Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsJDJD PDF

JDJD PDF

Uploaded by

Khurram ShahzadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- Investment Manager - Spider ManagementDocument2 pagesInvestment Manager - Spider ManagementMarshay HallNo ratings yet

- VP - EstanciaDocument2 pagesVP - EstanciaMarshay HallNo ratings yet

- Investment Officer, Innovations - Washington State Investment BoardDocument4 pagesInvestment Officer, Innovations - Washington State Investment BoardMarshay HallNo ratings yet

- Lamar Holdings - Job Specification - Financial Analyst - 8 Nov 20Document3 pagesLamar Holdings - Job Specification - Financial Analyst - 8 Nov 20abhinavg_9No ratings yet

- HARVARD Management CompanyDocument4 pagesHARVARD Management CompanyMarshay HallNo ratings yet

- Syllabus Course Description: Courses/default - HTMLDocument4 pagesSyllabus Course Description: Courses/default - HTMLHayder KedirNo ratings yet

- Ladrillo Investor PresentationDocument16 pagesLadrillo Investor PresentationMOVIES SHOPNo ratings yet

- Rob Brown, PHD, Cfa 5054 Evanwood AvenueDocument4 pagesRob Brown, PHD, Cfa 5054 Evanwood Avenuekurtis_workmanNo ratings yet

- JD - SR Analyst - Hyd 02Document1 pageJD - SR Analyst - Hyd 02the few of youNo ratings yet

- External Manager Selection and MonitoringDocument14 pagesExternal Manager Selection and MonitoringHadyNo ratings yet

- Associate - EstanciaDocument2 pagesAssociate - EstanciaMarshay HallNo ratings yet

- Spectrum of HF InvestorsDocument7 pagesSpectrum of HF InvestorsalgunoshombresNo ratings yet

- JD - Generic PMG - Analyst - Senior AnalystDocument1 pageJD - Generic PMG - Analyst - Senior AnalystSaubhagya SuriNo ratings yet

- Requirement PEDocument2 pagesRequirement PEAlex LimNo ratings yet

- Structure of Venture Capital FirmsDocument6 pagesStructure of Venture Capital FirmscongeniallNo ratings yet

- Envision Ventures - VC Associate SpecDocument2 pagesEnvision Ventures - VC Associate SpecAnonymous 4tAKEnxi3No ratings yet

- BlackRock 2020-2021 Investments Job DescriptionDocument13 pagesBlackRock 2020-2021 Investments Job DescriptionNora PetruțaNo ratings yet

- Quant Analyst JDDocument2 pagesQuant Analyst JDrahulhandoo14No ratings yet

- Business Development ManagerDocument2 pagesBusiness Development ManagerMarshay HallNo ratings yet

- Fundfocus: SchrodersDocument2 pagesFundfocus: Schrodersft2qzjpzqvNo ratings yet

- National Investment and Infrastructure Fund Limited: BackgroundDocument2 pagesNational Investment and Infrastructure Fund Limited: BackgroundChulbul PandeyNo ratings yet

- People Matters - India Junior Research SpecialistDocument2 pagesPeople Matters - India Junior Research SpecialistNaman JainNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- Treasury Management (M)Document9 pagesTreasury Management (M)Keisia Kate FabioNo ratings yet

- Fort Worth CIO Position SpecificationDocument5 pagesFort Worth CIO Position SpecificationMarshay HallNo ratings yet

- KPF Ceo PostDocument2 pagesKPF Ceo PostTimoara NatanNo ratings yet

- Private Equity Part 1Document5 pagesPrivate Equity Part 1Paolina NikolovaNo ratings yet

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocument8 pagesBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4No ratings yet

- Investment ManagementDocument2 pagesInvestment ManagementErika L. PlazaNo ratings yet

- Career As Finance Manager: Job ProfileDocument5 pagesCareer As Finance Manager: Job ProfileSneha KumarNo ratings yet

