Monetization Are Taking The Financial System Down 28 8 2010Document3 pagesBob Chapman Fiscal Debt and Monetization Are Taking The Financial System Down 28 8 2010sankaratNo ratings yet

- European ReformDocument3 pagesEuropean ReformChintu PatelNo ratings yet

- Burch Wealth Management 05.09.11Document3 pagesBurch Wealth Management 05.09.11admin866No ratings yet

- Global Financial Crisis and Sri LankaDocument5 pagesGlobal Financial Crisis and Sri LankaRuwan_SuNo ratings yet

- Down The Road To Economic HellDocument18 pagesDown The Road To Economic HellthecynicaleconomistNo ratings yet

- Never Accept Economic Truths Merely Because Somebody Said SoDocument3 pagesNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNo ratings yet

- Deflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)Document8 pagesDeflation - Making Sure It Doesn't Happen Here (Ben S. Bernanke)João Henrique F. VieiraNo ratings yet

- The Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargDocument10 pagesThe Deflation-Inflation Two-Step - Too Complex For Deflationsts To Grasp - MargcportzNo ratings yet

- The Answer Is BleakDocument3 pagesThe Answer Is Bleakayien21No ratings yet

- The Answer Is BleakDocument3 pagesThe Answer Is Bleakayien21No ratings yet

- CAPITAL MARKET Journal Tugas B.inggris - Muhammad Imam Wahid - 202111514Document5 pagesCAPITAL MARKET Journal Tugas B.inggris - Muhammad Imam Wahid - 202111514Muhammad imam wahidNo ratings yet

- IMF's Bold Recipe For Recovery: TagsDocument5 pagesIMF's Bold Recipe For Recovery: TagsKrishna SumanthNo ratings yet

- Fourth Q Uarter R Eport 2010Document16 pagesFourth Q Uarter R Eport 2010richardck61No ratings yet

- Jorg Guido Hulsmann - Deflation and Liberty (2008)Document46 pagesJorg Guido Hulsmann - Deflation and Liberty (2008)Ragnar DanneskjoldNo ratings yet

- Record Global Stock Prices Reflect Growth of Financial ParasitismDocument2 pagesRecord Global Stock Prices Reflect Growth of Financial ParasitismShane MishokaNo ratings yet

- The Broyhill Letter: Executive SummaryDocument4 pagesThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNo ratings yet

- Lowe Comments On InflationDocument12 pagesLowe Comments On InflationJayant YadavNo ratings yet

- Investment and Tax Planning Strategies For Uncertain Economic TimesDocument16 pagesInvestment and Tax Planning Strategies For Uncertain Economic TimesMihaela NicoaraNo ratings yet

- Government Policy and The Markets:: Prepare For Some Big ChangesDocument22 pagesGovernment Policy and The Markets:: Prepare For Some Big Changesrichardck50No ratings yet

- Hoisington Q1 2015Document9 pagesHoisington Q1 2015CanadianValue0% (1)

- MONEY AND BANKING (School Work)Document9 pagesMONEY AND BANKING (School Work)Lan Mr-aNo ratings yet

- Globalisation Fractures: How major nations' interests are now in conflictFrom EverandGlobalisation Fractures: How major nations' interests are now in conflictNo ratings yet

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsFrom EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNo ratings yet

- 2020 Tesla Impact ReportDocument94 pages2020 Tesla Impact Reportlongchempa100% (1)

- Chapter: Understanding The Difference Between Speculating and Hedging by Greg Beier, Reviewed by Alfred Chandler, HBSDocument12 pagesChapter: Understanding The Difference Between Speculating and Hedging by Greg Beier, Reviewed by Alfred Chandler, HBSlongchempaNo ratings yet

- Wisconsin State Retirement Fund Report 2016Document64 pagesWisconsin State Retirement Fund Report 2016longchempaNo ratings yet

- Beyond Traditional Beta 032015 CH DE Nordic FR ES IE IT LU NL UK PDFDocument24 pagesBeyond Traditional Beta 032015 CH DE Nordic FR ES IE IT LU NL UK PDFlongchempaNo ratings yet

- Currency War: What You Need To Know: Adam Shell, USA TODAYDocument2 pagesCurrency War: What You Need To Know: Adam Shell, USA TODAYlongchempaNo ratings yet

- December 2016 BWC USUN Poll Executive SummaryDocument8 pagesDecember 2016 BWC USUN Poll Executive SummarylongchempaNo ratings yet

- Michael Burry: Focus On Bargains and Not Stock Market Valuations - Base Hit InvestingDocument22 pagesMichael Burry: Focus On Bargains and Not Stock Market Valuations - Base Hit InvestinglongchempaNo ratings yet

- Climate Change From The Investor S PerspectiveDocument18 pagesClimate Change From The Investor S PerspectivelongchempaNo ratings yet

- Michael Burry: Focus On Bargains and Not Stock Market Valuations - Base Hit InvestingDocument22 pagesMichael Burry: Focus On Bargains and Not Stock Market Valuations - Base Hit InvestinglongchempaNo ratings yet

