Professional Documents

Culture Documents

Mock Test Paper - 1: 1) A) The Following Details Are Furnished To You

Mock Test Paper - 1: 1) A) The Following Details Are Furnished To You

Uploaded by

Kailash KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock Test Paper - 1: 1) A) The Following Details Are Furnished To You

Mock Test Paper - 1: 1) A) The Following Details Are Furnished To You

Uploaded by

Kailash KumarCopyright:

Available Formats

Mock Test Paper - 1

Question 1

1) a) The following details are furnished to you :

ABC pvt ltd has 4 shareholders (A,B,C,D) with each holding equal voting right.

B/F business losses of A.Y 2016 -17 is Rs 5 lakhs and UAD is Rs 3 lakhs.

It gives loan to Mr A of Rs 20 lakhs on 1-06-2016. The accumulated profits of the Co. was Rs 15 lakhs

at the time of disbursing the loan.

On 30-09-2016, ABC pvt ltd amalgamated with XY pvt ltd ( X & Y have equal voting right before

amalgamation ). The voting right of the shareholders in the amalgamated co. are as follows

A : 10% ; B : 10% ; C : 10% ; D : 10% ; X : 30% ; Y : 30%

Expenses on amalgamation was Rs 5 Lakhs.

Bad debts of Rs 2 lakhs written off by ABC pvt ltd in A.Y 15-16 was recovered by XY pvt ltd on

01-03-2017.

The business income (computed) excluding the above information of XY pvt ltd was Rs 10 lakhs.

Mr A who has acquired the shares of ABC pvt ltd on 01-06-2015 for Rs 1.5 lakhs transfers the shares

of XY pvt ltd on 01-03-2017for Rs 3.5 lakhs to Mr E for Rs 3 lakhs. (CII for F.Y 2015-16 : 1081 & for

F.Y 2016-17 : 1125)

Discuss the tax implications in the hands of XY pvt ltd & Mr A.

[10 marks]

Solution:

Tax implication in the hands of XY pvt Ltd

1. Sec 72A : B/f business loss & unabsorbed depreciation of the amalgamating co. shall be deemed

to be the loss & depreciation of the amalgamated co & shall be allowed to be c/f if the

conditions as laid therein is satisfied.

2. Sec 79: Sec 79 provides that in case of a closely held co., no loss incurred in the p.y shall be c/f &

set off against the income of the subsequent p.y unless the shares carrying atleast 51% of the

voting power of the co. are beneficially held on the last day of the p.y in which the loss is sought

to be set off, by the shareholders, who beneficially held the shares carrying atleast 51% of the

voting power on the last day of the p.y in which the losses was incurred. The regulation of

sec 79 applies only in respect of b/f business loss & not on UAD.

3. In the given situation we assume that the conditions laid down in sec 72A is satisfied. However,

since subsequent to the amalgamation the combined voting power of A,B,C & D has reduced

below 51% therefore the business loss of ABC pvt ltd for A.y 16-17 shall not be allowed in the

Logon to our website: www.dstclasses.in

1

hands of XY pvt ltd. However the UAD shall be allowed to be adjusted in terms of sec 72A as the

restriction of sec 79 does not extend to UAD.

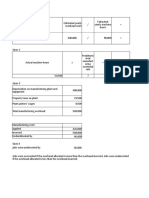

4. Computation of total income of XY pvt ltd

Particulars Rs

Business Income (Computed) 10,00,000

(-) Amalgamtion expenses (1/5th) u/s 35DD (1,00,000)

(+) Recovery of bad debts by successor assesse where the

deduction was allowed to the predecessor assesse cannot be NIL

chargeable as income u/s 41(4) held by SC in PK Kaimal

(-) UAD of amalgamating co. allowed as deduction u/s 72A (3,00,000)

Total Income 6,00,000

Tax Implication in the hands of Mr A:

1. Sec 2(22)(e) would be attracted as the loan is given by ABC pvt ltd, a co. in which public

are not substantially interested to Mr A, who is the beneficial owner of the shares

holding not less then 10% of voting power. However the deemed dividend u/s 2(22)(e) is

restricted upto the accumulated profits of the co. Thus in the present case deemed

dividend u/s 2(22) (e) is Rs 15 lakhs.

2. Mr A has received the shares of XY pvt ltd on account of amalgamation. As per FA 2016,

shares received by individual on amalgamation is not subject to tax u/s 56(2)(vii).

3. CG on transfer of shares of XY pvt ltd:

POH less then 2 years (1-06-15 to 1-3-17) & thus its a short term capital asset (FA

2016)

FVC - Rs 3.5 Lacs

Less : COA - Rs 1.5 Lacs

STCG - Rs 2 Lacs

Logon to our website: www.dstclasses.in

2

1) b) Determine the value of the securities held as stock-in-trade for the year ended 31.03.2017

Particulars Cost (Rs.) NRV (Rs.) Contention Contention

of assessee of AO

Shares

a. RIL 100 75 75

b. ICICI Bank 120 150 120

c. Tata Steel 140 120 120

d. Marico Ltd. 200 190 190

Total 560 535 505 535

Debentures

a. HUL 150 160 150

b. MARICO 105 90 90

c. HINDALCO 125 135 125

d. RIL 220 230 220

Total 600 615 585 600

Grand Total 1160 1150 1090 1135

The assessee contended that valuation of closing stock should be made individual security wise.

However, the AO contended that valuation would be done category wise. Examine the correctness

of the claim.

[4 marks]

Solution:

1. ICDS VIII requires that securities held as stock-in-trade to be valued at lower of cost or NRV. Further,

such comparison has to be done category-wise and not individual security wise.

2. Supreme Court in case of UCO Bank Ltd. v.CIT 240 ITR 355, held that it is not proper to take into

account anticipated profit. The requirement in ICDS VIII is in deviation with this as valuation of

security category-wise results in decrease in the value of some securities being absorbed by the

anticipated profits.

