Professional Documents

Culture Documents

HSL PCG "Currency Daily": 17 January, 2017

HSL PCG "Currency Daily": 17 January, 2017

Uploaded by

arun_algoCopyright:

Available Formats

You might also like

- CFA Level 1 Ethical Standards NotesDocument23 pagesCFA Level 1 Ethical Standards NotesAndy Solnik100% (7)

- CFI - FMVA Certification ProgramDocument42 pagesCFI - FMVA Certification ProgramAnesu ChibweNo ratings yet

- Experience The Fundamentals of Development: Oak StreetDocument95 pagesExperience The Fundamentals of Development: Oak StreetDrew DacanayNo ratings yet

- Wharton - 2015 Resume BookDocument36 pagesWharton - 2015 Resume BookMy50% (2)

- A Case Study On Ratio Analysis of PC JewellerDocument23 pagesA Case Study On Ratio Analysis of PC JewellerAllen D'CostaNo ratings yet

- The Risky Business of Hiring StarsDocument16 pagesThe Risky Business of Hiring StarsAspiring StudentNo ratings yet

- Financial Statement Analysis - Universal FinancialDocument67 pagesFinancial Statement Analysis - Universal Financialmadhav029No ratings yet

- Knall-Cohen Investment Fund Call-OutDocument2 pagesKnall-Cohen Investment Fund Call-OutYuhNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 21 October, 2016Document6 pagesHSL PCG "Currency Daily": 21 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 December, 2016Document6 pagesHSL PCG "Currency Daily": 08 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 February, 2017Document6 pagesHSL PCG "Currency Daily": 14 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 15 December, 2016Document6 pagesHSL PCG "Currency Daily": 15 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- Morning Report EquityDocument4 pagesMorning Report EquitySathyamNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": June 28, 2016Document6 pagesHSL PCG "Currency Daily": June 28, 2016umaganNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- DailyNewsLetter - 20 Oct 10Document3 pagesDailyNewsLetter - 20 Oct 10checrucifixNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- En Bloc,: No.l 34IRGIDHC/2021Document2 pagesEn Bloc,: No.l 34IRGIDHC/2021arun_algoNo ratings yet

- 16find and Replace Text Using Regular Expressions - JetBrains RiderDocument6 pages16find and Replace Text Using Regular Expressions - JetBrains Riderarun_algoNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- KNR Constructions: Outperformance Priced inDocument8 pagesKNR Constructions: Outperformance Priced inarun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoNo ratings yet

- Techno Electric & Engineering: Expensive ValuationsDocument9 pagesTechno Electric & Engineering: Expensive Valuationsarun_algoNo ratings yet

- Sanghvi Movers: Compelling ValuationsDocument9 pagesSanghvi Movers: Compelling Valuationsarun_algoNo ratings yet

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoNo ratings yet

- Challenges To Continue: NeutralDocument12 pagesChallenges To Continue: Neutralarun_algoNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Hindustan Zinc: Strong TailwindsDocument8 pagesHindustan Zinc: Strong Tailwindsarun_algoNo ratings yet

- Coal India: Back To Business As UsualDocument9 pagesCoal India: Back To Business As Usualarun_algoNo ratings yet

- Arpit K Jains ResumeDocument1 pageArpit K Jains ResumeYash JainNo ratings yet

- Deal Money SIP PDFDocument71 pagesDeal Money SIP PDFSaurav KumarNo ratings yet

- Technical AnalysisDocument65 pagesTechnical Analysisaurorashiva1No ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- CFA Level I Questions and Answers PDFDocument10 pagesCFA Level I Questions and Answers PDFAbdul WadudNo ratings yet

- Trending The Impact of Regulatory Action On The NCMDocument17 pagesTrending The Impact of Regulatory Action On The NCMProshareNo ratings yet

- CFI Student TranscriptDocument9 pagesCFI Student TranscriptSonia Seuc0% (1)

- Burney 2021Document15 pagesBurney 2021amirhayat15No ratings yet

- Exam Reviewer Midterm Financial ModelingDocument3 pagesExam Reviewer Midterm Financial ModelingKlinton Francis Consular BuyaNo ratings yet

- Reading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersDocument25 pagesReading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersAnshika SinghNo ratings yet

