Professional Documents

Culture Documents

The Valuation Return Form

The Valuation Return Form

Uploaded by

Cindy LakhramCopyright:

Available Formats

You might also like

- Motion To Set AsideDocument2 pagesMotion To Set AsideNicholas Ryan33% (3)

- Bhattarai Et Al 2022 Contractors Claims in An Epc and Turnkey Contract Lessons Learned From A Hydropower ProjectDocument8 pagesBhattarai Et Al 2022 Contractors Claims in An Epc and Turnkey Contract Lessons Learned From A Hydropower ProjectFarrahNo ratings yet

- The Valuation Return Form PDFDocument2 pagesThe Valuation Return Form PDFAnthony Basanta0% (2)

- Strategic Alliance Agreement Template Sample UkDocument6 pagesStrategic Alliance Agreement Template Sample UkSiddharth SodhiNo ratings yet

- Quiz Case - Hsin Chong Vs HenbleDocument16 pagesQuiz Case - Hsin Chong Vs HenbleWing Chak ChanNo ratings yet

- An Engineering Consultancy Firm Supplies TemporaryDocument1 pageAn Engineering Consultancy Firm Supplies TemporaryEroxKeoxHalliGalli0% (1)

- Section D: Track Record (For CW, CR, Me, FM and MW Workheads)Document3 pagesSection D: Track Record (For CW, CR, Me, FM and MW Workheads)ariya2727100% (1)

- Advance Payment NotesDocument2 pagesAdvance Payment NotesAvinaash VeeramahNo ratings yet

- Vat 7 CDocument3 pagesVat 7 CDylan Ramasamy67% (3)

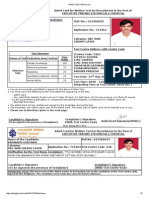

- NMDC 2015 - Admit CardDocument2 pagesNMDC 2015 - Admit CardgouthamsaiNo ratings yet

- Invoice For Kubota4820910632164408899Document14 pagesInvoice For Kubota4820910632164408899Rt OpNo ratings yet

- TAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Document1 pageTAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Dushyant ShuklaNo ratings yet

- 4-Storey Residential ProjectDocument11 pages4-Storey Residential ProjectAdrian Christian LeeNo ratings yet

- Aak Application FormDocument4 pagesAak Application FormNicholas KipkosgeyNo ratings yet

- Bangladesh Computer Samity: Membership Application FormDocument2 pagesBangladesh Computer Samity: Membership Application FormNisha100% (1)

- CP 0191 Payment CertificationDocument244 pagesCP 0191 Payment CertificationtabaquiNo ratings yet

- q1 Day 4 WorksheetDocument12 pagesq1 Day 4 WorksheetJohn Paul PagsolinganNo ratings yet

- L&T MetroDocument7 pagesL&T MetroSaigyan RanjanNo ratings yet

- Bank Statement Template 4 - TemplateLabDocument1 pageBank Statement Template 4 - TemplateLabStart AmazonNo ratings yet

- PCR COVID-19: Negative: If You Have Any Questions Regarding This Report Please Contact Your ProviderDocument1 pagePCR COVID-19: Negative: If You Have Any Questions Regarding This Report Please Contact Your ProviderLuis ReyesNo ratings yet

- Claims Ipc 09 - ReplyDocument17 pagesClaims Ipc 09 - ReplySyed Adnan AqibNo ratings yet

- Staad ChecksDocument26 pagesStaad ChecksDINESHNo ratings yet

- RICS - Unabsorbed HO OH and Loss of ProfitDocument84 pagesRICS - Unabsorbed HO OH and Loss of Profitfa ichNo ratings yet

- Sample NEORSD Bill 07-28-2016Document2 pagesSample NEORSD Bill 07-28-2016Sylvia HannekenNo ratings yet

- Company Name Div: Elec/Mech/Civil/ Interior: Internal Approval For Material SubmittalDocument6 pagesCompany Name Div: Elec/Mech/Civil/ Interior: Internal Approval For Material SubmittalKumlachew MengistuNo ratings yet

- Application For Interim MaintanennaceDocument3 pagesApplication For Interim MaintanennacePalak JoshiNo ratings yet

