Professional Documents

Culture Documents

Westpack JUL 21 Mornng Report

Westpack JUL 21 Mornng Report

Uploaded by

Miir ViirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Westpack JUL 21 Mornng Report

Westpack JUL 21 Mornng Report

Uploaded by

Miir ViirCopyright:

Available Formats

Wednesday 21 July 2010

Morning Report

Foreign Exchange Market News and views

Previous Range Today’s Open Expected US equities were initially stung by weak US housing starts and a

Asia Overnight 8.00am NZD cross Range Today disappointing Goldman Sachs earnings report, the S&P500 gapping lower

NZD 0.7046-0.7130 0.7079-0.7161 Ï0.7158 0.7100-0.7200

at the physical open but rebounding thereafter to be up 1.1% currently. The

rebound was attributed to rumours the Fed may embark on a new quantitative

AUD 0.8668-0.8786 0.8712-0.8835 Ï0.8833 Ð0.8104 0.8760-0.8860 easing program by reducing the interest payment on excess reserves from 25bp

JPY 86.66-87.19 86.70-87.32 Ï87.48 Ï62.62 87.00-88.00 to zero, effectively channeling those funds into the market. CNBC later quashed

EUR 1.2927-1.2975 1.2839-1.3029 Ð1.2889 Ï0.5554 1.2840-1.2940

the rumour. Commodities are little changed overall, although fast movers

oil (+1.2%) and copper (2.6%) outperformed after equities turned. US 10yr

GBP 1.5212-1.5270 1.5154-1.5310 Ï1.5274 Ï0.4686 1.5220-1.5320 treasuries are unchanged on the day at 2.95%, although they did reach a yield

low of 2.89% in line with the early equities weakness.

NZ Domestic Market (Previous day’s closing rates) Commodity currencies outperformed on the day. The US dollar index is little

Cash Curve Govt Stock Swap Rates (Qtrly) changed having gained during equities’ weakness and softened on the later

Cash 2.75% Nov-11 3.77% 1 Year 3.81% bounce. EUR peaked around the Sydney close at 1.3029 and plunged to 1.2839

2 Years 4.22%

before risk appetite stabilized it around 1.2900. USD/JPY rose from the 0.8700

30 Days 2.97% Apr-13 4.26% area to 87.50. CAD is a cent stronger on the day at 1.0480, and formed a bullish

3 Years 4.47%

60 Days 3.08% outside day despite the earlier 40 pip selloff on the Bank of Canada’s growth

Apr-15 4.72% 4 Years 4.66%

90 Days 3.23% downgrade accompanying its widely expected 25bp hike to 0.75%.

5 Years 4.81%

Dec-17 5.13% Outperformer AUD left Sydney around 0.8800 and declined to 0.8713 until risk

180 Days 3.44% 7 Years 5.08%

1 Year 3.77% May-21 5.38% 10 Years 5.35%

markets turned, currently at the day’s high of 0.8839.

NZD fell to 0.7080 but followed sentiment higher to 0.7164. AUD/NZD nudged

World Bourses and Indices higher from 1.2300 to 1.2350.

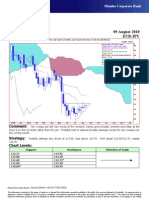

AUD USD US housing starts fall 5.0% in June, beyond market expectations for a 2%

Cash 4.50% 0.00 Fed Funds 0.00-0.25% fall but not as far as Westpac’s expectations of -8%. Markets were expecting a

90 Day 4.84% -0.01 3 Mth Libor 0.51% -0.01 fall in housing starts, following the end of the tax credit earlier this year. The fall

3 Year Bond 4.73% +0.12 10 Year Notes 2.95% -0.02 hasn’t been in line with home sales, and we anticipate further weakness into the

10 Year Bond 5.23% +0.11 30 Year Bonds 3.98% -0.01 summer months.

UK public sector net borrowing £14.5bn for June. After improving relative to

NZX 50 2995.4 +30.8 CRB 261.5 +0.3 analyst’ forecasts over the past two months, the June figures exceeded market

S&P/ASX200 4403.6 +45.3 Gold 1191.7 +8.3 expectations of £13.0bn. The May figures were also pulled higher from £16.0bn

Nikkei 9300.5 -107.9 Copper Fut. 299.95 +6.05 to £17.1bn but after adjusting for monthly gyrations the trend of greater monthly

FT100 5139.5 -8.8 Oil (WTI) 77.30 +0.79 borrowing requirements looks to have steadied.

