Professional Documents

Culture Documents

My Doc 2016 V4

My Doc 2016 V4

Uploaded by

ashokdb2kOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

My Doc 2016 V4

My Doc 2016 V4

Uploaded by

ashokdb2kCopyright:

Available Formats

News Release

Olam International reports S$20.5 million PATMI for Q3 2016

PATMI and Operational PATMI for 9M 2016 up 61.2% and 2.3% year-on-year to

S$249.1 million and S$261.4 million respectively

Q3 2016 PATMI and Operating PATMI (excluding exceptional items) down 8.6% and

20.2% year-on-year respectively to S$20.5 million

EBITDA in 9M 2016 and Q3 2016 up 3.4% and 7.7% year-on-year to S$853.9 million

and S$205.5 million respectively, supported by strong growth from Confectionery &

Beverage Ingredients and Food Staples & Packaged Foods segments

Net operating cash flow of S$812.6 million in 9M 2016 more than doubled; FCFF

negative at S$150.5 million mainly on higher Capex

Consolidated

Financial Results

for the period ended

Sept 30 (S$ million)

9M 2016

Volume ('000 MT)

Revenue

9M 2015

1

Restated

%

Change

Q3 2016

Q3 2015

Restated

%

Change

10,205.5

8,814.3

15.8

3,757.9

3,227.7

16.4

14,480.7

13,604.2

6.4

4,738.0

4,471.5

6.0

EBITDA

853.9

825.8

3.4

205.5

190.9

7.7

PAT

236.0

140.5

68.1

15.0

15.9

(5.5)

PATMI

249.1

154.6

61.2

20.5

22.5

(8.6)

Operational PATMI

261.4

255.6

2.3

20.5

25.7

(20.2)

Singapore, November 14, 2016 Olam International Limited (Olam, the Group, or the

Company) today reported financial results for the quarter (Q3 2016) and nine months (9M

2016) ended September 30, 2016.

For Q3 2016, Olam reported an 8.6% decrease in Profit After Tax and Minority Interest

(PATMI) year-on-year to S$20.5 million, on higher depreciation and amortisation charges

despite higher operating profit. Operational PATMI declined by S$5.2 million or 20.2% to

S$20.5 million.

Prior period financial statements have been restated due to changes to accounting standards pertaining to

Agriculture (SFRS 41) and Property, Plant and Equipment (SFRS 16) that came into effect from January 1, 2016.

Please refer to the Management Discussion and Analysis report for more information.

Page 1 of 6

News Release

Operating profit improved with Earnings Before Interest, Tax, Depreciation, and Amortisation

(EBITDA) up by 7.7% to S$205.5 million on the back of strong performance from

Confectionery & Beverage Ingredients and Food Staples & Packaged Foods, which offset

declines in other business segments.

Net finance costs were down to S$100.5 million on initiatives taken to optimise loan tenures

and reduce borrowing costs while taxes were lower at S$7.5million due to a change in the

geographical mix of earnings.

Sales volumes were up 16.4% as all segments except Confectionery & Beverage

Ingredients showed growth. Revenues rose by 6.0% as lower prices for some commodities

offset the higher volumes.

For 9M 2016, Olam reported a 61.2% increase in PATMI to S$249.1 million due to lower

exceptional losses from buying back high priced bonds (9M 2016: S$12.3 million; 9M 2015:

S$101.0 million). Operational PATMI was up 2.3% at S$261.4 million.

EBITDA grew 3.4% year-on-year to S$853.9 million and was driven by growth from the

Confectionery & Beverage Ingredients and Food Staples & Packaged Foods businesses,

which offset lower contribution from other segments.

Despite higher overall debt, net finance costs fell from S$327.6 million in 9M 2015 to

S$291.6 million in 9M 2016 as a result of the initiatives to optimise loan tenures and reduce

borrowing costs.

Sales volumes increased 15.8% as all segments registered higher volumes. Revenues grew

6.4% year-on-year as lower prices for some commodities offset the impact of higher

volumes.

Olam recorded substantially higher net operating cash flow of S$812.6 million in 9M 2016,

more than double the S$322.3 million from the previous corresponding period. However, this

was offset by a significant increase in net capital expenditure from the acquisition of wheat

milling assets from BUA Group, Brooks Peanut Company (Brooks) and continued

investments in upstream and midstream assets, resulting in negative Free Cash Flow to

Firm (FCFF) of S$150.5 million.

