Professional Documents

Culture Documents

Ebitda: Net Income

Ebitda: Net Income

Uploaded by

mohsin munara0 ratings0% found this document useful (0 votes)

8 views2 pagesEBITDA stands for earnings before interest, taxes, depreciation and amortization. It is a measure of a company's operating profitability and financial performance. EBITDA is calculated by taking a company's operating profit and adding back non-cash expenses such as depreciation and amortization. This adjustment eliminates the effects of financing and accounting decisions, allowing for more accurate comparison between companies. EBITDA is often used by investors and in valuation methods.

Original Description:

Ebitda

Original Title

A 30

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEBITDA stands for earnings before interest, taxes, depreciation and amortization. It is a measure of a company's operating profitability and financial performance. EBITDA is calculated by taking a company's operating profit and adding back non-cash expenses such as depreciation and amortization. This adjustment eliminates the effects of financing and accounting decisions, allowing for more accurate comparison between companies. EBITDA is often used by investors and in valuation methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesEbitda: Net Income

Ebitda: Net Income

Uploaded by

mohsin munaraEBITDA stands for earnings before interest, taxes, depreciation and amortization. It is a measure of a company's operating profitability and financial performance. EBITDA is calculated by taking a company's operating profit and adding back non-cash expenses such as depreciation and amortization. This adjustment eliminates the effects of financing and accounting decisions, allowing for more accurate comparison between companies. EBITDA is often used by investors and in valuation methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

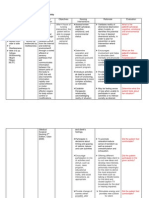

EBITDA

EBITDA stands for earnings before interest, taxes, depreciation

and amortization. EBITDA is one of the indicator of a

company's financial performance.

EBITDA is Calculated as

EBITDA = Operating Profit + Depreciation Expense + Amortization Expense

The more simple formula for EBITDA is:

EBITDA = Net Profit + Interest +Taxes + Depreciation + Amortization

EBITDA is essentially net income with interest, taxes, depreciation and

amortization added back to it. EBITDA can be used to analyze and compare

profitability between companies and industries because it eliminates the effects of

financing and accounting decisions. EBITDA is often used in valuation ratios and

compared to enterprise value and revenue.

EBITDA is calculated by adding back the non-cash expenses

of depreciation and amortization to a firm's operating income

EBITDA = EBIT + Depreciation + Amortization

Let's take a look at a hypothetical income statement for Company XYZ:

To calculate EBITDA, we find the line items for EBIT ($750,000), depreciation

($50,000) and amortization (n/a) and then use the formula above:

EBITDA = 750,000 + 50,000 + 0 = $800,000

A professional investor contemplating a change to the capital structure of a firm

(e.g., through a leveraged buyout) first evaluates a firm's fundamental earnings

potential (reflected by earnings before interest, taxes, depreciation and

amortization (EBITDA) and EBIT), and then determines the optimal use of debt vs.

equity.

To calculate EBIT, expenses (e.g. the cost of goods sold, selling and administrative

expenses) are subtracted from revenues. Net income is later obtained by

subtracting interest and taxes from the result.

You might also like

- Solution Manual For Financial Management Theory and Practice Third Canadian EditionDocument36 pagesSolution Manual For Financial Management Theory and Practice Third Canadian Editionejecthalibutudoh0100% (35)

- Philosophy of LawDocument8 pagesPhilosophy of LawEm Asiddao-DeonaNo ratings yet

- Revenue (Sales) XXX (-) Variable Costs XXXDocument10 pagesRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghNo ratings yet

- PDF GenfinalDocument29 pagesPDF GenfinalLorenzoNo ratings yet

- Deficient Diversional ActivityDocument2 pagesDeficient Diversional ActivityKimsha Concepcion100% (2)

- Project Proposal DraftDocument14 pagesProject Proposal DraftAdasa EdwardsNo ratings yet

- Understanding Voltage Regulators - Smart Grid Solutions - SiemensDocument5 pagesUnderstanding Voltage Regulators - Smart Grid Solutions - SiemenstusarNo ratings yet

- EbitdaDocument6 pagesEbitdaAlper AykaçNo ratings yet

- Earnings Before Interest and TaxesDocument7 pagesEarnings Before Interest and TaxesNiño Rey LopezNo ratings yet

- EBITDADocument1 pageEBITDAShraddha BhunjeNo ratings yet

- Core Finance TermsDocument2 pagesCore Finance TermsIndra BhushanNo ratings yet

- EBITDA - Earnings Before Interest, Taxes, Depreciation, and AmortizationDocument7 pagesEBITDA - Earnings Before Interest, Taxes, Depreciation, and AmortizationTanja MercadejasNo ratings yet

