Professional Documents

Culture Documents

90% of Women Surveyed Say Visiting Sephora Is A Highly Anticipated Event

90% of Women Surveyed Say Visiting Sephora Is A Highly Anticipated Event

Uploaded by

cristinandreeamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

90% of Women Surveyed Say Visiting Sephora Is A Highly Anticipated Event

90% of Women Surveyed Say Visiting Sephora Is A Highly Anticipated Event

Uploaded by

cristinandreeamCopyright:

Available Formats

Beauty by the Numbers 2015 Infographic Series: #8

Insiders Sneak Peak!

2015 PinkReport: The Sephora Shopper

Welcome TBC insiders! Each year, TBCs annual deep-dive PinkReport

gets to the heart of what makes the beauty consumer tick. This year,

weve prepared a generational analysis of the U.S. female consumers

purchase influencers, shopping behaviors and buying patterns at the

201

extraordinary beauty giant, Sephora. Your personal tour of some of the Se 5

phora

the juiciest bits from this years PinkReport is just a brushstroke SHOPPER

away. Happy reading, beautiful!

Download the whole 114-page report at benchmarkingcompany.com/shop/

90% of women

Madly in Love with Sephora

surveyed say 90% of women surveyed shop at Sephora,

visiting Sephora Sephora.com, or both occasionally or regularly

is a highly 85% Sephora.com is her first online destination to

browse beauty

anticipated event 79% Sephora.com is the first site she visits to buy

beauty

69% of Millennials shop both in-store and online,

compared to 59% of Gen-Xers and 49% Boomers

Budget Begone!

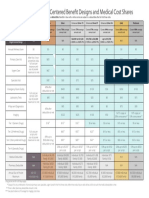

84% sometimes/ 2%2% She Spends at Sephora

always have a budget when

10%

10% 8%8% 62% of in-store/56% of

shopping in-store or online $1 $1

-$25

-$25 online shoppers spend

29% of these women 19%

19% 32%

32%

$26$26 - $50 $26-$75 each time they

- $50

say they are not always $51$51

- $75

- $75

shop

$76$76

- $100

- $100

successful in keeping $101

$101

- $200

- $200

28% spend >$76 each

purchases within budget at 30%

30% $201

$201 - $300 visit; 34% of Gen-Xers

- $300

Sephora spend $76-$300 each time

Claims matter! Her Personal Sephora Meet the Sephora

57% of all women Beauty Expert Shopper

surveyed check product 35% say a salespersons Maddie (18-24) and

reviews online before knowledge of the brand/ Megan (25-34) Millennial

shopping at Sephora stores product is influential in her Spends the most time at

Sephora/most tech-savvy

66% of Millennials make purchasing decision

95% tell her friends about

product review checking a 31% have been swayed beauty

habit 54% believes the store she

by a salesperson to buy a

35% of Millennials read product that was not on buys beauty products from

consumer claims on is a reflection of her

her radar

packaging Twice as likely to bring

32% of Gen-Xers read 40% spend >20 minutes friends with her to Sephora

than Boomers

consumer claims on in- with a salesperson learning

Jessie Gen-Xer (35-49)

store displays about products

Spends the most money at

Sephora

Loyalty and Trust 94% say they are confident

85% are inspired by

75% are Beauty Insider loyalty pictures of beautiful women

card holders to look their best

90% open their Beauty 74% buy beauty products

even if they dont need them

Insider emails Barbie Boomer (50+)

Nearly 1 in 3 women have Disposable income and still

shopped Sephora for 5-10 years buying big

40% note the loyalty program is a 47% spend $150-$500

annual on beauty

key reason why they shop Sephora

96% enjoy shopping for

beauty products

99% say theyre open to

trying new beauty products

Top Makeup Brands She Buys at Sephora

(full list=99 brands)

NARS Sephora Collection Too Faced Urban Decay

The First 5 Areas She

Benefit Cosmetics Bare Minerals/Escentuals MAKEUP Peruses in Sephora

FOREVER Smashbox Tarte Stila Clinique.* stores

Top Skincare Brands She Buys at Sephora

(full list=109 brands)

#1 Makeup

Murad GLAMGLOW bareMinerals Benefit #2 Lip Bar

Cosmetics Sephora Collection Laura #3 Womens Fragrances

Mercier Urban Decay Clinique #4 Tools & Makeup Brushes

Clarisonic Bobbi Brown Origins #5 Bath & Body

LOccitaine Tarte Smashbox.*

Top Hair Care Brands She Buys

at Sephora

(full list=45 brands) Call 703.871.5300 or visit

beautyproducttesting.com or

Sephora Collection philosophy info@benchmarkingcompany.

