Professional Documents

Culture Documents

Gross Profit Sales Revenue 100 %

Gross Profit Sales Revenue 100 %

Uploaded by

ErikasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gross Profit Sales Revenue 100 %

Gross Profit Sales Revenue 100 %

Uploaded by

ErikasCopyright:

Available Formats

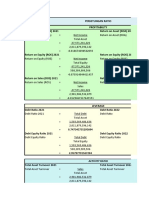

2015 2014

Gross Profit Margin

Gross profit 2972 2800

*100 % = 56.89 *100 % = 60.60

Sales Revenue * 100 % 5224 4620

Operating Profit Margin

Operating profit 855 861

*100 % = 16.94 *100 % = 18.63

Sales Revenue * 100 % 5224 4620

ity bil ta ofi Pr

ROSF

Net profit per year 484 513

*100 % = 19.99 *100 % = 23.13

Ordinary Shares Capital+ Reserves * 2421 2217

100 %

ROCE

885 861

*100 % = 16.32 *100 % = 20.43

Operating profit 2421 +300 2217 + 200

Share Capital+ Reserves+ Non Current Liabilities

* 100 %

Efficiency

2015 2014

Average Inventories turnover period

216 176

* 365 days = 35.01 *365 days = 35.2

Average Inventory 2252 1820

Cost of Sales * 365 days

Average Settlement period for trade 214 138

* 365 days = 33.9 * 365 days = 27.19

payables 2.300 1.852

Trade payables

365 days

Credit Purchase

Average Settlement period for trade 1.082 608

*365 days = 75.5 * 365 days = 48.03

receivables 5.224 4.620

Trade Receivables

Credit Sales Revenue * 365 days

Net Asset Turnover

Sales Revenue 5.224 4.620

= 0.96 = 1.095

660 + 1.761 + 3000

Share Capital+ Reserves+ Non Current Liabilities 600 + 1.617 + 2000

2015 2014

Current Ratio

Current Assets 1.334 1.325

=2.3 =5.96

Current Liabilities 572 222

Liquidity

Acid test Ratio

Current Assets ( Ex c luding Inventories ) 1.082+12 608+ 525

=1.91 =5.103

Current Liabilities 572 222

Gering Ratio

3000 2000

100 =55.3 100 =47. 4

NonCurrent Liabil i ties 660+ 1.761+3000 600+ 1.617+2000

Share Capital+ Reserves+ Non Current Liabilities

* 100%

Gearing

Internal Cover Ratio

Operating Profit 885 861

=3.672 =5.97 9

Interest Payable 241 144

You might also like

- Trading Plan TemplateDocument1 pageTrading Plan Templateivan hernandez83% (6)

- Coca Cola FsDocument5 pagesCoca Cola FsDanah Jane GarciaNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 7Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- Coca-Cola Working-From Sagar - PGPFIN StudentDocument23 pagesCoca-Cola Working-From Sagar - PGPFIN StudentAshutosh TulsyanNo ratings yet

- HEINEKENDocument26 pagesHEINEKENKana jillaNo ratings yet

- Bachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusDocument34 pagesBachelor of Business Management (Hons) Finance: Universiti Teknologi MARA, Melaka City CampusPuteri Nina100% (1)

- Excel Case Lady MDocument10 pagesExcel Case Lady MSayan BiswasNo ratings yet

- Industrial Internship Program: FinlaticsDocument7 pagesIndustrial Internship Program: FinlaticsRevanth GupthaNo ratings yet

- Harrison FA IFRS 11e CH12 SM Class PDFDocument9 pagesHarrison FA IFRS 11e CH12 SM Class PDFtest testNo ratings yet

- Marriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703Document3 pagesMarriott Corporation (A) Harvard Business School Case 9-394-085 Courseware 9-307-703CH NAIR100% (1)

- Quality Footwear Limited - Docx. Erikas Bacevicius.B00692176Document9 pagesQuality Footwear Limited - Docx. Erikas Bacevicius.B00692176ErikasNo ratings yet

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- 4 RatiosDocument6 pages4 RatiosJomar VillenaNo ratings yet

- The Du Pont System of The Analysis of Return Ratios: Applied To Sears, Roebuck & CoDocument5 pagesThe Du Pont System of The Analysis of Return Ratios: Applied To Sears, Roebuck & CoGraceYeeNo ratings yet

- Week 6 Assignment FNCE UCWDocument1 pageWeek 6 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Group 07Document29 pagesGroup 07dilshanindika1998No ratings yet

