Professional Documents

Culture Documents

June 7 2010 GMTD Fact Sheet

June 7 2010 GMTD Fact Sheet

Uploaded by

MattCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

June 7 2010 GMTD Fact Sheet

June 7 2010 GMTD Fact Sheet

Uploaded by

MattCopyright:

Available Formats

Game Trading Founded in 2003 and headquartered in Hunt Valley, MD, Game Trading Technologies, Inc.

Technologies, Inc. (www.gtti.com) is an industry-leading video game trading services provider focused on

valuation, procurement, refurbishment, and redistribution of pre-owned video games. The

(OTCBB: GMTD) Company provides an array of unique services to a number of national firms including Wal-Mart,

Best Buy, Blockbuster, 7-Eleven, Toys“R”Us, eBay, Gazelle, and GameFly allowing them to

better serve customers who want to trade their games for store credit or purchase pre-owned

games.

COMPANY PROFILE video game market, but it also is instrumental in driving NEW

Game Trading Technologies, Inc. (“GTTI” or the “Company”) game and console sales and presents one of the largest margin

is the publicly-traded parent of Gamers Factory opportunities for retailers that resell.

(www.gamersfactory.com), which was formed in 2003 by

experienced and successful video game industry veterans to GTTI is not aware of any competitor who offers game trade-in

focus on the fast growing, pre-owned video game market. valuation as a service to retailers and renters in conjunction with

guaranteed acquisition of those traded items, and that can

GTTI owns a proprietary “market-making” algorithm perform the refurbishment and logistical services that GTTI

technology that prices more than 10,000 pre-owned video games offers.

on a real-time basis. This “Pricing Engine” could be considered

the “Kelly Blue Book” of pre-owned video games. GTTI offers the only scalable pricing engine available for

GTTI may price, buy, and/or sell pre-owned video games, retailers to transact in pre-owned video games, including a

consoles and accessories with firms such as Toys “R” Us, Wal- turnkey software application for retailers who do not have a POS

Mart, 7-Eleven, Best Buy, GameFly, Gazelle, etc. These firms (point-of-sale) system to accommodate.

may use the Pricing Engine and related web based applications

to obtain real-time price quotes to manage the trade in process. FISCAL YEAR STATEMENT OF OPERATIONS (audited)

(US$ in thousands – FYE December 31st)

Customers of GTTI’s retail associates may have the opportunity 2007 2008 2009 Q1 2010

to trade in a single game or console, or an entire collection in

Revenues $13,592 $17,123 $36,701 $11,401

exchange for a gift card or other store credits. GTTI is

effectively providing additional liquidity to their industry retail Cost of Revenue 10,970 13,389 30,684 9,428

customers by purchasing their pre-owned games that are no Gross Profit 2,623 3,734 6,017 1,972

longer wanted and creating a new business and valuable new

traffic for their retail customers. In turn, their customers have EBITDA $2 $1,160 $2,469 n/a

new-found funds to spend in their stores on the NEW games and Income/(Loss) ($1,120) $325 $1,740 ($1,845)

gadgets they crave.

The association between GTTI and their retail and online

relationships has created a new ecosystem – first, turning their Share Data ($US)

customers pre-owned video games and consoles into cash, while Exchange: OTC BBB

Recent Price: $5.00

then re-offering those products to others at a more attractive

Shares Outstanding (3/31/10): 8,290,000

price than a new product. It is the Pricing Engine that allows

Fully Diluted (3/31/10): 14,575,000

this ecosystem to operate and correctly price the buys and sells.

