Professional Documents

Culture Documents

Dec 2013

Dec 2013

Uploaded by

B Sunil KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec 2013

Dec 2013

Uploaded by

B Sunil KumarCopyright:

Available Formats

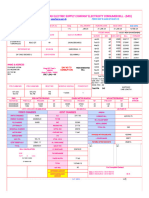

Total No.

of Pages: 4

Register Number: 5660

Name of the Candidate:

B.B.A. DEGREE EXAMINATION, 2013

(THIRD YEAR)

310. MANAGEMENT ACCOUNTING

(Common with Double Degree and Lateral Entry)

December] [Time : 3 Hours

Maximum : 100 Marks

SECTION-A (102=20)

Answer any TEN questions

1. Write short notes:

a) Index method

b) Financial accounting

c) Marginal cost

d) Management accounting

e) Profit volume ratio.

f) Pay back method.

g) Standard costing

h) Fixed cost

i) Zero base budgeting

j) Management decision

k) Cost audit

l). Budget.

SECTION-B (410=40)

Answer any FOUR questions

2. From the following, you are required to prepare production budget.

Product Estimated Opening stock units Estimated Closing stock units Estimated sales

X 5,000 6,400 21,600

Y 4,000 3,850 19,200

Z 6,000 7,800 23,100

2

3. Explain the essential features of management accounting.

4. Discuss the role of contribution in business decision making.

5. Describe the various functions of cost audit.

6. Explain the various methods of capital budgeting.

SECTION-C (220=40)

Answer any TWO questions

7. Describe the managerial applications of marginal costing techniques.

8. The company is considering investment of Rs.1,00,000 in a project. The following are the income

forecasts, after depreciation and tax,

First year Rs. 10,000, Second year Rs. 40,000, Third year Rs.60,000, Fourth year Rs. 20,000 and Fifth

year Rs. Nil.

From the above information, you are required to calculate:

ii) Pay-back-period.

iii) Discounted pay back period at 10% interest factor.

(Index: 0.909, 0.826,0.751,0.683 and 0.620)

9. Management accounting is accounting for effective management.- Explain this statement.

10. From the following particulars, calculate material cost, price, usage and mix variances.

The standard mix of product is :

X-300 units at Rs. 7.50 per unit

Y-400 units at Rs. 10 per unit

Z-500 units at Rs. 12.50 per unit

The actual consumption was:

X-320 units at Rs. 10 per unit.

Y-480 units at Rs. 7.50 per unit

Z-420 units at Rs. 15 per unit

3

jkpHhf;fk;

gFjp-m 102=20

VnjDk; gj;J tpdhf;fSf;F tpilasp

1. rpW Fwpg;g[ tiuf

m) Fwp Kiw

M) epjp fzf;fpay;

,) ,Wjp epiyr; bryt[

<) bkyhz;ik fzf;fpay;

c) yhg mst[ tpfpjk;

C) Kjy; kPl;g[f;fhy Kiw

v) ju mlf;ftpiy

V) epiyahd bryt[

I) g{#;a mog;gil tut[ bryt[j; jpl;lk;

x) nkyhz;ik KobtLj;jy;

X) mlf;fj; jzpf;if

Xs) tut[ bryt[j; jpl;lk;

gFjp-M (410=40)

VnjDk; ehd;F tpdhf;fSf;F tpilasp

2. fPH;fhQk; jftypd;go cw;gj;jp tut[ bryt[jpl;lj;jpidj; jahh; bra;at[k;:

bghUs; Muk;g ,Ug;g[ myFfs; ,Wjp ,Ug;g[ myFfs; tpw;gid myFfs;

X 5,000 6,400 21,600

Y 4,000 3,850 19,200

Z 6,000 7,800 23,100

3. nkyhz;ikf; fzf;fpaypd; Kf;fpa rpwg;gpay;g[fis tpsf;Ff

4. bjhHpy; KobtLj;jypy; g';fspg;gpd; g';fpid tpthp.

4

5. mlf;fj; jzpf;ifapd; gy;ntW gzpfis tpthjp.

6. gy;ntW tifahd _yjd tut[ bryt[ jpl;lj;jpid tpsf;Ff.

gFjp-, 220=40

VnjDk; ,uz;L tpdhf;fSf;F tpilasp

7. ,Wjp epiy bryt[f; fUj;J/ nkyhz;ikapy; vt;thW gad;gLj;jg;gLfpwJ vd;gjid tpthp.

8. xU epWtdk; %.1,00,000-j;jpid xU jpl;lj;jpy; KjyPL bra;aj; jpl;lkpl;Ls;sJ.

nja;khdj;jpw;F gpwF kw;Wk; thpf;F gpwF tUtha;.

