Professional Documents

Culture Documents

529credit SS1

529credit SS1

Uploaded by

loristurdevantOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

529credit SS1

529credit SS1

Uploaded by

loristurdevantCopyright:

Available Formats

Section 529 College Savings Plan Credit and Subtraction

First special session, omnibus tax bill (17-4727)

The bill allows a non-refundable income tax credit or an income tax subtraction for contributions to any states

section 529 college savings plan or prepaid tuition plan. A taxpayer may claim either the credit or the

subtraction, but not both.

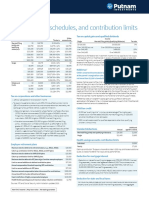

529 Plan Credit

For individual filers and married couples, the credit equals 50 percent of contributions, up to a maximum of

$500. The table below shows examples of the credits allowed at different contribution rates and income levels.

Individual, 1 dependent Married Couple, 2 dependents

Income (AGI) $500 in $1,000 in $500 in $1,000 in

Contributions Contributions Contributions Contributions

$20,000 $250 $500 $0 $0

$40,000 $250 $500 $250 $500

$65,000 $250 $500 $250 $500

$90,000 $200 $200 $250 $350

$115,000 $0 $0 $250 $250

$140,000 $0 $0 $200 $200

$165,000 $0 $0 $0 $0

For both individual and married couples, the maximum credit is phased out as income increases. For individual

filers, the maximum credit is phased out by two percent of adjusted gross income in excess of $75,000. The

credit is fully phased out for individual filers at $100,000 of adjusted gross income.

Income range (AGI) Maximum Credit (Single filers)

Up to $75,000 $500

$75,001 to $100,000 $500 minus 2% of AGI in excess of $75,000

$100,001 and above 0

For married couples filing joint returns, the maximum credit is phased out in two stages, and is fully phased out

when AGI reaches $160,000.

Income range (AGI) Maximum Credit (Married Couples Filing Joint Returns)

Up to $75,000 $500

$75,001 to $100,000 $500 minus 1% of AGI in excess of $75,000

$100,001 to $135,000 $250

$135,001 to $159,000 $250 minus 1% of AGI in excess of $135,000

$160,000 and above $0

529 Plan Subtraction

Allows a taxpayer to subtract up to $1,500 ($3,000 for married joint filers) of contributions to any states

section 529 college savings plan or prepaid tuition plan. The subtraction excludes amounts that are rolled-over

from other college savings plans. The subtraction is limited to taxpayers who do not claim the 529 Plan credit.

MN Department of Revenue estimates:

fiscal year 2018: $10.0 million income tax reduction ($7.5 million credit; $2.5 million subtraction)

fiscal year 2019: $10.4 million income tax reduction ($7.8 million credit; $2.6 million subtraction)

fiscal year 2020: $10.6 million income tax reduction ($8.0 million credit; $2.6 million subtraction)

fiscal year 2021: $11.0 million income tax reduction ($8.3 million credit; $2.7 million subtraction)

House Research Department; May 23, 2017

source: Department of Revenue estimate

You might also like

- Chapter 05 Test BankDocument73 pagesChapter 05 Test BankBrandon LeeNo ratings yet

- GrandjeanDocument129 pagesGrandjeanloristurdevant100% (1)

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- Barbara BeckDocument300 pagesBarbara BeckloristurdevantNo ratings yet

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocument3 pagesTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNo ratings yet

- 17vs18taxbracket FinalDocument2 pages17vs18taxbracket Finalapi-426611448No ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- 250 WDP MveDocument28 pages250 WDP MveMichael Van EssenNo ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- Alliance Tax Subsidies Levitt 2Document10 pagesAlliance Tax Subsidies Levitt 2llevittNo ratings yet

- TABL2751 Tax Rates 2021 - UpdatedDocument4 pagesTABL2751 Tax Rates 2021 - UpdatedPeper12345No ratings yet

- Income Disclosure Statement: JULY 2018 - JUNE 2019Document1 pageIncome Disclosure Statement: JULY 2018 - JUNE 2019tinotenda ganaganaNo ratings yet

- Lesson 1 DebtDocument21 pagesLesson 1 DebtAlf ChingNo ratings yet

- Rate+Sheet+and+Examples 2Document3 pagesRate+Sheet+and+Examples 2mayordrillNo ratings yet

- Racial Equity Impact Assessment: BILL 24-0236Document17 pagesRacial Equity Impact Assessment: BILL 24-0236Martin AustermuhleNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Windes 2021 Year End Year Round Tax Planning GuideDocument20 pagesWindes 2021 Year End Year Round Tax Planning GuideBrian SneeNo ratings yet

- GoBuyside 2016 United States Compensation StudyDocument5 pagesGoBuyside 2016 United States Compensation StudyBen HollowayNo ratings yet

- Student Loan Calculator With SAVE PlanDocument34 pagesStudent Loan Calculator With SAVE PlanZach LittleNo ratings yet

