Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

61 viewsSubsequent Events: AU Section 560

Subsequent Events: AU Section 560

Uploaded by

jottoThis document discusses subsequent events that may require adjustment or disclosure in financial statements. It defines subsequent events as events or transactions that occur after the balance sheet date but before the issuance of the financial statements. The two types of subsequent events are: 1) Those providing evidence of conditions that existed at the balance sheet date that affect estimates and may require adjustment. 2) Those providing evidence that conditions did not exist at the balance sheet date but arose afterwards, which do not result in adjustment but may require disclosure if significant.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Barber Shop Business Plan ExampleDocument34 pagesBarber Shop Business Plan ExampleJoseph Quill100% (3)

- AFN 132 Homework 1Document3 pagesAFN 132 Homework 1devhan12No ratings yet

- What Are Subsequent EventsDocument3 pagesWhat Are Subsequent EventsTian TianNo ratings yet

- Advanced Accounting Full Notes 11022021 RLDocument335 pagesAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- 74704bos60485 Inter p1 cp7 U1Document13 pages74704bos60485 Inter p1 cp7 U1Just KiddingNo ratings yet

- Accounting Standards Based On Items Impacting Financial StatementsDocument13 pagesAccounting Standards Based On Items Impacting Financial StatementsphotosqueofficialNo ratings yet

- Ias 10 & 37 - 1Document4 pagesIas 10 & 37 - 1Abdullah QureshiNo ratings yet

- Advance AccountsDocument5 pagesAdvance Accountsashish.jhaa756No ratings yet

- Module 017 Week006-Finacct3 Notes To The Financial StatementsDocument5 pagesModule 017 Week006-Finacct3 Notes To The Financial Statementsman ibeNo ratings yet

- 150.events After The Reporting PeriodDocument6 pages150.events After The Reporting PeriodMelanie SamsonaNo ratings yet

- Ias 10 Events After The Reporting Period: Fact SheetDocument8 pagesIas 10 Events After The Reporting Period: Fact SheetRJNo ratings yet

- NAS 10 ICAN Revision Classes IDocument9 pagesNAS 10 ICAN Revision Classes ISujan ShresthaNo ratings yet

- Topic 5 Events After Reporting Period 4studentsDocument22 pagesTopic 5 Events After Reporting Period 4studentsputerimanggis11No ratings yet

- Accounting Standard 4: Guided By: Dr. Narshing Subash Giri (Sir)Document12 pagesAccounting Standard 4: Guided By: Dr. Narshing Subash Giri (Sir)Siddhant GaikwadNo ratings yet

- 66638bos53803 cp1Document170 pages66638bos53803 cp1417 Rachit SinglaNo ratings yet

- ACT204 S12017 Week 11 Tutorial SolutionsDocument4 pagesACT204 S12017 Week 11 Tutorial SolutionsCJNo ratings yet

- Accounting PronouncementDocument179 pagesAccounting PronouncementAbhishek KaskarNo ratings yet

- Accounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateDocument0 pagesAccounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateThéotime HabinezaNo ratings yet

- Chapter 10Document8 pagesChapter 10Mark Kenneth ParagasNo ratings yet

- Accounting Standard 4Document9 pagesAccounting Standard 4api-3828505No ratings yet

- 19.25. (Estimated Time - 25 Minutes) : Item No. Audit Procedures Required Disclosure or Entry and ReasonsDocument2 pages19.25. (Estimated Time - 25 Minutes) : Item No. Audit Procedures Required Disclosure or Entry and ReasonsMonalisa MonmonNo ratings yet

- As PDFDocument158 pagesAs PDFShivam GuptaNo ratings yet

- NAS 10 IFRS Reference NoteDocument11 pagesNAS 10 IFRS Reference NoteSujan ShresthaNo ratings yet

- AS 4 Contingencies and Events Occurring After The Balance Sheet DateDocument8 pagesAS 4 Contingencies and Events Occurring After The Balance Sheet DateChandan KumarNo ratings yet

