Professional Documents

Culture Documents

Report PDF

Report PDF

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

You might also like

- Data HRDocument38 pagesData HRaroravikas76% (17)

- CIO List - West IndiaDocument3 pagesCIO List - West IndiaShankar BasuNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready Reckonerpankaj_mbmNo ratings yet

- Mutual Fund Research December 2020Document16 pagesMutual Fund Research December 2020paldevchaNo ratings yet

- Mutual Fund Case StudyDocument15 pagesMutual Fund Case Studyshubhangini SaindaneNo ratings yet

- Date: 12 Sept, 2019 Sep - Oct 2019: Retail Research: Mutual Fund Ready ReckonerDocument14 pagesDate: 12 Sept, 2019 Sep - Oct 2019: Retail Research: Mutual Fund Ready ReckonerVamshi SurapaneniNo ratings yet

- SREI Infrastructure Finance LTD: Retail ResearchDocument13 pagesSREI Infrastructure Finance LTD: Retail ResearchAbhijit TripathiNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Lenders+Deck+Mar'23 IFSDocument18 pagesLenders+Deck+Mar'23 IFSGautam MehtaNo ratings yet

- Account Statement: Portfolio SummaryDocument3 pagesAccount Statement: Portfolio SummaryPradeep ChauhanNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Identifying Phoenix:: Stocks Set For ComebackDocument19 pagesIdentifying Phoenix:: Stocks Set For Comebackabhinavsingh4uNo ratings yet

- Morning Star Report 20190720091752Document1 pageMorning Star Report 20190720091752YumyumNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Morning Star Report 20190720091759Document1 pageMorning Star Report 20190720091759Chaitanya VyasNo ratings yet

- Nippon India Banking and Financial Services FundDocument1 pageNippon India Banking and Financial Services FundKunik SwaroopNo ratings yet

- Axis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Larsen& Toubro LTD Initiating Coverage 15062020Document8 pagesLarsen& Toubro LTD Initiating Coverage 15062020Aparna JRNo ratings yet

- HDFC Large and Mid Cap Fund Regular PlanDocument1 pageHDFC Large and Mid Cap Fund Regular Plansuccessinvestment2005No ratings yet

- Morning Star Report 20190720091722Document1 pageMorning Star Report 20190720091722SunNo ratings yet

- Morning Star Report 20190725103349Document1 pageMorning Star Report 20190725103349SunNo ratings yet

- Morning Star Report 20190726102711Document1 pageMorning Star Report 20190726102711YumyumNo ratings yet

- Morning Star Report 20190726102445Document1 pageMorning Star Report 20190726102445YumyumNo ratings yet

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasNo ratings yet

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunNo ratings yet

- Sbi Large and Midcap FundDocument1 pageSbi Large and Midcap FundrigordaleNo ratings yet

- Morning Star Report 20190720091852Document1 pageMorning Star Report 20190720091852Chaitanya VyasNo ratings yet

- Money Control Balanced Mutual Fund Rating 2016Document4 pagesMoney Control Balanced Mutual Fund Rating 2016Anonymous q0irDXlWAmNo ratings yet

- Topic-Best Mutual Funds 2024Document5 pagesTopic-Best Mutual Funds 2024iamrdas02No ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Mutual Fund TATA - Security AnalysisDocument15 pagesMutual Fund TATA - Security AnalysisHarish YaduvanshiNo ratings yet

- Identifying Phoenix 2.0:: Stocks Set For ComebackDocument20 pagesIdentifying Phoenix 2.0:: Stocks Set For ComebackArvind MeenaNo ratings yet

- Morning Star Report 20190725103110Document1 pageMorning Star Report 20190725103110SunNo ratings yet

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunNo ratings yet

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumNo ratings yet

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DNo ratings yet

- Quant Small Cap Fund Direct PlanDocument1 pageQuant Small Cap Fund Direct PlanMuhammed SabirNo ratings yet

- Nippon India Small Cap Fund Direct PlanDocument1 pageNippon India Small Cap Fund Direct Planprashant_mishra89No ratings yet

- Morning Star Report 20190726102634Document1 pageMorning Star Report 20190726102634YumyumNo ratings yet