- Investing in Private Equity - (J.P. Morgan Asset Management)Document6 pagesInvesting in Private Equity - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- PIMCO EqS Pathfinder Fund Overview PO6015Document4 pagesPIMCO EqS Pathfinder Fund Overview PO6015tennismonkeyNo ratings yet

- Asset Manager JobDocument2 pagesAsset Manager Jobd ddNo ratings yet

- 158c1e0032-A Study On Portfolio Management" With Reference To "Pcs Securities, Hyd"Document63 pages158c1e0032-A Study On Portfolio Management" With Reference To "Pcs Securities, Hyd"ShadaanNo ratings yet

- Callahan Analyst 2021Document3 pagesCallahan Analyst 2021callahan.jonathan2727No ratings yet

- S1. Active Passive Paper EuDocument28 pagesS1. Active Passive Paper EuxaxasNo ratings yet

- What Is Fund Management?: BREAKING DOWN Funds ManagementDocument15 pagesWhat Is Fund Management?: BREAKING DOWN Funds ManagementANAMEEKA MOKALNo ratings yet

- Vice President, Private EquityDocument2 pagesVice President, Private EquityMarshay HallNo ratings yet

- L 7 Portfolio-Construction-Guide - Vanguard PDFDocument36 pagesL 7 Portfolio-Construction-Guide - Vanguard PDFRajesh AroraNo ratings yet

- Vacancies: Kenya Reinsurance Corporation LimitedDocument2 pagesVacancies: Kenya Reinsurance Corporation LimitedmautidavisNo ratings yet

- Management Trainee WIPRODocument2 pagesManagement Trainee WIPROShweta JoshiNo ratings yet

- Portfolio Manager - Sawgrass Asset Management, LLCDocument1 pagePortfolio Manager - Sawgrass Asset Management, LLCMarshay HallNo ratings yet

- Business Management For Head of Investments - Free Guide #005Document9 pagesBusiness Management For Head of Investments - Free Guide #005RublesNo ratings yet

- Iimc JD DeshawDocument3 pagesIimc JD DeshawVaishnaviRaviNo ratings yet

- VIP Resume1 GrayDocument4 pagesVIP Resume1 GraySrini UpadhyNo ratings yet

- Senior Investment Analyst or Investment Analyst or Research AnalDocument3 pagesSenior Investment Analyst or Investment Analyst or Research Analapi-78556480No ratings yet

- Investment Manager Selection White Paper PDFDocument4 pagesInvestment Manager Selection White Paper PDFHadyNo ratings yet

- Intro To AMDocument70 pagesIntro To AMzongweiterngNo ratings yet

- AC Ventures - Investment Analyst: Company DescriptionDocument2 pagesAC Ventures - Investment Analyst: Company DescriptionbobbyNo ratings yet

- Lexicon - Unit1 - IntroductionDocument26 pagesLexicon - Unit1 - IntroductionPushkarajNo ratings yet

- Black RockDocument3 pagesBlack RockAb CNo ratings yet

- Canaccord Enhanced Equity MandateDocument18 pagesCanaccord Enhanced Equity MandateStelu OlarNo ratings yet

- Holistic Wealth ManagementDocument10 pagesHolistic Wealth ManagementArie YudhistiraNo ratings yet

- Portfolio Associate, CreditDocument2 pagesPortfolio Associate, CreditMarshay HallNo ratings yet

- Value of Professional Funds ManagementDocument12 pagesValue of Professional Funds ManagementSathyaprasNo ratings yet

- Analyst - Aquisitions and Development v2Document2 pagesAnalyst - Aquisitions and Development v2asuarez2No ratings yet

- Summary of A Primer For Investment TrusteesDocument7 pagesSummary of A Primer For Investment TrusteesjonathanwsmithNo ratings yet

- Zicklin School of BusinessDocument20 pagesZicklin School of BusinessAli SharifiNo ratings yet

- Rasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Document7 pagesRasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Khurram ShahzadNo ratings yet

