Professional Documents

Culture Documents

Côte D'ivoire Exploration and Mining Review - MACIG 2017 - Global Business Report

Côte D'ivoire Exploration and Mining Review - MACIG 2017 - Global Business Report

Uploaded by

Stanislas De StabenrathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Côte D'ivoire Exploration and Mining Review - MACIG 2017 - Global Business Report

Côte D'ivoire Exploration and Mining Review - MACIG 2017 - Global Business Report

Uploaded by

Stanislas De StabenrathCopyright:

Available Formats

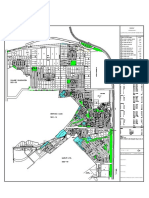

Satiri Hounde Pax

Boni

Siguiri Bougouni Zantiebougou Vindaloo

Faragouaran Koumantou Niena

COTE D'IVOIRE

Sikasso Bobo-Dioulasso

Yanfolila Koumbia

Niandankoro

WEST AFRICA COUNTRY PROFILE MACIG 2017 -8 -6 Orodaza Koumi -4 Ouessa Boura

Leo -2

Kolondieba Koloko Diebougou

Badogo

Fodekaria

Garalo

Mali Loulouni

Toussiana Klesso

Hamale

Kalana Syama Nandom Tumu

C

Kadiana Han

Cote dIvoire

Bate Nafadji Mandiana Banfora Lawra

oussa

Zegoua Kunche Bepkong

Kiniero

Tengrela

Kankan Orialen Manankoro Sissingue Gaoua

Burkina Faso

Pogo Banfora Fian Wahabu

Tiefinzo Nadawii

Tintioulen Niagoloko Funsi

Tindila Nielle

Ngandana Kaouara

Diawala Yala

Kaniasso (Mn) Tongon Wa

Population: 23,295,302 10 Minignan Mbengue

Batie West 10

Kouto Ouangolodougou Bulinga

Moribaya

Doropo

Land area: 322,463 km2 Bodougou Samatiguila Tioboulounao

kouno Ga

Official Language: French Krimbirila Sid

Madinani Tehini Varale

Komodou Sinematiali Ferkessedougou

Tieme

Chief of State: President Alassane Dramane OUATTARA

Guinea Sirana Odienne Boundiali

Boundiali

Ouango Fitini Koebounou

Korhogo

(since 4 December 2010) Nassian

YAMUSUKRO Sokoulama Bouna Sawla Grupe Larabanga

Tata de Samory Simandou (Fe) Busu

GDP (PPP): $78.62 billion Nianda Kananto

Simandou Chache

(Fe) Tafire

Growth Rate: 8.6% Konsankoro Bole

Damongo

Morondo Dianra

GDP per Capita (PPP): $3,300 Diamonds Sinko Tortiya

Bofossou

Banandje

Dianfa

(Diamond) Ghana

Borotou

SOURCE: CIA WORLD FACTBOOK Snonsamoridou Maluwe

Beyla Kotouba

Niakaranandougou

Macenta

Koro Kani

Voinjama Boola Fetekro

Seredou Sarhala Banda

Yirie Touba Nkwanta

TAXATION RATES IBRAHIM INDEX OF AFRICAN GOVERNANCE olahur Ouaninou

Tieningboue Bamboi

Wologisi Range Foumoadou Saguela Mankono Katiola Bondoukou (Mn)

SOURCE: PWC SOURCE: MO IBRAHIM FOUNDATION

(Fe) Nzebela Goueke Bassawa Bondoukou

change Africa Rank / 54 8 Koule Gueassou Sipilou (Ni) Soko Sampa

Kintampo

8

2016 since 2006 average Ni Sifie

Satama-Sokoro

Groumania Goumere

Corporate Income Tax Rate

Souhoule Seguela

Satama-Sokoura Nsawkaw

Samoye Biankouma

OVERALL GOVERNANCE 52.3 +13.1 50.0 21 Zorzor Lola Nimba (Fe)

Mount

Botro

Brobo

Pamproso

25%

Pela Nzerekore Wenchi

SAFETY & RULE OF LAW 55.1 +17.3 52.1 27 Samapleu (Ni) Bouake

Prikro Nkoranza

Tachiman

RULE OF LAW 42.1 +13.5 52.7 38 Yekepa (Fe) Alangouassou Koun-Fao Berekum

Vavoua Mbahiakro Akumadan

Dieke Sammiquellie Man Zuenoula

ACCOUNTABILITY 44.1 +25.0 35.1 16 Dormaa-Ahenkro Sunyani Nkenkaasu

Mount Klahoyo Ouelle

PERSONAL SAFETY 54.9 +16.6 45.7 18 Belefuanai

Ganta

Kahnplay Danane

(Fe) Tiebisson Agnibilekrou Takikro Duayaw Nkwanta

Abofour

Logouale Gamina Yaoure Ahafo

NATIONAL SECURITY 79.4 +14.3 75.2 31 Gbanga

Royalties

Bouafle Bechem

Bong Range Bangolo Bocanda Daoukro Kenyasi Mohu

Ity Mount Gao

PARTICIPATION & HUMAN RIGHTS 54.3 +18.6 50.0 25 Palala Saklepie

Daloa Juaben

Zouan Hounien (Fe)