Net gearing as at September 30, 2016 was 1.87 times, within the Groups gearing target of

around 2.0 times.

Page 2 of 6

News Release

M&A and Strategic Partnership with Mitsubishi Corporation

In Q3 2016, in addition to Brooks, the Group completed the following acquisitions:

- Palm and palm oil assets from SIAT Gabon for US$24.6 million through 60.0%

owned joint venture Olam Palm Gabon

- Remaining 50.0% in Acacia Investments (palm refining assets in Mozambique) for

US$24.0 million

Post Q3 2016, it acquired 100.0% of East African coffee specialist Schluter S.A. for US$7.5

million.

The Groups 30:70 joint venture with strategic partner Mitsubishi Corporation, MC Agri

Alliance, commenced operations on October 1, 2016. The joint venture imports and

distributes coffee, cocoa, sesame, edible nuts, spices, vegetable ingredients and tomato

products for the Japanese market.

Olams Co-Founder and Group CEO Sunny Verghese said: Our differentiated strategy

has enabled us to deliver improved performance year-to-date under challenging conditions.

We continue to explore selective opportunities in our prioritised platforms, while remaining

focused on ensuring the performance of our gestating assets.

Olams Executive Director and Group COO, A. Shekhar said: We have taken several

steps during the quarter to further strengthen our balance sheet, including a benchmark

perpetual bond issuance, tap of our senior bonds and refinancing of our syndicated loans.

Page 3 of 6

News Release

Segmental Review

Q3 2016

Segment

Sales Volume

Q3 2015

Q3 2016

Restated

Revenue

Q3 2015

Q3 2016

Restated

Edible Nuts, Spices &

416.7

331.2

985.6

Vegetable Ingredients

Confectionery &

324.6

326.0

1,435.9

Beverage Ingredients

Food Staples &

2,558.5

2,223.7

1,497.5

Packaged Foods

Food Category

3,299.8

2,880.9

3,919.0

Industrial Raw

458.2

346.8

819.0

Materials

Commodity Financial

N.A.

N.A.

Services

Non-Food Category

458.2

346.8

819.0

Total

3,757.9

3,227.7

4,738.0

Volume in 000 metric tonnes; Revenue & EBITDA in S$ million

EBITDA

Q3 2015

Q3 2016

Restated

1,140.9

65.0

90.3

1,361.3

68.6

42.2

1,352.1

60.0

31.1

3,854.3

193.6

163.6

616.8

11.8

16.1

0.3

0.1

11.2

11.9

205.5

27.3

190.9

617.1

4,471.5

9M 2016

Segment

Edible Nuts, Spices &

Vegetable Ingredients

Confectionery &

Beverage Ingredients

Food Staples &

Packaged Foods

Food Category

Industrial Raw

Materials

Commodity Financial

Services

Non-Food Category

Total

Sales Volume

9M 2015

9M 2016

Restated

Revenue

9M 2015

9M 2016

Restated

EBITDA

9M 2015

9M 2016

Restated

1,148.6

1,085.5

2,757.0

3,106.6

244.1

327.5

1,308.0

1,216.3

5,493.2

4,903.1

266.1

185.4

6,461.0

5,481.4

4,082.5

3,647.7

225.6

163.9

8,917.6

7,783.2

12,332.7

11,657.4

735.8

676.8

1,287.8

1,031.0

2,148.1

1,946.4

117.0

129.6

N.A.

N.A.

0.3

1.0

19.1

1,287.8

1,031.0

2,148.1

1,946.7

118.0

148.7

10,205.5

8,814.3

14,480.7

13,604.2

853.9

825.8

Volume in 000 metric tonnes; Revenue & EBITDA in S$ million

The Edible Nuts, Spices & Vegetable Ingredients segment saw volumes increase by

5.8% in 9M 2016, as higher peanut volumes, helped by the consolidation of Brooks, and

higher cashew volumes compensated for the reduced tomato paste volume. However,

revenues were lower by 11.3% mainly on account of lower almond and tomato paste prices.