S&P500 1082.2 +10.9 NZ TWI 67.33 +0.80

UK mortgage approvals fell to 48k from 51k in June. Mortgage approvals

eased relative to market expectations and there has been no growth in approvals

Upcoming Events for all of 2010. That said, monthly approvals remain elevated relative to their

Date Country Release Last Forecast trough of 35k in January 2009.

21 Jul NZ Jun External Migration Ann. 17,970 16,900 Bank of Canada raises overnight lending rate by 25bps to 0.75%, as

Jun Credit Card Transactions s.a. 1.9% – expected. The decision was not contentious for the markets yet the related

Aus May Leading Index, ann’lsd 7.6% – statement may have been a surprise to some. The BoC statement was less

US Fed’s Bernanke semi-annual testimony hawkish in tone than in April – it noted that the domestic economic recovery was

UK BoE MPC Minutes ‘more gradual’ than was expected at the April review and pointed to rebuilding

Can May Wholesale Sales –0.3% 0.4% of balance sheets as reasons for a slower global growth. The BoC’s inflation

22 Jul US Initial Jobless Claims we 17/7 429k 445k

forecasts were not materially changed. The bank reiterated that ‘considerable

Jun Existing Home Sales –2.2% –15.0%

monetary stimulus’ remains and restated that taking away of this stimulus will

Jun Leading Indicators 0.4% –0.3%

depend on ‘domestic and global…developments’.

Jpn May All-Industry Activity Index 1.8% –0.4%

Eur Jul PMI Manufacturing Adv 55.6 56.0

Jul PMI Services Adv 55.5 55.0

May Industrial New Orders 0.6% –0.3%

Outlook

Jul Consumer Confidence Adv –17 –18 AUD/USD and NZD/USD outlook next 24 hours: The strong US equities

UK Jun Retail Sales W/Auto Fuel 0.6% 0.5% close should be initially supportive. AUD resistance today lies overhead in the

Can May Retail Sales –2.0% 0.5% 0.8850-60 area. NZD should similarly be capped by the 0.7160-00 area.

BoC Monetary Policy Report

23 Jul Aus Q2 Export Price Index %qtr 3.8% 15.0%

Q2 Import Price Index %qtr 0.3% 2.4% Imre Speizer, Senior Market Strategist, NZ, Ph: (04) 470 8266

Eur Committee of Euro Banking Supervisors With contributions from Westpac Economics

Westpac Banking Corporation ABN 33 007 457 141 incorporated in Australia (NZ division). Information current as at 21 July 2010. All customers please note that this information has been prepared without taking account of your objectives,

financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation or needs. Australian customers can obtain Westpac’s financial services

guide by calling +612 9284 8372, visiting www.westpac.com.au or visiting any Westpac Branch. The information may contain material provided directly by third parties, and while such material is published with permission, Westpac accepts

no responsibility for the accuracy or completeness of any such material. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac

is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and

regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. © 2010 Westpac Banking Corporation. Past

performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable,

the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts.

You might also like

- VB-MAPP Flip Book SupplementsDocument47 pagesVB-MAPP Flip Book SupplementsDina Khalid89% (9)

- Acft 6-Week Training PlanDocument28 pagesAcft 6-Week Training PlanAnthony Dinicolantonio75% (4)

- RSDB Update 20190620Document1 pageRSDB Update 20190620Oana Durst100% (1)

- Far160 - Question 5 Tutorial Chapter 1Document2 pagesFar160 - Question 5 Tutorial Chapter 1Syaza AisyahNo ratings yet

- JUN 08 Westpack Morning ReportDocument1 pageJUN 08 Westpack Morning ReportMiir ViirNo ratings yet

- Westpack JUL 09 Mornng ReportDocument1 pageWestpack JUL 09 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 20 Mornng ReportDocument1 pageWestpack JUL 20 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 22 Mornng ReportDocument1 pageWestpack JUN 22 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 28 Mornng ReportDocument1 pageWestpack JUN 28 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 12 Mornng ReportDocument1 pageWestpack JUL 12 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 18 Mornng ReportDocument1 pageWestpack JUN 18 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 29 Mornng ReportDocument1 pageWestpack JUN 29 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 29 Mornng ReportDocument1 pageWestpack JUL 29 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 03 Mornng ReportDocument1 pageWestpack AUG 03 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 08 Mornng ReportDocument1 pageWestpack JUL 08 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 05 Mornng ReportDocument1 pageWestpack JUL 05 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 21 Mornng ReportDocument1 pageWestpack JUN 21 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 15 Mornng ReportDocument1 pageWestpack JUN 15 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 15 Mornng ReportDocument1 pageWestpack JUL 15 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 24 Mornng ReportDocument1 pageWestpack JUN 24 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 04 Mornng ReportDocument1 pageWestpack AUG 04 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 26 Mornng ReportDocument1 pageWestpack JUL 26 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 28 Mornng ReportDocument1 pageWestpack JUL 28 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 01 Mornng ReportDocument1 pageWestpack JUL 01 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 05 Mornng ReportDocument1 pageWestpack AUG 05 Mornng ReportMiir ViirNo ratings yet

