Professional Documents

Culture Documents

current account= - capital account 当进口小于出口时, current account surplus, 当进口多于出口时, current account

current account= - capital account 当进口小于出口时, current account surplus, 当进口多于出口时, current account

Uploaded by

Lydia Hu0 ratings0% found this document useful (0 votes)

14 views2 pagesThis document provides an overview of key concepts for FIN 450 Exam 1, including:

1. It defines a multinational corporation and discusses several theories of international trade such as comparative advantage and product cycle theory.

2. It outlines several methods for participating in international trade such as importing/exporting, licensing, franchising, joint ventures, and foreign subsidiaries.

3. It explains how the value of a multinational corporation depends on expected cash flows and exchange rates across countries as well as how the balance of payments works.

Original Description:

Original Title

EXAM 1 review.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of key concepts for FIN 450 Exam 1, including:

1. It defines a multinational corporation and discusses several theories of international trade such as comparative advantage and product cycle theory.

2. It outlines several methods for participating in international trade such as importing/exporting, licensing, franchising, joint ventures, and foreign subsidiaries.

3. It explains how the value of a multinational corporation depends on expected cash flows and exchange rates across countries as well as how the balance of payments works.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagescurrent account= - capital account 当进口小于出口时, current account surplus, 当进口多于出口时, current account

current account= - capital account 当进口小于出口时, current account surplus, 当进口多于出口时, current account

Uploaded by

Lydia HuThis document provides an overview of key concepts for FIN 450 Exam 1, including:

1. It defines a multinational corporation and discusses several theories of international trade such as comparative advantage and product cycle theory.

2. It outlines several methods for participating in international trade such as importing/exporting, licensing, franchising, joint ventures, and foreign subsidiaries.

3. It explains how the value of a multinational corporation depends on expected cash flows and exchange rates across countries as well as how the balance of payments works.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

FIN 450 Exam 1 Review

1. Multinational corporation (MNC)

2. Theory of Comparative Advantage: A

B

3. Imperfect Markets Theory: factors of production (i.e., capital, labor, resources, and land) are

somewhat immobile.

4. Product Cycle Theory: as a firm matures, it recognizes opportunities outside its domestic

market.

5.

International trade: Importing/exporting

Licensing: technology. Airport Starbucks

Franchising: strategy. McDonalds in France

Joint Ventures: Shanghai GM

Acquisitions of existing operations: full control. Daimler-Chrysler

Establishing new foreign subsidiaries

6. Thus, the value of the MNC now depends on Expected cash flows, which now also depend on

international and country-specific economic and political conditions. Expected exchange

rates.

Any changes in these, as well as changes in k due to how volatile cash flows are, will cause the

MNCs value to rise or fall.

7. The Balance of Payments is a summary of transactions between domestic and foreign

residents for a specific country (e.g., U.S.) over a specified period of time (e.g., a quarter,

year).

- Identity: current account= - capital account

- Current Account: summary of flow of funds due to purchases of goods or services (and

the provision of income on financial assets). balance of trade in goods and

services. current account surplus, current account

deficit.

- Capital Account: summary of flow of funds resulting from the sale of assets between one

specified country and all other countries over a specified period of time.

8. Capital account investment

- Direct foreign investment

- Portfolio investmentcross-border purchase of stocks and bonds.

- U.S. capital account is typically in surplus

- Investment has positive implications for the U.S. in the long-term.

9. Factors affecting international trade flows

- Inflation: import increase, current account decreases.

- National income current account decreases

- Government policy

- Exchange rate USD us IM>EX

CA decreases

10. Factors Affecting International Portfolio Investment

- Tax rates on Interest or Dividends

- Interest rate. Hedge funds and mutual funds are now engaged in global search for high

yields. Heavily engaged in the carry trade. The carry trade: borrow currencies that have

low interest rates (JPY) and buy currencies with high interest rates (AUD).

- Exchange rate. If Sony stock increases by 10 percent, but yen weakens by 15, then US

dollar return is (1+0.10)(1-0.15) 1 = -0.065, or -6.5%.

11. Impact of International Flows on U.S. Interest Rates

-

- interest relatively high, high returns, and safer.

