Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

240 viewsGCF Newsletter Spring 10

GCF Newsletter Spring 10

Uploaded by

andrealsmithThe unexpected repeal of the federal estate tax for 2010 and uncertainty about future laws has created difficulties for estate planning. Existing estate plans may have unintended consequences or miss new tax planning opportunities due to changes in exemption levels and tax treatment of inherited assets. The firm has experience handling cases involving claims of undue influence on estate plans and advising businesses on private offerings to raise capital.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Federal Income Tax (Wells)Document30 pagesFederal Income Tax (Wells)Bear100% (2)

- Land Use Control OutlineDocument70 pagesLand Use Control OutlineAnna ChaeNo ratings yet

- UCC IRS Form For Discharge of Estate Tax Liens f4422Document3 pagesUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (26)

- JamesHogan - Oct17, Guidance PresentationDocument49 pagesJamesHogan - Oct17, Guidance Presentationodovacar1No ratings yet

- Conveyance & Deemed ConveyanceDocument37 pagesConveyance & Deemed Conveyancenikita karwaNo ratings yet

- Estate Planning Tax Alert January 2010Document2 pagesEstate Planning Tax Alert January 2010Arnstein & Lehr LLPNo ratings yet

- Newsletter 2020 FinalDocument4 pagesNewsletter 2020 Finalapi-537549984No ratings yet

- Province of Batangas Vs RomuloDocument16 pagesProvince of Batangas Vs RomuloEarl NuydaNo ratings yet

- Abakada vs. Purisima (G.R. No. 166715 August 14, 2008)Document6 pagesAbakada vs. Purisima (G.R. No. 166715 August 14, 2008)MARK JORDAN D. CLARINNo ratings yet

- New York Enacts Foreclosure Abuse Prevention Act - Troutman Pepper - JDSupraDocument3 pagesNew York Enacts Foreclosure Abuse Prevention Act - Troutman Pepper - JDSupraJaniceWolkGrenadierNo ratings yet

- CIR v. Philippine Global CommunicationsDocument23 pagesCIR v. Philippine Global CommunicationsDaLe AparejadoNo ratings yet

- Family Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietyDocument4 pagesFamily Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietydhultstromNo ratings yet

- Lu 140323Document2 pagesLu 140323Samwel LawrenceNo ratings yet

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (46)

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (11)

- The Continuing Contingent Fee Tax Issue: Congress and The Supreme Court Fail To Provide Complete Relief To TaxpayersDocument24 pagesThe Continuing Contingent Fee Tax Issue: Congress and The Supreme Court Fail To Provide Complete Relief To TaxpayerspunktlichNo ratings yet

- Immigration Insiders Fall 2013 Print EditionDocument4 pagesImmigration Insiders Fall 2013 Print EditionWendy WhittNo ratings yet

- Law 1.4Document6 pagesLaw 1.4gilldarc13No ratings yet

- 96 - CIR v. Next Mobile - de LunaDocument2 pages96 - CIR v. Next Mobile - de LunaVon Lee De LunaNo ratings yet

- Perfecto vs. MeerDocument20 pagesPerfecto vs. MeerPaul PsyNo ratings yet

- 1 The-LimitationDocument4 pages1 The-Limitationhafeez benignNo ratings yet

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDocument36 pagesMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- Tax Mock Bar ExamDocument6 pagesTax Mock Bar ExamMarco RvsNo ratings yet

- File66646201assessment 3docxDocument14 pagesFile66646201assessment 3docxStudy SmartNo ratings yet

- Review of The Mortgage BillDocument3 pagesReview of The Mortgage BillReal TrekstarNo ratings yet

- Eric Metcalf TestimonyDocument3 pagesEric Metcalf TestimonyMail TribuneNo ratings yet

- Stream Ignite Appeal LossDocument10 pagesStream Ignite Appeal LossHeather DobrottNo ratings yet

- Avoidance of Fees Another Advantage of Structured SettlementsDocument1 pageAvoidance of Fees Another Advantage of Structured SettlementsBob NigolNo ratings yet

- Agriculture Law: 11-04Document8 pagesAgriculture Law: 11-04AgricultureCaseLawNo ratings yet

- BA64 Group 7Document21 pagesBA64 Group 7Nguyen Duc AnhNo ratings yet

- Defacto Relationships - Threshold IssuesDocument57 pagesDefacto Relationships - Threshold Issuesagatha_scarlettNo ratings yet

