Professional Documents

Culture Documents

Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On April-2010 DGH Prathanashimoga

Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On April-2010 DGH Prathanashimoga

Uploaded by

wilker6Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On April-2010 DGH Prathanashimoga

Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On April-2010 DGH Prathanashimoga

Uploaded by

wilker6Copyright:

Available Formats

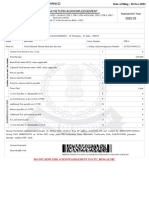

FORM 5

See Rule (11)

Return of tax payable by employer under Sub-section (1) of Section 6 of the Karnataka Tax on

1.Return of tax payable for the month ending April-2010

2.Name of the Employer: dgh

3.Address: prathanaShimoga

4.Registration Certificate No.712221 yytr

No of Employees during the month in respect of whom the tax payable is as

SL. Employees whose Monthly salaries or wages or No. of Employees Rate of Tax per Amount of tax

both are month

1 Rs. 10000 to Rs. 14999 0 0 0

2 Rs. 15000 above 0 0 0

Grand Total 0 0

Amount Paid

Balance 0

Amount paid under challan/Ch.N0./ 17/12/2010 Dated: 2010-12-17

I certify that all the employees who are liable to pay the tax in my emply uring the period of return

I Sri S.GuruRaj solemnly declare that the above statement are true to the best of my knowledge and belief.

Place: gfff

Date: 17/12/2010

You might also like

- Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On February-2010 PrarthanasadsdDocument1 pageReturn of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On February-2010 Prarthanasadsdwilker6No ratings yet

- As 22 With IfrsDocument21 pagesAs 22 With IfrsraunakkrjindalNo ratings yet

- 104-B, STREET 4, EDEN CITY, LAHORE, Lahore Cantonement Muhammad Salman EjazDocument3 pages104-B, STREET 4, EDEN CITY, LAHORE, Lahore Cantonement Muhammad Salman EjazFaizi93No ratings yet

- Tax ReturnDocument3 pagesTax ReturnUsam UlhaqNo ratings yet

- Nidhi Form 16 UpdateDocument3 pagesNidhi Form 16 UpdateAbhinav NigamNo ratings yet

- Form VDocument4 pagesForm VNavaneethakrishnan RangasamyNo ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- Tax Deducted at Source TDSDocument55 pagesTax Deducted at Source TDSDhruv SetiaNo ratings yet

- It Form Page 2Document1 pageIt Form Page 2Yuvi RajNo ratings yet

- Flat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatDocument4 pagesFlat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatferozaNo ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- A-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanDocument2 pagesA-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanAnjum RasheedNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- Kahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Document3 pagesKahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Asif ShahzadNo ratings yet

- Declaration 3820226262117Document4 pagesDeclaration 3820226262117Hafiz QasimNo ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- Aoapk6856n 2019-20 PDFDocument2 pagesAoapk6856n 2019-20 PDFSiva Kumar KNo ratings yet

- Professional Tax Jan 2023 PDFDocument1 pageProfessional Tax Jan 2023 PDFRaghavendra GandodiNo ratings yet

- TDS Ready ReckonerDocument29 pagesTDS Ready ReckonerShivani Singh ChandelNo ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- Pol 129298Document2 pagesPol 129298summu paulNo ratings yet

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Muhammad Aamir AbbasNo ratings yet

- House No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisDocument3 pagesHouse No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisMadiah abcNo ratings yet

- Unit 3: Bad Debts, Allowance For Doubtful Debts, Accruals and PrepaymentsDocument12 pagesUnit 3: Bad Debts, Allowance For Doubtful Debts, Accruals and Prepaymentsyaivna gopee100% (1)

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Declaration4110519073269 - ITR2015Document2 pagesDeclaration4110519073269 - ITR2015Saleemullah PathanNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2022billallahmedNo ratings yet

- Declaration 3520242026177Document3 pagesDeclaration 3520242026177fiaz AhmadNo ratings yet

