Professional Documents

Culture Documents

Chapter 3 - Job Order Costing (Part 1) : Measuring Direct Materials

Chapter 3 - Job Order Costing (Part 1) : Measuring Direct Materials

Uploaded by

Summer0 ratings0% found this document useful (0 votes)

33 views2 pagesJob-order costing is used when unique products are produced each period. It involves tracking direct materials, direct labor, and manufacturing overhead costs for each job. Direct materials are tracked using bills of materials and material requisition forms. Direct labor hours are tracked using time tickets. Manufacturing overhead is predicted and allocated to jobs using a predetermined overhead rate and allocation base like direct labor hours. This allows for estimating a job's total costs before completion.

Original Description:

Accounting

Original Title

Chapter 3 Notes - Part 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJob-order costing is used when unique products are produced each period. It involves tracking direct materials, direct labor, and manufacturing overhead costs for each job. Direct materials are tracked using bills of materials and material requisition forms. Direct labor hours are tracked using time tickets. Manufacturing overhead is predicted and allocated to jobs using a predetermined overhead rate and allocation base like direct labor hours. This allows for estimating a job's total costs before completion.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

33 views2 pagesChapter 3 - Job Order Costing (Part 1) : Measuring Direct Materials

Chapter 3 - Job Order Costing (Part 1) : Measuring Direct Materials

Uploaded by

SummerJob-order costing is used when unique products are produced each period. It involves tracking direct materials, direct labor, and manufacturing overhead costs for each job. Direct materials are tracked using bills of materials and material requisition forms. Direct labor hours are tracked using time tickets. Manufacturing overhead is predicted and allocated to jobs using a predetermined overhead rate and allocation base like direct labor hours. This allows for estimating a job's total costs before completion.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Chapter 3 Job Order Costing (Part 1)

Absorption costing all manufacturing cost, both fixed and variable, are accumulate

and summarized on managerial reports. The units fully absorb manufacturing

costs.

Job-order costing used when many different products with individual and unique

features are produced each period.

- Job the production activities for a custom product or service

Measuring Direct Materials:

- Bill of Materials is a document that lists the type and quantity of each type of

direct material needed to complete a unit of product

- Material requisition form document that Production Department uses that

specifies gthe type and quantity of materials to be taken from the warehouse

and identifies the job it will be charged for the cost of materials.

- Job cost sheet records the materials, labor, and manufacturing overhead costs

charged to that job.

Measuring Direct Labor:

- Time tickets hour-by-hour summary of the employees activities throughout

the day

o Computerized approach employee can swipe their badge to a specific

job they are working on, so the labor hours can be tracked

Overhead:

Due to perpetual inventory system, we must predict what overhead costs will be

and assign it to a job so that a jobs total costs can be estimated prior to its

completion.

*Product costs include manufacturing overhead as well as DM and DL, so we have to

record MOH and allocate it based on an allocation base.

- Allocation base measure (such as direct labor-hours or machine hours) that is

used to assign overhead costs to products and services

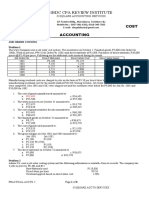

Predetermined Overhead Rate method for allocating MOH

Predetermined Overhead Rate = Estimated Manufacturing

Overhead Costs

Estimated total allocation base

Overhead application process of assigning overhead cost to jobs

Overhead applied to = Predetermined OH rate X Allocation base

incurred by the job

a particular job

You might also like

- t3 s08sDocument19 pagest3 s08sJohn BiliNo ratings yet

- LRA CITIZEN CHARTER HANDBOOK (Form) - FINAL 03122020 PDFDocument349 pagesLRA CITIZEN CHARTER HANDBOOK (Form) - FINAL 03122020 PDFCharmaine Coleta100% (2)

- Ey Ifrs 10 Consolidation For Fund Managers PDFDocument32 pagesEy Ifrs 10 Consolidation For Fund Managers PDFCindy Yin100% (2)

