Professional Documents

Culture Documents

Cash Flow Solutions2

Cash Flow Solutions2

Uploaded by

mithun mohanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Solutions2

Cash Flow Solutions2

Uploaded by

mithun mohanCopyright:

Available Formats

Cash Flow Solutions

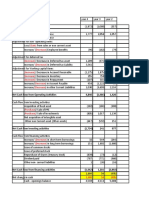

Question 1

Cash flows from operating activities

Profit before taxation and interest 132 2

Adjust for non cash items

Depreciation 39 2

Gain on Disposal (7) 2

32

164

Adjusted Profit

Increase in Inventory (6) 1

Increase in Trade R (2) 1

Increase in Trade P 5 1

Cash generated from operations (3)

161

Interest Paid (19) 2

Tax Paid (32) 2

Dividends paid (31) 1

Net cash inflow from operating activities 79

Cash flows from investing activities

Purchase of vehicles (90) 1

Proceeds from sales 20 1

Investments acquired (20) 1

Interest received 5 1

Net cash used in investing activities (85)

Cash flows from financing activities

Proceeds from share capital 35 1

Proceeds from long term borrowing 8 1

Net cash from financing activities 43

Increase/Decrease in cash 37

Cash and Cash equivalents at start of the period 6

Cash and Cash equivalents at end of the period 43

Workings

Operating profit before taxes and interest 137

Less Int. Rec 5

Operating Profit 132

Interest Paid 20 + 7 8= 19

Tax Paid 35+ 7 -10 = 32

Stock 20- 26 = 6 Increase -ve

Debtors 23 -21 = 2 Increase -ve

Creditors 18- 13 5 Increase +ve

Vehicles = 130 +90 -25 = 195

Gain on Sale (25 -12) = 13m Value Sold 20m 7m gain

Share capital gain + share premium = 32+ 3 = 35

20marks

5 marks

Cash flow shows relationship of liquidity, working capital management , rate

of investment in assets and changes in gearing etc.

Question 2

Cash flows from operating activities

Profit before interest 19,480

Depreciation 1,058

Total Adjusted Profit 20,538

Increase in Stock (inventories) (54)

Decrease in Trade receivables (Debtors) 276

Increase in Trade payables (Creditors) 1,920

Increase/Decrease due to working Capital changes 2,142

Total Cash generated from operations 22,680

Interest Paid (4,280)

Tax Paid (1,750)

Net cash inflow from operating activities 16,650

Cash flows from investing activities

Purchase of non-current assets 7,600

Proceeds from sales of non-current assets

Total Net cash used in investing activities 9,050

Cash flows from financing activities

Proceeds from share capital 1,064

Proceeds from long term borrowing 1,824

*Dividends paid (3,800)

Total Net cash from financing activities (912)

Increase/Decrease in cash 8,138

Cash and Cash equivalents at end of the period 9,838

Cash and Cash equivalents at start of the period 1,700

Shows where cash spent, indicates strategic intentions (acquisitions , assets

purchases etc). Ratio of funding by financing to operating funding.

Question 3

Expenses excluding interest paid = 627,340 9,630 = 617,710

Operating profit = gross profit expenses = 1,118,430 617,710 =

500,720

Cash flow statement 2006

Operating profit 500,720

Add back: depreciation 48,200

548,920

Changes in working capital

Stock increase (367,600 310,040) (57,560)

Debtors decrease 21,880

Creditors decrease (34,340)

Net cash inflow from operating activities 478,900

Explain why the effect of purchasing a fixed asset for cash is not the

same in the cash flow statement as in the profit and loss account

The purchase of a fixed asset for cash involves a cash outflow from

the business for the whole purchase price. This will be reflected as

capital expenditure in the cash flow statement for the year.

However, the fixed asset remains in use in the business.

Depreciation is over the period of its useful life. The original

purchase of the fixed asset has no impact on the profit and loss

account, but the periodic charges for depreciation do have an

impact, in that they reduce profit. The effect of the fixed asset

purchase, therefore, is reflected in a single transaction in one year

in the cash flow statement. However, the profit and loss account is

affected throughout the assets useful life because of the

depreciation charge.