- Cir VS SC Johnson and Son IncDocument3 pagesCir VS SC Johnson and Son IncCharmaine Ganancial SorianoNo ratings yet

- Bankruptcy Research PaperDocument7 pagesBankruptcy Research Papertgkeqsbnd100% (1)

- CTA v. ADMUDocument42 pagesCTA v. ADMUI.F.S. VillanuevaNo ratings yet

- CIR vs. Philippine Global CommunicationsDocument28 pagesCIR vs. Philippine Global CommunicationsChristle CorpuzNo ratings yet

- Philippine Long Distance Telephone Company, Inc. Vs PDFDocument8 pagesPhilippine Long Distance Telephone Company, Inc. Vs PDFChristian Joe QuimioNo ratings yet

- A Proposal For Banks To Take Back Deeds-In-Lieu-of ForeclosureDocument5 pagesA Proposal For Banks To Take Back Deeds-In-Lieu-of ForeclosureQuerpNo ratings yet

- March 31, 2020 DOJ Letter Re Collection of Civil Debt PaymentsDocument4 pagesMarch 31, 2020 DOJ Letter Re Collection of Civil Debt PaymentsScott DeatherageNo ratings yet

- Exhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesDocument5 pagesExhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesAdam LemboNo ratings yet

- Agriculture Law: 05-06Document8 pagesAgriculture Law: 05-06AgricultureCaseLawNo ratings yet

- Case Digests in Tax ReviewDocument29 pagesCase Digests in Tax ReviewAprille S. AlviarneNo ratings yet

- GREGORIO PERFECTO, Plaintiff and Appellee, vs. BIBIANO L. MEER, Collector of Internal Revenue, Defendant and AppellantDocument23 pagesGREGORIO PERFECTO, Plaintiff and Appellee, vs. BIBIANO L. MEER, Collector of Internal Revenue, Defendant and AppellantRyan Jhay YangNo ratings yet

- Evictions Covid19 080320 PDFDocument1 pageEvictions Covid19 080320 PDFActionNews WebPersonNo ratings yet

- 2012 Za q8 Lra EssayDocument3 pages2012 Za q8 Lra EssaysruthiNo ratings yet

- PLDT v. City of DavaoDocument10 pagesPLDT v. City of DavaoErl RoseteNo ratings yet

- E. Waiver of RightsDocument3 pagesE. Waiver of RightsYanna Beatriz NietoNo ratings yet

- Tax SyllabusDocument27 pagesTax SyllabusMaria Theresa AlarconNo ratings yet

- Gitlin 508Document41 pagesGitlin 508maxcharlie1No ratings yet

- Eren v. Commissioner, 4th Cir. (1999)Document7 pagesEren v. Commissioner, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Ferrer, Jr. v. BautistaDocument2 pagesFerrer, Jr. v. BautistaCamille Antoinette BarizoNo ratings yet

- 2009-12-14 Council Agenda Session MinutesDocument3 pages2009-12-14 Council Agenda Session MinutesEwing Township, NJNo ratings yet

- Section 30Document52 pagesSection 30Law Library ADNUNo ratings yet

- Smart Communcations Inc Vs SolidumDocument8 pagesSmart Communcations Inc Vs SolidumChingNo ratings yet

- Joy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Document13 pagesJoy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Scribd Government DocsNo ratings yet

- Agriculture Law: RL33070Document19 pagesAgriculture Law: RL33070AgricultureCaseLawNo ratings yet

- Module 4 Withholding Tax Case DigestsDocument15 pagesModule 4 Withholding Tax Case DigestsMVSNo ratings yet

- Napocor Vs QuezonDocument26 pagesNapocor Vs QuezonGreg PascuaNo ratings yet

- Poison To The Economy Taxing The Wealthy in The German Federal Parliament From 1996 To 2016Document16 pagesPoison To The Economy Taxing The Wealthy in The German Federal Parliament From 1996 To 2016Afd AfdNo ratings yet

- The Law of Succession in South Africa - (Chapter 7 Capacity To Benefit Under A Will or On Intestacy)Document29 pagesThe Law of Succession in South Africa - (Chapter 7 Capacity To Benefit Under A Will or On Intestacy)Asenathi SandisoNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- Romig vs. CIRDocument19 pagesRomig vs. CIRJerico GodoyNo ratings yet

- Cir V de LaraDocument2 pagesCir V de LaraHenri Vasquez100% (1)