- supply of funds increases, interest rate decrease

12. The over the counter Market(OTC) foreign exchange dealer

13. The spot market: largest & most liquid. Immediate delivery.

14. The forward market: major portion of FX market. Forward rate

rate

15. MNCs currency forward hedge against currency risk

16. eurodollar depositany US dollar deposit made anywhere in the world besides the US. It is also

possible to borrow in the eurodollar market (i.e., borrowing in dollars from a bank outside the

US).

17. A eurocurrency deposit is a deposit in any currency made in a bank located outside of the

home country of that currency. For example, depositing Swiss francs in a Singaporean bank.

18. International bonds

- Foreign bonds: issued by borrower that is foreign to the country where the bond is placed.

For example:

- Eurobonds: bonds sold in countries other than the country of the currency denominating

the bond

You might also like

- International Certificate in Wealth and Investment Management Ed1Document356 pagesInternational Certificate in Wealth and Investment Management Ed1Vineet Pratap Singh83% (12)

- Summary of International Political Economy by Thomas OatleyDocument16 pagesSummary of International Political Economy by Thomas Oatleykinza fattimaNo ratings yet

- Mba 204Document3 pagesMba 204True IndianNo ratings yet

- Bop & International Economics LinkagesDocument77 pagesBop & International Economics LinkagesGaurav Kumar100% (2)

- Terms of International FinanceDocument3 pagesTerms of International FinanceShahbaz NoorNo ratings yet

- Balance of PaymentsDocument7 pagesBalance of PaymentsAsim MohammedNo ratings yet

- Topic 9 International MarketsDocument27 pagesTopic 9 International MarketsKelly Chan Yun JieNo ratings yet

- International Financial ManagementDocument16 pagesInternational Financial ManagementShaheen MahmudNo ratings yet

- Tài liệu ĐTQTDocument20 pagesTài liệu ĐTQTHương GiangNo ratings yet

- Definition of International FinanceDocument11 pagesDefinition of International FinanceSuperProNo ratings yet

- Lesson 4GLOBAL FINANCEDocument4 pagesLesson 4GLOBAL FINANCEEloysa CarpoNo ratings yet

- Notes - Balance of PaymentsDocument4 pagesNotes - Balance of PaymentsMeenal SharmaNo ratings yet

- International Financial Management - 2 Credits: Assignment Set-1 (30 Marks)Document10 pagesInternational Financial Management - 2 Credits: Assignment Set-1 (30 Marks)mlnsarmaNo ratings yet

- Lecture 11external SectorDocument21 pagesLecture 11external SectorashwanisonkarNo ratings yet

- Chapter 7Document26 pagesChapter 7Alliyah KayeNo ratings yet

- Chapter - 8 Ifm BY Keerti SarafDocument20 pagesChapter - 8 Ifm BY Keerti SarafkeertisarafNo ratings yet

- 2 Balance of PaymentDocument26 pages2 Balance of PaymentkayeNo ratings yet

- Notes - Balance of PaymentDocument8 pagesNotes - Balance of PaymentHannah Denise BatallangNo ratings yet

- Session 2 - Balance of PaymentsDocument5 pagesSession 2 - Balance of PaymentsRochelle DanielsNo ratings yet

- Unit 1Document19 pagesUnit 1saurabh thakurNo ratings yet

- Chapter 6 InternationalDocument55 pagesChapter 6 Internationalmuudey sheikhNo ratings yet

- ch17. Financial ManagementDocument24 pagesch17. Financial ManagementnurendahNo ratings yet

- IFM BU TheoryDocument68 pagesIFM BU TheoryLukman Nw N BnglrNo ratings yet

- Assignment Reference Material (2020-21) I.B.O.-06 International Business FinanceDocument6 pagesAssignment Reference Material (2020-21) I.B.O.-06 International Business FinanceAnjnaKandariNo ratings yet

- International FinanceDocument39 pagesInternational FinancesrinivasNo ratings yet

- Consumers and TravelersDocument11 pagesConsumers and TravelersRahul AnandNo ratings yet

- Model Question PaperDocument10 pagesModel Question PaperRajesh DmNo ratings yet

- Open Economy Macroeconomics PDFDocument5 pagesOpen Economy Macroeconomics PDFAlans TechnicalNo ratings yet