Cote d'Ivoire

3% to 6%

Gbatala

PARTICIPATION 61.5 +36.5 47.9 23 Totota Bin Houye

Yamoussoukro Goaso Ejisu

Duekoue

Kotobi Kumasi

RIGHTS 49.5 +19.3 46.8 30 Gbotota Grale

Guiglo

Zoukougbeu Sintra Kokoumbo Abengourou

Niable Kukuom Bilpraw

Toulepleu

Bongouanou Bibiani

GENDER 51.8 -0.2 55.4 34 Blolekin

Toumodi Bongouanou Nsinsim Abore Bekwa

Tapeta Issia Oume Asawinso Bibiani North Esaase

SUSTAINABLE ECONOMIC OPPORTUNITY 48.4 +8.7 42.9 15 antro (Fe) Akoupe Obotan

Tobli Ouraganio Chirano Awaso Akrokeri

PUBLIC MANAGEMENT 46.0 +6.2 42.2 20 Kwendin

Bonikro Wiawso

Sefwi

(Bauxite) Obu

Guiberoua Obuasi

Hire Adzope Bekwai

BUSINESS ENVIRONMENT 55.6 +13.3 39.7 8

Liberia

Gagnoa

Zwedru Edikan Kubi

MINING SECTOR CONTRIBUTION TO GDP INFRASTRUCTURE 53.5 +11.6 39.1 11 Tameque 6 Yabayo

Agbaou

Tiassle Agou

Agona

Ayanfuri Dunkwa6

SOURCE: AFRICAN ECONOMIC OUTLOOK Divo Mampon

RURAL SECTOR 38.5 +3.6 51.5 45 Soubre

lakota Ndoussi Asankragua

2009 2013

Twifu

HUMAN DEVELOPMENT 51.4 +7.8 55.0 35 Putu (Fe) Bogosu Praso

Afema Bawdia

1% 1%

Sikensi Anyama

WELFARE 40.0 +12.1 47.4 39 Bogosu Damang

Bambli Aboisso

Prestea Wassa

EDUCATION 45.1 +11.1 47.9 29 Juazohn

Djiroutou Lauzoua Fobo Bonoua Abosso

(Mn) Abidjan Afema

Tarkwa Tarkwa

HEALTH 69.2 +0.5 69.6 28 Grand-Lahou

Dabou Elubo Iduapriem

Dugbe Sabo

Nsuta (Mn) Elmin

Greenville Kanwiake

Mpataba Nzema Nsuta

Fresco Hwini Butre

Twe Town

Grabo Esiama

Tatuke Sassandra Sekondi-Tako

FOREIGN DIRECT INVESTMENT FRASER INSTITUTE INVESTMENT ATTRACTIVENESS INDEX Nyaake

Axim

SOURCE: FRASER INSTITUTE Blebo San-Pedro

SOURCE: UNCTAD

Grand-Berebi

Pleebo

FDI, $ millions Grand Cess

RANK SCORE

- -

Tabou

75 66 Harper

2009 2014

70 64

4 4

65 62

MINERAL PRODUCTION (2014) -8 -6 -4 -2

SOURCE: British Geological Society

60 60

Gold 17,000 kg POST-EBURNEAN ANOROGENIC DOMAINS Horizon Markers (B2, B1)

Basic-ultrabasic complexes (Freetown, Guinea) Tourmaline-bearing sandstone and conglomerate

GEOLOGICAL DATA FROM BRGM - LAT/LONG WGS84

Diamonds 1,074 carats 55 58 Cretaceous to Recent Chert and quartzite levels

2017 - 3rd edition - info@sems-exploration.com

Upper Proterozoic to Paleozoic Manganses-rich levels: quartzite, gondite, phyllite

2011 2012 2013 2014 2015

EBURNEAN OROGENIC DOMAIN ARCHEAN AND/OR PROTEROZOIC GRANITIC GNEISS COMPLEXES

All rights reserved SEMS EXPLORATION

Map drafted by Kwaku Owusu-Ansah

www.sems-exploration.com

LOWER PROTEROZOIC TERRANES (2.4 - 1.6 Ga.) DEFORMED BY THE EBURNEAN OROGENESIS

Plutonic rocks Granitic, migmatitic and undifferentiated gneiss

BUSINESS ENVIRONMENT RANKING TRANSPARENCY INTERNATIONAL CORRUPTION PERCEPTIONS INDEX Basic-ultrabasic complexes Granitic, migmatitic and undifferentiated gneiss

IN AFRICA (OUT OF 48) SOURCE: TRANSPARENCY INTERNATIONAL Leucogranite Granite, gneiss, and migmatitic gneiss complexes

SOURCE: WORLD BANK Undifferentiated granitoids PRE-EBURNEAN OROGENIC DOMAIN

2015

Volcanic and fluviodeltaic formations ARCHEAN - LEONIAN (3.5 - 2.9 GA.) / LIBERIAN (2.9 - 2.5 GA.)

34 Plutonic rocks

Ease of Doing Business 18 Lithostructural assemblages (D2 and D3 deformation phases)

Geological boundary certain Geological boundary inferred Fluviodeltaic: sandstone, conglomerate, argillite (Tarkwaian) Undifferentiated plutonic rocks (Leonian to Late-Liberian)

32 Fault certain Fault inferred Plutonic-volcanic assemblage: minor volcanic rocks Greenstone belts and ironstone formations

Starting a Business 5 Thrusts Ironstone formation (meta-sedimentary, meta-basic rocks associated)

Undifferentiated volcanics, volcanosedimentary rocks

GOLD MINES Komatiitic to tholeiitic basalts Basic and ultrabasic formations

Dealing with Construction Permits 45 30

Existing Closed Gold resources/ projects Rhyodacitic to rhyolitic volcanic rocks, chert (b), graphitic horizons Gneissic complexes

Andesitic volcanic rocks, chert (b), graphitic horizons Migmatitic and undifferentiated gneisses

Getting Electricity 13 OTHER MINERALS Granulitic gneiss "basement"

28

Existing mines Closed mines Projects Basic volcanic rocks, chert (b), Mn levels (c)

Mineral fields Flysch-type formations with minor volcanic rocks -

Registering Property 16 26 Lithostructural assemblage (D1 to D3 deformation phases)

Country Borders Seaside Carbonates felsic volcanic rocks

2012 2013 2014 2015 Roads Minor roads Railway Felsic volcanoclastic rocks, dykes; chert (b), manganese levels (c)

Sems Offices Flysch-type : sandstone to argillite (graphitic, conglomeratic levels)

22 MACIG 2016

INTERVIEW MACIG 2017 MACIG 2017 EDITORIAL

Hon. Dr. Jean-Claude Cote dIvoire

Brou Wins the Gold

Minister of Mines

West Africas top mining

destination

by Laura Brangwin,

Cote DIvoire has come into the international spotlight as improvements to business environment by the World Bank.

Meredith Veit

West Africas next big destination for mining investment. Macroeconomic indicators confirm that the economic sit-

How important is mining to the economy today and what uation is highly positive: GDP growth has remained steady

minerals are the most prospective for the country? at around 9% per year for five years and there has been a

Our economy continues to be largely based on agriculture, commensurate rise in per capita income. As a result, foreign

however, at the same time, our nations industrial service and investment has increased.

mining sectors have been growing rapidly. We share sever- The global mining community has known for decades that sky to complete regional portfolios, said Ludivine Wouters,

al of the same prolific Birimian greenstone belts that have Cote DIvoire reviewed its mining code in 2014. Could you Cote dIvoire sits on resources worth exploiting, but tumul- managing partner at Latitude Five, an investment and adviso-

led to important mining in neighboring countries. Gold is our walk us through the main changes and how they will af- tuous circumstances above ground have kept most investors ry firm providing independent growth and transaction support

most important mineral with deposits of around 600 mt. Ex- fect investors? wary of setting up business within its borders. A coup, civil services to local and international investors and businesses

ploration is still at an early stage in our country, and is set The mining code was reviewed in 2014 to replace the previ- war, Ebola and economic downturn have plagued the coun- across West Africa, in mining, mining services and infrastruc-

to increase. We also have more than 4 billion mt iron ore of ous legislation introduced in 1995. This was intended more as trys entrance into the 21st century, but the re-election of ture.

deposits, as well as nickel, copper and significant reserves of a modernization to keep pace with the industry. We have reaf- President Ouattara in 2015 serves as an indication of Cote Players who left the market years ago are now seeking points

bauxite and manganese. firmed our commitment to international protocols such as the dIvoires recent stability. Those already established in Cote of re-entry, and current producers are snatching up as much

Currently, 175 exploration permits have been issued across Extractive Industries Transparency Initiative (EITI) and the Kim- dIvoire do not dwell on the conflicts of the past; instead there land as possible while they still can.