- Confidence Cement LTD Financial Ratios For The Years 2016 & 2017Document2 pagesConfidence Cement LTD Financial Ratios For The Years 2016 & 2017Bishal SahaNo ratings yet

- Desi Angelika AP w3Document11 pagesDesi Angelika AP w3DESI ANGELIKANo ratings yet

- PBCC ActivitiesDocument25 pagesPBCC ActivitiesykwaiNo ratings yet

- XLS EngDocument7 pagesXLS Engmariaj.hernandezNo ratings yet

- Strategic Financial ManagementDocument8 pagesStrategic Financial ManagementAbrarul HassanNo ratings yet

- Hi Growth FixedDocument36 pagesHi Growth FixedVikram GulatiNo ratings yet

- Ratio Formula Computation Result InterpretationDocument2 pagesRatio Formula Computation Result InterpretationAleya MonteverdeNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Letter To Shareholders: 667 Madison Ave. New York, NY 10065Document20 pagesLetter To Shareholders: 667 Madison Ave. New York, NY 10065Michael Cano LombardoNo ratings yet

- BUSI 2505 Assignment 1Document8 pagesBUSI 2505 Assignment 1Mona GreenNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Ratio AnalysisDocument17 pagesRatio Analysisdora76pataNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Document307 pagesAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNo ratings yet

- PNC Annual RPT 2020 LowresDocument229 pagesPNC Annual RPT 2020 LowresShehani ThilakshikaNo ratings yet

- III Practice of Horizontal & Verticle Analysis Activity IIIDocument8 pagesIII Practice of Horizontal & Verticle Analysis Activity IIIZarish AzharNo ratings yet

- III Practice of Horizontal & Verticle Analysis Activity IIIDocument8 pagesIII Practice of Horizontal & Verticle Analysis Activity IIIZarish AzharNo ratings yet

- Net Present Value and Other Investment Criteria: Chapter OrganizationDocument29 pagesNet Present Value and Other Investment Criteria: Chapter OrganizationTereraishe ChanakiraNo ratings yet

- Accounting NSC P1 MEMO May June 2023 Eng Eastern CapeDocument13 pagesAccounting NSC P1 MEMO May June 2023 Eng Eastern CapebsamashabaneNo ratings yet

- Interpretation of Final Accounts: Ratio AnalysisDocument25 pagesInterpretation of Final Accounts: Ratio AnalysisNguyễn Hạnh LinhNo ratings yet

- Individual Assignment 3 Part 2Document13 pagesIndividual Assignment 3 Part 2211124022108No ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosHira SiddiqueNo ratings yet

- RUE Hread TD: Ompany AckgroundDocument3 pagesRUE Hread TD: Ompany AckgroundAthulya SanthoshNo ratings yet

- Account AssgnDocument19 pagesAccount AssgnShuvs GoneNo ratings yet

- Sample Assignment UiTM Student PDFDocument319 pagesSample Assignment UiTM Student PDFZul HashimNo ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Problem Set - Week 4 - SolutionsDocument5 pagesProblem Set - Week 4 - SolutionsShravan DeshmukhNo ratings yet

- FA2 AssignmentDocument69 pagesFA2 AssignmentWilliam Lee j. jNo ratings yet

- Basic of FinanceDocument5 pagesBasic of FinanceKanitha MuniandyNo ratings yet

- Coca-Cola Residual Income Valuation TemplateDocument8 pagesCoca-Cola Residual Income Valuation TemplateAman TaterNo ratings yet

- Homework1 - K32 - Madrazo, JayannDocument5 pagesHomework1 - K32 - Madrazo, JayannJayann Danielle MadrazoNo ratings yet

- DBA401 - CS221051: Balance Sheet AssetsDocument10 pagesDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- Finance Quiz 3Document43 pagesFinance Quiz 3Peak ChindapolNo ratings yet

- ACCOUNTING P1 GR12 MEMO JUNE 2023 - EnglishDocument12 pagesACCOUNTING P1 GR12 MEMO JUNE 2023 - Englishfanelenzima03No ratings yet

- You Exec - Financial Statements FreeDocument13 pagesYou Exec - Financial Statements Freesk.propsearchNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- FY Financial Report 2022Document107 pagesFY Financial Report 2022satkiratd24No ratings yet

- 2) Integrating Statements PDFDocument8 pages2) Integrating Statements PDFAkshit SoniNo ratings yet

- Stanley Gibbons Group PLCDocument2 pagesStanley Gibbons Group PLCImran WarsiNo ratings yet

- 2022 KZN June P1 Memo 2Document8 pages2022 KZN June P1 Memo 2shandren19No ratings yet