- ECON357 v2 Assignment 2B!!Document16 pagesECON357 v2 Assignment 2B!!hannahNo ratings yet

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- XamIdea Economics Class 12Document462 pagesXamIdea Economics Class 12Aastha Sagar68% (25)

- ACCT 311 - Exam 2 Review and SolutionsDocument6 pagesACCT 311 - Exam 2 Review and SolutionsSummerNo ratings yet

- ACCT 311 - Exam 1 Review With SolutionsDocument6 pagesACCT 311 - Exam 1 Review With SolutionsSummerNo ratings yet

- Case 11-55Document3 pagesCase 11-55HETTYNo ratings yet

- Presentation On Absorption and Variable CostingDocument11 pagesPresentation On Absorption and Variable CostingAnusha MaharjanNo ratings yet

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDocument3 pagesADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishNo ratings yet

- Exercises On Chapter 3 PDFDocument8 pagesExercises On Chapter 3 PDFhanaNo ratings yet

- ACCT 311 - Exam 2 Review and SolutionsDocument6 pagesACCT 311 - Exam 2 Review and SolutionsSummerNo ratings yet

- ACCT 311 - Exam 1 Review With SolutionsDocument6 pagesACCT 311 - Exam 1 Review With SolutionsSummerNo ratings yet

- Definition of Job Order CostingDocument8 pagesDefinition of Job Order CostingWondwosen AlemuNo ratings yet

- Cost Accouting-JOCDocument3 pagesCost Accouting-JOCAli ImranNo ratings yet

- Steps in Job CostingDocument8 pagesSteps in Job CostingBhagaban DasNo ratings yet

- Chapter 3 Notes - Part 3Document2 pagesChapter 3 Notes - Part 3SummerNo ratings yet

- ACCT 311 - Chapter 6 NotesDocument4 pagesACCT 311 - Chapter 6 NotesSummerNo ratings yet

- Chapter 10 Solutions - Inclass ExercisesDocument12 pagesChapter 10 Solutions - Inclass ExercisesSummerNo ratings yet

- 610 Exam 2 Spring 11 PracticeDocument8 pages610 Exam 2 Spring 11 PracticeSummerNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 2Document2 pagesACCT 311 - Chapter 5 Notes - Part 2SummerNo ratings yet

- 610 Midterm 3 A PracticeDocument12 pages610 Midterm 3 A PracticeSummerNo ratings yet

- Chapter 9 - Flexible Budgets and Performance AnalysisDocument3 pagesChapter 9 - Flexible Budgets and Performance AnalysisSummerNo ratings yet

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- ACCT 311 - Exam 3 Review With SolutionsDocument7 pagesACCT 311 - Exam 3 Review With SolutionsSummerNo ratings yet

- Cost Sheet: Solutions To Assignment ProblemsDocument3 pagesCost Sheet: Solutions To Assignment ProblemsNidaNo ratings yet

- Assignment 1111Document8 pagesAssignment 1111SAAD HUSSAINNo ratings yet

- Cost Accounting AssignmentDocument3 pagesCost Accounting AssignmentMkaeDizonNo ratings yet

- Session 10-14 PGDM 2020-21Document44 pagesSession 10-14 PGDM 2020-21Krishnapriya NairNo ratings yet

- ch4 HorrgernDocument27 pagesch4 HorrgernMahmoud MohamedNo ratings yet

- Day 7 Chap 3 Rev. FI5 Ex PR PDFDocument5 pagesDay 7 Chap 3 Rev. FI5 Ex PR PDFJames Erick LermaNo ratings yet

- Sanders CompanyDocument6 pagesSanders CompanyculadiNo ratings yet

- 0568-Cost and Management AccountingDocument7 pages0568-Cost and Management AccountingWaqar AhmadNo ratings yet

- Lecture 2 BEP Numericals AnswersDocument16 pagesLecture 2 BEP Numericals AnswersSanyam GoelNo ratings yet

- Answers Homework # 15 Cost MGMT 4Document7 pagesAnswers Homework # 15 Cost MGMT 4Raman ANo ratings yet

