Professional Documents

Culture Documents

Summary Apollo and London Berhad

Summary Apollo and London Berhad

Uploaded by

Edan Kon Hua EnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary Apollo and London Berhad

Summary Apollo and London Berhad

Uploaded by

Edan Kon Hua EnCopyright:

Available Formats

Summary

Accordingly to the current ratio and the quick ratio, Apollo Food Holdings Bhd get a

higher rate for both of the ratio in the measurement of ability to pay back the debt obligation

using current assets for the pass 3 years. There is a vast difference of the ratios between two

companies which Apollo has a very good in performance. All in all, Apollo Food Holdings

Bhd have a better ability to pay the debt obligation compared to London Biscuits Bhd.

In order to generate good revenue, a company should manage their assets well to

generate sales. The total asset turnover and the average collection period for Apollo Food

Holdings Bhd has better performance compared to London Biscuits Bhd. Apollo Food

Holdings Bhd management team had managed their asset very well to generate higher sales

in the past three years. Moreover, both companies had successfully collected their debt

within the stated debt collection period respectively. However, Apollo Food Holdings Bhd is

more confident to collect the debts in shorter time as they have shorter stated debt collection

period. So, Apollo Food Holdings Bhd has a lower risk in incurring bad debts.

According to the profitability ratios, Apollo Food Holdings Bhd has a better result in

the profitability measurement. This mean that Apollo Food Holdings Bhd has a better ability

to generate earnings using their assets and equities. It is more favourable to invest in Apollo

Food Holdings Bhd as they has higher earnings per share which means higher return on every

share invested.

According to the analysis of the debt ratio, London Biscuits Bhd has a higher debt

ratio compared to Apollo Food Holdings Bhd. London Biscuits Bhd has a lower ability to pay

its debts using its assets. For each unit of assets contained higher obligations in London

Biscuits Bhd. Moreover, London Biscuits Bhd has a higher debt-to-equity ratio. They assets

is mainly financed by debts instead of companys equities. London Biscuits Bhd is more

leverage than Apollo Food Holdings Bhd, and this implies greater financial risk at London

Biscuits Bhd. However, both companies are still considered in optimum level in managing

their debts and equities.

According to the free cash flow, Apollo Food Holdings Bhd was performing gradually

better throughout the 3 years, however London Biscuits Bhd do not turn up very well in

performance. Apollo Food Holdings Bhd has a higher ability to pay debts and dividens.

In conclusion, Apollo Food Holdings Bhd performed better in overall compared to

London Biscuits Bhd. It is advisable to invest in Apollo Food Holdings Bhd because of their

better management and the ability to generate returns to the shareholders.

You might also like

- Financial Ratio Analysis AssignmentDocument10 pagesFinancial Ratio Analysis Assignmentzain5435467% (3)

- Jones Electrical DistributionDocument6 pagesJones Electrical DistributionMichelle Rodríguez100% (1)

- Universa Letter April 2020Document8 pagesUniversa Letter April 2020Zerohedge88% (25)

- Informative Speech Outline 05312015Document4 pagesInformative Speech Outline 05312015Laura Rivers100% (1)

- Why Coca-Cola's Dividend Growth Story Is So CompellingDocument2 pagesWhy Coca-Cola's Dividend Growth Story Is So Compellingdrshakthi001No ratings yet

- Conclusion and RecommendationsDocument3 pagesConclusion and RecommendationschayncikoNo ratings yet

- Coca Cola Financial AnalysisDocument8 pagesCoca Cola Financial AnalysisFredrick LiyengaNo ratings yet

- Acc!@@Document2 pagesAcc!@@kjoel.ngugiNo ratings yet

- Business FinanceDocument54 pagesBusiness FinanceMaria LigayaNo ratings yet

- LP Laboratories LTD Financing Working Capital Final Report Google PDFDocument10 pagesLP Laboratories LTD Financing Working Capital Final Report Google PDFSankalp MishraNo ratings yet

- RoeDocument3 pagesRoeShakir AbdullahNo ratings yet

- Ce 351 A2Document12 pagesCe 351 A2IsraelNo ratings yet

- Acccob2 Reflection #1Document8 pagesAcccob2 Reflection #1asiacrisostomoNo ratings yet

- What Is Return On Equity - ROE?Document12 pagesWhat Is Return On Equity - ROE?Christine DavidNo ratings yet

- English Ebook - Ratio Analysis by True Investing PDFDocument23 pagesEnglish Ebook - Ratio Analysis by True Investing PDFJackNo ratings yet

- Financial Evaluation Raymon Zuilan New England College of Business and FinanceDocument4 pagesFinancial Evaluation Raymon Zuilan New England College of Business and FinanceRay ZuilanNo ratings yet

- In-Text Activity Capital StructureDocument6 pagesIn-Text Activity Capital StructureKeana MendozaNo ratings yet

- Capital StructureDocument9 pagesCapital StructureRavi TejaNo ratings yet

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Analysis of Infosys LTDDocument18 pagesAnalysis of Infosys LTDshikhachaudhryNo ratings yet

- Ratio Analysis of Fauji FertilizerDocument6 pagesRatio Analysis of Fauji FertilizersharonulyssesNo ratings yet