Kjy; Mz;L %. 10,000

,uz;lhk; Mz;L %. 40,000

_d;whk; Mz;L %. 60,000

ehd;fhk; Mz;L %. 20,000

kw;Wk; Ie;jhk; Mz;L ve;j tUtha[k; ,y;iy nkw;Twpa jftypd;go

i) Kjy; kPl;g[ fhyk; kw;Wk;

ii) js;Sgo Kjy; kPl;g[f;fhyk; (10% tl;o fhuzp) fzf;fpLf

(js;Sgo kjpg;g[ 0.909, 0.826, 0.751, 0.683 ; 0.620)

9. nkyhz;ik fzf;fpay; vd;gJ xU rpwe;j nkyhz;ikf;F gad;gLj;jg;gLk; fzf;fpay;

MFk;- ,e;jf; Tw;wpid tpsf;Ff

10. fPH;fhQk; jftypd;go _yg;bghUs; mlf;ftpiy ntWghL/ _yg;bghUs; tpiy ntWghL/

_yg;bghUs; mst[ ntWghL/ kw;Wk; _yg;bghUs; fyit ntWghLfisf; fzf;fpLf.

bghUspd; juf;fyit:

X-300 myFfs; %7.50 tPjk;

Y-400 myFfs; %10.00 tPjk;

Z-500 myFfs; %12.50 tPjk;

bghUspd; cz;ik mst[:

X-320 myFfs; %.10 tPjk;

Y-480 myFfs; %.7.50 tPjk;

