Professional Documents

Culture Documents

PNB Vs Ca

PNB Vs Ca

Uploaded by

Sheilah Mae PadallaCopyright:

Available Formats

You might also like

- Contracts MCQsDocument12 pagesContracts MCQsHarlyneNo ratings yet

- Notes On Ra 10591Document9 pagesNotes On Ra 10591RLO1No ratings yet

- CS Form No. 7 Clearance FormDocument6 pagesCS Form No. 7 Clearance FormPark SungNo ratings yet

- International Corporate Bank V CADocument1 pageInternational Corporate Bank V CAAlexir MendozaNo ratings yet

- JAI-ALAI V BPIDocument6 pagesJAI-ALAI V BPIKeej DalonosNo ratings yet

- Dela Victoria Vs Burgos (Digest)Document1 pageDela Victoria Vs Burgos (Digest)Glorious El DomineNo ratings yet

- Vicente de Ocampo Vs Anita GatchalianDocument1 pageVicente de Ocampo Vs Anita GatchalianPaula Gaspar100% (1)

- Velasco Vs Tan LiuanDocument5 pagesVelasco Vs Tan LiuanSharon Padaoan RuedasNo ratings yet

- FEBTC Vs Gold Palace JewellryDocument2 pagesFEBTC Vs Gold Palace JewellryIyah Mipanga0% (1)

- MILAN v. NLRC G.R. No. 202961Document2 pagesMILAN v. NLRC G.R. No. 202961sally deeNo ratings yet

- My Cousin Vinny FinishedDocument4 pagesMy Cousin Vinny FinishedNimith KonaNo ratings yet

- Cadiz v. CA (Banking Law)Document6 pagesCadiz v. CA (Banking Law)Dredd LelinaNo ratings yet

- De Ocampo Vs GatchalianDocument2 pagesDe Ocampo Vs GatchalianCareyssa MaeNo ratings yet

- Samsung Construction Company Philippines, Inc. vs. FEBTCDocument3 pagesSamsung Construction Company Philippines, Inc. vs. FEBTCJackie CanlasNo ratings yet

- Development Bank of Rizal v. Sima WeiDocument6 pagesDevelopment Bank of Rizal v. Sima WeiKaren Patricio LusticaNo ratings yet

- Amparo - Cases 8, 10, 11 - ClaveroDocument3 pagesAmparo - Cases 8, 10, 11 - ClaveroCreamyyClaveroNo ratings yet

- Negotiable Instruments Case Digest - Great Eastern Life Ins. Co. v. Hongkong Shanghai BankDocument2 pagesNegotiable Instruments Case Digest - Great Eastern Life Ins. Co. v. Hongkong Shanghai Bankclaire beltranNo ratings yet

- NIL Case DigestsDocument3 pagesNIL Case DigestsOtep Belciña Lumabas100% (1)

- Cred Trans Pledge DigestDocument18 pagesCred Trans Pledge DigestNester MendozaNo ratings yet

- 04 STELCO Vs CADocument2 pages04 STELCO Vs CAGabriel de Vera100% (1)

- 01 Salas Vs CADocument1 page01 Salas Vs CAJermaeDelosSantosNo ratings yet

- Case Digest Aug 8 2018Document24 pagesCase Digest Aug 8 2018Anonymous IhmXvCHj3cNo ratings yet

- Firestone Vs CADocument2 pagesFirestone Vs CAHoward TuanquiNo ratings yet

- State Investment House Vs - Ca DigestDocument1 pageState Investment House Vs - Ca Digestmiss_cmNo ratings yet

- Gullas V PNB CDDocument1 pageGullas V PNB CDAllen OlayvarNo ratings yet

- THE ROMAN CATHOLIC BISHOP OF JARO vs. GREGORIO DE LA PEÑADocument1 pageTHE ROMAN CATHOLIC BISHOP OF JARO vs. GREGORIO DE LA PEÑACharlotteNo ratings yet