- Doctor PrescriptionDocument2 pagesDoctor PrescriptionKhurram ShahzadNo ratings yet

- Book 2Document2 pagesBook 2Khurram ShahzadNo ratings yet

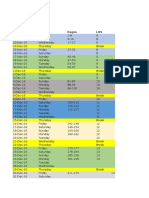

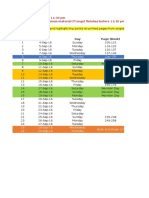

- No. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursDocument3 pagesNo. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursKhurram ShahzadNo ratings yet

- Guide To PE Due DiligenceDocument23 pagesGuide To PE Due DiligenceKhurram ShahzadNo ratings yet

- Basel III - Extract PageDocument1 pageBasel III - Extract PageKhurram ShahzadNo ratings yet

- Distribution Name Parameters and Domains Important FactsDocument4 pagesDistribution Name Parameters and Domains Important FactsKhurram ShahzadNo ratings yet

- Guide To PE Due DiligenceDocument23 pagesGuide To PE Due DiligenceKhurram ShahzadNo ratings yet

- Core Technical Subjects ListDocument1 pageCore Technical Subjects ListKhurram ShahzadNo ratings yet

- Name Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceDocument2 pagesName Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceKhurram ShahzadNo ratings yet

JDJD PDF

JDJD PDF

Uploaded by

Khurram Shahzad0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

JDJD.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageJDJD PDF

JDJD PDF

Uploaded by

Khurram ShahzadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

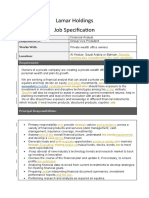

Title Investment Manager

Employer Mid-Size University Endowment Fund based in Saudi Arabia

Date Posted Oct 31st, 2016

Expires Nov 10th, 2016

Key Responsibilities Applicants should have a broad knowledge of the investment landscape,

covering major asset classes including public equity, real estate and private

equity. They should have a good grasp of investment theory macro-

economics, risk and return, portfolio construction and diversification

strategies. Ideally they will also have gained prior insights into different

structures in family offices/endowments as well as having knowledge of

investment strategies that have performed well.

This position requires leadership, supervisory, communication, and team

working skills. The essential duties of this position include, but are not

limited to, the following:

Source, evaluate, and monitor investment opportunities.

Provide the executive team and the investment committee with

concrete house opinion on investment opportunities through solid

qualitative and quantitative analysis.

Lead reference calls and visits with fund managers, portfolio

managers and other industry participants.

Serve as a central resource for current information on investment

opportunities, including data and analysis, comparisons across fund

managers, and the opinion of the investments team.

Supervise all the reporting activities of the fund including custodial,

accounting, and investment performance reporting.

Preferred CFA, MBA or Similar

Qualifications 5+ Years experience in a Family Office and or Sovereign Wealth Fund

Contact imrole@outlook.com

You might also like

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- Investment Manager - Spider ManagementDocument2 pagesInvestment Manager - Spider ManagementMarshay HallNo ratings yet

- VP - EstanciaDocument2 pagesVP - EstanciaMarshay HallNo ratings yet

- Investment Officer, Innovations - Washington State Investment BoardDocument4 pagesInvestment Officer, Innovations - Washington State Investment BoardMarshay HallNo ratings yet

- Lamar Holdings - Job Specification - Financial Analyst - 8 Nov 20Document3 pagesLamar Holdings - Job Specification - Financial Analyst - 8 Nov 20abhinavg_9No ratings yet

- HARVARD Management CompanyDocument4 pagesHARVARD Management CompanyMarshay HallNo ratings yet

- Syllabus Course Description: Courses/default - HTMLDocument4 pagesSyllabus Course Description: Courses/default - HTMLHayder KedirNo ratings yet

- Ladrillo Investor PresentationDocument16 pagesLadrillo Investor PresentationMOVIES SHOPNo ratings yet