- Declaration 3310586406613Document4 pagesDeclaration 3310586406613Muhammad WaqasNo ratings yet

- Order 3430259682085Document3 pagesOrder 3430259682085abuzar ranaNo ratings yet

- Chapter 21-Mfrs112 TaxationDocument45 pagesChapter 21-Mfrs112 TaxationNUR ALEEYA MAISARAH BT MOHD NASIRNo ratings yet

- Declaration 1610111025693Document3 pagesDeclaration 1610111025693Muhammad Aamir AbbasNo ratings yet

- Declaration3520115189692 - LahoreDocument5 pagesDeclaration3520115189692 - LahoreFarhan AliNo ratings yet

- Declaration 3430274906183Document4 pagesDeclaration 3430274906183Khokhar MirzaNo ratings yet

- Ponugoti Manga Itr 2022Document4 pagesPonugoti Manga Itr 2022Neduri Kalyan SrinivasNo ratings yet

- Mehreen MansoorDocument5 pagesMehreen MansoorFarhan AliNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- QFS - Afghan Tax SummaryDocument3 pagesQFS - Afghan Tax SummaryAhmad Nadeem MohammadiNo ratings yet

- Medl 40579Document2 pagesMedl 40579Kasaram NaveenNo ratings yet

- Deferred Tax AnalysisDocument12 pagesDeferred Tax AnalysisBHAT SHARMA AND ASSOCIATESNo ratings yet

- Https LMC - Up.nic - in Internet AuthenticatedUser TaxSubmit - Aspx PDFDocument2 pagesHttps LMC - Up.nic - in Internet AuthenticatedUser TaxSubmit - Aspx PDFVivek MishraNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- BillingStatement 364024053214Document2 pagesBillingStatement 364024053214MARY JERICA OCUPENo ratings yet

- Form 16 NikitaDocument3 pagesForm 16 Nikitaravinder singhalNo ratings yet

- Declaration 3120292219185Document4 pagesDeclaration 3120292219185umerkhanNo ratings yet

- Tax StatementDocument3 pagesTax StatementAimen Shoukat 771-FMS/BSAF/S22No ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Zeeshan H. JawadiNo ratings yet

- Concentrix Form 16Document9 pagesConcentrix Form 16Neeraj M.RNo ratings yet

- Flat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatDocument2 pagesFlat No.D2, Yasir View, Gulzar-E-Hijri, Scheme-33, Malir Malir Town Feroza AzmatferozaNo ratings yet

- 00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalDocument3 pages00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalBahawalpur 24/7No ratings yet

- Imamia Jantry 2024Document4 pagesImamia Jantry 2024zahid hussainNo ratings yet

- OuhjDocument6 pagesOuhjFairTax SolutionsNo ratings yet

- Income Tax Payment Challan: PSID #: 42730325Document1 pageIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifNo ratings yet

- Taxguru - In-All About DEFERRED TAX and Its Entry in BooksDocument8 pagesTaxguru - In-All About DEFERRED TAX and Its Entry in Bookskumar45caNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Return of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On February-2010 PrarthanasadsdDocument1 pageReturn of Tax Payable by Employer Under Sub-Section (1) of Section 6 of The Karnataka Tax On February-2010 Prarthanasadsdwilker6No ratings yet

- LeaveBalance ReportDocument1 pageLeaveBalance Reportwilker6No ratings yet

- ESI Monthly StatementDocument1 pageESI Monthly Statementwilker6No ratings yet

- Prarthana Engineering Pvt. Limited: Machenahalli, Nidige Post, Shimoga Dist. 25-B, Shimoga-Bhadravthi Indl. AreaDocument1 pagePrarthana Engineering Pvt. Limited: Machenahalli, Nidige Post, Shimoga Dist. 25-B, Shimoga-Bhadravthi Indl. Areawilker6No ratings yet

- Shifts JRXMLDocument1 pageShifts JRXMLwilker6No ratings yet