Professional Documents

Culture Documents

Derivative Question Sample Paper

Derivative Question Sample Paper

Uploaded by

dhruvg140 ratings0% found this document useful (0 votes)

25 views8 pagesfmk

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfmk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

25 views8 pagesDerivative Question Sample Paper

Derivative Question Sample Paper

Uploaded by

dhruvg14fmk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

Examples for Option:

Ex. 1. The stock price 6 months from the expiration of an option is $42, the exercise price of the option

$340, the risk free interest rate is 10% per annum and the volatility is 20% per annum. This means that

Sy=42, K= 40, 20.1, 0-0.2, T=0.5

=n (42/40) + (0.1 +0.28/2)K0.5_+0.7693

0.2v05

dy=4n 42/40) + (0.1 -0.22/2):0.5

o.2v05

And

ke-'T= 40e~995=38.049

Hence , ifthe option isa European call, its value cis given by

= 42N (0.7693) ~38,049N(0.6278)

Ifthe option is European put, its value pis given by

p=38.049N( -0.6278) — 42N (-0.7693)

Using the polynomial expression just given or the NORMSDIST function in Excel

N (0.7693) =0.7791, N(-0.7693)=0.2209

1N(0.6278)=0.7349, N(-0.6278)=0.2651

So that,

76,

Ignoring the time value of money, the stock price has to rise by $2.76 for the purchaser of the call to

breakeven. Similarly, the stock price has to fall by $2.81 for the purchaser of the put to break even,

Ex. 2. Consider a European call option on a stock when there are ex-dividend dates in two months and

five months. The dividend on each ex-dividend date is expected to be $0.50. The current share price is

$40, the exercise price is $40, the stock price volatility is 30% per annum, the risk free rate of interest is

‘9% per annum, and the time to maturity is six months. The present value of the dividend is:

Ose 09 + 0,5e-04167*0.09_ 9.9741

The option price can therefore be calculated from the Black-Scholes Formula, with

So =40-0.9741=39.0259 , K=40, 10.09 , 0=0.3 and 1-05

,=1n (39.0259/40) + (0.09 + 0.32/2)x0.5 0.2017

0.305

d,=1n (39.0259/40) + (0.0 9 - 0.32/2

03v05

Using the polynomial expression in section 13.9 or the NORMSDIST function in

5800 , Nd

Nay

And from the equation (13.20), the call price is,

3.67 or $3.67

39,0259 x 0.5800 - 40e~%99*95 0.4959

Bx > Calculate the price ofa 3-month European put option on a non-dlvidend paying stock witha strike

Beco a tan the current stock price(s $50, the rik- free interest rate i 10%per annuny and the

volatility is 30%per annum,

Ex 4. What's the price of a European call option on a non-dividend-paying stock when the stock price is

$52, the strike price is $50, the risk-free interest rate is 12%per annum, the voltlity is 30%per annum

‘and the time to maturity is 3 months?

Ex, What is the price of a European put option on a non-dividend-paying stock when the stock price s

$69, the strike price is $70, the risk free interest rate is S%per annum, the volatility is 35%per annum

and the time to maturity is 6 months?

EX6.A call option on a non-dividend-paying stock has a market price of $21/?, The stock price is $15, the

exercise price is $13, the time to maturity is 3 months, and the risk free interest rate is 5%per annum.

What is the implied volatility?

4 ‘GAINS /LOSSES FROM FORWARD HEDGE

RECEIPTS FROM THE BRITISH SALE

SPOTEXCHANE RATE | UNHEDGED POSITION | FORWARD HEDGE | GAIN/LOSSES FROM

ON MATURITY DATE | HEDGE

$1.60 [16,000,000 $14,600,000 -$1,4000,000

Qi. Assume that the spot exchange rate is $1.60per £ on the maturity date of the contract

a) Suppose that in the over the counter market Boeing purchased a put option on 10 million British

£ with an exercise price of $1.46 and a one year expiration. Assume that the option premium

(price) is 0.02 per£. How much will Boeing pay?

Soln: Boeing thus paid $0.02%10 million =$2,00,000.

, This transaction provides Boeing with the right but not the obligation to sell up to £10 million for

; $1.46/€ , regardless of the future spot rate.

b) If the spot exchange rate is $1.30 on the expiration date.

| Soln: Since Boeing has the right to sell $1.46, it will certainly exercise its put option on the fand

convert £10 million into $4.46 million.

i) Now, Boeing paid $2,00,000 upfront for the option and considering the time value of money,

i this upfront cost is:

'$2,00,000x1,061 = $212,200 as of expiration date.

