Professional Documents

Culture Documents

Fii Stats 03 Apr 2017

Fii Stats 03 Apr 2017

Uploaded by

advvelu0 ratings0% found this document useful (0 votes)

10 views1 pageNse fii sales and buy official data released by national stock exchange for 3.4.2017

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNse fii sales and buy official data released by national stock exchange for 3.4.2017

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views1 pageFii Stats 03 Apr 2017

Fii Stats 03 Apr 2017

Uploaded by

advveluNse fii sales and buy official data released by national stock exchange for 3.4.2017

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 1

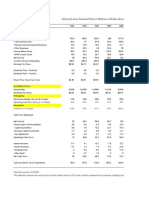

FII DERIVATIVES STATISTICS FOR 03-Apr-2017

OPEN INTEREST AT

THE END OF THE

BUY SELL DAY

No. of Amt in No. of Amt in No. of Amt in

contracts Crores contracts Crores contracts Crores

INDEX FUTURES 22449 1597.29 23679 1696.91 319408 22822.13

INDEX OPTIONS 297729 22295.98 276148 20739.68 739835 51851.18

STOCK FUTURES 89126 6376.55 86672 6220.01 1188530 80940.29

STOCK OPTIONS 55813 4149.66 52955 3890.09 40024 3031.77

Notes:

Both buy and sell positions have been considered

Options Value (Buy/Sell) = Strike price * Qty

Futures Value (Buy/Sell) = Traded Price * Qty

Value & Open Interest at the end of day:

Options Value (End of day) = Underlying Close Price * Qty

Futures Value (End of day) = Closing Futures Price * Qty (closing price is the daily settlement price of futures contracts)

You might also like

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKRating: 5 out of 5 stars5/5 (4)

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKRating: 5 out of 5 stars5/5 (1)

- SERIES 7 EXAM STUDY GUIDE + TEST BANKFrom EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKRating: 2.5 out of 5 stars2.5/5 (3)

- Final Presentation On Investing in Uganda's Capital MarketsDocument51 pagesFinal Presentation On Investing in Uganda's Capital MarketsSsembuya Magulu100% (1)

- Fii Stats 09 Sep 2010Document1 pageFii Stats 09 Sep 2010Murugan.SubramaniNo ratings yet

- Fii Stats 12 Oct 2015Document1 pageFii Stats 12 Oct 2015Uma ArunachalamNo ratings yet

- Fii Stats 27 Jan 2014Document1 pageFii Stats 27 Jan 2014Sanjeev PaliseryNo ratings yet

- Fii Stats 17 Feb 2017Document1 pageFii Stats 17 Feb 2017Dalu ChockiNo ratings yet

- Fii Stats 30 Jun 2010Document1 pageFii Stats 30 Jun 2010intraday_trader_nse5528No ratings yet

- Fii StatsDocument1 pageFii StatsksvelusamyNo ratings yet

- Fii Stats 12 Dec 2012Document1 pageFii Stats 12 Dec 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 16 Nov 2016Document1 pageFii Stats 16 Nov 2016pawanNo ratings yet

- Fii Stats 21 Nov 2012Document1 pageFii Stats 21 Nov 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 22 Nov 2012Document1 pageFii Stats 22 Nov 2012Arvind Sanu MisraNo ratings yet

- Fii Stats 27 Jan 2016Document1 pageFii Stats 27 Jan 2016ShanKar PadmanaBhanNo ratings yet

- When To TradeDocument6 pagesWhen To TradeOsman Elamin100% (1)

- Explanation of Net Change in Open InterestDocument8 pagesExplanation of Net Change in Open Interestaniljain16No ratings yet

- National Stock Exchange of India Limited Department: Futures & OptionsDocument56 pagesNational Stock Exchange of India Limited Department: Futures & OptionsPrince GardenNo ratings yet

- Nifty Tips PerformanceDocument34 pagesNifty Tips PerformanceshailspatsNo ratings yet

- Premarket Technical&Derivative Angel 24.11.16Document5 pagesPremarket Technical&Derivative Angel 24.11.16Rajasekhar Reddy AnekalluNo ratings yet

- 2010 IOMA SurveyDocument67 pages2010 IOMA SurveyhirendholiyaNo ratings yet

- VCL PresentationDocument47 pagesVCL PresentationSathis Kumar CNo ratings yet

- Financial Derivatives PresentationDocument27 pagesFinancial Derivatives PresentationCompliance CRGNo ratings yet

- Equity Derivatives BasicsDocument215 pagesEquity Derivatives BasicsNehu ChendvankarNo ratings yet

- SEBI Handbook 15Document216 pagesSEBI Handbook 15adoniscalNo ratings yet

- Intro FDRMDocument35 pagesIntro FDRMRupayan DuttaNo ratings yet

- National Stock Exchange of India - An OverviewDocument12 pagesNational Stock Exchange of India - An OverviewArtz TakNo ratings yet

- Address: 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai - 400093Document17 pagesAddress: 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai - 400093sidegigengineer1995No ratings yet

- Payment Master 26 AprDocument31 pagesPayment Master 26 Aprtopcop1000No ratings yet

- Project - Future and OptionsDocument24 pagesProject - Future and OptionspankajNo ratings yet

- Linear Tech Dividend PolicyDocument25 pagesLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Derivatives Market 150Document27 pagesDerivatives Market 150kegnataNo ratings yet

