Professional Documents

Culture Documents

Tutorial 11 Question 3 Paramita Sdn. BHD

Tutorial 11 Question 3 Paramita Sdn. BHD

Uploaded by

Brenda TanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 11 Question 3 Paramita Sdn. BHD

Tutorial 11 Question 3 Paramita Sdn. BHD

Uploaded by

Brenda TanCopyright:

Available Formats

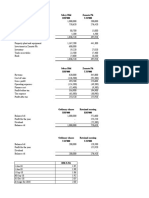

Tutorial 11 Question 3

Paramita Sdn. Bhd.

Common Expenses RM

Directors' fees 200,000

Salaries & wages 350,000

Audit fee 30,000 Interest

Secretarial fee (restricted to RM5,000) 5,000 Less: Common expenses

Telephone charges 10,000 Adjusted income

Food & drink (for employees) 46,000 Less: Capital allowance

Postage 4,000 Statutory income

Stationery 5,000 Rent

Donation - Less: Interest on bank loan-W&

Depreciation - Maintenance expenses- W

650,000 Less: Common expenses

Adjusted income

Gross income RM Less: Capital allowance

Dividends (single-tier exempt dividends) 900,000 Statutory income

Dividends (exempt) 150,000 Aggregate income

Interest 210,000

Rent 300,000

1,560,000 Chargable income

Common expenses attributable to RM Tax payable

Dividends (single-tier) 650,000 x 900,000 / 1,560,000 375,000 PL

Dividends (exempt) 650,000 x 150,000 / 1,560,000 62,500 PL

Interest 650,000 x 210,000 / 1,560,000 87,500

Rent 650,000 x 300,000 / 1,560,000 125,000

650,000

Capital allowance of RM78,000 for Plant & Machinery RM

Dividends (single-tier) 78,000 x 900,000 / 1,560,000 45,000 PL

Dividends (exempt) 78,000 x 150,000 / 1,560,000 7,500 PL

Interest 78,000 x 210,000 / 1,560,000 10,500

Rent 78,000 x 300,000 / 1,560,000 15,000

78,000

RM RM RM

210,000

Common expenses 87,500

122,500

Capital allowance 10,500

112,000

300,000

Interest on bank loan-W&E exp 60,000

Maintenance expenses- W&E exp 90,000

Common expenses 125,000 (276,923)

23,077

ital allowance 15,000

8,077

120,077

Restricted to 10% of RM 118,731 12,007.7

108,069

RM 108,069 x 24% 25,937

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- 2k Duolingo PlusDocument158 pages2k Duolingo PlusThomas De Doncker0% (1)

- Far410 - SS - Feb 2022Document9 pagesFar410 - SS - Feb 2022AFIZA JASMANNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Limited company 格式Document2 pagesLimited company 格式F4B21 Emily LeiNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Financial Template GuidelineDocument9 pagesFinancial Template GuidelineAmzar SaniNo ratings yet

- Latihan KP - Muhamad Imam Dharmawan - 2502017162hhDocument9 pagesLatihan KP - Muhamad Imam Dharmawan - 2502017162hhNatasha HerlianaNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- Chapter 12 PDFDocument11 pagesChapter 12 PDFgerNo ratings yet

- GROUP PROJECT REPORT 1 AmsyarDocument24 pagesGROUP PROJECT REPORT 1 AmsyarAmmarNo ratings yet

- Questionn 3-Dec 2018Document4 pagesQuestionn 3-Dec 2018GIROLYDIA EDDYNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- ACCT223 AY 21 22 Mid-Term AnswersDocument5 pagesACCT223 AY 21 22 Mid-Term AnswersLIAW ANN YINo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Answer Exercise 1Document2 pagesAnswer Exercise 1MUHAMMAD SYAZWAN MAZLANNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- Book 1Document2 pagesBook 1GIROLYDIA EDDYNo ratings yet