- Chapter 3 - Events After The Reporting PeriodDocument8 pagesChapter 3 - Events After The Reporting PeriodNURKHAIRUNNISANo ratings yet

- As 2Document170 pagesAs 2Udit RajNo ratings yet

- As-4Document3 pagesAs-4Rohit ThakurNo ratings yet

- Chapter 10 Completing The AuditDocument8 pagesChapter 10 Completing The AuditKayla Sophia PatioNo ratings yet

- Tutorial Event After Reporting Period Week 7Document10 pagesTutorial Event After Reporting Period Week 7Anna RomanNo ratings yet

- Audit Week 12 Final ReviewDocument53 pagesAudit Week 12 Final ReviewBernardusNo ratings yet

- Subsequent Events Guidance COVIDDocument5 pagesSubsequent Events Guidance COVIDAniket AhireNo ratings yet

- Completing The Audit - NotesDocument8 pagesCompleting The Audit - NotesLovenia M. FerrerNo ratings yet

- Numeric Value of Nomenclature As44Document10 pagesNumeric Value of Nomenclature As44Pramad BhattacharjeeNo ratings yet

- Ias 10 Events After The Reporting Date (2021)Document8 pagesIas 10 Events After The Reporting Date (2021)Nolan TitusNo ratings yet

- 11 As 4 Event Occuring After The Balance Sheet DateDocument14 pages11 As 4 Event Occuring After The Balance Sheet DateDipen AdhikariNo ratings yet

- 15 As4Document7 pages15 As4Selvi balanNo ratings yet

- Chapter17 - AnswerDocument5 pagesChapter17 - AnswerGon FreecsNo ratings yet

- Accounting Standard (AS) 4 Contingencies and Events Occurring After The Balance Sheet DateDocument6 pagesAccounting Standard (AS) 4 Contingencies and Events Occurring After The Balance Sheet Datehiral mitaliaNo ratings yet

- LKAS 10 - Events After The Reporting Period - 1556879250 - LKAS 10 - Events After The Reporting PeriodDocument10 pagesLKAS 10 - Events After The Reporting Period - 1556879250 - LKAS 10 - Events After The Reporting PeriodSineth NeththasingheNo ratings yet

- ch24 PDFDocument23 pagesch24 PDFAlvandy PurnomoNo ratings yet

- IAS 10 Events After The Reporting Period-A Closer LookDocument7 pagesIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaNo ratings yet

- 2022 Ias 10Document4 pages2022 Ias 10gmimranhossain996No ratings yet

- ED PSAK 8 Revised 2002Document11 pagesED PSAK 8 Revised 2002low profileNo ratings yet

- Completing The AuditDocument8 pagesCompleting The AuditDeryl GalveNo ratings yet

- IAS 10 - Events After Reporting DateDocument8 pagesIAS 10 - Events After Reporting DateKhuraim Abu BakrNo ratings yet

- Pwcbankruptciesguide TrimmedDocument28 pagesPwcbankruptciesguide TrimmedSamar PratapNo ratings yet

- 01 Events After Balance Sheet DateDocument3 pages01 Events After Balance Sheet DateMd. Iqbal HasanNo ratings yet

- CA Inter (QB) - Chapter 7Document31 pagesCA Inter (QB) - Chapter 7suniljbd08No ratings yet

- Subsequent Events Definition and Relates Audit ProceduresDocument5 pagesSubsequent Events Definition and Relates Audit ProceduresAyesha RasoolNo ratings yet

- Ias 10 Events After The Reporting Period SummaryDocument2 pagesIas 10 Events After The Reporting Period Summaryanon_806011137No ratings yet

- 74889bos60524 cp4 U2Document35 pages74889bos60524 cp4 U2Bala Guru Prasad TadikamallaNo ratings yet

- Ias 10Document12 pagesIas 10Reever RiverNo ratings yet

- Objective: Session 29 - Ias 10 Events After The Reporting PeriodDocument4 pagesObjective: Session 29 - Ias 10 Events After The Reporting PeriodZohair HumayunNo ratings yet