EBITDA declined by 25.5% on lower contribution from the almond business and tomato

processing operations, which offset gains in other businesses.

Page 4 of 6

News Release

The Confectionery & Beverage Ingredients segment recorded a 7.5% increase in volumes

primarily on the consolidation of results for the acquired Cocoa Processing assets, although

this was partially offset by lower supply chain volumes on adverse weather impact on cocoa

beans in West Africa. Revenues grew 12.0% on the back of higher sales volumes and higher

prices for both Cocoa and Coffee. EBITDA increased 43.5% aided by Cocoa recording

better year-on-year performance due to the results of the acquired Cocoa Processing

assets. Coffee also saw better performance from both green coffee supply chain and soluble

coffee operations.

Food Staples & Packaged Foods volumes were 17.9% higher mainly because of higher

wheat milling volumes following the acquisition of BUA Groups wheat milling assets in

Nigeria, as well as higher volumes from Grains origination and export operations and in Rice

trading. As a result of the higher volumes, revenue increased 11.9% even as prices for Rice,

Palm and Dairy declined during the period. EBITDA grew 37.6% due to improved

performance across most platforms, except Packaged Foods, where performance was

affected by ongoing currency volatility and disruption of its dairy and beverage juice

production in Nigeria following a plant fire in April 2016.

The Industrial Raw Materials segment delivered 24.9% growth in volumes on higher Cotton

volumes in 9M 2016. Revenues rose 10.4% as cotton prices increased along with higher

volumes. However, EBITDA declined by 9.7% as lower margins recorded by the Cotton

business offset the increased contribution from SEZ in Gabon.

Commodity Financial Services booked an EBITDA of S$1.0 million compared to S$19.1

million in 9M 2015 due to lower contribution from the market-making and volatility trading

business while the funds business performed well.

Outlook and Prospects

The long-term trends in the agri-commodity sector remain attractive, and Olam is well

positioned to benefit from this as a core global supply chain business with selective

integration into higher value upstream and mid/downstream segments. Olam believes its

diversified and well-balanced portfolio with leadership positions in many segments provides

a resilient platform to navigate current uncertainties in global markets, and continues to

execute on its strategic plan to invest in prioritised platforms between 2016 and 2021.

Issued on behalf of Olam International Limited by: WATATAWA Consulting, 28 Maxwell

Road #03-03 Red Dot Traffic Building Singapore 069120

Page 5 of 6

News Release

For further information, please contact:

Olam Investor Relations

Aditya Renjen, Vice President, +65 66031104, +65 96570339, aditya.renjen@olamnet.com

Chow Hung Hoeng, General Manager, +65 63179471, +65 98346335,

chow.hunghoeng@olamnet.com

WATATAWA Consulting

Simon Pangrazio, Managing Partner, +65 90603513, simon.pangrazio@watatawa.asia

Josephine Chew, Associate Partner, +65 90610353, josephine.chew@watatawa.asia

Notes to Editors

1.

With effect from January 1, 2016, SFRS 16 and 41 have been amended and now require

biological assets that meet the definition of a bearer plant to be accounted for as Property,

Plant and Equipment in accordance with SFRS 16. For more details, please refer to this quarters

Management Discussion and Analysis report.

2.

This release should be read and understood only in conjunction with the full text of Olam

International Limiteds Third Quarter and Nine Months 2016 Financial Statements and

Management Discussion and Analysis lodged on SGX-NET on November 14, 2016.

About Olam International Limited

Olam International is a leading agri-business operating across the value chain in 70 countries,

supplying various products across 16 platforms to over 16,200 customers worldwide. From a direct

sourcing and processing presence in most major producing countries, Olam has built a global

leadership position in many of its businesses. Headquartered in Singapore and listed on the SGX-ST

on February 11, 2005, Olam currently ranks among the top 50 largest listed companies in Singapore

in terms of market capitalisation and is a component stock in the S&P Agribusiness Index and the

DAXglobal Agribusiness Index. In 2016 Fortune recognised Olam at #23 in its Change the World list.

More information on Olam can be found at www.olamgroup.com.

Olam is located at 9 Temasek Boulevard #11-02 Suntec Tower Two Singapore 038989.