Capitalization ($US)

2009 revenues of $36.7 million, over 100% increase from $17 Market Capitalization (5/26/10): $41.5 MM

million in 2008. Net income increased to $1.74 million – up Total Asset (3/31/10): $10,429,000

from $325,499 in 2008. First quarter 2010 revenue of Current Liabilities (3/31/10): $6,260,717

L/T Liabilities (3/31/10): $4,527,296

$11,401,287 as compared to revenue of $8,341,060 for the first

quarter 2009, an increase of $3,060,227 or 37%. First quarter

Income ($US)

gross profit increased by $531,069 to $1,972,637, or 37%, as

Total Revenue (3/31/10): $11,401,287

compared to $1,441,568 for the first quarter 2009. Cost of Revenue (3/31/10): $9,428,651

GTTI operates a 33.000 sq. ft. refurbishment and logistics center Total Expenses (3/31/10): $3,864,931

in Maryland. The facility is capable of processing 500,000 game Income (3/31/10): ($1,864,801)

units monthly with a storage capacity in excess of 1,300,000

(Refer to the Company’s complete SEC filings at www.sec.gov)

units. As of December 31, 2009, GTTI had 68 full-time

employees.

INVESTMENT HIGHLIGHTS SUMMARY

The video game market is growing dramatically, particularly the pre- As the pre-owned video game industry grows and is more broadly

owned segment of the marketplace. offered by retailers, there will be a larger need to facilitate the flow of

pre-owned products from owners who no longer want these valuable

Over 3.4 billion units of software product (games) exist and items to buyers who are searching for the same products. GTTI aims

hundreds of millions of hardware units have been sold since to fulfill this need in the market by creating the ultimate outlet for

2000 which constitutes a significant market opportunity. Most consumers to exchange these items, turning them into currency that

games that are sold are never re-sold, traded in, or recycled. can be used to purchase other goods. By creating a fluent

marketplace based on real-time product valuation utilizing their

Pre-owned segment represents a tremendous value proposition proprietary pricing engine, GTTI has created an agnostic buying and

for customers. It not only is the largest growth segment of the selling platform for the worldwide, multi-billion dollar video gaming

industry.

10957 McCormick Road Hunt Valley, Maryland 21031 Telephone: (410) 316-9900 Fax: (410) 316-9901 Web: www.gtti.com

You might also like

- Nintendo Case Analysis - Dang Vinh GiangDocument25 pagesNintendo Case Analysis - Dang Vinh GiangVĩnh Giang86% (7)

- Ubisoft Swot AnalysisDocument10 pagesUbisoft Swot AnalysisAkash MandalNo ratings yet

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- YGG Whitepaper EnglishDocument32 pagesYGG Whitepaper EnglishRenz FernandezNo ratings yet

- GameStop Equity Research ReportDocument6 pagesGameStop Equity Research Reportadib_motiwala100% (2)

- Emotiv Case AnalysisDocument3 pagesEmotiv Case AnalysisJuhee PritanjaliNo ratings yet

- Bearn Sterns and Co.Document10 pagesBearn Sterns and Co.eidel18400% (1)

- Strategic Analysis of Nintendo PDFDocument21 pagesStrategic Analysis of Nintendo PDFCaio Lima Toth100% (1)

- R&D Tax CreditDocument7 pagesR&D Tax Creditb_tallerNo ratings yet

- AC1Document1 pageAC1Lyanna Mormont25% (4)

- 8e Ch3 Mini Case Client ContDocument10 pages8e Ch3 Mini Case Client Contaponic28100% (1)

- Gamestop: Thesis OverviewDocument8 pagesGamestop: Thesis OverviewinteractivebuysideNo ratings yet

- Section 1: Internal PerformanceDocument7 pagesSection 1: Internal PerformanceHieuNo ratings yet

- DMarket White Paper ENDocument34 pagesDMarket White Paper ENBuzz AldrinNo ratings yet

- PwC@How Telco Can Win With GamingDocument24 pagesPwC@How Telco Can Win With GamingbadboybluefcNo ratings yet

- Masbate Water Venture Executive Summary 2024Document3 pagesMasbate Water Venture Executive Summary 2024Norberto CercadoNo ratings yet

- Strategic Analysis of Nintendo: MMM001 - International Strategic ManagementDocument21 pagesStrategic Analysis of Nintendo: MMM001 - International Strategic Managementaudreen loricoNo ratings yet