- Details of Tender Awarded More Than 1 Crore 19-12-2018Document28 pagesDetails of Tender Awarded More Than 1 Crore 19-12-2018Ravi TejaNo ratings yet

- Interpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Document4 pagesInterpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Anonymous oQWqJ5OwZNo ratings yet

- Introduction To FIDIC Forms of Contracts: Choice of Contract TypeDocument64 pagesIntroduction To FIDIC Forms of Contracts: Choice of Contract TypeAhmed Ghanem100% (1)

- Contacts ManagementDocument27 pagesContacts ManagementjaysonNo ratings yet

- Extension of TimeDocument2 pagesExtension of TimeAshraf MohamedNo ratings yet

- Nomination - External Timber Joinery - Banyan Grove - DMIDocument4 pagesNomination - External Timber Joinery - Banyan Grove - DMIDeepum HalloomanNo ratings yet

- Estimate Sheet - Crs-tp2 BuildingDocument112 pagesEstimate Sheet - Crs-tp2 BuildingRhowelle TibayNo ratings yet

- Exhibit A Value Engineering Change ProposalDocument4 pagesExhibit A Value Engineering Change ProposalDynie Likes FireflyNo ratings yet

- Silent NightDocument2 pagesSilent NightJoe PSNo ratings yet

- Contract Agreement For Hammer Nasa ConstDocument17 pagesContract Agreement For Hammer Nasa ConstAcroll_pjNo ratings yet

- Request For Proposal (RFP) : ND STDocument61 pagesRequest For Proposal (RFP) : ND STkavindra singhNo ratings yet

- Application Form For Upgrading of Contractors - 0Document16 pagesApplication Form For Upgrading of Contractors - 0Elisha WankogereNo ratings yet

- GH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDDocument6 pagesGH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDmanugeorgeNo ratings yet

- Conveyancing C28Document25 pagesConveyancing C28Anthony KipropNo ratings yet

- Brigade Oasis Phase 2 Allotment LetterDocument5 pagesBrigade Oasis Phase 2 Allotment LettersrikhereNo ratings yet

- UntitledDocument2 pagesUntitledMichelle LeeNo ratings yet

- Currency Exchnage FormatDocument1 pageCurrency Exchnage FormatSarvjeet SinghNo ratings yet

- BOQ For Mr. JohnDocument39 pagesBOQ For Mr. JohnerickNo ratings yet

- Land Form5 Application For Conversion From Leasehold Out of Former Public Land To FreeholdDocument3 pagesLand Form5 Application For Conversion From Leasehold Out of Former Public Land To FreeholdmoonlightkisiwabranchNo ratings yet

- Land Acquisition RulesDocument11 pagesLand Acquisition RulesIqram MeonNo ratings yet

- 26.elevated GRP Water Tank EPS FactoryDocument79 pages26.elevated GRP Water Tank EPS FactoryOCHILLOH STEVENo ratings yet

- Notice of Short Fixed Term Lease AgreementDocument2 pagesNotice of Short Fixed Term Lease Agreementsabita basnetNo ratings yet

- Ric Jaminzaidad Pvt. LTD.: Application For BookingDocument2 pagesRic Jaminzaidad Pvt. LTD.: Application For BookingANUNo ratings yet

- EDD Application FormDocument3 pagesEDD Application Formmmathambo2704No ratings yet

- Entree Foods P.O Box 4457-00200 Nairobi, KenyaDocument6 pagesEntree Foods P.O Box 4457-00200 Nairobi, KenyaEazi X AnzigareNo ratings yet

- Republic of Kenya: County Governmentof Kirinyaga P.O. BOX 260 KutusDocument10 pagesRepublic of Kenya: County Governmentof Kirinyaga P.O. BOX 260 KutusGovernor Joseph NdathiNo ratings yet

- Date Received From Constituency: ./ ./ . Date Approved at Region: ../.. /.. Date Sent To HQ: ..... /.. /..Document4 pagesDate Received From Constituency: ./ ./ . Date Approved at Region: ../.. /.. Date Sent To HQ: ..... /.. /..K KamauNo ratings yet

- Pao Bill FormDocument11 pagesPao Bill Formకొల్లి రాఘవేణిNo ratings yet

- Project Audit GuidelinesDocument69 pagesProject Audit GuidelinesJohn NjorogeNo ratings yet

