Professional Documents

Culture Documents

VCT Table 8.6 Funds Raised and Number of VCTs Oct 2016

VCT Table 8.6 Funds Raised and Number of VCTs Oct 2016

Uploaded by

Kelvin MgigaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VCT Table 8.6 Funds Raised and Number of VCTs Oct 2016

VCT Table 8.6 Funds Raised and Number of VCTs Oct 2016

Uploaded by

Kelvin MgigaCopyright:

Available Formats

Venture Capital Trusts 1

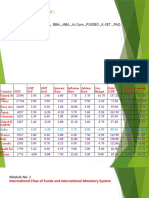

Table 8.6: Amount of funds raised and number of Venture Capital trusts (VCT).

Numbers: actual; Amounts: million

Year

Rate of Income Tax

Relief (%)5

Funds raised 2

VCTs raising funds

in the year3

VCTs managing

funds 4

Amount

Number

Number

1995-96

160

12

12

20

1996-97

170

13

18

20

1997-98

190

16

26

20

1998-99

165

11

34

20

1999-00

270

20

43

20

2000-01

450

38

61

20

2001-02

155

45

70

20

2002-03

70

32

71

20

2003-04

70

31

71

20

2004-05

520

58

98

40

2005-06

780

82

108

40

2006-07

270

32

121

30

2007-08

230

54

131

30

2008-09

150

46

129

30

2009-10

340

68

122

30

2010-11

350

78

128

30

2011-12

325

76

124

30

2012-13

400

65

118

30

2013-14

440

66

97

30

2014-15

435

57

94

30

2015-16

435

43

80

30

6,375

Total

Source : Pricewaterhousecoopers, Allenbridge, Trustnet, Investegate and London Stock Exchange VCTs information and news announcements

1. The data sources are outside the managerial control of HM Revenue & Customs (HMRC) and therefore we cannot ensure

their completeness and quality; hence, this table falls outside the scope of National Statistics.

2. The amount of funds raised by VCTs raising funds in each tax year, rounded to the nearest 5 million.

3. The number of VCTs raising funds in each tax year, consisting of both new VCTs raising funds for the first time and

existing ones raising further funds.

4. The number of VCTs in existence in each tax year.

5. The rate of investors' income tax relief in each tax year; capital gains tax deferral relief was available

until 5 April 2004.

** The totals are not given to avoid duplication of number of VCTs as VCTs can raise funds in multiple tax-years.

Enquiries

Statistical enquiries should be addressed to: Irina Foss VCT Statistics, KAI Direct Business Taxes, HM Revenue & Customs,

Room 2/43,100 Parliament Street, London, SW1A 2BQ.Tel: 03000 586 261, E-mail:

Michael.Mcdaid@hmrc.gsi.gov.uk

For more general enquiries please refer to the HMRC website:

www.hmrc.gov.uk

or contact the Venture Capital Helpline on 0115 974 1250 for general enquiries.

The next update of these tables, with information for 2016-17, will be published on October 17.

You might also like

- Instructor's Manual: Financial Accounting & ReportingDocument337 pagesInstructor's Manual: Financial Accounting & ReportingradioheadddddNo ratings yet

- Walmart's Financial Reporting AnalysisDocument30 pagesWalmart's Financial Reporting AnalysisRabab BI0% (1)

- Stoxx Real EstateDocument11 pagesStoxx Real EstateRoberto PerezNo ratings yet

- 2011 AfmrDocument72 pages2011 AfmrreachernieNo ratings yet

- Ftse 100Document0 pagesFtse 100james22121No ratings yet

- Oati 30 enDocument48 pagesOati 30 enerereredssdfsfdsfNo ratings yet

- Chapter 20 Mutual Fund IndustryDocument55 pagesChapter 20 Mutual Fund IndustryrohangonNo ratings yet

- Intouch December 2 2013Document5 pagesIntouch December 2 2013ArunkumarNo ratings yet

- Venture Capital Trusts Statistics Table 8.6 CommentaryDocument12 pagesVenture Capital Trusts Statistics Table 8.6 CommentaryKelvin MgigaNo ratings yet

