Professional Documents

Culture Documents

Republic of The Philippines, Represented by The Philippine Reclamation Authority Vs

Republic of The Philippines, Represented by The Philippine Reclamation Authority Vs

Uploaded by

Hersie BundaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic of The Philippines, Represented by The Philippine Reclamation Authority Vs

Republic of The Philippines, Represented by The Philippine Reclamation Authority Vs

Uploaded by

Hersie BundaCopyright:

Available Formats

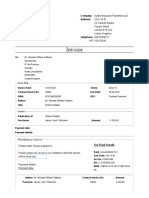

Republic of the Philippines, Represented by the Philippine Reclamation

Authority

vs

City of Paranaque

July 18, 2012

Facts:

The pubic Estates Authority is a government corporation created to

provide a coordinated, economical and efficient reclamation of lands, and the

administration and operation of lands belonging to, managed by the

government with the object of maximizing their utilization and hastening

their development consistent with public interest. By virtue of EO No. 525

issued by the President Marcos, PEA was designated as the agency primarily

responsible for integrating, directing and coordinating all reclamation

projects for and on behalf of the national government. Then President Gloria

Macapagal Arroyo issued an order transforming PEA into PRA, which shall

perform the same functions of the PEA for reclamation activities.

By virtue of its mandate, PRA reclaimed several portions of the forehor

and offshore areas of Manila Bay, including those Paraaque City and was

subsequently issued the corresponding title. then Paraaque City Treasurer

issued Warrants of Levy on PRAs reclaimed properties located in Paraaque

City based on the assessment for delinquent real property taxes made by

then Paraaque City Assessor. PRA filed a petition for prohibition with prayer

for temporary restraining order or writ of preliminary injunction against

Carabeo before the RTC, it also issued an order denying PRAs petition for the

issuance of a temporary restraining order. PRA sent a letter to Carabeo

requesting the latter not to proceed with the public auction of the subject

reclaimed properties. In response, Carabeo sent a letter stating that the

public auction could not be deferred because the RTC had already denied

PRAs TRO application. The RTC denied PRAs prayer for the issuance of a

writ of preliminary injunction for being moot and academic considering the

sale has been consummated already.

PRA filed a Motion for Leave to File and Admit Attached Supplemental

Petition which sought to declare as null and void the assessment for real

property taxes, the levy based on the said assessment and the sale

conducted. The RTC rendered its decision dismissing PRAs petition. Hence,

this petition.

Issues:

1. Whether or not PRA is government incorporated instrumentality and

is, therefore, exempt from real property tax and of the local

government code taxation.

2. Whether or not the lower court erred in failing to consider that

reclaimed lands are part of the public domain. Hence, tax exempt.

Laws:

a. Section 16, Article XII of the 1987 Constitution

b. Section 133 of the Local Government Code

Petitioner Respondent

1. PRA asserts that it is not a 1. City of Paraaque argues that

GOCC under Section 2(13) of PRA since its creation

the Introductory Provisions of consistently represented itself

the Administrative Code. to be a GOCC. PRAs very own

Neither is it a GOCC under charter declared it to be a

Section 16, Article XII of the GOCC and that it has entered

1987 Constitution because it is into several thousands of

not required to meet the test of contracts where it represented

economic viability. itself to be a GOCC.

2. PRA insists that, as an

incorporated instrumentality of

the National Government, it is

exempt from payment of real

property tax except when the

beneficial use of the real

property is granted to a taxable

person

Ruling:

1. PRA is not a GOCC either under Section 2(3) of the Introductory

Provisions of the Administrative Code or under Section 16, Article XII of

the 1987 Constitution. The facts, the evidence on record and

jurisprudence on the issue support the position that PRA was not

organized either as a stock or a non-stock corporation. Neither was it

created by Congress to operate commercially and compete in the

private market. Instead, PRA is a government instrumentality vested

with corporate powers and performing an essential public service

pursuant to Section 2(10) of the Introductory Provisions of the

Administrative Code. Being an incorporated government

instrumentality, it is exempt from payment of real property tax.

Respondent has no valid or legal basis in taxing the subject reclaimed

lands managed by PRA. On the other hand, Section 234(a) of the LGC,

in relation to its Section 133(o), exempts PRA from paying realty taxes

and protects it from the taxing powers of local government units. It is

clear from Section 234 that real property owned by the Republic is

exempt from real property tax unless the beneficial use thereof has

been granted to a taxable person. At bar, there is no proof that PRA

granted the beneficial use of the subject reclaimed lands to a taxable

entity. There is no showing on record either that PRA leased the subject

reclaimed properties to a private taxable entity.

