Professional Documents

Culture Documents

Sample Development Appraisal

Sample Development Appraisal

Uploaded by

chrispittmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Development Appraisal

Sample Development Appraisal

Uploaded by

chrispittmanCopyright:

Available Formats

Appendix 6A Development appraisal of a mixed use

development

Timescale

Commences Months

Project start date Oct 2006

Pre-construction Oct 2006 3

Construction Jan 2007 18

Project length 21

Total project length 22

(including exit period)

Assumptions

Construction

1. Construction costs paid on S-curve

2. Professional fees are related to construction costs, including contingency

Disposal

1. Purchasers costs based on net capitalisation

2. Purchasers costs deducted from sale (not added to cost)

3. Sales fees based on sales plus net capitalisation

4. Sales fees added to cost (not deducted from sale)

Interest

1. Single credit/debit rate of interest adopted for all payments/receipts (12.00%)

2. Interest compounded annually and charged annually

3. Same rate of interest in each discounted cash-flow (DCF) period

4. Interest not calculated on items in final DCF period

5. Interest not included in internal rate of return (IRR) calculations

6. Effective rates of interest used

Cash-flow

1. Payments in arrears

2. Receipts in advance

3. Initial IRR guess rate is 8.00%

Property Valuation in an Economic Context

2007 by Peter Wyatt

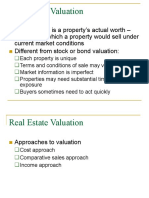

Valuation

1. Formulae are annually in arrears

2. Tenants rent valued as true income stream

Appraisal Summary

INCOME

Sales Valuation ft Rate ft Value

Apartments 10 units at 50 000 500 000

500 000

Rental Area ft Rate ft Rent pa

Summary

Offices 1 500 95.00 142 500

Shops 800 140.00 112 000

Factories 1 900 70.00 133 000

4 200 387 500

Investment Yield Factor Cap. Rent

Valuation

Offices 142 500 YP @ 7.0000% 14.2857 2 035 714

Valuation Rent

Shops 112 000 YP @ 6.0000% 16.6667 1 866 667

Valuation Rent

Factories 133 000 YP @ 9.0000% 11.1111 1 477 778

Valuation Rent 5 380 159

GROSS DEVELOPMENT VALUE 5 880 159

Purchaser's Costs 2.50% -131 223

NET DEVELOPMENT VALUE 5 748 935

NET REALISATION 5 748 935

EXPENDITURE

ACQUISITION COSTS

Acquisition Price 1 200 000

Acquisition Agent 2.00% 24 000

Fees

Acquisition Legal 2.00% 24 000

Fees

Town Planning 11 000

Survey 65 000

1 324 000

CONSTRUCTION COSTS

Summary ft Rate ft Cost

Offices 2 000 600.00 1 200 000

Shops 1 000 500.00 500 000

Factories 2 000 300.00 600 000

Apartments 10 units at -30 000 300 000

5 000 2 600 000

Contingency 5.00% 130 000

Property Valuation in an Economic Context

2007 by Peter Wyatt

Road/Site Works 25 000

Statutory Costs 2 000

157 000

PROFESSIONAL FEES

Architect 4.00% 109 200

Quantity Surveyor 3.00% 81 900

Structural Engineer 3.00% 81 900

Mech./Elec. 1.00% 27 300

Engineer

Project Manager 1.00% 27 300

327 600

MARKETING

Marketing 10 000

Letting Agent Fees 10.00% 38 750

48 750

FINANCE

Debit Rate 12.00%

Credit Rate 12.00%

(Effective)

