Professional Documents

Culture Documents

Lehman Brothers Holdings Inc

Lehman Brothers Holdings Inc

Uploaded by

kayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lehman Brothers Holdings Inc

Lehman Brothers Holdings Inc

Uploaded by

kayCopyright:

Available Formats

Lehman Brothers Holdings Inc.

was the fourth-largest global financial service firm in the United States at

the time of its collapse. It was founded by Henry Lehman, Emanuel Lehman and Mayer Lehman in 1850.

On September 15, 2008, the company filed for Chapter 11 bankruptcy protection which resulted in 26,000

employees losing their jobs and millions of investors losing all of their money. For many years, Lehman

executives manipulated the balance sheets and financial reports by allegedly selling approximately $50

billion of toxic assets to banks outside of the country. The company faced the penalties of the largest

bankruptcy in the United States history. Unfortunately, the S.E.C did not prosecute Lehman executives

and the companys auditors from Ernst &Young due to lack of evidence.

A year before the company filed bankruptcy, the company faced a great loss after closing its subprime

lender BNC Mortgage due to the collapse of the housing market. The collapse of the housing market

caused the devaluation of the companys stocks and assets. The executives at Lehman misused accounting

gimmicks at the end of each quarter that temporarily remove securities that creates the deception of the

company doing well when it really was not.

Auditors from Ernst and Young were responsible to review the companys financial statements over many

years. Allegedly, the auditors failed to disclose the companys use of Repo 105. Repo 105 is an

accounting maneuver where a short-term repurchase agreement is classified as a sale. That practice made

the company hid over $50 billion. Recently, Ernst & Young agreed to pay 10 million to settle a lawsuit

accusing the firm for helping Lehman Brothers deceive investors.

I believe that the auditors from Ernst & Young failed to ensure the accuracy and reliability of the financial

statements. If the company did not declare bankruptcy, the S.E.C would not have discovered the major

cover-ups in the companys financial statements for over many years.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 13.125.engagement Letter Internal AuditDocument13 pages13.125.engagement Letter Internal Auditkay83% (6)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CH 1Document17 pagesCH 1kayNo ratings yet

- RTFDocument28 pagesRTFkayNo ratings yet

- RTFDocument31 pagesRTFkayNo ratings yet

- Textual Analysis YaDocument2 pagesTextual Analysis YakayNo ratings yet

- ACCT 3125 Chapter 5 SolutionsDocument7 pagesACCT 3125 Chapter 5 SolutionskayNo ratings yet

- HW 3Document3 pagesHW 3kayNo ratings yet

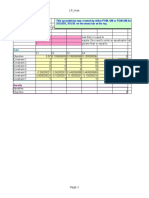

- This Spreadsheet Was Created by Either POM, QM or POM-QM For Windows, V4. Then Go To TOOLS, SOLVER, SOLVE On The Menu Bar at The TopDocument2 pagesThis Spreadsheet Was Created by Either POM, QM or POM-QM For Windows, V4. Then Go To TOOLS, SOLVER, SOLVE On The Menu Bar at The TopkayNo ratings yet

- Column1 Kennesaw Online Catalog - January - March 2014: Section # of CoursesDocument2 pagesColumn1 Kennesaw Online Catalog - January - March 2014: Section # of CourseskayNo ratings yet