- EBITDADocument3 pagesEBITDAGiddel Ann Kristine VelasquezNo ratings yet

- EBIT - WikipediaDocument2 pagesEBIT - Wikipediapuput075No ratings yet

- EBITDADocument1 pageEBITDAMenu Harry GandhiNo ratings yet

- PAT and EBITDADocument2 pagesPAT and EBITDATravel DiaryNo ratings yet

- EBITDADocument2 pagesEBITDAMihaela DumitruNo ratings yet

- EBITDADocument11 pagesEBITDANikhil KumarNo ratings yet

- EBITDA - Meaning, Formula, and HistoryDocument7 pagesEBITDA - Meaning, Formula, and Historymanosekhar8562No ratings yet

- What Is EBITDA Margin?Document4 pagesWhat Is EBITDA Margin?Jonhmark AniñonNo ratings yet

- EBIT Revenue COGS Operating Expenses or EBIT Net Income + Interest + Taxes Where: COGS Cost of Goods SoldDocument3 pagesEBIT Revenue COGS Operating Expenses or EBIT Net Income + Interest + Taxes Where: COGS Cost of Goods SoldLeahC.No ratings yet

- 03-Measures of Perfomance in Private SectorDocument5 pages03-Measures of Perfomance in Private SectorHastings KapalaNo ratings yet

- EbitdaDocument4 pagesEbitdaShashank PalNo ratings yet

- EbitdaDocument11 pagesEbitdaM B SAKILNo ratings yet

- Case StudyDocument3 pagesCase StudyNeha AroraNo ratings yet

- EBITDA Cheat SheetDocument4 pagesEBITDA Cheat SheetyanceNo ratings yet

- Raw DataDocument4 pagesRaw DataM B SAKILNo ratings yet

- Income StatementDocument20 pagesIncome StatementkasoziNo ratings yet

- Earnings Before Interest and TaxesDocument3 pagesEarnings Before Interest and TaxesBOBBY212No ratings yet

- Profit and Loss StatementDocument2 pagesProfit and Loss StatementDivyang BhattNo ratings yet

- Weak Leaner ActivityDocument5 pagesWeak Leaner ActivityAshwini shenolkarNo ratings yet

- Net Income NI Definition Uses and How To Calculate ItDocument4 pagesNet Income NI Definition Uses and How To Calculate IthieutlbkreportNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Document36 pagesSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (52)

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (23)

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Full Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter ChapterDocument36 pagesFull Solution Manual For Financial Management Theory and Practice Third Canadian Edition PDF Docx Full Chapter Chapterzanycofferswubjt100% (12)

- ACC 327 Pre-Class Case 2Document3 pagesACC 327 Pre-Class Case 2xingwentong0527No ratings yet

- Lecture 11 IncomeDocument14 pagesLecture 11 IncomeСильвия ГабриэльNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- LIQUIDITY RATIOS As We Know From Word Liquidity Which Means To LiquefyDocument3 pagesLIQUIDITY RATIOS As We Know From Word Liquidity Which Means To LiquefyAbdullah ChNo ratings yet

- Income Statement: Profit and LossDocument7 pagesIncome Statement: Profit and LossNavya NarulaNo ratings yet

- CH 5Document21 pagesCH 5gebremedhnNo ratings yet

- Free Cash FlowDocument1 pageFree Cash Flowkishorepatil8887No ratings yet

- Eva & RoiDocument3 pagesEva & RoiZahirSadiNo ratings yet

- Report - Basic Financial Statements-EriveDocument18 pagesReport - Basic Financial Statements-Eriveevita eriveNo ratings yet

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananNo ratings yet

- AMA Lecture 2Document54 pagesAMA Lecture 2Mohammed FouadNo ratings yet

- Non Abm 1 Information Sheet 3.2Document3 pagesNon Abm 1 Information Sheet 3.2Johnmer AvelinoNo ratings yet

- FBMINT T1 EBITDA - EBIT - EBT - EAT EngDocument11 pagesFBMINT T1 EBITDA - EBIT - EBT - EAT EngTamer BAKICIOLNo ratings yet

- How To Calculate Return On Total AssetsDocument1 pageHow To Calculate Return On Total AssetsArthur Omolo OgonjiNo ratings yet

- Far 4Document9 pagesFar 4Sonu NayakNo ratings yet

- Ebit Revenue - Operating ExpensesDocument7 pagesEbit Revenue - Operating ExpensesArchay TehlanNo ratings yet

- More About The Income Statement and Statement of Stockholders' Equity Chapter 11Document32 pagesMore About The Income Statement and Statement of Stockholders' Equity Chapter 11Rupesh PolNo ratings yet

- Ratio Analysis 2.1Document69 pagesRatio Analysis 2.1Sivaji AmmuNo ratings yet

- 1 Business Vs Economic Profit: Table of ContentsDocument8 pages1 Business Vs Economic Profit: Table of ContentsKashaf AmjadNo ratings yet