- Stock Tiger RecommendationDocument11 pagesStock Tiger RecommendationRatilal M JadavNo ratings yet

- Resume of Luis BaezDocument4 pagesResume of Luis BaezYoginder SinghNo ratings yet

- Bre-X FullcaseDocument18 pagesBre-X FullcaseDeepti Suresh MhaskeNo ratings yet

- PC - BJP Manifesto - Apr 2024 20240414230902Document12 pagesPC - BJP Manifesto - Apr 2024 20240414230902Mohammed Israr ShaikhNo ratings yet

- Financial Statement Analysis at Heritage FoodsDocument83 pagesFinancial Statement Analysis at Heritage FoodsAbdul RahmanNo ratings yet

- Financial Analyst Skills ResumeDocument4 pagesFinancial Analyst Skills Resumepdxdepckg100% (1)

- Part HibanDocument41 pagesPart HibanMaharaja SudalaimadanNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- Why Is ETH Outperforming?: The Role of Futures and MicrostructureDocument8 pagesWhy Is ETH Outperforming?: The Role of Futures and MicrostructureLucas ManfrediNo ratings yet

- Hedge YeDocument25 pagesHedge YeZerohedgeNo ratings yet

- Trent LTD: Store Addition Trajectory To Further AccelerateDocument10 pagesTrent LTD: Store Addition Trajectory To Further AccelerateRaviNo ratings yet

HSL PCG "Currency Daily": 17 January, 2017

HSL PCG "Currency Daily": 17 January, 2017

Uploaded by

arun_algoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSL PCG "Currency Daily": 17 January, 2017

HSL PCG "Currency Daily": 17 January, 2017

Uploaded by

arun_algoCopyright:

Available Formats

HSL PCG CURRENCY DAILY

17 January, 2017

PRIVATE CLIENT GROUP [PCG]

VIEW POINT

STRATEGY FOR THE DAY Rupee to Consolidate in the Range of 68.40 to 67.70

Rupee yesterday erased all the early morning losses and closed

USDINR JAN FUT. marginally higher against the US dollar on expectation of foreign

fund flow after strong economic data. The local currency closed at

CONSOLIDATE IN RANGE OF 67.80-68.30 68.10 a dollar, up 0.09% from Friday's close of 68.16. The rupee

opened at 68.24 a dollar and touched a high and a low of 68.27 and

MAJOR CURRENCY 68.09, respectively. The 10-year bond yield closed at 6.441%,

compared to Friday's close of 6.417%.

Prev. The one month forward USDINR NDF quotes at 68.37 from

Close Chg. % Chg. yesterdays 68.39 at 5 pm indicating flat opening at domestic

Close

bourses.

USDINR 68.095 68.156 -0.061 -0.09%

Technically, spot USDINR is facing multiple top resistance around

DXY INDX 101.47 101.18 0.290 0.29% 68.39 and taking support at 68.70. In near term, the pair likely to

EURUSD 1.062 1.060 0.002 0.17% consolidate in the said range.

GBPUSD 1.207 1.205 0.002 0.18% Dollar Bounces Ahead of UK PM Mays Speech

USDJPY 114.00 114.20 -0.200 -0.18% The dollar gained versus all G-10 peers apart from the yen. The

DG USDINR 68.176 68.194 -0.018 -0.03% Japanese currency is in demand as a haven amid dropping equities.

The dollar index, basket of six currencies, quotes at 101.47 with the

GLOBAL INDICES gain of 0.29% after yesterdays low volume trade amid US market

close. Overnight volatility surged above 30% handle for the first

time since August ahead of PM Mays speech today even though an

Prev. exact time hasnt been announced yet.

Close Chg. % Chg.

Close Pound Tumbles To 3 Month Low

SGX NIFTY 8452.0 8433.0 19 0.23% The Pound flirted with a three-month low today, hit by fears that

NIFTY 8412.8 8400.4 12 0.15% Prime Minister Theresa May's speech later in the day will set Britain

SENSEX 27288.2 27238.1 50 0.18% on course to lose access to the lucrative European Union single

HANG-SENG 22805.5 22718.2 87 0.38% market. Prime Minister Theresa May to announce 12-point plan for

Brexit that will promise no partial membership of the U.K. in EU,

NIKKEI 18981.6 19095.2 -114 -0.60%

The Telegraph reports, without saying where it got the information.