the country. These cover the full spectrum of our mineral berley Process. Similarly, we have introduced and formalized is a stir of excitement for having found the pot of gold before

wealth but the vast majority are focused on gold. On the the mining convention. Exploration permits have increased the rest. The increase in gold prices, coupled with large-scale

production side, total gold output has increased five fold be- from seven years to 10 years and the process for applying for regulatory reform, makes Cote dIvoires large portion of the

tween 2010 and 2015. Production reached over 23 mt/y in exploration rights has been overhauled. Now there is a maxi- Birimian belt more attractive than ever. SEMS Exploration

2015 and we have five industrial gold mines in operation. Two mum turnaround time between application and response. In Services opened an office in Cote dIvoire twelve years ago,

new mines are under construction: Perseus is currently build- terms of fiscal incentives, there are fiscal exemptions during and weve always had the feeling of maybe next year until

ing its Sissingu mine in the North and the Afema mine on exploration and construction phases that make the country now, as everything has really come together, noted Simon

the intersection of the Bibiani and Asankrangwa belts is under more attractive to investors. As for local community develop- Meadows Smith, managing director of SEMS.

development. A third mine (Yaour) will also start in 2017. ment, there are now clear guidelines for the mines and on the At the start of 2017, news headlines over-assumingly reframed

There are four manganese mines in operation, with strong level of contribution they are expected to provide to their host Cote dIvoire as erupting with violence and chaos. On January

potential for more to be developed in the future. Needless communities. On the environmental side, there are stricter 6, there was an uprising of discontent soldiers marching for

to say, the sector has been adversely affected by weak com- guidelines so that the land can be reclaimed for agricultural higher pay, which was resolved within days as the Minister

modity prices but exploration is continuing across all our min- usage once the mining operation has come to an end. Finally, of Defense tranquilly submitted to their demands for better

erals. Importantly, the nickel project and the bauxite deposit we have introduced a new fiscal regime with royalty and tax- working conditions. Meanwhile, the former Prime Minister

will be developed in 2017. ation rates based on international best practice. We believe Daniel Duncan resigned on January 9th, according Cote dIvo-

that the new code strikes an optimal balance between incen- ires new constitution which was ratified in October 2016. The

President Ouattaras reelection in 2015 cemented Cote tivizing investment and ensuring that the country maximizes peaceful shifting of elected officials and sensible concessions

DIvoires reputation as a peaceful democracy. Do you benefits from its natural resources. to just public demands are signs of a healthily functioning gov-

believe that the country will now see a large surge in for- ernment under President Alassane Outtaras purview.

eign investment? While Cote DIvoires power supply is praised as the GBRs survey results, which was issued to mining execu-

President Ouattaras successful re-election in 2015 confirmed strongest in West Africa, can it keep pace with expected tives already present within the country, indicate that 71%

to the world that Cote DIvoire has developed into a stable demand? of respondents feel that public-private sector relations have

and mature democracy. When he came to power in 2011, the The current situation is good. Total production is enough for improved over the past year. While Cote dIvoire still lags be-

reforms and policies that he introduced reassured the private domestic demand, including household use, industrial and hind more developed mining destinations in the region such as

sector and completely changed investment perspectives on mining. We even have a small surplus which is exported. To Ghana, Burkina Faso and Mali, it is now offering a golden op-

our country. What the private sector wants is confidence satisfy this expected strong demand, the government has portunity for companies active in the region to expand. Cte

and stability. This has been delivered. In 2013 and 2014, Cote devised a major investment program to double capacity by dIvoire is the latest destination of choice, with significant po-

DIvoire was recognized as one of the 10 best performers for 2020. In parallel, we will be diversifying our energy mix. tential that has never been fully explored providing the blue

24 MACIG 2016 MACIG 2016 25

EDITORIAL MACIG 2017 MACIG 2017 EDITORIAL

Regulation Rather than opening an office and investing large

Exploration & is more-or-less a grassroots project in

Cte dIvoire in accompaniment with

their advanced project in Burkina Faso.

Production

amount of cash in a difficult environment, we develop Newcrest is working in partnership with

consignment stock deal where suppliers have access local exploration company TD Continen-

tal to develop their three licenses that

to our infrastructure and clients. The only risk a

have preliminarily been deemed valua-

foreign supplier takes is to hold stock within our ble, but more tests need to be done to

Ouattaras National Development Plan (NDP) 2016-2020 in- facilities, so it is a way to enter West Africa at very low confirm the reserves. Michel Sogjiedo

cludes structural reforms that aim to further stimulate the cost and have access to X&M expertise in West Africa. Mian, president director general of TD

recent surge in both private and public sector investment. Continental noted that the company is

Agriculture remains the primary contributor to GDPcocoa, also interested in collaborating with

coffee, cashew nuts and sugar having all seen an increase in The sustainability of Cote dIvoires Given Cote dIvoires perfect combina- mines with smaller production targets

- Stanislas de Stabenrath,

production in 2015yet mining has risen as a critical focus mining industry, however, primarily tion of geological prospectivity, eco- and semi industrial licenses. We noticed

over the past two administrations. We are predicting about

X&M that a significant amount of deposits are

depends on the uptake of exploration nomic and fiscal stability, and infrastruc-

2% of the 8% projected GDP growth for 2016 will be min- activity. Hosting only five gold produc- tural ease, Bristow prays he will find his sometimes abandoned by senior com-

ing related, states Madeleine Tanoe, partner at Pricewater- ersLa Mancha, Newcrest, Randgold, next major gold mine within Cote dIvo- panies as the production capacity is not

houseCoopers Cote dIvoire. The passage of the new min- Perseus and Taurus Goldthe 23.5 met- ires borders. large enough for them, but they are still

ing code, in March 2014, removed the additional profit tax ric tons per year (mt/y) current output Given the lifecycle of mining permits valuable.

(which was formerly payable by permit holders at the rate of is miniscule in comparison to the 600 pre-2014, now is the time for renewals A notable number of Ivoirian juniors

7% of turnover), introduced greater transparency in permit- mt/y known potential, and microscopic and purchases, and the existing multi- have entered the mining scene and are

ting procedures, elongated the time period for initial explo- in comparison to the cumulative un- nationals are knocking on the Ministrys interested in smaller-scale project devel-

ration permits (extending the range from 3 to 4 years), and mapped reserves. Two new mines are door looking for more. Most recently, opment. The process by which mining

limited State participation to 15% of the share capital of each under construction: Perseus is currently Perseus Mining acquired Amara Mining companies achieve a license to operate

mining company, among other changes. Another advantage building its Sissingu mine in the North in April of 2016, granting access to their in Cote dIvoire is fair and equal for both

is that companies pay no tax for an exploration permit, and operations, explains Eric Kondo, managing director of Mining and Taurus Gold is underway with the Sissingu and Yaoure gold projects. The local and international companies, ex-