- As 4Document4 pagesAs 4abhishekkapse654No ratings yet

- Fa 3 Chapter 5 Events After The Reporting PeriodDocument6 pagesFa 3 Chapter 5 Events After The Reporting PeriodKristine Florence TolentinoNo ratings yet

- Ind As 10Document13 pagesInd As 10mohd52No ratings yet

- NAS 10 - SummaryDocument2 pagesNAS 10 - Summarysitoulamanish100No ratings yet

- Audit Review PSA 560 Subsequent EventsDocument2 pagesAudit Review PSA 560 Subsequent Eventsetackenneth961No ratings yet

- MPRA Paper 36783Document8 pagesMPRA Paper 36783ksmuthupandian2098No ratings yet

- IAS 10 Group 5 - WPS OfficeDocument2 pagesIAS 10 Group 5 - WPS OfficeIfyNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- M.B.A. CbcsDocument189 pagesM.B.A. CbcsMir AijazNo ratings yet

- MGT 101 100% GuessDocument9 pagesMGT 101 100% GuessBint e HawaNo ratings yet

- Harvard Financial Report 2011Document47 pagesHarvard Financial Report 2011Akif MalikNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Ind - Ass.CF I ProblemsDocument3 pagesInd - Ass.CF I ProblemsNop SopheaNo ratings yet

- Synopsis-BBA Project - KIRAN NAINWAR 1Document10 pagesSynopsis-BBA Project - KIRAN NAINWAR 1Kiran NainwarNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- Double Entry Book Keeping System Class 12 AccountDocument11 pagesDouble Entry Book Keeping System Class 12 AccountDixit PhuyalNo ratings yet

- Working Capital ManagementDocument98 pagesWorking Capital ManagementGanesh PatashalaNo ratings yet

- The Four Financial StatementsDocument3 pagesThe Four Financial Statementsmuhammadtaimoorkhan100% (3)

- Pcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureDocument15 pagesPcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureErika EsguerraNo ratings yet

- Ffs Material 1Document7 pagesFfs Material 1jaydeep kriplaniNo ratings yet

- 2017 May Exam SolutionDocument9 pages2017 May Exam SolutionSimbarashe MupfupiNo ratings yet

- Earnings Before Interest and TaxesDocument3 pagesEarnings Before Interest and TaxesBOBBY212No ratings yet

- LiabilitiesDocument37 pagesLiabilitiesJamil RiveraNo ratings yet

- Accounting Information System For BZ MilkteaDocument66 pagesAccounting Information System For BZ Milkteajames medinaNo ratings yet

- Annual Report Sikkim UniversityDocument54 pagesAnnual Report Sikkim UniversityAnirban LahiriNo ratings yet

- Salon de Elegance FinalDocument35 pagesSalon de Elegance FinalRon Benlheo OpolintoNo ratings yet

- Advanced Financial Accounting and ReportingDocument7 pagesAdvanced Financial Accounting and ReportingMark Domingo MendozaNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupebi ayatNo ratings yet

- Pop 6Document30 pagesPop 6josh cruzNo ratings yet

- V. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesDocument3 pagesV. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesYuri Anne MasangkayNo ratings yet

- Pse Anrpt2010Document59 pagesPse Anrpt2010John Paul Samuel ChuaNo ratings yet

- CBSE Class 12 Accountancy Financial Statements of Company PDFDocument10 pagesCBSE Class 12 Accountancy Financial Statements of Company PDFishita gargNo ratings yet

- Module 2 - Business Transaction and Their Analysis Part 2Document9 pagesModule 2 - Business Transaction and Their Analysis Part 21BSA5-ABM Espiritu, CharlesNo ratings yet

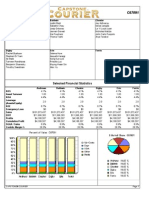

- Capstone Round 0 ReportDocument16 pagesCapstone Round 0 Reportcricket1223100% (1)

- Accounting Principles: Second Canadian EditionDocument47 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Work Sheet Questions For Accounting & Finance For ManagersDocument8 pagesWork Sheet Questions For Accounting & Finance For Managersabdoahmednur2No ratings yet