- Deed of Agreement (Basera Breeze)Document10 pagesDeed of Agreement (Basera Breeze)amnrs786No ratings yet

- Forms PDFDocument32 pagesForms PDFKV Vijayendra100% (2)

- NCC Upgrade Form 2024Document6 pagesNCC Upgrade Form 2024sachombelatNo ratings yet

- Application Form - TemporaryDocument10 pagesApplication Form - TemporaryKhalid Ali AbdallaNo ratings yet

- Tenancy AgreementDocument3 pagesTenancy AgreementSerge AfanouNo ratings yet

- Copies: Commissioner of ValuationsDocument2 pagesCopies: Commissioner of ValuationsAnthony BasantaNo ratings yet

- The Fallout of War: The Regional Consequences of the Conflict in SyriaFrom EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNo ratings yet

- Kris Marketing LTD Organization Chart: Managing Director Ass't Manager/ SupervisorDocument1 pageKris Marketing LTD Organization Chart: Managing Director Ass't Manager/ SupervisorCindy LakhramNo ratings yet

- Law PresentationDocument11 pagesLaw PresentationCindy LakhramNo ratings yet

- Industrial Experience Ii: at Kris Marketing LTD Presented By: Rekha Singh-Cindy Lakhram-58328Document8 pagesIndustrial Experience Ii: at Kris Marketing LTD Presented By: Rekha Singh-Cindy Lakhram-58328Cindy LakhramNo ratings yet

- Marketing Plan of Pizza HutDocument11 pagesMarketing Plan of Pizza HutCindy LakhramNo ratings yet

- Physical EducationDocument36 pagesPhysical EducationCindy LakhramNo ratings yet

- Reflection Introduction To The Balance SheetDocument17 pagesReflection Introduction To The Balance SheetCindy LakhramNo ratings yet

- Drama PortfolioDocument21 pagesDrama PortfolioCindy LakhramNo ratings yet

- Solid Waste ManagementDocument59 pagesSolid Waste ManagementCindy LakhramNo ratings yet

- Books of Original Entry-1Document3 pagesBooks of Original Entry-1Cindy LakhramNo ratings yet

- Research and Practice: Changing Roles of Australian HRM PractitionersDocument19 pagesResearch and Practice: Changing Roles of Australian HRM PractitionersCindy LakhramNo ratings yet

- Clausnitzer v. Federal Express Corporation - Document No. 7Document11 pagesClausnitzer v. Federal Express Corporation - Document No. 7Justia.comNo ratings yet

- Succession Notes 2. AlbanoDocument4 pagesSuccession Notes 2. AlbanotmaderazoNo ratings yet

- 4 Bidding Procedure For Consulting.09162016Document63 pages4 Bidding Procedure For Consulting.09162016Dustin FormalejoNo ratings yet

- Easements HandoutsDocument9 pagesEasements HandoutsCarina Amor ClaveriaNo ratings yet

- People V Teresita Puig and Romeo PorrasDocument1 pagePeople V Teresita Puig and Romeo PorrasGressa LacsonNo ratings yet

- APTDocument104 pagesAPTbimsantosNo ratings yet

- Oct 8Document9 pagesOct 8crisNo ratings yet

- There Is Still Trust Property Registered in The Name of A Deregistered CompanyDocument3 pagesThere Is Still Trust Property Registered in The Name of A Deregistered CompanyMirandaNo ratings yet

- Civil Pro DigestDocument6 pagesCivil Pro DigestaeronastyNo ratings yet

- Proceedings, A Foresight To The Bar Exam: Question and Answer Noted, Bar Questions, Cases and Updated Laws, 2011)Document69 pagesProceedings, A Foresight To The Bar Exam: Question and Answer Noted, Bar Questions, Cases and Updated Laws, 2011)Bonazorte IncNo ratings yet

- தொடுவானம் -ஜெயகணேஷ்-ThoduVanamDocument36 pagesதொடுவானம் -ஜெயகணேஷ்-ThoduVanamRamnathNo ratings yet

- Jan 2018Document3 pagesJan 2018chandni babunuNo ratings yet

- Implementing Rules and Regulations Irr in The Conduct of The 10th Picpa National Accounting Quiz Showdown NaqdownDocument20 pagesImplementing Rules and Regulations Irr in The Conduct of The 10th Picpa National Accounting Quiz Showdown NaqdownCloudKielGuiangNo ratings yet