Cote dIvoire is one of the only countries that offers a five- Consulting Services in Cote dIvoire, as well as treasurer and Afema Mine on the intersection of the Egyptian company Centamin purchased plained Bamba Tahi Henri, director of

year tax exemption following commencement of commercial legal consultant for the Chamber of Mines and consulted on Bibiani and Asankrangwa belts. Three Ampella Mining in 2015, beginning what B&F Minerals. Compared with Burkina

the draft of the new mining code. manganese mines also contribute to

The current Minister of Mines, Mr Brou, has developed and national GDP, but adverse commodity

implemented incredibly favorable policies; however, we have prices have kept operations lean. Thank-

yet to see enough money pumped into the exploration indus- ful to the upswing in gold prices, Cote

try worldwide, which is why the sector is picking up slowly, dIvoires major multinationals have both

noted Stanislas de Stabenrath, director general of Exploration increased their exploration budgets and

& Mining Suppliers (X&M). begun strategic acquisitions. Although

As the government works to effectively implement the new Cote dIvoire continues to attract signifi-

legislation, Cote dIvoires NDP also posits a necessity for in- cant attention as the newest exploration

creasing its capacity in raw materials processing. Pragmati- destination of West Africa explained

cally, any form of value addition has seen little fruition to date Wouters, new entrants sometimes

across industries. Cote dIvoire is focusing on diversification remain cautious despite the hype, with

of its mineral production, with developments in manganese, M&A over the last years often consol-

calcined bauxite and nickel; however, in a number of cases, idating any advanced or significant ex-

mining licenses are being applied for and granted on the back ploration into the hands of current pro-

of studies that do not include any processing. We are not ex- ducers.

porting minerals; we are exporting ore, noted Ludivine Wout- Randgold has been expanding its Ton-

ers. This attracts operators looking for projects with the po- gon operation, but has also heavily in-

tential to rapidly generate cash flow, but seems at odds with vested in collecting dated information

the States industrialization policy. and newly mapping Cote dIvoire to cre-

Due to the adolescence of Cote dIvoires mining industry, ate an extensive database from which

after extracting and crushing the ore, it must be exported for they can make precise and focused

further treatment to countries that have longer mining histo- exploration decisions. In addition to

ries, such as Ghana or Mali. Gold remains the countrys driv- established projects in the north of the

ing resource, which limits the possibilities of beneficiation by country, explained Mark Bristow, CEO

nature, but the integration of labs and refineries present in- of Randgold, Randgold has just start-

teresting opportunities for impending investment given Cote ed a footprint in the Southeast of Cote

dIvoires central West African location and the ease of doing dIvoire, as we think it has merit worth

business in comparison to its neighbors. investigating.

26 MACIG 2016 MACIG 2016 27

EDITORIAL MACIG 2017 MACIG 2017 EDITORIAL

Faso and Mali, in Cote dIvoire there are

many more local companies which have

drilling this target, which is resulting in

impressively high gold grades in some

obtained from Africa, explains Ms. Camera, chairman and

CEO of Tigui Mining Group. Her focus is thus centered around

TD Continental holds approximately 20 licenses,

managed to obtain licenses to work in holes. There is a significant amount of gold and diamonds, and within the next two years, we plan

the mining sector; however, this is often work still to be done in all of our per- to be in the exploration phase on at least one of my licenses,

which are operated within the framework of joint

dependent on the quality of the entity. mit areas, but currently Boundiali is the she explains. Mr. Bictogo and Ms. Camara are both working ventures agreements, and in collaboration with

B&F currently possesses a license to joint ventures main focus. Kokumbo is to prove that it is possible, and should be easier, for Africans international partners whose technical expertise and

operate in four separate areas of the also part of a very well mineralized belt and foreign investors to thrive in the mining industry. financial strength have proven suitable for large-scale

country, and has already invested more and we have had some encouraging Cote dIvoire is not an exception to the global challenge of mining projects.

than $2 million in a project in Daloa that diamond drilling results there as well, sustaining national security. March 13, 2016, the first ter-

they hope to bring towards the feasibil- concluded Roberts. rorist attack in the countrys history occurred at the Grand

- Michel Sodjiedo Mian,

ity stage. Though most explorers remain fixated Bassam beach resort. Mining executives, however, posit that

Some dedicated multinational juniors on gold, Cote dIvoire has approximate- this should not serve as a deterrent to entry. The administra- President Director General,

are expectantly pouring significant in- ly 4 billion mt of iron ore in the Western tion and the ministry are working to uphold their promises T.D. Continental S.A

vestment into the country. Predictive part of the country. This is complement- for increased security and improved transparency across a

Discovery, which operates on a project ed by around 350 million mt lateritic multitude of institutional layers. The United Nations is steadily

generator model, created a joint venture nickel as well as additional reserves of decreasing the number of uniformed personnel stationed in

with Toro Gold to develop their Bound- copper and manganese. Base metal Abidjan, Cote dIvoires economic capital, and has increased

iali, Ferkessedougou, and Kokumbo exploration and exploitation is neglect- confidence in Cote dIvoires governance. Cote dIvoire be-

concessions. In our initial geochemical ed, noted Nouho Kon, principal con- came EITI compliant in 2013, the diamond embargo was lifted

survey in 2014, the most interesting re- sultant for NF Consult, gold is an asset by the UN in 2014, and Kimberley diamonds resumed exports

sult was a 24 part per billion (ppb) anom- in which you can invest your money for in March of 2015. In January of 2016, the Ministry of Industry

aly from a 15 square kilometer (sq. km) faster development: while creating and and Mines made the commitment to implement a modern

catchment at Boundiali, which we then exploring a gold mine can take 14 or mining cadaster system for improved efficiency and clarity of

thought could reflect a world class gold 15 years, a base metal needs 20 or 25 ownership.

deposit, stated Paul Roberts, managing years minimum to be developed, and

director of Predictive Discovery. that time makes a big difference.

Toro and Predictive have recently begun Local entrepreneur and newly ac-

claimed mining junior Moumini Bictogo

has managed to add value to Lagune

Exploration Afriques bauxite extraction

operations, with the aim of moving into

Gold is an asset in which you full production by the close of 2016.

Within one site, Lagune Exploration Af-

can invest your money for faster

rique discovered 25,000,000 tonnes of

development: while creating and bauxite; however, after conducting cost

exploring a gold mine can take analyses it was uncovered that selling

14 or 15 years, a base metal needs basic bauxite would not be economical-

20 or 25 years minimum to be ly advantageous. Thus, we are work-

developed, and that time makes a ing to build a calcination factory to bring

more value to the mineralincreasing

big difference.

its profit potential by 200%-300%, ex-

plained Bictogo.

Upon its construction, Lagune Explo-

- Nouho Kon, ration Afrique will be the first and only

Principal Consultant, West African metallurgical company in

NF Consult nationality.