- I.B Unit 3Document17 pagesI.B Unit 3Nandini SinhaNo ratings yet

- Bhasme NotesDocument13 pagesBhasme NotesRutvik DicholkarNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsMahender TewatiaNo ratings yet

- Ibt Chapter 10Document5 pagesIbt Chapter 10Joules LacsamanaNo ratings yet

- International FinanceDocument47 pagesInternational Financedohongvinh40No ratings yet

- Open Economy MacroeconomicsDocument34 pagesOpen Economy MacroeconomicsvampireedNo ratings yet

- GLOBAL FINANCE WITH E-BANKING (Part 4)Document4 pagesGLOBAL FINANCE WITH E-BANKING (Part 4)Jenina Rose SalvadorNo ratings yet

- FIN 422 (Chapter 2)Document9 pagesFIN 422 (Chapter 2)Sumaiya AfrinNo ratings yet

- Ch.2 - International Flow of FundDocument88 pagesCh.2 - International Flow of FundDavid GeorgeNo ratings yet

- CH 3 International Flow of FundsDocument13 pagesCH 3 International Flow of Fundspagal larkiNo ratings yet

- International Financial ManagementDocument43 pagesInternational Financial Managementirshan amirNo ratings yet

- Sources of International FinancingDocument6 pagesSources of International FinancingSabha Pathy100% (2)

- Ibo-06 2020-21Document13 pagesIbo-06 2020-21arun1974No ratings yet

- Chapter 13 Homework - Group 4Document12 pagesChapter 13 Homework - Group 4Châu Anh TrịnhNo ratings yet

- Module 4 Mon Bsacore6Document5 pagesModule 4 Mon Bsacore6Kryzzel Anne JonNo ratings yet

- MNC Chapter 14Document5 pagesMNC Chapter 14Alis UyênNo ratings yet

- International FinanceDocument8 pagesInternational Financeyatinmehta358No ratings yet

- International Capital Markets - AnkurDocument24 pagesInternational Capital Markets - AnkurRaj K GahlotNo ratings yet

- 6.BA 1 Chapter 06 DPDocument7 pages6.BA 1 Chapter 06 DPDilshansasankayahoo.comNo ratings yet

- International Finance: Unit HighlightsDocument26 pagesInternational Finance: Unit HighlightsBivas MukherjeeNo ratings yet

- MF0006 - AKA-Set 1Document12 pagesMF0006 - AKA-Set 1AmbrishNo ratings yet

- Lecture 2: Canada's Balance of PaymentsDocument4 pagesLecture 2: Canada's Balance of PaymentsmbizhtkNo ratings yet

- International Financial Market and International Monetary SystemDocument6 pagesInternational Financial Market and International Monetary SystemRohainamae aliNo ratings yet

- Homework 8Document4 pagesHomework 8Phương NhiiNo ratings yet

- Foriegn Currency HandoutDocument11 pagesForiegn Currency Handoutdemeketeme2013No ratings yet

- Mirza Nasir Jahan MehdiDocument18 pagesMirza Nasir Jahan MehdiAsad Abbas KhadimNo ratings yet

- ÖrnekSoru IFM MidtermDocument5 pagesÖrnekSoru IFM MidtermMustafa TotanNo ratings yet

- Balance of Payments WorksheetDocument3 pagesBalance of Payments WorksheetPrineet AnandNo ratings yet

- Prayoga Dwi Nugraha - Summary CH 12 Buku 2Document10 pagesPrayoga Dwi Nugraha - Summary CH 12 Buku 2Prayoga Dwi NugrahaNo ratings yet

- Vsip - Info - Finance Chapter 21 5 PDF FreeDocument12 pagesVsip - Info - Finance Chapter 21 5 PDF FreepriyaNo ratings yet

- Balance of PaymentDocument29 pagesBalance of PaymentArafat HossainNo ratings yet

- International Macroeconomics Chapter 3: Open Economy Macroeconomics - Exchange Rates and The Balance of PaymentsDocument9 pagesInternational Macroeconomics Chapter 3: Open Economy Macroeconomics - Exchange Rates and The Balance of PaymentsdkwlNo ratings yet