- Axis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- HDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResDocument4 pagesHDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResYogesh RathodNo ratings yet

- Funds PageDocument1 pageFunds Page7csNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Morning Star Report 20190720091834Document1 pageMorning Star Report 20190720091834Chaitanya VyasNo ratings yet

- Axis Short Term Retail Growth: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Morning Star Report 20190720091713Document1 pageMorning Star Report 20190720091713SunNo ratings yet

- 02the Economic Times WealthDocument5 pages02the Economic Times WealthvivoposNo ratings yet

- Mahindra Manulife Credit Risk FundDocument1 pageMahindra Manulife Credit Risk FundYogi173No ratings yet

- Fundcard: Axis Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Axis Treasury Advantage Fund - Direct PlanYogi173No ratings yet

- HDFC Securities Sees 24% UPSIDE in IDFC LTDDocument14 pagesHDFC Securities Sees 24% UPSIDE in IDFC LTDTarunNo ratings yet

- Lic MF Infrastructure Fund Direct PlanDocument1 pageLic MF Infrastructure Fund Direct PlanvmtrinkaNo ratings yet

- Morning Star Report 20190720091835Document1 pageMorning Star Report 20190720091835Chaitanya VyasNo ratings yet

- Axis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityChaitanya VyasNo ratings yet

- Morning Star Report 20190720091751Document1 pageMorning Star Report 20190720091751YumyumNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- ICRA - Stock Update - 070322Document10 pagesICRA - Stock Update - 070322arunNo ratings yet

- Sbi-Bluechip-Fund Jan 2021Document1 pageSbi-Bluechip-Fund Jan 2021pdk jyotNo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- 08-2022 August SalariesDocument20 pages08-2022 August SalariesRevanth kumarNo ratings yet

- Contractors Mailing Add GUJDocument54 pagesContractors Mailing Add GUJganesh kondikire100% (2)

- List of All BANKS of BPLDocument12 pagesList of All BANKS of BPLashi_vidNo ratings yet

- Main 201bbbbbb9 20 Bank Cheque & Receipt No 1Document12 pagesMain 201bbbbbb9 20 Bank Cheque & Receipt No 1Govind ThakorNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument1 pageStock Screener, Technical Analysis ScannerRikNo ratings yet

- GrasimDocument443 pagesGrasimMainali GautamNo ratings yet

- Reasoning Direction Sense Practice Questions Free Ebook WWW - Letsstudytogether.coDocument37 pagesReasoning Direction Sense Practice Questions Free Ebook WWW - Letsstudytogether.conischalgaire806No ratings yet

- CP RedeemedDocument171 pagesCP RedeemedkinananthaNo ratings yet

- SL - No. Scrip Code Scrip Name Haircut % IsinDocument9 pagesSL - No. Scrip Code Scrip Name Haircut % IsinAnjaneyulu ReddyNo ratings yet

- Account Name Area/PatchDocument4 pagesAccount Name Area/PatchSandeep ShahNo ratings yet

- ListIGBCAP - 08 Jan 2020Document20 pagesListIGBCAP - 08 Jan 2020aWARDSNo ratings yet

- Jfjkjjuy PDFDocument12 pagesJfjkjjuy PDFbeo saraipaliNo ratings yet

- ChemicalsDocument2 pagesChemicalsravishankarNo ratings yet

- Top 10 Companies OF NSC & BSCDocument1 pageTop 10 Companies OF NSC & BSCJď SharmaNo ratings yet

- 09-02-2021-CA ListDocument13 pages09-02-2021-CA ListNeeraj AroraNo ratings yet

- Ifcb2009 68Document1,038 pagesIfcb2009 68anon_823030012No ratings yet

- INTRUDING BULL's Stock Tracker - Recommended StocksDocument1 pageINTRUDING BULL's Stock Tracker - Recommended StocksYash SakpalNo ratings yet

- Mahindra GroupDocument2 pagesMahindra GroupMayank SaigalNo ratings yet

- Interior Design - Case StudyDocument15 pagesInterior Design - Case StudyManasviJindalNo ratings yet

