Professional Documents

Culture Documents

Nashiagreerdigi Notes 1

Nashiagreerdigi Notes 1

Uploaded by

api-337357614Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nashiagreerdigi Notes 1

Nashiagreerdigi Notes 1

Uploaded by

api-337357614Copyright:

Available Formats

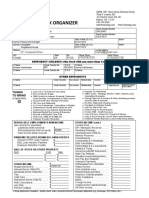

DN2 CODE

4/7/17 DATE

3B BLOCK DIGINOTES

NAME

NaShia Greer

TITLE

How to Understand Your Paycheck

NOTES

- There are two main sections of your paycheck stub: earnings and deductions

- Earnings show your rate in the number of hours in your pay period

- Gross pay is the money that you make before taxes and deductions

- Common tax deductions are subtracted from your gross pay

- These taxes include federal income tax and state income tax

- Those taxes help pay for roads, military, school, police departments, etc

- Federal Insurance Contributions Act (FICA) include Medicare and social security

- These taxes are used to help fund federal programs for retirement and disability

- Health insurance may or may not show up on your paycheck

-

You might also like

- 5 23 1CP575Notice - 1684772891148Document3 pages5 23 1CP575Notice - 1684772891148FGHJJ FDJFHDNo ratings yet

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- Federal EinDocument2 pagesFederal EinMoonlight MunchiesNo ratings yet

- Total Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To PayDocument18 pagesTotal Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To PayJoe GormanNo ratings yet

- CP575Notice 1616092386156Document2 pagesCP575Notice 1616092386156Izy ChefNo ratings yet

- Rangel Taxes 2019Document38 pagesRangel Taxes 2019Josue Perez VelezNo ratings yet

- A4 Gip Application FormDocument2 pagesA4 Gip Application FormNeil DalanonNo ratings yet

- Kearstin Jones DiginotesDocument1 pageKearstin Jones Diginotesapi-335991685No ratings yet

- Kierra Thompson dn2Document1 pageKierra Thompson dn2api-336796903No ratings yet

- DGN 2Document1 pageDGN 2api-335990514No ratings yet

- DGN 2Document1 pageDGN 2api-336250742No ratings yet

- Digi Notes 31Document1 pageDigi Notes 31api-335842582No ratings yet

- FunsDocument1 pageFunsapi-338775974No ratings yet

- Digi Notespaycheck Docx2Document1 pageDigi Notespaycheck Docx2api-335851898No ratings yet

- DGN 2 JimiayaDocument1 pageDGN 2 Jimiayaapi-335820288No ratings yet

- DN 2Document1 pageDN 2api-336219657No ratings yet

- Digi Notes Alijahthomas 2Document1 pageDigi Notes Alijahthomas 2api-336008717No ratings yet

- IND - IRS 1095A Tax Form-6900930177-21-Jan-2023Document6 pagesIND - IRS 1095A Tax Form-6900930177-21-Jan-2023Roberto E. Rodriguez0% (1)

- 2074-EG - Earnings VerificationDocument2 pages2074-EG - Earnings Verificationicarocardoso66No ratings yet

- Tanya David EINDocument2 pagesTanya David EINsaniapayoneerebayNo ratings yet

- D128677126 - 5683065978370584 - Gpa 2Document4 pagesD128677126 - 5683065978370584 - Gpa 2mandeeps7173No ratings yet

- Six LLC (EIN - 84-4408052) - Form 1099-NEC - 2023Document1 pageSix LLC (EIN - 84-4408052) - Form 1099-NEC - 2023nansolokoNo ratings yet

- SB Order 10-2023 - Clarifications On MSSC Scheme 2023 PDFDocument2 pagesSB Order 10-2023 - Clarifications On MSSC Scheme 2023 PDFsachinrajesh2kNo ratings yet

- Clay County Social Services Income Maint. Unit 715 11TH ST. N. #102 MOORHEAD, MN 56560-2042Document4 pagesClay County Social Services Income Maint. Unit 715 11TH ST. N. #102 MOORHEAD, MN 56560-2042kalenemariekNo ratings yet

- Team 0 GIS 2024Document6 pagesTeam 0 GIS 2024Nhez LacsamanaNo ratings yet

- De 429 DiDocument2 pagesDe 429 Dipauline.manzanilla1212No ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SphilgoldNo ratings yet

- +KR Cis Usghi - ChaseDocument4 pages+KR Cis Usghi - Chaserasool mehrjooNo ratings yet

- Acen Conso Sec Form 17-A (Ye 31 Dec 2022)Document446 pagesAcen Conso Sec Form 17-A (Ye 31 Dec 2022)Romnick Dela Cruz GasparNo ratings yet