Tiguidanke Camara, a Guinean interna-

tional businesswoman, is also working

to make her name known in the mining

community. Her current focus is acqui-

sition, strategically investing in Cote

dIvoire as a door to the rest of West

Africa. I first started paying attention

to mining during my modeling career,

when I become aware of the fact that

many of the jewels I was wearing were

28 MACIG 2016 MACIG 2016 29

INTERVIEW MACIG 2017 MACIG 2017 EXPERT OPINION

Mark Beating the

Bristow investment

trends

CEO,

Randgold

Ludivine Wouters,

Managing Partner,

Latitude Five

You have become the weathervane for gold mining desti- the communities in such a way that they can continue to thrive

nations in West Africa. Why is Cte dIvoire currently your economically even after the mine is closed. We call this our leg-

country of optimal choice? acy strategy.

Randgold looks at all African countries and we rank them against Ahead of starting a mine, we conduct a social baseline study Over the last few years, despite global market conditions, whilst others need to reaffirm their place among top invest-

our risk assessment criteria. We will look at geological prospec- to understand the activities of the surrounding communities. West Africas gold sector has continued to attract significant ment destinations, such as Mali, Niger and Guinea.

tivity first, which is the potential to find a gold deposit larger than Wherever we can, we will develop needed infrastructure and investment, from regional producers as well as new entrants Since 2010, the mining sector has had to deal with a con-

3 million ounces that will deliver an IRR of 20% a year at a $1000 ensure that all villages in our affected area have access to clean acquiring development, pre-development or exploration as- stant flow of regulatory transitions across the region: de-

long term gold price. There are many African countries that will water. Every six months, we have discussions with the leaders sets, often with a similar strategy of spreading their invest- spite already revising fiscal terms in 2012, Senegal recently

fit this filter for gold, such as Senegal, Mali, Cte dIvoire, Bur- of the villages to identify problems in the community and find ment across two or three jurisdictions in the region. Though adopted a revision of its mining legislation after months of

kina Faso, Ghana, and the entire Archean gold field geology in solutions together. We run business development courses for Canadian and Australian gold producers looking for consoli- delay and hesitation, significantly reducing fiscal incentives;

Central and Eastern Africa which stretches from Dar es Salaam the communities, and we try to encourage the local entrepre- dation and geographical diversification have played a domi- Burkina Faso is still in the process of adopting implementa-

to North Eastern DRC. neurs to dream big. With big aspirations, financing is required nant role in this growth, investors and operators from other tion regulation for the revised mining code of June 2015, also

The second filter is the economic and fiscal regime of the coun- and this is how micro-financing starts. Randgold will financially regions, including Turkey and the Middle East, China and India characterized by an increase in fiscal burden; Mali recently

try. We will also consider the economic and political regime of support local businesses in their economic endeavors because are increasingly active in the sector, bringing financial capac- announced a revision of its 2012 mining legislation, with the

the country, such. Lastly we will consider the infrastructures most banks do not consider it. ity as well as operational expertise to a variety of projects. stated objective of increasing returns to the country and na-

such as accessibility of power and water supply. This remained true in 2016, with significant M&A across the tional economy. These processes will continue into 2017: in

When we apply all of these filters, the only A-grade country is Do you have a final message about Cte dIvoire, and your sector and increasing exploration budgets, including those an environment where exploration and project generation are

Cte dIvoire. Cte dIvoire has a competent civil service and perspective on West Africa in the future? deployed by new project generation vehicles. West Africa key drivers of growth for the mining sector, they should not

the country is run not only by politicians, but also by a cadre of Africa is an emerging continent, and by 2025 it is going to have has also seen growth in other minerals, with minerals sands, hinder investment.

professionals. People have stayed working in their departments the highest percentage of young people in the entire world. lithium, graphite and calcined bauxite projects progressing In most cases these transitions include extensive industry

for many years and there is history and knowledge. Cte dIvoire West Africa is rich in natural resources and there is still a signifi- across the region as the global energy and technology land- consultation, aiming to provide law makers with consensual

is also a very favorable destination for mining as it has the best cant amount of opportunities in the region. Cte dIvoire stands scape evolves. proposals, though the final legislation may be significantly im-

infrastructure in West Africa. out as a mining destination in West Africa, as it has the infra- The hope is that the next two to three years see higher and pacted by internal political and social drivers. Operators have

structure, a reputable political and administrative structure, and sustained gold prices stimulating exploration and develop- mostly succeeded in obtaining that contractual frameworks

Can you elaborate on the accessibility of power in Cte significant endowments. The country has the fundamental re- ment expenditure in West African gold. After several years of including stability provisions remain unaffected, though rene-

dIvoire, considering this was a challenge for Randgold re- quirements of building the basis of a sustainable community expenditure discipline, a number of gold producers, including gotiation has been required in some cases. Mining associa-

cently? which is potable water, primary healthcare, primary education, South African companies, are in a position to take advantage tions and chambers continue to request improvements in the

Currently things are more or less up and running. We built a and food security. For any mining company it would be a great of healthier balance sheets and stronger cash flows: West rapidity and transparency of permitting processes in a num-

power line from the Korhogo substation and linked some of the advantage to find the next world class mine in Cte dIvoire. Africa should a destination of significant interest for them. ber of West African jurisdictions.

villages in the vicinity to the power line as they were deprived of In addition to its projects in the north of the country, Randgold Two aspects should dominate the regulatory landscape in

electricity. It is a single power line and it comes with its challeng- has just started a footprint in the southeast of Cte dIvoire, as West Africa in the coming years: one is the efforts of Gov-

es, but the government is working on building additional power we think it has merit worth investigating. There has not been and managing regulatory transitions ernments across the region to curb illegal mining, particularly

lines and roads. much exploration in Cte dIvoire and there is no comprehensive in the gold sector, with international organisations and do-

We have always had a backup power station that can run our database on which new entrants can base their exploration. A Francophone West Africa benefits from a higher degree of nors pressing for regional coordination; another one is the

entire mine without the grid. competitive advantage for us is that we have been in the country legal and regulatory harmonization than other African regions, emergence of local content regulation or initiatives, as Gov-

long enough to build a map and databank which are now helping facilitating market entry and regional growth decisions. Inves- ernments and civil society organisations seek to increase

Can you elaborate on Randgolds PAMF-CI initiative? us make smart and focused decisions. tor and operator confidence indicators, such as the Policy Per- positive returns from mining for local economies. In both

To elevate economic activity within the footprint of our mines, We also continue to work with all the sector players and the ception Index published annually by the Fraser Institute, show cases, it will be important to ensure that industry views are

we run multiple microfinance operations such as PAMF-CI to as- government to attract new investments into the industry as well that some regional jurisdictions remain very strong among Af- expressed and taken into consideration in adopting workable

sist locals in creating their own businesses. Our aim is to benefit as the economy as a whole. rican peers, including Burkina Faso, Ghana and Cte dIvoire, regulation.