SHANGHAI 3098.7 3103.4 -5 -0.15% The pound quoted at $1.207, having slumped to a three-month low

S&P INDEX 2274.6 2274.6 Close Close of $1.1983 on yesterday, which was its weakest point in more than

DOW JONES 19885.7 19885.7 Close Close three decades barring the several minutes in early today on Oct 7

NASDAQ 5574.1 5574.1 Close Close when it tanked to as low as $1.1491.

FTSE Yen also trades near a one-month high on uncertainty over Brexit.

7327.1 7337.8 -11 -0.15%

Concerns over U.S. President-elect Donald Trump's protectionist

CAC 4882.2 4922.5 -40 -0.82%

policies are also undermining risk sentiment, helping to push up the

DAX 11554.7 11629.2 -74 -0.64% yen back to its highest levels in more than five weeks.

PRIVATE CLIENT GROUP [PCG]

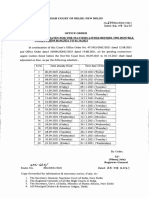

TECHNICAL OUTLOOK

SPOT USDINR DAILY CHART

Technical Observations

USDINR formed bearish candle after previous days doji candle. However, it sustains above middle band of the Bollinger.

Momentum oscillators RSI given negative cross over and negative divergence indicating weakness in the pair.

The pair may continue to consolidate in the range of 68.40 to 67.70. Fresh position can be created only on break out.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

Contracts Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR JAN17 68.20 68.26 67.93 68.06 68.13 68.33 68.46 68.53 Consolidation

EURINR JAN17 72.30 72.42 71.61 71.92 72.11 72.61 72.92 73.11 Short Covering

GBPINR JAN17 82.33 82.25 81.46 81.70 82.02 82.57 82.81 83.12 Fresh Short

JPYINR JAN17 59.74 59.82 59.27 59.48 59.61 59.95 60.17 60.30 Long Buildup

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 68.39 67.95 68.39 67.33 68.86 66.07 68.17 68.07 67.90 67.35 67.15

EURINR 72.69 71.67 73.35 70.42 77.49 70.42 72.27 71.46 72.14 73.30 74.23

GBPINR 83.69 82.51 86.82 81.78 100.49 80.89 82.95 83.44 84.32 84.65 88.75

JPYINR 59.72 57.93 60.00 57.25 68.11 55.73 59.26 58.34 59.70 62.29 62.92

CURRENCY MOVEMENT

Open Chg. in Chg. in

Currency Open High Low Close Chg. Volume

Interest OI Volume

SPOT USDINR 68.24 68.27 68.09 68.10 -0.06 -- -- -- --

USDINR JAN. FUT. 68.34 68.39 68.19 68.20 -0.08 1817462 -49317 649165 -63198

SPOT EURINR 72.41 72.49 72.08 72.15 -0.46 -- -- -- --

EURINR JAN. FUT. 72.73 72.73 72.23 72.30 -0.45 32588 -4947 45573 3358

SPOT GBPINR 82.05 82.33 81.78 82.15 -1.09 -- -- -- --

GBPINR JAN. FUT. 82.38 82.49 81.94 82.33 -1.16 32927 6683 118483 61989

SPOT JPYINR 59.74 59.93 59.59 59.64 0.16 -- -- -- --

JPYINR JAN. FUT. 59.87 60.04 59.69 59.74 0.12 21948 1031 32221 -2887

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

01/16/2017 12:00 IN Wholesale Prices YoY Dec 3.56% 3.39% 3.15%

01/16/2017 15:30 EC Trade Balance SA Nov -- 22.7b 19.7b

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Prior

01/17/2017 10:00 JN Industrial Production YoY Nov F -- 4.60%

01/17/2017 15:00 UK CPI YoY Dec 1.40% 1.20%

01/17/2017 15:00 UK House Price Index YoY Nov -- 6.90%

01/17/2017 15:30 EC ZEW Survey Expectations Jan -- 18.1

01/17/2017 19:00 US Empire Manufacturing Jan 8 9

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

You might also like

- CFA Level 1 Ethical Standards NotesDocument23 pagesCFA Level 1 Ethical Standards NotesAndy Solnik100% (7)

- CFI - FMVA Certification ProgramDocument42 pagesCFI - FMVA Certification ProgramAnesu ChibweNo ratings yet

