Professional Documents

Culture Documents

Westpack JUL 01 Mornng Report

Westpack JUL 01 Mornng Report

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Westpack JUL 01 Mornng Report

Westpack JUL 01 Mornng Report

Uploaded by

Miir ViirCopyright:

Available Formats

Thursday 1 July 2010

Morning Report

Foreign Exchange Market News and views

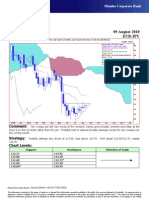

Previous Range Today’s Open Expected Sentiment remains decidedly bearish. The S&P500 opened on key support at 1040-42

and whipped around in a tight 10pt range for much of the day before a late lurch lower saw

Asia Overnight 8.00am NZD cross Range Today

it finish down 0.8%. Sentiment was given a lift in early dealings by a smaller than expected

NZD 0.6895-0.6942 0.6858-0.6955 Ð0.6858 0.6820-0.6900 uptake at the ECB’s 3mth liquidity tender. The ECB lent €132bn to European banks – much

smaller than the €442bn in 1yr funds that mature tomorrow, a sign that the region’s

AUD 0.8463-0.8527 0.8436-0.8567 Ð0.8418 Ð0.8147 0.8370-0.8460

financial sector may not be as stressed as feared. That good news was however countered

JPY 88.39-88.69 88.42-88.77 Ð88.47 Ð60.67 88.00-89.00 by weaker US data. Moody’s announcement that Spain was on a review for downgrade

EUR 1.2167-1.2224 1.2204-1.2305 Ï1.2226 Ð0.5609 1.2150-1.2280 pressured markets in afternoon trading as well. US 10yr Treasuries took a breather with

yields mostly unchanged following the past week’s huge gains. Commodities were up on

GBP 1.5028-1.5088 1.4936-1.5069 Ð1.4947 Ð0.4588 1.4900-1.5000 the day (+0.92%).

The smaller than expected uptake at the ECB’s 3mth liquidity tender helped stabilise risk

NZ Domestic Market (Previous day’s closing rates) sentiment in early offshore dealings. But as NY entered the fray, and following weaker US

jobs data, currencies shed a good amount of their earlier gains vs the USD. EUR traded back

Cash Curve Govt Stock Swap Rates (Qtrly)

from 1.2300 to 1.2240, while both AUD and NZD fell to fresh lows for their recent push

Cash 2.75% Nov-11 3.67% 1 Year 3.74% lower. The AUD shed 150pts from its highs and printed session lows near 0.8415 before

2 Years 4.11% it found some support while NZD fell about 100pts from its highs to lows near 0.6858.

30 Days 2.96% Apr-13 4.17%

3 Years 4.39% US Chicago PMI was moderately lower In June falling to 59.1 from 59.7. That said,

60 Days 3.03% a reading above 50 reflects expansion and the survey has been above this key level for

Apr-15 4.65% 4 Years 4.61%

90 Days 3.15% nine consecutive months now. Within the detail the report was mixed, with new orders

5 Years 4.79% falling to 59.1 from 62.7 and order backlogs also down. Prices paid were slightly lower and

Dec-17 5.12%

180 Days 3.39% 7 Years 5.09% encouragingly, the employment component rose back above 50 to 54.2.

1 Year 3.70% May-21 5.34% 10 Years 5.38% US ADP employment came in weaker than the market consensus posting a rise

of just 13k in June compared with 57k in May. This was the smallest rise since Feb and

World Bourses and Indices suggests an even weaker than already expected non-farm payrolls report on Friday. The

ADP report revealed a fall of 35k in construction industries but a rise in service providers

AUD USD by 30k.

Cash 4.50% 0.00 Fed Funds 0.00-0.25%

Nomura Japanese manufacturing PMI fell to 53.9 in June. That compares to 54.7 in

90 Day 4.87% -0.10 3 Mth Libor 0.53% 0.00 May. The projections encased in the METI IP report are basically consistent with this update,

3 Year Bond 4.56% -0.08 10 Year Notes 2.94% -0.01 implying moderate gains in production in the months ahead.

10 Year Bond 5.11% -0.05 30 Year Bonds 3.90% -0.03 Japanese labour income fell 0.2%yr nominal, +0.7% in real terms. Overtime earnings

remain the major source of strength in these numbers. OT is up 10.3%yr, while regular

NZX 50 2972.1 -19.0 CRB 258.5 +2.2 earnings are still slightly negative. The consolidation of the labour market has supported

S&P/ASX200 4301.5 -44.2 Gold 1242.0 +2.5 incomes to a degree, but there is nothing in this report to curb one’s anxiety about the

Nikkei 9382.6 -188.1 Copper Fut. 290.90 -0.10 post-stimulus consumer.

