Professional Documents

Culture Documents

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Uploaded by

Shyam SunderCopyright:

Available Formats

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- DMC Sparkle Water RefillingDocument19 pagesDMC Sparkle Water RefillingRaul Nocete100% (3)

- Income Tax Return 2019Document9 pagesIncome Tax Return 2019Sh'Nanigns X3No ratings yet

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocument69 pagesReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Third Quarter Financial Results Ended 31st December 2016 PDFDocument2 pagesThird Quarter Financial Results Ended 31st December 2016 PDFPreeti KhatwaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- FINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Document4 pagesFINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Avantel LimitedDocument17 pagesAvantel LimitedContra Value BetsNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDocument20 pagesSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalNo ratings yet

- 4.varroc Consolidated Result Sheet June 2021 SignedDocument3 pages4.varroc Consolidated Result Sheet June 2021 SignedA kumarNo ratings yet

- Unaudited Financial Results Quarter Ended 31 12 2011Document1 pageUnaudited Financial Results Quarter Ended 31 12 2011Rakshit MathurNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Review Report 311210Document1 pageReview Report 311210Hriday PandeyNo ratings yet

- Balaji Published Results 28-102010Document2 pagesBalaji Published Results 28-102010Saurabh YadavNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Berger Paints 11Document1 pageBerger Paints 11Hiya ChoudharyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dec 2021Document2 pagesDec 2021akshay kausaleNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- Avantel LimitedDocument4 pagesAvantel Limitedvivek14061991No ratings yet

- Sep 2010-Audited ResultsDocument2 pagesSep 2010-Audited Resultssalilsingh86No ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument9 pagesBSE Limited National Stock Exchange of India LimitedArvind PurohitNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Financial Results 2023 DecDocument15 pagesFinancial Results 2023 DecDenish GalaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Result Update Aug 02 02082023123958Document7 pagesFinancial Result Update Aug 02 02082023123958Surajit DasNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Module - Accounting For Business CombinationDocument16 pagesModule - Accounting For Business CombinationRJ Kristine DaqueNo ratings yet

- BussDocument31 pagesBussfirdewus wondye100% (1)

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document16 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageSuresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Chingu WorksheetDocument74 pagesChingu Worksheetanis khanNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- 03 Intro To AccountingDocument407 pages03 Intro To AccountingAllzoommood100% (3)

- Classification of Land and Building Costs Spitfire Company Was I PDFDocument1 pageClassification of Land and Building Costs Spitfire Company Was I PDFAnbu jaromiaNo ratings yet

- TT03 QuestionDocument1 pageTT03 QuestionTrinh Nguyen Linh ChiNo ratings yet

- Cash AdvanceDocument2 pagesCash AdvanceMatths Apoche100% (2)

- TOA Quizzer With AnswersDocument55 pagesTOA Quizzer With AnswersRussel100% (1)

- General Instructions: Prepare The Journal and Adjusting Entries) OF ABC ELECTRONIC REPAIR SERVICES FOR THE Month of December 2019Document3 pagesGeneral Instructions: Prepare The Journal and Adjusting Entries) OF ABC ELECTRONIC REPAIR SERVICES FOR THE Month of December 2019Daniella Mae ElipNo ratings yet

- Assignment Part 4Document3 pagesAssignment Part 4Darwin Dionisio ClementeNo ratings yet

- 15.asset ManagementDocument11 pages15.asset ManagementShasikanta MNo ratings yet

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- Regent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Document68 pagesRegent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Arjun SalwanNo ratings yet

- FarDocument7 pagesFarVince MiramonNo ratings yet

- Uniform Format of Accounts - SummaryDocument8 pagesUniform Format of Accounts - SummaryGotta Patti House100% (1)

- 1231231231231231Document11 pages1231231231231231JV De VeraNo ratings yet

- Far Volume 1, 2 and 3 TheoryDocument17 pagesFar Volume 1, 2 and 3 TheoryKimberly Etulle CelonaNo ratings yet