- AFFIDAVIT OF DISCREPANCY BlankDocument1 pageAFFIDAVIT OF DISCREPANCY BlankkristelNo ratings yet

- Class Act Pepper V Midland Credit Encore NoticeofMotion - 3Document2 pagesClass Act Pepper V Midland Credit Encore NoticeofMotion - 3Sean RamseyNo ratings yet

- Plus English 101 Phrase Book: Unit 2: Lesson 4: Have/HasDocument5 pagesPlus English 101 Phrase Book: Unit 2: Lesson 4: Have/HasEmalNo ratings yet

- University of North Bengal: Admit Card Semester-Iii Examination Under Cbcs - 2019Document1 pageUniversity of North Bengal: Admit Card Semester-Iii Examination Under Cbcs - 2019Abhishek PŕãśădNo ratings yet

- Property Law 20Document2 pagesProperty Law 20ShirishNo ratings yet

- Testamentary Succession 4Document30 pagesTestamentary Succession 4talk2marvin70No ratings yet

- Free Consent and Coercion (Law of Contract)Document11 pagesFree Consent and Coercion (Law of Contract)Harish gola0% (1)

- Paras Chapter 2 Testamentary Succession Section 5 LegitimeDocument8 pagesParas Chapter 2 Testamentary Succession Section 5 LegitimeEllen Glae DaquipilNo ratings yet

- Bim 1135Document6 pagesBim 1135chek86351No ratings yet

- Rule 18 and 19 DigestsDocument4 pagesRule 18 and 19 DigestsJL A H-DimaculanganNo ratings yet

- Koelling Et Al v. Burlingame Capital Partners II Et Al - Document No. 3Document1 pageKoelling Et Al v. Burlingame Capital Partners II Et Al - Document No. 3Justia.comNo ratings yet

- 'Most Immediate' Reminder Government of Telangana Irrigation and Cad DepartmentDocument5 pages'Most Immediate' Reminder Government of Telangana Irrigation and Cad DepartmentMaheshbabu SarellaNo ratings yet

- PALE CasesDocument240 pagesPALE Caseslars1No ratings yet

- Word Wheel PDFDocument23 pagesWord Wheel PDFma.elaine a. ongNo ratings yet

- Monique Rathbun v. Scientology: Motion For Leave To File Supplemental AuthorityDocument17 pagesMonique Rathbun v. Scientology: Motion For Leave To File Supplemental AuthorityTony OrtegaNo ratings yet

The Valuation Return Form

The Valuation Return Form

Uploaded by

Cindy LakhramOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Valuation Return Form

The Valuation Return Form

Uploaded by

Cindy LakhramCopyright:

Available Formats

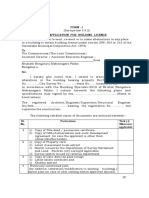

GOVERNMENT OF THE REPUBLIC OF TRINIDAD AND TOBAGO

MINISTRY OF FINANCE

VALUATION DIVISION

www.finance.gov.tt/propertytax

Dear Owner/Agent,

Please complete the Schedule II form below and return to any office of the Valuation Division (Table

ww.

below), together with COPIES of as many supporting documents as possible from the following list

(kindly check box{es} to indicate documents submitted):

Deed/RPO Certificate of Sketch of Building T&TEC bill (no more

Title Site Plan than 3 months old)

Land Survey Plan Building Plan Town & Country

Previous Land and Rent/Lease agreement Planning Approval

Building Taxes receipt for Completion Certificate (Status of Land)

property identified WASA bill (no more than Town & Country

Photograph of exterior of 3 months old) Planning Approved Use

the Property (Change of use)

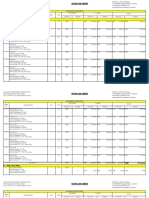

Valuation Division Office Address Tel #

Area/Region

Port of Spain #109 Henry Street, Port of Spain

Tunapuna & Arima #25-27 Eastern Main Road, Arouca

Sangre Grande Corner Brierley and Henderson Streets, Sangre Grande 612-9700

Chaguanas #206, Caroni Savannah Road, Charlieville, Chaguanas option #7

Rio Claro & San Fernando #29-31, Point-a-Pierre Road, Palms Club Building, San Fernando

Point Fortin Techier Road, Point Fortin

Siparia Siparia Administrative Complex, High Street, Siparia

Tobago Caroline Building, No. 2 Hamilton Street, Scarborough, Tobago

On completion, the Schedule II form should be returned to any office of the Valuation Division by May

22nd, 2017.