Land 261 955

Building 270 650

Total Finance Cost 532 606

TOTAL COSTS 4 989 956

PROFIT 758 980

Performance Measures

Profit on Cost% 15.21%

Profit on GDV% 12.91%

Profit on NDV% 13.20%

Development Yield (ERV Basis) 7.77%

Equivalent Yield (Normal) 7.20%

Equivalent Yield (True) 7.54%

IRR % 26.51%

Rent Cover 2 yrs 0 mths

Profit Erosion (finance rate 12.000%) 1 yr 3 mths

Sensitivity Analysis: Table of Profit Amount and Profit on Cost %

Land Price

Interest Rates - (20 000) - (10 000) 0 + 10 000 + 20 000

% 1 180 000 1 190 000 1 200 000 1 210 000 1 220 000

- 0.400% 802,296 789,789 777,282 764,775 752,268

16.219% 15.926% 15.634% 15.344% 15.055%

- 0.200% 793,225 780,680 768,136 755,591 743,046

16.006% 15.713% 15.422% 15.132% 14.843%

0.000% 784,146 771,563 758,980 746,397 733,814

15.794% 15.501% 15.210% 14.920% 14.632%

+ 0.200% 775,056 762,435 749,814 737,193 724,572

15.583% 15.290% 14.999% 14.709% 14.421%

+ 0.400% 765,958 753,299 740,639 727,980 715,321

15.371% 15.079% 14.788% 14.499% 14.211%

Property Valuation in an Economic Context

2007 by Peter Wyatt

Detailed cash-flow

Sep 2006 Dec 2006 Mar 2007 Jun 2007 Sep 2007 Dec 2007 Mar 2008 Jun 2008 Jul 2008

QuarterlyB/F 0 (1,324,000) (1,573,424) (2,089,499) (2,954,416) (3,655,556) (4,248,072) (4,941,206)

Revenue

Cap - Offices 0 0 0 0 0 0 0 0 2,035,714

Cap Shops 0 0 0 0 0 0 0 0 1,866,667

Cap - Factories 0 0 0 0 0 0 0 0 1,477,778

Sale - Apartments 0 0 0 0 0 0 0 0 500,000

Purchaser's Costs 0 0 0 0 0 0 0 0 (131,223)

Acquisition Costs

Acquisition Price 0 (1,200,000) 0 0 0 0 0 0 0

Acquisition Agent 0 (24,000) 0 0 0 0 0 0 0

Fees

Acquisition Legal 0 (24,000) 0 0 0 0 0 0 0

Fees

Town Planning 0 (11,000) 0 0 0 0 0 0 0

Survey 0 (65,000) 0 0 0 0 0 0 0

Construction

Costs/Fees

Road/Site Works 0 0 (25,000) 0 0 0 0 0 0

Con. - Offices 0 0 (87,288) (202,542) (265,174) (275,174) (232,542) (137,280) 0

Con. - Apartments 0 0 (21,827) (50,635) (66,292) (68,792) (58,135) (34,319) 0

Con. - Shops 0 0 (36,375) (84,391) (110,488) (114,655) (96,892) (57,199) 0

Con. - Factories 0 0 (43,646) (101,271) (132,586) (137,586) (116,271) (68,640) 0

Contingency 0 0 (9,457) (21,942) (28,727) (29,810) (25,192) (14,872) 0

Statutory Costs 0 0 (2,000) 0 0 0 0 0 0

Architect 0 0 (7,944) (18,431) (24,131) (25,041) (21,161) (12,492) 0

Quantity Surveyor 0 0 (5,958) (13,823) (18,098) (18,781) (15,871) (9,369) 0

Structural Engineer 0 0 (5,958) (13,823) (18,098) (18,781) (15,871) (9,369) 0

Mech./Elec. 0 0 (1,986) (4,608) (6,033) (6,260) (5,290) (3,123) 0

Engineer

Project Manager 0 0 (1,986) (4,608) (6,033) (6,260) (5,290) (3,123) 0

Marketing/Letting

Marketing 0 0 0 0 0 0 0 0 (10,000)

Property Valuation in an Economic Context

2007 by Peter Wyatt

Letting Agent Fees 0 0 0 0 0 0 0 0 (38,750)