- Accountancy in AdvocacyDocument15 pagesAccountancy in AdvocacytripathichotuNo ratings yet

- Testate Estate of Felix de GuzmanDocument3 pagesTestate Estate of Felix de GuzmanTine TineNo ratings yet

- T - Accounts and Trial Balance - m10Document7 pagesT - Accounts and Trial Balance - m10jesson cabelloNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- BUSINESS PLAN AssignementDocument21 pagesBUSINESS PLAN AssignementBenjamin EliasNo ratings yet

- Compulsory Disclosures: Segments & Related Parties: Presented By: Alex Lina Sam JessDocument37 pagesCompulsory Disclosures: Segments & Related Parties: Presented By: Alex Lina Sam JessSam DunlopNo ratings yet

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Resubmission of Standalone Financial Results For December 31, 2014 (Company Update)

Uploaded by

Shyam SunderCopyright:

Available Formats

SHRI LAKSHMI COTSYN LIMITED

An ISO 9001:2008 Certified Company

CIN:L17122UP1988PLC009985

Regd. Office : 19/X-1, KRISHNAPURAM, G.T. ROAD, KANPUR-208007

Tel. No. : 0512-2401492,2402893,2402733, Fax, 0512-2402339, E mail : shri@shrilakshmi.in

Corp. Office: C-40, Sector-57, Gautam Budh Nagar, Noida - 201301(U.P.)

Tel. No. 0120-4722700, Fax 0120- 4722722

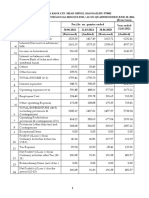

STANDALONE UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED ON 31ST DECEMBER 2014

(Rs. in Crores except for shares & EPS)

Accounting

Quarter Ended year Ended

PART I Nine Months Ended (9 months)

31.12.2014 30.09.2014 31.12.2013 31.12.2014 31.12.2013 31.03.2014

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

Sr. No Particulars

1 Income from operations

(a) Net Sales/Income from operations 168.24 149.71 219.58 496.29 1478.86 730.74

Total Income from operations(net) 168.24 149.71 219.58 496.29 1478.86 730.74

2 Total Expenditure 261.13 238.33 326.87 758.61 1466.70 1009.51

(a) Cost of materials consumed 197.46 169.69 185.23 562.91 1176.32 707.89

(b) Employee benefits expenses 11.60 13.58 19.85 37.83 55.24 51.80

(c) Depreciation and amortisation expense 26.66 26.50 27.31 79.40 94.89 78.47

(d) Other Expenses 25.41 28.56 94.48 78.47 140.25 171.35

3 Profit from operations before other income,

finance costs & exceptional items (1-2) (92.89) (88.62) (107.29) (262.32) 12.16 (278.77)