- LBS 2017Document7 pagesLBS 2017Wan Mohd Khairil Wan IbrahimNo ratings yet

- Chapter 1Document27 pagesChapter 1Eldar AlizadeNo ratings yet

- Review Assignment 2023 1Document11 pagesReview Assignment 2023 1An NguyenNo ratings yet

- Horana Plantation Ratio Analysis - Accounting AssignmentDocument7 pagesHorana Plantation Ratio Analysis - Accounting AssignmentNuwani ManasingheNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Report For The Directors of Glan NI Cheese LTDDocument17 pagesReport For The Directors of Glan NI Cheese LTDErikasNo ratings yet

- Report For The Directors of Glan NI Cheese LTDDocument17 pagesReport For The Directors of Glan NI Cheese LTDErikasNo ratings yet

- Presentation IKEADocument10 pagesPresentation IKEAErikasNo ratings yet

- APT Sungard ModelDocument4 pagesAPT Sungard ModelFabio PolpettiniNo ratings yet

- Triangle Chart Patterns and Day Trading StrategiesDocument10 pagesTriangle Chart Patterns and Day Trading Strategiespeeyush24No ratings yet

- Y N - Securities Law: Asay OtesDocument10 pagesY N - Securities Law: Asay OtesBrandon BeachNo ratings yet

- MCM Tutorial 2Document3 pagesMCM Tutorial 2SHU WAN TEHNo ratings yet

- Analisa Rasio Keuangan Terhadap Kinerja Bank Umum Di IndonesiaDocument9 pagesAnalisa Rasio Keuangan Terhadap Kinerja Bank Umum Di IndonesiaAni SafiraNo ratings yet

- Cds Guidelines RBIDocument14 pagesCds Guidelines RBIJaiprakash ToshniwalNo ratings yet

- Project On Investment BankingDocument66 pagesProject On Investment BankingRaveena Rane0% (1)

- L5 Financial PlansDocument55 pagesL5 Financial Plansfairylucas708No ratings yet

- 巴倫週刊 (Barrons) 2022 11 28Document78 pages巴倫週刊 (Barrons) 2022 11 28YuenNo ratings yet

- Assignment #1 Questions ONLY (ISpace)Document4 pagesAssignment #1 Questions ONLY (ISpace)ziqingyeNo ratings yet

- Pricing Strategy Chapter 2 2Document16 pagesPricing Strategy Chapter 2 2Elmer John BallonNo ratings yet

- Pemi Additional FormDocument1 pagePemi Additional FormJun GomezNo ratings yet

- Trading and Hedging OptionsDocument35 pagesTrading and Hedging Optionsnaimabdullah275% (4)

- Comparative Analysis of Unit Linked Insurance Plans and Mutual Funds (Max - Newyork)Document105 pagesComparative Analysis of Unit Linked Insurance Plans and Mutual Funds (Max - Newyork)Nitendra Singh100% (5)

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument14 pagesSol. Man. - Chapter 16 - Accounting For DividendscpawannabeNo ratings yet

- Warren Buffet CaseDocument4 pagesWarren Buffet Casetania shaheenNo ratings yet

- Gold Pecker Setup GuideDocument2 pagesGold Pecker Setup GuidegaminNo ratings yet

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Stock - ExcercisesDocument2 pagesStock - ExcercisesThùy LinhNo ratings yet

- CapmDocument3 pagesCapmTalha SiddiquiNo ratings yet

- IBDRoadmap PDFDocument7 pagesIBDRoadmap PDFPavitraNo ratings yet

- Structured Products Nov 2019 EIBSDocument38 pagesStructured Products Nov 2019 EIBSAli AkberNo ratings yet

- International Finance Chapter 7 Part 1Document11 pagesInternational Finance Chapter 7 Part 1Rohil ChitrakarNo ratings yet

- Amity Global Business School, Amity University: A Dissertation Project Report ON Competitive Advantage of Icici DirectDocument68 pagesAmity Global Business School, Amity University: A Dissertation Project Report ON Competitive Advantage of Icici Directthakurankit212100% (1)

- SBI and ABCD of Customer RetentionDocument3 pagesSBI and ABCD of Customer RetentionDynamic LevelsNo ratings yet

- Karachi Stock ExchangeDocument23 pagesKarachi Stock Exchangekhurrams603572No ratings yet

- WAC11 2018 JAN A2 QP AB RemovedDocument13 pagesWAC11 2018 JAN A2 QP AB RemovedSharen HariNo ratings yet