Telephone: +65 63394100, Facsimile: +65 63399755.

Page 6 of 6

You might also like

- Bhel InternshipDocument37 pagesBhel InternshipLakshmi Kandula100% (1)

- 70 Ebook Photography Download FreeDocument3 pages70 Ebook Photography Download Free-roger Ron Taylor-100% (3)

- Training Doc Mercedes 900Document195 pagesTraining Doc Mercedes 900mliugong98% (41)

- Olam International Reports 26.6% Growth in PATMI For Q1 2017Document4 pagesOlam International Reports 26.6% Growth in PATMI For Q1 2017ashokdb2kNo ratings yet

- Year Ended 51Document24 pagesYear Ended 51ashokdb2kNo ratings yet

- In Brief 2009-10 - EDocument10 pagesIn Brief 2009-10 - EJulian VarelaNo ratings yet

- JBS Institutional Presentation Including 2015 ResultsDocument26 pagesJBS Institutional Presentation Including 2015 ResultsJBS RINo ratings yet

- Result Y15 Doc3Document6 pagesResult Y15 Doc3ashokdb2kNo ratings yet

- 28feb2019 NewsRelease 4QFY2018Document5 pages28feb2019 NewsRelease 4QFY2018AlezNgNo ratings yet

- Excluding Exceptional Gains, Olam's H1 FY2010 Core Earnings Grew 39.1%Document7 pagesExcluding Exceptional Gains, Olam's H1 FY2010 Core Earnings Grew 39.1%ouerdienNo ratings yet

- 2015Document178 pages2015Syrel SantosNo ratings yet

- Olam International Reports 28.5% PATMI Growth For Q2 2017: News ReleaseDocument5 pagesOlam International Reports 28.5% PATMI Growth For Q2 2017: News Releaseashokdb2kNo ratings yet

- Urc PDFDocument178 pagesUrc PDFJanuaryNo ratings yet

- Tiger BrandsAnnual Financial Results November 2011Document20 pagesTiger BrandsAnnual Financial Results November 2011anon_470778742No ratings yet

- 15nov2017 NewsRelease 3QFY2017Document5 pages15nov2017 NewsRelease 3QFY2017ashokdb2kNo ratings yet

- 1Q16 Earnings PresentationDocument18 pages1Q16 Earnings PresentationJBS RINo ratings yet

- Wilmar Results News ReleaseDocument6 pagesWilmar Results News ReleaseNorol IslamiNo ratings yet

- News Release: Strong Start To The YearDocument5 pagesNews Release: Strong Start To The Yearalberto micheliniNo ratings yet

- Olam International Significantly Improves PATMI To S$351.3 Million For 2016Document6 pagesOlam International Significantly Improves PATMI To S$351.3 Million For 2016ashokdb2kNo ratings yet

- 1Q14 PresentationDocument21 pages1Q14 PresentationJBS RINo ratings yet

- 2Q14 PresentationDocument28 pages2Q14 PresentationJBS RINo ratings yet

- BC - PRR 9 Month Fy2015 16 en Final 0Document5 pagesBC - PRR 9 Month Fy2015 16 en Final 0alberto micheliniNo ratings yet

- giám sát chiến lượcDocument25 pagesgiám sát chiến lượcDiệu Anh ChiinsNo ratings yet

- Year Ended 53Document24 pagesYear Ended 53ashokdb2kNo ratings yet

- DemonstraDocument88 pagesDemonstraJBS RINo ratings yet

- Bega Cheese Annual Report 2015Document92 pagesBega Cheese Annual Report 2015Princess JoyNo ratings yet

- Press Release enDocument8 pagesPress Release enShoaib AzamNo ratings yet

- 9 Mths Ended 31 MarDocument42 pages9 Mths Ended 31 Marashokdb2kNo ratings yet

- ITC - HDFC Securities - May 2011Document6 pagesITC - HDFC Securities - May 2011Arpit TripathiNo ratings yet

- Dabur Investor Presentation 2011Document22 pagesDabur Investor Presentation 2011atewarigrNo ratings yet

- FMA Assignment 1Document11 pagesFMA Assignment 1naconrad1888No ratings yet

- Interim Financial Results: For The Six Months Ended 31 December 2006Document2 pagesInterim Financial Results: For The Six Months Ended 31 December 2006LungisaniNo ratings yet

- Quarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginDocument19 pagesQuarterly Release: Klabin's Quarter Profit Up 58% With Steady EBITDA MarginKlabin_RINo ratings yet

- BRF - Deutsche Paris Jun15Document30 pagesBRF - Deutsche Paris Jun15PedroShawNo ratings yet

- Callebaut Annual Report 2009Document140 pagesCallebaut Annual Report 2009Cristian VasilescuNo ratings yet

- ACI LimitedDocument6 pagesACI Limitedtanvir616No ratings yet

- SMFB Fy21 Press Release - SMFB Delivers Strong Performance, Profits Up 40% in 2021Document1 pageSMFB Fy21 Press Release - SMFB Delivers Strong Performance, Profits Up 40% in 2021mac macNo ratings yet

- Recommendation: ProblemDocument2 pagesRecommendation: ProblemThanh TungNo ratings yet

- Quarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Document18 pagesQuarterly Release: Klabin Reports Net Profit of R$ 111 Million in 4Q06, and Reaches R$ 474 Million in 2006Klabin_RINo ratings yet

- Earnings ReleaseDocument8 pagesEarnings ReleaseBVMF_RINo ratings yet

- Earnings Update - Q2FY16 (Company Update)Document9 pagesEarnings Update - Q2FY16 (Company Update)Shyam SunderNo ratings yet

- Consolidated Financial Statements of ILI Q4 2019Document75 pagesConsolidated Financial Statements of ILI Q4 2019chrisjames20036No ratings yet

- Urc 2009 ArDocument128 pagesUrc 2009 ArbluecoldsunsetNo ratings yet

- Osotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisDocument7 pagesOsotspa Public Company Limited: Q4'18 and FY18 Management Discussion & AnalysisEcho WackoNo ratings yet

- Edita Food Industries Reports FY2020 EarningsDocument8 pagesEdita Food Industries Reports FY2020 EarningsHesham ElnggarNo ratings yet

- Management Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)Document25 pagesManagement Report First Quarter 2020 Results: OPERATING HIGHLIGHTS (Continuing Operations)monjito1976No ratings yet

- AngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216Document11 pagesAngelBrokingResearch CadilaHealthcare 3QFY0216RU 240216HitechSoft HitsoftNo ratings yet

- Garanti Securities - Company Reports - ÜLKER BISKÜVI (ULKER)Document28 pagesGaranti Securities - Company Reports - ÜLKER BISKÜVI (ULKER)Владимир СуворовNo ratings yet

- Q2 2014 Earnings Call FINALDocument21 pagesQ2 2014 Earnings Call FINALad9292No ratings yet

- Research Note - Shoprite FY23 Results 220923Document3 pagesResearch Note - Shoprite FY23 Results 220923zaahirahabrahams786No ratings yet

- Competitive and Profitable Growth in Challenging Markets: 2016 Full Year ResultsDocument20 pagesCompetitive and Profitable Growth in Challenging Markets: 2016 Full Year ResultsFouur TrisNo ratings yet

- KeellsFoods Annual Report 2010 2011Document72 pagesKeellsFoods Annual Report 2010 2011Tharindu Madhawa PadmabanduNo ratings yet

- Result Presentation For December 31, 2015 (Result)Document18 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- BM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010Document12 pagesBM&FBOVESPA S.A. Announces Earnings For The Fourth Quarter of 2010BVMF_RINo ratings yet

- Institutional Presentation 3Q15Document43 pagesInstitutional Presentation 3Q15JBS RINo ratings yet

- Result Y15 Doc1Document17 pagesResult Y15 Doc1ashokdb2kNo ratings yet

- FMCG Sector Quarterly Update - Dec2010: Volume Growth Intact, Rising Input Costs A Key ConcernDocument12 pagesFMCG Sector Quarterly Update - Dec2010: Volume Growth Intact, Rising Input Costs A Key ConcernRohit GharatNo ratings yet

- Result Presentation For December 31, 2015 (Result)Document24 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Press Release: Nestlé Reports Full-Year Results For 2021Document15 pagesPress Release: Nestlé Reports Full-Year Results For 2021Anh Thy Nguyễn TrầnNo ratings yet