WEN by Chaz Dean Bumble and com for information on Beauty

Bumble ALTERNA Ojon.* Product Testing and specialized

beauty consumer research.

*Just a sampling, in no specific order. Full rankings available in the complete PinkReport.

*Based on a study conducted of U.S. female

beauty consumers from November 2014-May 2015

with 3,133 respondents and 2,197 respondents

respectively. The 2015 PinkReport is an independent

analysis of the Sephora shopper and was not

commissioned or requested by the company. All

analyses and investigations are independent and

unbiased.

You might also like

- Logistics Project ReportDocument62 pagesLogistics Project Reportveereshkoutal0% (1)

- Samsung Rs2555sl Service ManualDocument54 pagesSamsung Rs2555sl Service ManualFiliberto barbieriNo ratings yet

- Case Study - M&S (Final)Document10 pagesCase Study - M&S (Final)RehmanNo ratings yet

- Components of ShoeDocument28 pagesComponents of ShoeucssNo ratings yet

- NYC Shopping Guide To SoHoDocument14 pagesNYC Shopping Guide To SoHoA_Dissident_Is_Here100% (1)

- Mansur Gavriel ReportDocument55 pagesMansur Gavriel Reportamanda100% (1)

- Types of Curtain FabricsDocument31 pagesTypes of Curtain FabricsVishal Dubey100% (1)

- The Mall Phenomenon: Shopper CharacteristicsDocument2 pagesThe Mall Phenomenon: Shopper CharacteristicsTejasa MishraNo ratings yet

- Victoria's Secret PresentationDocument26 pagesVictoria's Secret PresentationThanh TranNo ratings yet

- Final Ogs 2023Document13 pagesFinal Ogs 2023Thu PhươngNo ratings yet

- 8451 White Paper Holiday Shopper Insights and How Brands Can Respond 2022Document17 pages8451 White Paper Holiday Shopper Insights and How Brands Can Respond 2022Sagar GadhviNo ratings yet

- Purchase Behavior Prob. of Purchase Income ($000) Predicted Prob. of PurchaseDocument2 pagesPurchase Behavior Prob. of Purchase Income ($000) Predicted Prob. of Purchasekrish lopezNo ratings yet

- 2020 Health Benefits Table PDFDocument1 page2020 Health Benefits Table PDFTitoNo ratings yet

- Colorful Rasta Jamaican Hat Bob Marley Knitted Cap Wig Caribbean Fancy WishDocument1 pageColorful Rasta Jamaican Hat Bob Marley Knitted Cap Wig Caribbean Fancy WishivycogzzNo ratings yet

- Montreaux Chocolate USA Spreadsheet T3 21Document7 pagesMontreaux Chocolate USA Spreadsheet T3 21Kriti GoenkaNo ratings yet

- OriginalDocument36 pagesOriginalXiaochen TangNo ratings yet

- Money MonsterDocument20 pagesMoney MonstertinhhoanghonNo ratings yet

- General Bargaining InformationDocument14 pagesGeneral Bargaining InformationNabil BkimalNo ratings yet

- Appendix - BarakoffeeDocument8 pagesAppendix - Barakoffeejizelle.ricaldem.02No ratings yet

- On Chocolates PresentationDocument14 pagesOn Chocolates PresentationRajneesh Chandra BhattNo ratings yet

- Wonderbra: Alyssa Tucci Josh John Mike Palumberi Patrick Catalano Rachel CunninghamDocument43 pagesWonderbra: Alyssa Tucci Josh John Mike Palumberi Patrick Catalano Rachel Cunninghamjjohn9176No ratings yet

- Egg Hunt MathDocument10 pagesEgg Hunt MathChristine DemeterNo ratings yet

- Back of Sephora Gift Card - Google SearchDocument1 pageBack of Sephora Gift Card - Google SearchmaikamoreytNo ratings yet

- Appendix-Barakoffee ItonaDocument25 pagesAppendix-Barakoffee Itonajizelle.ricaldem.02No ratings yet

- Airline FeesDocument1 pageAirline FeesDajeNo ratings yet

- Business Plan: (School Based Assessment)Document13 pagesBusiness Plan: (School Based Assessment)IsraelNo ratings yet

- BBB Online Scammers 2020 ReportDocument16 pagesBBB Online Scammers 2020 ReportCityNewsTorontoNo ratings yet