- Capital Account ConvertibilityDocument15 pagesCapital Account Convertibilitynaveen728No ratings yet

- Tenets of Effective Monetary Policy in The Philippines: Jasmin E. DacioDocument14 pagesTenets of Effective Monetary Policy in The Philippines: Jasmin E. DacioEmeldinand Padilla MotasNo ratings yet

- Foreign Debt, Balance of Payments, and The Economic Crisis of The Philippines in 1983-84Document26 pagesForeign Debt, Balance of Payments, and The Economic Crisis of The Philippines in 1983-84Cielo GriñoNo ratings yet

- TradeDocument18 pagesTradeMiteshwar ManglaniNo ratings yet

- Pakistan Balance of PaymentsDocument94 pagesPakistan Balance of PaymentsHamzaNo ratings yet

- Balance of Payment ECO 415Document6 pagesBalance of Payment ECO 415DaudNo ratings yet

- Macroeconomics 9th Edition Abel Test Bank 1Document38 pagesMacroeconomics 9th Edition Abel Test Bank 1paula100% (49)

- Egypt's External PositionDocument83 pagesEgypt's External Positionmfathy2009No ratings yet

- International Capital MovementDocument37 pagesInternational Capital MovementAnonymous tvdt6znW3No ratings yet

- Notes On ME (2) Unit 1Document16 pagesNotes On ME (2) Unit 1Shashwat SinhaNo ratings yet

- Japan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010Document56 pagesJapan's Balance of Payments For 2009: This Is An English Translation of The Japanese Original Released On March 5, 2010keziavalenniNo ratings yet

- F Bops270613Document8 pagesF Bops270613PALADUGU MOUNIKANo ratings yet

- Answer To In-Class Problem-RijkdomDocument2 pagesAnswer To In-Class Problem-RijkdomnigusNo ratings yet

- Determination of Exchange Rates & Balance of PaymentsDocument15 pagesDetermination of Exchange Rates & Balance of PaymentsBivek DahalNo ratings yet

- Egypt Balance of PaymentDocument7 pagesEgypt Balance of PaymentBram DirgantaraNo ratings yet

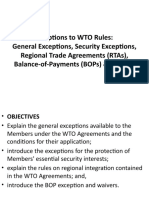

- Exceptions To Wto Rules: General Exceptions, Security Exceptions, Regional Trade Agreements (Rtas), Balance of Payments (Bops) & WaiversDocument35 pagesExceptions To Wto Rules: General Exceptions, Security Exceptions, Regional Trade Agreements (Rtas), Balance of Payments (Bops) & WaiversliyaNo ratings yet

- Progression of FERA To FEMADocument49 pagesProgression of FERA To FEMAMoaaz AhmedNo ratings yet

- SM 9 PDFDocument20 pagesSM 9 PDFROHIT GULATINo ratings yet

- Ebc 29Document7 pagesEbc 29ViplavNo ratings yet

- SEM 3 MA ECO InternationTradeTheory and Policy ENGLISHDocument17 pagesSEM 3 MA ECO InternationTradeTheory and Policy ENGLISHmanwanimuki12No ratings yet

- Bop & International Economics LinkagesDocument77 pagesBop & International Economics LinkagesGaurav Kumar100% (2)

- Forex Reserves IndiaDocument27 pagesForex Reserves IndiaDhaval Lagwankar100% (2)

- Cost Accounting Unit 1Document16 pagesCost Accounting Unit 1archana_anuragiNo ratings yet

- A Counrty Project Report ON Japan in Depth Study of Indian EconomicDocument18 pagesA Counrty Project Report ON Japan in Depth Study of Indian EconomicjbdhoriyaniNo ratings yet

- Financial Markets Case StudyDocument7 pagesFinancial Markets Case StudyKrizel July MoncayNo ratings yet

- MGT 361 Pastyear Exam Questions Chapter 5: Balance of PaymentDocument23 pagesMGT 361 Pastyear Exam Questions Chapter 5: Balance of Paymentmeeya100% (1)

- Currency Exchange Rate and International Trade and Capital FlowsDocument39 pagesCurrency Exchange Rate and International Trade and Capital FlowsudNo ratings yet