2. The subject lands are reclaimed lands, specifically portions of the

foreshore and offshore areas of Manila Bay. As such, these lands

remain public lands and form part of the public domain. They are

properties of public dominion. The ownership of such lands remains

with the State unless they are withdrawn by law or presidential

proclamation from public use. Thus, the assessment, levy and

foreclosure made on the subject reclaimed lands by respondent, as

well as the issuances of certificates of title in favor of respondent, are

without basis.

You might also like

- ADGE SyllabusDocument8 pagesADGE SyllabusHersie Bunda100% (1)

- Republic of The Philippines Represented by The Philippine Reclamation Authority (PRA) Vs City of Paranaque 677 SCRA 246Document4 pagesRepublic of The Philippines Represented by The Philippine Reclamation Authority (PRA) Vs City of Paranaque 677 SCRA 246Khian JamerNo ratings yet

- Ifrs 13Document3 pagesIfrs 13syedtahaaliNo ratings yet

- Jollibee Foods Corporation's Contractualization Issue in The PhilippinesDocument2 pagesJollibee Foods Corporation's Contractualization Issue in The PhilippinesLoida Gigi AbanadorNo ratings yet

- Corpo Cases 1Document251 pagesCorpo Cases 1KayeCie RLNo ratings yet

- RP Vs City of Parañaque G.R. No. 191109Document21 pagesRP Vs City of Parañaque G.R. No. 191109John BernalNo ratings yet

- Republic vs. City of ParanaqueDocument8 pagesRepublic vs. City of ParanaqueJohn WeiNo ratings yet

- 13-Republic V Paranaque (2012)Document13 pages13-Republic V Paranaque (2012)evreynosoNo ratings yet

- Republic vs. City of ParanaqueDocument17 pagesRepublic vs. City of ParanaqueMariaFaithFloresFelisartaNo ratings yet

- 2 Rebublic-v-ParanaqueDocument12 pages2 Rebublic-v-ParanaqueKobe Lawrence VeneracionNo ratings yet

- Petitioner Vs Vs Respondent: Third DivisionDocument13 pagesPetitioner Vs Vs Respondent: Third DivisionRobert Jayson UyNo ratings yet

- Petitioner Vs Vs Respondent: Third DivisionDocument13 pagesPetitioner Vs Vs Respondent: Third DivisionJade Marlu DelaTorreNo ratings yet

- Petitioner RespondentDocument15 pagesPetitioner RespondentKiz AndersonNo ratings yet

- #7 Republic of The Philippines v. Paranaque, G.R. No. 191908, July 18, 2012Document11 pages#7 Republic of The Philippines v. Paranaque, G.R. No. 191908, July 18, 2012noemi alvarezNo ratings yet

- Republic vs. City of ParañaqueDocument13 pagesRepublic vs. City of ParañaqueRon Ico RamosNo ratings yet

- Republic V Parañaque DigestDocument3 pagesRepublic V Parañaque DigestNikki Estores Gonzales100% (1)

- REPUBLIC v. CITY OF PARAÑAQUEDocument17 pagesREPUBLIC v. CITY OF PARAÑAQUEKhate AlonzoNo ratings yet

- Republic of The Philippines V. City of Parañaque: TopicDocument3 pagesRepublic of The Philippines V. City of Parañaque: TopicKrisNo ratings yet

- 12 REPUBLIC v. PARANAQUEDocument1 page12 REPUBLIC v. PARANAQUETriciaNo ratings yet

- Republic v. Paranaque DigestedDocument4 pagesRepublic v. Paranaque DigestedChariNo ratings yet

- Philippine Reclamation Authority vs. City of Parañaque (18 July 2012)Document3 pagesPhilippine Reclamation Authority vs. City of Parañaque (18 July 2012)RICKY ALEGARBESNo ratings yet

- Republic Vs City of Paranaque Digest GR No. 191109Document2 pagesRepublic Vs City of Paranaque Digest GR No. 191109Patrick James Tan100% (4)

- 1.03. Rop v. City of Paranaque G.R. No. 191109Document2 pages1.03. Rop v. City of Paranaque G.R. No. 191109Nei BacayNo ratings yet

- Republic of The Philippines v. City of Paranaque, G.R. No. 191109, July 18, 2012Document10 pagesRepublic of The Philippines v. City of Paranaque, G.R. No. 191109, July 18, 2012heyy rommelNo ratings yet