- FIN 5003 Midterm Review Winter 2024 - TaggedDocument21 pagesFIN 5003 Midterm Review Winter 2024 - TaggedYash PatelNo ratings yet

- Tax Foundation FF6241Document5 pagesTax Foundation FF6241muhammad mudassarNo ratings yet

- Housekeeping Matters: Please Silence Your Cell PhonesDocument61 pagesHousekeeping Matters: Please Silence Your Cell PhonesSaurabh RajNo ratings yet

- Crosswalk CPA Review: Tax Inflation Adjustments 2021Document15 pagesCrosswalk CPA Review: Tax Inflation Adjustments 2021Adhira VenkatNo ratings yet

- Penn-Wharton Budget Model Brief "Forgiving Student Loans: Budgetary Costs and Distributional Impact"Document7 pagesPenn-Wharton Budget Model Brief "Forgiving Student Loans: Budgetary Costs and Distributional Impact"CurtisNo ratings yet

- Ey Tax Rates Alberta 2023 01 15 v1Document2 pagesEy Tax Rates Alberta 2023 01 15 v1AltafNo ratings yet

- FIRE EstimatorDocument10 pagesFIRE EstimatorJared PerezNo ratings yet

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- Simple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICDocument52 pagesSimple Financial Plan & Unit Economics - Lead Gen - Template - v3.0 by Future Flow - PUBLICRaúl GuerreroNo ratings yet

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Document3 pagesTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangNo ratings yet

- ZIM 2024 Tax Reference GuideDocument7 pagesZIM 2024 Tax Reference GuideAlex MilarNo ratings yet

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StoreNo ratings yet

- US Master Tax Guide (PDFDrive)Document1,258 pagesUS Master Tax Guide (PDFDrive)sutan mNo ratings yet

- Income Tax Calculator FY 2020 2021Document8 pagesIncome Tax Calculator FY 2020 2021LalitNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- Ruben Lopes Insurace Case StudyDocument3 pagesRuben Lopes Insurace Case Studygabbarsinghh00123No ratings yet

- PR 5Document7 pagesPR 5vanessagreco17No ratings yet

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Tax Rates Ontario 2019Document2 pagesTax Rates Ontario 2019Pratik BajajNo ratings yet

- Read This First:: Loan & General InfoDocument14 pagesRead This First:: Loan & General InfoJoannaNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- Ac00unting 2Document45 pagesAc00unting 2Hazem El SayedNo ratings yet

- Age Pension Age Set To Change 2023Document11 pagesAge Pension Age Set To Change 2023FrankNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Your 2013 Income Taxes Have Gone UP Folks!Document2 pagesYour 2013 Income Taxes Have Gone UP Folks!mikerogeroNo ratings yet

- Tutorial 7 Solutions PDFDocument4 pagesTutorial 7 Solutions PDFmusuotaNo ratings yet

- 2013 Tax Ref. Guide RateDocument2 pages2013 Tax Ref. Guide RateeabooksNo ratings yet

- Budget WorksheetDocument4 pagesBudget Worksheetsenuli WithanachchiNo ratings yet

- Benefits SummaryDocument2 pagesBenefits SummaryGustavo StorNo ratings yet

- California State Controller'S Office Paycheck Calculator - 2021 Tax RatesDocument1 pageCalifornia State Controller'S Office Paycheck Calculator - 2021 Tax RatesSamantha JahansouzshahiNo ratings yet

- Carried Interest Partnership Template v1Document3 pagesCarried Interest Partnership Template v1arsocialidNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Full Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All ChapterDocument42 pagesFull Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All Chaptermaizonsudar100% (5)

- 2019-2020 Tax GuideDocument2 pages2019-2020 Tax Guidecherry LiNo ratings yet

- Tugas Minggu Ke 5Document4 pagesTugas Minggu Ke 5Devenda Kartika RoffandiNo ratings yet

- Corrected Criticism On Tax Changes - September 26, 2017 - MAGARIL, MikhaelDocument20 pagesCorrected Criticism On Tax Changes - September 26, 2017 - MAGARIL, MikhaelMikhael MagarilNo ratings yet

- Taxes in Canada-Final 2011Document145 pagesTaxes in Canada-Final 2011Dayarayan CanadaNo ratings yet

- What You Need To Know For Tax Season 2023 - ReviewDocument34 pagesWhat You Need To Know For Tax Season 2023 - ReviewJagmohan TeamentigrityNo ratings yet

- 2019 Tax GuideDocument20 pages2019 Tax GuidetaulantzeNo ratings yet

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Minnesota Graduation Rates Continue Upward Trend As Gaps Continue To CloseDocument3 pagesMinnesota Graduation Rates Continue Upward Trend As Gaps Continue To CloseloristurdevantNo ratings yet