- Sadaya v. SevillaDocument2 pagesSadaya v. SevillaJanno SangalangNo ratings yet

- Crisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Document9 pagesCrisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Krister VallenteNo ratings yet

- Nego-International Bank v. GuecoDocument3 pagesNego-International Bank v. GuecoIrish GarciaNo ratings yet

- Jai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118Document11 pagesJai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118AlvinRelox100% (1)

- Warehouse Receipts LawDocument28 pagesWarehouse Receipts LawVenice SantibañezNo ratings yet

- Batch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Document55 pagesBatch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Jc RobredilloNo ratings yet

- Bank of America NT & SA vs. Philippine Racing ClubDocument17 pagesBank of America NT & SA vs. Philippine Racing ClubRoberto Damian JrNo ratings yet

- Allied Bank vs. Lim Sio WanDocument1 pageAllied Bank vs. Lim Sio WanRealKD30No ratings yet

- RemDocument15 pagesRemMohammad Yusof MacalandapNo ratings yet

- Merc1 CaseDocument17 pagesMerc1 CaseaypodNo ratings yet

- 4 Pua Vs Sps Bun Tiong and TengDocument11 pages4 Pua Vs Sps Bun Tiong and TengtheresagriggsNo ratings yet

- SSS V CADocument2 pagesSSS V CARZ ZamoraNo ratings yet

- Facts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Document2 pagesFacts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Cy MichaelisNo ratings yet

- 07 Villanueva vs. NiteDocument1 page07 Villanueva vs. NiteGabriel de VeraNo ratings yet

- Case Name Facts & Issue RulingDocument15 pagesCase Name Facts & Issue RulingApril ToledoNo ratings yet

- Case Digest NegoDocument10 pagesCase Digest NegoAlee AbdulcalimNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Prudential Bank V IACDocument3 pagesPrudential Bank V IACdonnamariebollos100% (1)

- Cases in Negotiable Instruments LawDocument35 pagesCases in Negotiable Instruments Lawyumiganda50% (6)

- Credit TransactionsDocument19 pagesCredit Transactionsjpoy61494No ratings yet

- VICTORIA ILANO v. HON. DOLORES L. ESPAOLDocument1 pageVICTORIA ILANO v. HON. DOLORES L. ESPAOLelaine bercenioNo ratings yet

- Injustice Based On His Foreign CitizenshipDocument1 pageInjustice Based On His Foreign Citizenshipbryan168No ratings yet

- Bar Exams in Mercantile Law ReviewDocument150 pagesBar Exams in Mercantile Law ReviewDrexel Arginald AltavanoNo ratings yet

- Case DigestsDocument18 pagesCase DigestsJaime CorpuzNo ratings yet

- Garcia v. Llamas (2003)Document1 pageGarcia v. Llamas (2003)Jeliza ManaligodNo ratings yet

- 08 Lim v. PeopleDocument1 page08 Lim v. PeopleGuian LimNo ratings yet

- (Kinds of Agency) Case Citatio N: Date: Petitio Ners: Respo Ndents: Doctri NeDocument8 pages(Kinds of Agency) Case Citatio N: Date: Petitio Ners: Respo Ndents: Doctri NeCarie LawyerrNo ratings yet

- NIL 02 Areza Vs Express Savings Bank PDFDocument23 pagesNIL 02 Areza Vs Express Savings Bank PDFnette PagulayanNo ratings yet

- RCBC vs. Hi-Tri Development Corp.Document3 pagesRCBC vs. Hi-Tri Development Corp.Shiela PilarNo ratings yet

- Belgian Catholic Missionaries v. Magallanes PressDocument2 pagesBelgian Catholic Missionaries v. Magallanes PressAgee Romero-Valdes100% (1)

- Caltex Vs CA (Digest)Document2 pagesCaltex Vs CA (Digest)Glorious El Domine100% (1)