- Republic of The Philippines, Represented by The Philippine Reclamation Authority (Pra) vs. City of ParanaqueDocument2 pagesRepublic of The Philippines, Represented by The Philippine Reclamation Authority (Pra) vs. City of Paranaquefranzadon100% (1)

- Recent Cases On Beneficial UseDocument13 pagesRecent Cases On Beneficial UseLeighNo ratings yet

- Phil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Document29 pagesPhil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Juni VegaNo ratings yet

- 13 Republic V ParanaqueDocument7 pages13 Republic V ParanaqueAtty MglrtNo ratings yet

- RP vs. ParañaqueDocument8 pagesRP vs. ParañaqueMulan DisneyNo ratings yet

- CARIÑO - Republic V ParañaqueDocument1 pageCARIÑO - Republic V ParañaqueGail CariñoNo ratings yet

- MNB BNMKNKDocument4 pagesMNB BNMKNKNorr MannNo ratings yet

- Republic vs. ParanaqueDocument7 pagesRepublic vs. ParanaqueMj BrionesNo ratings yet

- Manila International Airport Authority vs. Court of Appeals, Paranaque City G.R. No. 155650 July 20, 2006Document26 pagesManila International Airport Authority vs. Court of Appeals, Paranaque City G.R. No. 155650 July 20, 2006Juni VegaNo ratings yet

- Manila International Airport Authority vs. Court of Appeals, Paranaque City G.R. No. 155650 July 20, 2006Document26 pagesManila International Airport Authority vs. Court of Appeals, Paranaque City G.R. No. 155650 July 20, 2006Juni VegaNo ratings yet

- MCIA vs. City CouncilDocument4 pagesMCIA vs. City CouncilKeisha Camille OliverosNo ratings yet

- G.R. No. 191109Document10 pagesG.R. No. 191109anna sarilNo ratings yet

- Supreme Court: Custom SearchDocument10 pagesSupreme Court: Custom Searchanna sarilNo ratings yet

- Basco Et Al vs. PAGCORDocument4 pagesBasco Et Al vs. PAGCORLoraine RingonNo ratings yet

- NDC Vs Cebu City and PacisDocument8 pagesNDC Vs Cebu City and PacisPaolo Antonio EscalonaNo ratings yet

- 5TH CaseDocument8 pages5TH Casecharmaine riveraNo ratings yet

- Law Case Digest G.R. No. 191109Document2 pagesLaw Case Digest G.R. No. 191109Kielle Castelle0% (2)

- Pubcorp Digests 2Document27 pagesPubcorp Digests 2Dana DNo ratings yet

- Republic of The Philippines VS Parañaque, GR No. 191908, July 18, 2012Document3 pagesRepublic of The Philippines VS Parañaque, GR No. 191908, July 18, 2012Don Michael ManiegoNo ratings yet

- Real Property Case DigestsDocument45 pagesReal Property Case DigestsKristine Jay Perez-CabusogNo ratings yet

- MIAA v. Court of Appeals: Carpio, JDocument31 pagesMIAA v. Court of Appeals: Carpio, JIsaias S. Pastrana Jr.No ratings yet

- Real Property Taxation Case DigestDocument8 pagesReal Property Taxation Case DigestKimberly SendinNo ratings yet

- National Development Co. v. Cebu City, 215 SCRA 382 - Exemption - Government IntrumentalitiesDocument2 pagesNational Development Co. v. Cebu City, 215 SCRA 382 - Exemption - Government IntrumentalitiesIVYJEAN LAGURANo ratings yet

- National Development Company v. Cebu CityDocument7 pagesNational Development Company v. Cebu CityR. BonitaNo ratings yet

- State Immunity From Suit Lansang Vs Ca GR.108667 FEB 23, 2000 FactsDocument107 pagesState Immunity From Suit Lansang Vs Ca GR.108667 FEB 23, 2000 FactsJunpyo ArkinNo ratings yet

- 227 Republic v. City of ParañaqueDocument3 pages227 Republic v. City of ParañaqueGain DeeNo ratings yet

- City Treasurer of Taguig v. BCDADocument11 pagesCity Treasurer of Taguig v. BCDAYang AlcoranNo ratings yet

- City of Pasig V RepublicDocument3 pagesCity of Pasig V RepublicMijo SolisNo ratings yet