- Final Project On Engro FinalDocument27 pagesFinal Project On Engro FinalKamran GulNo ratings yet

- Core Business: Consumable Food and LiquorDocument6 pagesCore Business: Consumable Food and Liquorshahanabbas123No ratings yet

- Ratio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Document22 pagesRatio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Yeasir MalikNo ratings yet

- Springfield Managerial AccountingDocument13 pagesSpringfield Managerial Accountingclassmate100% (1)

- QUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Document3 pagesQUESTION 1 - Evaluate US Tire's Financial Health. How Well Is The Company Performing?Anna KravcukaNo ratings yet

- Report On Liquidity Ratios-1Document38 pagesReport On Liquidity Ratios-1Dalia's TechNo ratings yet

- ACTB212F Introduction To Accounting 2. (1) DocxDocument18 pagesACTB212F Introduction To Accounting 2. (1) DocxUsmän MïrżäNo ratings yet

- Starboard Value Activist - CalgonDocument53 pagesStarboard Value Activist - CalgonCanadianValueNo ratings yet

- Capital Structure of HDFC BankDocument11 pagesCapital Structure of HDFC BankAvinash BeheraNo ratings yet

- Interpretation and Comments Capital StructureDocument2 pagesInterpretation and Comments Capital StructureMarcel JonathanNo ratings yet

- FinanceDocument16 pagesFinanceLiyaana Ahmad100% (1)

- Comparative Financial ReportDocument36 pagesComparative Financial ReportShahada SagorNo ratings yet

- Best Mutual Funds To Invest in 2011: DSPBR Top 100 Equity RegDocument5 pagesBest Mutual Funds To Invest in 2011: DSPBR Top 100 Equity RegSavan KhanparaNo ratings yet

- Return On EquityDocument7 pagesReturn On EquitySyed JawwadNo ratings yet

- Liquidity Ratio Current Ratio Current Assets/Current Liabilities Coca Cola Year ( 000) 2008 2009Document5 pagesLiquidity Ratio Current Ratio Current Assets/Current Liabilities Coca Cola Year ( 000) 2008 2009Michael FernandezNo ratings yet

- InterpretationsDocument2 pagesInterpretationsLaghimaNo ratings yet

- Summery of California Pizza Kitchen CaseDocument1 pageSummery of California Pizza Kitchen CaseAbid Ullah67% (3)

- Business MemoDocument2 pagesBusiness MemotuphamanhstorageNo ratings yet

- Introduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdDocument18 pagesIntroduction To Finance: Course Code: FIN201 Lecturer: Tahmina Ahmed Section: 7 Email: Tahmina98ahmedsbe@iub - Edu.bdTarif IslamNo ratings yet

- Task 1Document10 pagesTask 1Julian KiuNo ratings yet

- Financial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Document17 pagesFinancial Statement Analysis, For Coca Cola Co and Pepsico Inc. Bright Investments Consultancy (Student Name)Shloak AgrawalNo ratings yet

- FM Cia 3Document6 pagesFM Cia 3Priyanshu ChhabariaNo ratings yet

- BWBB 3083 Corporate Banking (Terms Loan)Document11 pagesBWBB 3083 Corporate Banking (Terms Loan)neemNo ratings yet

- Return On Equity: Investing ConceptsDocument9 pagesReturn On Equity: Investing Conceptsapi-555390406No ratings yet

- INFOSYS & INTERGLOBE Return Ratios AnalysisDocument6 pagesINFOSYS & INTERGLOBE Return Ratios AnalysisHari HaranNo ratings yet

- Management Accounting 200819Document21 pagesManagement Accounting 200819Akriti ThakurNo ratings yet

- Vladi FAF Financial ReportDocument4 pagesVladi FAF Financial ReportVladi DimitrovNo ratings yet

- Finance Main AssignmentDocument19 pagesFinance Main AssignmentĐaŋush Ralston Fox67% (3)

- Jollibee Foods CorporationDocument42 pagesJollibee Foods CorporationPierre50% (4)

- Cases in Finance - FIN 200Document3 pagesCases in Finance - FIN 200avegaNo ratings yet

- 2 EditedDocument3 pages2 EditedKANIZ FATEMA KEYANo ratings yet

- Individual Assignment 1 PDFDocument5 pagesIndividual Assignment 1 PDFNanthini KrishnanNo ratings yet

- Financial Forecast-WordDocument1 pageFinancial Forecast-WordPutri NickenNo ratings yet

- Final Presentation On Bank Al-HabibDocument25 pagesFinal Presentation On Bank Al-Habibimran50No ratings yet

- Is GMA 7 UnderleveragedDocument7 pagesIs GMA 7 UnderleveragedRalph Julius VillanuevaNo ratings yet

- Coca Cola Inc and Pepsico IncDocument8 pagesCoca Cola Inc and Pepsico IncmosesNo ratings yet

- Ratio Final ProjectDocument12 pagesRatio Final Projectapi-267012628No ratings yet

- Fundamental Ratio Analysis of Almari: Your NameDocument8 pagesFundamental Ratio Analysis of Almari: Your Nameabdulla mohammadNo ratings yet