3. Accordingly, the contention of AO is correct and the securities shall be valued at Rs. 1, 135

1) c) A securitisation trust has following incomes for the P.Y. 2016-17:

a) Interest income: 5 Lakhs

b) Dividend income: 7 Lakhs

c) Short term capital gains: 15 Lakhs

Discuss the tax consequences of the above income in the hands of securitisation trust and the investors,

Assuming that the trust has distributed 5 Lakhs to the investor Assume the investor is a) resident

individual b) resident company c) foreign company

[6 marks]

Solution:

Taxability in the hands of the securitization trust: Exempt u/s 10(23DA)

Logon to our website: www.dstclasses.in

3

Although, the securitisation trust will have to deduct TDS on income distributed to the investors u/s

194LBC

i.e. on Rs. 5 lakhs @25% + Surcharge+ CESS

Note: In absence of information it is assumed that investors here mean Individuals/HUF

Taxability in the hands of Investors: The income of Rs. 5 Lakhs would be taxable in the hands of

investor in the same proportion as it is in the hands of securitization trust i.e. in the ratio of 5:7:15

1. Interest income: Rs. 5 Lakhs x 5/27 = Rs. 92,593 @ Normal slab rates applicable to individuals

2. Dividend income: Rs. 5 Lakhs x 7/27 = Rs. 1,29,630 Exempt

3. Short term capital gains: Rs. 5 Lakhs x 15/27 = Rs. 2,77,778 @ Normal slab rates applicable to

individuals

Question 2

2) a) Mr Peter a technocrat and an NRI till F.Y 15-16 returns to India for permanent settlement on 1-6-

16. Following details are furnished :

1. He owns a residential house property in Chennai which he sold on 30-04-16. The house property

was acquired on 2011-12 for Rs 80 lakhs & its sold for Rs 1.25 crores. He invests the partial sale

proceeds towards acquiring the shares of the company which is incorporated on 01-06-16. The

company engaged in design and manufacture of solar equipments. He owns 80% of equity

shares in the new company. The design of solar equipments of various dimensions is made Mr.

Peter & the company obtained the intellectual property in such design in the name of Mr. Peter.

The co. invests Rs 16 cr in new eligible plant & machinery on 31-12-16.

2. Being the true & 1st inventor for the invention Mr peter receives Rs 25 lakhs on 01-02-2017 from

imparting information containing the working of various solar equipment design prepared.

3. Mr peter applies for housing loan on 1-5-2016 which was sanctioned for Rs 30 lakhs on 15-5-16.

The house property was acquired by him on 31-10-16 for Rs 49 lakhs. Interest paid by him was

Rs 2,35,000.

4. Mr peter was staying in rented accommodation from 1-06-16 till 31-10-16. Rent paid by him was

Rs 8,000 p.m.

5. He holds securities of foreign co. (which he acquired when he was staying abroad) from which

interest accrued and received by him outside India was Rs 2 lakh.

6. Rent received from giving furniture on hire Rs 6 lakhs.

7. Further he had invested in the debentures of indian co. while he was an NRI on 1-1-14 for Rs 10

lakhs. The said debentures were transferred on 1-11-16 for Rs 18 lakhs. Further the interest on

said debentures earned during P.Y 16-17 was Rs 1 lakh. The TTBR & SR was as follows:

Date TTBR TTSR

1-1-14 48 49

1-11-16 54 55

Logon to our website: www.dstclasses.in

4

8. Mr Peter wants to avail the benefit of chapter XIIA in A.Y 17-18. Compute his total income & tax

liability for A.y 17-18. [CII of 2011-12 785 & 2016-17 1125]

[16 marks]

Solution:

Watch Video

Question 3:

3) a) During the P.Y. 2016-17, Mr. Roy, an Indian citizen was in India for 195 days. He has also been

resident of India in last 10 years During the P.Y.2016-17, he was also a resident of Australia. As per

Article 4 of India-Australia DTAA

where an individual is a resident of both the Contracting States, then he shall be deemed to be resident

of the Contracting State in which he has permanent home available to him. If he has permanent home in

both the Contracting States, he shall be deemed to be a resident of the Contracting State with which his

personal and economic relations are closer (centre of vital interests)

He has permanent home in both India & Australia. He has earned in Australia 6 Lakhs as other income.

His family stays in India. He also derived rental income of 3,25,000 from property let out in India.

During the year, he paid 32,000 through credit card to insure health of his non-resident mother aged

82 years not dependent on him.

As per India-Australia DTAA the income would be taxable in country where it is earned and not in the

other country, but would be included for computation of tax rate in such other country. Rate of tax in

Australia is 20%.

A) Determine the residential status as per tie-breaker rules and compute the tax liability of Mr. Roy.

B) Also, compute the tax liability of Mr. Roy assuming there is no DTAA.

[8 marks]

Solution:

i) During the previous year 2016-2017 Mr. Roy was a resident & ordinary resident since he had

stayed in India for more than 183 days during P.Y., and has been resident for last 10 Yrs.

ii) He is also a tax resident of Australia.

iii) Where an individual is a resident of 2 countries, then the residency has to be determined as

per tie breaker rules under the tax treaty.

iv) Mr. Roy has permanent home in both countries. Accordingly his resident status is to be

determined based on centre of vital interest.

v) Family of Mr. Roy is in India and accordingly, Mr. Roy has personal & economic relations

closer to India & Accordingly, as per tie - breaker rules, Mr. Roy will be resident of India.

A) India has DTTA with Australia

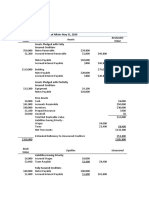

Computation of tax payable by Mr. Roy for A.Y 2017-2018

Logon to our website: www.dstclasses.in

5

Particulars Amount

Rental income from property let out in India 3,25,000

(-) standard deduction @ 30% u/s 24(a) (97,500)

Gross total income 2,27,500

(-) chapter VI A deduction

U/s 80D for medical premium paid (25000)

(Mr. Roy would not be entitled for deduction

of 30,000 even if his mother is 82 years old

, since the higher limit of deduction of

30,000 is available in respect of an individual

who is of age of 60 years or more and

Resident of India during P.Y)

2,02,500

Other income earned in Australia 6,00,000

Taxable Income 8,02,500

Tax on Total Income

Upto 2,50,000 NIL

2,50,000 - 5,00,000 @ 10% 50,000

5,00,000 - 8,02,500 @ 20% 60,500 85,500

Add: Cess @ 3% 2,565

Tax Payable ----(1) 88,065

Average Tax Rate in India 10.97%

(88,065/8,02,500) x 100

Tax Liability:

As per DTAA with Australia, the income earned in foreign country would not be taxable in

India, but it has to be included in the total income only for computation of tax rate.

Accordingly, Mr. Roy would be liable to pay tax only on income earned in India @ 10.97% &

not on the foreign income.

