Professional Documents

Culture Documents

Retail Research: Concentrated and Diversified Equity Mutual Fund Schemes

Retail Research: Concentrated and Diversified Equity Mutual Fund Schemes

Uploaded by

Dinesh ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Retail Research: Concentrated and Diversified Equity Mutual Fund Schemes

Retail Research: Concentrated and Diversified Equity Mutual Fund Schemes

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

23 Jan 2017

RETAIL RESEARCH

Concentrated and Diversified Equity Mutual Fund schemes

Top Performing Concentrated and Diversified Equity Mutual Fund Schemes:

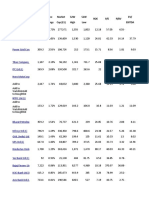

Sr.No. Scheme Name Corpus (Rs in Total No of Top 10 3 Years 5 Years 3 Years Standard

Crs) Equity Holdings CAGR CAGR CAGR Deviation

Holdings (%) Trailing Trailing Rolling

Returns Returns returns

1 HDFC Equity Fund - (G) 15470 52.00 55.60 19.09 16.10 18.05 1.17

2 ICICI Pru Value Discovery Fund (G) 14919 42.00 60.73 26.95 22.95 28.57 0.87

3 Birla Sun Life Frontline Equity Fund (G) 13973 80.00 37.65 18.22 17.83 18.81 0.90

4 HDFC Top 200 Fund (G) 12428 66.00 46.50 17.13 14.68 15.76 1.11

5 ICICI Pru Focused Bluechip Equity Fund (G) 11636 54.00 45.20 16.54 15.91 16.74 0.90

6 SBI BlueChip Fund (G) 10104 54.00 45.59 20.11 19.25 21.42 0.87

7 Reliance Equity Opportunities Fund (G) 9419 54.00 42.83 16.85 17.06 19.19 0.97

8 Franklin India Prima Plus - (G) 9365 64.00 40.35 21.79 18.55 22.81 0.83

9 Franklin India Bluechip Fund - (G) 7634 44.00 44.78 15.84 13.85 16.07 0.84

10 Kotak Select Focus Fund (G) 7181 52.00 43.13 23.38 20.05 23.02 0.90

11 ICICI Pru Dynamic Plan (G) 5789 51.00 51.67 16.96 17.04 17.57 0.76

12 Franklin India High Growth Companies Fund (G) 5116 33.00 62.60 27.02 23.84 27.05 1.00

13 UTI-Equity Fund (G) 4828 51.00 46.91 15.97 15.73 17.95 0.89

14 UTI-Opportunities Fund (G) 4308 51.00 43.58 12.67 12.63 13.39 0.93

15 UTI-Mastershare (G) 3655 52.00 39.79 15.51 13.66 15.96 0.85

16 DSP BR Top 100 Equity Fund (G) 3368 33.00 51.59 14.76 12.53 14.03 0.99

17 Birla Sun Life Equity Fund (G) 3295 69.00 41.23 25.68 21.52 24.93 0.97

18 Franklin India Opportunities Fund - (G) 2999 44.00 42.21 21.62 16.69 21.70 0.91

19 Reliance Vision Fund - (G) 2898 28.00 67.30 20.57 14.61 20.22 1.05

20 Franklin India Flexi Cap Fund (G) 2810 48.00 46.64 20.53 17.65 22.08 0.82

21 L&T Equity Fund (G) 2771 61.00 40.47 18.40 15.27 18.50 0.94

22 Reliance Regular Savings Fund - Equity (G) 2651 49.00 38.85 19.90 16.99 20.12 1.04

23 Mirae Asset India Opportunities Fund (G) 2557 52.00 41.31 21.79 19.39 22.27 0.95

24 Reliance Top 200 Fund (G) 2338 37.00 48.48 19.31 17.22 19.45 1.02

25 Birla Sun Life Top 100 Fund (G) 2229 63.00 42.49 18.65 18.00 19.63 0.90

26 DSP BR Equity Fund (G) 2220 64.00 33.04 20.28 15.52 19.09 1.01

27 L&T India Value Fund (G) 2196 77.00 33.27 32.23 25.20 30.07 1.07

28 Birla Sun Life Advantage Fund (G) 2065 66.00 38.91 25.35 20.33 26.45 1.03

29 AXIS Equity Fund (G) 1886 34.00 54.09 12.33 14.21 14.52 0.90

30 ICICI Pru Multicap Fund - (G) 1877 46.00 39.26 21.39 18.29 21.50 0.83

31 DSP BR Focus 25 Fund (G) 1868 27.00 56.79 20.37 15.24 19.90 0.98