- D&L Industries 1Q16 Press Release 030316Document3 pagesD&L Industries 1Q16 Press Release 030316Paul Michael AngeloNo ratings yet

- 2Q 2010 Release Eng FinalDocument9 pages2Q 2010 Release Eng FinalAlexander ChesnkovNo ratings yet

- Old Chang Kee LTD - Form Annual Report (Jul-08-2016)Document177 pagesOld Chang Kee LTD - Form Annual Report (Jul-08-2016)aaaaaasdNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets: November 2018From EverandFood Outlook: Biannual Report on Global Food Markets: November 2018No ratings yet

- Q220 HP Inc. Earnings SummaryDocument2 pagesQ220 HP Inc. Earnings Summaryashokdb2kNo ratings yet

- Q222 HP Inc. Earnings SummaryDocument1 pageQ222 HP Inc. Earnings Summaryashokdb2kNo ratings yet

- Q122 HP Inc. Earnings SummaryDocument2 pagesQ122 HP Inc. Earnings Summaryashokdb2kNo ratings yet

- Q121 HP Inc. Earnings Summary FINALDocument2 pagesQ121 HP Inc. Earnings Summary FINALashokdb2kNo ratings yet

- Q322 Earnings SummaryDocument1 pageQ322 Earnings Summaryashokdb2kNo ratings yet

- FY22 HP Inc. Earnings SummaryDocument2 pagesFY22 HP Inc. Earnings Summaryashokdb2kNo ratings yet

- Fact SheetDocument4 pagesFact Sheetashokdb2kNo ratings yet

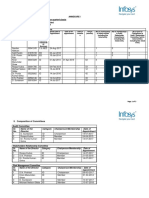

- Composition of Board of Directors: Annexure I Format To Be Submitted by Listed Entity On Quarterly Basis - 30-Jun-2019 IDocument5 pagesComposition of Board of Directors: Annexure I Format To Be Submitted by Listed Entity On Quarterly Basis - 30-Jun-2019 Iashokdb2kNo ratings yet

- q3 Jan12 2023Document3 pagesq3 Jan12 2023ashokdb2kNo ratings yet

- Media Presentation q3 Fy22Document10 pagesMedia Presentation q3 Fy22ashokdb2kNo ratings yet

- Press Release q3 Fy22Document9 pagesPress Release q3 Fy22ashokdb2kNo ratings yet

- Ifrs Inr Press ReleaseDocument7 pagesIfrs Inr Press Releaseashokdb2kNo ratings yet

- HCL Tech Q3 FY22 Investor ReleaseDocument28 pagesHCL Tech Q3 FY22 Investor Releaseashokdb2kNo ratings yet

- Infosys Limited and SubsidiariesDocument56 pagesInfosys Limited and Subsidiariesashokdb2kNo ratings yet

- US GAAP - Financials Dec'2021Document50 pagesUS GAAP - Financials Dec'2021ashokdb2kNo ratings yet

- Wipro Limited: Investor PresentationDocument22 pagesWipro Limited: Investor Presentationashokdb2kNo ratings yet

- q1 Ifrs Usd Earnings ReleaseDocument26 pagesq1 Ifrs Usd Earnings Releaseashokdb2kNo ratings yet

- Additional Information: Ratio AnalysisDocument7 pagesAdditional Information: Ratio Analysisashokdb2kNo ratings yet

- I. Composition of Board of Directors: 1. Name of Listed Entity 2. Quarter EndingDocument8 pagesI. Composition of Board of Directors: 1. Name of Listed Entity 2. Quarter Endingashokdb2kNo ratings yet

- 31.7% Yoy 37.8% Fy 21.1% Q4 21.3% Fy $9.0Bn FyDocument4 pages31.7% Yoy 37.8% Fy 21.1% Q4 21.3% Fy $9.0Bn Fyashokdb2kNo ratings yet

- Ifrs Inr Press ReleaseDocument8 pagesIfrs Inr Press Releaseashokdb2kNo ratings yet

- Infosys To Announce Fourth Quarter and Annual Results On April 20, 2020Document3 pagesInfosys To Announce Fourth Quarter and Annual Results On April 20, 2020ashokdb2kNo ratings yet