VAT Paid 0 0 0 0 0 0 0 0 0

VAT recovered 0 0 0 0 0 0 0 0 0

Quarterly Total 0 (1,324,000) (249,424) (516,075) (675,659) (701,139) (592,516) (349,787) 5,700,185

Debit Rate (1) %pa 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00

Credit Rate (1) 12.00 12.00 12.00 12.00 12.00 12.00 12.00 12.00

%pa

Interest 0 0 0 (189,259) 0 0 (343,347) 0

C/f Quarterly 0 (1,324,000) (1,573,424) (2,089,499) (2,954,416) (3,655,556) (4,248,072) (4,941,206) 758,980

Property Valuation in an Economic Context

2007 by Peter Wyatt

You might also like

- Week 2 - Content - Sales Letter Mechanics and TemplateDocument36 pagesWeek 2 - Content - Sales Letter Mechanics and TemplateAdrian NowowiejskiNo ratings yet

- REPE Case 02 45 Milk Street Investment RecommendationDocument20 pagesREPE Case 02 45 Milk Street Investment RecommendationziuziNo ratings yet

- Sua BalancesheetDocument2 pagesSua BalancesheetAnonymous vGRnDxUcBNo ratings yet

- 1 - Proposed Development - ProformaDocument1 page1 - Proposed Development - ProformaReden Mejico PedernalNo ratings yet

- Quantity TakeoffDocument2 pagesQuantity Takeoffshahed555No ratings yet

- SOR PWD (WB) Building Works 2010Document10 pagesSOR PWD (WB) Building Works 2010Sourabh Mandal0% (1)

- BKM9e-Answers-Chap003-Margin and Short Extra QuestionsDocument3 pagesBKM9e-Answers-Chap003-Margin and Short Extra QuestionsLê Chấn PhongNo ratings yet

- Housing ModelDocument12 pagesHousing ModelAsif KhanNo ratings yet

- Project: 261 670 90: Developer Proforma For Mixed-Used Hotel & Condominium ProjectDocument1 pageProject: 261 670 90: Developer Proforma For Mixed-Used Hotel & Condominium ProjectReden Mejico PedernalNo ratings yet

- AnushreeDocument2 pagesAnushreesweetieezzsharmaNo ratings yet

- Emp Capital Partners - 4Q12 Investor LetterDocument7 pagesEmp Capital Partners - 4Q12 Investor LetterLuis AhumadaNo ratings yet

- Construction Contract Financial ClausesDocument20 pagesConstruction Contract Financial ClausesHaarikaNo ratings yet

- PricingBrew Journal CatalogDocument16 pagesPricingBrew Journal CatalogmindbrewNo ratings yet

- Digital Marketing Plan - Conversion Funnel Exercise - Solutions - Pablo Martín Antoranz PDFDocument17 pagesDigital Marketing Plan - Conversion Funnel Exercise - Solutions - Pablo Martín Antoranz PDFAdnanFXNo ratings yet

- Renting A Property: A Clear, Impartial Guide ToDocument16 pagesRenting A Property: A Clear, Impartial Guide ToChris GonzalesNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- 100+ List Building Ideas You Need To StealDocument12 pages100+ List Building Ideas You Need To Stealjuan manuel espejel50% (2)

- Guide To Managing Renewals ProjectsDocument39 pagesGuide To Managing Renewals ProjectsnourNo ratings yet

- 2 Financial Mathematics For Real EstateDocument31 pages2 Financial Mathematics For Real EstateLeon M. EggerNo ratings yet

- Google Ads Budget Calculator Updated Aug 2020 1Document2 pagesGoogle Ads Budget Calculator Updated Aug 2020 1vider39605No ratings yet

- Contingent consideration-PWCDocument23 pagesContingent consideration-PWCKath ONo ratings yet

- 11 Ways To Increase SalesDocument4 pages11 Ways To Increase SalesmithunNo ratings yet

- INSTITUTE: University School of Business DEPARTMENT ..Management.Document42 pagesINSTITUTE: University School of Business DEPARTMENT ..Management.Sadaf BegNo ratings yet