32 UTI-Bluechip Flexicap Fund (G) 1735 54.00 43.40 12.80 13.34 14.03 0.88

33 SBI Magnum Equity Fund (G) 1629 32.00 52.48 16.24 14.87 17.20 0.90

34 SBI Magnum Multiplier Fund (G) 1588 48.00 44.46 20.58 19.16 23.03 0.98

RETAIL RESEARCH Page |1

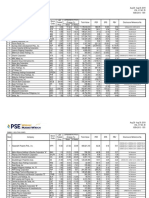

RETAIL RESEARCH

35 ICICI Pru Top 100 Fund - (G) 1530 38.00 51.27 17.04 16.15 16.62 0.85

36 SBI Magnum Multicap Fund (G) 1392 65.00 38.80 24.25 20.23 24.36 0.93

37 DSP BR Opportunities Fund (G) 1326 64.00 41.27 22.49 18.89 21.20 1.05

38 HDFC Capital Builder -(G) 1300 53.00 42.24 20.51 18.45 21.02 0.99

39 Tata Equity Opportunities Fund - Regular (G) 1183 45.00 38.43 19.55 18.03 19.91 0.91

40 BNP Paribas Equity Fund (G) 1172 42.00 43.30 16.35 15.96 18.22 0.93

41 Kotak 50 (G) 1152 52.00 46.64 16.65 14.15 16.82 0.88

42 HDFC Large Cap Fund (G) 1124 21.00 74.13 10.01 11.80 9.31 0.96

43 Reliance Focused Large Cap Fund (G) 1014 24.00 52.20 14.61 15.74 16.00 0.98

44 Kotak Opportunities (G) 1004 58.00 38.41 21.60 17.94 20.30 0.92

45 HDFC Growth Fund (G) 971 44.00 51.35 17.37 13.05 15.41 1.02

46 JM Equity Fund - (G) 941 52.00 49.87 15.11 12.18 15.03 0.77

47 L&T India Special Situations Fund (G) 875 52.00 36.16 19.72 18.03 19.11 0.95

48 UTI-Top 100 Fund (G) 820 51.00 40.73 15.38 13.84 16.12 0.90

49 Tata Large Cap Fund - Regular (G) 782 40.00 50.57 13.80 14.01 14.86 0.85

50 UTI-Wealth Builder Fund (G) 748 51.00 42.86 9.85 8.52 8.41 0.59

51 ICICI Pru Select Large Cap Fund (G) 718 15.00 78.40 15.16 14.43 15.59 0.95

52 Tata Equity P/E Fund - (G) 687 41.00 51.51 29.09 20.34 25.96 0.94

53 Canara Robeco Equity Diversified (G) 685 57.00 36.57 13.57 13.35 13.67 1.01

54 Quantum Long-Term Equity Fund (G) 628 24.00 58.95 19.79 17.80 18.55 0.90

55 HSBC Equity Fund (G) 556 32.00 55.81 14.49 12.30 13.57 1.00

56 IDFC Classic Equity Fund (G) 549 61.00 45.93 15.80 15.60 14.41 0.91

57 HDFC Core & Satellite Fund (G) 543 26.00 56.45 20.93 14.14 19.48 1.06

The above consists of equity mutual schemes (large and multicap) having corpus of >Rs.500 cr and 5+ years history. Base date is Jan 19, 2017

Key observations:

Concentrated equity mutual funds are focused investment options whose portfolios are constructed with less than 30 stocks to earn greater returns at optimum level of risk. On the other ha

portfolios of diversified equity funds comprise of more than 30 stocks and upto even 90 stocks with an aim to reduce the volatility in the portfolio return.

Performance: The concentrated equity mutual funds have delivered mediocre returns (barring one or two schemes) over various time frames and relatively underperformed their counterpa

of Equity Diversified category.

Risk: The risk as measured by Standard Deviation (3 years period) for concentrated equity mutual funds is relatively higher than that of the diversified equity funds.

Funds with concentrated portfolios show higher risk and lower returns when compared to those with diversified portfolios.

In the study, 120 schemes selected from large cap and multi cap categories were classified into 4 portfolio buckets of 30 schemes each. Viz: Up to 30 stocks, 31-42 stocks, 43-52 stocks and

87 stocks.