COMMISSIONER OF VALUATIONS

SCHEDULE II

RETURN REQUIRED UNDER SECTION 6 OF THE VALUATION OF LAND

ACT, CHAP. 58:03

I HEREBY DECLARE that I am the owner or agent of the premises mentioned hereunder and that the

several particulars stated in this return are to the best of my knowledge and belief true and correct.

1. Premises ................................................................................................

2. Name of Owner(s) ........................................................................

...............

3. For what purpose used ..............................................................................

[Turn over to page 2]

Page 2

4. Whether rented, leased or occupied by owner...

(a) If rented

(i) Number of rooms occupied by tenant; .

(ii) Name of tenant(s), with monthly rent payable by each

........................................................

(iii) Number of rooms untenanted, with rental value of each

..

..

(iv) Rent paid

(v) Whether tenant pays land rent of site; if so how much?

(b) If leasedname of lessee

Rent reserve under lease ..per year

Whether lessee pays the taxes ...

Whether lessee pays premiums of insurance and if so how much?

....................................................................................................................................

(c) If occupied by owner or relativesrental value thereof $...............................................

If occupied by owner or relativespart thereof $.................................................................

5. Additions or alterations to building (if any) since date of last return.

................................................

Dated this day of , 20

Signature and Address of Owner or Agent

(If space provided is not sufficient, details must be given on a separate sheet)

________________________________________________________________

Contact of Property Owner/Agent:

Tel. No(s): _______________________________________ E-mail: _____________________________

You might also like

- Motion To Set AsideDocument2 pagesMotion To Set AsideNicholas Ryan33% (3)

- Bhattarai Et Al 2022 Contractors Claims in An Epc and Turnkey Contract Lessons Learned From A Hydropower ProjectDocument8 pagesBhattarai Et Al 2022 Contractors Claims in An Epc and Turnkey Contract Lessons Learned From A Hydropower ProjectFarrahNo ratings yet

- The Valuation Return Form PDFDocument2 pagesThe Valuation Return Form PDFAnthony Basanta0% (2)

- Strategic Alliance Agreement Template Sample UkDocument6 pagesStrategic Alliance Agreement Template Sample UkSiddharth SodhiNo ratings yet

- Quiz Case - Hsin Chong Vs HenbleDocument16 pagesQuiz Case - Hsin Chong Vs HenbleWing Chak ChanNo ratings yet

- An Engineering Consultancy Firm Supplies TemporaryDocument1 pageAn Engineering Consultancy Firm Supplies TemporaryEroxKeoxHalliGalli0% (1)

- Section D: Track Record (For CW, CR, Me, FM and MW Workheads)Document3 pagesSection D: Track Record (For CW, CR, Me, FM and MW Workheads)ariya2727100% (1)

- Advance Payment NotesDocument2 pagesAdvance Payment NotesAvinaash VeeramahNo ratings yet

- Vat 7 CDocument3 pagesVat 7 CDylan Ramasamy67% (3)

- NMDC 2015 - Admit CardDocument2 pagesNMDC 2015 - Admit CardgouthamsaiNo ratings yet

- Invoice For Kubota4820910632164408899Document14 pagesInvoice For Kubota4820910632164408899Rt OpNo ratings yet

- TAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Document1 pageTAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Dushyant ShuklaNo ratings yet

- 4-Storey Residential ProjectDocument11 pages4-Storey Residential ProjectAdrian Christian LeeNo ratings yet

- Aak Application FormDocument4 pagesAak Application FormNicholas KipkosgeyNo ratings yet

- Bangladesh Computer Samity: Membership Application FormDocument2 pagesBangladesh Computer Samity: Membership Application FormNisha100% (1)

- CP 0191 Payment CertificationDocument244 pagesCP 0191 Payment CertificationtabaquiNo ratings yet

- q1 Day 4 WorksheetDocument12 pagesq1 Day 4 WorksheetJohn Paul PagsolinganNo ratings yet

