Professional Documents

Culture Documents

Maple BrownAbbott Australian Geared Equity Fund Factsheet Retail

Maple BrownAbbott Australian Geared Equity Fund Factsheet Retail

Uploaded by

petrioravainenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maple BrownAbbott Australian Geared Equity Fund Factsheet Retail

Maple BrownAbbott Australian Geared Equity Fund Factsheet Retail

Uploaded by

petrioravainenCopyright:

Available Formats

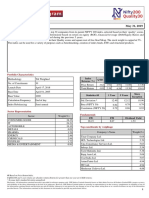

Maple-Brown Abbott Australian Geared Equity Fund (Retail) As at 31 January 2017

Retail 1 month 3 months 1 year 3 years 4 years 5 years

performance* % % pa % pa

% % % pa

Growth return 0.27 15.44 36.27 0.42 3.34 7.89

Distribution return 0.00 4.09 10.38 6.91 6.55 6.25

Total return 0.27 19.53 46.65 7.33 9.89 14.14

Benchmark return 1 -0.79 6.65 17.34 7.40 8.30 10.57

* The Fund performance relates to retail investors only. If you are a wholesale investor, you can obtain up to date returns at maple-brownabbott.com.au.

Inception date: 01 October 2002

1 Benchmark: S&P/ASX 200 Index (Total Returns)

Fund update The fund returned 0.27% (after fees) for the month, outperforming the benchmark by 1.06%.

The gearing level of the fund as at end of January was 40.9%.

January proved a solid start to the year for the portfolio and marked our 6th straight month of strong outperformance.

We remain overweight resources and this was a key driver of the strong result.

The Australian equity market had a weak month, with the S&P/ASX 200 Index (Total Returns) falling 0.8%. Macroeconomic

data was mixed, with a lower than expected CPI release contrasting with improved business conditions, stronger building

approvals and a resurgent Australian dollar. Bond yields fell modestly, with the Australian Government 10-year finishing

the month at 2.7%. Sector performance was varied and, in a break from recent experience, there was no clear shift in risk

appetite. The key theme was strength in Materials (+4.7%), with higher prices for iron ore and most metals, including

gold, supporting the miners. Health Care (+4.8%) also performed very well, driven by a small number of stock-specific

factors. Utilities (+0.9%) outperformed, as did Energy (+0.5%), despite a modest decline in the oil price. A-REITs (-4.8%)

was the worst performing sector, followed by Industrials (-4.7%), Consumer Discretionary (-4.3%), Information Technology

(-4.0%) and Financials (-2.1%).

Actual asset

allocation by Fund % Benchmark %

sector Energy 8.20 4.27

Materials 23.80 17.14

Industrials 0.70 6.33

Consumer discretionary 4.60 4.69

Consumer staples 12.00 6.83

Healthcare 2.30 6.64

Financials 34.70 37.77

Information technology 2.50 1.20

Telecommunication services 3.40 4.39

Utilities 1.70 2.62

Real Estate 2.40 8.13

Cash 3.70 0.00

Total 100.00 100.00

Investor Services : 1800 034 402 Adviser Services : 1800 034 402

Maple-Brown Abbott Australian Geared Equity Fund (Retail) | 1

Market The MSCI AC World Index fell by 2.0% in AUD terms in January. Global equity markets continued its rally early in the

month, however pulled back late in the month. The dominant event of the month was the inauguration of Donald Trump

commentary

as 45th President of the United States and subsequent focus on what policy action he intends to make a priority in his

administration. International markets were mixed, with the USA and China stronger and Europe weaker.

In the US, financial markets were very strong with the Dow Jones Index moving above 20,000 for the first time in its

history. The US markets were driven by strong performance of materials and cyclical stocks whereas defensive sectors such

as Health care, Telecommunications and Utilities underperformed. US Economic data was mixed. Manufacturing and

non-manufacturing data were better than expected however the unemployment rate increased slightly to 4.7%.

The Asia ex-Japan region started the year positively with strong gains recorded in January, reversing much of the market

weakness experienced in the final months of 2016. Around the region there was a raft of data releases including China

inflation and South Korean employment figures which pointed to stronger economic growth ahead.

The Australian equity market followed the global lead early in the month however sold off late in the month. Australian

economic data was mixed with residential building approvals and retail sales better than expected, however this was offset

by weak Consumer Price Inflation data. It is expected that the Reserve Bank of Australia will leave the cash rate of 1.5%

unchanged in their first meeting in February 2017.