30 MACIG 2016 MACIG 2016 31

EDITORIAL MACIG 2017 MACIG 2017 EDITORIAL

Services content development should be tackled

via capacity training, according to GBRs

industry executives survey results. Sou-

ment to support the development of the

economy, states Jean-Michel Maheut,

regional director for Bollor. The exist-

develop consignment stock deal where suppliers have access

to our infrastructure and clients. The only risk a foreign suppli-

dure Industrielle Et Construction (SIC-CI) ing infrastructure is acceptable for gold, We want to enter into a dialogue with mining er takes is to hold stock within our facilities, so it is a way to

is an Ivoirian industrial welding and con- which does not need as many contain- enter West Africa at very low cost and have access to X&M

companies so as to ensure a healthy environment for

struction company which began working ers, but more investment is needed for expertise in West Africa. We are already holding large stock on

for the main oil refinery of Cote dIvoire. the containers in order to support export the good of the workers, the communities nearby and behalf of private and ASX listed companies. X&M has set the

To support new exploration companies After the new mining code was passed, volumes of exporting base metals such for the mining companies themselves. largest stock of Standard (CRM) in West Africa in partnership

and offer local expertise, Cote dIvoire is SIC-CI decided to integrate the mining as Manganese and iron ore. Construc- with Ore Research and Exploration (OREAS), an Australian pri-

home to an array of Africa-experienced industry into their business under the tion will also commence within the next vate company.

service providers and small consulting premise that multinationals would be two years for a new containers and ves- - Yao Kossonou,

firms. Amongst these firms is Biotitiale, more inclined to dedicate energy to- sels quay and a logistics industrial area

General Manager,

an environmental consultancy firm, wards knowledge transfer. It is never near Yamoussoukro. Conclusion

launched in 2012. If a client wishes easy for a new company to get a market The promising direction of the coun-

Biotitiale

us to complete all requirements until a share in mining, noted Mandjou Kourou- try and the strength of the Society for Aside from challenges common to the operational environ-

permit is obtained, we can provide that ma, director general of SIC-CI, but we Mining Development (SODEMI) have ment of African terrain, Cote dIvoire is unanimously deemed

service, or else we can help with par- have local competencies in place with cultivated trust from many multination- the top mining destination in West Africa for those who have

ticularities related to each mine. We can an excellent and talented team of local al suppliers and service providers as the experience and girth to commit to a long-term vision in the

coach a company as to how to obtain all workers. By using local talent we can well. EPC Groupe, a world leader in the region. Its exceptional infrastructure, connectivity, and political

of the various permissions required from save costs for both ourselves and our manufacturing, storage and distribution stability fill in the cracks of what was once a shaky foundation.

the Ministry of Industry and Mines as clients. of explosives, recently installed a mod- Now that the implementation of these essential elements are

well as other institutions, especially in Indeed Abidjan, the commercial capital ular group plant in Cote dIvoire. Our proving successful, thought leaders are able to more fluidly ad-

all matters concerning safety, security of Cote dIvoire, is emerging as a local vocate for development on a grander scale: We should start

and the protection of the environment, service hub to the francophone West sharing the knowledge that we have as to optimize projects

explained general manager for Biotitiale, African mining region in part to do investment illustrates our belief in the potential of the coun- and industry operations. The mutualization of knowledge and

Yao Kossonou. with its strategic location, infrastructure try, says Jean-Jacques Koua, managing director of EPC Cote skills would benefit everyone in the country as well as in the

Exploration companies also require and port facilities, but increasingly due Though it is set into the dIvoire. Multinationals that are already present in the country entire West African region, explains Shane Brady, managing

sample analysis, but laboratory support to a well functioning legal system, gov- new Mining Code, the local are preemptively training staff in correspondence with their ex- partner of WINGI Group.

has not been historically easy to access ernment and a relatively well educated pectations for minings impact on domestic power needs: We

development funds in place seem

from Cote dIvoire. ENVAL is one local population. CAT distributor Manuten- have implemented programs for training young people around

consortium taking advantage of this gap tion Africaine built its training center in

to have a few difficulties to be fully mining sitesmainly concerning electrical engineeringto as-

in the market. What began in 2000 as Abidjan given its great confidence in the implemented. A wider sure that we also retain the human capital needed to keep up

an environmental impacts bureau has country. Cote dIvoire certainly has the consultation with the stakeholders with the increase in energy demand, states Dalil Paraiso, West

since evolved into a multi-industry physi- best infrastructure in West Africa, ex- would help amending accordingly Africa general director for Schneider Electric.

ochemical laboratory for pollution, oil and plains Ludovic Boland, mining manager this important law, which EY, for example, has chosen Abidjan as its regional base, as

soon mineral sample analyses. ENVAL for Manutention Africaine, Power sup- Eric Nguessan, partner, EY Cote dIvoire, explained: EY Cote

should contribute to the realization

operates the largest laboratory in Cote ply in the country is good and most of dIvoire positioned itself in Abidjan as the center point between

the mines are running on the grid with

of tangible projects, as well as to

dIvoire, and is the second laboratory to Canada and Australia because a great deal of foreign direct in-

achieve ISO 17025 certification, ahead of only backup power plants. Road infra- the acceptance by the communities vestment comes from those two mining powerhouses. Glob-

SGS, Bureau Veritas, and Intertek. This structure is much better than the roads of the mining ally, EY has nine world mining partners, and in West Africa, EY

new laboratory will be the very first of its in other territories, and mines are easily projects. Cote dIvoire is the hub for the region. From Abidjan, we cover

kind in Cote dIvoire for mining analysis, accessible. Earthmoving and construc- Togo, Mali, Burkina Faso, Niger, and Benin. Hyspec, which pro-

Bakary Coulibaly, managing director of tion equipment provider Kanu Equipment vides hydraulic hoses, greasing machines, oil transfer services

ENVAL, explained. Due to our proximity Cote dIvoire has evolved to become the and more, offers itself as a case study for the strategic value

- Bodiel Ndiaye,

to the mines, we can deliver results in companys largest operational branch in of Abidjan as a hub. We experienced 180% growth due to our

a shorter time frame at the same level the region. By 2019, the government President, increase in services from the strong clientele that we currently

of standards as the laboratories in Ghana aims to have built around 7000km of Mining Association in Cote hold. We have good products and even better know how, so

or South Africa. When given a sample for new, modern roadways. This develop- d'Ivoire (GPMCI) we are confident that we will continue to grow, says Michel

analysis, our results are ready between ment has already begun, and new inves- Bertoncini, managing director of Hyspec Cote dIvoire.

a 24-hour to 48-hour timeframesome- tors are increasingly more present, says X&M Suppliers is another Abidjan success story, as their man-

thing that is impossible for our competi- Francois Bigara, managing director of the aging director Stanislas de Stabenrath has honed in on risk

tors to deliver. Cote dIvoire division. adverse business models to steadily increase investor confi-

Stringent local content laws are not in The national government is working on a dence in the stability of the country. We are also assisting

place at present, with the intention of port extension project to further increase foreign supply companies to have a better access to the West

providing one less obstacle to entry for accessibility and ease the logistics of ex- African market by signing consignment stock agreement with

businesses. Within the players in the port. In Cte dIvoire the government is X&M, says Stabenrath, Rather than opening an office and

market, a strong majority think that local very focused on infrastructure develop- investing large amount of cash in a difficult environment, we

32 MACIG 2016 MACIG 2016 33

SURVEY MACIG 2017 MACIG 2017 SURVEY

GBR Mining Opinion Survey Cote d'Ivoire

RESPONDENTS ACTIVE

IN THE FOLLOWING

SEGMENTS

Production: 8.5%

Exploration: 34.2%

I think the mining sector in I think development of local Cote d'Ivoire offers good Since the beginning of 2016

Legal: 12.7%

Africa has a positive outlook content should be addressed exploration potential with it has become easier to raise

Equipment/Services: 29.7%

for 2017. in the following way: attractive conditions relation capital for mining ventures in

Financial Institution: 4.2%

to other West African Cote d'Ivoire.