- Westpack JUN 16 Mornng ReportDocument1 pageWestpack JUN 16 Mornng ReportMiir ViirNo ratings yet

- Westpack AUG 09 Mornng ReportDocument1 pageWestpack AUG 09 Mornng ReportMiir ViirNo ratings yet

- Westpack JUL 02 Mornng ReportDocument1 pageWestpack JUL 02 Mornng ReportMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 04 UOB Asian MarketsDocument2 pagesAUG 04 UOB Asian MarketsMiir ViirNo ratings yet

- Daily Market Report: Corporate & Investment Banking Currency Risk ManagementDocument1 pageDaily Market Report: Corporate & Investment Banking Currency Risk ManagementInternational Business TimesNo ratings yet

- Currency Street: The Greenback Up Amidst Disappointing June DataDocument5 pagesCurrency Street: The Greenback Up Amidst Disappointing June Dataविवेक कुमार मुकेशNo ratings yet

- Australian Dollar Outlook 16 May 2011Document1 pageAustralian Dollar Outlook 16 May 2011International Business Times AUNo ratings yet

- WRP March 8TH 2024Document57 pagesWRP March 8TH 2024denokgroupNo ratings yet

- FX Insight eDocument16 pagesFX Insight esilviu_catrinaNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- Australian Dollar Outlook 01 June 2011Document1 pageAustralian Dollar Outlook 01 June 2011International Business Times AUNo ratings yet

- Week 6 OutlookDocument1 pageWeek 6 OutlookJC CalaycayNo ratings yet

- Asian Market - UOB Treasury Research - 2010 March 8Document5 pagesAsian Market - UOB Treasury Research - 2010 March 8mdyboyNo ratings yet

- AUG 03 UOB Asian MarketsDocument3 pagesAUG 03 UOB Asian MarketsMiir ViirNo ratings yet

- SevensReport9 23 20 PDFDocument6 pagesSevensReport9 23 20 PDFsirdquantsNo ratings yet

- AUG 06 UOB Asian MarketsDocument2 pagesAUG 06 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 06 UOB Global MarketsDocument2 pagesAUG 06 UOB Global MarketsMiir ViirNo ratings yet

- Daily Market Reflection 09 JuneDocument7 pagesDaily Market Reflection 09 JunePriya RathoreNo ratings yet

- Inside Debt: U.S. Markets Today Chart of The DayDocument6 pagesInside Debt: U.S. Markets Today Chart of The DayBoris MangalNo ratings yet

- Daily Market ReportDocument7 pagesDaily Market ReportPriya RathoreNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017Document16 pagesHSL PCG "Currency Insight"-Weekly: 13 February, 2017Dinesh ChoudharyNo ratings yet

- ScotiaBank AUG 03 Daily FX UpdateDocument3 pagesScotiaBank AUG 03 Daily FX UpdateMiir ViirNo ratings yet

- AUG 05 UOB Asian MarketsDocument2 pagesAUG 05 UOB Asian MarketsMiir ViirNo ratings yet

- FX Insight eDocument15 pagesFX Insight etrinugrohoNo ratings yet

- EconomyDocument7 pagesEconomypresencabNo ratings yet

- Weekly FX Focus: Currency Current Trend Support / Resistance Market CommentaryDocument9 pagesWeekly FX Focus: Currency Current Trend Support / Resistance Market CommentarykennyNo ratings yet

- Weekly Report - 28 MayDocument4 pagesWeekly Report - 28 MayDan HathurusingheNo ratings yet

- Sep 16Document12 pagesSep 16kn0qNo ratings yet

- 09022024tda NamDocument9 pages09022024tda Nambright.sock2093No ratings yet

- Fox 2june PDFDocument7 pagesFox 2june PDFPriya RathoreNo ratings yet

- RBS - Round Up - 010210Document9 pagesRBS - Round Up - 010210egolistocksNo ratings yet

- Australian Dollar OutlookDocument1 pageAustralian Dollar OutlookmotlaghNo ratings yet

