Professional Documents

Culture Documents

FHA Appraisals 170302

FHA Appraisals 170302

Uploaded by

Ed StewartCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 12 LBO Model Seven Days Case StudyDocument6 pages12 LBO Model Seven Days Case StudyDNo ratings yet

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

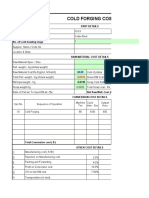

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Market Segments: (Structure of FX Market)Document4 pagesMarket Segments: (Structure of FX Market)Leo the BulldogNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- Sunteck Realty LTD.: Rachana Vipul HingarajiaDocument317 pagesSunteck Realty LTD.: Rachana Vipul HingarajiaMr. S0UR48HNo ratings yet

- Travel Warehouse LTD Distributes Suitcases To Retail Stores at TheDocument2 pagesTravel Warehouse LTD Distributes Suitcases To Retail Stores at TheMiroslav GegoskiNo ratings yet

- Accounting Grade 8 YEAR PLAN 2024Document3 pagesAccounting Grade 8 YEAR PLAN 2024jemimanzinu6No ratings yet

- AP Micro 2-6 Excise TaxesDocument12 pagesAP Micro 2-6 Excise TaxesARINNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument4 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Income From HPDocument8 pagesIncome From HPNidaNo ratings yet

- OmartDocument12 pagesOmartmohamedsadiq555No ratings yet

- Intermediate Accounting 2Document18 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Ration and Proportion Questions For Bank PO Mains Exam: WWW - Guidely.inDocument12 pagesRation and Proportion Questions For Bank PO Mains Exam: WWW - Guidely.inAkhil SemwalNo ratings yet

- Hosteller 4 TH 5 THDocument4 pagesHosteller 4 TH 5 THDhriti AgarwalNo ratings yet

- TYBFM A 36 Vignesh Khandelwal Black BookDocument74 pagesTYBFM A 36 Vignesh Khandelwal Black Bookpreet doshiNo ratings yet

- Chap 1 - Business IncomeDocument75 pagesChap 1 - Business IncometheputeriizzahNo ratings yet

- Business Plan QuestionnaireDocument3 pagesBusiness Plan QuestionnaireZain KhalidNo ratings yet

- 0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics IDocument44 pages0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics I18651 SYEDA AFSHANNo ratings yet

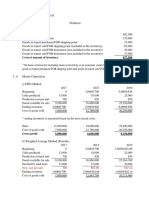

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Test of Controls For Some Major ActivitiesDocument22 pagesTest of Controls For Some Major ActivitiesMohsin RazaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument54 pagesThis Paper Is Not To Be Removed From The Examination HallskikiNo ratings yet

- Problem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreDocument17 pagesProblem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreMark Angelo BustosNo ratings yet

- Term Debt Is Not Recorded As A LiabilityDocument3 pagesTerm Debt Is Not Recorded As A Liabilitychristian dagNo ratings yet

- Introduction To Economics Group Assignment KenenisaDocument1 pageIntroduction To Economics Group Assignment KenenisaGelan DuferaNo ratings yet

- Invoice - Ptron Bassbuds Pro (New)Document1 pageInvoice - Ptron Bassbuds Pro (New)Jee AdvancedNo ratings yet

- Contents:: The "Triple Rebound" StrategyDocument8 pagesContents:: The "Triple Rebound" StrategyRàví nikezim 100No ratings yet

- Gs 51 General 6 PageDocument6 pagesGs 51 General 6 PageOneNationNo ratings yet

- Functions of MarketingDocument1 pageFunctions of MarketingmariNo ratings yet

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet

FHA Appraisals 170302

FHA Appraisals 170302

Uploaded by

Ed StewartCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FHA Appraisals 170302

FHA Appraisals 170302

Uploaded by

Ed StewartCopyright:

Available Formats

FHA APPRAISALS

Those of you who have bought or sold a home are familiar with two keys to the transaction

being completed. One of these keys is the appraisal. If the appraised value of the home is less

than the contract price of the home, lenders almost always refuse to make the buyer a loan

based on anything other than the appraised value, oftentimes necessitating a renegotiation of

the contract price.

The second key is whether or not the loan is being guaranteed by a quasi-government entity

such as the FHA, as the FHA, in particular, requires an appraiser to follow very specific

guidelines in performing his appraisal. If you want the full spiel on these FHA guidelines, I refer

you to HUD Handbook 4150.2 available on the HUD website.

Allow me to begin by quickly defining what an appraisal is. An appraisal is an expert

assessment/opinion of a particular home in order to determine its market value. During the

appraisal process, the appraiser will look at comparable properties that have sold recently in the

same area as the one being purchased.

In a "conventional" appraisal where a non-government-insured home loan is being used, the

appraiser is only concerned with the condition of the property as it relates to value. However,

when an FHA loan is being used the appraiser has two objectives, first to determine the current

market value of the property (as is the case with a conventional appraisal), and second to do a

property inspection to make sure the home meets HUD's minimum standards for health and

safety.