Top 10 holdings

Fund % Benchmark %

BHP Billiton 10.10 5.77

Westpac Banking Corporation 9.33 7.19

ANZ Banking Group 8.46 5.80

National Australia Bank 6.83 5.46

Rio Tinto Limited 4.85 1.91

Wesfarmers Limited 4.49 3.07

Woodside Petroleum 4.45 1.54

Woolworths Limited 4.09 2.14

Origin Energy 3.72 0.84

QBE Insurance Group 3.64 1.15

Investment The Fund aims to outperform (before fees) the S&P 200 Index (Total Returns) over rolling four-year periods.

objective

Benefits of The Maple-Brown Abbott Australian Geared Equity Fund is an actively managed Australian share portfolio that aims to

investing in Fund deliver long term capital growth with the potential for enhanced performance through the use of gearing. It offers

potential to receive half-yearly distributions and tax effective income through access to franked dividends.

Key features

Retail

Fund size $21.6 million

APIR code ADV0077AU

Date established October 2002

Distribution frequency June, December

$1,500 ($1,000 for Regular Savings Plan )

1

Minimum investment

Minimum withdrawal $500

Withdrawal period 5 business days

Entry fee 4.10% maximum

Ongoing fee (MER)3 2.05% pa2

Distribution reinvestment Yes

Buy/Sell spread (%) 0.40/0.40

Exit fee Nil

1 Conditions apply.

2 Includes effect of GST.

3 The Maple-Brown Abbott Australian Geared Equity Fund charges an ongoing fee of 2.05% pa of the total assets of the Fund, that is, your investment plus borrowings, instead of net assets, which is

used for other Funds. If comparing on a net asset basis, assuming a gearing ratio of 50%, this would represent an ongoing fee of 4.10% pa.

Investor Services : 1800 034 402 Adviser Services : 1800 034 402

The Maple-Brown Abbott Australian Geared Equity Fund is issued by Maple-Brown Abbott Limited (MBA) ABN 73 001 208 564 AFSL No. 237296. A Product Disclosure Statement (PDS) for the Fund is available at maple-brownabbott.com.au, by calling 1800 034 402

or from your financial adviser. Financial advisers, please call 1800 034 402. This fact sheet contains general information only and does not take into account individual financial circumstances. Investors should consider the PDS and whether the Fund is appropriate

to their circumstances, and seek professional advice before investing in the Fund. An investment in the Fund does not represent an investment in, deposit with or other liability of MBA. It is subject to investment risk, including possible delays in repayment and loss

of income and principal invested. MBA does not guarantee the return of capital, performance of the Fund or any specific rate of return. Performance figures are calculated using withdrawal values and assume that income is reinvested. Annual management fees

and expenses have been taken into account; however, no allowance has been made for entry fees, tax or any rebates that may be given. Past performance is not a reliable indicator of future performance.

Maple-Brown Abbott Australian Geared Equity Fund (Retail) | 2

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Complete Guide To Value InvestingDocument43 pagesComplete Guide To Value Investingsantoshpinge3417No ratings yet

- This Study Resource Was: Busse PlaceDocument4 pagesThis Study Resource Was: Busse PlaceRohit Singh KushwahaNo ratings yet

- National Hard Money Lender DirectoryDocument5 pagesNational Hard Money Lender Directoryolivexa100% (1)

- Chapter 3 Receivables Exercises T1AY2021Document6 pagesChapter 3 Receivables Exercises T1AY2021Cale Robert RascoNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- Factsheet_Nifty50_ShariahDocument2 pagesFactsheet_Nifty50_ShariahMohammad AleemNo ratings yet

- EDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMDocument190 pagesEDEL - Portfolio Monthly 31-Mar-2020 - 10042020 - 073716 - PMReedos LucknowNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- Ind Niftysmallcap 50Document2 pagesInd Niftysmallcap 50Santosh TandaleNo ratings yet

- Monetary Policy Information CompendiumDocument28 pagesMonetary Policy Information CompendiumrehmanejazNo ratings yet

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhNo ratings yet

- Ind Nifty MidSmallcap 400Document2 pagesInd Nifty MidSmallcap 400GovindarajanVaradachariNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahtabinzargarNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- ABSL Commodity EquityDocument14 pagesABSL Commodity EquityArmstrong CapitalNo ratings yet

- MO FMS One Pager Oct'22Document2 pagesMO FMS One Pager Oct'22Himanshu TamrakarNo ratings yet

- NP EX 4 SunriseDocument13 pagesNP EX 4 SunriseakbarNo ratings yet

- EBLSL Daily Market Update 4th August 2020Document1 pageEBLSL Daily Market Update 4th August 2020Moheuddin SehabNo ratings yet