- List of Bank in MaharashtraDocument50 pagesList of Bank in MaharashtraGunjanNo ratings yet

- Ramkesh New Statment-1Document13 pagesRamkesh New Statment-1rajmeenameenaji9797No ratings yet

- Dabi LeadsDocument21 pagesDabi LeadsRiya KaharNo ratings yet

- CIT Mapping South BengalDocument12 pagesCIT Mapping South Bengalleninanthony89488No ratings yet

- MPRDC - Company ListDocument4 pagesMPRDC - Company ListarvindNo ratings yet

- Bank IFSC Code MICR Code Branch N Address Contact City District StateDocument36 pagesBank IFSC Code MICR Code Branch N Address Contact City District StateAnkur JariwalaNo ratings yet

- OperatorsDocument98 pagesOperatorsJeetendra SahaniNo ratings yet

- Mumbai CFOsDocument5 pagesMumbai CFOsMusterNo ratings yet

- Below Is The List of India IncDocument2 pagesBelow Is The List of India IncDipin NambiarNo ratings yet

Report PDF

Report PDF

Uploaded by

Dinesh ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report PDF

Report PDF

Uploaded by

Dinesh ChoudharyCopyright:

Available Formats

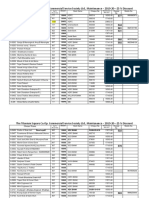

RETAIL RESEARCH MUTUAL FUNDS SEPTEMBER 2016

MF READY RECKONER

Equity Funds

Fund Return

1 Year 3 Year 5 Year Value

Size Since Crisil Risk Return

Scheme Name & ISIN NAV (Rs) Return Return Return Top holdings Researc

(Crs. Inception Rank Grade Grade

(%) (%) (%) h Rating

Rs) (%)