- Strategic Analysis of Nintendo PDFDocument21 pagesStrategic Analysis of Nintendo PDFaudreen loricoNo ratings yet

- EPOC Launch StrategyDocument2 pagesEPOC Launch StrategySinhaNo ratings yet

- Super Mario Lite PaperDocument20 pagesSuper Mario Lite PaperFlshNo ratings yet

- MetaEXP - The Play-and-Earn MetaverseDocument45 pagesMetaEXP - The Play-and-Earn MetaverseGustavo FrancoNo ratings yet

- DLF Ltd. Buy: Uilding NdiaDocument4 pagesDLF Ltd. Buy: Uilding NdiaTakreem AliNo ratings yet

- BGB Whitepaper enDocument9 pagesBGB Whitepaper enVN PRESSNo ratings yet

- EmotivCase HarshVardhan 61910582 PDFDocument2 pagesEmotivCase HarshVardhan 61910582 PDFHarsh VardhanNo ratings yet

- Formal Business Proposal Revised DraftDocument13 pagesFormal Business Proposal Revised Draftapi-736663565No ratings yet

- Ignite-The Ultimate League of Entrepreneurs End GameDocument6 pagesIgnite-The Ultimate League of Entrepreneurs End GameAnshika GargNo ratings yet

- Project XDocument12 pagesProject XPurnansh GuptaNo ratings yet

- WORD TAREA ACADEMICA 1 IncompletoDocument6 pagesWORD TAREA ACADEMICA 1 IncompletoAndres FuentesNo ratings yet

- Discussion Forum 7: How Might A SWOT Analysis Have Helped Electronic Arts Assess Its Slippage in The Video-Game Market?Document4 pagesDiscussion Forum 7: How Might A SWOT Analysis Have Helped Electronic Arts Assess Its Slippage in The Video-Game Market?রাফি ইসলামNo ratings yet

- SonyDocument3 pagesSonyishikakhurNo ratings yet

- Nintendo Consumer BehaviourDocument18 pagesNintendo Consumer BehaviourChu Yung-Lun100% (1)

- Elevate 6Document7 pagesElevate 6kittutanmayNo ratings yet

- Fabwelt (Welt) : White PaperDocument16 pagesFabwelt (Welt) : White PaperRanggaNo ratings yet

- Zion InfotechDocument3 pagesZion InfotechSoham Sinha RayNo ratings yet

- Nintendo Research PaperDocument8 pagesNintendo Research Paperhubegynowig3100% (1)

- Abeats Light PaperDocument15 pagesAbeats Light PaperybnijkomNo ratings yet

- Introduction To Video Games Creation Module 14: The Games Industry and Data Analytics, 1 ECTS (Beta)Document41 pagesIntroduction To Video Games Creation Module 14: The Games Industry and Data Analytics, 1 ECTS (Beta)Morteza DianatfarNo ratings yet

- Nintendo: Sales and Marketing Recommendations For Nintendo in The United StatesDocument17 pagesNintendo: Sales and Marketing Recommendations For Nintendo in The United StatesSuki ZhangNo ratings yet

- Gods Unchained Whitepaper Gods Unchained WhitepaperDocument34 pagesGods Unchained Whitepaper Gods Unchained WhitepaperDeciperNo ratings yet

- GameStop's New Management Wins Over Michael Burry (Of 'The Big Short') in Proxy Fight - The Motley FoolDocument5 pagesGameStop's New Management Wins Over Michael Burry (Of 'The Big Short') in Proxy Fight - The Motley FoolABermNo ratings yet

- GET Whitepaper GUTS Tickets LatestDocument41 pagesGET Whitepaper GUTS Tickets LatestDaniel ChangNo ratings yet

- Nintendo Strategy in 2009 by Dwitya AribawaDocument3 pagesNintendo Strategy in 2009 by Dwitya AribawaDwitya Aribawa100% (1)