- L&T MetroDocument7 pagesL&T MetroSaigyan RanjanNo ratings yet

- Bank Statement Template 4 - TemplateLabDocument1 pageBank Statement Template 4 - TemplateLabStart AmazonNo ratings yet

- PCR COVID-19: Negative: If You Have Any Questions Regarding This Report Please Contact Your ProviderDocument1 pagePCR COVID-19: Negative: If You Have Any Questions Regarding This Report Please Contact Your ProviderLuis ReyesNo ratings yet

- Claims Ipc 09 - ReplyDocument17 pagesClaims Ipc 09 - ReplySyed Adnan AqibNo ratings yet

- Staad ChecksDocument26 pagesStaad ChecksDINESHNo ratings yet

- RICS - Unabsorbed HO OH and Loss of ProfitDocument84 pagesRICS - Unabsorbed HO OH and Loss of Profitfa ichNo ratings yet

- Sample NEORSD Bill 07-28-2016Document2 pagesSample NEORSD Bill 07-28-2016Sylvia HannekenNo ratings yet

- Company Name Div: Elec/Mech/Civil/ Interior: Internal Approval For Material SubmittalDocument6 pagesCompany Name Div: Elec/Mech/Civil/ Interior: Internal Approval For Material SubmittalKumlachew MengistuNo ratings yet

- Application For Interim MaintanennaceDocument3 pagesApplication For Interim MaintanennacePalak JoshiNo ratings yet

- Details of Tender Awarded More Than 1 Crore 19-12-2018Document28 pagesDetails of Tender Awarded More Than 1 Crore 19-12-2018Ravi TejaNo ratings yet

- Interpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Document4 pagesInterpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Anonymous oQWqJ5OwZNo ratings yet

- Introduction To FIDIC Forms of Contracts: Choice of Contract TypeDocument64 pagesIntroduction To FIDIC Forms of Contracts: Choice of Contract TypeAhmed Ghanem100% (1)

- Contacts ManagementDocument27 pagesContacts ManagementjaysonNo ratings yet

- Extension of TimeDocument2 pagesExtension of TimeAshraf MohamedNo ratings yet

- Nomination - External Timber Joinery - Banyan Grove - DMIDocument4 pagesNomination - External Timber Joinery - Banyan Grove - DMIDeepum HalloomanNo ratings yet

- Estimate Sheet - Crs-tp2 BuildingDocument112 pagesEstimate Sheet - Crs-tp2 BuildingRhowelle TibayNo ratings yet

- Exhibit A Value Engineering Change ProposalDocument4 pagesExhibit A Value Engineering Change ProposalDynie Likes FireflyNo ratings yet

- Silent NightDocument2 pagesSilent NightJoe PSNo ratings yet

- Contract Agreement For Hammer Nasa ConstDocument17 pagesContract Agreement For Hammer Nasa ConstAcroll_pjNo ratings yet

- Request For Proposal (RFP) : ND STDocument61 pagesRequest For Proposal (RFP) : ND STkavindra singhNo ratings yet

- Application Form For Upgrading of Contractors - 0Document16 pagesApplication Form For Upgrading of Contractors - 0Elisha WankogereNo ratings yet

- GH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDDocument6 pagesGH-03, Sector-2, Greater Noida West: Nirala Projects Pvt. LTDmanugeorgeNo ratings yet

- Conveyancing C28Document25 pagesConveyancing C28Anthony KipropNo ratings yet

- Brigade Oasis Phase 2 Allotment LetterDocument5 pagesBrigade Oasis Phase 2 Allotment LettersrikhereNo ratings yet

- UntitledDocument2 pagesUntitledMichelle LeeNo ratings yet

- Currency Exchnage FormatDocument1 pageCurrency Exchnage FormatSarvjeet SinghNo ratings yet

- BOQ For Mr. JohnDocument39 pagesBOQ For Mr. JohnerickNo ratings yet

- Land Form5 Application For Conversion From Leasehold Out of Former Public Land To FreeholdDocument3 pagesLand Form5 Application For Conversion From Leasehold Out of Former Public Land To FreeholdmoonlightkisiwabranchNo ratings yet

- Land Acquisition RulesDocument11 pagesLand Acquisition RulesIqram MeonNo ratings yet