- 23Document251 pages23Sai KalyanNo ratings yet

- Orascom Development HLDG: Key Figures (EUR) Buying and Selling (In MLN EUR) PriceDocument4 pagesOrascom Development HLDG: Key Figures (EUR) Buying and Selling (In MLN EUR) Priceruven_oberlaenderNo ratings yet

- Module 1 FDDDocument44 pagesModule 1 FDDLolsNo ratings yet

- Derivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsDocument13 pagesDerivatives Stock Futures Index Futures Currency Futures Total Outstanding Contracts Squared Off ContractsVarun BaxiNo ratings yet

- Table 4: Registered Sub-BrokersDocument1 pageTable 4: Registered Sub-BrokersSajoy P.B.No ratings yet

- 5 Days FREE Online Certification Training CourseDocument10 pages5 Days FREE Online Certification Training CourseJayesh kolheNo ratings yet

- How To Analyze FII Derivatives DataDocument5 pagesHow To Analyze FII Derivatives DataramaNo ratings yet

- Introduction To Financial Markets & InstitutionsDocument11 pagesIntroduction To Financial Markets & InstitutionsRasesh ShahNo ratings yet

- Aim Day Trader 20120104Document28 pagesAim Day Trader 20120104Philip MorrishNo ratings yet

- 03.12.2019latest (Daily Trends in FPI - FII Investments)Document1 page03.12.2019latest (Daily Trends in FPI - FII Investments)xxNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNo ratings yet

- Training TopicsDocument5 pagesTraining Topicssivalakshmi mavillaNo ratings yet

- Chambal Breweries & Distilleries LTD.: Debt / Others Corp Announcements FinancialsDocument2 pagesChambal Breweries & Distilleries LTD.: Debt / Others Corp Announcements Financialssun1986No ratings yet

- TP Fo Fix NNF Protocol 1.4Document87 pagesTP Fo Fix NNF Protocol 1.4Ronitsinghthakur SinghNo ratings yet

- Equities DerivativesDocument3 pagesEquities DerivativesHetal VaghoraNo ratings yet

- Swing Trading With Technical AnalysisDocument39 pagesSwing Trading With Technical AnalysisSteve SheldonNo ratings yet

- Calculators: General Bond Calculator: Security/Trade InformationDocument3 pagesCalculators: General Bond Calculator: Security/Trade Informationlienntq81No ratings yet

- Selector December 2004 Quarterly NewsletterDocument4 pagesSelector December 2004 Quarterly Newsletterapi-237451731No ratings yet

- Equity Introduction The Indian Equity Market HasDocument2 pagesEquity Introduction The Indian Equity Market HassahilbansaNo ratings yet

- Futures and Options Trading: Pradiptarathi Panda Assistant Professor, NismDocument43 pagesFutures and Options Trading: Pradiptarathi Panda Assistant Professor, NismMaunil OzaNo ratings yet

- DLF Company AnalysisDocument41 pagesDLF Company AnalysisboobraviNo ratings yet

- 2014 IOMA Derivatives Market SurveyDocument45 pages2014 IOMA Derivatives Market SurveyasifNo ratings yet

- Rakesh Jhunjhunwala'sDocument34 pagesRakesh Jhunjhunwala'sneo26950% (2)

- TradingDocument4 pagesTradingmovie downloadNo ratings yet

- Study of IPO Wealth Creators or Destroyers: An Indian PerspectiveDocument7 pagesStudy of IPO Wealth Creators or Destroyers: An Indian PerspectiveNaga RajNo ratings yet

- Data DefinitionsDocument19 pagesData DefinitionsArundhathi MNo ratings yet

- Sep 2020 Nifty FuturesDocument2 pagesSep 2020 Nifty FuturesAkash VettavallamNo ratings yet

- FX Option Performance: An Analysis of the Value Delivered by FX Options since the Start of the MarketFrom EverandFX Option Performance: An Analysis of the Value Delivered by FX Options since the Start of the MarketNo ratings yet

- t000004815 - Filename - Tender Crude Antifoulant Cdu 1 and Cdu 2Document53 pagest000004815 - Filename - Tender Crude Antifoulant Cdu 1 and Cdu 2Prashant SinghNo ratings yet

- Nokia 305 User Guide: Issue 1.2Document41 pagesNokia 305 User Guide: Issue 1.2Prashant SinghNo ratings yet

- Line Designation Table - Pre-TreatmentDocument5 pagesLine Designation Table - Pre-TreatmentPrashant SinghNo ratings yet

- SAMSUNG SEM-3036E - Piping Design Manual (Rack Piping) PDFDocument48 pagesSAMSUNG SEM-3036E - Piping Design Manual (Rack Piping) PDFPrashant SinghNo ratings yet

- Pressure Drop Caln - 1Document390 pagesPressure Drop Caln - 1Prashant SinghNo ratings yet

- SAMSUNG SEM-3074E - Piping Design Manual (Pump Piping)Document21 pagesSAMSUNG SEM-3074E - Piping Design Manual (Pump Piping)Tanveer Ahmad100% (2)

- Financial DerivativeDocument54 pagesFinancial DerivativePrashant SinghNo ratings yet

- Offshore DrillingDocument62 pagesOffshore DrillingOmar Sindbad100% (1)

- Indicators of Economic DevelopmentDocument20 pagesIndicators of Economic DevelopmentPrashant SinghNo ratings yet

- RESUMEHRDocument2 pagesRESUMEHRPrashant SinghNo ratings yet