Question 4

Cash flows from operating activities

Profit before interest and tax 22,040

Depreciation 1,289

Total Adjusted Profit 23,329

Increase in Stock (inventories) (36)

Decrease in Trade receivables (Debtors) 268

Increase in Trade payables (Creditors) 2,100

Increase/Decrease due to working Capital changes 2,332

Total Cash generated from operations 25,661

Interest Paid (5,240)

Tax Paid (1,750)

Net cash inflow from operating activities 18,671

Cash flows from investing activities

Purchase of non-current assets

Proceeds from sales of non-current assets 8,400

Investments acquired/Interest Received

Total Net cash used in investing activities 27,071

Cash flows from financing activities

Proceeds from share capital 1,176

Proceeds from long term borrowing (2,016)

*Dividends paid (4,200)

Total Net cash from financing activities (5,040)

Increase/Decrease in cash 22,031

Cash and Cash equivalents at start of the period 23,731

Cash and Cash equivalents at end of the period 1,700

Question 5

Cash flows from operating activities

m m

Profit before taxation 101

Adjust for non cash items

Depreciation 30

Gain on Disposals (5)

25

Total Adjusted Profit 126

Increase in Stock (inventories) (5)

Increase in Debtors (trade receivables) (2)

Increase in Creditors ( trade payables) 1

Increase/Decrease due to Working Capital (6)

Total Cash generated from operations 120

Interest Paid (16)

Tax Paid (29)

Net cash inflow from operating activities 75

Cash flows from investing activities

Purchase of non-current assets (80)

Proceeds from sales of non-current assets 25

Interest Received 4

Total Net cash used in investing activities (51)

Cash flows from financing activities

Proceeds from share capital 12

Proceeds from long term borrowing 5

*Dividends paid (14)

Total Net cash from financing activities 3

Increase/Decrease in cash 27

Cash and Cash equivalents at start of the period 5

Cash and Cash equivalents at end of the period 32

Adjust profits for interest 105 becomes 101

Question 6

Cash flows from operating activities

Profit before taxation (13)

Depreciation 5

Gain on Disposals (1)

Total Adjusted Profit (9)

Increase in Stock (inventories) 20

Increase in Debtors (trade receivables) 13

Increase in Creditors ( trade payables) 8

Increase/Decrease due to working Capital changes 41

Total Cash generated from operations 32

Interest Paid 0

Tax Paid 0

Net cash inflow from operating activities 32

Cash flows from investing activities

Purchase of non-current assets 0

Proceeds from sales of non-current assets 3

Investments acquired/Interest Received 0

Total Net cash used in investing activities 3

Cash flows from financing activities

Proceeds from share capital 0

Proceeds from long term borrowing 0

*Dividends paid 0

Total Net cash from financing activities

Increase/Decrease in cash 35

Cash and Cash equivalents at start of the period 10

Cash and Cash equivalents at end of the period 45

15 marks

Suitable answers will address a range of issues and may include:

Stock Management, Costs of holding (interest, insurance obsolescence),

overproduction, Debtor Management Costs of allowing credit, cost of denying

credit, require policies, monitoring of credit worthiness, bad debts, use of

discounts. Naturally Cash Management Interest loss, policies on cash flow,

overdraft use, limiting the length of OCC Creditor Management Cost of credit,

use of free credit, etc (10 marks)

Question 7

Cash flow statement for the year ended 30 June 2008

Reconciliation of operating profit to net cash inflow from operating

activities

000

Operating profit 115

Depreciation charges 35

Loss on sale of vehicle 3

Decrease in stocks 10

Increase in trade receivables (19)

Decrease in trade payables (7)

Net cash inflow from operating activities 137

Tax paid (52)

85

Cash flows from investing activities

Payments to acquire tangible fixed assets (75)

Receipts from sales of tangible fixed assets 12

(63)

22

Cash flows from financing activities

Proceeds from share capital 0

Proceeds from long term borrowing 0

*Equity dividends paid (20)

Increase in cash 2

Indicates the use of funds during the period.

Should note the changes in working capital, reduced stock levels but

management of debtors and creditors indicative of poor control?