- Using Stories To Get Great ClientsDocument24 pagesUsing Stories To Get Great ClientsCulea Maria SimonaNo ratings yet

- Construction Carpenter Business PlanDocument35 pagesConstruction Carpenter Business PlanjweremaNo ratings yet

- MTN Ghana New 1Document156 pagesMTN Ghana New 1Hubert AnipaNo ratings yet

- Sample Contractors Scope of Work DocumentDocument8 pagesSample Contractors Scope of Work DocumentchristianNo ratings yet

- Public Housing in SingaporeDocument26 pagesPublic Housing in SingaporeSeptia HeryantiNo ratings yet

- 6.9 Marketing CampaignsDocument10 pages6.9 Marketing CampaignsLyleth LutapNo ratings yet

- SevernWoods Custom Homes Cost Guide 2022Document11 pagesSevernWoods Custom Homes Cost Guide 2022Carby SumNo ratings yet

- POE - Elemental Cost Breakdown TemplateDocument8 pagesPOE - Elemental Cost Breakdown TemplateAnonymous 5i2CjYvAMNo ratings yet

- InVEMA13 - Real Estate ValuationDocument9 pagesInVEMA13 - Real Estate ValuationDaniel ValerianoNo ratings yet

- Investing in German Real Estate 2019Document56 pagesInvesting in German Real Estate 2019vanyushaNo ratings yet

- Forbes List of BillionairesDocument3 pagesForbes List of BillionairesRohit Rits RanaNo ratings yet

- CronosGroup Investor Deck Jan 17Document16 pagesCronosGroup Investor Deck Jan 17kaiselkNo ratings yet

- Calculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Document19 pagesCalculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Anil GowdaNo ratings yet

- 4 Rules For Managing A Virtual TeamDocument2 pages4 Rules For Managing A Virtual TeamamirziadNo ratings yet

- Recapture of Low-Income Housing Credit: or Trust)Document4 pagesRecapture of Low-Income Housing Credit: or Trust)saffar12No ratings yet

- Urban Infill Community LibraryDocument8 pagesUrban Infill Community LibraryYang JinglooNo ratings yet

- Development of Microsoft Excel TemplateDocument57 pagesDevelopment of Microsoft Excel TemplateVetriselvan ArumugamNo ratings yet

- 7 Musts of A Real Estate NewsletterDocument6 pages7 Musts of A Real Estate NewsletterCarolNo ratings yet

- Achievements in Thought Leadership S.iyer 2000-2013Document19 pagesAchievements in Thought Leadership S.iyer 2000-2013Shubhadha IyerNo ratings yet

- PropSquare PresentationDocument11 pagesPropSquare PresentationUday Gub BhargavNo ratings yet

- Project ManagerDocument3 pagesProject Managerapi-121653481No ratings yet

- Cashflow TemplateDocument4 pagesCashflow TemplateGlasior Lvl2No ratings yet

- BUSS1000 - S1 2024 - Consulting Report Rubric - FINAL V2Document6 pagesBUSS1000 - S1 2024 - Consulting Report Rubric - FINAL V2An Ho XuanNo ratings yet

- S&D Unit 1-2 CombinedDocument106 pagesS&D Unit 1-2 CombinedAdityaSahuNo ratings yet

- Quotation - Supply ONLY For Door LeavesDocument11 pagesQuotation - Supply ONLY For Door LeavesCC Cost AdvisoryNo ratings yet

- Building The E-Mail List: Sideways Sales LetterDocument6 pagesBuilding The E-Mail List: Sideways Sales Lettermelb100% (1)

- 90 Day Real Estate Marketing PlanDocument2 pages90 Day Real Estate Marketing Planneetug100% (1)

- Bidding Documents (Two Stage Two Envelopes-TSTE) TorgharDocument63 pagesBidding Documents (Two Stage Two Envelopes-TSTE) TorgharEngr Amir Jamal QureshiNo ratings yet