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Narrative Report 049 Camus QDocument2 pagesNarrative Report 049 Camus QHanabishi RekkaNo ratings yet

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- Mesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Document58 pagesMesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Özgur ÇNo ratings yet

- 2007 2013d Suggested Answers JayArhSals LadotDocument334 pages2007 2013d Suggested Answers JayArhSals LadotAngelic TesioNo ratings yet

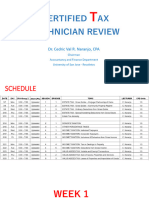

- Weekdays - Complete - CTT Review March 2022Document377 pagesWeekdays - Complete - CTT Review March 2022tyrion lawinNo ratings yet

- TRANSFER TAXES ReviewerDocument5 pagesTRANSFER TAXES ReviewerChreazel RemigioNo ratings yet

- Planning For The Future - Living Trusts, Estate and Tax PlanningDocument6 pagesPlanning For The Future - Living Trusts, Estate and Tax PlanningArnstein & Lehr LLP100% (1)

- Taxation Law: Questions and Suggested AnswersDocument142 pagesTaxation Law: Questions and Suggested AnswersDianne MedianeroNo ratings yet

- Dizon vs. CTA, CIR - Estate Tax - Date of Death Valuation PrincipleDocument35 pagesDizon vs. CTA, CIR - Estate Tax - Date of Death Valuation PrincipleVictoria aytonaNo ratings yet

- RMO No.48-2018Document2 pagesRMO No.48-2018PAMELA KALAWNo ratings yet

- Positive Effects of Train Law On The PhilippinesDocument1 pagePositive Effects of Train Law On The PhilippinesRHIANA SMILE LOPEZNo ratings yet

- Taxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Document8 pagesTaxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Bryan Christian MaragragNo ratings yet

- Net Estate & Estate Tax: Conjugal Partnership of GainsDocument10 pagesNet Estate & Estate Tax: Conjugal Partnership of GainsKrestyl Ann GabaldaNo ratings yet

- ToppingDocument37 pagesToppingRojim Asio DilaoNo ratings yet

- TX12 - Estate TaxDocument14 pagesTX12 - Estate TaxPatrick Kyle AgraviadorNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- TAX. M-1401 Estate Tax: Hakdog Basic TerminologiesDocument26 pagesTAX. M-1401 Estate Tax: Hakdog Basic TerminologiesAie GeraldinoNo ratings yet

- A Jobs Recovery: Congressman Chuck Fleischmann's Jobs Plan For AmericaDocument22 pagesA Jobs Recovery: Congressman Chuck Fleischmann's Jobs Plan For AmericaRepChuckNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

- CA51015 Departmentals Quiz 1, 2, and 3Document37 pagesCA51015 Departmentals Quiz 1, 2, and 3artemisNo ratings yet

- Estate-Taxation QAsDocument9 pagesEstate-Taxation QAsTeresaNo ratings yet

- 1 2 Sample Letter To Congress Senators 00286357Document2 pages1 2 Sample Letter To Congress Senators 00286357Ermon PanesNo ratings yet

- Tax Advice For Inheriting Real EstateDocument2 pagesTax Advice For Inheriting Real EstatehafuchieNo ratings yet

GCF Newsletter Spring 10

GCF Newsletter Spring 10

Uploaded by

andrealsmith0 ratings0% found this document useful (0 votes)

240 views2 pagesThe unexpected repeal of the federal estate tax for 2010 and uncertainty about future laws has created difficulties for estate planning. Existing estate plans may have unintended consequences or miss new tax planning opportunities due to changes in exemption levels and tax treatment of inherited assets. The firm has experience handling cases involving claims of undue influence on estate plans and advising businesses on private offerings to raise capital.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe unexpected repeal of the federal estate tax for 2010 and uncertainty about future laws has created difficulties for estate planning. Existing estate plans may have unintended consequences or miss new tax planning opportunities due to changes in exemption levels and tax treatment of inherited assets. The firm has experience handling cases involving claims of undue influence on estate plans and advising businesses on private offerings to raise capital.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

240 views2 pagesGCF Newsletter Spring 10

GCF Newsletter Spring 10

Uploaded by

andrealsmithThe unexpected repeal of the federal estate tax for 2010 and uncertainty about future laws has created difficulties for estate planning. Existing estate plans may have unintended consequences or miss new tax planning opportunities due to changes in exemption levels and tax treatment of inherited assets. The firm has experience handling cases involving claims of undue influence on estate plans and advising businesses on private offerings to raise capital.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Gould Cooksey Fennell, P.A.