Funds which had a portfolio of 43-52 stocks and 53-87 stocks gave higher returns with lower risk (standard deviation) than those which had a portfolio of 31-42 stocks and 43-52 stocks.

Conclusion is that diversified equity funds (multi cap) have the potential to generate higher returns with lower risk then concentrated funds (large Cap).

RETAIL RESEARCH Page |2

RETAIL RESEARCH

Returns(% p.a. - CAGR)

Parameter Returns Upto 30 31-42 43-52 53-87

stocks stocks stocks stocks

Average 5 yr trailing 14.03 14.99 15.52 17.07

Average 3 yr trailing 17.47 16.59 17.58 19.28

Median 5 yr trailing 14.43 14.76 15.45 17.45

Median 3 yr trailing 16.91 14.76 16.80 18.52

Average 3 yr rolling 16.57 16.96 17.87 19.57

Median 3 yr rolling 16.00 15.52 17.46 19.14

Risk (SD) 0.97 0.94 0.90 0.94

Different funds use different investment strategies for generating risk-adjusted returns.

Funds using concentrated portfolio.

Benefits:

Invest after thorough research in high conviction sectors and stocks

Focussed approach

Lower portfolio turnover as number of stocks are less and exposure per stock is higher.

More risk and probability of earning higher returns

Funds using Diversified portfolio.

Benefits:

Invest in a broad range of sectors and stocks

Individual stock exposure is controlled leading to greater risk control

Higher portfolio turnover as number of stocks are more and exposure per stock is lower.

Lesser risk and probability of earning moderate returns

RETAIL RESEARCH Page |3

RETAIL RESEARCH

Senior Analyst: Prashant Mehta (prashant.mehta@hdfcsec.com)

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022)

2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

Disclaimer: Mutual Funds and Debt investments are subject to risk. Past performance is no guarantee for future performance this document has been prepared by HDFC Securities Limited and is meant for sole

use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security.

The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options

on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for

non-Institutional Clients

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or

may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no.

INH000002475."

RETAIL RESEARCH Page |4

You might also like

- Event Management WorkbookDocument15 pagesEvent Management WorkbookworldontopNo ratings yet

- Assignment On Element 1 Contractor ManagementDocument3 pagesAssignment On Element 1 Contractor ManagementSAFETY VOFPL0% (1)

- ProQual Level 6 NVQ Diploma in Occupational HS PracticeDocument31 pagesProQual Level 6 NVQ Diploma in Occupational HS PracticeSaddem Hadfi100% (2)

- I3CON Handbook 2 FinalDocument260 pagesI3CON Handbook 2 FinalNeshvar DmitriNo ratings yet

- EY Innovating With RegTechDocument16 pagesEY Innovating With RegTechChristina Grammatikopoulou0% (1)

- 01 Adm 05695 RumaDas 20220328 Portfolio DetailedDocument26 pages01 Adm 05695 RumaDas 20220328 Portfolio DetailedAnirNo ratings yet

- Suresh Rathi Securities PVT LTD.: Ronak JajooDocument17 pagesSuresh Rathi Securities PVT LTD.: Ronak JajooRonak JajooNo ratings yet

- 61b0a0056fbe6.1638965253.SIP Report 27092021Document3 pages61b0a0056fbe6.1638965253.SIP Report 27092021delightadvertisementNo ratings yet

- Allocation Analysis-13-11-2023-08-08-56Document49 pagesAllocation Analysis-13-11-2023-08-08-56fortune144370No ratings yet

- Staywealthy Investment Services: Portfolio Valuation SummaryDocument2 pagesStaywealthy Investment Services: Portfolio Valuation SummaryGauri TripathiNo ratings yet

- IP Atch: Sip WatchDocument4 pagesIP Atch: Sip WatchTP Surya Prakash CfpNo ratings yet

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DNo ratings yet

- Equity MF July 2010Document3 pagesEquity MF July 2010theguru2929No ratings yet

- April 19Document52 pagesApril 19sahithi reddyNo ratings yet

- 52 Week High Low NAV Equity FundDocument4 pages52 Week High Low NAV Equity FundWealth Maker BuddyNo ratings yet

- HDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023Document16 pagesHDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023ashoksoftNo ratings yet

- Mutual Fund Name Ran K Corpus As On 31.12.10 Corpus As On 30.09.10 Net Inc/dec in CorpusDocument3 pagesMutual Fund Name Ran K Corpus As On 31.12.10 Corpus As On 30.09.10 Net Inc/dec in CorpusdshilkarNo ratings yet