Subsequent Events: AU Section 560

Subsequent Events: AU Section 560

Uploaded by

jotto100%(1)100% found this document useful (1 vote)

61 views1 pageThis document discusses subsequent events that may require adjustment or disclosure in financial statements. It defines subsequent events as events or transactions that occur after the balance sheet date but before the issuance of the financial statements. The two types of subsequent events are: 1) Those providing evidence of conditions that existed at the balance sheet date that affect estimates and may require adjustment. 2) Those providing evidence that conditions did not exist at the balance sheet date but arose afterwards, which do not result in adjustment but may require disclosure if significant.

Original Description:

Original Title

560 03

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses subsequent events that may require adjustment or disclosure in financial statements. It defines subsequent events as events or transactions that occur after the balance sheet date but before the issuance of the financial statements. The two types of subsequent events are: 1) Those providing evidence of conditions that existed at the balance sheet date that affect estimates and may require adjustment. 2) Those providing evidence that conditions did not exist at the balance sheet date but arose afterwards, which do not result in adjustment but may require disclosure if significant.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

61 views1 pageSubsequent Events: AU Section 560

Subsequent Events: AU Section 560

Uploaded by

jottoThis document discusses subsequent events that may require adjustment or disclosure in financial statements. It defines subsequent events as events or transactions that occur after the balance sheet date but before the issuance of the financial statements. The two types of subsequent events are: 1) Those providing evidence of conditions that existed at the balance sheet date that affect estimates and may require adjustment. 2) Those providing evidence that conditions did not exist at the balance sheet date but arose afterwards, which do not result in adjustment but may require disclosure if significant.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

P1: JsY

AICP034-p865-982 AICPA034-PS.cls June 30, 2006 11:12

Subsequent Events 961

AU Section 560

Subsequent Events

Source: SAS No. 1, section 560; SAS No. 12; SAS No. 98.

Issue date, unless otherwise indicated: November, 1972.

.01 An independent auditor's report ordinarily is issued in connection

with historical financial statements that purport to present financial position

at a stated date and results of operations and cash flows for a period ended

on that date. However, events or transactions sometimes occur subsequent to

the balance-sheet date, but prior to the issuance of the financial statements,

that have a material effect on the financial statements and therefore require

adjustment or disclosure in the statements. These occurrences hereinafter are

referred to as "subsequent events." [As amended, effective September 2002, by

Statement on Auditing Standards No. 98.]

.02 Two types of subsequent events require consideration by management

and evaluation by the independent auditor.

.03 The first type consists of those events that provide additional evidence

with respect to conditions that existed at the date of the balance sheet and

affect the estimates inherent in the process of preparing financial statements.

All information that becomes available prior to the issuance of the financial

statements should be used by management in its evaluation of the conditions

on which the estimates were based. The financial statements should be adjusted

for any changes in estimates resulting from the use of such evidence.

.04 Identifying events that require adjustment of the financial statements

under the criteria stated above calls for the exercise of judgment and knowl-

edge of the facts and circumstances. For example, a loss on an uncollectible trade

account receivable as a result of a customer's deteriorating financial condition

leading to bankruptcy subsequent to the balance-sheet date would be indicative

of conditions existing at the balance-sheet date, thereby calling for adjustment

of the financial statements before their issuance. On the other hand, a similar

loss resulting from a customer's major casualty such as a fire or flood subse-

quent to the balance-sheet date would not be indicative of conditions existing

at the balance-sheet date and adjustment of the financial statements would

not be appropriate. The settlement of litigation for an amount different from

the liability recorded in the accounts would require adjustment of the financial

statements if the events, such as personal injury or patent infringement, that

gave rise to the litigation had taken place prior to the balance-sheet date.