- Singapore's Housing and Development Act, 1959Document146 pagesSingapore's Housing and Development Act, 1959Sahil KhadkaNo ratings yet

- Sales Forecast For Bhushan Steel LimitedDocument31 pagesSales Forecast For Bhushan Steel LimitedOmkar HandeNo ratings yet

- Forney Offering Memorandum - NEW PDFDocument47 pagesForney Offering Memorandum - NEW PDFJose ThankachanNo ratings yet

- Sales Plan Presentation TemplateDocument13 pagesSales Plan Presentation TemplateTunde OsiboduNo ratings yet

- Lendlease Corporation Limited (LLC) : Strategic SWOT Analysis ReviewDocument37 pagesLendlease Corporation Limited (LLC) : Strategic SWOT Analysis ReviewKerie ThamNo ratings yet

- Hardware Contract TemplateDocument5 pagesHardware Contract TemplateMohamed MahmoudNo ratings yet

- DeathoftheCreativeAgency v3Document18 pagesDeathoftheCreativeAgency v3Brandon WalowitzNo ratings yet

- IC Residential Construction Scope of Work Checklist 11358Document10 pagesIC Residential Construction Scope of Work Checklist 11358Tony HaddadNo ratings yet

- Lake Road Executive SummaryDocument7 pagesLake Road Executive SummarySam ParrNo ratings yet

- GHA Overheating in New Homes Tool and GuidanceDocument49 pagesGHA Overheating in New Homes Tool and GuidancechrispittmanNo ratings yet

- The Value of Good DesignDocument11 pagesThe Value of Good DesignchrispittmanNo ratings yet

- Cibse Steps To Net Zero Carbon Buildings 1Document5 pagesCibse Steps To Net Zero Carbon Buildings 1chrispittmanNo ratings yet

- Target Zero Supermarket Guidance Doc v2Document82 pagesTarget Zero Supermarket Guidance Doc v2chrispittman100% (1)

- Target Zero Warehouse Guidance Doc v2Document83 pagesTarget Zero Warehouse Guidance Doc v2chrispittmanNo ratings yet

- Research Note - Thermal ComfortDocument6 pagesResearch Note - Thermal ComfortchrispittmanNo ratings yet

- How To Write Clearly PDFDocument16 pagesHow To Write Clearly PDFchrispittmanNo ratings yet

- Building On Strong FoundationsDocument33 pagesBuilding On Strong FoundationschrispittmanNo ratings yet

- Research Note - Daylight and LightingDocument10 pagesResearch Note - Daylight and LightingchrispittmanNo ratings yet

- Workplace PlanningDocument194 pagesWorkplace PlanningchrispittmanNo ratings yet

- A Theory of Workplace PlanningDocument55 pagesA Theory of Workplace PlanningchrispittmanNo ratings yet

- A Checklist For Effective Reports: Tick Box When CheckedDocument1 pageA Checklist For Effective Reports: Tick Box When CheckedchrispittmanNo ratings yet

- World of Work 2018 - Environmental Scanning Report FinalDocument9 pagesWorld of Work 2018 - Environmental Scanning Report FinalchrispittmanNo ratings yet

- Working Without WallsDocument84 pagesWorking Without WallschrispittmanNo ratings yet

- 2017-Herd Behavior in The French Stock MarketDocument20 pages2017-Herd Behavior in The French Stock MarketAhmed El-GayarNo ratings yet

- Tybcom - Share NotesDocument749 pagesTybcom - Share NotesManojj21No ratings yet

- 04 - Tutorial 4 - Week 6 SolutionsDocument8 pages04 - Tutorial 4 - Week 6 SolutionsJason ChowNo ratings yet

- Working Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath NairdocDocument66 pagesWorking Capital Management of INDIAN OVERSEAS bANK. Completed by Sarath Nairdocsarathspark100% (5)

- SIMSREE Part Time Brochure 1Document9 pagesSIMSREE Part Time Brochure 1Sweety KumariNo ratings yet