Z-420 myFfs; %.15 tPjk;

~~~~~~~~~~~

You might also like

- Operation Management in Textile IndustryDocument83 pagesOperation Management in Textile IndustryRishi Khanna57% (14)

- Decision-Making Management: A Tutorial and ApplicationsFrom EverandDecision-Making Management: A Tutorial and ApplicationsNo ratings yet

- Company Profile at CMC LimitedDocument20 pagesCompany Profile at CMC LimitedAnkur DubeyNo ratings yet

- B.B.A. DEGREE EXAMINATION December 2014Document3 pagesB.B.A. DEGREE EXAMINATION December 2014Crystal MurrayNo ratings yet

- Account-XII Set ADocument6 pagesAccount-XII Set AKshitizz TamangNo ratings yet

- I Sem EAFM Public FinanceDocument2 pagesI Sem EAFM Public FinanceSuryaNo ratings yet

- FinanceDocument4 pagesFinanceNeha agrawalNo ratings yet

- Corporate AccountDocument6 pagesCorporate AccountMartin AlaxanderNo ratings yet

- Roll No. ................................... : Time: Three Hours Maximum Marks: 100Document7 pagesRoll No. ................................... : Time: Three Hours Maximum Marks: 100Manohar SumathiNo ratings yet

- Il!ililililililililtililililtil: MarksDocument7 pagesIl!ililililililililtililililtil: MarksHamsa PNo ratings yet

- M.B.A. Degree Examination, 2010: 120. Financial and Management AccountingDocument6 pagesM.B.A. Degree Examination, 2010: 120. Financial and Management AccountingAbhimita GaineNo ratings yet

- I Sem BADM Mangamenet Accountancy)Document2 pagesI Sem BADM Mangamenet Accountancy)SuryaNo ratings yet

- P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VFDocument4 pagesP) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VF P) Lr5S Låtlo Sfof (No RFNG / N) VFDo Something GoodNo ratings yet

- BBA - IV Sem Business Mathematics-1Document2 pagesBBA - IV Sem Business Mathematics-1Amit SinghNo ratings yet

- M.B.A. Degree Examination - 2011: 120. Financial and Management AccountingDocument6 pagesM.B.A. Degree Examination - 2011: 120. Financial and Management AccountingAbhimita GaineNo ratings yet

- Business StatisticsDocument3 pagesBusiness StatisticsEmind Annamalai JPNagarNo ratings yet

- BCM 304Document5 pagesBCM 304SHIVAM SANTOSHNo ratings yet

- Bba V Sem Business BudgetingDocument2 pagesBba V Sem Business BudgetingAditi PareekNo ratings yet

- 57 Elective1 Advanced Financial Management Repeaters CBCS 2016 17onlyDocument4 pages57 Elective1 Advanced Financial Management Repeaters CBCS 2016 17onlypremium info2222No ratings yet

- Bcom 4 Sem Corporate Accounting 2 12293 2020Document7 pagesBcom 4 Sem Corporate Accounting 2 12293 2020deepaksingh260503No ratings yet

- Study Note 2Document13 pagesStudy Note 2Anoj KoiralaNo ratings yet

- 7762 Management Accounting Aug Sep 2023Document15 pages7762 Management Accounting Aug Sep 2023yogeshyogi60980No ratings yet

- Bid Document-2 - 221010 - 134231Document192 pagesBid Document-2 - 221010 - 134231Amren ShahNo ratings yet

- Post Graduate Diploma in International Business Operations/Master of Commerce (Pgdibo/M. Com.) Term-End Examination December, 2020Document8 pagesPost Graduate Diploma in International Business Operations/Master of Commerce (Pgdibo/M. Com.) Term-End Examination December, 202090599486 29No ratings yet

- CASBA Registration FormDocument2 pagesCASBA Registration FormxovokuNo ratings yet

- brpXwK76cilbrxKb 1692080612Document3 pagesbrpXwK76cilbrxKb 1692080612Yogesh PaudelNo ratings yet

- 16CCCCM1Document2 pages16CCCCM1balakumarNo ratings yet

- QP SGG21001561 121 03 1 KN-296 5464Document12 pagesQP SGG21001561 121 03 1 KN-296 5464Ashutosh UpadhyayNo ratings yet

- Fifth Semester Commerce Corporate Accounting (CBCS - 2017 Onwards)Document12 pagesFifth Semester Commerce Corporate Accounting (CBCS - 2017 Onwards)VELAVAN ARUNADEVINo ratings yet

- 2018 AccDocument8 pages2018 AccMeghna TripathiNo ratings yet

- Final Update2Document50 pagesFinal Update2msgosNo ratings yet

- Application Form 2011Document5 pagesApplication Form 2011ixploreNo ratings yet

- Final Practrice (Unit 4 and 5)Document9 pagesFinal Practrice (Unit 4 and 5)mjlNo ratings yet

- Indirect Taxes: (K.M V Olrqfu"B Á'UDocument41 pagesIndirect Taxes: (K.M V Olrqfu"B Á'UMohitraheja007No ratings yet

- Question Paper Code: 1058: Economics (Macro Economics)Document6 pagesQuestion Paper Code: 1058: Economics (Macro Economics)Samarth GaurNo ratings yet

- Mco 07Document6 pagesMco 07Amit ManharNo ratings yet

- Financial Accounting Outside XII 2007Document7 pagesFinancial Accounting Outside XII 2007anon-758934No ratings yet

- M.A. Degree Examination, 2010: Total No. of Pages: Register NumberDocument2 pagesM.A. Degree Examination, 2010: Total No. of Pages: Register NumbervanamamalaiNo ratings yet

- Nat IncmDocument6 pagesNat IncmOwais Ibni HassanNo ratings yet

- Ju (J (L$ Ju (J (L$ Ju (J (L$ Ju (J (L$ "Uuuu" K/Liffsf) KF& K/Liffsf) KF& K/Liffsf) KF& K/Liffsf) Kf&////Os - D Os - D Os - D Os - DDocument2 pagesJu (J (L$ Ju (J (L$ Ju (J (L$ Ju (J (L$ "Uuuu" K/Liffsf) KF& K/Liffsf) KF& K/Liffsf) KF& K/Liffsf) Kf&////Os - D Os - D Os - D Os - DApilNo ratings yet