- Philbin Financial GroupDocument13 pagesPhilbin Financial GroupakbarNo ratings yet

- Monetary Policy Information CompendiumDocument29 pagesMonetary Policy Information CompendiumfarriyNo ratings yet

- Aditya Birla Sun Life Nasdaq 100 FoFDocument15 pagesAditya Birla Sun Life Nasdaq 100 FoFArmstrong CapitalNo ratings yet

- SBI Technology Opportunities FundDocument14 pagesSBI Technology Opportunities FundArmstrong CapitalNo ratings yet

- Bond Fund (: Sfin - ULIF002100105BONDULPFND111)Document1 pageBond Fund (: Sfin - ULIF002100105BONDULPFND111)Pawan SinghjiNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- EBLSL Daily Market Update 6th August 2020Document1 pageEBLSL Daily Market Update 6th August 2020Moheuddin SehabNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20jerkrakeshNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- Fund Facts - HDFC Mid-Cap Opportunities Fund - May 24Document2 pagesFund Facts - HDFC Mid-Cap Opportunities Fund - May 24mk2bmh9sNo ratings yet

- ICICI Global Stable Equity FundDocument11 pagesICICI Global Stable Equity FundArmstrong CapitalNo ratings yet

- NP Ex 4-2Document15 pagesNP Ex 4-2kakerraj00029No ratings yet

- Market Cap (% of GDP)Document56 pagesMarket Cap (% of GDP)Md. Real MiahNo ratings yet

- Download Fact Sheet of NIFTY 200 (.pdf)Document2 pagesDownload Fact Sheet of NIFTY 200 (.pdf)Tushar PaygudeNo ratings yet

- Factsheet NiftyNonCyclicalConsumerDocument2 pagesFactsheet NiftyNonCyclicalConsumerdheerendra sharmaNo ratings yet

- Factsheet_NiftyEVNewAgeAutomotiveDocument2 pagesFactsheet_NiftyEVNewAgeAutomotiveDEBANJAN DUTTANo ratings yet

- Factsheet NiftyMidcap150Momentum50Document2 pagesFactsheet NiftyMidcap150Momentum50Jose CANo ratings yet

- IndiaBulls Fund FactsheetDocument1 pageIndiaBulls Fund Factsheetshivam234agrawalNo ratings yet

- Ind Niftysmallcap 50Document2 pagesInd Niftysmallcap 50Google finderNo ratings yet

- Factsheet Nifty500 ShariahDocument2 pagesFactsheet Nifty500 ShariahMohammad UsmanNo ratings yet

- Non-Retirement - Future - InstantXRay 2011 09 15Document2 pagesNon-Retirement - Future - InstantXRay 2011 09 15RaghavanJayaramanNo ratings yet

- Sbi Life Top 300 Fund PerformanceDocument1 pageSbi Life Top 300 Fund PerformanceVishal Vijay SoniNo ratings yet

- Mirae Asset Health Care FundDocument30 pagesMirae Asset Health Care FundArmstrong CapitalNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Anil KumarNo ratings yet

- Factsheet 1705131940285Document2 pagesFactsheet 1705131940285umanarayanvaishnavNo ratings yet

- Sbi Life Balanced Fund PerformanceDocument1 pageSbi Life Balanced Fund PerformanceVishal Vijay SoniNo ratings yet

- Project Report of Financial ManagementDocument13 pagesProject Report of Financial ManagementAhmad RazaNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Satori Fund II LP Monthly Newsletter - 2023 06Document7 pagesSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliNo ratings yet

- Nifty FactsheetDocument2 pagesNifty FactsheetTudou patelNo ratings yet

- Kotak Equity OpportunitiesDocument8 pagesKotak Equity OpportunitiesKiran VidhaniNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100ketuNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- A Project Report On Agri-Input Supply CentreDocument14 pagesA Project Report On Agri-Input Supply CentreSuresh Varma0% (1)

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNo ratings yet

- EBLSL Daily Market Update 5th August 2020Document1 pageEBLSL Daily Market Update 5th August 2020Moheuddin SehabNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Prasad ChowdaryNo ratings yet

- Chem DBDocument17 pagesChem DBmd abNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Aman JainNo ratings yet

- Democracy and Citizenship: Theory and Practice: EditorialDocument1 pageDemocracy and Citizenship: Theory and Practice: EditorialpetrioravainenNo ratings yet