- Eva Deo Women DeodorantsDocument18 pagesEva Deo Women DeodorantsAthulya SajithNo ratings yet

- Asian Nomads May 17Document49 pagesAsian Nomads May 17Davy ChauNo ratings yet

- Trading Journal CC 2.0Document1,724 pagesTrading Journal CC 2.0vladvlad091989No ratings yet

- Zalora Lite 2Document1 pageZalora Lite 2Rowena HipolitoNo ratings yet

- Retail Analytics - IRMADocument17 pagesRetail Analytics - IRMAKartik KaushikNo ratings yet

- Marketing Research: Walls Carte Dor Ice Cream ParlorsDocument27 pagesMarketing Research: Walls Carte Dor Ice Cream ParlorsAleem HabibNo ratings yet

- Consumer SurveyDocument35 pagesConsumer SurveymounikaNo ratings yet

- BF WipDocument12 pagesBF WipMriganka DasNo ratings yet

- FOCA Compensation ChartDocument1 pageFOCA Compensation ChartprojectcurveappealNo ratings yet

- The Upside - 2007Document28 pagesThe Upside - 2007eoseeva9No ratings yet

- Marjorie Bse 4a EconomicsDocument25 pagesMarjorie Bse 4a Economics062691No ratings yet

- Arvind BrandsDocument11 pagesArvind BrandsAmchitama W MominNo ratings yet

- Sensitivity SlideDocument4 pagesSensitivity SlideIan TanNo ratings yet

- Research of Mini Store in Vietnam Asia Plus IncDocument23 pagesResearch of Mini Store in Vietnam Asia Plus IncLinh HuynhNo ratings yet

- Investing Basics (Slides)Document53 pagesInvesting Basics (Slides)c zoeNo ratings yet

- Vision Global Amway Plan 2014Document46 pagesVision Global Amway Plan 2014Benjamin PuentesNo ratings yet

- 2024 Asia Lifestyle Consumer ProfileDocument27 pages2024 Asia Lifestyle Consumer Profileb00795517No ratings yet

- Michela O'Connor Abrams: President, Dwell MediaDocument41 pagesMichela O'Connor Abrams: President, Dwell MediaOpportunity Green ConferenceNo ratings yet

- Non MTG Money Management System.Document25 pagesNon MTG Money Management System.Shajidul Sheik ShajidNo ratings yet

- Story Coffe: Every Sip of Coffee Has Its Own StoryDocument12 pagesStory Coffe: Every Sip of Coffee Has Its Own Storymelysa tikaNo ratings yet

- YENrPtVf High Five Program 2019 PDFDocument1 pageYENrPtVf High Five Program 2019 PDFBaroliya SanjayNo ratings yet

- Jempé: Garcia, Eric John Ungab, Justine Dave Balajadia, Phyrra Janus Monton, Marianne Karl Owebar, EuniceDocument11 pagesJempé: Garcia, Eric John Ungab, Justine Dave Balajadia, Phyrra Janus Monton, Marianne Karl Owebar, EuniceJames ScoldNo ratings yet

- Anti Fraud Controls InfographicDocument1 pageAnti Fraud Controls InfographicEnrique HernandezNo ratings yet

- Making Exit Interviews CountDocument15 pagesMaking Exit Interviews CountVadamala RavikanthNo ratings yet

- W1WS-Rimbawan-Bayu Sadewo-AdvancedDocument2 pagesW1WS-Rimbawan-Bayu Sadewo-AdvancedrimbawanbayusadewoNo ratings yet

- Count by SixesDocument1 pageCount by SixesMassi YahiNo ratings yet

- Facebook 2020 Festive BehaviorDocument42 pagesFacebook 2020 Festive BehaviorVi NguyễnNo ratings yet

- Emilia The EntertainingDocument89 pagesEmilia The EntertainingJustine CejalvoNo ratings yet

- Survey Questionnaire 2Document3 pagesSurvey Questionnaire 2Franxis YlardexNo ratings yet

- Psmcoffeesurvey20180316fin 180319011458 PDFDocument37 pagesPsmcoffeesurvey20180316fin 180319011458 PDFFemi EvalnesNo ratings yet

- Catálogo de Perfumen ? ??Document30 pagesCatálogo de Perfumen ? ??lariissa buitragoNo ratings yet

- Help in Questn RecmndtnDocument62 pagesHelp in Questn Recmndtnvicky18dNo ratings yet