Indian Income = 2,27,500 25,000 = 2,02,500

Tax @ 10.97% on 2,02,500 = 22,214

Rounded off to 22,210

B) India has not DTAA with Australia

Computation of Tax Payable by Mr. Roy for A.Y. 2017-18

Particulars Amount

Tax on both foreign & Income

(as computed in (A1) above) 88,065

Less: Relief U/s 91 on Foreign income

Logon to our website: www.dstclasses.in

6

600,000 @ 10.97% (65,820)

(lower of average Indian tax rate (10.97%) or

foreign tax rate (20%))

Tax Payable 22,245

Note: Assessee shall be allowed relief U/s 91 if all the following conditions are fulfilled:-

a) Assessee is resident in India during the relevant P.Y.

b) Income accrues/arises to him outside India during that P.Y.

c) Such income is not deemed to accrue/arise in India during that P.Y.

d) The foreign income has been subjected to income tax in the foreign country in the hands

of the assessee & the assessee has paid tax on such income in the foreign country.

e) There is no DTAA U/s 90 with that country

Accordingly, Mr. Roy would be eligible for relief U/s 91 since all the conditions are satisfied.

3) b) Discuss the correctness or otherwise of the following statements:

(i) The provisions of MAT u/s 115JB are not applicable to all foreign companies

(ii) Units set up in International Financial Services Center (IFSC) are entitled to special tax concessions

[4 marks]

Solution:

(i) The statement is not correct.

The Finance Act, 2016 has inserted Explanation 4 to section 115JB with retrospective effect from

1.4.2001 to provide for non-applicability of levy of MAT under 115JB on foreign companies

subject to satisfaction of certain conditions:

(I) Whether the foreign company is resident of a country or a specified territory with which

India has a DTAA under section 90(1) or the Central Government has adopted any

agreement between specified associations for double taxation relief under section

90A(1), it should not have a permanent establishment in India in accordance with the

provisions of such Agreement.

(II) Where the foreign company is a resident of country with which India does not have an

agreement of the nature referred in clause (i) above, it should not be required to seek

registration under any law for the time being in force relating to companies.

The provision of MAT under section 115JBwould not be attracted in case of such foreign

companies satisfying these conditions.

Further, in the case of any foreign company (not satisfying the above conditions for non-

applicability of MAT), amount of income accruing or arising from

(A) The capital gains arising on transactions in securities; or

(B) The interest, royalty or fees for technical services chargeable to tax at the rate or rates

specified in Chapter XII,

If such income is credited to profit and loss account and the income-tax payable thereon in

accordance with the provisions of the Act, other than the provisions of Chapter XII-B, is at the

rate less than the rate of 18.5%, shall be reduced while computing book profits.

Thus, since the non applicability of MAT is either subject to fulfillment of the prescribed

condition, and in other cases (i.e., cases where MAT is applicable), non- applicability is restricted

Logon to our website: www.dstclasses.in

7

to only specified income, the statement that the provisions of section 115JB are not applicable

in the case of foreign companies is not correct.

(ii) The statement is correct.

(1) Exemption for STT and CTT: With effect from 1.6.2016, securities transaction tax is not

leviable in respect of taxable securities transactions entered into by any person on a

recognized stock exchange located in an International Financial Service Center (IFSC) where

the consideration for such transaction is paid or payable in foreign currency.

Likewise, commodities transaction tax is not leviable in respect of taxable commodities

transactions entered into by any person on a recognized association located in unit of IFSC

where the consideration for such transaction is paid or payable in foreign currency.

(2) Exemption of LTCGs on sale of securities, even if STT is not paid: Long term capital gains in

respect of income arising from transaction undertaken in foreign currency on a recognized

stock exchange located in an International Financial Service Center would be exempt under

section 10(38) even though securities transaction tax is not paid in respect of such

transactions.

(3) Concessional rate of tax on short term capital gains, even if STT is not paid: Short capital

gains arising from transaction undertaken in foreign currency ona recognized stock

exchange located in an International Financial Currency Service Center would be taxable at

the concessional rate of 15% under section 111A even though securities transaction tax is

not paid in respect of such transactions.

(4) Concessional Rate of MAT: In case of a Company, being a unit located in an International

Financial Service Center and deriving its income solely in convertible foreign exchange, the

minimum alternate tax under section 115JB shall be chargeable at the rate of 9% instead of

18.5%.

(5) Exemption from tax on distributed profits: In case of a company being a unit located in an

International Financial Service Center, deriving income solely in convertible foreign

exchange, there would be no tax on any amount declared, distributed or paid by such

company, by way of dividends (whether interim or otherwise) on or after 1st April, 2017 out

of its current income, either in the hands of the company or the person receiving such

dividend.

3) c) Mr. A is an executive director of ABC Pvt. Ltd. Further he holds 75% equity shares in the company.

He has let out his commercial property to the company for monthly rent. The company incurred 2.51

crores towards construction and improvement of factory premises which was used by it for the purpose

of its business. The AO held that the amounts spent by the company towards repairs and renovation is

taxable in the hands of Mr. A as:

a) Deemed dividend U/s 2(22)(e); or

b) Perquisite

Is the contention of the AO valid? (4 Marks)

Solution:

The facts of the case are similar to the case of CIT v. Vir Vikram Vaid (2014) 367 ITR 365 (Bom)

Analysis of the case:

Logon to our website: www.dstclasses.in

8

a) Deemed dividend:

i. No money had been paid by way of advance or loan to the shareholder who has substantial

interest in the company.

ii. Further, the amount spent was towards repairs and renovation of the premises owned by the

assessee but occupied by the company as lessee. There is no dispute that the company had

taken on rent the aforesaid premises.

iii. The expenditure incurred by virtue of repairs and renovation on the premises cannot be

brought within the definition of advance or loan given to the shareholder having substantial

interest in the company, though he is the owner of the premises.

b) Perquisite:

iv. It cannot be treated as payment by the company on behalf of the shareholder or for the individual

benefit of such shareholder. If held in such manner, it is a mere assumption not tenable in law.

Conclusion:

The High Court, accordingly, held that the repair and renovation expenses in respect of premises

occupied by the company cannot be treated as deemed dividend in the hands of shareholder being the

owner of the building. Accordingly, applying the ratio decendi of the case, repair and renovation

expenses in respect of premises occupied by the company cannot be treated as deemed dividend in

the hands of Mr. A.