- AMSHOLD Report 03710962Document19 pagesAMSHOLD Report 03710962EU UK Data LtdNo ratings yet

- 690 Tables #1Document6 pages690 Tables #1cary_puyatNo ratings yet

- Flash EconomicsDocument7 pagesFlash EconomicsDalila SartorNo ratings yet

- En Presentation Merrill Lynch Oct2011 Presentation Banco SabadellDocument35 pagesEn Presentation Merrill Lynch Oct2011 Presentation Banco SabadellseyviarNo ratings yet

- 002 Homework2 SendDocument15 pages002 Homework2 Sendluis ayalaNo ratings yet

- Economics References Committee: The SenateDocument74 pagesEconomics References Committee: The SenateJuan JoséNo ratings yet

- WEO DataDocument1 pageWEO Datacasarodriguez8621No ratings yet

- Annualreport 2011Document78 pagesAnnualreport 2011DrSues02No ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- Exchequer Final Statement JuneDocument5 pagesExchequer Final Statement JunePolitics.ieNo ratings yet

- Analysis TransCanada Vs EnbridgeDocument3 pagesAnalysis TransCanada Vs EnbridgeJohnGaglianoNo ratings yet

- Facts Fiction and Reform: Neil WarrenDocument11 pagesFacts Fiction and Reform: Neil WarrenamudaryoNo ratings yet

- Aseanas 20140430Document3 pagesAseanas 20140430bodaiNo ratings yet

- Venture Capital FundingDocument40 pagesVenture Capital FundingFortuneNo ratings yet

- Indonesias Economic Outlook 2011Document93 pagesIndonesias Economic Outlook 2011lutfhizNo ratings yet

- Selector December 2010 Quarterly NewsletterDocument26 pagesSelector December 2010 Quarterly Newsletterapi-237451731No ratings yet

- Chapter 1Document15 pagesChapter 1Manjunath BVNo ratings yet

- Report Retrieve ControllerDocument13 pagesReport Retrieve ControllerPetra FaheyNo ratings yet

- North South University: Economic Conditions of Bangladesh During 1972-2019Document16 pagesNorth South University: Economic Conditions of Bangladesh During 1972-2019Shoaib AhmedNo ratings yet

- Vietnam Quant WeeklyDocument13 pagesVietnam Quant WeeklyDuc Ngoc LeNo ratings yet

- Inquirer Briefing by Cielito HabitoDocument47 pagesInquirer Briefing by Cielito Habitoasknuque100% (2)

- 2 - Msci Europe Ex-UkDocument3 pages2 - Msci Europe Ex-UkRoberto PerezNo ratings yet

- UK Airlines' Activity 1997 - 2010Document9 pagesUK Airlines' Activity 1997 - 2010Ola AkandeNo ratings yet

- Isthmus Partners - GCC & UAE Overview - Two Page FlyerDocument2 pagesIsthmus Partners - GCC & UAE Overview - Two Page FlyerMaterhonNo ratings yet

- DDDM07ITA156NWDBDocument2 pagesDDDM07ITA156NWDBnghitran.31211021469No ratings yet

- Morning Report 09oct2014Document2 pagesMorning Report 09oct2014Joseph DavidsonNo ratings yet

- MRE110926Document3 pagesMRE110926naudaslietas_lvNo ratings yet

- CreditSuisse Tenaris 26-05-2011Document10 pagesCreditSuisse Tenaris 26-05-2011stirner_07No ratings yet

- Ranges (Up Till 12.10pm HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 12.10pm HKT) : Currency Currencyapi-290371470No ratings yet

- The Impact of Globalisation On The Australian EconomyDocument8 pagesThe Impact of Globalisation On The Australian EconomyEngr AtiqNo ratings yet

- Nomura European Equity Strategy - August 21 2011 - Worse Than 08Document16 pagesNomura European Equity Strategy - August 21 2011 - Worse Than 08blemishesNo ratings yet

- Chinese PMI Disappoints: Morning ReportDocument3 pagesChinese PMI Disappoints: Morning Reportnaudaslietas_lvNo ratings yet