So, what are some of the primary inspection areas required of FHA inspectors by HUD

standards?

the home must be habitable and comfortable, without any potential hazards to occupants

the lot should be graded in a way that prevents moisture from entering the home

all bedrooms should have egress to the exterior (doors or windows) for reasons of fire safety

as it is possible homes built before 1978 still contain lead-based paint, the appraiser must

check for peeling, chipping, etc.

all steps and stairways must have a handrail for safety

the heating system must be sufficient to create "healthful and comfortable living conditions"

inside the home

the roof should be in a good state of repair

the foundation should be in good repair and able to withstand "all normal loads imposed" on it

In the event the inspector identifies any violations of HUD standards, the inspector will do a final

inspection later and if the discrepancies are corrected before that final inspection the loan/deal

will move forward. Bottom line? While different, FHA appraisals are not unnecessarily strict

and prevent very few transactions from actually being consummated.

Ed Stewart lives in Grant Parish and is a licensed real estate agent in Louisiana. He is associated

with Keller Williams Realty Cenla Partners in Alexandria and can be reached on his cell (318-201-

3991) or office telephone (318-619-7796). Each Keller Williams Realty office is independently

owned and operated. Send your real estate questions to Ed via email at edstewart@kw.com or

chronicle1876@yahoo.com.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 12 LBO Model Seven Days Case StudyDocument6 pages12 LBO Model Seven Days Case StudyDNo ratings yet

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocument1 pageODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 94.cold Forging Cost Estimation SheetDocument5 pages94.cold Forging Cost Estimation SheetVenkateswaran venkateswaranNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Market Segments: (Structure of FX Market)Document4 pagesMarket Segments: (Structure of FX Market)Leo the BulldogNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- Sunteck Realty LTD.: Rachana Vipul HingarajiaDocument317 pagesSunteck Realty LTD.: Rachana Vipul HingarajiaMr. S0UR48HNo ratings yet

- Travel Warehouse LTD Distributes Suitcases To Retail Stores at TheDocument2 pagesTravel Warehouse LTD Distributes Suitcases To Retail Stores at TheMiroslav GegoskiNo ratings yet

- Accounting Grade 8 YEAR PLAN 2024Document3 pagesAccounting Grade 8 YEAR PLAN 2024jemimanzinu6No ratings yet

- AP Micro 2-6 Excise TaxesDocument12 pagesAP Micro 2-6 Excise TaxesARINNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument4 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Income From HPDocument8 pagesIncome From HPNidaNo ratings yet

- OmartDocument12 pagesOmartmohamedsadiq555No ratings yet

- Intermediate Accounting 2Document18 pagesIntermediate Accounting 2cpacpacpaNo ratings yet

- Ration and Proportion Questions For Bank PO Mains Exam: WWW - Guidely.inDocument12 pagesRation and Proportion Questions For Bank PO Mains Exam: WWW - Guidely.inAkhil SemwalNo ratings yet

- Hosteller 4 TH 5 THDocument4 pagesHosteller 4 TH 5 THDhriti AgarwalNo ratings yet

- TYBFM A 36 Vignesh Khandelwal Black BookDocument74 pagesTYBFM A 36 Vignesh Khandelwal Black Bookpreet doshiNo ratings yet

- Chap 1 - Business IncomeDocument75 pagesChap 1 - Business IncometheputeriizzahNo ratings yet

- Business Plan QuestionnaireDocument3 pagesBusiness Plan QuestionnaireZain KhalidNo ratings yet

- 0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics IDocument44 pages0224 II Semester Five Years B.A.LL.B. Examination, December 2012 Economics I18651 SYEDA AFSHANNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Test of Controls For Some Major ActivitiesDocument22 pagesTest of Controls For Some Major ActivitiesMohsin RazaNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument54 pagesThis Paper Is Not To Be Removed From The Examination HallskikiNo ratings yet

- Problem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreDocument17 pagesProblem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreMark Angelo BustosNo ratings yet

- Term Debt Is Not Recorded As A LiabilityDocument3 pagesTerm Debt Is Not Recorded As A Liabilitychristian dagNo ratings yet

- Introduction To Economics Group Assignment KenenisaDocument1 pageIntroduction To Economics Group Assignment KenenisaGelan DuferaNo ratings yet

- Invoice - Ptron Bassbuds Pro (New)Document1 pageInvoice - Ptron Bassbuds Pro (New)Jee AdvancedNo ratings yet

- Contents:: The "Triple Rebound" StrategyDocument8 pagesContents:: The "Triple Rebound" StrategyRàví nikezim 100No ratings yet

- Gs 51 General 6 PageDocument6 pagesGs 51 General 6 PageOneNationNo ratings yet

- Functions of MarketingDocument1 pageFunctions of MarketingmariNo ratings yet

- CH 09 MBADocument20 pagesCH 09 MBAManvitha ReddyNo ratings yet