FT100 4916.9 +2.7 Oil (WTI) 75.57 -0.34 Japanese housing starts were 4.6% lower over the year to May, well below April’s

S&P500 1033.0 -8.3 NZ TWI 66.34 -0.55 0.6%yr outcome and market expectations for a +5%yr outcome for May.

Japanese construction orders were up 9.2%yr in May. This was a sharp turnaround

from the 25%yr decline in April, though this series is generally very volatile. In May, private

Upcoming Events construction orders were up 10.2%yr while government construction orders were down

Date Country Release Last Forecast 13.5%yr.

1 Jul NZ Jun ANZ Commodity Price Index 2.5% – Euroland inflation slowed further to 1.4% in the preliminary reading for June. The

Aus May Retail Sales 0.6% 0.3% decline in energy prices is likely to have played its part in the softer reading. Although

May Dwelling Approvals –14.8% –1.5% Euroland CPI had been drifting higher in the past quarter, it is still well below any level that

Jun AiG PMI 56.3 – the ECB should be concerned about.

US Jun ISM Manufacturing 59.7 58.0 Canadian GDP was flat in April following the 0.6% growth in March. The slowdown was

May Construction Spending 2.7% –1.8% driven by the retail and manufacturing sectors but growth in mining and wholesale provided

May Pending Home Sales 6.0% –25.0% some offset. In recent months, Canadian GDP has been robust with only one reading below

Jun Total Vehicle Sales, mn ann’lsd 11.6 11.5 0.5% in the past five months so April’s weak number is not cause for concern just yet.

Initial Jobless Claims, w/e 26/6 457k 455k

Jpn Q2 Tankan Lrg Manuf Conditions –14 –3

Outlook

Q2 Tankan Lrg Non–Manuf –14 –5

Eur Jun PMI Factory (F) 55.6 a 55.6 AUD/USD and NZD/USD outlook next 24 hours: Aust retail sales and building approvals

Ger May Retail Sales %yr –3.1% –0.6% for June will be a focus but the June China purchasing managers surveys will be the main

point of interest in Asia today. Worries over Chinese growth have been a key negative

UK Jun House Prices %yr 6.9% –

for commodities, equities and the commodity currencies in recent sessions. Weaker than

Jun Factory PMI 58.0 56.5

expected data out of China will see both AUD and NZD losses accelerate. NZD should run

2 Jul US Jun Non-Farm Payrolls chg 431k 0k into sellers above 0.6900 on the day while AUD should meet resistance into 0.8500.

Jun Private Payrolls chg 41k 180k

Jun Unemployment Rate 9.7% 9.9%

May Factory Orders 1.2% –0.8% Imre Speizer, Senior Market Strategist, NZ, Ph: (04) 470 8266

Eur May PPI %yr 2.8% 3.1% With contributions from Westpac Economics

Westpac Banking Corporation ABN 33 007 457 141 incorporated in Australia (NZ division). Information current as at 1 July 2010. All customers please note that this information has been prepared without taking account of your objectives,

financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Australian customers can obtain Westpac’s financial services

guide by calling +612 9284 8372, visiting www.westpac.com.au or visiting any Westpac Branch. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts

no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac

is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and

regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. © 2010 Westpac Banking Corporation. Past

performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable,

the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

You might also like

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- Westpack AUG 05 Mornng ReportDocument1 pageWestpack AUG 05 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 05 Mornng ReportDocument1 pageWestpack JUL 05 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 28 Mornng ReportDocument1 pageWestpack JUN 28 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 09 Mornng ReportDocument1 pageWestpack JUL 09 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 18 Mornng ReportDocument1 pageWestpack JUN 18 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 29 Mornng ReportDocument1 pageWestpack JUN 29 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 02 Mornng ReportDocument1 pageWestpack JUL 02 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 28 Mornng ReportDocument1 pageWestpack JUL 28 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 03 Mornng ReportDocument1 pageWestpack AUG 03 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 08 Mornng ReportDocument1 pageWestpack JUL 08 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 09 Mornng ReportDocument1 pageWestpack AUG 09 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 04 Mornng ReportDocument1 pageWestpack AUG 04 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 15 Mornng ReportDocument1 pageWestpack JUL 15 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 20 Mornng ReportDocument1 pageWestpack JUL 20 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 16 Mornng ReportDocument1 pageWestpack JUN 16 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 29 Mornng ReportDocument1 pageWestpack JUL 29 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 21 Mornng ReportDocument1 pageWestpack JUL 21 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 26 Mornng ReportDocument1 pageWestpack JUL 26 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 12 Mornng ReportDocument1 pageWestpack JUL 12 Mornng ReportMiir ViirNo ratings yet