- Financial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDDocument17 pagesFinancial Statement and Comparative Analysis at Idbi Federal Insurance Co LTDManikanthBhavirisettyNo ratings yet

- Kota FibresDocument4 pagesKota FibresZhijian HuangNo ratings yet

- Global Reporting InitiativeDocument4 pagesGlobal Reporting InitiativeEdan Kon Hua EnNo ratings yet

- Kitchenware SDN BHD Minutes of The Third Management Committee Meeting Held On Tuesday, 24 May, 2016 at 11a.m. in The Conference RoomDocument3 pagesKitchenware SDN BHD Minutes of The Third Management Committee Meeting Held On Tuesday, 24 May, 2016 at 11a.m. in The Conference RoomEdan Kon Hua EnNo ratings yet

- A Little Story PianoDocument5 pagesA Little Story PianoEdan Kon Hua EnNo ratings yet

- ATTENTION Latest News For Our TripDocument1 pageATTENTION Latest News For Our TripEdan Kon Hua EnNo ratings yet

- Market Efficiency: T C S B D V .3, PP. 959-970Document13 pagesMarket Efficiency: T C S B D V .3, PP. 959-970Citra Permata YuriNo ratings yet

- 15-Composition Levy Scheme PDFDocument3 pages15-Composition Levy Scheme PDFPreet SeepatNo ratings yet

- Overview of Financial AccountingDocument16 pagesOverview of Financial AccountingHarleen KaurNo ratings yet

- FEU Financial ReportDocument183 pagesFEU Financial ReportEdgar L. BajamundiNo ratings yet

- CFA L1 Ethics QuestionsDocument46 pagesCFA L1 Ethics QuestionsMaulik PatelNo ratings yet

- Name of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)Document2 pagesName of The Subject: Financial Management Course Code and Subject Code: CC 203, FM Course Credit: Full (50 Sessions of 60 Minutes Each)pranab_nandaNo ratings yet

- Forward Contract: Derivative Goes DownDocument4 pagesForward Contract: Derivative Goes DownNitinKumarAmbasthaNo ratings yet

- Financial Derivatives: Sessions 1-2Document8 pagesFinancial Derivatives: Sessions 1-2Amit babarNo ratings yet

- At May 2008 IssueDocument68 pagesAt May 2008 IssueTradingSystem100% (1)

- Vale Day - Capex, Iron Ore Market, Partnerships & Cost Cuts - 04dez13 - BBDDocument13 pagesVale Day - Capex, Iron Ore Market, Partnerships & Cost Cuts - 04dez13 - BBDbenjah2No ratings yet

- Private BankingDocument49 pagesPrivate Bankingcamwills2100% (14)

- Financial Management - Chapter 1 NotesDocument2 pagesFinancial Management - Chapter 1 Notessjshubham2No ratings yet

- NY Disclosure Form For Buyer and Seller BuyerDocument2 pagesNY Disclosure Form For Buyer and Seller BuyerPhillip KingNo ratings yet

- Surat Perjanjian FounderDocument10 pagesSurat Perjanjian FounderAndy PermanaNo ratings yet

- Money of The FutureDocument321 pagesMoney of The FutureWeb Financial Group100% (1)

- 5 IIM Graduates Who Quit Job To Become EntrepreneursDocument19 pages5 IIM Graduates Who Quit Job To Become EntrepreneursCharu ModiNo ratings yet

- List of Pfrs 2018Document5 pagesList of Pfrs 2018Myda Rafael100% (1)

- Financial Statement Analysis of Non Financial SectorDocument6 pagesFinancial Statement Analysis of Non Financial SectorTayyaub khalidNo ratings yet

- A Presentation On National Stock ExchangeDocument10 pagesA Presentation On National Stock ExchangeMohit SuranaNo ratings yet

- Spinoff InvestingDocument13 pagesSpinoff InvestingSai TejaNo ratings yet

- NSE Nifty 50 Valuation Report - Educational PurposeDocument13 pagesNSE Nifty 50 Valuation Report - Educational PurposeSumantha SahaNo ratings yet

- An Analysis of Personal Financial Literacy Among College StudentsDocument8 pagesAn Analysis of Personal Financial Literacy Among College StudentsDenny Rakhmad Widi AshariNo ratings yet

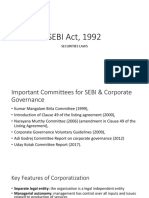

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarNo ratings yet

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangNo ratings yet

- JM Financial Credit Solutions Limited NCDDocument48 pagesJM Financial Credit Solutions Limited NCDVVRAONo ratings yet

- Bayer, G. (1940) - Stock and Commodity Traders' Hand-Book of Trend Determination (66 P.)Document66 pagesBayer, G. (1940) - Stock and Commodity Traders' Hand-Book of Trend Determination (66 P.)w_fib100% (4)

- Basic Accounting ConceptsDocument3 pagesBasic Accounting ConceptsVanSendrel Parate100% (1)

- Fidelity Advisor Retirement Income Services WorksheetDocument8 pagesFidelity Advisor Retirement Income Services WorksheetkbmajmudarNo ratings yet