Equity - Diversified - Large CAP

Birla Sun Life Frontline Equity Fund HDFC Bank, ITC

179.28 13,134 15.43 25.04 18.63 22.90 CPR 2 5 Star Low Higher

(G) INF209K01BR9 RIL, L&T & Infosys

Franklin India Prima Plus - (G) HDFC Bank, Infy, ICICI Bank,

482.57 8,903 12.16 28.87 19.39 19.34 CPR 2 4 Star Low Higher

INF090I01239 Bharti Airtel & Indus Bank

Equity - Diversified - Multi CAP

Franklin India High Growth HDFC Bank, Axis bank, SBI, TVS

31.45 4,974 10.49 33.82 23.58 13.43 CPR 2 5 Star Average Higher

Companies (G) INF090I01981 Mot & ICICI Bank

ICICI Pru Value Discovery Fund (G) L&T, NTPC, Axis Bank, Sun

123.25 13,883 10.84 35.53 23.92 23.21 CPR 2 5 Star Low Higher

INF109K01AF8 Pharma & ICICI Bank

Equity - Diversified - Mid n Small CAP

Franklin India Smaller Companies Equitas Hold, Finolex Cabl, Yes

46.65 3,494 25.06 45.86 29.71 15.60 CPR 1 4 Star Lower High

Fund (G) INF090I01569 Bk, eClerx Serv & Repco Home

DSP BR Micro-Cap Fund (G) KPR Mills, Sharda Cropchem,

50.45 3,399 27.41 53.91 28.95 19.22 CPR 1 4 Star Low High

INF740K01797 SRF, Eveready Ind & Navin Fluo

Reliance Small Cap Fund (G) Intellect De, Navin Fluor, GIC

28.83 2,335 19.98 48.81 27.26 19.49 CPR 2 3 Star Average Higher

INF204K01HY3 hou, Orient cement, Atul

HDFC Mid-Cap Opportunities Fund Bajaj Finance, Voltas, HPCL,

44.47 12,259 20.55 40.79 24.27 17.65 CPR 2 4 Star Low Average

(G) INF179K01CR2 Tube invest & Cholamand

Canara Robeco Emerging Equities Indusind Bank, IOC, Yes Bank,

68.81 1,205 19.24 46.06 26.95 18.31 CPR 2 3 Star Average Average

Fund (G) INF760K01167 Divis Lab, & Ramco Cement

Equity - Sector/Thematic Funds

Tata Ethical Fund - (G) (Shariah) Hindustan Unil, INFY, Ultratech

134.41 507 3.28 22.65 17.19 16.41 CPR 3 4 Star Lower Higher

INF277K01956 Cement, TCS & Bajaj Auto

ICICI Pru Banking & Fin Serv (G) HDFC Bk, ICICI Bk, Indus Bk,

44.23 1,079 24.97 35.82 24.23 20.38 NA 4 Star Lower Higher

(Banking) INF109K01BU5 Axis Bank & Yes Bank

Franklin Build India Fund (G) HDFC Bank, ICICI Bank, Axis

32.03 655 14.64 39.39 25.61 18.14 CPR 1 5 Star Lower Higher

(Infrastructure) INF090I01AE7 Bank, SBI & L&T.

UTI-Transportation & Logistics (G) Hero Moto, Tata Mot, M&M,

95.85 772 10.50 48.72 30.75 18.75 NA NA NA NA

(Auto) INF789F01299 Adani Ports & Bosch

Birla Sun Life MNC Fund - (G) (MNC) Maruti Suzuki, Bosch, Gillette,

612.12 3,670 6.02 35.77 24.35 18.50 CPR 3 NA NA NA

INF209K01322 Bayer Crop, Glaxosmithk

Birla Sun Life India GenNext Fund (G) HDFC Bank, Maruti Suzuki

62.39 446 18.22 29.03 21.49 17.99 CPR 2 NA NA NA

(Consumption) INF209K01447 India, ITC, Eicher Motors

SBI Pharma Fund (G) (Pharma) Sun Pharma, Lupin, Aurobindo

141.82 1,087 -1.28 30.32 26.51 17.29 NA NA NA NA

INF200K01446 Phar, Divi's Lab & Strides Sha

ICICI Pru Exports and Other Services Cipla, Motherson Sumi, Natco

48.51 834 4.53 30.34 26.60 15.83 CPR 2 NA NA NA

Fund (G) (Services) INF109K01BB5 Pharma, Astrazeneca Pha

Equity - Tax Planning

AXIS Long Term Equity Fund (G) HDFC Bk, Kotak Mahi Bank,

32.93 10,035 9.60 32.72 23.06 19.59 CPR 2 5 Star Lower Higher

INF846K01131 TCS, Sun Pharma & HDFC

Birla Sun Life Tax Relief '96 (G) Sundaram-Clayton, Honeywell

23.51 2,366 13.21 30.34 19.62 10.78 CPR 1 4 Star Low High

INF209K01108 Automation, Bayer Crop, ICRA

DSP BR Tax Saver Fund (G) HDFC Bank, SBI, Indusind Bank,

37.14 1,364 19.03 29.73 20.61 14.63 CPR 2 4 Star Average High

INF740K01185 INFY & BPCL

RETAIL RESEARCH Page |1

RETAIL RESEARCH

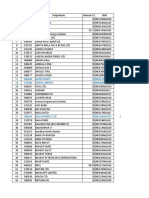

Hybrid Funds

Fund Return

1 Year 3 Year 5 Year Value

Size Since Crisil Risk Return

Scheme Name & ISIN NAV (Rs) Return Return Return Top holdings Researc

(Crs. Inception Rank Grade Grade

(%) (%) (%) h Rating

Rs) (%)

Hybrid - Equity Oriented (At least 65% in equity)

HDFC Balanced Fund (G) Eq:ICICI Bank, Infy, HDFC Bank,

119.82 6,657 13.48 27.50 17.37 16.83 CPR 2 4 Star Low Higher

INF179K01392 RIL & SBI

Tata Balanced Fund - Plan A (G) Eq: HDFC Bank, INFY, Yes Bk,

183.81 6,579 10.57 26.16 18.82 16.66 CPR 3 4 Star Average Higher

INF277K01303 HCL & Power Grid

L&T India Prudence Fund (G) Eq: INFY, ICICI Bank, ITC, HDFC

21.21 2,361 10.89 25.06 18.20 14.50 CPR 2 5 Star Low Higher

INF917K01LB0 Bank & Indusind Bank

HDFC Prudence Fund - (G) INFY, SBI, ICICI Bank, Axis Bk &

407.86 10,852 12.78 26.18 15.39 18.17 CPR 4 2 Star Higher Average

INF179K01AV8 L&T

Hybrid - Monthly Income Plan - Long Term (About 15% to 30% in equity)

Reliance Monthly Income Plan (G) Eq: Sundaram-Clayton, Axis Bk,

36.82 2,529 9.77 13.89 11.15 10.84 CPR 3 3 Star High High

INF204K01FD1 HDFC Bank, RIL & Infy.