Other: 10.7%

STRONGLY AGREE jurisdictions.

BY INVESTING IN STRONGLY AGREE (10.5%)

*more than one answer possible

(26.2%) LOCAL CAPACITY STRONGLY AGREE

TRAINING (57.7%) (32.5%) AGREE (36.8%)

AGREE (57.2%)

BY INTRODUCING A AGREE (35%) NEITHER AGREE OR

NEITHER AGREE OR LOCAL CONTENT ACT

DISAGREE (9.5%) (24.4%)

DISAGREE (39.5%)

NEITHER AGREE OR

DISAGREE (7.1%) DISAGREE (22.5%) DISAGREE (13.2%)

OTHER (11.1%)

STRONGLY DISAGREE (0%) DISAGREE (10%) STRONGLY DISAGREE (0%)

What do you think is the top I think the key factor for LOCAL CAPACITY & ACT (6.8%)

factor to consider when Cote d'lvoire currently STRONGLY DISAGREE (0%)

looking to invest in an being so attractive for

African Country? mining investment is:

POLITICAL STABILITY

AND STABILITY POWER SUPPLY (3.2%)

(45.7%) I think that public-private sec- I think the risk of investing in The mining industry in I think that the rate of permit

POLITICAL tor relations have improved in mining in Africa has Cote d'Ivoire has a processing is:

GOOD Cote d'Ivoire's mining sector decreased in the last 5 years. positive outlook for 2017.

INFRASTRUCTURE

STABILITY (28.4%) over the last 12 months.

(INCLUDING POWER INFRASTUCTURE DEVELOPMENTS STRONGLY AGREE (9.8%) STRONGLY AGREE VERY GOOD (16.2%)

SUPPLY) (20.4%) (19%) STRONGLY AGREE (15,7%)

(27.5%)

AGREE (55,2%) AGREE (43.9%) ABOUT RIGHT

LEGAL FRAMEWORK MINING CODE (21%)

(11.8%) NEITHER AGREE OR

AGREE (55%) (43.3%)

NEITHER AGREE OR

MINERAL DISAGREE (21.9%)

TAX ENVIRONMENT (6.8%) DISAGREE (29,1%) NEITHER AGREE OR TOO SLOW (40.5%)

POTENTIAL (28.4%) DISAGREE (24.4%) DISAGREE (17.5%)

ECONOMICAL GROWTH (6.8%) DISAGREE (0%)

INTERNATIONAL PERCEPTION/ STRONGLY DISAGREE (0%) DISAGREE (0%)

STRONGLY DISAGREE (0%)

*Some respondents chose multiple sectors

INVESTMENT RATINGS(8.5) STRONGLY DISAGREE (0%)

34 MACIG 2016 MACIG 2016 35

You might also like

- Still and Quiet MomentsDocument3 pagesStill and Quiet MomentsRicardo Suarez G100% (1)

- IPA Copper Sizing Guide Barry SmithDocument116 pagesIPA Copper Sizing Guide Barry SmithBen ConnonNo ratings yet

- Phase 1 To 5 GurgaonDocument1 pagePhase 1 To 5 Gurgaonrashi1717No ratings yet

- The Musician's Guide Workbook CH 12Document12 pagesThe Musician's Guide Workbook CH 12Gus MendozaNo ratings yet

- Citation 550 Panel Poster-Revision 6 07-17-1Document1 pageCitation 550 Panel Poster-Revision 6 07-17-1Luis GarciaNo ratings yet

- BC Rich Stealth Full RockarDocument1 pageBC Rich Stealth Full RockarPablo FerrariNo ratings yet

- Study On The Economic Impact of Toledo's AirportsDocument39 pagesStudy On The Economic Impact of Toledo's AirportsSarah McRitchieNo ratings yet

- Independizacion Martha Angelica Maria Del Transito Cespedes Abanto de MurguiaDocument1 pageIndependizacion Martha Angelica Maria Del Transito Cespedes Abanto de MurguiaIlmer SoriaNo ratings yet

- Bruderer Ningbo ALP FR AC TTA: Restaurante Praça AlimentaçãoDocument2 pagesBruderer Ningbo ALP FR AC TTA: Restaurante Praça AlimentaçãoAlex Antonioli100% (1)

- Koolertron Amag-Keyboard User Guide: Row 1 Row 2 Row 3 Col 1 Col 3 $4 !1 8 %5 @2 (9 6 #3Document2 pagesKoolertron Amag-Keyboard User Guide: Row 1 Row 2 Row 3 Col 1 Col 3 $4 !1 8 %5 @2 (9 6 #3leanne langNo ratings yet

- ABL Trilateral AgreementDocument7 pagesABL Trilateral AgreementBLSolidarityNo ratings yet

- Zmd-dd-sbn4 Sbn8 User ManualDocument28 pagesZmd-dd-sbn4 Sbn8 User ManualLuis Alfonso PozasNo ratings yet

- Holbrook d13 d15 d18 ModelsDocument66 pagesHolbrook d13 d15 d18 ModelsPeter HartNo ratings yet

- Kawasaki FC150V FC180VDocument14 pagesKawasaki FC150V FC180VDarekn15No ratings yet

- I765 and I765ws - SAMPLEDocument2 pagesI765 and I765ws - SAMPLEElrandomheroNo ratings yet

- precisionXT 60331-kppm57Document11 pagesprecisionXT 60331-kppm57write2kerryNo ratings yet

- Song of Freedom MadridDocument1 pageSong of Freedom Madridroger_lewis_14No ratings yet

- GEOLOGICAL MAP OF WEST AFRICA - Côte D'ivoire, Burkina Faso, Ghana, Mali, Guinea, LiberiaDocument1 pageGEOLOGICAL MAP OF WEST AFRICA - Côte D'ivoire, Burkina Faso, Ghana, Mali, Guinea, LiberiaStanislas De Stabenrath100% (4)

- Kawaguchiko Retro Bus RoutemapDocument1 pageKawaguchiko Retro Bus RoutemapMohd Shahril Abd LatiffNo ratings yet