- Pascual Vs Secretary of Works Refer To ShekinaDocument5 pagesPascual Vs Secretary of Works Refer To ShekinaNorman jOyeNo ratings yet

- REPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18Document3 pagesREPUBLIC v. CITY OF PARAÑAQUE, GR No. 191109, 2012-07-18LawrenceAltezaNo ratings yet

- MCIAA Vs Marcos (Digest)Document2 pagesMCIAA Vs Marcos (Digest)Glenn FortesNo ratings yet

- Mactan Cebu International Airport Authority vs. City of Lapu-LapuDocument6 pagesMactan Cebu International Airport Authority vs. City of Lapu-LapuJennilyn Gulfan YaseNo ratings yet

- MIAA Vs CA, GR No. 155650, July 20, 2006Document3 pagesMIAA Vs CA, GR No. 155650, July 20, 2006Vel June De LeonNo ratings yet

- MIAADocument15 pagesMIAAJohn Romano AmansecNo ratings yet

- Posted On January 26, 2018 by ARDEEND Leave A CommentDocument3 pagesPosted On January 26, 2018 by ARDEEND Leave A CommentOliveros DMNo ratings yet

- Admin CasesDocument40 pagesAdmin CasesEve SaltNo ratings yet

- Non StockDocument2 pagesNon StockClaire MontefalconNo ratings yet

- Property Case ReviewerDocument66 pagesProperty Case ReviewerJackie CanlasNo ratings yet

- Basic Law of the Macao Special Administrative Region of the People' s Republic of ChinaFrom EverandBasic Law of the Macao Special Administrative Region of the People' s Republic of ChinaNo ratings yet

- Social Security System: National ID: 3910-8560-4315-4706 07-1615283-1Document3 pagesSocial Security System: National ID: 3910-8560-4315-4706 07-1615283-1Hersie BundaNo ratings yet

- ProbationDocument3 pagesProbationHersie BundaNo ratings yet

- IN WITNESS WHEREOF, I Hereunto Set My Hand and Affix My Notarial Seal On The Date and Place Above WrittenDocument1 pageIN WITNESS WHEREOF, I Hereunto Set My Hand and Affix My Notarial Seal On The Date and Place Above WrittenHersie BundaNo ratings yet

- Waiver of Rights 12Document2 pagesWaiver of Rights 12Hersie BundaNo ratings yet

- SPA LoreynDocument1 pageSPA LoreynHersie BundaNo ratings yet

- Special Power of Attorney 11Document1 pageSpecial Power of Attorney 11Hersie BundaNo ratings yet

- ScriptDocument2 pagesScriptHersie Bunda100% (1)

- Right of WayDocument1 pageRight of WayHersie BundaNo ratings yet

- Module8 ADGEDocument8 pagesModule8 ADGEHersie BundaNo ratings yet

- Fernando 2Document1 pageFernando 2Hersie BundaNo ratings yet

- JA-LOCSIN - Draft No.2Document7 pagesJA-LOCSIN - Draft No.2Hersie BundaNo ratings yet

- Module6 ADGEDocument11 pagesModule6 ADGEHersie BundaNo ratings yet

- Motion For ExecutionDocument2 pagesMotion For ExecutionHersie BundaNo ratings yet

- SPA LoreynDocument1 pageSPA LoreynHersie BundaNo ratings yet

- Bail FinalDocument2 pagesBail FinalHersie BundaNo ratings yet

- QuizDocument1 pageQuizHersie BundaNo ratings yet

- Letter of IntentDocument1 pageLetter of IntentHersie BundaNo ratings yet

- Justine SpaDocument1 pageJustine SpaHersie BundaNo ratings yet

- SPA ManangDocument2 pagesSPA ManangHersie BundaNo ratings yet

- Waiver of Rights and InterestDocument2 pagesWaiver of Rights and InterestHersie BundaNo ratings yet

- Affidavit of DiscrepancyDocument1 pageAffidavit of DiscrepancyHersie BundaNo ratings yet

- Joint AffidavitDocument1 pageJoint AffidavitHersie BundaNo ratings yet

- Finals 2Document3 pagesFinals 2Hersie BundaNo ratings yet

- Bscrim 3aDocument2 pagesBscrim 3aHersie BundaNo ratings yet

- Module2 ADGEDocument12 pagesModule2 ADGEHersie BundaNo ratings yet

- Module1 ADGEDocument11 pagesModule1 ADGEHersie BundaNo ratings yet

- Module1 ADGE BUNDADocument11 pagesModule1 ADGE BUNDAHersie BundaNo ratings yet

- Position Paper Salcedo Et Al AntiqueDocument12 pagesPosition Paper Salcedo Et Al AntiqueHersie BundaNo ratings yet