2010 Estate Tax Repeal Creates

newsletter Attorney

Uncertainty for Existing Plans Spotlight

To the great surprise of nearly everyone, Congress was unable to

accomplish expected revisions to the Federal Estate Tax in 2009.

Consequently, the previously scheduled one-year repeal for 2010 that was Eugene O’Neill

not expected to survive did, in fact, occur as of January 1, 2010. While chairs Gould

Cooksey Fennell’s

this repeal is, in many ways, welcome news, its unexpected arrival and

Commercial

uncertain future create an extremely difficult tax planning environment. Litigation and

Many in Congress have indicated intent to reverse this repeal and to Construction

apply such reversal retroactively. Therefore, although temporary repeal Disputes Practice

is the current law of the land, the true circumstance that will apply for Group, with an

2010 remains very uncertain. Likewise, for the years beyond 2010, we emphasis on construction law,

have tremendous uncertainty as well. The laws in place currently call business, real estate and probate

for the estate tax to return with a vengeance on January 1, 2011, back litigation. He is triple board-certified

would not occur, and the deceased owner’s income tax basis in assets will in Civil Trial, Business Litigation,

to an exemption level of only $1,000,000 (down from the 2009 level of “carry over” to the heirs who inherit those assets. However, under some and Construction Law Mr. O’Neill

$3,500,000). There is considerable hope and belief that Congress will act fairly complicated new rules, the decedent’s executor is given the ability is also listed among Florida’s “Super

to increase those exemption levels considerably, but again, those details to increase the basis of various assets, subject to certain total amount Lawyers”, a service which identifies

cannot be known and expectations vary substantially. The generation- limitations. the top 5% of attorneys in the state,

skipping tax laws and the generation-skipping tax exemption levels as chosen by their peers and through

These profound changes in the tax laws, and the tremendous

are also similarly affected by the current, temporary repeal and by the the independent research of Law &

uncertainty surrounding them for this year and beyond, create two very

uncertain future of these laws, both within 2010 and beyond. Politics Magazine.

significant risks for existing estate plans. One is the risk that language in

Another significant change under the current 2010 law is the existing documents tied to tax laws or exemption levels which have now For additional information

elimination of the basis “step-up” on inherited assets for capital gain changed may trigger unintended, adverse consequences as to the division regarding Mr. O’Neill or other

and loss purposes. Under the law that applied up until January 1, 2010, and/or distribution of assets. The other is that existing documents could GCF attorneys visit

the income tax basis of an asset was automatically changed to its current fail to take advantage of significant new tax planning opportunities www.gouldcooksey.com

value as of its owner’s death. This year, however, that automatic change created by these changes in the laws.

772.231.1100 ▪ 979 Beachland Boulevard ▪ Vero Beach, FL 32963 ▪ www.gouldcooksey.com

RESTORING ESTATE ASSETS LOST PRESORTED

FIRST CLASS MAIL

THROUGH UNDUE INFLUENCE U.S. POSTAGE

Even the most well thought-out estate plan can be disrupted by undue influence, fraud PAID

or duress. Fortunately, the law provides a way to recover assets lost when someone is 979 Beachland Boulevard VERO BEACH, FL

inappropriately pressured to make changes to a will, trust or other legal document. With PERMIT NO. 36

Vero Beach, FL 32963

five attorneys holding an LLM in Estate Planning or Taxation and four litigation attorneys,

GCF has experience handling cases involving claims of undue influence. While undue

influence can take on many forms the most common include:

• Changes to an estate plan promoted by a new friend or acquaintance who became close

to the decedent in the last months of life.

• Changes to a long established estate plan through influence by a relative, trusted advisor,

or caregiver, writing a child or children out of the will.

• Health care workers or live-in aides who utilize the express or implied threat of withholding

care to manipulate a decedent into changing his or her will.

• Transfer of assets or changes to a will following a decline in mental capacity, isolation

from family and friends and a growing dependence on the person prompting the changes.

FUNDING BUSINESSES THROUGH

PRIVATE OFFERINGS

The demographics of our community make it a popular place for businesses to raise

capital through limited private offerings.