- Performing Islam Volume 4 Issue 2 2015 (Doi 10.1386/pi.4.2.151 - 1) Afzal-Khan, Fawzia - The Politics of Pity and The Individual Heroine Syndrome - Mukhtaran Mai and Malala Yousafzai of PakistanDocument22 pagesPerforming Islam Volume 4 Issue 2 2015 (Doi 10.1386/pi.4.2.151 - 1) Afzal-Khan, Fawzia - The Politics of Pity and The Individual Heroine Syndrome - Mukhtaran Mai and Malala Yousafzai of PakistanpetrioravainenNo ratings yet

- The New Yorker 2017 10-23Document104 pagesThe New Yorker 2017 10-23petrioravainen100% (2)

- Scotland and Catalonia: Two Historic Nations Challenge A Three Hundred Year - Old Status QuoDocument13 pagesScotland and Catalonia: Two Historic Nations Challenge A Three Hundred Year - Old Status QuopetrioravainenNo ratings yet

- Joseph Nye - Will The Liberal Order SurviveDocument8 pagesJoseph Nye - Will The Liberal Order SurvivepetrioravainenNo ratings yet

- Fees 2016 Francisco HomesDocument9 pagesFees 2016 Francisco HomesGolden SunriseNo ratings yet

- Modes of PaymentDocument6 pagesModes of Paymentnailazmat_91No ratings yet

- Chapter 3-Comparison and Selection Among AlternativesDocument35 pagesChapter 3-Comparison and Selection Among AlternativesSaeed KhawamNo ratings yet

- Chulalongkorn University Academic Testing Center (CU-ATC) : Registration ReportDocument1 pageChulalongkorn University Academic Testing Center (CU-ATC) : Registration ReportChanaphorn TechanitiNo ratings yet

- Project Report For Goat Farm: 100 Does + 04 BucksDocument8 pagesProject Report For Goat Farm: 100 Does + 04 BucksSatyaNo ratings yet

- Bank ChallanDocument1 pageBank ChallanKaushik NadikuditiNo ratings yet

- Rev 5 Zimbabwe Revenue Authority Return For The Remittance of Withholding TaxesDocument2 pagesRev 5 Zimbabwe Revenue Authority Return For The Remittance of Withholding TaxesZIMWASENo ratings yet

- Role of Commercial Banks in Economic DevelopmentDocument4 pagesRole of Commercial Banks in Economic Developmentvamsibu86% (7)

- PDFDocument3 pagesPDFPrabha KaranNo ratings yet

- Chapter 1Document3 pagesChapter 1zyl manuelNo ratings yet

- Unlu Strategy Jan2024Document74 pagesUnlu Strategy Jan2024f7wczmr665No ratings yet

- KW 3 Documents 01Document40 pagesKW 3 Documents 01Chethan GowdaNo ratings yet

- Full TaxDocument220 pagesFull TaxRahulNo ratings yet

- F 51124304Document3 pagesF 51124304hanamay_07No ratings yet

- IFRS 17 Module 7 - Revision Pack V3 30-06-2012Document35 pagesIFRS 17 Module 7 - Revision Pack V3 30-06-2012JasonSpringNo ratings yet

- Banking Pricnciples and Practices Lecture Notes ch3Document17 pagesBanking Pricnciples and Practices Lecture Notes ch3ejigu nigussieNo ratings yet

- Engineering EconomyDocument74 pagesEngineering EconomyAhmad PshtiwanNo ratings yet

- Chapter 15Document16 pagesChapter 15kylicia bestNo ratings yet

- Chapter 17 Financial ManagementDocument24 pagesChapter 17 Financial ManagementPervin ScribdNo ratings yet

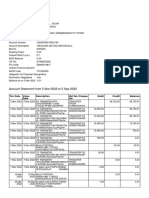

- Account Statement From 5 Mar 2022 To 5 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 5 Mar 2022 To 5 Sep 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMonirul IslamNo ratings yet

- RBI V Peerless PDFDocument21 pagesRBI V Peerless PDFManisha SinghNo ratings yet

- Ias 7 Cash FlowDocument15 pagesIas 7 Cash FlowManda simzNo ratings yet

- Fundamental & Technical Analysis On HDFC BankDocument56 pagesFundamental & Technical Analysis On HDFC BankYogendra SanapNo ratings yet

- NIL LectureDocument9 pagesNIL LectureIssa SegundoNo ratings yet

- Sponsor DocsDocument2 pagesSponsor DocsMaisa SantosNo ratings yet

- Dire Dawa UniversityDocument9 pagesDire Dawa Universityanwaradem225No ratings yet