Logon to our website: www.dstclasses.in

9

Question 4

4) a) Examine the following transactions and discuss whether the transfer price declared by the

following assessees, who have exercised a valid option for application of safe harbour rules, can be

accepted by the Income-tax Authorities-

Aggregate

value of

Declared

Sr transactions Operating

Assessee International transaction Operating

No. entered into Expense

Margin

in the

P.Y.2016-17

1 C & Co., a Provision of contract R & D services 100 crore 20 crore 70 crore

partnership firm relating to development of internet

registered under technology, to XYZ & Co., a foreign

the Partnership firm, which holds 12% interest in C &

Act, 1932 Co.

2 D Ltd., an Indian Provision of contract R &D services 50 crore 9 crore 30 crore

company relating to generic pharmaceutical

drug, to ABC Inc., a foreign company

which guarantees 15% of the total

borrowings of D Ltd.

In all the above cases, it may be assumed that the Indian entity which provides the services assumes

insignificant risk. It may also be assumed that the foreign entities referred to above are non-resident in

India.

Would your answer change, if in any of the cases mentioned above, the foreign entity is located in a

notified jurisdictional area?

[6 marks]

Solution:

1. XYZ & Co. & C & Co are deemed to be AEs as the condition of one enterprise, being a

foreign firm, holding not less than 10% interest in another enterprise, being an Indian firm, is

satisfied. Therefore, provision of contract R & D services relating to software development by

C & Co., an Indian firm, to XYZ& Co., a foreign firm, is an international transaction between

AEs, and consequently, the provisions of transfer pricing are attracted in this case.

C & Co. should have declared an operating profit margin of not less than 30% in relation to

operating expense, to be covered within the safe harbour rules. However, since C & Co. has

declared an operating profit margin of only 28.57% (i.e. 20/70 x 100), the same is not in

accordance with the circumstances mentioned in Rule 10TD. Hence, it is not binding on the

income-tax authorities to accept the transfer price declared by C & Co.

Logon to our website: www.dstclasses.in

10

2. ABC Inc., a foreign company, guarantees 15% of the total borrowings of D Ltd., an Indian

company. Since ABC Inc. guarantees not less than 10% of the total borrowings of D Ltd., ABC Inc.

and D Ltd. are deemed to be associated enterprises. Therefore, provision of contract R & D

services relating to generic pharmaceutical drug by D Ltd., an Indian company, to ABC Inc., a

foreign company, is an international transaction b e tw e en associated enterprises, and

consequently, the provisions of transfer pricing are attracted in this case.

Provision of contract R & D services in relation to generic pharmaceutical drug is an eligible

international transaction. Since D Ltd. is providing such services to a non - resident associated

enterprise and has exercised a valid option for safe harbour rules, it is an eligible assessee.

Irrespective of the aggregate value of transactions entered into in the P.Y. 2016-17, D Ltd.

should have declared an operating profit margin of not less than 29% in relation to

operating expense, to be covered within the scope of safe harbour rules. In this case, since D

Ltd. has declared an operating profit margin of 30% (i.e. 9/30 x 100), the same is in accordance

with the circumstances mentioned in Rule 10TD. Hence, the income tax authorities shall accept

the transfer price declared by D Ltd. in respect of such international transaction.

4) b) Balance sheet of A Pvt Ltd:

Particulars Amount ()

Liabilities

Equity share capital 2,00,000

Reserves and surplus 6,50,000

Assets

Cash 8,25,000

P&L A/c (Dr Balance) 25,000

On 01/04/16, A Pvt Ltd gives loan of 2,00,000 to Mr X holding 11% voting power. On 02/04/16, Mr X

repays the loan to the company.

On 31/07/16, A Pvt Ltd gives a loan of 2,00,000 to a firm in which Mr Z is a partner and holds a

substantial interest. Mr Z holds 20% voting power in A Pvt Ltd as on the date of loan.

On 30/09/16, A Pvt Ltd gives a loan of 3,00,000 to its supervisor having salary of 4,000 p.m., who

in turn advanced the said amount of loan to Mr P, who holds 70% of the paid up capital of A Pvt Ltd.

Discuss the taxability u/s 2(22)(e) in the hand of the shareholders.

[6 marks]

Solution:

As per Section 2(22)(e), payment made by a closely held company of any sum by way of advance or

loan to a shareholder holding not less than 10% of the voting power of the company as on the date

when such loans or advances are made or to any concern in which such shareholder has

substantial interest at any time during the previous year or to any person on behalf of such

shareholder shall be deemed to be dividend in the hands of such shareholder.

Accumulated Profits = Reserves and surplus P&L A/c (Dr Balance)

= Rs. 6,50,000 Rs. 25,000 = Rs. 6,25,000

Logon to our website: www.dstclasses.in

11

Loan given to Mr X on 01/04/16

Mr X holds 11% of voting power. Therefore, any loan and advances to him will attract the

provisions of

Section 2(22)(e).

For Company A Pvt Ltd In the hands of Mr X

Accumulated Profits = Rs. 6,25,000 Rs. 2,00,000 = Loan of Rs. 2,00,000 will be taxable as deemed

Rs. 4,25,000. dividend u/s 2(22)(e).

[Repayment of loan shall have no relevance and

will not be added back to the accumulated profits]

Loan given to a firm in which Mr. Z is a partner and holds substantial interest on 31/07/16

A Pvt Ltd gave loan to a firm in which Mr Z is a partner and holds a substantial interest. Mr Z holds

20% voting power in the company as on the date of loan. Therefore, any loan and advances to the

concern will attract the provisions of Section 2(22)(e) and will be taxable in the hands of such

shareholder.

For Company A Pvt Ltd In the hands of Mr Z

Accumulated Profits = Rs. 4,25,000 Rs. 2,00,000 = Loan of Rs. 2,00,000 will be taxable as deemed

Rs. 2,25,000. dividend u/s 2(22)(e).

Loan given to supervisor, who in turn advanced the said amount of loan to Mr P on

30/09/16

A Pvt Ltd gave loan to its supervisor who in turn advanced the said amount of loan to Mr P,

who holds

70% of the paid up capital of the company; It shall be construed as the amount given to the benefit of

Mr. P and will be treated as deemed dividend chargeable u/s 2(22)(e) in the hands of Mr P [L.

Alagusundaram Chettair v CIT (2001) (SC)].

For Company A Pvt Ltd In the hands of Mr Z

Accumulated Profits = Rs. 2,25,000 Rs. 2,25,000 = Loan of Rs. 3,00,000 restricted to the amount of

NIL accumulated profit i.e. Rs. 2,25,000 will be taxable

as deemed dividend under section 2(22)(e).