.05 The second type consists of those events that provide evidence with

respect to conditions that did not exist at the date of the balance sheet being

reported on but arose subsequent to that date. These events should not re-

sult in adjustment of the financial statements.1 Some of these events, however,

may be of such a nature that disclosure of them is required to keep the finan-

cial statements from being misleading. Occasionally such an event may be so

significant that disclosure can best be made by supplementing the historical

1

This paragraph is not intended to preclude giving effect in the balance sheet, with appropriate

disclosure, to stock dividends or stock splits or reverse splits consummated after the balance-sheet

date but before issuance of the financial statements.

AU §560.05

You might also like

- Barber Shop Business Plan ExampleDocument34 pagesBarber Shop Business Plan ExampleJoseph Quill100% (3)

- AFN 132 Homework 1Document3 pagesAFN 132 Homework 1devhan12No ratings yet

- What Are Subsequent EventsDocument3 pagesWhat Are Subsequent EventsTian TianNo ratings yet

- Advanced Accounting Full Notes 11022021 RLDocument335 pagesAdvanced Accounting Full Notes 11022021 RLSivapriya Kamat100% (1)

- 74704bos60485 Inter p1 cp7 U1Document13 pages74704bos60485 Inter p1 cp7 U1Just KiddingNo ratings yet

- Accounting Standards Based On Items Impacting Financial StatementsDocument13 pagesAccounting Standards Based On Items Impacting Financial StatementsphotosqueofficialNo ratings yet

- Ias 10 & 37 - 1Document4 pagesIas 10 & 37 - 1Abdullah QureshiNo ratings yet

- Advance AccountsDocument5 pagesAdvance Accountsashish.jhaa756No ratings yet

- Module 017 Week006-Finacct3 Notes To The Financial StatementsDocument5 pagesModule 017 Week006-Finacct3 Notes To The Financial Statementsman ibeNo ratings yet

- 150.events After The Reporting PeriodDocument6 pages150.events After The Reporting PeriodMelanie SamsonaNo ratings yet

- Ias 10 Events After The Reporting Period: Fact SheetDocument8 pagesIas 10 Events After The Reporting Period: Fact SheetRJNo ratings yet

- NAS 10 ICAN Revision Classes IDocument9 pagesNAS 10 ICAN Revision Classes ISujan ShresthaNo ratings yet

- Topic 5 Events After Reporting Period 4studentsDocument22 pagesTopic 5 Events After Reporting Period 4studentsputerimanggis11No ratings yet

- Accounting Standard 4: Guided By: Dr. Narshing Subash Giri (Sir)Document12 pagesAccounting Standard 4: Guided By: Dr. Narshing Subash Giri (Sir)Siddhant GaikwadNo ratings yet

- 66638bos53803 cp1Document170 pages66638bos53803 cp1417 Rachit SinglaNo ratings yet

- ACT204 S12017 Week 11 Tutorial SolutionsDocument4 pagesACT204 S12017 Week 11 Tutorial SolutionsCJNo ratings yet

- Accounting PronouncementDocument179 pagesAccounting PronouncementAbhishek KaskarNo ratings yet

- Accounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateDocument0 pagesAccounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateThéotime HabinezaNo ratings yet

- Chapter 10Document8 pagesChapter 10Mark Kenneth ParagasNo ratings yet

- Accounting Standard 4Document9 pagesAccounting Standard 4api-3828505No ratings yet

- 19.25. (Estimated Time - 25 Minutes) : Item No. Audit Procedures Required Disclosure or Entry and ReasonsDocument2 pages19.25. (Estimated Time - 25 Minutes) : Item No. Audit Procedures Required Disclosure or Entry and ReasonsMonalisa MonmonNo ratings yet

- As PDFDocument158 pagesAs PDFShivam GuptaNo ratings yet

- NAS 10 IFRS Reference NoteDocument11 pagesNAS 10 IFRS Reference NoteSujan ShresthaNo ratings yet

- AS 4 Contingencies and Events Occurring After The Balance Sheet DateDocument8 pagesAS 4 Contingencies and Events Occurring After The Balance Sheet DateChandan KumarNo ratings yet

- Chapter 3 - Events After The Reporting PeriodDocument8 pagesChapter 3 - Events After The Reporting PeriodNURKHAIRUNNISANo ratings yet