- R.A. 876Document6 pagesR.A. 876HaruNo ratings yet

- PNB V. CA - 256 SCRA 491 FACTS: DECS Issued A Check in Favor of Abante Marketing Containing A Specific Serial NumberDocument1 pagePNB V. CA - 256 SCRA 491 FACTS: DECS Issued A Check in Favor of Abante Marketing Containing A Specific Serial NumberRL N DeiparineNo ratings yet

- PNB Vs CA (Digest)Document2 pagesPNB Vs CA (Digest)Glorious El DomineNo ratings yet

- PNB Vs CADocument1 pagePNB Vs CARed HaleNo ratings yet

- Palaña Nego CasesDocument3 pagesPalaña Nego CasesMary Ann IsananNo ratings yet

- Philippine National Bank vs. Court of Appeals, G.R. No. 107508, April 25, 1996Document2 pagesPhilippine National Bank vs. Court of Appeals, G.R. No. 107508, April 25, 1996Leslie LernerNo ratings yet

- Remedial Law IiDocument3 pagesRemedial Law IiSheilah Mae PadallaNo ratings yet

- Metrobank Vs CabilzoDocument1 pageMetrobank Vs CabilzoSheilah Mae PadallaNo ratings yet

- Paternity and Filiation: Kinds/Status of Children-Legitimate Children, Art. 164 and Art. 54 and 43 (1)Document32 pagesPaternity and Filiation: Kinds/Status of Children-Legitimate Children, Art. 164 and Art. 54 and 43 (1)Sheilah Mae PadallaNo ratings yet

- Pci Vs CADocument1 pagePci Vs CASheilah Mae PadallaNo ratings yet

- Metropolitan Waterworks Vs CADocument1 pageMetropolitan Waterworks Vs CASheilah Mae PadallaNo ratings yet

- Diplomatic and Consular RelationsDocument6 pagesDiplomatic and Consular RelationsSheilah Mae Padalla100% (1)

- Nego Finals Group OBEDocument9 pagesNego Finals Group OBESheilah Mae PadallaNo ratings yet

- Labor Cases Strikes and LockoutsDocument67 pagesLabor Cases Strikes and LockoutsSheilah Mae PadallaNo ratings yet

- Gonzales V RCBCDocument2 pagesGonzales V RCBCSheilah Mae PadallaNo ratings yet

- Torts Bar QuestionsDocument19 pagesTorts Bar QuestionsSheilah Mae PadallaNo ratings yet

- Torts Midterm ReviewerDocument20 pagesTorts Midterm ReviewerSheilah Mae PadallaNo ratings yet

- Termination CasesDocument47 pagesTermination CasesSheilah Mae PadallaNo ratings yet

- Nego Bar QuestionsDocument38 pagesNego Bar QuestionsSheilah Mae PadallaNo ratings yet

- People vs. Edano G.R. No. 188133, July 7, 2014Document3 pagesPeople vs. Edano G.R. No. 188133, July 7, 2014Athea Justine YuNo ratings yet

- CARBONELL V CADocument2 pagesCARBONELL V CACarol AugustNo ratings yet

- Criminal Law Dissertation TopicsDocument4 pagesCriminal Law Dissertation TopicsPaySomeoneToWriteAPaperForMeUK100% (1)

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarNo ratings yet

- Syracuse Diocese and Former Utica Area Priest Face LawsuitDocument12 pagesSyracuse Diocese and Former Utica Area Priest Face LawsuitJustine AshleyNo ratings yet

- Rule 69 Garingan Vs GaringanDocument3 pagesRule 69 Garingan Vs GaringanAlexandra Nicole Manigos BaringNo ratings yet

- SK Appointment TabionDocument5 pagesSK Appointment TabionJerryme CastilloNo ratings yet