4) c) PP Inc, a UK company sets up a liaison office in India to look after its day to day business operations

in India and to identify market opportunities in India. The liaison office takes decisions relating to day to

day routine operations and performs support functions that are preparatory and auxiliary in nature. The

key management and commercial decisions are in substance made by the board of directors in UK.

Determine the residential status of PP Inc for AY 2017-18. Also comment whether the liaison office

would constitute business connection or permanent establishment of PP Inc in India.

[4 marks]

Solution:

PP Inc has only liaison office in India through which it carries out its daily business operations in India

and identify market opportunities in India. The place where decisions relating to day to day routine

operations are taken and support function that are preparatory or auxiliary in nature are performed are

not relevant in determining POEM.

Logon to our website: www.dstclasses.in

12

Further, the key management and commercial decisions are taken outside India and BOD is also outside

India. Accordingly, PP Inc, being a foreign company, is a non-resident for AY 2017-18, since its POEM is

based outside India.

Liaison Office maintained solely for carrying on preparatory & auxiliary services & not undertaking

commercial, trading or Industrial activity do not constitute business connection in India.

Question 5:

5) a) Mr. Hitarth purchases the following property

Stamp Original

Stamp duty

duty value COA of

Purchase value on

on property Date of

price registration

Agreement agreement Date of to seller original

Seller [Amount date

date date registration before purchase

( In [Amount

[Amount agreement by seller

Lakhs)] ( In

( In date ( In

Lakhs)]

Lakhs)] Lakhs)

June 1, August 30 01/01/2014

Clover 40* 42 49

2016 10,2016

August 5, December 20 02/10/2014

Richard 60** 70 75

2016 2, 2016

* 1 Lakh is paid by cheque on June 1, 2016 and 39 Lakhs paid on August 5, 2016.

** 10 Lakhs was paid by cheque on 7th August, 2016 and 50 Lakhs paid on December, 2016.

Discuss the taxability in the hands of Mr. Hitarth, Clover and Richard. Assume that Clover & Richard are

not dealer in property and have held the property as capital asset.

[6 marks]

Solution:

In the hands of Mr. Hitarth

For the property purchased from Clover, since part of the consideration is paid on the date of

agreement. Consequently, stamp duty value on the date of agreement will be considered.

The excess of stamp duty value (as on date of agreement) over purchase price is Rs. 2 Lakhs which is

taxable u/s 56(2)(vii)(b) in the P.Y. in which the property is received.

If possession is given during the P.Y. 2016-17, Rs. 2 Lakhs will be taxable in the P.Y. 2016-17. Cost of

acquisition in his hands will be Rs. 42 Lakhs.

For the property purchased from Richard, since part of the consideration is not paid on/before the

date of agreement. Consequently, stamp duty value on the date of registration will be considered.

The excess of stamp duty value (as on date of registration) over purchase price is Rs. 15 Lakhs which

is taxable u/s 56(2)(vii)(b) in the P.Y. in which the property is received.

If possession is given during the P.Y. 2016-17, Rs. 15 Lakhs will be taxable in the P.Y. 2016-17. Cost of

acquisition in his hands will be Rs. 75 Lakhs.

In the hands of Clover

Logon to our website: www.dstclasses.in

13

Capital Gain (Since, not dealer in property, income would be taxable under capital gains and not under

PGBP)

As per FA 2016, if the Whole or part of consideration is paid by cheque/bank draft or ECS through a

bank A/c on or before the date of agreement, SDV as on date of agreement shall be taken. Therefore,

in the instant case, since, the part consideration is paid in cheque on/before the date of agreement i.e.

June 1, 2016, SDV as on date of agreement shall be taken.

Particulars Amount

Full value of consideration (U/s 50C) 42,00,000

(-) Cost of Acquisition 30,00,000

SHORT TERM CAPITAL GAIN 12,00,000

In the hands of Richard

Capital Gain (Since, not dealer in property, income would be taxable under capital gains and not under

PGBP)

As per FA 2016, if the Whole or part of consideration is paid by cheque/bank draft or ECS through a

bank A/c on or before the date of agreement, SDV as on date of agreement shall be taken. Therefore,

in the instant case, since, the part consideration is not paid in cheque on/before the date of agreement

i.e. August 5, 2016, SDV as on date of registration shall be taken.

Particulars Amount

Full value of consideration (U/s 50C) 75,00,000

(-) Coat of Acquisition 20,00,000

SHORT TERM CAPITAL GAIN 55,00,000

5) b) Mr. Raj invested into gold bonds under the two different schemes, the details of which are given as

under:

Particulars Sovereign Gold Bond Scheme, Gold Monetisation Scheme,

2015 (Scheme I) 2015 (Scheme II)

No. of units purchased on 1st 100 units for 10 Lakhs 50 units for 6 Lakhs

Jan, 2016

Redeemed into physical gold on 50 units 30 units

31st Aug, 2016 Received physical gold worth Received physical gold worth

8 Lakhs 4 Lakhs

Transferred bonds on 31 50 units for 12 Lakhs

st

20 units for 7 Lakhs

March, 2017

Interest earned during 1 Lakh 70,000

P.Y.2016-17

Compute the taxable income of Mr. Raj for the P.Y. 2016-17.

[6 marks]

Solution:

Logon to our website: www.dstclasses.in

14

Particulars Sovereign Gold Bond Scheme, Gold Monetisation Scheme,

2015 (Scheme I) 2015 (Scheme II)

Interest Taxable Exempt U/s 10(15)(vi)

Capital Asset u/s 2(14) Yes No

Capital Gain on Redemption Exempt U/s 47 (viic) Exempt

Transfer Taxable Exempt ( Not Capital Asset)

Capital Gain on transfer of Sovereign Gold Bonds

Particulars Amount (in Lakhs)

Fair Value Cost 600

(-) Cost of Acquisition (50 x 10L) 500

Capital Gain 100

Interest 1

TAXABLE INCOME 101

5) c) Whether the high court has the power to review its own order? [4 Marks]

Solution:

The Supreme Court in Meghalaya steels Ltd. (2015) has held as under:

The power of review is inherent as per the constitution of India.

Such power is essentially to prevent miscarriage of justice or to correct grave errors committed

by it.

Sec. 206A(7) states that all provisions that would apply in relation to appeals in the code of civil

procedures (CPC) would also apply to appeals U/s 260A.