- PortfolioSummary RAJARATNAM SABAPATHYDocument6 pagesPortfolioSummary RAJARATNAM SABAPATHYDurga DeviNo ratings yet

- KBC Knowledge Series - Top Ten SchemesDocument2 pagesKBC Knowledge Series - Top Ten SchemesktiindiaNo ratings yet

- SIP Performance For Select Schemes Leaflet (As On 29th April 2022)Document4 pagesSIP Performance For Select Schemes Leaflet (As On 29th April 2022)Akash BNo ratings yet

- 8to5frompivot&IR1 40Document3 pages8to5frompivot&IR1 40riteshNo ratings yet

- Nifty 50Document3 pagesNifty 50Arjun BhatnagarNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Sl. No Names of Mutual Fund Companies and Schemes NAVDocument7 pagesSl. No Names of Mutual Fund Companies and Schemes NAVnadeem_rjNo ratings yet

- ValueResearchFundcard RelianceGrowth 2010dec30Document6 pagesValueResearchFundcard RelianceGrowth 2010dec30Maulik DoshiNo ratings yet

- Performance Report For May MonthDocument3 pagesPerformance Report For May MonthSujeshNo ratings yet

- MFDocument380 pagesMFjayram 8080100% (1)

- Date Friday, January 21, 2011Document4 pagesDate Friday, January 21, 2011valuengrowthNo ratings yet

- SIP Performance of Select Equity Schemes Leaflet - November 2023Document4 pagesSIP Performance of Select Equity Schemes Leaflet - November 2023Tanuj BhattNo ratings yet

- SIP 10-15-20 Years Performance July 2021Document2 pagesSIP 10-15-20 Years Performance July 2021ABCNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- HDFC EquityDocument6 pagesHDFC EquityDarshan ShettyNo ratings yet

- wk39 Sep2022mktwatchDocument3 pageswk39 Sep2022mktwatchcraftersxNo ratings yet

- 10topivot&IR1 60Document3 pages10topivot&IR1 60riteshNo ratings yet

- Gilt Funds Traling Returns From 2015Document2 pagesGilt Funds Traling Returns From 2015Sandeep BorseNo ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranNo ratings yet

- Insurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresDocument2 pagesInsurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- Fundcard: Franklin India Taxshield FundDocument4 pagesFundcard: Franklin India Taxshield FundvinitNo ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesPraful ThakreNo ratings yet

- wk35 Sep2022mktwatchDocument3 pageswk35 Sep2022mktwatchcraftersxNo ratings yet

- IIFL MF Recommendation June 2024 EditedDocument27 pagesIIFL MF Recommendation June 2024 EditedVais VaishnavNo ratings yet

- HDFCsec MFReckonerFeb2022Document11 pagesHDFCsec MFReckonerFeb2022Sanjib DekaNo ratings yet

- Axis Long Term Equity FundDocument4 pagesAxis Long Term Equity FundChittaNo ratings yet

- ACDVol 2018 2019 PDFDocument15 pagesACDVol 2018 2019 PDFTesthdjNo ratings yet

- ACDVol 2018 2019Document15 pagesACDVol 2018 2019Nirav ShahNo ratings yet

- BEST MUTUAL FUNDS TO INVEST by Sonu ThakurDocument1 pageBEST MUTUAL FUNDS TO INVEST by Sonu ThakursonuNo ratings yet

- L&TIndiaValueFund 2017jul25Document4 pagesL&TIndiaValueFund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Document6 pagesValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNo ratings yet

- Equity Schemes Return Sheet-23.11.2023Document1 pageEquity Schemes Return Sheet-23.11.2023photonxcomNo ratings yet

- CMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)Document7 pagesCMP Price Market 52W 52W ROE P/E P/BV EV/ Change Cap (CR) High Low Ebitda Ompany Name (M.Cap)SandeepMalooNo ratings yet

- Ranking PageDocument1 pageRanking PageRomon YangNo ratings yet

- Peer Group Focused 3 1Document1 pagePeer Group Focused 3 1Jinesh JadavNo ratings yet

- RelianceTaxSaver (ELSS) Fund 2017jul25Document4 pagesRelianceTaxSaver (ELSS) Fund 2017jul25Krishnan ChockalingamNo ratings yet