- Experience The Fundamentals of Development: Oak StreetDocument95 pagesExperience The Fundamentals of Development: Oak StreetDrew DacanayNo ratings yet

- Wharton - 2015 Resume BookDocument36 pagesWharton - 2015 Resume BookMy50% (2)

- A Case Study On Ratio Analysis of PC JewellerDocument23 pagesA Case Study On Ratio Analysis of PC JewellerAllen D'CostaNo ratings yet

- The Risky Business of Hiring StarsDocument16 pagesThe Risky Business of Hiring StarsAspiring StudentNo ratings yet

- Financial Statement Analysis - Universal FinancialDocument67 pagesFinancial Statement Analysis - Universal Financialmadhav029No ratings yet

- Knall-Cohen Investment Fund Call-OutDocument2 pagesKnall-Cohen Investment Fund Call-OutYuhNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 12 January, 2017Document6 pagesHSL PCG "Currency Daily": 12 January, 2017shobhaNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 23 November, 2016Document6 pagesHSL PCG "Currency Daily": 23 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 06 December, 2016Document6 pagesHSL PCG "Currency Daily": 06 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 27 December, 2016Document6 pagesHSL PCG "Currency Daily": 27 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 29 December, 2016Document6 pagesHSL PCG "Currency Daily": 29 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 29 November, 2016Document6 pagesHSL PCG "Currency Daily": 29 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 22 February, 2017Document6 pagesHSL PCG "Currency Daily": 22 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 28 December, 2016Document6 pagesHSL PCG "Currency Daily": 28 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 23 February, 2017Document6 pagesHSL PCG "Currency Daily": 23 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 21 October, 2016Document6 pagesHSL PCG "Currency Daily": 21 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 25 November, 2016Document6 pagesHSL PCG "Currency Daily": 25 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 December, 2016Document6 pagesHSL PCG "Currency Daily": 08 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 20 December, 2016Document6 pagesHSL PCG "Currency Daily": 20 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 18 October, 2016Document6 pagesHSL PCG "Currency Daily": 18 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 30 November, 2016Document6 pagesHSL PCG "Currency Daily": 30 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 December, 2016Document6 pagesHSL PCG "Currency Daily": 02 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 March, 2017Document6 pagesHSL PCG "Currency Daily": 03 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 19 October, 2016Document6 pagesHSL PCG "Currency Daily": 19 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 14 February, 2017Document6 pagesHSL PCG "Currency Daily": 14 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 November, 2016Document6 pagesHSL PCG "Currency Daily": 03 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 18 November, 2016Document6 pagesHSL PCG "Currency Daily": 18 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 15 December, 2016Document6 pagesHSL PCG "Currency Daily": 15 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 16 February, 2017Document6 pagesHSL PCG "Currency Daily": 16 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 December, 2016Document6 pagesHSL PCG "Currency Daily": 01 December, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 16 December, 2016Document6 pagesHSL PCG "Currency Daily": 16 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 14 December, 2016Document6 pagesHSL PCG "Currency Daily": 14 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": 17 November, 2016Document6 pagesHSL PCG "Currency Daily": 17 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Daily": 08 November, 2016Document6 pagesHSL PCG "Currency Daily": 08 November, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 26 December, 2016arun_algoNo ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- Morning Report EquityDocument4 pagesMorning Report EquitySathyamNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 03 December, 2016shobhaNo ratings yet

- HSL PCG "Currency Daily": June 28, 2016Document6 pagesHSL PCG "Currency Daily": June 28, 2016umaganNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016Document16 pagesHSL PCG "Currency Insight"-Weekly: 24 October, 2016khaniyalalNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- DailyNewsLetter - 20 Oct 10Document3 pagesDailyNewsLetter - 20 Oct 10checrucifixNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 18 February, 2017Dinesh ChoudharyNo ratings yet

- En Bloc,: No.l 34IRGIDHC/2021Document2 pagesEn Bloc,: No.l 34IRGIDHC/2021arun_algoNo ratings yet

- 16find and Replace Text Using Regular Expressions - JetBrains RiderDocument6 pages16find and Replace Text Using Regular Expressions - JetBrains Riderarun_algoNo ratings yet