That does not in any manner suggest-

- Either that the other provisions of the CPC are excluded

- OR the HC inherent jurisdiction is affected in any manner.

Question 6:

6)a) Daimler Ltd an Indian company is a subsidiary of Daimler Pte Singapore. Daimler India has sold raw

material amounting to 7,000 units at 9,200/unit to Daimler Pte. Daimler Ltd. has also sold similar raw

material to other unrelated enterprises. The details of the comparables are provided below. Compute

the Arms Length Price (ALP) and determine whether Daimler Ltd. has supplied the raw material at ALP.

The total income of Daimler Ltd. during the P.Y.2016-17 was 9,00,000. [Assume Comparable

Uncontrolled Price (CUP) method as the most appropriate method].

Comparable Unrelated Parties Price for P.Y.2016-17 Price for P.Y.2015-16

Reyant Ltd. 8,990/unit 9,800/unit

Ciaz Ltd. 9,400/unit 10,000/unit

Logon to our website: www.dstclasses.in

15

Shivam Ltd. 8,400/unit 10,000/unit

Ariham Ltd. 11,000/unit 9,690/unit

Rihan Ltd. No transaction 8,980/unit

Divam Ltd. 10,000/unit 11,100/unit

Duke Ltd. 10,990/unit 6,000/unit

Super Ltd. 9,900/unit 8,790/unit

Christler Ltd. 10,330/unit 7,980/unit

[8 marks]

Solution:

1. Associated Enterprise:

In this case, Daimler Ltd. is a subsidiary of Daimler Pte. Accordingly, both are associated

enterprises within the meaning of Section 92A.

2. International transaction:

Sale of goods to a non-resident associated enterprise would fall within the meaning of

international transaction. Accordingly, the provisions of transfer pricing would apply and the price

is required to be computed with regard to Arms length price (ALP).

3. Assumptions:

a. Assuming, Daimler India is tested

party.

b. Company has not entered into safe harbour and APA

provisions.

4. Determination of ALP:

a. As per third proviso to Section 92C(2) of the Income-tax Act, 1961, if more than 1 price is

determined by using most appropriate method, then ALP shall be computed by applying the

range concept.

b. As per rule 10CA of Income-tax Rules, range concept would apply only if the number of

comparables is 6 or more than 6.

c. Since, in the instant case there are 8 comparables available, the range concept would

apply.

5. Use of multiple year data:

In the instant case, CUP method is used, the concept of multiyear data would not apply.

Accordingly, only the data of the current year i.e. P.Y. 2016-17 is to be considered. Data pertaining

to P.Y. 2015-16 is irrelevant.

6. ALP as per Range Concept:

Step 1: Arrange the dataset in the ascending order:

Sr. No Comparable Price for P.Y. 2016-17

1 Shivam Ltd. Rs. 8,400/unit

Logon to our website: www.dstclasses.in

16

2 Reyant Ltd. Rs. 8,990/unit

3 Ciaz Ltd. Rs. 9,400/unit

4 Super Ltd. Rs. 9,900/unit

5 Divam Ltd. Rs. 10,000/unit

6 Christler Ltd. Rs. 10,330/unit

7 Duke Ltd. Rs. 10,990/unit

8 Ariham Ltd. Rs. 11,000/unit

Step 2: Determine the 35th and 65th percentile:

i. The data place of 35th percentile = 8*35% = 2.8

Since, this is not whole number, the next number shall be taken i.e. 3. Therefore, the value at

3 rd place is Rs. 9,400/unit.

ii. The data place of 65th percentile = 8*65% = 5.2

Since, this is not whole number, the next number shall be taken i.e. 6. Therefore, the value at

6 th place is Rs. 10,330/unit.

Accordingly, the ALP range is between Rs. 9,400/unit Rs. 10,330/unit.

However, the transaction price is Rs. 9,200/unit and is not within the ALP range.

Step 3: Determine the median:

The data place of the median, i.e., 50th percentile = 8*50% = 4

Since, this is whole number, average of prices at 4th and 5th place shall be taken, i.e.,

(Rs. 9,900 + Rs. 10,000)/2 =Rs. 9,950/unit

Therefore, ALP shall be Rs. 9,950/unit.

Step 4 : Adjustment to Transfer Price:

Since, the transfer price is lower than ALP, adjustment of Rs. 750/unit (Rs. 9,950-Rs. 9,200) is required.

Computation of adjusted total income:

Particulars Amount (Rs.)

Total income 9,00,000

Add: TP adjustment (7000 units* Rs. 750/unit) 52,50,000

Total Income as determined 61,50,000

6)b) Mr A acquired house property from a builder. The details of the same are as follows:

House property : Lease hold land cost Rs 10 Lakhs ; House property Constructed : Cost Rs 8 lakhs on such

lease hold land. (Separate agreement was entered in respect of the same from the builder.)

1. Date of agreement 11-06-13

2. Date when the property was registered : 11-09-15

3. Date of conversion of lease hold land to free hold land : 1-03-16

4. Date of sale of property : 1-1-17

Logon to our website: www.dstclasses.in

17

5. Sale consideration : Land Rs 15 lakhs & Building Rs 12 lakhs

Further in respect of the entire consideration the assesee purchased a house property in the name of his

wife.

Compute the amount of Capital Gains [8 marks]

Solution:

Computation of Capital Gains

Particulars Amount Amount

( in Lakhs) ( in Lakhs)

For Land : (11/06/2013 01/01/2017) (Note 1)

Full Value Consideration (assuming greater than stamp

duty value U/s 50C) 15,00,000

(-) Indexed Cost of Acquisition [10L x (1125/939)] 11,98,083

(-) Indexed Cost of Improvement (Note 2) NIL

Long Term Capital Gain on Land (A) 3,01,917

For Building : (11/06/2013 01/01/2017) (Note 1)

Full Value Consideration (assuming greater than stamp

duty value U/s 50C) 12,00,000

(-) Indexed Cost of Acquisition [8L x (1125/939)] 9,58,466

Long Term Capital Gain on Building (B) 2,41,533

Total Long Term Capital Gain (A + B) 5,43,450

(-) Exemption U/s 54 - (Note 3) (2,41,533)

TAXABLE LONG TERM CAPITAL GAIN 3,01,917

Note:

1) The Madras High Court in S.K.Jeyashankar case has held the right to the property flows from the

date of agreement. Further fact that the property was registered in another date& the

possession was given on the later date, does not take away the fact that the right was created at

the time of the agreement. Hence in the present case the capital asset under consideration is a

long term in nature.