- RBS - Round Up - 140510Document10 pagesRBS - Round Up - 140510egolistocksNo ratings yet

- Trim Daily 20210423Document13 pagesTrim Daily 20210423Wahyu Agung YuwonoNo ratings yet

- Australian Dollar Outlook 19 May 2011Document1 pageAustralian Dollar Outlook 19 May 2011International Business Times AUNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- AUG-09-DJ European Forex TechnicalsDocument3 pagesAUG-09-DJ European Forex TechnicalsMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- Jyske Bank Aug 09 em DailyDocument5 pagesJyske Bank Aug 09 em DailyMiir ViirNo ratings yet

- AUG-09 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- JYSKE Bank AUG 09 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNo ratings yet

- Familiarity Questionnaire OCQ 90.2003Document5 pagesFamiliarity Questionnaire OCQ 90.2003yani0707No ratings yet

- Leaning Tower of PisaDocument21 pagesLeaning Tower of PisaTAJAMULNo ratings yet

- Capital Structure DeterminationDocument20 pagesCapital Structure DeterminationJeet SummerNo ratings yet

- General Specifications: Model SC4A Conductivity Sensors and Fittings For 2-Electrode SystemsDocument24 pagesGeneral Specifications: Model SC4A Conductivity Sensors and Fittings For 2-Electrode SystemsMadel D.No ratings yet

- Assignment Utilities 2Document3 pagesAssignment Utilities 2Drew FrancisNo ratings yet

- HR One User Guide For Mobility V1.2Document34 pagesHR One User Guide For Mobility V1.2Mohammed QahtaniNo ratings yet

- Warhammer 40k - Codex - Errata - Dark Angels Q&A v2.0Document2 pagesWarhammer 40k - Codex - Errata - Dark Angels Q&A v2.0Jakub KalembaNo ratings yet

- R BalajiDocument81 pagesR BalajiBalaji radhakrishnanNo ratings yet

- Reference Book - HEXIS PDFDocument12 pagesReference Book - HEXIS PDFAnonymous fz8GlwsAmlNo ratings yet

- Final Ma MaDocument30 pagesFinal Ma MaKUMARAGURU PONRAJNo ratings yet

- DuwarDocument2 pagesDuwarMy ChannelNo ratings yet

- EXP-6-Measurement of Screw ParametersDocument2 pagesEXP-6-Measurement of Screw Parametersnavneetkpatil8409No ratings yet

- Human Druid DND Simple Char PDFDocument1 pageHuman Druid DND Simple Char PDFMuhammad Fathul Al-AssalamNo ratings yet

- Steris Amsco Century v120Document2 pagesSteris Amsco Century v120Juan OrtizNo ratings yet

- Mlitt Dissertation ST AndrewsDocument8 pagesMlitt Dissertation ST AndrewsBuyResumePaperCanada100% (1)

- Battery Unit ServicingDocument8 pagesBattery Unit ServicingLeonardo Alfonso Carcamo CarreñoNo ratings yet

- LS 5 Understanding The Self and Society 3Document70 pagesLS 5 Understanding The Self and Society 3Rotary Club Of Cubao SunriseNo ratings yet

- LBCDocument14 pagesLBCanililhanNo ratings yet

- HP Man DP9.00 Device Support Matrix PDFDocument65 pagesHP Man DP9.00 Device Support Matrix PDFHanh TranNo ratings yet

- AloeVera - Full GuideDocument20 pagesAloeVera - Full GuideSafi KhanNo ratings yet

- Methodology For Wood Door Jamb InstallationDocument1 pageMethodology For Wood Door Jamb InstallationKamen RiderNo ratings yet

- 1st Year Chemistry Practical 1 - Stoichiometry in SolutionDocument5 pages1st Year Chemistry Practical 1 - Stoichiometry in SolutionNoel SimpasaNo ratings yet

- Balmer Lawrie & Co HRDocument6 pagesBalmer Lawrie & Co HRPraneet TNo ratings yet

- Product Manual: A.T.E. Enterprises Private Limited (Business Unit: HMX)Document23 pagesProduct Manual: A.T.E. Enterprises Private Limited (Business Unit: HMX)Siva MohanNo ratings yet

- Fondu PDFDocument2 pagesFondu PDFRaghda Jammoul100% (1)

- 10 MeasuringDevicesPowerMonitoring LV10 042020 EN 202006081510359865Document36 pages10 MeasuringDevicesPowerMonitoring LV10 042020 EN 202006081510359865hamed hamamNo ratings yet