- HSL PCG "Currency Daily": 10 January, 2017Document6 pagesHSL PCG "Currency Daily": 10 January, 2017arun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 05 January, 2017Document6 pagesHSL PCG "Currency Daily": 05 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 11 January, 2017Document6 pagesHSL PCG "Currency Daily": 11 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 20 January, 2017Document6 pagesHSL PCG "Currency Daily": 20 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 06 January, 2017Document6 pagesHSL PCG "Currency Daily": 06 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 18 January, 2017Document6 pagesHSL PCG "Currency Daily": 18 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 31 January, 2017Document6 pagesHSL PCG "Currency Daily": 31 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail Researcharun_algoNo ratings yet

- HSL PCG "Currency Daily": 25 January, 2017Document6 pagesHSL PCG "Currency Daily": 25 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Daily": 19 January, 2017Document6 pagesHSL PCG "Currency Daily": 19 January, 2017arun_algoNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail Researcharun_algoNo ratings yet

- KNR Constructions: Outperformance Priced inDocument8 pagesKNR Constructions: Outperformance Priced inarun_algoNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 21 January, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 21 January, 2017arun_algoNo ratings yet

- Techno Electric & Engineering: Expensive ValuationsDocument9 pagesTechno Electric & Engineering: Expensive Valuationsarun_algoNo ratings yet

- Sanghvi Movers: Compelling ValuationsDocument9 pagesSanghvi Movers: Compelling Valuationsarun_algoNo ratings yet

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoNo ratings yet

- Challenges To Continue: NeutralDocument12 pagesChallenges To Continue: Neutralarun_algoNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Hindustan Zinc: Strong TailwindsDocument8 pagesHindustan Zinc: Strong Tailwindsarun_algoNo ratings yet

- Coal India: Back To Business As UsualDocument9 pagesCoal India: Back To Business As Usualarun_algoNo ratings yet

- Arpit K Jains ResumeDocument1 pageArpit K Jains ResumeYash JainNo ratings yet

- Deal Money SIP PDFDocument71 pagesDeal Money SIP PDFSaurav KumarNo ratings yet

- Technical AnalysisDocument65 pagesTechnical Analysisaurorashiva1No ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- CFA Level I Questions and Answers PDFDocument10 pagesCFA Level I Questions and Answers PDFAbdul WadudNo ratings yet

- Trending The Impact of Regulatory Action On The NCMDocument17 pagesTrending The Impact of Regulatory Action On The NCMProshareNo ratings yet

- CFI Student TranscriptDocument9 pagesCFI Student TranscriptSonia Seuc0% (1)

- Burney 2021Document15 pagesBurney 2021amirhayat15No ratings yet

- Exam Reviewer Midterm Financial ModelingDocument3 pagesExam Reviewer Midterm Financial ModelingKlinton Francis Consular BuyaNo ratings yet

- Reading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersDocument25 pagesReading 2 Capital Market Expectations, Part 2 Forecasting Asset Class Returns - AnswersAnshika SinghNo ratings yet

- Stock Tiger RecommendationDocument11 pagesStock Tiger RecommendationRatilal M JadavNo ratings yet

- Resume of Luis BaezDocument4 pagesResume of Luis BaezYoginder SinghNo ratings yet

- Bre-X FullcaseDocument18 pagesBre-X FullcaseDeepti Suresh MhaskeNo ratings yet

- PC - BJP Manifesto - Apr 2024 20240414230902Document12 pagesPC - BJP Manifesto - Apr 2024 20240414230902Mohammed Israr ShaikhNo ratings yet

- Financial Statement Analysis at Heritage FoodsDocument83 pagesFinancial Statement Analysis at Heritage FoodsAbdul RahmanNo ratings yet

- Financial Analyst Skills ResumeDocument4 pagesFinancial Analyst Skills Resumepdxdepckg100% (1)

- Part HibanDocument41 pagesPart HibanMaharaja SudalaimadanNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- Why Is ETH Outperforming?: The Role of Futures and MicrostructureDocument8 pagesWhy Is ETH Outperforming?: The Role of Futures and MicrostructureLucas ManfrediNo ratings yet

- Hedge YeDocument25 pagesHedge YeZerohedgeNo ratings yet

- Trent LTD: Store Addition Trajectory To Further AccelerateDocument10 pagesTrent LTD: Store Addition Trajectory To Further AccelerateRaviNo ratings yet