- 2023 FSAE Structural Equivalency Spreadsheet Steel Tube V1.1Document27 pages2023 FSAE Structural Equivalency Spreadsheet Steel Tube V1.1Lucas DuarteNo ratings yet

- Invoice HancoDocument4 pagesInvoice Hancoiwan-jatikusumo-2552No ratings yet

- 04.09.23 Easter Sunday Large Print BulletinDocument12 pages04.09.23 Easter Sunday Large Print BulletinFirst Congregational Church of EvanstonNo ratings yet

- Cleveland Division of Police 4th DistrictDocument1 pageCleveland Division of Police 4th DistrictWKYC.comNo ratings yet

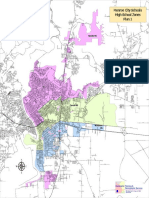

- Monroe City Schools High School Zones Plan 1: Neville HSDocument1 pageMonroe City Schools High School Zones Plan 1: Neville HSSabrina LeBoeufNo ratings yet

- Erika - Marcia Sinfonica Michele SautaDocument11 pagesErika - Marcia Sinfonica Michele SautaMichele SautaNo ratings yet

- 1983 Owners Manual XVZ12 Yamaha VentureDocument70 pages1983 Owners Manual XVZ12 Yamaha VentureDingy101100% (1)

- Mwana Kondo 4. Isaac KABUNDIDocument2 pagesMwana Kondo 4. Isaac KABUNDIPiersy Mukamba100% (1)

- Our Town June 21, 1924Document4 pagesOur Town June 21, 1924narberthcivicNo ratings yet

- HBW - 15 InfoDocument13 pagesHBW - 15 InfoSandra Baillie100% (4)

- Ga h61m s2 b3 r1.0 BitmapDocument2 pagesGa h61m s2 b3 r1.0 Bitmapsỹ QuốcNo ratings yet

- 01 General InformationDocument24 pages01 General InformationTomPolishAussieNo ratings yet

- Chiisana Koi No Uta - C MajorDocument1 pageChiisana Koi No Uta - C MajorDuy Thien VuNo ratings yet

- 5Q1265 Schematic DGRM SJF21WDNDocument2 pages5Q1265 Schematic DGRM SJF21WDNSilomo-saka Mamba0% (1)

- Delta 24-902 UniviseDocument2 pagesDelta 24-902 Univiseoldgoaly8330No ratings yet

- FramesDocument1 pageFramespatrickcjh5236No ratings yet

- Describing Technical Functions and ApplicationsDocument2 pagesDescribing Technical Functions and ApplicationsgraypitraNo ratings yet

- GA H110M DS2 - 10 - BV BoardviewDocument2 pagesGA H110M DS2 - 10 - BV BoardviewAnh NguyễnNo ratings yet

- Israel Israel God Is CallingDocument6 pagesIsrael Israel God Is CallingLima Lima100% (1)

- Brand Alphabet QuizDocument1 pageBrand Alphabet Quizsravya5No ratings yet

- 3117296-Yuri On Ice OST - Yuri On Ice TheIsther Sheet Music Full Sheet PDFDocument7 pages3117296-Yuri On Ice OST - Yuri On Ice TheIsther Sheet Music Full Sheet PDFnyguy06No ratings yet

- District 17Document1 pageDistrict 17Genna ContinoNo ratings yet

- Redmi K30 ProDocument2 pagesRedmi K30 Projo sephNo ratings yet

- Metal Casting From GrooverDocument26 pagesMetal Casting From GrooverAndriya NarasimhuluNo ratings yet

- Statutory Instrument No 64 of 2012 - The Liquor Licensing (Permitted Hours) Regulations 2012Document2 pagesStatutory Instrument No 64 of 2012 - The Liquor Licensing (Permitted Hours) Regulations 2012PMRCZAMBIANo ratings yet

- Faizya by Moulana Faiz Ul Hassan Saharan PuriDocument23 pagesFaizya by Moulana Faiz Ul Hassan Saharan PurisunnivoiceNo ratings yet

- CG Interchange PlanDocument3 pagesCG Interchange PlanAkshay NampalliwarNo ratings yet

- CENTO OpeningMenu Final 120921Document1 pageCENTO OpeningMenu Final 120921Farley ElliottNo ratings yet

- Kayla Bourque Search Warrant ApplicationDocument30 pagesKayla Bourque Search Warrant ApplicationThe Province100% (1)

- Tanmaya PDFDocument1 pageTanmaya PDFPradeep Kumar BaralNo ratings yet

- Roberto Miguel Rodriguez Notary ApplicationDocument4 pagesRoberto Miguel Rodriguez Notary ApplicationCamdenCanaryNo ratings yet

- Plano de Ubicacion Illanya-A-2Document1 pagePlano de Ubicacion Illanya-A-2Yaneth Quispe SotoNo ratings yet

- GIPA Document Listing Criminal Convictions Held by NSW Police Officers.Document9 pagesGIPA Document Listing Criminal Convictions Held by NSW Police Officers.ABC News OnlineNo ratings yet

- Revised Pay Scale 2011Document8 pagesRevised Pay Scale 2011fizex2250% (2)

- Sems Ci 2022 12072022Document1 pageSems Ci 2022 12072022FreNo ratings yet

- Province - de - Tshopo - RDCDocument1 pageProvince - de - Tshopo - RDCMOSTAFANo ratings yet

- Dhemaji District (Assam E-District Project) : Bikash Sonowal Bichitra SonowalDocument1 pageDhemaji District (Assam E-District Project) : Bikash Sonowal Bichitra Sonowalwww.kpancardNo ratings yet

- Zonal Boundary Map With Village NameDocument1 pageZonal Boundary Map With Village NameAjay KrishnanNo ratings yet

- Sierra Leone Planning MapDocument1 pageSierra Leone Planning MapMirsadNo ratings yet

- JABINES - PDF 1 1Document1 pageJABINES - PDF 1 1ice iceNo ratings yet

- Ilovepdf MergedDocument12 pagesIlovepdf MergedFan FollowingNo ratings yet

- City Index: Updated: APRIL 2016Document1 pageCity Index: Updated: APRIL 2016Dutches DariaganNo ratings yet

- Interview Stanislas de Stabenrath - Managing Director X&M Suppliers - MAGIC 2017Document2 pagesInterview Stanislas de Stabenrath - Managing Director X&M Suppliers - MAGIC 2017Stanislas De StabenrathNo ratings yet

- X&M Pipe Marking CatalogueDocument20 pagesX&M Pipe Marking CatalogueStanislas De StabenrathNo ratings yet

- X&M Photoluminescent - Glow in The Dark BrochureDocument4 pagesX&M Photoluminescent - Glow in The Dark BrochureStanislas De StabenrathNo ratings yet

- X&M Geological Supply Catalogue (Exploration and Mining Suppliers)Document14 pagesX&M Geological Supply Catalogue (Exploration and Mining Suppliers)Stanislas De StabenrathNo ratings yet