HDFC Monthly Income Plan - LTP (G) Eq: SBI, Infy, ICICI Bank, L&T &

39.02 3,695 12.14 15.49 11.18 11.34 CPR 3 3 Star Higher Average

INF179K01AE4 Axis Bk

Debt Funds

Fund Return

1 Year 2 Year 3 Year Value

Size Since Crisil Risk Return

Scheme Name & ISIN NAV (Rs) Return Return Return Top Holdings Researc

(Crs. Inception Rank Grade Grade

(%) (%) (%) h Rating

Rs) (%)

Liquid Funds

HDFC Liquid Fund (G) Tbill, CP: SAIL, CBLO:

3,078.80 34,194 7.92 8.32 8.73 7.34 CPR 2 3 Star Average Average

INF179KB1HK0 Corporation Bank, IOB,

JM High Liquidity Fund - (G) CD: OBC, Axis Bk, IOB, Canara

42.65 4,597 8.03 8.41 8.79 8.08 CPR 3 4 Star Low High

INF192K01882 Bank. CP: Tata Pow

Ultra Short Term Funds

ICICI Pru Flexible Income Plan - CP: HDFC, Vedanta, PFC, SIDBI.

297.10 19,258 8.91 9.08 9.51 8.13 CPR 3 3 Star Average Average

Regular (G) INF109K01746 CD: Axis Bk.

IDFC Ultra Short Term Fund (G) Debt: Edelweiss comm, DLF,

22.02 4,920 8.75 8.94 9.45 7.72 CPR 3 2 Star High Average

INF194K01FU8 Albrecht. CD: HDFC Bk. CP:

Short Term Income Funds

Birla Sun Life Treasury Optimizer - GOI, Bonds: Reliance Jio Info,

299.69 6,354 11.54 11.22 11.17 7.94 - 5 Star Lower Higher

Ret (G) INF209K01LV0 Indiabulls Hou, STFC.

Sundaram Select Debt - STAP (G) Debt: STFC, SIDBI, LIC Hou, CD:

26.98 974 8.45 8.94 9.60 7.35 CPR 3 2 Star High Low

INF903J01FG3 Corp Bank, IDBI Bank

Income Funds

ICICI Pru Long Term Plan - Retail (G) GOI: 7.88% GOI 2030, 8.3%

19.25 1,011 13.17 13.19 13.29 10.42 - 5 Star Average Higher

INF109K01712 GOI 2040, 8.3% GOI 2042

UTI-Dynamic Bond Fund (G) GOI: 7.88% GOI 2030, 8.6%

17.89 1,056 11.21 10.92 11.31 9.87 CPR 3 4 Star Low Average

INF789F01JQ5 GOI 2028, Debt: Reliance

HDFC Medium Term Opportunities Debt: REC, HDFC, Petronet. CD:

17.28 5,922 10.13 10.10 10.59 9.28 CPR 2 4 Star Lower High

Fund (G) INF179K01DC2 Vijaya Bk, Canara Bank

Gilt Funds

SBI Magnum Gilt Fund - Long term 8.32% GOI 2032, 9.23% GOI

34.44 2,011 11.85 13.96 12.17 8.21 CPR 3 3 Star Low Higher

(G) INF200K01982 2043, 9.2% GOI 2030, 8.17%

L&T Gilt Fund (G) G sec: 7.88% GOI 2030, 8.13%

40.06 126 13.18 13.93 12.40 8.82 CPR 1 4 Star Low Higher

INF917K01BP1 GOI 2045

RETAIL RESEARCH Page |2

RETAIL RESEARCH

Note:

NAV value as on Aug 26, 2016. Portfolio data as on July 2016.