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- Week 3 Asset Based Valuation Part 2 MG3Document26 pagesWeek 3 Asset Based Valuation Part 2 MG3VENICE MARIE ARROYONo ratings yet

- Session 14 & 15 Financial Analysis - The Determinents of PerformanceDocument15 pagesSession 14 & 15 Financial Analysis - The Determinents of PerformancePooja MehraNo ratings yet

- Coverage RatioDocument4 pagesCoverage RatioNishant RaiNo ratings yet

- Ebitda: Depreciation, and AmortizationDocument3 pagesEbitda: Depreciation, and AmortizationriefkurNo ratings yet

- Engineering Economy ProblemsDocument19 pagesEngineering Economy ProblemsEmperor VallenNo ratings yet

- Lesson Plan - First Clarinet Lesson Context:: Time Sequencing AssessmentDocument2 pagesLesson Plan - First Clarinet Lesson Context:: Time Sequencing Assessmentapi-454899087No ratings yet

- Duane Shinn Piano Course CatalogDocument13 pagesDuane Shinn Piano Course Catalog4scribble0375% (4)

- Annotated BibliographyDocument4 pagesAnnotated Bibliographyapi-302549909No ratings yet

- Imperial V DavidDocument1 pageImperial V DavidAlyssa Mae Ogao-ogaoNo ratings yet

- 60. Đề Thi Thử TN THPT 2021 - Môn Tiếng Anh - Sở GD & ĐT Hưng Yên - File Word Có Lời GiảiDocument6 pages60. Đề Thi Thử TN THPT 2021 - Môn Tiếng Anh - Sở GD & ĐT Hưng Yên - File Word Có Lời GiảiMinh DươngNo ratings yet

- Goldfarb School of Nursing at Barnes-Jewish College Textbooks - Summer 2020Document6 pagesGoldfarb School of Nursing at Barnes-Jewish College Textbooks - Summer 2020brad0% (1)

- Your World 3 Grammar Presentation 1 2Document7 pagesYour World 3 Grammar Presentation 1 2epalmerNo ratings yet

- Roll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaDocument3 pagesRoll Number Name Subject Marks Obtained Total Grade Result: 2967917 Bhagesh Ari MauryaShiv PoojanNo ratings yet

- Chemical Analysis of Caustic Soda and Caustic Potash (Sodium Hydroxide and Potassium Hydroxide)Document16 pagesChemical Analysis of Caustic Soda and Caustic Potash (Sodium Hydroxide and Potassium Hydroxide)wilfred gomezNo ratings yet

- Genrich Altshuller-Innovation Algorithm - TRIZ, Systematic Innovation and Technical Creativity-Technical Innovation Center, Inc. (1999)Document290 pagesGenrich Altshuller-Innovation Algorithm - TRIZ, Systematic Innovation and Technical Creativity-Technical Innovation Center, Inc. (1999)Dendra FebriawanNo ratings yet

- Research in Organizational Behavior: Sabine SonnentagDocument17 pagesResearch in Organizational Behavior: Sabine SonnentagBobby DNo ratings yet

- 723PLUS Digital Control - WoodwardDocument40 pages723PLUS Digital Control - WoodwardMichael TanNo ratings yet

- The Role of Majority and Minority Language Input in The Early Development of A Bilingual VocabularyDocument15 pagesThe Role of Majority and Minority Language Input in The Early Development of A Bilingual VocabularyPoly45No ratings yet

- Abraham Kuyper and The Rise of NeoDocument12 pagesAbraham Kuyper and The Rise of NeoDragos StoicaNo ratings yet

- Keraplast Wound Care BrochureDocument4 pagesKeraplast Wound Care BrochureclventuriniNo ratings yet

- NCBTSDocument44 pagesNCBTSGlenn GomezNo ratings yet

- Self WorthDocument5 pagesSelf WorthSav chan123No ratings yet

- Cholera in Juba, Central Equatoria State, Republic of South SudanDocument6 pagesCholera in Juba, Central Equatoria State, Republic of South Sudanapi-289294742No ratings yet

- 40K - Malcador Tank v1Document2 pages40K - Malcador Tank v1SKL2002No ratings yet

- In Re SantiagoDocument2 pagesIn Re SantiagoKing BadongNo ratings yet

- Horn Persistence Natural HornDocument4 pagesHorn Persistence Natural Hornapi-478106051No ratings yet

- ICEfaces Asynchronous HTTP ServerDocument33 pagesICEfaces Asynchronous HTTP ServerIniyaNo ratings yet

- Vodafone Albania User ManualDocument102 pagesVodafone Albania User ManualKudret BojkoNo ratings yet

- 14 9 B People Vs MalnganDocument3 pages14 9 B People Vs MalnganAAMCNo ratings yet