- SDocument59 pagesSmoniquettnNo ratings yet

- Cost Accounting and Control OutputDocument21 pagesCost Accounting and Control OutputApril Joy ObedozaNo ratings yet

- Standard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceDocument5 pagesStandard Costing: SUPER SUMMARY (Reading Method 1) Material VarianceWinnieOngNo ratings yet

- 6e Brewer CH03 B EOCDocument10 pages6e Brewer CH03 B EOCLiyanCenNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Basic Characteristics of Process CostingDocument1 pageBasic Characteristics of Process CostingMeghan Kaye LiwenNo ratings yet

- OverheadDocument15 pagesOverheadSwapnil Jade100% (1)

- CST Accounting by Ig ClassesDocument39 pagesCST Accounting by Ig Classesraman sharma100% (1)

- Equivalent Process AccountDocument4 pagesEquivalent Process AccountPrasanna Sharma100% (2)

- Chapter 3 System Design Job Order Costing SystemDocument76 pagesChapter 3 System Design Job Order Costing SystemMulugeta GirmaNo ratings yet

- Job Order CostingDocument43 pagesJob Order CostingNefvi Desqi AndrianiNo ratings yet

- Cost II Chapter ThreeDocument11 pagesCost II Chapter ThreeSemira100% (1)

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingJonathan Smoko100% (1)

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument56 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Week 10&11 Assignment-HernandezDocument3 pagesWeek 10&11 Assignment-HernandezDigna HernandezNo ratings yet

- STANDARD COSTING and Variance AnalysisDocument28 pagesSTANDARD COSTING and Variance AnalysisDanica VillaganteNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- Cost Accounting Research PaperDocument4 pagesCost Accounting Research PaperBhavya VermaNo ratings yet

- Duo PLC Produces Two Products A and B Each HasDocument2 pagesDuo PLC Produces Two Products A and B Each HasAmit Pandey50% (2)

- Systems Design: Job-Order CostingDocument60 pagesSystems Design: Job-Order CostingPriha AliNo ratings yet

- BOI Application FormDocument11 pagesBOI Application Formien_dsNo ratings yet

- Accounting CostingDocument156 pagesAccounting CostingMorning32100% (1)

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- Chapter 03Document22 pagesChapter 03Nelly YulindaNo ratings yet

- Chapter 3 AccountingDocument3 pagesChapter 3 Accountingmirzaaish112233No ratings yet

- CH 3 NewDocument15 pagesCH 3 Newwagawmesele458No ratings yet

- Lesson 10 Costing SystemsDocument8 pagesLesson 10 Costing SystemsSuhanna DavisNo ratings yet

- Job Costing HandoutDocument4 pagesJob Costing HandoutChise YukariNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 2Document2 pagesACCT 311 - Chapter 5 Notes - Part 2SummerNo ratings yet

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- ACCT 311 - Chapter 6 NotesDocument4 pagesACCT 311 - Chapter 6 NotesSummerNo ratings yet

- Chapter 9 - Flexible Budgets and Performance AnalysisDocument3 pagesChapter 9 - Flexible Budgets and Performance AnalysisSummerNo ratings yet

- ACCT 311 - Exam 3 Review With SolutionsDocument7 pagesACCT 311 - Exam 3 Review With SolutionsSummerNo ratings yet

- Chapter 8 - Inclass ExercisesDocument8 pagesChapter 8 - Inclass ExercisesSummerNo ratings yet

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- Chapter 10 Solutions - Inclass ExercisesDocument12 pagesChapter 10 Solutions - Inclass ExercisesSummerNo ratings yet

- Chapter 9 - Inclass ExercisesDocument5 pagesChapter 9 - Inclass ExercisesSummerNo ratings yet

- Chapter 13 Solutions - Inclass ExercisesDocument8 pagesChapter 13 Solutions - Inclass ExercisesSummerNo ratings yet