- Rob Brown, PHD, Cfa 5054 Evanwood AvenueDocument4 pagesRob Brown, PHD, Cfa 5054 Evanwood Avenuekurtis_workmanNo ratings yet

- JD - SR Analyst - Hyd 02Document1 pageJD - SR Analyst - Hyd 02the few of youNo ratings yet

- External Manager Selection and MonitoringDocument14 pagesExternal Manager Selection and MonitoringHadyNo ratings yet

- Associate - EstanciaDocument2 pagesAssociate - EstanciaMarshay HallNo ratings yet

- Spectrum of HF InvestorsDocument7 pagesSpectrum of HF InvestorsalgunoshombresNo ratings yet

- JD - Generic PMG - Analyst - Senior AnalystDocument1 pageJD - Generic PMG - Analyst - Senior AnalystSaubhagya SuriNo ratings yet

- Requirement PEDocument2 pagesRequirement PEAlex LimNo ratings yet

- Structure of Venture Capital FirmsDocument6 pagesStructure of Venture Capital FirmscongeniallNo ratings yet

- Envision Ventures - VC Associate SpecDocument2 pagesEnvision Ventures - VC Associate SpecAnonymous 4tAKEnxi3No ratings yet

- BlackRock 2020-2021 Investments Job DescriptionDocument13 pagesBlackRock 2020-2021 Investments Job DescriptionNora PetruțaNo ratings yet

- Quant Analyst JDDocument2 pagesQuant Analyst JDrahulhandoo14No ratings yet

- Business Development ManagerDocument2 pagesBusiness Development ManagerMarshay HallNo ratings yet

- Fundfocus: SchrodersDocument2 pagesFundfocus: Schrodersft2qzjpzqvNo ratings yet

- National Investment and Infrastructure Fund Limited: BackgroundDocument2 pagesNational Investment and Infrastructure Fund Limited: BackgroundChulbul PandeyNo ratings yet

- People Matters - India Junior Research SpecialistDocument2 pagesPeople Matters - India Junior Research SpecialistNaman JainNo ratings yet

- Portfolio Management - Advanced (May 21, 2020)Document2 pagesPortfolio Management - Advanced (May 21, 2020)Via Commerce Sdn BhdNo ratings yet

- Treasury Management (M)Document9 pagesTreasury Management (M)Keisia Kate FabioNo ratings yet

- Fort Worth CIO Position SpecificationDocument5 pagesFort Worth CIO Position SpecificationMarshay HallNo ratings yet

- KPF Ceo PostDocument2 pagesKPF Ceo PostTimoara NatanNo ratings yet

- Private Equity Part 1Document5 pagesPrivate Equity Part 1Paolina NikolovaNo ratings yet

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocument8 pagesBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4No ratings yet

- Investment ManagementDocument2 pagesInvestment ManagementErika L. PlazaNo ratings yet

- Career As Finance Manager: Job ProfileDocument5 pagesCareer As Finance Manager: Job ProfileSneha KumarNo ratings yet

- Investing in Private Equity - (J.P. Morgan Asset Management)Document6 pagesInvesting in Private Equity - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- PIMCO EqS Pathfinder Fund Overview PO6015Document4 pagesPIMCO EqS Pathfinder Fund Overview PO6015tennismonkeyNo ratings yet

- Asset Manager JobDocument2 pagesAsset Manager Jobd ddNo ratings yet

- 158c1e0032-A Study On Portfolio Management" With Reference To "Pcs Securities, Hyd"Document63 pages158c1e0032-A Study On Portfolio Management" With Reference To "Pcs Securities, Hyd"ShadaanNo ratings yet

- Callahan Analyst 2021Document3 pagesCallahan Analyst 2021callahan.jonathan2727No ratings yet

- S1. Active Passive Paper EuDocument28 pagesS1. Active Passive Paper EuxaxasNo ratings yet

- What Is Fund Management?: BREAKING DOWN Funds ManagementDocument15 pagesWhat Is Fund Management?: BREAKING DOWN Funds ManagementANAMEEKA MOKALNo ratings yet