Returns are trailing and annualized (CAGR).

The notations '5 Star & CPR 1' (used by VR & Crisil respectively) are considered as top in respective rating and ranking scales. NA = Not Available.

The performance of the funds are rated and classified by Value Research in the following ways. Top 10% funds in each category were classified ***** funds, the next 22.5% got a **** star, while the middle 35% got a ***, while the

next 22.5% and bottom 10% got ** and * respectively.

The criteria used in computing the CRISIL Composite Performance Rank are Superior Return Score, based on NAVs over the Quarter Ended June 2016, Based on percentile of number of schemes considered in the category, the schemes

are ranked as follows: CPR 1- Very Good performance, CPR 2 - Good performance, CPR 3 - Average performance, CPR 4 - Below average and CPR 5 - Relatively weak performance in the category.

Schemes shortlisted based on the corpus and age. Final picks arrived from return score (respective weightage given for rolling returns generated from the last 7 years NAV history for 1m, 3m, 6m, 1yr, 2yr & 3yr) and risk score.

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office.

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022)

2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475."

Disclaimer: Mutual Funds investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited and is meant for sole use by the

recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information

contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to ti me positions or options on, and buy and sell

securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may

not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH Page |3

You might also like

- Data HRDocument38 pagesData HRaroravikas76% (17)

- CIO List - West IndiaDocument3 pagesCIO List - West IndiaShankar BasuNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready Reckonerpankaj_mbmNo ratings yet

- Mutual Fund Research December 2020Document16 pagesMutual Fund Research December 2020paldevchaNo ratings yet

- Mutual Fund Case StudyDocument15 pagesMutual Fund Case Studyshubhangini SaindaneNo ratings yet

- Date: 12 Sept, 2019 Sep - Oct 2019: Retail Research: Mutual Fund Ready ReckonerDocument14 pagesDate: 12 Sept, 2019 Sep - Oct 2019: Retail Research: Mutual Fund Ready ReckonerVamshi SurapaneniNo ratings yet

- SREI Infrastructure Finance LTD: Retail ResearchDocument13 pagesSREI Infrastructure Finance LTD: Retail ResearchAbhijit TripathiNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Lenders+Deck+Mar'23 IFSDocument18 pagesLenders+Deck+Mar'23 IFSGautam MehtaNo ratings yet

- Account Statement: Portfolio SummaryDocument3 pagesAccount Statement: Portfolio SummaryPradeep ChauhanNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Identifying Phoenix:: Stocks Set For ComebackDocument19 pagesIdentifying Phoenix:: Stocks Set For Comebackabhinavsingh4uNo ratings yet

- Morning Star Report 20190720091752Document1 pageMorning Star Report 20190720091752YumyumNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Morning Star Report 20190720091759Document1 pageMorning Star Report 20190720091759Chaitanya VyasNo ratings yet

- Nippon India Banking and Financial Services FundDocument1 pageNippon India Banking and Financial Services FundKunik SwaroopNo ratings yet

- Axis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Larsen& Toubro LTD Initiating Coverage 15062020Document8 pagesLarsen& Toubro LTD Initiating Coverage 15062020Aparna JRNo ratings yet

- HDFC Large and Mid Cap Fund Regular PlanDocument1 pageHDFC Large and Mid Cap Fund Regular Plansuccessinvestment2005No ratings yet

- Morning Star Report 20190720091722Document1 pageMorning Star Report 20190720091722SunNo ratings yet

- Morning Star Report 20190725103349Document1 pageMorning Star Report 20190725103349SunNo ratings yet

- Morning Star Report 20190726102711Document1 pageMorning Star Report 20190726102711YumyumNo ratings yet

- Morning Star Report 20190726102445Document1 pageMorning Star Report 20190726102445YumyumNo ratings yet

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasNo ratings yet

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunNo ratings yet

- Sbi Large and Midcap FundDocument1 pageSbi Large and Midcap FundrigordaleNo ratings yet

- Morning Star Report 20190720091852Document1 pageMorning Star Report 20190720091852Chaitanya VyasNo ratings yet