2) The Allahabad High Court in Smt. Rama Rani Kala case has held that conversion of the right of

the lessee from leasehold to freehold is only by way of improvement of her rights over the

property which he / she has enjoyed. Accordingly in determining the period of holding, the date

from original acquisition of asset being the lessee shall be considered. The question does not

provides the cost of the improvement (i.e. for conversion) and hence not considered.

3) The Delhi High Court in Kamal Wahals case has held that Section 54 does not require purchase

of a new residential house property in the name of the assessee himself. It only require to

purchase or construct a residential house. Hence, property purchased in the name of his wife

will qualify for the exemption U/s 54/54F.

Logon to our website: www.dstclasses.in

18

You might also like

- On January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, ADocument17 pagesOn January 1, 20X5, Pirate Company Acquired All of The Outstanding Stock of Ship Inc.,Norwegian Company, AKailash KumarNo ratings yet

- Prince Corporation Acquired 100 Percent of Sword CompanyDocument2 pagesPrince Corporation Acquired 100 Percent of Sword CompanyKailash Kumar50% (2)

- Jennys FroyoDocument16 pagesJennys FroyoKailash Kumar100% (2)

- Silven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsDocument5 pagesSilven Industries, Which Manufactures and Sells A Highly Successful Line of Summer Lotions and Insect RepellentsKailash KumarNo ratings yet

- Is A Construction Company Specializing in Custom PatiosDocument8 pagesIs A Construction Company Specializing in Custom PatiosKailash KumarNo ratings yet

- The Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowDocument4 pagesThe Balance Sheet at December 31, 2018, For Nevada Harvester Corporation Includes The Liabilities Listed BelowKailash KumarNo ratings yet

- Rain Industries: QIP-Pitch BookDocument20 pagesRain Industries: QIP-Pitch BookRanjith KumarNo ratings yet

- Case Study - Nike IncDocument6 pagesCase Study - Nike Inc80starboy80No ratings yet

- Aswath Damodaran - A Primer On Financial StatementsDocument10 pagesAswath Damodaran - A Primer On Financial Statementssujay85No ratings yet

- Us DPP Book Fas123r PDFDocument466 pagesUs DPP Book Fas123r PDFNavya BinaniNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- 629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNDocument19 pages629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNMukesh kannan MahiNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Accountancy FinalDocument13 pagesAccountancy FinalVikram KaushalNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Document20 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Test Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDocument8 pagesTest Series: October, 2019 Mock Test Paper Final (Old) Course: Group - I Paper - 1: Financial ReportingDev ReddyNo ratings yet

- Corporate ACDocument4 pagesCorporate ACElavarasan NNo ratings yet

- 03 QP - Prelims - 2021-22 - XII - AccountsDocument5 pages03 QP - Prelims - 2021-22 - XII - AccountsSharvari PatilNo ratings yet

- Advance Accounts TestDocument3 pagesAdvance Accounts Testdivya shahasaneNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Of Questions-6: LimitedprovidesDocument16 pagesOf Questions-6: Limitedprovidesanila rathodaNo ratings yet

- Question SFM GMDocument10 pagesQuestion SFM GMPraDeepMspNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- GRP I - Law (N) - Suggested Ans - Nov 2018Document22 pagesGRP I - Law (N) - Suggested Ans - Nov 2018ABC LtdNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument12 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- P17Document21 pagesP17anandhan61No ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Financial Reporting May 22 Mock Test Ques PPRDocument7 pagesFinancial Reporting May 22 Mock Test Ques PPRVrinda GuptaNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Accountancy-SQP 23-24Document12 pagesAccountancy-SQP 23-24Ashutosh SinghNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- 18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 2021Document5 pages18CSU13 PSG College of Arts & Science Bcom (CS) Degree Examination May 202119BCS531 Nisma FathimaNo ratings yet

- SFM Series 2 QuesDocument6 pagesSFM Series 2 Queskomalchandwani.dnlNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- MOCK PAPER Final 23 24Document16 pagesMOCK PAPER Final 23 24k74pqnqdtcNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- Company and Cost ManagementDocument11 pagesCompany and Cost ManagementPadmambigai Chandra SekaranNo ratings yet

- Corporate Practice QPDocument10 pagesCorporate Practice QPr queNo ratings yet

- ACCOUNTS Specimen For ISCDocument15 pagesACCOUNTS Specimen For ISCStudy HelpNo ratings yet

- Final Ca: MAY '19 Financial ReportingDocument13 pagesFinal Ca: MAY '19 Financial ReportingJINENDRA JAINNo ratings yet

- 588c69bdc763b - Sample Paper Accountancy - 230102 - 185610Document7 pages588c69bdc763b - Sample Paper Accountancy - 230102 - 185610sanchitchaudhary431No ratings yet

- De CV62 S NX QSB Tetgkk WaDocument24 pagesDe CV62 S NX QSB Tetgkk WaShabanaNo ratings yet

- Accountancy SQPDocument13 pagesAccountancy SQPDeepak Kr. VishwakarmaNo ratings yet

- Sem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758Document5 pagesSem-5 10 BCOM HONS DSE-5.2A CORPORATE-ACCOUNTING-0758hussain shahidNo ratings yet

- Assessement Test 6 - Change of PSR - Docx - 1661182024584Document2 pagesAssessement Test 6 - Change of PSR - Docx - 1661182024584Shreya PushkarnaNo ratings yet

- Ca Final (Advanced Auditing & Professional Ethics) Mock Test - IDocument18 pagesCa Final (Advanced Auditing & Professional Ethics) Mock Test - ISrinivas RevankarNo ratings yet

- Partnership FundamentalsDocument5 pagesPartnership Fundamentalsdiyadhannawat06No ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- CA Final DT Q MTP 2 May 23Document9 pagesCA Final DT Q MTP 2 May 23Mayur JoshiNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- Accounts Dec21 Suggested Answer InterDocument27 pagesAccounts Dec21 Suggested Answer InterKotadiya RonakNo ratings yet

- Answer Key Is Available Only On Grewal Conceptual Learning App' (Available On Playstore and Appstore)Document18 pagesAnswer Key Is Available Only On Grewal Conceptual Learning App' (Available On Playstore and Appstore)Royal WafersNo ratings yet