- 26.elevated GRP Water Tank EPS FactoryDocument79 pages26.elevated GRP Water Tank EPS FactoryOCHILLOH STEVENo ratings yet

- Notice of Short Fixed Term Lease AgreementDocument2 pagesNotice of Short Fixed Term Lease Agreementsabita basnetNo ratings yet

- Ric Jaminzaidad Pvt. LTD.: Application For BookingDocument2 pagesRic Jaminzaidad Pvt. LTD.: Application For BookingANUNo ratings yet

- EDD Application FormDocument3 pagesEDD Application Formmmathambo2704No ratings yet

- Entree Foods P.O Box 4457-00200 Nairobi, KenyaDocument6 pagesEntree Foods P.O Box 4457-00200 Nairobi, KenyaEazi X AnzigareNo ratings yet

- Republic of Kenya: County Governmentof Kirinyaga P.O. BOX 260 KutusDocument10 pagesRepublic of Kenya: County Governmentof Kirinyaga P.O. BOX 260 KutusGovernor Joseph NdathiNo ratings yet

- Date Received From Constituency: ./ ./ . Date Approved at Region: ../.. /.. Date Sent To HQ: ..... /.. /..Document4 pagesDate Received From Constituency: ./ ./ . Date Approved at Region: ../.. /.. Date Sent To HQ: ..... /.. /..K KamauNo ratings yet

- Pao Bill FormDocument11 pagesPao Bill Formకొల్లి రాఘవేణిNo ratings yet

- Project Audit GuidelinesDocument69 pagesProject Audit GuidelinesJohn NjorogeNo ratings yet

- Deed of Agreement (Basera Breeze)Document10 pagesDeed of Agreement (Basera Breeze)amnrs786No ratings yet

- Forms PDFDocument32 pagesForms PDFKV Vijayendra100% (2)

- NCC Upgrade Form 2024Document6 pagesNCC Upgrade Form 2024sachombelatNo ratings yet

- Application Form - TemporaryDocument10 pagesApplication Form - TemporaryKhalid Ali AbdallaNo ratings yet

- Tenancy AgreementDocument3 pagesTenancy AgreementSerge AfanouNo ratings yet

- Copies: Commissioner of ValuationsDocument2 pagesCopies: Commissioner of ValuationsAnthony BasantaNo ratings yet

- The Fallout of War: The Regional Consequences of the Conflict in SyriaFrom EverandThe Fallout of War: The Regional Consequences of the Conflict in SyriaNo ratings yet

- Kris Marketing LTD Organization Chart: Managing Director Ass't Manager/ SupervisorDocument1 pageKris Marketing LTD Organization Chart: Managing Director Ass't Manager/ SupervisorCindy LakhramNo ratings yet

- Law PresentationDocument11 pagesLaw PresentationCindy LakhramNo ratings yet

- Industrial Experience Ii: at Kris Marketing LTD Presented By: Rekha Singh-Cindy Lakhram-58328Document8 pagesIndustrial Experience Ii: at Kris Marketing LTD Presented By: Rekha Singh-Cindy Lakhram-58328Cindy LakhramNo ratings yet

- Marketing Plan of Pizza HutDocument11 pagesMarketing Plan of Pizza HutCindy LakhramNo ratings yet

- Physical EducationDocument36 pagesPhysical EducationCindy LakhramNo ratings yet

- Reflection Introduction To The Balance SheetDocument17 pagesReflection Introduction To The Balance SheetCindy LakhramNo ratings yet

- Drama PortfolioDocument21 pagesDrama PortfolioCindy LakhramNo ratings yet

- Solid Waste ManagementDocument59 pagesSolid Waste ManagementCindy LakhramNo ratings yet

- Books of Original Entry-1Document3 pagesBooks of Original Entry-1Cindy LakhramNo ratings yet

- Research and Practice: Changing Roles of Australian HRM PractitionersDocument19 pagesResearch and Practice: Changing Roles of Australian HRM PractitionersCindy LakhramNo ratings yet

- Clausnitzer v. Federal Express Corporation - Document No. 7Document11 pagesClausnitzer v. Federal Express Corporation - Document No. 7Justia.comNo ratings yet

- Succession Notes 2. AlbanoDocument4 pagesSuccession Notes 2. AlbanotmaderazoNo ratings yet