- Lejano vs. PeopleDocument62 pagesLejano vs. PeopleRachele GreeneNo ratings yet

- KAUTILYADocument22 pagesKAUTILYANamo PandeyNo ratings yet

- Harris The Archival SliverDocument24 pagesHarris The Archival Sliverdaniel martinNo ratings yet

- Hare - Hawes - Cutting ActDocument14 pagesHare - Hawes - Cutting ActGee Lee100% (1)

- 5 JurisprudenceDocument8 pages5 JurisprudencePulkitNo ratings yet

- Bar Questions 2004 and 2005Document4 pagesBar Questions 2004 and 2005El G. Se ChengNo ratings yet

- LEGAL ETHICS (Prob Areas) Digest CaseDocument3 pagesLEGAL ETHICS (Prob Areas) Digest Casewainie_deroNo ratings yet

- United States Court of Appeals For The Third CircuitDocument22 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Danan v. SerranoDocument2 pagesDanan v. SerranojenwinNo ratings yet

- Sec. 2. Corporation Defined. - A Corporation Is An Artificial Being Created byDocument9 pagesSec. 2. Corporation Defined. - A Corporation Is An Artificial Being Created byRose Jean Raniel OropaNo ratings yet

- ICHONG v. HERNANDEZ Case DigestDocument2 pagesICHONG v. HERNANDEZ Case DigestKrizzaShayneRamosArqueroNo ratings yet

- Denr Ao-4699Document9 pagesDenr Ao-4699Belle MadrigalNo ratings yet

- Absolute LiabilityDocument22 pagesAbsolute LiabilitySwayam SambhabNo ratings yet

- United States v. Hernandez-Banega, 10th Cir. (2017)Document2 pagesUnited States v. Hernandez-Banega, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- The County of Severin in 16-17th CenturiesDocument12 pagesThe County of Severin in 16-17th CenturiesAdrian maginaNo ratings yet

- IPC 3rd SemDocument17 pagesIPC 3rd SemRahul kumarNo ratings yet

- The Census Count and Prisons: The Problem, The Solutions and What The Census Can DoDocument1 pageThe Census Count and Prisons: The Problem, The Solutions and What The Census Can DoDemosNo ratings yet

- Income TaxationDocument28 pagesIncome TaxationHi HelloNo ratings yet

- Facts Under Indian Evidence LawDocument15 pagesFacts Under Indian Evidence LawNihit SinghalNo ratings yet

- United States v. Joseph, 4th Cir. (2009)Document4 pagesUnited States v. Joseph, 4th Cir. (2009)Scribd Government DocsNo ratings yet

PNB Vs Ca

PNB Vs Ca

Uploaded by

Sheilah Mae PadallaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PNB Vs Ca

PNB Vs Ca

Uploaded by

Sheilah Mae PadallaCopyright:

Available Formats

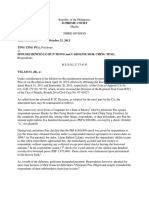

PHILIPPINE NATIONAL BANK vs.

COURT OF APPEALS

G.R. No. 107508, April 25, 1996

FACTS:

DECS issued a check in favor of Abante Marketing containing a specific serial

number, drawn against PNB. The check was deposited by Abante in its account with

Capitol and the latter consequently deposited the same with its account with

PBCOM which later deposited it with petitioner for clearing. The check was

thereafter cleared. However, on a relevant date, petitioner PNB returned the check

on account that there had been a material alteration on it. Subsequent debits were

made but Capitol cannot debit the account of Abante any longer for the latter had

withdrawn all the money already from the account. This prompted Capitol to seek

reclarification from PBCOM and demanded the recrediting of its account. PBCOM

followed suit by doing the same against PNB. Demands unheeded, it filed an action

against PBCOM and the latter filed a third-party complaint against petitioner.

ISSUE:

Whether or not there was a material alteration.