4 Other Income 3.18 9.07 13.08 19.16 10.64 23.01

5 Profit from operations before finance cost (3+4) (89.71) (79.55) (94.21) (243.16) 22.80 (255.76)

6 Finance Cost 36.26 44.99 65.02 157.02 269.43 196.71

7 Profit from ordinary activities before Tax(5-6) (125.97) (124.54) (159.23) (400.18) (246.63) (452.47)

8 Tax expense (Including Deferred Tax) - - - 30.00 -

9 Net Profit/ Loss after Tax (7-8) (125.97) (124.54) (159.23) (400.18) (276.63) (452.47)

10 Exceptional items (85.43) (141.57) - (311.63) - (171.68)

11 Net Loss after Exceptional items (9-10) (211.40) (266.11) (159.23) (711.81) (276.63) (624.15)

A PARTICULARS OF SHAREHOLDING

12 Paid up Equity Share Capital (Face value Rs.10) 28.47 28.47 28.47 28.47 28.47 28.47

13 Reserves excluding revaluation reserves - - - - - (415.01)

14 Earnings Per Share (EPS) (in Rs.) - - - - - -

15 Public Shareholding

- Number of Shares 15976411 14943481 15167445 14943481 15167445 14907445

- Percentage of Shareholding 56.12 52.49 53.27 52.49 53.27 52.36

16 Promoters & Promoter group Shareholding

a) Pledged/Encumbered

- No. of Shares 8503635 9536565 4423568 9536565 4423568 4423568

- Percentage of Shares of Promoters & promoters

Group 68.06 70.50 33.25 70.50 33.25 32.61

- Percentage of Shares of total share capital 29.87 33.50 15.54 33.50 15.54 15.54

b) Non -encumbered

- No. of Shares 3990599 3990599 8879632 3990599 8879632 9139632

- Percentage of Shares of Promoters/ Promoters Group 29.50 29.50 66.75 29.50 66.75 67.39

- Percentage of Shares of total share capital 14.01 14.01 31.19 14.01 31.19 32.10

B INVESTOR COMPLAINTS

- Pending at the beginning of the quarter (Nos) 1

- Received during the quarter (Nos) 1

-Disposed off during the quarter (Nos) 2

-Lying unresolved at the end of the quarter (Nos) 0

NOTES:

Dated :12.08.2015

Place: Kanpur Chairman & Managing Director

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- DMC Sparkle Water RefillingDocument19 pagesDMC Sparkle Water RefillingRaul Nocete100% (3)

- Income Tax Return 2019Document9 pagesIncome Tax Return 2019Sh'Nanigns X3No ratings yet

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocument69 pagesReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Resubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Document1 pageResubmission of Standalone & Consolidated Financial Results For March 31, 2015 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document2 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Third Quarter Financial Results Ended 31st December 2016 PDFDocument2 pagesThird Quarter Financial Results Ended 31st December 2016 PDFPreeti KhatwaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- FINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Document4 pagesFINANCIAL RESULTS FOR THE QUARTER ENDED DECEMBER 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Avantel LimitedDocument17 pagesAvantel LimitedContra Value BetsNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDocument20 pagesSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Devyani International Q3 ResultsDocument9 pagesDevyani International Q3 ResultsSaurabh AggarwalNo ratings yet

- 4.varroc Consolidated Result Sheet June 2021 SignedDocument3 pages4.varroc Consolidated Result Sheet June 2021 SignedA kumarNo ratings yet

- Unaudited Financial Results Quarter Ended 31 12 2011Document1 pageUnaudited Financial Results Quarter Ended 31 12 2011Rakshit MathurNo ratings yet

- March29 AGMDocument4 pagesMarch29 AGMakshay kausaleNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Result September 2012Document1 pageResult September 2012akshay kausaleNo ratings yet

- Unitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Document4 pagesUnitech Limited: CIN: L74899DL1971PLC009720 Statement of Consolidated Results For The Quarter & Year Ended March 31, 2014Bhuvan MalikNo ratings yet

- Q4 20 - DhunseriDocument8 pagesQ4 20 - Dhunserica.anup.kNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Review Report 311210Document1 pageReview Report 311210Hriday PandeyNo ratings yet

- Balaji Published Results 28-102010Document2 pagesBalaji Published Results 28-102010Saurabh YadavNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Berger Paints 11Document1 pageBerger Paints 11Hiya ChoudharyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- December23 AGMDocument2 pagesDecember23 AGMakshay kausaleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dec 2021Document2 pagesDec 2021akshay kausaleNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- Financial Results 310324 PDFDocument14 pagesFinancial Results 310324 PDFvikramgandhi89No ratings yet