- JUN 08 Westpack Morning ReportDocument1 pageJUN 08 Westpack Morning ReportMiir ViirNo ratings yet

- Westpack JUN 22 Mornng ReportDocument1 pageWestpack JUN 22 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 24 Mornng ReportDocument1 pageWestpack JUN 24 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 15 Mornng ReportDocument1 pageWestpack JUN 15 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 06 UOB Global MarketsDocument2 pagesAUG 06 UOB Global MarketsMiir ViirNo ratings yet

- Westpack JUN 21 Mornng ReportDocument1 pageWestpack JUN 21 Mornng ReportMiir ViirNo ratings yet

- Jyske Bank Jul 28 em DailyDocument5 pagesJyske Bank Jul 28 em DailyMiir ViirNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- AUG 05 UOB Global MarketsDocument2 pagesAUG 05 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Inside Debt: Markets Today Chart of The DayDocument6 pagesInside Debt: Markets Today Chart of The Dayitein74No ratings yet

- 09022024tda NamDocument9 pages09022024tda Nambright.sock2093No ratings yet

- Cacib FX DailyDocument5 pagesCacib FX DailyNova AnnuristianNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument6 pagesInside Debt: U.S. Markets Today Chart of The DayBoris MangalNo ratings yet

- Promising US Data: Morning ReportDocument3 pagesPromising US Data: Morning Reportnaudaslietas_lvNo ratings yet

- Ashmore Weekly Commentary 5 Jan 2024Document3 pagesAshmore Weekly Commentary 5 Jan 2024bagus.dpbri6741No ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- US Fed Between A Stock and A Bond Place 100810Document4 pagesUS Fed Between A Stock and A Bond Place 100810tuyetnt20016337No ratings yet

- WEEK 48 - DAILY For December 2, 2010Document2 pagesWEEK 48 - DAILY For December 2, 2010JC CalaycayNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- Downtrend Over... Question MarkDocument3 pagesDowntrend Over... Question MarkJustinC.PaoliniNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- Jyske Bank Aug 02 em DailyDocument6 pagesJyske Bank Aug 02 em DailyMiir ViirNo ratings yet

- Fixed Income Report: Global Market UpdateDocument4 pagesFixed Income Report: Global Market UpdateWinston FieroNo ratings yet

- July 3 The Small-Cap BeatDocument6 pagesJuly 3 The Small-Cap BeatStéphane Solis100% (2)

- G10 FX Week Ahead: Tailgating Treasury YieldsDocument8 pagesG10 FX Week Ahead: Tailgating Treasury YieldsrockieballNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoNo ratings yet

- JUL 15 DanskeDailyDocument3 pagesJUL 15 DanskeDailyMiir ViirNo ratings yet

- Market Outlook: Dealer's DiaryDocument21 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- Dollar Rally Looks For Fuel - Can Nfps Carry The Bull Run?: Wise Money IndiaDocument5 pagesDollar Rally Looks For Fuel - Can Nfps Carry The Bull Run?: Wise Money IndiakrahulsoniNo ratings yet

- Market Investopedia Report 18th June 2024Document9 pagesMarket Investopedia Report 18th June 2024tanmay agrawalNo ratings yet

- Monitor Markets 20230908Document2 pagesMonitor Markets 20230908Kicki AnderssonNo ratings yet

- Household Debt A Concern For The Riksbank: Morning ReportDocument4 pagesHousehold Debt A Concern For The Riksbank: Morning Reportnaudaslietas_lvNo ratings yet

- USI Daily Report 31july2014 PDFDocument6 pagesUSI Daily Report 31july2014 PDFMyesha DigoNo ratings yet