Note these can written along with the tax and interest payments higher

up

You might also like

- DanitaCronkhite1 MT 482 Assignment Unit 7Document10 pagesDanitaCronkhite1 MT 482 Assignment Unit 7leeyaa aNo ratings yet

- M096LON 2122MAYAUG - Exam - QuestionDocument10 pagesM096LON 2122MAYAUG - Exam - QuestionMaya RotonNo ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Informe Kreps Vol 2Document762 pagesInforme Kreps Vol 2franciscopesanteNo ratings yet

- TNL 201712145194201801254Document2 pagesTNL 201712145194201801254Harshit Suri100% (1)

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Cashflows From Operating Activities: Code Profit Before Tax 1Document21 pagesCashflows From Operating Activities: Code Profit Before Tax 1Lâm Ninh TùngNo ratings yet

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Document7 pagesGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahNo ratings yet

- Module 2Document4 pagesModule 2Trúc LyNo ratings yet

- Cash Flow Statement Cashflows From Operations Cash Receipts From CustomersDocument16 pagesCash Flow Statement Cashflows From Operations Cash Receipts From CustomersAfruza Akter MunniNo ratings yet

- Statement of Changes in Financial PositionDocument19 pagesStatement of Changes in Financial Positionankitkhanijo100% (1)

- Fsa On Thi FinalDocument40 pagesFsa On Thi FinaltrangNo ratings yet

- Day 5 - Cash FlowsDocument24 pagesDay 5 - Cash FlowsRehan HabibNo ratings yet

- 2013 04 24 171829 Accounting 504 6q Uestions 1 1Document16 pages2013 04 24 171829 Accounting 504 6q Uestions 1 1jodh26No ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingDocument11 pagesSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Document 42Document5 pagesDocument 42Comm SofianNo ratings yet

- Shell Phil. Financial Statement 2018Document11 pagesShell Phil. Financial Statement 2018Craibeth Cherub GomezNo ratings yet

- Colgate Financial Model UnsolvedDocument27 pagesColgate Financial Model Unsolvedrsfgfgn fhhsdzfgv100% (1)

- Attock Cement 3 Statement ModelDocument67 pagesAttock Cement 3 Statement ModelRabia HashimNo ratings yet

- Desi Angelika AP w3Document11 pagesDesi Angelika AP w3DESI ANGELIKANo ratings yet

- Standardized Financial Statements - SolutionDocument25 pagesStandardized Financial Statements - SolutionanisaNo ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- PBCC ActivitiesDocument25 pagesPBCC ActivitiesykwaiNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Cash Flows From Operating Activites: Operating Profit Beforre Working Capital Changes Net Change inDocument4 pagesCash Flows From Operating Activites: Operating Profit Beforre Working Capital Changes Net Change inDesi HollywoodNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Financial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMDocument27 pagesFinancial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- KKL25Document5 pagesKKL25kalharaeheliyaNo ratings yet

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnNo ratings yet

- Microsoft Financial Data - FY19Q3Document29 pagesMicrosoft Financial Data - FY19Q3trisanka banikNo ratings yet

- Financial Plan For A Start UpDocument12 pagesFinancial Plan For A Start UpNayab ArshadNo ratings yet

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Key Chapter 1Document4 pagesKey Chapter 1duyanh.vinunihanoiNo ratings yet

- FA and FFA Extra MTQs Exam AnswerDocument5 pagesFA and FFA Extra MTQs Exam AnswerAnar ShahNo ratings yet

- Cash-Flow-Statement (1) Marvell TechnologiesDocument5 pagesCash-Flow-Statement (1) Marvell TechnologiesRuthNo ratings yet

- A Reformulation: Intel CorporationDocument15 pagesA Reformulation: Intel Corporationmnhasan150No ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- Comparative Financials Pakistani Rupees in '000 (PKR) 2015: Fixed AssetsDocument19 pagesComparative Financials Pakistani Rupees in '000 (PKR) 2015: Fixed AssetsMuhammad Daniyal HassanNo ratings yet

- Analysis of Cash Flow Statement of Nestle India Ltd. Presented By: Ankit SuranaDocument8 pagesAnalysis of Cash Flow Statement of Nestle India Ltd. Presented By: Ankit SuranaAnkit SuranaNo ratings yet

- Accounting: BasicsDocument18 pagesAccounting: Basicsdany2884bcNo ratings yet

- Infineon Annual Report 2021-153-156Document4 pagesInfineon Annual Report 2021-153-156Ddaeng StudiosNo ratings yet

- Cash Flow Statement-ShortDocument27 pagesCash Flow Statement-ShortLaurene Delos ReyesNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Practice Exam - SolutionsDocument12 pagesPractice Exam - SolutionsSu Suan TanNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- Investment Analysis and Portfolio Management 2012Document61 pagesInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- AnalysisDocument14 pagesAnalysisMaryiam HashmiNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- Interpretation of Final Accounts: Ratio AnalysisDocument25 pagesInterpretation of Final Accounts: Ratio AnalysisNguyễn Hạnh LinhNo ratings yet