- Avantel LimitedDocument4 pagesAvantel Limitedvivek14061991No ratings yet

- Sep 2010-Audited ResultsDocument2 pagesSep 2010-Audited Resultssalilsingh86No ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument9 pagesBSE Limited National Stock Exchange of India LimitedArvind PurohitNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Financial Results 2023 DecDocument15 pagesFinancial Results 2023 DecDenish GalaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dolat: Algoieg-IlimitedDocument14 pagesDolat: Algoieg-IlimitedPãräs PhútélàNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Result Update Aug 02 02082023123958Document7 pagesFinancial Result Update Aug 02 02082023123958Surajit DasNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Module - Accounting For Business CombinationDocument16 pagesModule - Accounting For Business CombinationRJ Kristine DaqueNo ratings yet

- BussDocument31 pagesBussfirdewus wondye100% (1)

- Fundamentals of Finance: Ignacio Lezaun English Edition 2021Document16 pagesFundamentals of Finance: Ignacio Lezaun English Edition 2021Elias Macher CarpenaNo ratings yet

- Suresh G. Lalwani - Managerial Accounting Page 1 of 1Document1 pageSuresh G. Lalwani - Managerial Accounting Page 1 of 1akanksha chauhanNo ratings yet

- Chingu WorksheetDocument74 pagesChingu Worksheetanis khanNo ratings yet

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Document21 pagesPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNo ratings yet

- 03 Intro To AccountingDocument407 pages03 Intro To AccountingAllzoommood100% (3)

- Classification of Land and Building Costs Spitfire Company Was I PDFDocument1 pageClassification of Land and Building Costs Spitfire Company Was I PDFAnbu jaromiaNo ratings yet

- TT03 QuestionDocument1 pageTT03 QuestionTrinh Nguyen Linh ChiNo ratings yet

- Cash AdvanceDocument2 pagesCash AdvanceMatths Apoche100% (2)

- TOA Quizzer With AnswersDocument55 pagesTOA Quizzer With AnswersRussel100% (1)

- General Instructions: Prepare The Journal and Adjusting Entries) OF ABC ELECTRONIC REPAIR SERVICES FOR THE Month of December 2019Document3 pagesGeneral Instructions: Prepare The Journal and Adjusting Entries) OF ABC ELECTRONIC REPAIR SERVICES FOR THE Month of December 2019Daniella Mae ElipNo ratings yet

- Assignment Part 4Document3 pagesAssignment Part 4Darwin Dionisio ClementeNo ratings yet

- 15.asset ManagementDocument11 pages15.asset ManagementShasikanta MNo ratings yet

- AfarDocument6 pagesAfarRolando PasamonteNo ratings yet

- Regent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Document68 pagesRegent Enterprises Limited: Telephone No. 011-24338696 +91 9910303928, CIN-LI5500DL1994PLCI53183Arjun SalwanNo ratings yet

- FarDocument7 pagesFarVince MiramonNo ratings yet

- Uniform Format of Accounts - SummaryDocument8 pagesUniform Format of Accounts - SummaryGotta Patti House100% (1)

- 1231231231231231Document11 pages1231231231231231JV De VeraNo ratings yet

- Far Volume 1, 2 and 3 TheoryDocument17 pagesFar Volume 1, 2 and 3 TheoryKimberly Etulle CelonaNo ratings yet

- Accountancy in AdvocacyDocument15 pagesAccountancy in AdvocacytripathichotuNo ratings yet

- Testate Estate of Felix de GuzmanDocument3 pagesTestate Estate of Felix de GuzmanTine TineNo ratings yet

- T - Accounts and Trial Balance - m10Document7 pagesT - Accounts and Trial Balance - m10jesson cabelloNo ratings yet

- 03 Joint ArrangementsxxDocument62 pages03 Joint ArrangementsxxAnaliza OndoyNo ratings yet

- BUSINESS PLAN AssignementDocument21 pagesBUSINESS PLAN AssignementBenjamin EliasNo ratings yet

- Compulsory Disclosures: Segments & Related Parties: Presented By: Alex Lina Sam JessDocument37 pagesCompulsory Disclosures: Segments & Related Parties: Presented By: Alex Lina Sam JessSam DunlopNo ratings yet