- Vice President, Private EquityDocument2 pagesVice President, Private EquityMarshay HallNo ratings yet

- L 7 Portfolio-Construction-Guide - Vanguard PDFDocument36 pagesL 7 Portfolio-Construction-Guide - Vanguard PDFRajesh AroraNo ratings yet

- Vacancies: Kenya Reinsurance Corporation LimitedDocument2 pagesVacancies: Kenya Reinsurance Corporation LimitedmautidavisNo ratings yet

- Management Trainee WIPRODocument2 pagesManagement Trainee WIPROShweta JoshiNo ratings yet

- Portfolio Manager - Sawgrass Asset Management, LLCDocument1 pagePortfolio Manager - Sawgrass Asset Management, LLCMarshay HallNo ratings yet

- Business Management For Head of Investments - Free Guide #005Document9 pagesBusiness Management For Head of Investments - Free Guide #005RublesNo ratings yet

- Iimc JD DeshawDocument3 pagesIimc JD DeshawVaishnaviRaviNo ratings yet

- VIP Resume1 GrayDocument4 pagesVIP Resume1 GraySrini UpadhyNo ratings yet

- Senior Investment Analyst or Investment Analyst or Research AnalDocument3 pagesSenior Investment Analyst or Investment Analyst or Research Analapi-78556480No ratings yet

- Investment Manager Selection White Paper PDFDocument4 pagesInvestment Manager Selection White Paper PDFHadyNo ratings yet

- Intro To AMDocument70 pagesIntro To AMzongweiterngNo ratings yet

- AC Ventures - Investment Analyst: Company DescriptionDocument2 pagesAC Ventures - Investment Analyst: Company DescriptionbobbyNo ratings yet

- Lexicon - Unit1 - IntroductionDocument26 pagesLexicon - Unit1 - IntroductionPushkarajNo ratings yet

- Black RockDocument3 pagesBlack RockAb CNo ratings yet

- Canaccord Enhanced Equity MandateDocument18 pagesCanaccord Enhanced Equity MandateStelu OlarNo ratings yet

- Holistic Wealth ManagementDocument10 pagesHolistic Wealth ManagementArie YudhistiraNo ratings yet

- Portfolio Associate, CreditDocument2 pagesPortfolio Associate, CreditMarshay HallNo ratings yet

- Value of Professional Funds ManagementDocument12 pagesValue of Professional Funds ManagementSathyaprasNo ratings yet

- Analyst - Aquisitions and Development v2Document2 pagesAnalyst - Aquisitions and Development v2asuarez2No ratings yet

- Summary of A Primer For Investment TrusteesDocument7 pagesSummary of A Primer For Investment TrusteesjonathanwsmithNo ratings yet

- Zicklin School of BusinessDocument20 pagesZicklin School of BusinessAli SharifiNo ratings yet

- Rasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Document7 pagesRasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Khurram ShahzadNo ratings yet

- Doctor PrescriptionDocument2 pagesDoctor PrescriptionKhurram ShahzadNo ratings yet

- Book 2Document2 pagesBook 2Khurram ShahzadNo ratings yet

- No. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursDocument3 pagesNo. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursKhurram ShahzadNo ratings yet

- Guide To PE Due DiligenceDocument23 pagesGuide To PE Due DiligenceKhurram ShahzadNo ratings yet

- Basel III - Extract PageDocument1 pageBasel III - Extract PageKhurram ShahzadNo ratings yet

- Distribution Name Parameters and Domains Important FactsDocument4 pagesDistribution Name Parameters and Domains Important FactsKhurram ShahzadNo ratings yet

- Guide To PE Due DiligenceDocument23 pagesGuide To PE Due DiligenceKhurram ShahzadNo ratings yet

- Core Technical Subjects ListDocument1 pageCore Technical Subjects ListKhurram ShahzadNo ratings yet

- Name Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceDocument2 pagesName Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceKhurram ShahzadNo ratings yet