- SPECIAL POWER OF ATTORNEY Jose GIORGIO BORRES1Document1 pageSPECIAL POWER OF ATTORNEY Jose GIORGIO BORRES1Hersie BundaNo ratings yet

- Production Function - Handwritten Notes - (Aarambh 2024)Document10 pagesProduction Function - Handwritten Notes - (Aarambh 2024)Pranjal GuptaNo ratings yet

- UnpaidDocument2 pagesUnpaidMike PattisonNo ratings yet

- Registry of Specific Purpose Fund, Commitments, Payments and Balances Capital OutlayDocument1 pageRegistry of Specific Purpose Fund, Commitments, Payments and Balances Capital OutlaySK GACAO PALO, LEYTENo ratings yet

- SWOT Analysis of GreenizDocument6 pagesSWOT Analysis of Greenizhammad ulhaqNo ratings yet

- FE 405 Ps 3 AnsDocument12 pagesFE 405 Ps 3 Anskannanv93No ratings yet

- A394 E17 ChallanDocument1 pageA394 E17 ChallanSanjeev KumarNo ratings yet

- Bangladesh Red Crescent Society: National Ileadquarter SpecificationDocument1 pageBangladesh Red Crescent Society: National Ileadquarter SpecificationWORLDWIDE TRANSLATIONNo ratings yet

- Principles of Public Finance (Notes For Final Exams by Muhammad Ali)Document27 pagesPrinciples of Public Finance (Notes For Final Exams by Muhammad Ali)Muhammad AliNo ratings yet

- Bijela Lista-Januar 2016Document15 pagesBijela Lista-Januar 2016MarkysMNENo ratings yet

- Receipt SHITTA-BEY OLUWADAMILOLADocument3 pagesReceipt SHITTA-BEY OLUWADAMILOLAOluwadamilola Shitta-beyNo ratings yet

- NKJKDocument19 pagesNKJKanonimoNo ratings yet

- Konkan Railway MapDocument15 pagesKonkan Railway Mapdskrishna100% (1)

- Finance ThesisDocument75 pagesFinance Thesisjain2007gauravNo ratings yet

- India Warehousing Market Report 2021Document98 pagesIndia Warehousing Market Report 2021starmine@rediffmail.comNo ratings yet

- MPSA As of September 2019Document45 pagesMPSA As of September 201904 pandaNo ratings yet

- Reading Practice Set 1 Agriculture, Iron, and The Bantu PeoplesDocument1 pageReading Practice Set 1 Agriculture, Iron, and The Bantu PeoplesRăzvan Adrian CârcuNo ratings yet

- Impact of Merging Between Digital Platforms: A Case Study of Tokopedia and GojekDocument34 pagesImpact of Merging Between Digital Platforms: A Case Study of Tokopedia and GojekDwi Putri GultomNo ratings yet

- 1 MWG Chapter 1 Preference and ChoiceDocument7 pages1 MWG Chapter 1 Preference and ChoiceDavid ZajicekNo ratings yet

- Civil ListDocument34 pagesCivil Listrichard anishNo ratings yet

- Valuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueDocument5 pagesValuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueAnonymous ikQZphNo ratings yet

- Hanoi, Vietnam: School of Advanced Educational Programs National Economics UniversityDocument7 pagesHanoi, Vietnam: School of Advanced Educational Programs National Economics UniversityHồng NhungNo ratings yet

- Neumann Andreas PDFDocument267 pagesNeumann Andreas PDFAnonymous EnrdqTNo ratings yet

- American Revolution 2.0Document332 pagesAmerican Revolution 2.0rock577No ratings yet

- IJCRT FDI Paper ImportantDocument7 pagesIJCRT FDI Paper Importantkumarm141968No ratings yet

- E-Learning in SloveniaDocument90 pagesE-Learning in SloveniaSlovenian Webclassroom Topic ResourcesNo ratings yet

- IB Economics SL 3 - ElasticitiesDocument6 pagesIB Economics SL 3 - ElasticitiesTerran100% (7)

- Top 10 Entrepreneur in The PhillipinesDocument5 pagesTop 10 Entrepreneur in The PhillipinesRandom vinesNo ratings yet

- Q1 PT MathDocument7 pagesQ1 PT MathCrizelda AmarentoNo ratings yet