- Serres C CapDocument2 pagesSerres C CaploristurdevantNo ratings yet

- Right To Try StatementDocument4 pagesRight To Try StatementloristurdevantNo ratings yet

- Lewis V CraigDocument1 pageLewis V CraigloristurdevantNo ratings yet

- Opioid Plan EditorialDocument1 pageOpioid Plan EditorialloristurdevantNo ratings yet

- House Ways and Means CommitteeDocument1 pageHouse Ways and Means CommitteeloristurdevantNo ratings yet

- CHC LetterDocument2 pagesCHC LetterloristurdevantNo ratings yet

- MGTI Letterhead V10Document2 pagesMGTI Letterhead V10loristurdevantNo ratings yet

- BHP Waiver 2018Document2 pagesBHP Waiver 2018loristurdevantNo ratings yet

- Statement On President Trump's CSR Announcement: C I B 2550 U A W S 255 S S - P, M 55114 651-645-0099 FAX 651-645-0098Document1 pageStatement On President Trump's CSR Announcement: C I B 2550 U A W S 255 S S - P, M 55114 651-645-0099 FAX 651-645-0098loristurdevantNo ratings yet

- Minnesota vs. 3MDocument37 pagesMinnesota vs. 3MBrett BachmanNo ratings yet

- 2016 10 27 Letter Historical Society Board Art RecommendationsDocument2 pages2016 10 27 Letter Historical Society Board Art RecommendationsloristurdevantNo ratings yet

- Biodiesel Impact Study - Report March 2015docx FINALDocument45 pagesBiodiesel Impact Study - Report March 2015docx FINALloristurdevantNo ratings yet

- Child Protection Oversight CommitteeDocument1 pageChild Protection Oversight CommitteeloristurdevantNo ratings yet

- 2015 ACS Press ReleaseDocument2 pages2015 ACS Press ReleaseloristurdevantNo ratings yet

- Concentrix Services India Private Limited PAYSLIP FOR The Month of November - 2019Document5 pagesConcentrix Services India Private Limited PAYSLIP FOR The Month of November - 2019Sumit PatilNo ratings yet

- Filing of Returns and PaymentDocument10 pagesFiling of Returns and PaymentOmie Jehan Hadji-AzisNo ratings yet

- DIGIROVERSDocument1 pageDIGIROVERSAbhijit SarkarNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- Payslip: Take-Home Pay 1,679.54Document1 pagePayslip: Take-Home Pay 1,679.54Sreten TodorovicNo ratings yet

- Gross Estate IntroductionDocument2 pagesGross Estate IntroductionJustz LimNo ratings yet

- Mandla - Reddy PayslipDocument1 pageMandla - Reddy PayslipMedi Srikanth NethaNo ratings yet

- Income Tax Theory by T.S. Reddy From Margham Publication 2022-23Document1 pageIncome Tax Theory by T.S. Reddy From Margham Publication 2022-23Riya M50% (2)

- TaxationDocument4 pagesTaxationKatzkie DesuNo ratings yet

- DQQPK6242H - 2023-24 2Document4 pagesDQQPK6242H - 2023-24 2Annu SharmaNo ratings yet

- Kotak Mahindra Life Insurance Company LTD Lta Claim FormDocument2 pagesKotak Mahindra Life Insurance Company LTD Lta Claim FormCricket KheloNo ratings yet

- Payslip 00037846Document1 pagePayslip 00037846Monti SiwachNo ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDocument21 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanNo ratings yet

- Capital Gains Taxation-3Document37 pagesCapital Gains Taxation-3Cory RitaNo ratings yet

- Qap FormatDocument8 pagesQap FormatPau Line EscosioNo ratings yet

- Example #1 Future Budget ProjectDocument13 pagesExample #1 Future Budget ProjectkelseythemathteacherNo ratings yet

- Supporting Organization FormDocument2 pagesSupporting Organization FormpatalataNo ratings yet

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

- Goods and Services Tax: B2B - Invoice DetailsDocument1 pageGoods and Services Tax: B2B - Invoice DetailsSOURAV GUPTANo ratings yet

- Taxation On PartnershipDocument28 pagesTaxation On PartnershipEvie Marionette100% (1)

- Filing of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaDocument13 pagesFiling of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaMohan PatelNo ratings yet

- Cir Vs Tours SpecialistDocument1 pageCir Vs Tours SpecialistKim Lorenzo CalatravaNo ratings yet

- (m12) Att Paper 1 - Part 1 QPDocument16 pages(m12) Att Paper 1 - Part 1 QPAhmad Jehangiri100% (1)

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- BPS LTD v. Ketua Pengarah Hasil Dalam Negeri (1997) MSTC 2847Document7 pagesBPS LTD v. Ketua Pengarah Hasil Dalam Negeri (1997) MSTC 2847Vasanth TamilselvanNo ratings yet

- Assignment 2Document1 pageAssignment 2HareemNo ratings yet