- ValueResearchFundcard SBIBluechipFund 2017jan27 PDFDocument4 pagesValueResearchFundcard SBIBluechipFund 2017jan27 PDFcaptjas9886No ratings yet

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVDocument3 pagesWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyNo ratings yet

- ValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18Document4 pagesValueResearchFundcard ICICIPrudentialFocusedBluechipEquityFund 2017dec18santoshk.mahapatraNo ratings yet

- Provisional Financial - Mar 2021Document8 pagesProvisional Financial - Mar 2021Anamika NandiNo ratings yet

- HDFC BankDocument4 pagesHDFC BankKshitiz BhandulaNo ratings yet

- Horizontal Balance SheetDocument2 pagesHorizontal Balance Sheetkathir_petroNo ratings yet

- Mutual Fund: SEPTEMBER, 2020Document58 pagesMutual Fund: SEPTEMBER, 2020farron_vNo ratings yet

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- SIP Performance One Pager - August 2021Document2 pagesSIP Performance One Pager - August 2021Rony BNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- Report PDFDocument3 pagesReport PDFDinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- Ms 77 Yeow Et AlDocument37 pagesMs 77 Yeow Et Alippc 7No ratings yet

- Sheqxel Hse Kpi Dashboard Template IiiDocument10 pagesSheqxel Hse Kpi Dashboard Template IiiAmira SmineNo ratings yet

- SAS 300 Accounting and Internal Control Systems AnDocument14 pagesSAS 300 Accounting and Internal Control Systems AnRahul TiwariNo ratings yet

- NRC Report On FitzPatrick Condenser LeaksDocument15 pagesNRC Report On FitzPatrick Condenser LeaksTim KnaussNo ratings yet

- NedbankDocument5 pagesNedbankPriyanka GirdariNo ratings yet

- Resume TusharDocument3 pagesResume TusharPriya MewadaNo ratings yet

- Disereation of Absl Mutual FundDocument79 pagesDisereation of Absl Mutual FundKEDARANATHA PADHYNo ratings yet

- HeliOffshore Industry Action Plan Night Deck Landing PracticesDocument14 pagesHeliOffshore Industry Action Plan Night Deck Landing Practicesalihkhalil77No ratings yet

- ISO27k ISMS 8.1 Implementation Project Estimator 2022Document35 pagesISO27k ISMS 8.1 Implementation Project Estimator 2022Natália Gomes KnobNo ratings yet

- Matrik HirarcDocument1 pageMatrik HirarcRobiyyana100% (4)

- Mit PDFDocument115 pagesMit PDFsukanta60No ratings yet

- FRM Final ProjectDocument5 pagesFRM Final ProjectOkasha AliNo ratings yet

- Standing Order On Auditing in An IT Environment 20200814093221Document29 pagesStanding Order On Auditing in An IT Environment 20200814093221SprasadNo ratings yet

- ICS ProjectDocument22 pagesICS Projectauf haziqNo ratings yet

- LPG Technical Cod enDocument83 pagesLPG Technical Cod enZecheru100% (1)

- Guide For Young Investors Autor Capital Market AuthorityDocument28 pagesGuide For Young Investors Autor Capital Market AuthoritypremiumfreeNo ratings yet

- NSQHS StandardsDocument80 pagesNSQHS StandardsDwi Suranto100% (1)

- Do Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewDocument34 pagesDo Risk Assessment Tools Help Manage and Reduce Risk of Violence and Reoffending A Systematic ReviewGilberto Zúñiga MonjeNo ratings yet

- Module 4 - 8 - unified-course-pack-CWTS-1Document24 pagesModule 4 - 8 - unified-course-pack-CWTS-1Chloe CabingatanNo ratings yet

- Steve Romick SpeechDocument28 pagesSteve Romick SpeechCanadianValueNo ratings yet

- 9119 Risk Breakdown StructureDocument5 pages9119 Risk Breakdown StructureNicolas ValleNo ratings yet

- TLE7 ICT TD M11 v3Document27 pagesTLE7 ICT TD M11 v3EdcheloNo ratings yet

- Costco Annual ReportDocument80 pagesCostco Annual ReportVarun GuptaNo ratings yet

- Press Publication 2009 Annual Report UkDocument268 pagesPress Publication 2009 Annual Report UkMalkeet SinghNo ratings yet

- Risk Management - Handbook Basketball Webpage VersionDocument8 pagesRisk Management - Handbook Basketball Webpage Versionapi-241422635No ratings yet