- Company Analysis-NetflixDocument7 pagesCompany Analysis-NetflixMr. Tharindu Dissanayaka - University of KelaniyaNo ratings yet

- Telephone Gaming AccessoriesDocument61 pagesTelephone Gaming AccessoriesKaran SinghNo ratings yet

- Complementary GoodsDocument33 pagesComplementary GoodsSHARKI HarshitNo ratings yet

- Gaming Lounge Business PlanDocument9 pagesGaming Lounge Business PlanStephen NjeruNo ratings yet

- Strategy Formulation and ImplementationDocument7 pagesStrategy Formulation and ImplementationHarsha VardhanNo ratings yet

- Game StopDocument5 pagesGame StopCynthia MoraisNo ratings yet

- Valuation of The Week 1642879836Document9 pagesValuation of The Week 1642879836MauricioNo ratings yet

- ErthaDocument16 pagesErthaTom ChoiNo ratings yet

- BigBilly AR - Move2earn (Beta)Document10 pagesBigBilly AR - Move2earn (Beta)Joe DagherNo ratings yet

- DragonBiteWhitePaper 8c67Document61 pagesDragonBiteWhitePaper 8c67hotaro orekiNo ratings yet

- WDWFDocument3 pagesWDWFDan NgugiNo ratings yet

- Goto Uob 02 Jan 2024 240116 124127Document5 pagesGoto Uob 02 Jan 2024 240116 124127marcellusdarrenNo ratings yet

- White PaperDocument6 pagesWhite PaperYassin MejNo ratings yet

- Alta Fox Capital 2019 Q2 LetterDocument7 pagesAlta Fox Capital 2019 Q2 LetterSmitty WNo ratings yet

- The Netflix of GamingDocument6 pagesThe Netflix of GamingArun KsNo ratings yet

- LetsGoDay Litepaper DeckDocument21 pagesLetsGoDay Litepaper DeckTRR MputNo ratings yet

- Business Plan Game LodgeDocument7 pagesBusiness Plan Game LodgeqzhbgdzeeNo ratings yet

- 9449.JP GMO - Stronger Momentum Expected AheadDocument10 pages9449.JP GMO - Stronger Momentum Expected AheadaNo ratings yet

- Flip 2 PlayDocument39 pagesFlip 2 Playflip2 playNo ratings yet

- Reptile Chronicles WhitepaperDocument49 pagesReptile Chronicles WhitepaperTymur TkachenkoNo ratings yet

- Changing the Game (Review and Analysis of Edery and Mollick's Book)From EverandChanging the Game (Review and Analysis of Edery and Mollick's Book)No ratings yet

- ATHX Investor Fact SheetDocument1 pageATHX Investor Fact SheetMattNo ratings yet

- GROVD Investor Fact SheetDocument2 pagesGROVD Investor Fact SheetMattNo ratings yet

- PHIE Coroporate ProfileDocument2 pagesPHIE Coroporate ProfileMattNo ratings yet

- Health Sciences & Regenerative Medicine Investor PresentationDocument46 pagesHealth Sciences & Regenerative Medicine Investor PresentationMattNo ratings yet

- PHIE Company BrochureDocument12 pagesPHIE Company BrochureMattNo ratings yet

- USCS Fact SheetDocument3 pagesUSCS Fact SheetMattNo ratings yet

- Bitzio Investor Fact SheetDocument2 pagesBitzio Investor Fact SheetMattNo ratings yet

- UNDT Corporate ProfileDocument2 pagesUNDT Corporate ProfileMattNo ratings yet

- CNHA Investor Fact SheetDocument2 pagesCNHA Investor Fact SheetMattNo ratings yet

- DYE Strategic VisionDocument20 pagesDYE Strategic VisionMattNo ratings yet

- Small-Cap Research: Cardiogenics HldgsDocument23 pagesSmall-Cap Research: Cardiogenics HldgsMattNo ratings yet

- Revolution Resources Investor FactsheetDocument2 pagesRevolution Resources Investor FactsheetMattNo ratings yet