- Money Control Balanced Mutual Fund Rating 2016Document4 pagesMoney Control Balanced Mutual Fund Rating 2016Anonymous q0irDXlWAmNo ratings yet

- Topic-Best Mutual Funds 2024Document5 pagesTopic-Best Mutual Funds 2024iamrdas02No ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Mutual Fund TATA - Security AnalysisDocument15 pagesMutual Fund TATA - Security AnalysisHarish YaduvanshiNo ratings yet

- Identifying Phoenix 2.0:: Stocks Set For ComebackDocument20 pagesIdentifying Phoenix 2.0:: Stocks Set For ComebackArvind MeenaNo ratings yet

- Morning Star Report 20190725103110Document1 pageMorning Star Report 20190725103110SunNo ratings yet

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunNo ratings yet

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumNo ratings yet

- MF Ready Reckoner Schemes Oct 2016Document4 pagesMF Ready Reckoner Schemes Oct 2016Murali Krishna DNo ratings yet

- Quant Small Cap Fund Direct PlanDocument1 pageQuant Small Cap Fund Direct PlanMuhammed SabirNo ratings yet

- Nippon India Small Cap Fund Direct PlanDocument1 pageNippon India Small Cap Fund Direct Planprashant_mishra89No ratings yet

- Morning Star Report 20190726102634Document1 pageMorning Star Report 20190726102634YumyumNo ratings yet

- Axis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- HDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResDocument4 pagesHDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResYogesh RathodNo ratings yet

- Funds PageDocument1 pageFunds Page7csNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Morning Star Report 20190720091834Document1 pageMorning Star Report 20190720091834Chaitanya VyasNo ratings yet

- Axis Short Term Retail Growth: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Morning Star Report 20190720091713Document1 pageMorning Star Report 20190720091713SunNo ratings yet

- 02the Economic Times WealthDocument5 pages02the Economic Times WealthvivoposNo ratings yet

- Mahindra Manulife Credit Risk FundDocument1 pageMahindra Manulife Credit Risk FundYogi173No ratings yet

- Fundcard: Axis Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Axis Treasury Advantage Fund - Direct PlanYogi173No ratings yet

- HDFC Securities Sees 24% UPSIDE in IDFC LTDDocument14 pagesHDFC Securities Sees 24% UPSIDE in IDFC LTDTarunNo ratings yet

- Lic MF Infrastructure Fund Direct PlanDocument1 pageLic MF Infrastructure Fund Direct PlanvmtrinkaNo ratings yet

- Morning Star Report 20190720091835Document1 pageMorning Star Report 20190720091835Chaitanya VyasNo ratings yet

- Axis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityChaitanya VyasNo ratings yet

- Morning Star Report 20190720091751Document1 pageMorning Star Report 20190720091751YumyumNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- ICRA - Stock Update - 070322Document10 pagesICRA - Stock Update - 070322arunNo ratings yet

- Sbi-Bluechip-Fund Jan 2021Document1 pageSbi-Bluechip-Fund Jan 2021pdk jyotNo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocument2 pagesFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNo ratings yet

- David Windover-The Triangle Trading Method-EnDocument156 pagesDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- Safe Software FME Desktop v2018Document1 pageSafe Software FME Desktop v2018Dinesh ChoudharyNo ratings yet

- ApplicationForm (GH FLATS)Document15 pagesApplicationForm (GH FLATS)Dinesh ChoudharyNo ratings yet

- MotiveWave Volume AnalysisDocument49 pagesMotiveWave Volume AnalysisDinesh ChoudharyNo ratings yet

- Equity MF SIP Baskets For 2017: Retail ResearchDocument2 pagesEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNo ratings yet

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocument4 pagesRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: Franklin India Prima Plus FundDocument3 pagesRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNo ratings yet

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocument8 pagesRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocument4 pagesEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNo ratings yet

- Monthly Report - Nov 2016: Retail ResearchDocument10 pagesMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNo ratings yet

- Report PDFDocument10 pagesReport PDFDinesh ChoudharyNo ratings yet

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocument4 pagesRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNo ratings yet

- Retail Research: MF Ready ReckonerDocument3 pagesRetail Research: MF Ready ReckonerDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 08 February, 2017Document6 pagesHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNo ratings yet