If properly established, private offerings allow businesses to offer securities which

are exempt from certain Federal & State securities laws. GCF’s Business & Corporate

Group attorneys are experienced in providing business clients advice on the formation

and implementation of limited private offerings and assistance with the documentation of facebook.com/gouldcooksey

business plans, preparation of necessary disclosure agreements and provide business tax

planning advice. In the last few months, GCF attorneys completed several such projects for DAVID M. CARTER ■ BRIAN J. CONNELLY ■ BYRON T. COOKSEY ■ TODD W. FENNELL

clients seeking to raise in excess of 10 million dollars in capital for new business ventures. Anthony P. Guettler ■ TROY B. HAFNER ■ WILLIAM N. KIRK ■ CHRISTOPHER H. MARINE

JASON L. ODOM ■ EUGENE J. O’NEILL ■ Christopher K. Pegg ■ SANDRA G. RENNICK

You might also like

- Federal Income Tax (Wells)Document30 pagesFederal Income Tax (Wells)Bear100% (2)

- Land Use Control OutlineDocument70 pagesLand Use Control OutlineAnna ChaeNo ratings yet

- UCC IRS Form For Discharge of Estate Tax Liens f4422Document3 pagesUCC IRS Form For Discharge of Estate Tax Liens f4422Anonymous 23VuLx100% (26)

- JamesHogan - Oct17, Guidance PresentationDocument49 pagesJamesHogan - Oct17, Guidance Presentationodovacar1No ratings yet

- Conveyance & Deemed ConveyanceDocument37 pagesConveyance & Deemed Conveyancenikita karwaNo ratings yet

- Estate Planning Tax Alert January 2010Document2 pagesEstate Planning Tax Alert January 2010Arnstein & Lehr LLPNo ratings yet

- Newsletter 2020 FinalDocument4 pagesNewsletter 2020 Finalapi-537549984No ratings yet

- Province of Batangas Vs RomuloDocument16 pagesProvince of Batangas Vs RomuloEarl NuydaNo ratings yet

- Abakada vs. Purisima (G.R. No. 166715 August 14, 2008)Document6 pagesAbakada vs. Purisima (G.R. No. 166715 August 14, 2008)MARK JORDAN D. CLARINNo ratings yet

- New York Enacts Foreclosure Abuse Prevention Act - Troutman Pepper - JDSupraDocument3 pagesNew York Enacts Foreclosure Abuse Prevention Act - Troutman Pepper - JDSupraJaniceWolkGrenadierNo ratings yet

- CIR v. Philippine Global CommunicationsDocument23 pagesCIR v. Philippine Global CommunicationsDaLe AparejadoNo ratings yet

- Family Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietyDocument4 pagesFamily Tax Planning Forum: 2010 Tax Relief Act Sparks Both Relief and AnxietydhultstromNo ratings yet

- Lu 140323Document2 pagesLu 140323Samwel LawrenceNo ratings yet

- Full Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions ManualDocument36 pagesFull Download South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manualblindoralia100% (46)

- Dwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFDocument36 pagesDwnload Full South Western Federal Taxation 2020 Comprehensive 43rd Edition Maloney Solutions Manual PDFsuidipooshi100% (11)

- The Continuing Contingent Fee Tax Issue: Congress and The Supreme Court Fail To Provide Complete Relief To TaxpayersDocument24 pagesThe Continuing Contingent Fee Tax Issue: Congress and The Supreme Court Fail To Provide Complete Relief To TaxpayerspunktlichNo ratings yet

- Immigration Insiders Fall 2013 Print EditionDocument4 pagesImmigration Insiders Fall 2013 Print EditionWendy WhittNo ratings yet

- Law 1.4Document6 pagesLaw 1.4gilldarc13No ratings yet

- 96 - CIR v. Next Mobile - de LunaDocument2 pages96 - CIR v. Next Mobile - de LunaVon Lee De LunaNo ratings yet

- Perfecto vs. MeerDocument20 pagesPerfecto vs. MeerPaul PsyNo ratings yet

- 1 The-LimitationDocument4 pages1 The-Limitationhafeez benignNo ratings yet

- Making Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime GiftsDocument36 pagesMaking Use of The Illinois Rules - Part 1: Reducing Illinois Estate Taxes Through Lifetime Giftsrobertkolasa100% (1)

- Tax Mock Bar ExamDocument6 pagesTax Mock Bar ExamMarco RvsNo ratings yet

- File66646201assessment 3docxDocument14 pagesFile66646201assessment 3docxStudy SmartNo ratings yet