RULING:

An alteration is said to be material if it alters the effect of the instrument. It means an

unauthorized change in the instrument that purports to modify in any respect the

obligation of a party or an unauthorized addition of words or numbers or other

change to an incomplete instrument relating to the obligation of the party. In other

words, a material alteration is one which changes the items which are required to be

stated under Section 1 of the NIL.

In this case, the alleged material alteration was the alteration of the serial number of

the check in issue which is not an essential element of a negotiable instrument

under Section 1. PNB alleges that the alteration was material since it is an accepted

concept that a TCAA check by its very nature is the medium of exchange of

governments, instrumentalities and agencies. As a safety measure, every government

office or agency is assigned checks bearing different serial numbers. But this contention

has to fail. The checks serial number is not the sole indicia of its origin. The name of the

government agency issuing the check is clearly stated therein. Thus, the checks drawer

is sufficiently identified, rendering redundant the referral to its serial number.

Therefore, there being no material alteration in the check committed, PNB could not

return the check to PBCOM. It should pay the same.

You might also like

- Contracts MCQsDocument12 pagesContracts MCQsHarlyneNo ratings yet

- Notes On Ra 10591Document9 pagesNotes On Ra 10591RLO1No ratings yet

- CS Form No. 7 Clearance FormDocument6 pagesCS Form No. 7 Clearance FormPark SungNo ratings yet

- International Corporate Bank V CADocument1 pageInternational Corporate Bank V CAAlexir MendozaNo ratings yet

- JAI-ALAI V BPIDocument6 pagesJAI-ALAI V BPIKeej DalonosNo ratings yet

- Dela Victoria Vs Burgos (Digest)Document1 pageDela Victoria Vs Burgos (Digest)Glorious El DomineNo ratings yet

- Vicente de Ocampo Vs Anita GatchalianDocument1 pageVicente de Ocampo Vs Anita GatchalianPaula Gaspar100% (1)

- Velasco Vs Tan LiuanDocument5 pagesVelasco Vs Tan LiuanSharon Padaoan RuedasNo ratings yet

- FEBTC Vs Gold Palace JewellryDocument2 pagesFEBTC Vs Gold Palace JewellryIyah Mipanga0% (1)

- MILAN v. NLRC G.R. No. 202961Document2 pagesMILAN v. NLRC G.R. No. 202961sally deeNo ratings yet

- My Cousin Vinny FinishedDocument4 pagesMy Cousin Vinny FinishedNimith KonaNo ratings yet

- Cadiz v. CA (Banking Law)Document6 pagesCadiz v. CA (Banking Law)Dredd LelinaNo ratings yet

- De Ocampo Vs GatchalianDocument2 pagesDe Ocampo Vs GatchalianCareyssa MaeNo ratings yet

- Samsung Construction Company Philippines, Inc. vs. FEBTCDocument3 pagesSamsung Construction Company Philippines, Inc. vs. FEBTCJackie CanlasNo ratings yet

- Development Bank of Rizal v. Sima WeiDocument6 pagesDevelopment Bank of Rizal v. Sima WeiKaren Patricio LusticaNo ratings yet

- Amparo - Cases 8, 10, 11 - ClaveroDocument3 pagesAmparo - Cases 8, 10, 11 - ClaveroCreamyyClaveroNo ratings yet

- Negotiable Instruments Case Digest - Great Eastern Life Ins. Co. v. Hongkong Shanghai BankDocument2 pagesNegotiable Instruments Case Digest - Great Eastern Life Ins. Co. v. Hongkong Shanghai Bankclaire beltranNo ratings yet

- NIL Case DigestsDocument3 pagesNIL Case DigestsOtep Belciña Lumabas100% (1)

- Cred Trans Pledge DigestDocument18 pagesCred Trans Pledge DigestNester MendozaNo ratings yet

- 04 STELCO Vs CADocument2 pages04 STELCO Vs CAGabriel de Vera100% (1)