- The Capital Asset Pricing Model - : The Cost of EquityDocument8 pagesThe Capital Asset Pricing Model - : The Cost of EquityMuhammad YahyaNo ratings yet

- Share Based Payment Implementation Guidance PDFDocument30 pagesShare Based Payment Implementation Guidance PDFNhel AlvaroNo ratings yet

- Nyamu Faith - The Effect of Macroeconomic Factors On Financial Performance of Insurance Firms in KenyaDocument46 pagesNyamu Faith - The Effect of Macroeconomic Factors On Financial Performance of Insurance Firms in KenyaCJ WATTPADNo ratings yet

- Selling Today Partnering To Create Value Global 13th Edition Reece Test BankDocument18 pagesSelling Today Partnering To Create Value Global 13th Edition Reece Test Bankdavidazariaxo3100% (29)

- Technical Note On LBO Valuation and ModelingDocument30 pagesTechnical Note On LBO Valuation and Modelingsulaimani keedaNo ratings yet

- Term Paper Fin441 1Document31 pagesTerm Paper Fin441 1SAIMA SALAMNo ratings yet

- Cost of Capital in Uncertain TimeDocument8 pagesCost of Capital in Uncertain Timebalal_hossain_10% (1)

- A.J. Frost Robert Prechter Elliott Wave PrincipleDocument52 pagesA.J. Frost Robert Prechter Elliott Wave PrincipleNabamita Pyne0% (1)

- Mrunal Sir Latest 2020 Handout 4 PDFDocument21 pagesMrunal Sir Latest 2020 Handout 4 PDFdaljit singhNo ratings yet

- Private Placement and Preferential AllotmentDocument2 pagesPrivate Placement and Preferential AllotmentAparajita MarwahNo ratings yet

- Portfolio Management 1Document29 pagesPortfolio Management 1Fariwar WahezyNo ratings yet

- Introduction of Vedanta GroupDocument7 pagesIntroduction of Vedanta Groupgreen_destiny0999No ratings yet

- Acca f7 Revision Notespdf PDF FreeDocument65 pagesAcca f7 Revision Notespdf PDF FreeDivyansh BhatnagarNo ratings yet

- Cryptocurrencies Vs Real EstateDocument3 pagesCryptocurrencies Vs Real EstateAnunobi JaneNo ratings yet

- A Project Report: ON Mutual Fund: A Globally Proven Investment Avenue Submitted in Partial Fulfillment ForDocument51 pagesA Project Report: ON Mutual Fund: A Globally Proven Investment Avenue Submitted in Partial Fulfillment ForSaiby khan KhanNo ratings yet

- fn3023 Exc14Document29 pagesfn3023 Exc14ArmanbekAlkinNo ratings yet

- Paper20A Set1Document10 pagesPaper20A Set1Ramanpreet KaurNo ratings yet

- Pak Electron Limited (PEL) : Financial PositionDocument5 pagesPak Electron Limited (PEL) : Financial PositionAbdul RehmanNo ratings yet

- Reading and Interpreting Banks Balance SheetDocument8 pagesReading and Interpreting Banks Balance SheetRavalika PathipatiNo ratings yet

- Chapter 15 The Managent of Capital (Rose)Document64 pagesChapter 15 The Managent of Capital (Rose)TÂM PHẠM CAO MỸNo ratings yet

- C.O.Capital - Capital Budgeting (OK Na!)Document8 pagesC.O.Capital - Capital Budgeting (OK Na!)Eunice BernalNo ratings yet

- Suggested and Sample Questions For Chapter 3Document3 pagesSuggested and Sample Questions For Chapter 3THL LNo ratings yet

- ADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Document197 pagesADIB YAZID - Nota Ringkas CEILLI (Bahasa Inggeris)Ashlee JingNo ratings yet

- 2020 Preqin Global Infrastructure Report Sample PagesDocument12 pages2020 Preqin Global Infrastructure Report Sample PagesMarco ErmantazziNo ratings yet