- Assignment ACC506 Mac-Jun 2017Document16 pagesAssignment ACC506 Mac-Jun 2017Syahmi AhmadNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Gross Profit 25,450.00Document6 pagesGross Profit 25,450.00AliNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- Asm ACCOUNTINGDocument16 pagesAsm ACCOUNTINGVũ Khánh HuyềnNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- Pham Le Thuy Duong - HW9Document4 pagesPham Le Thuy Duong - HW9Dương PhạmNo ratings yet

- Group Project 2 Sabry Zamato SolutionDocument5 pagesGroup Project 2 Sabry Zamato SolutionSyafahani SafieNo ratings yet

- 8b Tut Questions SolutionsDocument3 pages8b Tut Questions SolutionsMk SANo ratings yet

- Assignment Ficd113Document4 pagesAssignment Ficd113Eiril DanielNo ratings yet

- Chapter 8 - Tutorial IDocument6 pagesChapter 8 - Tutorial INUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Business Ribbons and Crafts Statement of Financial Position As at 31 December 2017Document2 pagesBusiness Ribbons and Crafts Statement of Financial Position As at 31 December 2017--bolabolaNo ratings yet

- Chapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDocument12 pagesChapter 21 - Advacc Solman Chapter 21 - Advacc SolmanDrew BanlutaNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTUsran Ali BubinNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- CL 3 Suggested Solution For Pilot PaperDocument15 pagesCL 3 Suggested Solution For Pilot PaperRoshanNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Business Income TutorialDocument5 pagesBusiness Income TutorialzulfikriNo ratings yet

- RM RM RM Net Sales: Less: Cost of Goods SoldDocument2 pagesRM RM RM Net Sales: Less: Cost of Goods SoldDESIREE DESSY MAIDI STUDENTNo ratings yet

- Paramita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesDocument2 pagesParamita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesBrenda TanNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- 2017 Sec 4E5N Prelim Paper 2 - AnsDocument7 pages2017 Sec 4E5N Prelim Paper 2 - AnsDamien SeowNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Uas Metode KuantitifDocument12 pagesUas Metode Kuantitifariyanto wibowoNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- Taxation Nyama AssignmentDocument14 pagesTaxation Nyama AssignmentTakudzwa BenjaminNo ratings yet

- Critical Success FactorsDocument4 pagesCritical Success FactorsBrenda TanNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- Strength: SWOT of Proton Holdings BerhadDocument3 pagesStrength: SWOT of Proton Holdings BerhadBrenda TanNo ratings yet

- Emerald SDN BHDDocument3 pagesEmerald SDN BHDBrenda TanNo ratings yet

- Paramita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesDocument2 pagesParamita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesBrenda TanNo ratings yet

- A) Computation of Chargeable Income For The Year of Assessment 2015 MR - Au (Deceased) Estate of MR - Au Income Business I (Malaysia) - S4 (A)Document2 pagesA) Computation of Chargeable Income For The Year of Assessment 2015 MR - Au (Deceased) Estate of MR - Au Income Business I (Malaysia) - S4 (A)Brenda TanNo ratings yet

- Document 2Document1 pageDocument 2Brenda TanNo ratings yet

- TAX T5 Question 1Document2 pagesTAX T5 Question 1Brenda TanNo ratings yet

- AP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- AR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- John Hopkins IbdDocument38 pagesJohn Hopkins IbdNovita ApramadhaNo ratings yet

- Reflection Paper: Chapter 2Document3 pagesReflection Paper: Chapter 2RedgiemarkNo ratings yet

- HES 005 Session 5 SASDocument10 pagesHES 005 Session 5 SASG INo ratings yet

- 1800 Mechanical Bender: Instruction ManualDocument42 pages1800 Mechanical Bender: Instruction ManualPato Loco Rateria100% (1)

- AVCN1 Full BDocument395 pagesAVCN1 Full BPhương TrungNo ratings yet

- MBA Interviews (Undergraduation Questions)Document14 pagesMBA Interviews (Undergraduation Questions)anshshah1310No ratings yet