- 4 Bidding Procedure For Consulting.09162016Document63 pages4 Bidding Procedure For Consulting.09162016Dustin FormalejoNo ratings yet

- Easements HandoutsDocument9 pagesEasements HandoutsCarina Amor ClaveriaNo ratings yet

- People V Teresita Puig and Romeo PorrasDocument1 pagePeople V Teresita Puig and Romeo PorrasGressa LacsonNo ratings yet

- APTDocument104 pagesAPTbimsantosNo ratings yet

- Oct 8Document9 pagesOct 8crisNo ratings yet

- There Is Still Trust Property Registered in The Name of A Deregistered CompanyDocument3 pagesThere Is Still Trust Property Registered in The Name of A Deregistered CompanyMirandaNo ratings yet

- Civil Pro DigestDocument6 pagesCivil Pro DigestaeronastyNo ratings yet

- Proceedings, A Foresight To The Bar Exam: Question and Answer Noted, Bar Questions, Cases and Updated Laws, 2011)Document69 pagesProceedings, A Foresight To The Bar Exam: Question and Answer Noted, Bar Questions, Cases and Updated Laws, 2011)Bonazorte IncNo ratings yet

- தொடுவானம் -ஜெயகணேஷ்-ThoduVanamDocument36 pagesதொடுவானம் -ஜெயகணேஷ்-ThoduVanamRamnathNo ratings yet

- Jan 2018Document3 pagesJan 2018chandni babunuNo ratings yet

- Implementing Rules and Regulations Irr in The Conduct of The 10th Picpa National Accounting Quiz Showdown NaqdownDocument20 pagesImplementing Rules and Regulations Irr in The Conduct of The 10th Picpa National Accounting Quiz Showdown NaqdownCloudKielGuiangNo ratings yet

- AFFIDAVIT OF DISCREPANCY BlankDocument1 pageAFFIDAVIT OF DISCREPANCY BlankkristelNo ratings yet

- Class Act Pepper V Midland Credit Encore NoticeofMotion - 3Document2 pagesClass Act Pepper V Midland Credit Encore NoticeofMotion - 3Sean RamseyNo ratings yet

- Plus English 101 Phrase Book: Unit 2: Lesson 4: Have/HasDocument5 pagesPlus English 101 Phrase Book: Unit 2: Lesson 4: Have/HasEmalNo ratings yet

- University of North Bengal: Admit Card Semester-Iii Examination Under Cbcs - 2019Document1 pageUniversity of North Bengal: Admit Card Semester-Iii Examination Under Cbcs - 2019Abhishek PŕãśădNo ratings yet

- Property Law 20Document2 pagesProperty Law 20ShirishNo ratings yet

- Testamentary Succession 4Document30 pagesTestamentary Succession 4talk2marvin70No ratings yet

- Free Consent and Coercion (Law of Contract)Document11 pagesFree Consent and Coercion (Law of Contract)Harish gola0% (1)

- Paras Chapter 2 Testamentary Succession Section 5 LegitimeDocument8 pagesParas Chapter 2 Testamentary Succession Section 5 LegitimeEllen Glae DaquipilNo ratings yet

- Bim 1135Document6 pagesBim 1135chek86351No ratings yet

- Rule 18 and 19 DigestsDocument4 pagesRule 18 and 19 DigestsJL A H-DimaculanganNo ratings yet

- Koelling Et Al v. Burlingame Capital Partners II Et Al - Document No. 3Document1 pageKoelling Et Al v. Burlingame Capital Partners II Et Al - Document No. 3Justia.comNo ratings yet

- 'Most Immediate' Reminder Government of Telangana Irrigation and Cad DepartmentDocument5 pages'Most Immediate' Reminder Government of Telangana Irrigation and Cad DepartmentMaheshbabu SarellaNo ratings yet

- PALE CasesDocument240 pagesPALE Caseslars1No ratings yet

- Word Wheel PDFDocument23 pagesWord Wheel PDFma.elaine a. ongNo ratings yet

- Monique Rathbun v. Scientology: Motion For Leave To File Supplemental AuthorityDocument17 pagesMonique Rathbun v. Scientology: Motion For Leave To File Supplemental AuthorityTony OrtegaNo ratings yet