This means that under option hedge, the net $ proceeds from the British sale becomes;

‘$14,600,000- $212,200=$14,387,800

Since Boeing is going to exercise its put option on the pound whenever the future spot exchange

rate falls below the exercise rate of $1.46, itis assured of a “minimum” dollar receipt of

$14,387,800 from the British sale.

.2.(a)Suppose Boeing imported a Rolls-Royce jet engine for £5 million payable in one year with

the following market condition:

The U.S interest rate 6.00% per annum

The U.K interest rate 6.50% per annum

‘The spot exchange rate $1.80/£

‘The forward exchange rate _| $1.75/E(1-year maturity)

If Boeing decides to hedge this payable exposure using a forward contract, it needs to buy £5

On the maturity date of the forward contract , Boeing will receive £5,000,000 from the counter par

the contract in exchange for $8,750,000. Boeing can use 5,000,000 to make payment to Rolls ~Royc

Since Boeing will have £5,000,000 for sure in exchange for a given dollar amount, that is, $8,750,000

fegardiless for the spot exchange rate that may prevail in one year, Boeing's foreign currency payable

fully hedged

(b) ifthe British pound appreciates against the dollar beyond $1.80/€, the strike price of the option

contract

}© exercise its options and purchase £5,000,000 for $9,000,000 i.e

£5,000,000x$1.80/£=$9,000,000

(c)if Boeing decides to use currency options contract to hedge its pound payable, it needs to buy “call

ptions on £5,000,000. Boeing will have to decide on the exercise and strike price for the call options.

We assume that Boeing chooses the exercise price of $1.80/E with a premium of $0.018 per pound.

What would be the total cost of options as of maturity date (considering the time value

Soln: $0.018£5,000,000%1.06-$95,4

(d) if the spot rate on the maturity date turns out to be below its strike price

Soin: Boeing will let the option expire and purchase the pound amount in the spot market. Thus

will be able to secure £5,000,000 for a maximum of $9,0:

$9,000,000+595,000-$9,095,400

Q3: Suppose that the variance of daly returns of a security with B= 1.2, is 8.2. Further, the standard

Geviation of dally returns of an index is 1.7. Calculate the magnitude of risk reduction which complete

hhedging will achieve and the risk faced by the investor with hedging,

Soln : Total risk, var (kj)=8.2

Market risk, 6)? var (ky) = (1.2)2(1.7;

616

Thus, the risk reduction by hedging = 4.1616 and risk faced by investor, non-market risk

8.2-4.1616- 4.0384

G4. A call option involving 200 shares , due to mature, i selling for Rs 3.25 on a share which is seling at

the market at Rs.66. The option has an exercise price equal to Rs.62.

Calculate the net profit.

Soln: Here, the call price is lower than its intrinsic value. An arbitrageur may buy the call for 200 shares

by paying Rs.650 (200x3.25), exercise it and get the shares by paying Rs.12,400.

The 200 shares may be sold immediately in the market to get Rs.13,200.

Hence, it would yield a net profit Rs.13,200 - Rs. 12,400 - Rs.650 = Rs.150.

Q5. Suppose that a call option involving 100 shares is selling for Rs.5.25 when the share price is Rs.64

and exercise price is Rs.60. Calculate the profit.

Soln: here, an arbitrageur can sell the call on 100 shares to receive Rs.525 and buy the shares for

Rs.6400.

When the call, being in-the- money , is exercised, shares can be delivered for Rs.6000. This would result

in an arbitrage profit of

5.6,000+ Rs.525 ~ Rs.Rs.6400 = Rs.125,

S,,and the

Thus, the price of a call on expiration isa function of the share price at the expiration

exercise price, E This is equal to 0 when SE and S,-€ when S,>E.

‘a beta value of 1.17. Suppose that the spot index i

Q6. The manager has a portfolio of Rs.2 lacs, w

1120 and the future price is Rs.1125. Further the future contract has a multiple of 50. How can you use

the stock index futures if

(a) The portfolio beta is decreased to 0.9

(b) The portfolio beta is increased to 1.5,

Soln:

1.17 t0 0.8, the portfolio manager may sell off a portion of

(a) To decrease the portfolio beta from

isk: less securities. if we let the existing portfolio as asset

equities and use the proceeds to buy

and the risk-less security as asset 2, we have,

By=01By ot;

10;f;+(1— :)B2_ (since the new portfolio consist of only two assets)

xisting portfolio or

0.9 ( the desired portfolio beta), fy=1.17(the beta value of the

We have fi,

is being a risk-less asset)

asset 1) and f.