- 01 Salas Vs CADocument1 page01 Salas Vs CAJermaeDelosSantosNo ratings yet

- Case Digest Aug 8 2018Document24 pagesCase Digest Aug 8 2018Anonymous IhmXvCHj3cNo ratings yet

- Firestone Vs CADocument2 pagesFirestone Vs CAHoward TuanquiNo ratings yet

- State Investment House Vs - Ca DigestDocument1 pageState Investment House Vs - Ca Digestmiss_cmNo ratings yet

- Gullas V PNB CDDocument1 pageGullas V PNB CDAllen OlayvarNo ratings yet

- THE ROMAN CATHOLIC BISHOP OF JARO vs. GREGORIO DE LA PEÑADocument1 pageTHE ROMAN CATHOLIC BISHOP OF JARO vs. GREGORIO DE LA PEÑACharlotteNo ratings yet

- Sadaya v. SevillaDocument2 pagesSadaya v. SevillaJanno SangalangNo ratings yet

- Crisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Document9 pagesCrisologo-Jose v. Court of Appeals, G.R. No. 80599, September 15, 1989Krister VallenteNo ratings yet

- Nego-International Bank v. GuecoDocument3 pagesNego-International Bank v. GuecoIrish GarciaNo ratings yet

- Jai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118Document11 pagesJai Alai Vs BPI Facts: (2) Republic Vs Ebrada: NEGO Forgery Cases APR118AlvinRelox100% (1)

- Warehouse Receipts LawDocument28 pagesWarehouse Receipts LawVenice SantibañezNo ratings yet

- Batch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Document55 pagesBatch 1 Herrera Vs Petro Phil Corp 146 SCRA 385Jc RobredilloNo ratings yet

- Bank of America NT & SA vs. Philippine Racing ClubDocument17 pagesBank of America NT & SA vs. Philippine Racing ClubRoberto Damian JrNo ratings yet

- Allied Bank vs. Lim Sio WanDocument1 pageAllied Bank vs. Lim Sio WanRealKD30No ratings yet

- RemDocument15 pagesRemMohammad Yusof MacalandapNo ratings yet

- Merc1 CaseDocument17 pagesMerc1 CaseaypodNo ratings yet

- 4 Pua Vs Sps Bun Tiong and TengDocument11 pages4 Pua Vs Sps Bun Tiong and TengtheresagriggsNo ratings yet

- SSS V CADocument2 pagesSSS V CARZ ZamoraNo ratings yet

- Facts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Document2 pagesFacts:: ROMEO C. GARCIA, Petitioner, vs. DIONISIO V. LLAMAS, Respondent. G.R. No. 154127 December 8, 2003Cy MichaelisNo ratings yet

- 07 Villanueva vs. NiteDocument1 page07 Villanueva vs. NiteGabriel de VeraNo ratings yet

- Case Name Facts & Issue RulingDocument15 pagesCase Name Facts & Issue RulingApril ToledoNo ratings yet

- Case Digest NegoDocument10 pagesCase Digest NegoAlee AbdulcalimNo ratings yet

- Clark Vs Sellner DigestDocument1 pageClark Vs Sellner Digestjim jim100% (1)

- Prudential Bank V IACDocument3 pagesPrudential Bank V IACdonnamariebollos100% (1)

- Cases in Negotiable Instruments LawDocument35 pagesCases in Negotiable Instruments Lawyumiganda50% (6)

- Credit TransactionsDocument19 pagesCredit Transactionsjpoy61494No ratings yet

- VICTORIA ILANO v. HON. DOLORES L. ESPAOLDocument1 pageVICTORIA ILANO v. HON. DOLORES L. ESPAOLelaine bercenioNo ratings yet

- Injustice Based On His Foreign CitizenshipDocument1 pageInjustice Based On His Foreign Citizenshipbryan168No ratings yet

- Bar Exams in Mercantile Law ReviewDocument150 pagesBar Exams in Mercantile Law ReviewDrexel Arginald AltavanoNo ratings yet