- Review of The Mortgage BillDocument3 pagesReview of The Mortgage BillReal TrekstarNo ratings yet

- Eric Metcalf TestimonyDocument3 pagesEric Metcalf TestimonyMail TribuneNo ratings yet

- Stream Ignite Appeal LossDocument10 pagesStream Ignite Appeal LossHeather DobrottNo ratings yet

- Avoidance of Fees Another Advantage of Structured SettlementsDocument1 pageAvoidance of Fees Another Advantage of Structured SettlementsBob NigolNo ratings yet

- Agriculture Law: 11-04Document8 pagesAgriculture Law: 11-04AgricultureCaseLawNo ratings yet

- BA64 Group 7Document21 pagesBA64 Group 7Nguyen Duc AnhNo ratings yet

- Defacto Relationships - Threshold IssuesDocument57 pagesDefacto Relationships - Threshold Issuesagatha_scarlettNo ratings yet

- Cir VS SC Johnson and Son IncDocument3 pagesCir VS SC Johnson and Son IncCharmaine Ganancial SorianoNo ratings yet

- Bankruptcy Research PaperDocument7 pagesBankruptcy Research Papertgkeqsbnd100% (1)

- CTA v. ADMUDocument42 pagesCTA v. ADMUI.F.S. VillanuevaNo ratings yet

- CIR vs. Philippine Global CommunicationsDocument28 pagesCIR vs. Philippine Global CommunicationsChristle CorpuzNo ratings yet

- Philippine Long Distance Telephone Company, Inc. Vs PDFDocument8 pagesPhilippine Long Distance Telephone Company, Inc. Vs PDFChristian Joe QuimioNo ratings yet

- A Proposal For Banks To Take Back Deeds-In-Lieu-of ForeclosureDocument5 pagesA Proposal For Banks To Take Back Deeds-In-Lieu-of ForeclosureQuerpNo ratings yet

- March 31, 2020 DOJ Letter Re Collection of Civil Debt PaymentsDocument4 pagesMarch 31, 2020 DOJ Letter Re Collection of Civil Debt PaymentsScott DeatherageNo ratings yet

- Exhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesDocument5 pagesExhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesAdam LemboNo ratings yet

- Agriculture Law: 05-06Document8 pagesAgriculture Law: 05-06AgricultureCaseLawNo ratings yet

- Case Digests in Tax ReviewDocument29 pagesCase Digests in Tax ReviewAprille S. AlviarneNo ratings yet

- GREGORIO PERFECTO, Plaintiff and Appellee, vs. BIBIANO L. MEER, Collector of Internal Revenue, Defendant and AppellantDocument23 pagesGREGORIO PERFECTO, Plaintiff and Appellee, vs. BIBIANO L. MEER, Collector of Internal Revenue, Defendant and AppellantRyan Jhay YangNo ratings yet

- Evictions Covid19 080320 PDFDocument1 pageEvictions Covid19 080320 PDFActionNews WebPersonNo ratings yet

- 2012 Za q8 Lra EssayDocument3 pages2012 Za q8 Lra EssaysruthiNo ratings yet

- PLDT v. City of DavaoDocument10 pagesPLDT v. City of DavaoErl RoseteNo ratings yet

- E. Waiver of RightsDocument3 pagesE. Waiver of RightsYanna Beatriz NietoNo ratings yet

- Tax SyllabusDocument27 pagesTax SyllabusMaria Theresa AlarconNo ratings yet

- Gitlin 508Document41 pagesGitlin 508maxcharlie1No ratings yet

- Eren v. Commissioner, 4th Cir. (1999)Document7 pagesEren v. Commissioner, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Ferrer, Jr. v. BautistaDocument2 pagesFerrer, Jr. v. BautistaCamille Antoinette BarizoNo ratings yet

- 2009-12-14 Council Agenda Session MinutesDocument3 pages2009-12-14 Council Agenda Session MinutesEwing Township, NJNo ratings yet

- Section 30Document52 pagesSection 30Law Library ADNUNo ratings yet

- Smart Communcations Inc Vs SolidumDocument8 pagesSmart Communcations Inc Vs SolidumChingNo ratings yet

- Joy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Document13 pagesJoy Manufacturing Company v. Commissioner of Internal Revenue, 230 F.2d 740, 3rd Cir. (1956)Scribd Government DocsNo ratings yet

- Agriculture Law: RL33070Document19 pagesAgriculture Law: RL33070AgricultureCaseLawNo ratings yet