- Ecological ModellingDocument15 pagesEcological ModellinglongchempaNo ratings yet

- Analytical ActivismDocument392 pagesAnalytical ActivismlongchempaNo ratings yet

- AMERICAN ENTERPRISE INSTITUTE HAPPINESS, FREE ENTERPRISE, AND HUMAN FLOURISHING: A SPECIAL ONLINE EVENT FEATURING HIS HOLINESS THE DALAI LAMA PANEL I MORAL FREE ENTERPRISE: ECONOMIC PERSPECTIVES IN BUSINESS AND POLITICS DISCUSSION: HIS HOLINESS THE DALAI LAMA ARTHUR C. BROOKS, AEI JONATHAN HAIDT, NEW YORK UNIVERSITY GLENN HUBBARD, COLUMBIA UNIVERSITY DANIEL S. LOEB, THIRD POINT LLC 9:00 AM – 10:15 AM THURSDAY, FEBRUARY 20, 2014Document20 pagesAMERICAN ENTERPRISE INSTITUTE HAPPINESS, FREE ENTERPRISE, AND HUMAN FLOURISHING: A SPECIAL ONLINE EVENT FEATURING HIS HOLINESS THE DALAI LAMA PANEL I MORAL FREE ENTERPRISE: ECONOMIC PERSPECTIVES IN BUSINESS AND POLITICS DISCUSSION: HIS HOLINESS THE DALAI LAMA ARTHUR C. BROOKS, AEI JONATHAN HAIDT, NEW YORK UNIVERSITY GLENN HUBBARD, COLUMBIA UNIVERSITY DANIEL S. LOEB, THIRD POINT LLC 9:00 AM – 10:15 AM THURSDAY, FEBRUARY 20, 2014longchempaNo ratings yet

- Writing Effective Grant ProposalsDocument65 pagesWriting Effective Grant ProposalslongchempaNo ratings yet

- 2015 National Security StrategyDocument35 pages2015 National Security StrategylongchempaNo ratings yet

- Analytical ActivismDocument392 pagesAnalytical ActivismlongchempaNo ratings yet

- Trial Balance ExampleDocument4 pagesTrial Balance ExampleMasood MehmoodNo ratings yet

- SWOT Analysis TemplateDocument14 pagesSWOT Analysis TemplateStrauss67No ratings yet

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinNo ratings yet

- BANK OF ENGLAND: Working Paper No 529Document61 pagesBANK OF ENGLAND: Working Paper No 529Dr. KIRIAKOS TOBRAS - ΤΟΜΠΡΑΣNo ratings yet

- KPMG Janned Al KamarDocument51 pagesKPMG Janned Al KamarKy HendersonNo ratings yet

- Final Study Guide Accounting 101Document2 pagesFinal Study Guide Accounting 101Jonathan MoonNo ratings yet

- Adjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Document9 pagesAdjudication Order in The Matter of M/s Coromandel International Limited (Erstwhile Liberty Phosphate Limited) Page 1 of 9Shyam SunderNo ratings yet

- Prevention of Oppression and MismanagementDocument4 pagesPrevention of Oppression and MismanagementNIRAVNo ratings yet

- Best Practices For Reducing InventoryDocument8 pagesBest Practices For Reducing InventoryNicolas YoumbiNo ratings yet

- Article Arpan MahapatraDocument11 pagesArticle Arpan MahapatraarpanmahapatraNo ratings yet

- Statement of Cash Flows: AASB 1026Document37 pagesStatement of Cash Flows: AASB 1026kazimkorogluNo ratings yet

- 2019 Pardee Annual Report - Low ResolutionDocument36 pages2019 Pardee Annual Report - Low ResolutionNate Tobik100% (2)

- Manoy Millenial PDFDocument28 pagesManoy Millenial PDFmikariaNo ratings yet

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavNo ratings yet

- Order in The Matter of Pailan Agro India Limited and Its DirectorsDocument14 pagesOrder in The Matter of Pailan Agro India Limited and Its DirectorsShyam SunderNo ratings yet

- Financial Management Tutorial 2 AnswersDocument6 pagesFinancial Management Tutorial 2 AnswersDelfPDF100% (2)

- Company Profile - Sun & SandsDocument8 pagesCompany Profile - Sun & SandsShallu BhugraNo ratings yet

- Value For Money Analysis.5.10.12Document60 pagesValue For Money Analysis.5.10.12Jason SanchezNo ratings yet

- Noble GroupDocument5 pagesNoble GroupTheng Roger100% (1)

- 07 Chapter 2Document30 pages07 Chapter 2WebNo ratings yet

- Residual Income Valuation:: Valuing Common EquityDocument39 pagesResidual Income Valuation:: Valuing Common EquityLuis CarrilloNo ratings yet

- Ib Club Careers - Interview Tips PDFDocument9 pagesIb Club Careers - Interview Tips PDFqcrvtbNo ratings yet

- Final ThesisDocument128 pagesFinal ThesisArshad ShaikhNo ratings yet

- Annual Administration Report ProfarmaDocument4 pagesAnnual Administration Report ProfarmacherryprasaadNo ratings yet