- Catchment Analysis and Consumer BehaviourDocument34 pagesCatchment Analysis and Consumer BehaviourAmey Sankhe50% (2)

- Product PlanningDocument11 pagesProduct Planning20BBA044 SHANANDHANo ratings yet

- Pink Papaya Hostess Rewards ProDocument1 pagePink Papaya Hostess Rewards ProDana BallNo ratings yet

- What People Pay For Music Lessons PDFDocument16 pagesWhat People Pay For Music Lessons PDFsean kimNo ratings yet

- International OutletDocument12 pagesInternational OutletAlejandro PinedaNo ratings yet

- Easy Passive Income: Earn Extra Money With Coin FunnelsFrom EverandEasy Passive Income: Earn Extra Money With Coin FunnelsRating: 4 out of 5 stars4/5 (1)

- ADocument3 pagesAcristinandreeamNo ratings yet

- Features: Commercial Series FreezersDocument2 pagesFeatures: Commercial Series FreezerscristinandreeamNo ratings yet

- Anunt Afp3 TUDOSIDocument5 pagesAnunt Afp3 TUDOSIcristinandreeamNo ratings yet

- A Supply Chain Makeover For Sephora: How The Beauty Retailer Reduced Inventory Levels, While Improving Customer ServiceDocument4 pagesA Supply Chain Makeover For Sephora: How The Beauty Retailer Reduced Inventory Levels, While Improving Customer ServicecristinandreeamNo ratings yet

- BUS478 Case Synopsis For: Sephora: Erin Yin Leo Duan Nana Fong Jingmei Qin Lucy LiangDocument9 pagesBUS478 Case Synopsis For: Sephora: Erin Yin Leo Duan Nana Fong Jingmei Qin Lucy LiangcristinandreeamNo ratings yet

- CEO Statement of Support and Form For SigningDocument5 pagesCEO Statement of Support and Form For SigningcristinandreeamNo ratings yet

- Group CDocument39 pagesGroup CcristinandreeamNo ratings yet

- Vanish Foundation Shade Guide: Find Your Perfect ShadeDocument1 pageVanish Foundation Shade Guide: Find Your Perfect ShadecristinandreeamNo ratings yet

- Anunt Afp3 TUDOSIDocument12 pagesAnunt Afp3 TUDOSIcristinandreeamNo ratings yet

- Colorvision: Spring 2013 LooksDocument24 pagesColorvision: Spring 2013 LookscristinandreeamNo ratings yet

- Anunt Afp3 TUDOSIDocument2 pagesAnunt Afp3 TUDOSIcristinandreeamNo ratings yet

- (Dāna) Vaccha, Gotta SuttaDocument5 pages(Dāna) Vaccha, Gotta SuttacristinandreeamNo ratings yet

- Tustin To Dana Point: Via Irvine Center DR / Moulton Pkwy / Golden Lantern STDocument2 pagesTustin To Dana Point: Via Irvine Center DR / Moulton Pkwy / Golden Lantern STcristinandreeamNo ratings yet

- Anunt Afp3 TUDOSIDocument4 pagesAnunt Afp3 TUDOSIcristinandreeamNo ratings yet

- Subchapter A: General Financial Assurance Requirements 37.1, 37.11, 37.21, 37.31, 37.41, 37.51, 37.52, 37.61, 37.71, 37.81 Effective January 30, 2003Document6 pagesSubchapter A: General Financial Assurance Requirements 37.1, 37.11, 37.21, 37.31, 37.41, 37.51, 37.52, 37.61, 37.71, 37.81 Effective January 30, 2003cristinandreeamNo ratings yet

- Subchapter A: General Provisions 19.1, 19.3 Effective November 11, 2010 19.1. DefinitionsDocument3 pagesSubchapter A: General Provisions 19.1, 19.3 Effective November 11, 2010 19.1. DefinitionscristinandreeamNo ratings yet

- Subchapter F: Water Quality Emergency and Temporary Orders 35.301 - 35.303 Effective December 10, 1998Document4 pagesSubchapter F: Water Quality Emergency and Temporary Orders 35.301 - 35.303 Effective December 10, 1998cristinandreeamNo ratings yet

- Subchapter N: Financial Assurance Requirements For The Texas Risk Reduction Program Rules 37.4001, 37.4011, 37.4021, 37.4031 Effective March 21, 2000Document2 pagesSubchapter N: Financial Assurance Requirements For The Texas Risk Reduction Program Rules 37.4001, 37.4011, 37.4021, 37.4031 Effective March 21, 2000cristinandreeamNo ratings yet