- G5 Q2W5 DLL SCIENCE MELCsDocument9 pagesG5 Q2W5 DLL SCIENCE MELCsJohnnefer Caballero CinenseNo ratings yet

- 510 - Sps Vega vs. SSS, 20 Sept 2010Document2 pages510 - Sps Vega vs. SSS, 20 Sept 2010anaNo ratings yet

- A - B - C - Data Entry Operations (OS)Document24 pagesA - B - C - Data Entry Operations (OS)Indu GoyalNo ratings yet

- Surface To Air Missile SA-10 (S300)Document4 pagesSurface To Air Missile SA-10 (S300)Branislav LackovicNo ratings yet

- Ifage Bachelor 1 General English Chapter 1 Basics 1 2023 2024Document22 pagesIfage Bachelor 1 General English Chapter 1 Basics 1 2023 2024coordinateurlpa coordinateurlpaNo ratings yet

- International Expansion StrategyDocument15 pagesInternational Expansion StrategykananguptaNo ratings yet

- Pe 4Document5 pagesPe 4slide_poshNo ratings yet

- Pakistan Exams BC Bank AccountsDocument4 pagesPakistan Exams BC Bank AccountskhulsanNo ratings yet

- Dodla Dairy Hyderabad Field Visit 1Document23 pagesDodla Dairy Hyderabad Field Visit 1studartzofficialNo ratings yet

- Artificial SatelliteDocument11 pagesArtificial Satellitejames bond 001No ratings yet

- Db2 Interview QUESTIONS - Advertisement: Java Inteview Questions DB2 SQL Tutorial Mainframe Inteview QuestionsDocument21 pagesDb2 Interview QUESTIONS - Advertisement: Java Inteview Questions DB2 SQL Tutorial Mainframe Inteview Questionssroul4No ratings yet

- Builder - PDF (China Substitution)Document11 pagesBuilder - PDF (China Substitution)Finsen SooNo ratings yet

- Test Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020Document19 pagesTest Tasks For Reading: Presented by Lesley Nayeli Chávez Velázquez March 2020api-511296445No ratings yet

- Fractal Audio fm3 Omg9 ManualDocument7 pagesFractal Audio fm3 Omg9 Manualenezio vieiraNo ratings yet

- Navyfield Full ManualDocument11 pagesNavyfield Full Manualmarti1125100% (2)

- Part 2 Twentieth Century Naval Dockyards Devonport and Portsmouth Characterisation ReportDocument52 pagesPart 2 Twentieth Century Naval Dockyards Devonport and Portsmouth Characterisation ReportToby ChessonNo ratings yet

- Customer Service ExecutiveDocument54 pagesCustomer Service ExecutiveRakshita Bhat100% (1)

- Linear Phase Finite Impulse ResponseDocument30 pagesLinear Phase Finite Impulse ResponseHafizuddin AliNo ratings yet

- PQR Amp WPQ Standard Testing Parameter WorksheetDocument4 pagesPQR Amp WPQ Standard Testing Parameter WorksheetvinodNo ratings yet

- Ngá Nghä©a Unit 4Document5 pagesNgá Nghä©a Unit 4Nguyen The TranNo ratings yet

- 6.5 CalcDocument4 pages6.5 CalctholmesNo ratings yet

- The Mavericks MNIT 1st Year 2022-23Document3 pagesThe Mavericks MNIT 1st Year 2022-23Shantul KhandelwalNo ratings yet

- (Download PDF) Nicos Wish An MM Age Play Age Gap Romance The Littles of Cape Daddy Book 4 Zack Wish Lana Kyle Full Chapter PDFDocument69 pages(Download PDF) Nicos Wish An MM Age Play Age Gap Romance The Littles of Cape Daddy Book 4 Zack Wish Lana Kyle Full Chapter PDFshnankumpu48100% (10)