- As 2Document170 pagesAs 2Udit RajNo ratings yet

- As-4Document3 pagesAs-4Rohit ThakurNo ratings yet

- Chapter 10 Completing The AuditDocument8 pagesChapter 10 Completing The AuditKayla Sophia PatioNo ratings yet

- Tutorial Event After Reporting Period Week 7Document10 pagesTutorial Event After Reporting Period Week 7Anna RomanNo ratings yet

- Audit Week 12 Final ReviewDocument53 pagesAudit Week 12 Final ReviewBernardusNo ratings yet

- Subsequent Events Guidance COVIDDocument5 pagesSubsequent Events Guidance COVIDAniket AhireNo ratings yet

- Completing The Audit - NotesDocument8 pagesCompleting The Audit - NotesLovenia M. FerrerNo ratings yet

- Numeric Value of Nomenclature As44Document10 pagesNumeric Value of Nomenclature As44Pramad BhattacharjeeNo ratings yet

- Ias 10 Events After The Reporting Date (2021)Document8 pagesIas 10 Events After The Reporting Date (2021)Nolan TitusNo ratings yet

- 11 As 4 Event Occuring After The Balance Sheet DateDocument14 pages11 As 4 Event Occuring After The Balance Sheet DateDipen AdhikariNo ratings yet

- 15 As4Document7 pages15 As4Selvi balanNo ratings yet

- Chapter17 - AnswerDocument5 pagesChapter17 - AnswerGon FreecsNo ratings yet

- Accounting Standard (AS) 4 Contingencies and Events Occurring After The Balance Sheet DateDocument6 pagesAccounting Standard (AS) 4 Contingencies and Events Occurring After The Balance Sheet Datehiral mitaliaNo ratings yet

- LKAS 10 - Events After The Reporting Period - 1556879250 - LKAS 10 - Events After The Reporting PeriodDocument10 pagesLKAS 10 - Events After The Reporting Period - 1556879250 - LKAS 10 - Events After The Reporting PeriodSineth NeththasingheNo ratings yet

- ch24 PDFDocument23 pagesch24 PDFAlvandy PurnomoNo ratings yet

- IAS 10 Events After The Reporting Period-A Closer LookDocument7 pagesIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaNo ratings yet

- 2022 Ias 10Document4 pages2022 Ias 10gmimranhossain996No ratings yet

- ED PSAK 8 Revised 2002Document11 pagesED PSAK 8 Revised 2002low profileNo ratings yet

- Completing The AuditDocument8 pagesCompleting The AuditDeryl GalveNo ratings yet

- IAS 10 - Events After Reporting DateDocument8 pagesIAS 10 - Events After Reporting DateKhuraim Abu BakrNo ratings yet

- Pwcbankruptciesguide TrimmedDocument28 pagesPwcbankruptciesguide TrimmedSamar PratapNo ratings yet

- 01 Events After Balance Sheet DateDocument3 pages01 Events After Balance Sheet DateMd. Iqbal HasanNo ratings yet

- CA Inter (QB) - Chapter 7Document31 pagesCA Inter (QB) - Chapter 7suniljbd08No ratings yet

- Subsequent Events Definition and Relates Audit ProceduresDocument5 pagesSubsequent Events Definition and Relates Audit ProceduresAyesha RasoolNo ratings yet

- Ias 10 Events After The Reporting Period SummaryDocument2 pagesIas 10 Events After The Reporting Period Summaryanon_806011137No ratings yet

- 74889bos60524 cp4 U2Document35 pages74889bos60524 cp4 U2Bala Guru Prasad TadikamallaNo ratings yet

- Ias 10Document12 pagesIas 10Reever RiverNo ratings yet

- Objective: Session 29 - Ias 10 Events After The Reporting PeriodDocument4 pagesObjective: Session 29 - Ias 10 Events After The Reporting PeriodZohair HumayunNo ratings yet