- Module 4 Withholding Tax Case DigestsDocument15 pagesModule 4 Withholding Tax Case DigestsMVSNo ratings yet

- Napocor Vs QuezonDocument26 pagesNapocor Vs QuezonGreg PascuaNo ratings yet

- Poison To The Economy Taxing The Wealthy in The German Federal Parliament From 1996 To 2016Document16 pagesPoison To The Economy Taxing The Wealthy in The German Federal Parliament From 1996 To 2016Afd AfdNo ratings yet

- The Law of Succession in South Africa - (Chapter 7 Capacity To Benefit Under A Will or On Intestacy)Document29 pagesThe Law of Succession in South Africa - (Chapter 7 Capacity To Benefit Under A Will or On Intestacy)Asenathi SandisoNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- Romig vs. CIRDocument19 pagesRomig vs. CIRJerico GodoyNo ratings yet

- Cir V de LaraDocument2 pagesCir V de LaraHenri Vasquez100% (1)

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Narrative Report 049 Camus QDocument2 pagesNarrative Report 049 Camus QHanabishi RekkaNo ratings yet

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- Mesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Document58 pagesMesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Özgur ÇNo ratings yet

- 2007 2013d Suggested Answers JayArhSals LadotDocument334 pages2007 2013d Suggested Answers JayArhSals LadotAngelic TesioNo ratings yet

- Weekdays - Complete - CTT Review March 2022Document377 pagesWeekdays - Complete - CTT Review March 2022tyrion lawinNo ratings yet

- TRANSFER TAXES ReviewerDocument5 pagesTRANSFER TAXES ReviewerChreazel RemigioNo ratings yet

- Planning For The Future - Living Trusts, Estate and Tax PlanningDocument6 pagesPlanning For The Future - Living Trusts, Estate and Tax PlanningArnstein & Lehr LLP100% (1)

- Taxation Law: Questions and Suggested AnswersDocument142 pagesTaxation Law: Questions and Suggested AnswersDianne MedianeroNo ratings yet

- Dizon vs. CTA, CIR - Estate Tax - Date of Death Valuation PrincipleDocument35 pagesDizon vs. CTA, CIR - Estate Tax - Date of Death Valuation PrincipleVictoria aytonaNo ratings yet

- RMO No.48-2018Document2 pagesRMO No.48-2018PAMELA KALAWNo ratings yet

- Positive Effects of Train Law On The PhilippinesDocument1 pagePositive Effects of Train Law On The PhilippinesRHIANA SMILE LOPEZNo ratings yet

- Taxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Document8 pagesTaxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Bryan Christian MaragragNo ratings yet

- Net Estate & Estate Tax: Conjugal Partnership of GainsDocument10 pagesNet Estate & Estate Tax: Conjugal Partnership of GainsKrestyl Ann GabaldaNo ratings yet

- ToppingDocument37 pagesToppingRojim Asio DilaoNo ratings yet

- TX12 - Estate TaxDocument14 pagesTX12 - Estate TaxPatrick Kyle AgraviadorNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- TAX. M-1401 Estate Tax: Hakdog Basic TerminologiesDocument26 pagesTAX. M-1401 Estate Tax: Hakdog Basic TerminologiesAie GeraldinoNo ratings yet

- A Jobs Recovery: Congressman Chuck Fleischmann's Jobs Plan For AmericaDocument22 pagesA Jobs Recovery: Congressman Chuck Fleischmann's Jobs Plan For AmericaRepChuckNo ratings yet

- Estate Tax101Document14 pagesEstate Tax101Alexandra Garcia100% (3)

- Ma. Faith R. Tan: Payable To A Revocable Beneficiary."Document1 pageMa. Faith R. Tan: Payable To A Revocable Beneficiary."Faith Reyna TanNo ratings yet

- CA51015 Departmentals Quiz 1, 2, and 3Document37 pagesCA51015 Departmentals Quiz 1, 2, and 3artemisNo ratings yet

- Estate-Taxation QAsDocument9 pagesEstate-Taxation QAsTeresaNo ratings yet

- 1 2 Sample Letter To Congress Senators 00286357Document2 pages1 2 Sample Letter To Congress Senators 00286357Ermon PanesNo ratings yet

- Tax Advice For Inheriting Real EstateDocument2 pagesTax Advice For Inheriting Real EstatehafuchieNo ratings yet