- Case DigestsDocument18 pagesCase DigestsJaime CorpuzNo ratings yet

- Garcia v. Llamas (2003)Document1 pageGarcia v. Llamas (2003)Jeliza ManaligodNo ratings yet

- 08 Lim v. PeopleDocument1 page08 Lim v. PeopleGuian LimNo ratings yet

- (Kinds of Agency) Case Citatio N: Date: Petitio Ners: Respo Ndents: Doctri NeDocument8 pages(Kinds of Agency) Case Citatio N: Date: Petitio Ners: Respo Ndents: Doctri NeCarie LawyerrNo ratings yet

- NIL 02 Areza Vs Express Savings Bank PDFDocument23 pagesNIL 02 Areza Vs Express Savings Bank PDFnette PagulayanNo ratings yet

- RCBC vs. Hi-Tri Development Corp.Document3 pagesRCBC vs. Hi-Tri Development Corp.Shiela PilarNo ratings yet

- Belgian Catholic Missionaries v. Magallanes PressDocument2 pagesBelgian Catholic Missionaries v. Magallanes PressAgee Romero-Valdes100% (1)

- Caltex Vs CA (Digest)Document2 pagesCaltex Vs CA (Digest)Glorious El Domine100% (1)

- R.A. 876Document6 pagesR.A. 876HaruNo ratings yet

- PNB V. CA - 256 SCRA 491 FACTS: DECS Issued A Check in Favor of Abante Marketing Containing A Specific Serial NumberDocument1 pagePNB V. CA - 256 SCRA 491 FACTS: DECS Issued A Check in Favor of Abante Marketing Containing A Specific Serial NumberRL N DeiparineNo ratings yet

- PNB Vs CA (Digest)Document2 pagesPNB Vs CA (Digest)Glorious El DomineNo ratings yet

- PNB Vs CADocument1 pagePNB Vs CARed HaleNo ratings yet

- Palaña Nego CasesDocument3 pagesPalaña Nego CasesMary Ann IsananNo ratings yet

- Philippine National Bank vs. Court of Appeals, G.R. No. 107508, April 25, 1996Document2 pagesPhilippine National Bank vs. Court of Appeals, G.R. No. 107508, April 25, 1996Leslie LernerNo ratings yet

- Remedial Law IiDocument3 pagesRemedial Law IiSheilah Mae PadallaNo ratings yet

- Metrobank Vs CabilzoDocument1 pageMetrobank Vs CabilzoSheilah Mae PadallaNo ratings yet

- Paternity and Filiation: Kinds/Status of Children-Legitimate Children, Art. 164 and Art. 54 and 43 (1)Document32 pagesPaternity and Filiation: Kinds/Status of Children-Legitimate Children, Art. 164 and Art. 54 and 43 (1)Sheilah Mae PadallaNo ratings yet

- Pci Vs CADocument1 pagePci Vs CASheilah Mae PadallaNo ratings yet

- Metropolitan Waterworks Vs CADocument1 pageMetropolitan Waterworks Vs CASheilah Mae PadallaNo ratings yet

- Diplomatic and Consular RelationsDocument6 pagesDiplomatic and Consular RelationsSheilah Mae Padalla100% (1)

- Nego Finals Group OBEDocument9 pagesNego Finals Group OBESheilah Mae PadallaNo ratings yet

- Labor Cases Strikes and LockoutsDocument67 pagesLabor Cases Strikes and LockoutsSheilah Mae PadallaNo ratings yet

- Gonzales V RCBCDocument2 pagesGonzales V RCBCSheilah Mae PadallaNo ratings yet

- Torts Bar QuestionsDocument19 pagesTorts Bar QuestionsSheilah Mae PadallaNo ratings yet

- Torts Midterm ReviewerDocument20 pagesTorts Midterm ReviewerSheilah Mae PadallaNo ratings yet