- Chapter 12: Payment of Fees 12.1, 12.3, 12.5 Effective March 30, 2000Document1 pageChapter 12: Payment of Fees 12.1, 12.3, 12.5 Effective March 30, 2000cristinandreeamNo ratings yet

- Chapter 21: Water Quality Fees 21.1 - 21.4 Effective July 30, 2009 21.1. Purpose and ScopeDocument9 pagesChapter 21: Water Quality Fees 21.1 - 21.4 Effective July 30, 2009 21.1. Purpose and ScopecristinandreeamNo ratings yet

- Chapter 10 - Commission Meetings 10.1 - 10.9 Effective March 27, 2003Document4 pagesChapter 10 - Commission Meetings 10.1 - 10.9 Effective March 27, 2003cristinandreeamNo ratings yet

- Subchapter A: Purpose, Applicability, and Definitions 35.1 - 35.3 Effective December 10, 1998Document1 pageSubchapter A: Purpose, Applicability, and Definitions 35.1 - 35.3 Effective December 10, 1998cristinandreeamNo ratings yet

- The Lesa BagDocument32 pagesThe Lesa Bagieneaa2000100% (1)

- Indian Paint Industry Mrp-1 Raj 92Document96 pagesIndian Paint Industry Mrp-1 Raj 92srp1880% (1)

- Crochet PatternDocument4 pagesCrochet PatternTravis Guffey100% (1)

- Introduction To UnileverDocument9 pagesIntroduction To UnileverJeremy OlsonNo ratings yet

- Leather Coats & Jackets PDFDocument10 pagesLeather Coats & Jackets PDFvipul kumar0% (2)

- In-Custody Death Investigation - Xavier Moore (Part 9 of 11) - Interview With Officer Nikos Kastmiler (#104) .Document18 pagesIn-Custody Death Investigation - Xavier Moore (Part 9 of 11) - Interview With Officer Nikos Kastmiler (#104) .Berkeley CopwatchNo ratings yet

- Lincoln Electric MP210 Manual PDFDocument96 pagesLincoln Electric MP210 Manual PDFbbeisslerNo ratings yet

- Copy FF1 (U1-U7)Document15 pagesCopy FF1 (U1-U7)World EnglishNo ratings yet

- Countable @uncountable ExercisesDocument2 pagesCountable @uncountable ExercisesMarija Vasileska0% (1)

- Mrs Bixby and The Colonel's Coat - GlossaryDocument2 pagesMrs Bixby and The Colonel's Coat - GlossaryAdrian Molero GamezNo ratings yet

- Fabric Science Assignment 1 On "Hemp" & "Bamboo" Cohesiveness PropertyDocument10 pagesFabric Science Assignment 1 On "Hemp" & "Bamboo" Cohesiveness PropertyaadishNo ratings yet

- Unit 2 - Act. 6 - Unit 2 - Task Getting A Job!Document15 pagesUnit 2 - Act. 6 - Unit 2 - Task Getting A Job!BrigithGualdronAyala0% (1)

- Cassava Cake Cooking Instructions:: Dessertlutong Pinoypanlasang Pinoypanlasang Pinoy RecipesDocument3 pagesCassava Cake Cooking Instructions:: Dessertlutong Pinoypanlasang Pinoypanlasang Pinoy RecipesDiana TardecillaNo ratings yet

- 1st Distance Exam Beg 2Document6 pages1st Distance Exam Beg 2anyonariNo ratings yet

- 550 Crockpot Recipes US STYLEDocument212 pages550 Crockpot Recipes US STYLEdemo1967No ratings yet

- Dmart Final Print OutDocument25 pagesDmart Final Print OutSukanya SubramanianNo ratings yet

- Punch-Drunk Love (Script)Document76 pagesPunch-Drunk Love (Script)mertberNo ratings yet

- Food Matters Chocolate RecipesDocument10 pagesFood Matters Chocolate RecipesHéctorMartínezSalazarNo ratings yet

- E-Marketplace, E-Mall, E-TailingDocument5 pagesE-Marketplace, E-Mall, E-TailingprudviNo ratings yet

- Sustainable Luxury: Myth or Reality?Document26 pagesSustainable Luxury: Myth or Reality?Devon Rojas100% (1)

- Rachel Boston - Rune LookbookDocument15 pagesRachel Boston - Rune LookbookRachelElvisBoston100% (1)

- Energized Electrical PermitDocument3 pagesEnergized Electrical PermitMohd AzharNo ratings yet