- As 4Document4 pagesAs 4abhishekkapse654No ratings yet

- Fa 3 Chapter 5 Events After The Reporting PeriodDocument6 pagesFa 3 Chapter 5 Events After The Reporting PeriodKristine Florence TolentinoNo ratings yet

- Ind As 10Document13 pagesInd As 10mohd52No ratings yet

- NAS 10 - SummaryDocument2 pagesNAS 10 - Summarysitoulamanish100No ratings yet

- Audit Review PSA 560 Subsequent EventsDocument2 pagesAudit Review PSA 560 Subsequent Eventsetackenneth961No ratings yet

- MPRA Paper 36783Document8 pagesMPRA Paper 36783ksmuthupandian2098No ratings yet

- IAS 10 Group 5 - WPS OfficeDocument2 pagesIAS 10 Group 5 - WPS OfficeIfyNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- M.B.A. CbcsDocument189 pagesM.B.A. CbcsMir AijazNo ratings yet

- MGT 101 100% GuessDocument9 pagesMGT 101 100% GuessBint e HawaNo ratings yet

- Harvard Financial Report 2011Document47 pagesHarvard Financial Report 2011Akif MalikNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Ind - Ass.CF I ProblemsDocument3 pagesInd - Ass.CF I ProblemsNop SopheaNo ratings yet

- Synopsis-BBA Project - KIRAN NAINWAR 1Document10 pagesSynopsis-BBA Project - KIRAN NAINWAR 1Kiran NainwarNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- Double Entry Book Keeping System Class 12 AccountDocument11 pagesDouble Entry Book Keeping System Class 12 AccountDixit PhuyalNo ratings yet

- Working Capital ManagementDocument98 pagesWorking Capital ManagementGanesh PatashalaNo ratings yet

- The Four Financial StatementsDocument3 pagesThe Four Financial Statementsmuhammadtaimoorkhan100% (3)

- Pcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureDocument15 pagesPcoa 008 - Intermediate Accounting Ii MODULE 5: Debt RestructureErika EsguerraNo ratings yet

- Ffs Material 1Document7 pagesFfs Material 1jaydeep kriplaniNo ratings yet

- 2017 May Exam SolutionDocument9 pages2017 May Exam SolutionSimbarashe MupfupiNo ratings yet

- Earnings Before Interest and TaxesDocument3 pagesEarnings Before Interest and TaxesBOBBY212No ratings yet

- LiabilitiesDocument37 pagesLiabilitiesJamil RiveraNo ratings yet

- Accounting Information System For BZ MilkteaDocument66 pagesAccounting Information System For BZ Milkteajames medinaNo ratings yet

- Annual Report Sikkim UniversityDocument54 pagesAnnual Report Sikkim UniversityAnirban LahiriNo ratings yet

- Salon de Elegance FinalDocument35 pagesSalon de Elegance FinalRon Benlheo OpolintoNo ratings yet

- Advanced Financial Accounting and ReportingDocument7 pagesAdvanced Financial Accounting and ReportingMark Domingo MendozaNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupebi ayatNo ratings yet

- Pop 6Document30 pagesPop 6josh cruzNo ratings yet

- V. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesDocument3 pagesV. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesYuri Anne MasangkayNo ratings yet

- Pse Anrpt2010Document59 pagesPse Anrpt2010John Paul Samuel ChuaNo ratings yet

- CBSE Class 12 Accountancy Financial Statements of Company PDFDocument10 pagesCBSE Class 12 Accountancy Financial Statements of Company PDFishita gargNo ratings yet

- Module 2 - Business Transaction and Their Analysis Part 2Document9 pagesModule 2 - Business Transaction and Their Analysis Part 21BSA5-ABM Espiritu, CharlesNo ratings yet

- Capstone Round 0 ReportDocument16 pagesCapstone Round 0 Reportcricket1223100% (1)

- Accounting Principles: Second Canadian EditionDocument47 pagesAccounting Principles: Second Canadian EditionEshetieNo ratings yet

- Work Sheet Questions For Accounting & Finance For ManagersDocument8 pagesWork Sheet Questions For Accounting & Finance For Managersabdoahmednur2No ratings yet