- Retail Research: SIP in Equity Schemes - A Ready ReckonerDocument6 pagesRetail Research: SIP in Equity Schemes - A Ready ReckonerDinesh ChoudharyNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 February, 2017Document6 pagesHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 03 February, 2017Document6 pagesHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNo ratings yet

- Indian Currency Market: Retail ResearchDocument6 pagesIndian Currency Market: Retail ResearchDinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 02 March, 2017Document6 pagesHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 28 February, 2017Document6 pagesHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 09 February, 2017Document6 pagesHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 01 March, 2017Document6 pagesHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNo ratings yet

- 08-2022 August SalariesDocument20 pages08-2022 August SalariesRevanth kumarNo ratings yet

- Contractors Mailing Add GUJDocument54 pagesContractors Mailing Add GUJganesh kondikire100% (2)

- List of All BANKS of BPLDocument12 pagesList of All BANKS of BPLashi_vidNo ratings yet

- Main 201bbbbbb9 20 Bank Cheque & Receipt No 1Document12 pagesMain 201bbbbbb9 20 Bank Cheque & Receipt No 1Govind ThakorNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument1 pageStock Screener, Technical Analysis ScannerRikNo ratings yet

- GrasimDocument443 pagesGrasimMainali GautamNo ratings yet

- Reasoning Direction Sense Practice Questions Free Ebook WWW - Letsstudytogether.coDocument37 pagesReasoning Direction Sense Practice Questions Free Ebook WWW - Letsstudytogether.conischalgaire806No ratings yet

- CP RedeemedDocument171 pagesCP RedeemedkinananthaNo ratings yet

- SL - No. Scrip Code Scrip Name Haircut % IsinDocument9 pagesSL - No. Scrip Code Scrip Name Haircut % IsinAnjaneyulu ReddyNo ratings yet

- Account Name Area/PatchDocument4 pagesAccount Name Area/PatchSandeep ShahNo ratings yet

- ListIGBCAP - 08 Jan 2020Document20 pagesListIGBCAP - 08 Jan 2020aWARDSNo ratings yet

- Jfjkjjuy PDFDocument12 pagesJfjkjjuy PDFbeo saraipaliNo ratings yet

- ChemicalsDocument2 pagesChemicalsravishankarNo ratings yet

- Top 10 Companies OF NSC & BSCDocument1 pageTop 10 Companies OF NSC & BSCJď SharmaNo ratings yet

- 09-02-2021-CA ListDocument13 pages09-02-2021-CA ListNeeraj AroraNo ratings yet

- Ifcb2009 68Document1,038 pagesIfcb2009 68anon_823030012No ratings yet

- INTRUDING BULL's Stock Tracker - Recommended StocksDocument1 pageINTRUDING BULL's Stock Tracker - Recommended StocksYash SakpalNo ratings yet

- Mahindra GroupDocument2 pagesMahindra GroupMayank SaigalNo ratings yet

- Interior Design - Case StudyDocument15 pagesInterior Design - Case StudyManasviJindalNo ratings yet

- List of Bank in MaharashtraDocument50 pagesList of Bank in MaharashtraGunjanNo ratings yet

- Ramkesh New Statment-1Document13 pagesRamkesh New Statment-1rajmeenameenaji9797No ratings yet

- Dabi LeadsDocument21 pagesDabi LeadsRiya KaharNo ratings yet

- CIT Mapping South BengalDocument12 pagesCIT Mapping South Bengalleninanthony89488No ratings yet

- MPRDC - Company ListDocument4 pagesMPRDC - Company ListarvindNo ratings yet

- Bank IFSC Code MICR Code Branch N Address Contact City District StateDocument36 pagesBank IFSC Code MICR Code Branch N Address Contact City District StateAnkur JariwalaNo ratings yet

- OperatorsDocument98 pagesOperatorsJeetendra SahaniNo ratings yet

- Mumbai CFOsDocument5 pagesMumbai CFOsMusterNo ratings yet

- Below Is The List of India IncDocument2 pagesBelow Is The List of India IncDipin NambiarNo ratings yet