- Your Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersFrom EverandYour Next Great Stock: How to Screen the Market for Tomorrow's Top PerformersRating: 3 out of 5 stars3/5 (1)

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- Adaro 'Caplok' Bukit Enim Energy US $ 46 Million: TranslateDocument1 pageAdaro 'Caplok' Bukit Enim Energy US $ 46 Million: TranslatemdshoppNo ratings yet

- The Economy of Pakistan Is The 23rd Largest in The World in Terms of Purchasing Power ParityDocument3 pagesThe Economy of Pakistan Is The 23rd Largest in The World in Terms of Purchasing Power ParityasadNo ratings yet

- Study4Success: Banking Abbreviations For ExamsDocument7 pagesStudy4Success: Banking Abbreviations For ExamsSuraj RoyNo ratings yet

- Customer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument5 pagesCustomer No.: 21058097 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresskiran gangurdeNo ratings yet

- Eco 502 Assignment - Mahamud Hoq 19364071Document2 pagesEco 502 Assignment - Mahamud Hoq 19364071NAVID ANJUM KHANNo ratings yet

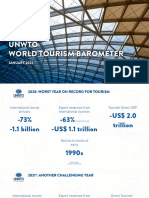

- Unwto World Tourism Barometer: JANUARY 2022Document16 pagesUnwto World Tourism Barometer: JANUARY 2022Hugo SousaNo ratings yet

- India Economics - Global Trade Thematic-020419Document13 pagesIndia Economics - Global Trade Thematic-020419nandu2002002No ratings yet

- Networth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) ReferenceDocument3 pagesNetworth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) Referencesamraju1No ratings yet

- Budget Direct 2019 Singapore Tourism StatisticsDocument3 pagesBudget Direct 2019 Singapore Tourism StatisticsBudget DirectNo ratings yet

- The Globalization of World EconomyDocument2 pagesThe Globalization of World EconomyAllysa LeanNo ratings yet

- Analisis Faktor-Faktor Yang Memotivasi Manajemen PerusahaanDocument16 pagesAnalisis Faktor-Faktor Yang Memotivasi Manajemen PerusahaanFernandus gultomNo ratings yet

- (Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Document2 pages(Sem.-VI) Examination Oct - Nov.-2019 Indian Economy - (NEW)Manoj ValaNo ratings yet

- Seminar Paper On KIIFBDocument4 pagesSeminar Paper On KIIFBAthiraNo ratings yet

- ThailandDocument2 pagesThailandAra VampsNo ratings yet

- ECO 403 Ass 01Document2 pagesECO 403 Ass 01Ghazanfar AliNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanManish ChawdaNo ratings yet

- Balance of Payment of PakistanDocument27 pagesBalance of Payment of PakistanAwais AwanNo ratings yet

- Tasmac RTIDocument4 pagesTasmac RTIAarya BandaruNo ratings yet

- OpTransactionHistoryTpr02 08 2022Document46 pagesOpTransactionHistoryTpr02 08 2022sanket enterprisesNo ratings yet

- Assignment 2Document1 pageAssignment 2Sha HerNo ratings yet

- GST InvoiceDocument1 pageGST InvoiceAfzal WasimNo ratings yet

- Internationalisation Strategies 1Document21 pagesInternationalisation Strategies 1mohammad AliNo ratings yet

- JAMJOOM METAL INDUSTRIES Fabrication of Metal INDUSTRIAL GOODSDocument1 pageJAMJOOM METAL INDUSTRIES Fabrication of Metal INDUSTRIAL GOODSmeshar alsiyani100% (1)

- PPT Manajemen Pemerintahan TATIKDocument7 pagesPPT Manajemen Pemerintahan TATIKanjasNo ratings yet

- Market Report Manish ShitlaniDocument22 pagesMarket Report Manish ShitlanimanisjiNo ratings yet

- Bab Ii Tinjauan Teori: Type Level of Development CharateristicsDocument2 pagesBab Ii Tinjauan Teori: Type Level of Development CharateristicsInggritia Safitri mNo ratings yet

- Business 10 Chapter 4 Part 2Document15 pagesBusiness 10 Chapter 4 Part 2cecilia capiliNo ratings yet

- Principles and Practices of Banking: Bharathi SunagarDocument20 pagesPrinciples and Practices of Banking: Bharathi Sunagarbharathi.sunagar5389No ratings yet

- GST Notes For ExamDocument2 pagesGST Notes For ExamShivajee SNo ratings yet