- Picpa Members FormDocument2 pagesPicpa Members FormRahma SanglitanNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The Sarsalanalishah4465No ratings yet

- Approved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue ServiceDocument1 pageApproved Ein - FS Ventures Inc PDF Irs Tax Forms Internal Revenue Serviceharwelldustin837No ratings yet

- Ga VR App 2019Document2 pagesGa VR App 2019MaliNo ratings yet

- Change of Address: Complete This Part To Change Your Home Mailing AddressDocument2 pagesChange of Address: Complete This Part To Change Your Home Mailing AddressTrevorNo ratings yet

- 2020 Income Tax Organizer: 211 Crescent DriveDocument2 pages2020 Income Tax Organizer: 211 Crescent DriveLeslie HutchinsonNo ratings yet

- Application Form Enwealth New AccountDocument2 pagesApplication Form Enwealth New AccounticttumainiNo ratings yet

- Consumer Information:: Name: Date of Birth: GenderDocument4 pagesConsumer Information:: Name: Date of Birth: GenderSomnath SarkarNo ratings yet

- Harry Thomas JR IRS Form 3949aDocument2 pagesHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- 2017 PAZ A Form 1040 Individual Tax Return - RecordsDocument18 pages2017 PAZ A Form 1040 Individual Tax Return - RecordsAntonio PazNo ratings yet

- North Trend Marketing Corporation: NET PAY: 3,525.64Document1 pageNorth Trend Marketing Corporation: NET PAY: 3,525.64Mike Rowen BanaresNo ratings yet

- 433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)Document4 pages433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)douglas jonesNo ratings yet

- Barbyq Dire IrsDocument2 pagesBarbyq Dire IrsrolfNo ratings yet

- Total Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To PayDocument11 pagesTotal Amount Due: We Hope You're Enjoying Your Services. See Below For Ways To Payshaliena leeNo ratings yet

- Explanation With Documents - InderDocument95 pagesExplanation With Documents - InderInderpaal SinghNo ratings yet

- Corporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SDocument2 pagesCorporation. The LLC Will Be Treated As A Corporation As of The Effective Date of The SVõ Quốc CôngNo ratings yet

- JR3G, LLC Company LLCDocument2 pagesJR3G, LLC Company LLCQuân NguyễnNo ratings yet

- Idbi Home Loan Insurance Tax 1Document1 pageIdbi Home Loan Insurance Tax 1dinesh makwanaNo ratings yet

- SO 0061E00001JLLYIQA5 ExpansionDocument2 pagesSO 0061E00001JLLYIQA5 ExpansionCARLOS MARIO MONCADA SILVERANo ratings yet

- Metrobank Annual Report 2020Document250 pagesMetrobank Annual Report 2020Hera IgnatiusNo ratings yet

- Name Change Authorization: Fax Cover SheetDocument5 pagesName Change Authorization: Fax Cover SheetDaniel CastroNo ratings yet

- Hamza Ahmed Paystub 1Document1 pageHamza Ahmed Paystub 1Shan AhmedNo ratings yet

- PAG-IBIG Loan Payment-Feb 2020Document4 pagesPAG-IBIG Loan Payment-Feb 2020Tonie Naelgas GutierrezNo ratings yet

- 71330-01-000000068 MBR ElecDocument24 pages71330-01-000000068 MBR Elecdavidjones.n2012No ratings yet

- UntitledDocument39 pagesUntitledJohn Andrei SapinosoNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument6 pagesRequest For Taxpayer Identification Number and Certificationcade chevalierNo ratings yet

- EINNNIDocument2 pagesEINNNIOPL OJJJNo ratings yet

- Distance Application For Admissions (2017)Document1 pageDistance Application For Admissions (2017)Otsile KatukulaNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- STR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Document6 pagesSTR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Onyeta HICUwnaNo ratings yet

- Book 1 NashiagreerspreadsheetDocument1 pageBook 1 Nashiagreerspreadsheetapi-337357614No ratings yet

- NashiagreermmDocument1 pageNashiagreermmapi-337357614No ratings yet

- Key Terms 1Document1 pageKey Terms 1api-337357614No ratings yet

- Writing PromptnashiagreerDocument1 pageWriting Promptnashiagreerapi-337357614No ratings yet

- DiginotesnashiagreerDocument1 pageDiginotesnashiagreerapi-337357614No ratings yet

- Writing Prompt2nashiagreerDocument1 pageWriting Prompt2nashiagreerapi-337357614No ratings yet

- Nashiagreerdiginotes 3 BDocument1 pageNashiagreerdiginotes 3 Bapi-337357614No ratings yet

- NashiagreerdiginotesDocument1 pageNashiagreerdiginotesapi-337357614No ratings yet