Professional Documents

Culture Documents

Deductablity of Expenses Table

Deductablity of Expenses Table

Uploaded by

api-3582013960 ratings0% found this document useful (0 votes)

57 views1 pageOriginal Title

deductablity of expenses table

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

57 views1 pageDeductablity of Expenses Table

Deductablity of Expenses Table

Uploaded by

api-358201396Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

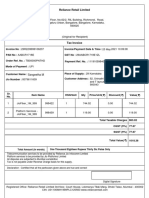

Deductibility of Expenses

TABLE TO ASSIST WITH CLASSIFICATION OF ENTERTAINMENT EXPENSES

Expense

Situation Income tax FBT GST classification

Employee takes two clients Employee s portion $50 is Employees portion is not Dont claim GST Entertainment

to lunch at a restaurant non-deductible subject to FBT assuming it is expense

cost $150 a minor and infrequent

fringe benefit.

Clients portion $100 non- Clients portion No FBT Do not claim Entertainment

deductible GST expense

Employee has meal in Tax deductible No FBT (otherwise Claim GST Travelling

restaurant while travelling deductible rule) Expense

on business trip.

Employer provides Tax deductible Exempt from FBT Claim ITC Staff amenities

sandwiches and juice for when GST

working lunch in office credits

(not entertainment) available

Employer provides Non-deductible (its an Exempt from FBT on account Do not claim Entertainment

substantial lunch with entertainment expense of being minor and GST

wine for employees in because of the large meal infrequent

office but not in canteen and the provision of

alchohol)

Employer provides social Non-deductible on account Exempt from FBT assume Do not claim Entertainment

function for employees in of being entertainment minor and infrequent GST

office

Employer provides social Cost per employee Cost per employee Exempt Do not claim Entertainment

function for employees Non-deductible (assume benefit GST expenses

and associates in office because its minor &

infrequent)

Cost per associate Cost per associate Claim GST Entertainment

Tax deductible (as FBT is Taxable fringe benefit (Consider not

levied on the benefit) providing this

benefit to

associates to

avoid FBT

impact)

Christmas party provided Not tax deductible Exempt fringe benefit as it is Do not claim Entertainment

to employees & clients provided on the business GST

- Provided on the premises

business premises

Christmas party provided Not tax deductible (provided No FBT if an exempt fringe Do not claim Entertainment

to employees & clients the minor and infrequent benefit if the total cost of GST

- Not provided on the benefit exemption applies) party per employee is less

premises than $300 per employee.

Gifts provided to Not tax deductible (assume No FBT if an exempt fringe Do not claim Entertainment

employees at Christmas that it is a minor & benefit if the total cost of GST

time infrequent benefit) party per employee is less

than $300 per employee.

Gifts made to clients in the Tax deductible Not subject to FBT as the Claim GST Client gifts

ordinary course of expense is not classed as where available

business where they are Entertainment under s 32-5

not included in the class of (TR 94/55 & ID 2004/427)

expenses listed above.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- Reliance Retail Limited: Sangeetha MDocument3 pagesReliance Retail Limited: Sangeetha MHariharan RNo ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- CIR vs. Esso Standard: Compensation and Set-OffDocument2 pagesCIR vs. Esso Standard: Compensation and Set-OffGabriel HernandezNo ratings yet

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine TaxationMay MayNo ratings yet

- Tax AssignmentDocument13 pagesTax AssignmentYitera SisayNo ratings yet

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDocument2 pagesBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNo ratings yet

- 23061100002934ICIC ChallanReceiptDocument2 pages23061100002934ICIC ChallanReceiptSamyak DahaleNo ratings yet

- Lembar Kerja Tryout - JurnalDocument5 pagesLembar Kerja Tryout - JurnalArif RamadhaniNo ratings yet

- Combine For Print Part TwoDocument13 pagesCombine For Print Part TwoEloiza Lajara RamosNo ratings yet

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDocument2 pagesFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNo ratings yet

- Paye Calculator-2Document11 pagesPaye Calculator-2MORRIS MURIGINo ratings yet

- GP Fund Calculation Formula Sheet For GP Fund StatementDocument4 pagesGP Fund Calculation Formula Sheet For GP Fund StatementLucky KhanNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Definitions - Punjab Land Revenue Act, 1887Document2 pagesDefinitions - Punjab Land Revenue Act, 1887Lokendra SinghNo ratings yet

- Package One - Lowering The Personal Income Tax - #TaxReformNowDocument4 pagesPackage One - Lowering The Personal Income Tax - #TaxReformNowJarwikNo ratings yet

- Invoices 22feb2022Document21 pagesInvoices 22feb2022Merliza JusayanNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatya0% (1)

- Ewt Exam - FormareDocument3 pagesEwt Exam - FormareMikaela SalvadorNo ratings yet

- Test 4Document3 pagesTest 4rehmamali98oNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- Tax QuizDocument6 pagesTax QuizAshley GanaNo ratings yet

- BIR Ruling No. 307-82Document2 pagesBIR Ruling No. 307-82Alfred Hernandez CampañanoNo ratings yet

- Tax On Rental Income 2015-16Document8 pagesTax On Rental Income 2015-16Uganda Revenue AuthorityNo ratings yet

- Nirc and TrainDocument5 pagesNirc and TrainJasmine Marie Ng CheongNo ratings yet

- Zimra 2016 Tax Tables PDFDocument2 pagesZimra 2016 Tax Tables PDFKathryn BrownNo ratings yet

- Income Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Document8 pagesIncome Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Jnv MANACAMP RAIPURNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- 1 Useful Calender For Every Accountant 2010Document13 pages1 Useful Calender For Every Accountant 2010bharat100% (1)