- Chapter 5 Solution To Problems and CasesDocument22 pagesChapter 5 Solution To Problems and Caseschandel08No ratings yet

- Modified UCA Cash Flow FormatDocument48 pagesModified UCA Cash Flow FormatJohan100% (1)

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- 2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Document6 pages2020 Sem 1 ACC10007 Discussion Questions (And Solutions) - Topic 3Renee WongNo ratings yet

- 2000 Financial Statements enDocument72 pages2000 Financial Statements enEarn8348No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Final Exam in PP1: Topic: The Difference Between Socialized Housing and Economic HousingDocument17 pagesFinal Exam in PP1: Topic: The Difference Between Socialized Housing and Economic HousingLou PotesNo ratings yet

- Managing Withholding Taxesfor BrazilDocument29 pagesManaging Withholding Taxesfor BrazilLuiz A M V BarraNo ratings yet

- Invoice 44 VishaalDocument1 pageInvoice 44 Vishaalsiva manikandanNo ratings yet

- High Variation in R&D Expenditure by Australian Firms: Department of Industry Tourism and ResourcesDocument20 pagesHigh Variation in R&D Expenditure by Australian Firms: Department of Industry Tourism and ResourcesSayla SiddiquiNo ratings yet

- Functional AreasDocument9 pagesFunctional Areasvasavi thaduvaiNo ratings yet

- Bombay Stamp ActDocument69 pagesBombay Stamp ActAjit BijlaneyNo ratings yet

- Gatchalian V Cir Case DigestDocument1 pageGatchalian V Cir Case DigestfredNo ratings yet

- Juliet Apparels Pvt. LTDDocument1 pageJuliet Apparels Pvt. LTDraj sahil100% (1)

- Inquiry - Radio Holland Middle East LLCDocument8 pagesInquiry - Radio Holland Middle East LLCKarim RamzyNo ratings yet

- Public FinanceDocument48 pagesPublic FinanceJorge Labante100% (1)

- Company Information: Fecto Sugar Mills LimitedDocument30 pagesCompany Information: Fecto Sugar Mills LimitedSyeda Kainat AqeelNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet

- Project GuideDocument22 pagesProject GuideMr DamphaNo ratings yet

- PAKPLAS Magazine 2018 (Low Res)Document172 pagesPAKPLAS Magazine 2018 (Low Res)Yq GillNo ratings yet

- Chap8 PDFDocument63 pagesChap8 PDFFathinus SyafrizalNo ratings yet

- Lto V City of ButuanDocument1 pageLto V City of ButuanPrincess Ayoma0% (1)

- Case 1: Compania General de Tabacos vs. French and Unson G. R. No. L-14027, 1919 FactsDocument29 pagesCase 1: Compania General de Tabacos vs. French and Unson G. R. No. L-14027, 1919 FactsMercy LingatingNo ratings yet

- RPH RevisedDocument22 pagesRPH RevisedElla Mae BasquezNo ratings yet

- Shenzhen SJET Supply Chain Co., LTD. (B) : Information System and The Establishment of An "Ecosystem"Document21 pagesShenzhen SJET Supply Chain Co., LTD. (B) : Information System and The Establishment of An "Ecosystem"max wenNo ratings yet

- Case Digest of CIR v. Aichi ForgingDocument4 pagesCase Digest of CIR v. Aichi ForgingJeng Pion100% (1)

- BODIN & GASS - Exercises For Teaching The Analytic Hierarchy Process PDFDocument21 pagesBODIN & GASS - Exercises For Teaching The Analytic Hierarchy Process PDFAndriantsalamaNo ratings yet

- Quote en My Mttakafulink003 1461858518108Document19 pagesQuote en My Mttakafulink003 1461858518108matnezkhairiNo ratings yet

- Preliminary Assessment NoticeDocument2 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- 1st Sem Syllabus (AgriStudyHub)Document17 pages1st Sem Syllabus (AgriStudyHub)chunnilalmanhare996No ratings yet

- Slip Novo NordiskDocument1 pageSlip Novo Nordiskagus suyantoNo ratings yet

- CH 18 ControlDocument20 pagesCH 18 ControlSameh YassienNo ratings yet

- Salary Slip Aavas March-18Document1 pageSalary Slip Aavas March-18कृष्ण चतुर्वेदी जयरामपुरा0% (2)

- Hul PPT (CTP)Document31 pagesHul PPT (CTP)vedantNo ratings yet