- Ifrs Usd Press ReleaseDocument8 pagesIfrs Usd Press Releaseashokdb2kNo ratings yet

- q4 and 12m Fy20 Financial Results AuditorsreportsDocument20 pagesq4 and 12m Fy20 Financial Results Auditorsreportsashokdb2kNo ratings yet

- Solubility Equilibrium HomeworkDocument2 pagesSolubility Equilibrium HomeworkEyayu ZewduNo ratings yet

- Quantitative Interpretation of The Response of Surface Plasmon Resonance Sensors To Adsorbed FilmsDocument13 pagesQuantitative Interpretation of The Response of Surface Plasmon Resonance Sensors To Adsorbed FilmsKaren Régules MedelNo ratings yet

- Drop Tower MQP Final ReportDocument70 pagesDrop Tower MQP Final ReportFABIAN FIENGONo ratings yet

- Vol 3 2451-2468 PedreschiDocument18 pagesVol 3 2451-2468 PedreschiAveksaNo ratings yet

- 132kv, 1200sqmm UNDER GROUND CABLE WORKSDocument4 pages132kv, 1200sqmm UNDER GROUND CABLE WORKSBadhur ZamanNo ratings yet

- M20 LatticeDocument30 pagesM20 LatticeKerwin Cley UgaleNo ratings yet

- Ejercicios PruerbaDocument5 pagesEjercicios PruerbaGato LliviNo ratings yet

- Filter BrochureDocument2 pagesFilter BrochureCanadaPool100% (1)

- Advanced LWRsDocument4 pagesAdvanced LWRsyaprak dönerNo ratings yet

- End-Of-Year Test: ListeningDocument3 pagesEnd-Of-Year Test: ListeningRox Purdea0% (1)

- Assignment2 NamocDocument5 pagesAssignment2 NamocHenry Darius NamocNo ratings yet

- Campbeltown's Kilkerran Gun BatteryDocument2 pagesCampbeltown's Kilkerran Gun BatteryKintyre On RecordNo ratings yet

- Jam Making Process: Stage 1: SelectionDocument2 pagesJam Making Process: Stage 1: Selectionashc2525100% (1)

- Project 1 - School - Architecture Design - HandoutDocument6 pagesProject 1 - School - Architecture Design - Handoutawais anjumNo ratings yet

- Electric Vehicles Case StudyDocument2 pagesElectric Vehicles Case StudyVaibhav RaulkarNo ratings yet

- Motor Circuit Analysis For Energy, Reliability and Production Cost ImprovementsDocument4 pagesMotor Circuit Analysis For Energy, Reliability and Production Cost ImprovementsAmin Mustangin As-SalafyNo ratings yet

- Geography & Resources of The PhilippinesDocument12 pagesGeography & Resources of The PhilippinesPaulAliboghaNo ratings yet

- Fan Heater - B-011 - Data SheetsDocument9 pagesFan Heater - B-011 - Data SheetsNadim Ahmad SiddiqueNo ratings yet

- PTCL Stormfiber Packages - Google SearchDocument1 pagePTCL Stormfiber Packages - Google Searchmachinekicking63No ratings yet

- BWB BrochureDocument5 pagesBWB BrochureUswatul HasanahNo ratings yet

- Direction TestDocument3 pagesDirection TestprascribdNo ratings yet

- Production Planning Control AssignmentDocument13 pagesProduction Planning Control AssignmentdpksobsNo ratings yet

- Adriafil SummerDocument5 pagesAdriafil SummerTatu AradiNo ratings yet

- Assignment 3: Task #1 Has (10 Parts) That Corresponds To CLO # 2 For A Total of 30 PointsDocument2 pagesAssignment 3: Task #1 Has (10 Parts) That Corresponds To CLO # 2 For A Total of 30 PointsWaqas AliNo ratings yet

- Tabel EmisivitasDocument16 pagesTabel EmisivitasImam Bukhori100% (1)

- Lesson Plan Format (Acad)Document4 pagesLesson Plan Format (Acad)Aienna Lacaya MatabalanNo ratings yet

- Agile ManufacturingDocument17 pagesAgile Manufacturingkaushalsingh20No ratings yet