- Chapter 1 NotesDocument3 pagesChapter 1 NotesSummerNo ratings yet

- 610 Midterm 3 A PracticeDocument12 pages610 Midterm 3 A PracticeSummerNo ratings yet

- 610 Exam 2 Spring 11 PracticeDocument8 pages610 Exam 2 Spring 11 PracticeSummerNo ratings yet

- Adorn WPC OD 14-1Document11 pagesAdorn WPC OD 14-1Amey BhosaleNo ratings yet

- Rieter C 81 Card Brochure 3586 v1 98697 enDocument28 pagesRieter C 81 Card Brochure 3586 v1 98697 enAyan MukherjeeNo ratings yet

- Universal Business SolutionsDocument6 pagesUniversal Business SolutionsAbraham AchuNo ratings yet

- Quant Checklist 464 by Aashish Arora For Bank Exams 2024Document117 pagesQuant Checklist 464 by Aashish Arora For Bank Exams 2024sharpleakeyNo ratings yet

- Hammer Union CatalogDocument34 pagesHammer Union CatalogReyna NavaNo ratings yet

- BUDGET Part & SERVICE 2024 PLBDocument32 pagesBUDGET Part & SERVICE 2024 PLBService JakartaNo ratings yet

- 3 - Frank - Chapter03 - Rational Consumer ChoiceDocument40 pages3 - Frank - Chapter03 - Rational Consumer ChoiceNOPPHANUT NGAMVITROJENo ratings yet

- Ardia Vermosa Ardia Ph2B B29.L9 20201003Document2 pagesArdia Vermosa Ardia Ph2B B29.L9 20201003Mark Gil De LeonNo ratings yet

- Marquee - Hafiz Stainless Steel Items List PDFDocument2 pagesMarquee - Hafiz Stainless Steel Items List PDFHafeezKhanNo ratings yet

- ECO604 Course Outline2017Document4 pagesECO604 Course Outline2017snazrulNo ratings yet

- Macroeconomics: Policies and Analysis Project Title - Vive La FranceDocument16 pagesMacroeconomics: Policies and Analysis Project Title - Vive La FranceArpita SenNo ratings yet

- CH 01 - QS 1-17-18 Ac 3-4Document14 pagesCH 01 - QS 1-17-18 Ac 3-4Sharmi laNo ratings yet

- Transmittal LetterDocument8 pagesTransmittal LetterAbby TademNo ratings yet

- Fake Invoice SSDocument24 pagesFake Invoice SSSUBHASH SHARMANo ratings yet

- MECO Lecture24Document24 pagesMECO Lecture24Syed AhmedNo ratings yet

- IndicatorsDocument3 pagesIndicators'Izzad AfifNo ratings yet

- Urban and Regional Planning Theories and Issues PDFDocument172 pagesUrban and Regional Planning Theories and Issues PDFJohn Michael BlancaflorNo ratings yet

- Redisgn by Srwa Hidayat PDFDocument149 pagesRedisgn by Srwa Hidayat PDFmahnazNo ratings yet

- Capitalism: Meaning, Stages, Features, Merits, De-Merits and ConclusionDocument12 pagesCapitalism: Meaning, Stages, Features, Merits, De-Merits and ConclusionAnand RajNo ratings yet

- Kaushal Parmar 22B3M063Document25 pagesKaushal Parmar 22B3M063Kaushal ParmarNo ratings yet

- MGT-9 2023Document10 pagesMGT-9 2023Srishti 2k22No ratings yet

- 50 KG Garlic Processing Plant Quotation BY Divine GroupDocument2 pages50 KG Garlic Processing Plant Quotation BY Divine GroupWhatever NothingNo ratings yet

- Summary MAS291Document9 pagesSummary MAS291Hiếu PhạmNo ratings yet

- Structural Standard Drawings - 20210713Document36 pagesStructural Standard Drawings - 20210713TH YungNo ratings yet

- 3 - CREATE Sample Problem Tax On Domestic CorporationsDocument2 pages3 - CREATE Sample Problem Tax On Domestic CorporationsZenNo ratings yet