- M.A. Degree Examination, 2010: (Rural Management) (First Year) (Paper - V)Document3 pagesM.A. Degree Examination, 2010: (Rural Management) (First Year) (Paper - V)vanamamalaiNo ratings yet

- Evaluation - Health Bajura - Final - PrintDocument16 pagesEvaluation - Health Bajura - Final - PrintNaresh AwasthiNo ratings yet

- Marketing PDFDocument2 pagesMarketing PDFAlimam AnsariNo ratings yet

- Mco 05Document12 pagesMco 05Nilanjan GhoshNo ratings yet

- 5355 550 Social Work Research and StatisticsDocument2 pages5355 550 Social Work Research and StatisticsNithin SindheNo ratings yet

- Management AccountingDocument2 pagesManagement AccountingMateen PathanNo ratings yet

- Manege Rial Economics May 2009Document3 pagesManege Rial Economics May 2009Moumita GangulyNo ratings yet

- SCM Midterm Exercises Answer KeyDocument30 pagesSCM Midterm Exercises Answer KeyChin FiguraNo ratings yet

- Accountancy D 2018Document13 pagesAccountancy D 2018Sachin KumarNo ratings yet

- I Sem EAFM FINANCIAL MANAGEMENTDocument3 pagesI Sem EAFM FINANCIAL MANAGEMENTSuryaNo ratings yet

- TS 6Document7 pagesTS 6Athul EmmoNo ratings yet

- Gujarat Technological University: Seat No.: - Enrolment No.Document1 pageGujarat Technological University: Seat No.: - Enrolment No.Milan JoshiNo ratings yet

- Ee 8Document2 pagesEe 8Rohit MEPNo ratings yet

- Khata Besi Bagar BandhDocument38 pagesKhata Besi Bagar Bandhrajendra timalsinaNo ratings yet

- 310 Management Accounting May 2021Document4 pages310 Management Accounting May 2021abc1No ratings yet

- (Accounting & Finance) : 330: Investm Ent M Anagem EntDocument2 pages(Accounting & Finance) : 330: Investm Ent M Anagem EntRajaramanNo ratings yet

- Ljbfyl (X?N) S) DD CFKM/G) Zabdf PQ/ LBG'KG) (5 - Bfof" LSGF/FDF Lbopsf) C /SN) K"0Ff ( /S Hgfp"B5Document4 pagesLjbfyl (X?N) S) DD CFKM/G) Zabdf PQ/ LBG'KG) (5 - Bfof" LSGF/FDF Lbopsf) C /SN) K"0Ff ( /S Hgfp"B5Adarsh RaiNo ratings yet

- Roll No. ...................... Total Pages: 7: BCQ/D-21Document7 pagesRoll No. ...................... Total Pages: 7: BCQ/D-21AkNo ratings yet

- Bangalore University Previous Year Question Paper AFM 1Document3 pagesBangalore University Previous Year Question Paper AFM 1Ramakrishna NagarajaNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- Ecommerce Ch2Document31 pagesEcommerce Ch2Daniel100% (1)

- RTHD L3gxiktDocument2 pagesRTHD L3gxiktRobin RahmanNo ratings yet

- A Tale of Two ShipyardsDocument15 pagesA Tale of Two ShipyardsMirella KaloyanovaNo ratings yet

- Fesco Online BillDocument2 pagesFesco Online BillTaimoor ShabeerNo ratings yet

- The Role of Banks, Non-Banks and The Central Bank in The Money Creation ProcessDocument21 pagesThe Role of Banks, Non-Banks and The Central Bank in The Money Creation Processwm100% (1)

- Quality in Health Care PDFDocument102 pagesQuality in Health Care PDFjeetNo ratings yet

- Richard McWilliams PDFDocument4 pagesRichard McWilliams PDFAnonymous mSczftAH4ONo ratings yet

- Epari Sahil Sip ReportDocument34 pagesEpari Sahil Sip ReportK Abinash Prusty0% (1)

- Recall n45Document19 pagesRecall n45Paul PhillipsNo ratings yet

- Soa 0000000007093223Document3 pagesSoa 0000000007093223daisy.gatewaygroupNo ratings yet

- Mark Hayes PHD Thesis As Bound PDFDocument197 pagesMark Hayes PHD Thesis As Bound PDFJawad AliNo ratings yet

- TsiDocument8 pagesTsiGeorge Van BommelNo ratings yet

- Job Description - Client Services Representative (00008D4N)Document3 pagesJob Description - Client Services Representative (00008D4N)Omar MudassarNo ratings yet

- Renting of Toys in NewsDocument11 pagesRenting of Toys in NewssanjairailNo ratings yet

- LEC 2 - INTRO - HR MGRDocument19 pagesLEC 2 - INTRO - HR MGRleo max arceoNo ratings yet

- Caleb Cater ResumeDocument1 pageCaleb Cater Resumeapi-431735417No ratings yet

- Lec 17 NPV, IRR, Profitability IndexDocument29 pagesLec 17 NPV, IRR, Profitability Indexsuryatrikal123No ratings yet

- Affidavit of EvidenceDocument7 pagesAffidavit of Evidenceshivam5singh-25No ratings yet

- Imi Brochure 2014 FinalDocument72 pagesImi Brochure 2014 Finalarpit_9688No ratings yet

- BudgetingDocument4 pagesBudgetingMarife Arellano AlcobendasNo ratings yet

- Role of Mutual Funds in Retail Investment-45-MfsDocument11 pagesRole of Mutual Funds in Retail Investment-45-MfsSakshi GuptaNo ratings yet

- Smart TravelerDocument2 pagesSmart TravelerKire Gonzalez CruzNo ratings yet

- SyllabusDocument2 pagesSyllabusDedi SupiyadiNo ratings yet

- Bacolod CityDocument28 pagesBacolod CityReynhard Dale100% (1)

- WWM IntroDocument26 pagesWWM IntroMuhammad Azhar SaleemNo ratings yet

- AIFDocument30 pagesAIFMayank AgarwalNo ratings yet

- 7 Microsoft Philippines v. CIRDocument9 pages7 Microsoft Philippines v. CIRAnonymous 8liWSgmINo ratings yet

- Chapter 1 PDFDocument30 pagesChapter 1 PDFZi VillarNo ratings yet