- Equity Research: Cardiogenics HldgsDocument24 pagesEquity Research: Cardiogenics HldgsMattNo ratings yet

- Revolution Resources FactsheetDocument2 pagesRevolution Resources FactsheetMattNo ratings yet

- AOLS Research ReportDocument32 pagesAOLS Research ReportMattNo ratings yet

- RV Investor FactsheetDocument2 pagesRV Investor FactsheetMattNo ratings yet

- APDN Investor FactsheetDocument1 pageAPDN Investor FactsheetMattNo ratings yet

- Intermediate Accounting 3 PDFDocument86 pagesIntermediate Accounting 3 PDFChelsy SantosNo ratings yet

- Free Basic Operating Agreement - LLC Single Member - Devonnile LLCDocument9 pagesFree Basic Operating Agreement - LLC Single Member - Devonnile LLCOsama RaghibNo ratings yet

- RR 3-98Document6 pagesRR 3-98matinikkiNo ratings yet

- PEZA NotesDocument25 pagesPEZA NotesJane BiancaNo ratings yet

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Document10 pagesP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNo ratings yet

- Finals Lecture Discussion On Special JournalsDocument36 pagesFinals Lecture Discussion On Special JournalsGarpt Kudasai100% (1)

- Module 16 Investment PropertyDocument50 pagesModule 16 Investment PropertyKathy CeracasNo ratings yet

- Travel Policy Wordings 202205CDocument52 pagesTravel Policy Wordings 202205CHuatNo ratings yet

- Chapter 4 Revenue and Other ReceiptsDocument46 pagesChapter 4 Revenue and Other Receiptsroselynm18100% (1)

- 21merz Wuetrich PDFDocument27 pages21merz Wuetrich PDFWael TrabelsiNo ratings yet

- Mango Fund - Loan Information FormDocument1 pageMango Fund - Loan Information FormEdwinNo ratings yet

- Financial Accounting - Chapter 8Document70 pagesFinancial Accounting - Chapter 8Hamza PagaNo ratings yet

- Cash AdvanceDocument2 pagesCash AdvanceMatths Apoche100% (2)

- DBB2104 Unit-09Document24 pagesDBB2104 Unit-09anamikarajendran441998No ratings yet

- Far Volume 1, 2 and 3 TheoryDocument17 pagesFar Volume 1, 2 and 3 TheoryKimberly Etulle CelonaNo ratings yet

- FIN202 - Chap 3 - Selected ExercisesDocument2 pagesFIN202 - Chap 3 - Selected ExercisesThanh ThảoNo ratings yet

- Chapter 2 Part 1: Elements of Financial StatementDocument2 pagesChapter 2 Part 1: Elements of Financial StatementDanica Shane EscobidalNo ratings yet

- 15.asset ManagementDocument11 pages15.asset ManagementShasikanta MNo ratings yet

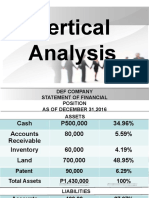

- Vertical AnalysisDocument8 pagesVertical AnalysisHannah Mae BautistaNo ratings yet

- Government Accounting - PPEDocument4 pagesGovernment Accounting - PPEEliyah JhonsonNo ratings yet

- BussDocument31 pagesBussfirdewus wondye100% (1)

- Accounting 1, Chapter 5Document4 pagesAccounting 1, Chapter 5Akademik PPMA JordanNo ratings yet

- St. Joseph's College of CommerceDocument34 pagesSt. Joseph's College of CommerceVelluri Mahesh KumarNo ratings yet

- TT03 QuestionDocument1 pageTT03 QuestionTrinh Nguyen Linh ChiNo ratings yet

- 201 - 19-20 Practice FinalDocument21 pages201 - 19-20 Practice FinalRahadian ToramNo ratings yet

- Tutorial Test 5: 1. Three Types of ActivitiesDocument4 pagesTutorial Test 5: 1. Three Types of ActivitiesVan Nguyen Thi HoangNo ratings yet