- Nov 16 AccountsDocument25 pagesNov 16 AccountsAmit RanaNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Paper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementDocument30 pagesPaper - 2: Strategic Financial Management Questions Foreign Exchange Risk ManagementNirupa ChoppaNo ratings yet

- 20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Document8 pages20CCP07/18CCP07 PSG College of Arts & Science Mcom (Ca) Degree Examination May 2021Jerry PonmaniNo ratings yet

- Corporate Accounting - IIDocument5 pagesCorporate Accounting - IIjeganrajrajNo ratings yet

- DT MT 2Document9 pagesDT MT 2RaghavanNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- MTP 11 1 Questions 1696062519Document6 pagesMTP 11 1 Questions 1696062519kabeeramitbarot96No ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Thompson Industrial Products Inc Is A DiversifiedDocument4 pagesThompson Industrial Products Inc Is A DiversifiedKailash KumarNo ratings yet

- (Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Document4 pages(Identifying The Appropriate Net Asset Classification) For Each of The Following Transactions, Identify The Net Asset Classification (Kailash KumarNo ratings yet

- Fernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Document3 pagesFernandez Corp. Invested Its Excess Cash in Available-For-Sale Securities During 2014.Kailash KumarNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Pastore Drycleaners Has Capacity To Clean UpDocument4 pagesPastore Drycleaners Has Capacity To Clean UpKailash KumarNo ratings yet

- Bracey Company Manufactures and Sells One ProductDocument2 pagesBracey Company Manufactures and Sells One ProductKailash KumarNo ratings yet

- Crane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoDocument2 pagesCrane Inc. Entered Into A Contract To Deliver One of Its Specialty Mowers To Kickapoo Landscaping CoKailash KumarNo ratings yet

- O-Level Accounting Paper 2 Topical and yDocument343 pagesO-Level Accounting Paper 2 Topical and yKailash Kumar100% (4)

- Kristen Lu Purchased A Used Automobile ForDocument1 pageKristen Lu Purchased A Used Automobile ForKailash KumarNo ratings yet

- Tristar Production Company Began Operations On SeptemberDocument2 pagesTristar Production Company Began Operations On SeptemberKailash KumarNo ratings yet

- Diamond Hardware Uses The Periodic Inventory SystemDocument7 pagesDiamond Hardware Uses The Periodic Inventory SystemKailash KumarNo ratings yet

- Paragraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Document2 pagesParagraph Blue Corporation Acquired Controlling Ownership of Sentence Skyler Corporation On December 31, 20X3, and A Consolidated Balance Sheet Was Prepared Immediately.Kailash KumarNo ratings yet

- Bethany's Bicycle CorporationDocument15 pagesBethany's Bicycle CorporationKailash Kumar100% (2)

- 2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderDocument2 pages2-13 White Company Has Two Departments Cutting and Finishing. The Company Uses A Job-OrderKailash KumarNo ratings yet

- La Femme Accessories Inc Produces Womens HandbagsDocument1 pageLa Femme Accessories Inc Produces Womens HandbagsKailash KumarNo ratings yet

- James Kimberley President of National Motors Receives A BonusDocument1 pageJames Kimberley President of National Motors Receives A BonusKailash KumarNo ratings yet

- Smith Foundry in Colomus Ohio Uses A PredeterminedDocument2 pagesSmith Foundry in Colomus Ohio Uses A PredeterminedKailash KumarNo ratings yet

- Accounting For CorporaationsDocument19 pagesAccounting For CorporaationsShaheer KhurramNo ratings yet

- TM Account XIIDocument260 pagesTM Account XIIPadma Ratna Vidya MandirNo ratings yet

- CH 2 - Investasi SahamDocument42 pagesCH 2 - Investasi SahamJulia Pratiwi ParhusipNo ratings yet

- CH 2 NotesDocument4 pagesCH 2 NotesVincent TranNo ratings yet

- New FRA ASSIGNMENT 1Document3 pagesNew FRA ASSIGNMENT 1Suraj ApexNo ratings yet

- 2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com 4th Sem SH College Autonomous March Corporate Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Company HistoryDocument5 pagesCompany HistoryElisa FlorentinoNo ratings yet

- Indian Depository ReceiptsDocument11 pagesIndian Depository Receiptsmeenakshi56100% (1)

- FM Assignment 2 FinalDocument10 pagesFM Assignment 2 Finalkj0850226No ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- CBSE Class 12 Accountancy Company Accounts Share Capital WorksheetDocument13 pagesCBSE Class 12 Accountancy Company Accounts Share Capital WorksheetJenneil CarmichaelNo ratings yet

- The Ultimate Guide For Scaling Sales and Raising Capital 100 SaaS Questions Answered V1Document105 pagesThe Ultimate Guide For Scaling Sales and Raising Capital 100 SaaS Questions Answered V1Sanket DasguptaNo ratings yet

- Ar 2015 Indopora e Reporting PDFDocument143 pagesAr 2015 Indopora e Reporting PDFTohiroh FitriNo ratings yet

- Bank Mergers PerformanceDocument19 pagesBank Mergers PerformanceLily SarriNo ratings yet

- Mindtree ISDocument6 pagesMindtree ISAswini Kumar BhuyanNo ratings yet

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Document2 pagesBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaNo ratings yet

- Villareal Vs RamirezDocument1 pageVillareal Vs RamirezCMGNo ratings yet

- Setting An Audit StrategyDocument14 pagesSetting An Audit Strategyhassanjamil123No ratings yet

- The (Un) Enforceability of Investor Rights in Indian Private EquityDocument32 pagesThe (Un) Enforceability of Investor Rights in Indian Private EquityAnurag DashNo ratings yet

- Journal Entries and Posting To T-AccountsDocument15 pagesJournal Entries and Posting To T-AccountsMary100% (6)

- Auditing MiscDocument11 pagesAuditing MiscLlyod Francis LaylayNo ratings yet

- Itc Limited: Final Project Semester-1Document34 pagesItc Limited: Final Project Semester-1pgdm 5No ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 25 PDFDocument24 pagesNism 5 A - Mutual Fund Exam - Practice Test 25 PDFmurugan dass50% (2)

- Ar Byb 2015 PDFDocument342 pagesAr Byb 2015 PDFLPI Universitas AirlanggaNo ratings yet

- Module 8 Lesson 1 Short Answer QsDocument3 pagesModule 8 Lesson 1 Short Answer QsMd IbrahimNo ratings yet

- First Philippine International Bank Vs CADocument1 pageFirst Philippine International Bank Vs CAdennis espinozaNo ratings yet