- Bank of America Merrill Lynch Miami Gems Conference: June 8-10, 2010Document26 pagesBank of America Merrill Lynch Miami Gems Conference: June 8-10, 2010FibriaRINo ratings yet

- Nervous Markets: Morning ReportDocument3 pagesNervous Markets: Morning Reportnaudaslietas_lvNo ratings yet

- Spanish Debt Costs Further Up: Morning ReportDocument3 pagesSpanish Debt Costs Further Up: Morning Reportnaudaslietas_lvNo ratings yet

- Gambling, 2010: Katherine MarshallDocument5 pagesGambling, 2010: Katherine MarshallOpenFileCGYNo ratings yet

- Premarket Technical&Derivative Ashika 30.11.16Document4 pagesPremarket Technical&Derivative Ashika 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Cartels Portrayed 1609 1231262623831807 2Document84 pagesCartels Portrayed 1609 1231262623831807 2rajendra_timilsina2003No ratings yet

- Highlights of Recent Trends in Financial MarketsDocument23 pagesHighlights of Recent Trends in Financial MarketsMuhammed SuhailNo ratings yet

- Daily Trade Journal - 11.03.2014Document6 pagesDaily Trade Journal - 11.03.2014Randora LkNo ratings yet

- FTSE Emerging IndexDocument3 pagesFTSE Emerging IndexjonfleckNo ratings yet

- Ftse 100Document10 pagesFtse 100mikolass22No ratings yet

- Barings To Miami Pension PlanDocument25 pagesBarings To Miami Pension Planturnbj75No ratings yet

- Slightly Tighter Norwegian Credit Standards: Morning ReportDocument3 pagesSlightly Tighter Norwegian Credit Standards: Morning Reportnaudaslietas_lvNo ratings yet

- FT Global 500 December 2008 Market Values and Prices at 31 December 2008Document15 pagesFT Global 500 December 2008 Market Values and Prices at 31 December 2008Páginica CaralibroNo ratings yet

- Beta SecuritiesDocument5 pagesBeta SecuritiesZSNo ratings yet

- June Financial Soundness Indicators - 2007-12Document53 pagesJune Financial Soundness Indicators - 2007-12shakira270No ratings yet

- Avram - RDTSpirit 6Document7 pagesAvram - RDTSpirit 6insan_adNo ratings yet

- Spain & The Fdi: From Net Borrower To Net Creditor: Matilde Madrid Vienna, March 7th 2008Document17 pagesSpain & The Fdi: From Net Borrower To Net Creditor: Matilde Madrid Vienna, March 7th 2008Lina MandarinaNo ratings yet

- InstructionsDocument1 pageInstructionsKelvin MgigaNo ratings yet

- Torrent Downloaded From Glodls - ToDocument1 pageTorrent Downloaded From Glodls - ToKelvin MgigaNo ratings yet

- MWANCHIDocument1 pageMWANCHIKelvin MgigaNo ratings yet

- MilkHygiene4 - MilkDocument37 pagesMilkHygiene4 - MilkKelvin MgigaNo ratings yet

- Enterprisese Investment SchemeDocument2 pagesEnterprisese Investment SchemeKelvin MgigaNo ratings yet

- Developing An Implementation Research Proposal: Session 3: Project PlanDocument15 pagesDeveloping An Implementation Research Proposal: Session 3: Project PlanKelvin MgigaNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- Concept of Working Capital Management: April 2016Document7 pagesConcept of Working Capital Management: April 2016Kelvin MgigaNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- Venture Capital Trusts Statistics Table 8.6 CommentaryDocument12 pagesVenture Capital Trusts Statistics Table 8.6 CommentaryKelvin MgigaNo ratings yet

- Enterprisese Investment SchemeDocument2 pagesEnterprisese Investment SchemeKelvin MgigaNo ratings yet

- IPSAS 23 Related Examples PDFDocument4 pagesIPSAS 23 Related Examples PDFKelvin MgigaNo ratings yet

- F5 Progress Test Answer Question 2Document2 pagesF5 Progress Test Answer Question 2Kelvin MgigaNo ratings yet