- Termination CasesDocument47 pagesTermination CasesSheilah Mae PadallaNo ratings yet

- Nego Bar QuestionsDocument38 pagesNego Bar QuestionsSheilah Mae PadallaNo ratings yet

- People vs. Edano G.R. No. 188133, July 7, 2014Document3 pagesPeople vs. Edano G.R. No. 188133, July 7, 2014Athea Justine YuNo ratings yet

- CARBONELL V CADocument2 pagesCARBONELL V CACarol AugustNo ratings yet

- Criminal Law Dissertation TopicsDocument4 pagesCriminal Law Dissertation TopicsPaySomeoneToWriteAPaperForMeUK100% (1)

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarNo ratings yet

- Syracuse Diocese and Former Utica Area Priest Face LawsuitDocument12 pagesSyracuse Diocese and Former Utica Area Priest Face LawsuitJustine AshleyNo ratings yet

- Rule 69 Garingan Vs GaringanDocument3 pagesRule 69 Garingan Vs GaringanAlexandra Nicole Manigos BaringNo ratings yet

- SK Appointment TabionDocument5 pagesSK Appointment TabionJerryme CastilloNo ratings yet

- Lejano vs. PeopleDocument62 pagesLejano vs. PeopleRachele GreeneNo ratings yet

- KAUTILYADocument22 pagesKAUTILYANamo PandeyNo ratings yet

- Harris The Archival SliverDocument24 pagesHarris The Archival Sliverdaniel martinNo ratings yet

- Hare - Hawes - Cutting ActDocument14 pagesHare - Hawes - Cutting ActGee Lee100% (1)

- 5 JurisprudenceDocument8 pages5 JurisprudencePulkitNo ratings yet

- Bar Questions 2004 and 2005Document4 pagesBar Questions 2004 and 2005El G. Se ChengNo ratings yet

- LEGAL ETHICS (Prob Areas) Digest CaseDocument3 pagesLEGAL ETHICS (Prob Areas) Digest Casewainie_deroNo ratings yet

- United States Court of Appeals For The Third CircuitDocument22 pagesUnited States Court of Appeals For The Third CircuitScribd Government DocsNo ratings yet

- Danan v. SerranoDocument2 pagesDanan v. SerranojenwinNo ratings yet

- Sec. 2. Corporation Defined. - A Corporation Is An Artificial Being Created byDocument9 pagesSec. 2. Corporation Defined. - A Corporation Is An Artificial Being Created byRose Jean Raniel OropaNo ratings yet

- ICHONG v. HERNANDEZ Case DigestDocument2 pagesICHONG v. HERNANDEZ Case DigestKrizzaShayneRamosArqueroNo ratings yet

- Denr Ao-4699Document9 pagesDenr Ao-4699Belle MadrigalNo ratings yet

- Absolute LiabilityDocument22 pagesAbsolute LiabilitySwayam SambhabNo ratings yet

- United States v. Hernandez-Banega, 10th Cir. (2017)Document2 pagesUnited States v. Hernandez-Banega, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- The County of Severin in 16-17th CenturiesDocument12 pagesThe County of Severin in 16-17th CenturiesAdrian maginaNo ratings yet

- IPC 3rd SemDocument17 pagesIPC 3rd SemRahul kumarNo ratings yet

- The Census Count and Prisons: The Problem, The Solutions and What The Census Can DoDocument1 pageThe Census Count and Prisons: The Problem, The Solutions and What The Census Can DoDemosNo ratings yet

- Income TaxationDocument28 pagesIncome TaxationHi HelloNo ratings yet

- Facts Under Indian Evidence LawDocument15 pagesFacts Under Indian Evidence LawNihit SinghalNo ratings yet

- United States v. Joseph, 4th Cir. (2009)Document4 pagesUnited States v. Joseph, 4th Cir. (2009)Scribd Government DocsNo ratings yet