Substituting the known values we get;

0.921; x 1.17

@-«,)0

w, = 0.76923

This implies that a portfolio consisting of Rs.15.3846 lacs , 0.76923 times Rs.20 lacs , invested in three

securities as given above and Rs.20 lacs - Rs.15.3846 lacs = Rs.4.6154 lacs in risk-less securities (T-bills)

would have a beta of 0.9,

Alternatively the manager can sell stock index futures contracts

no.of units of spot position requiring hedging

Number of future contracts to trade=hx a

no.of units underlyimg one futures contract

Here we may beta of the portfolio to serve as h* and take the ratio of the monetary value (rupee value)

Of the spot position to be hedged, and the monetary value of the spot index.

cau

Rupee value of the spot position to be hedged Rs. 4.6154 lacs

Rupee value of one year futures contract = index valuex multiplier

112050=Rs.56,000=R5.0.56 lacs

Number of futures contra a from 1.17 to0.9

iets required to change portfolio be

= 1.17x4.6154/0.56=9.

‘Thus instead of selling Rs.4.6154 lacs ofthe risky equity portfolio, the manager can reduce the beta t

0.9 by selling 9.643 (10) stock index fut

equity stock portfolio by selling the required number of futures to hedge Rs.5.40 lacs of that portfolio.

es . The manager may therefore continue to own the Rs20 lacs

(b) To increase the portfolio beta from 1.17 to 1.50:

Soln: By = B,4(1 — w,))

15 = @4x1.17 + (1 ~ @1)0

, = 1.28205

This implies shorting the risk-less asset T-bills with a market value of 0.28205x20=Rs.5.641 lacs,

So that the total investment in the portfolio of three securities be Rs.25.641 lacs and Rs.5.641,

lacs is borrowed.

The aim of increasing beta to 1.5 can be achieved alternatively by buying stock index future

contracts equivalent to Rs.5.641lacs.

Therefore,

Number of future contracts required to change portfolio beta from

1.17 to 1,50=1.17%5,641/0.56=11.786.

rS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- S. No. City Lounge Name Airport Terminal Airport Name AddressDocument3 pagesS. No. City Lounge Name Airport Terminal Airport Name Addressdhruvg14No ratings yet

- DL 2018 q1 Allinone PDFDocument191 pagesDL 2018 q1 Allinone PDFdhruvg14No ratings yet

- Diners 10X TNC Jan 2021Document5 pagesDiners 10X TNC Jan 2021dhruvg14No ratings yet

- Tax Point Date Description Tax Amount Net Amount: Sgst/UtgstDocument1 pageTax Point Date Description Tax Amount Net Amount: Sgst/Utgstdhruvg14No ratings yet

- DL 160225 q4 Allinone PDFDocument472 pagesDL 160225 q4 Allinone PDFdhruvg14No ratings yet

- TV White Space Regulatory Framework: 2015/SOM2/TEL51/DSG/WKSP1/002Document15 pagesTV White Space Regulatory Framework: 2015/SOM2/TEL51/DSG/WKSP1/002dhruvg14No ratings yet

- Sales LTL Sales Growth At: Up by 14.8% 12.7%Document1 pageSales LTL Sales Growth At: Up by 14.8% 12.7%dhruvg14No ratings yet

- Basic Treasury PDFDocument206 pagesBasic Treasury PDFdhruvg14No ratings yet

- Cost, Risk-Taking, and Value in The Airline IndustryDocument23 pagesCost, Risk-Taking, and Value in The Airline Industrydhruvg14No ratings yet

- Fixed Income: Securities & MarketsDocument57 pagesFixed Income: Securities & Marketsdhruvg14No ratings yet

- Geometry by Total GadhaDocument0 pagesGeometry by Total GadhaRohit Sharma70% (10)

- FMK NotesDocument19 pagesFMK Notesdhruvg14No ratings yet

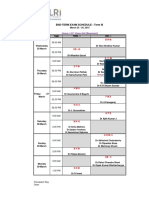

- End-Term Exam Schedule - Term III 2014-16Document1 pageEnd-Term Exam Schedule - Term III 2014-16dhruvg14No ratings yet

- HW 06 CorrectionDocument3 pagesHW 06 Correctiondhruvg14No ratings yet

- The Evolving Brand Logic: A Service-Dominant Logic PerspectiveDocument18 pagesThe Evolving Brand Logic: A Service-Dominant Logic Perspectivedhruvg14No ratings yet