Professional Documents

Culture Documents

Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing Approach

Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing Approach

Uploaded by

Jay BrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing Approach

Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing Approach

Uploaded by

Jay BrockCopyright:

Available Formats

1

Chapter 6

Activity-Based Costing

Answers to End of Chapter Exercises

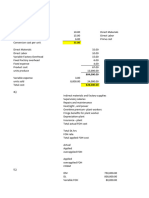

Q 6.1

a) Tradtional costing approach

Alpha Beta

Direct materials 56.00 75.00

Direct labour 4.00 8.00

60.00 83.00

23.53 47.06

Cost per unit 83.53 130.06

labour hours 0.8 1.6

Units 5,000 40,000

hours 4,000 64,000 68,000

Overheads 2,000,000

Overhead rate = 29.41

b) Activity Based costing approach

Alpha Beta Total

Purchase orders 28,000 56,000 84,000

Scrap/rework 72,000 144,000 216,000

Product testing 120,000 330,000 450,000

Machinery 500,000 750,000 1,250,000

Total 720,000 1,280,000 2,000,000

units 5,000 40,000

Overhead cost per unit 144 32

Alpha Beta

Direct materials 56 75

Direct labour 4 8

60 83

overhead cost per unit 144 32

Cost per unit 204 115

c) The cost of the two products is significantly different using a traditional approach to costing

compared to ABC. If cost is being used as a basis for pricing, then an uncompetitive rate may be

being set, resulting in lower sales.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

Q 6.2

Cost Cost of

per unit 120 units

Direct cost of production 1100.00 132,000

material handling 103.50 12,420

machinery 8.00 960

assembly 655.50 78,660

inspection 60.00 7,200

Manufacturing cost per unit 1927.00 231,240

R&D 140.00

marketing 200.00

Total cost per unit 2267.00

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

Q 6.3

Tradtional costing approach

Snappit Badger

Direct materials 16.00 25.00

Direct labour 20.00 22.00

36.00 47.00

144.00 198.00

Cost per unit 180.00 245.00

mark-up 25% 45.00 61.25

225.00 306.25

labour hours 2 2.75

Calculation of overhead rate:

Hours 3500 1500 = 5,000 hours in total

Overheads 360,000

Overhead rate = 72.00 (360,000/5,000)

Activity Based costing approach

Snappit Badger Total

machine A 150000 150,000

Machine B 75000 75,000

Set up costs 6000 24000 30,000

Handling charges 25000 25000 50,000

Other overheads 33000 22000 55,000

Total 214000 146000 360,000

units 1,750 545

Overhead cost per unit 122.29 267.67

Snappit Badger 0

Direct materials 16.00 25.00

Direct labour 20.00 22.00

36.00 47.00

Overhead cost per unit 122.29 267.67

Cost per unit 158.29 314.67

mark-up 25% 39.57 78.67

197.86 393.34

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

4

Q 6.4 a)

i) Traditional costing approach

A B C

Direct materials 25.00 62.50 105.00

Direct labour 4.00 8.00 8.00

29.00 70.50 113.00

105.00 210.00 210.00

Cost per unit 134.00 280.50 323.00

Mark-up 20% 26.80 56.10 64.60

160.80 336.60 387.60

Labour hours per unit 0.5 1 1

Number of units 20,000 1,000 10,000

Total hours per product 10,000 1,000 10,000 21,000

Overheads 4,410,000

Overhead rate = 4,410,000/21,000 = 210.00

ii) Activity Based costing approach

A B C Total

Machining 1,112,000 417,000 1,251,000 2,780,000

Material orders 277,300 35,400 277,300 590,000

Space 436,800 187,200 416,000 1,040,000

Total 1,826,100 639,600 1,944,300 4,410,000

units 20,000 1,000 10,000

Overhead cost per unit 91.31 639.60 194.43

A B C

Direct materials 25.00 62.50 105.00

Direct labour 4.00 8.00 8.00

29.00 70.50 113.00

Overhead per unit 91.31 639.60 194.43

Cost per unit 120.31 710.10 307.43

Mark-up 20% 24.06 142.02 61.49

144.37 852.12 368.92

b) The indication from the costing exercise is that product B has been substantially under-costed

when the traditional approach has been used, while for Products A and C there has been an

over-costing. This might have implications for the pricing of the three products. Note that there

are dangers in using cost information for decision making purposes. See for example discussion

in the chapter on the problems with identifying an accurate product or service cost for decision-

making purposes.

c) See also b) above

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

You might also like

- PDFDocument10 pagesPDFshubham_soneja94100% (2)

- 90 Day PlanDocument50 pages90 Day PlanShamsheer Ali Turk100% (1)

- End Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattDocument14 pagesEnd Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattShivani TannuNo ratings yet

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- The ISO 9000 Family of Standards Is Related To Quality Management Systems and Designed To Help Organizations Ensure That They Meet The Needs of Customers and Other StakeholdersDocument14 pagesThe ISO 9000 Family of Standards Is Related To Quality Management Systems and Designed To Help Organizations Ensure That They Meet The Needs of Customers and Other StakeholdersGaurav GuptaNo ratings yet

- Example2 7NewsDealerDocument22 pagesExample2 7NewsDealerAnonymous kRfQgX100% (1)

- CACC 520-781 Accounting For ManagementDocument7 pagesCACC 520-781 Accounting For ManagementEmadNo ratings yet

- Etude de Cas Club MedDocument3 pagesEtude de Cas Club MedSimon Philippon100% (1)

- Corporate Strategy and DiversificationDocument8 pagesCorporate Strategy and DiversificationAbbas HassanNo ratings yet

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- FAMA '22 SolutionDocument4 pagesFAMA '22 SolutionRushil JoshiNo ratings yet

- Maria 081947Document4 pagesMaria 081947Clay MaaliwNo ratings yet

- ClassicPenCompany 2023B2PGPMX012 KshitijDocument3 pagesClassicPenCompany 2023B2PGPMX012 KshitijSuraj KumarNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- 16 Destinbrass - Solution-EnG YtcAIvEG2FDocument12 pages16 Destinbrass - Solution-EnG YtcAIvEG2Fshubhangi.jain582No ratings yet

- Group 7 - Excel - Destin BrassDocument9 pagesGroup 7 - Excel - Destin BrassSaumya SahaNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- ABC Practice Problems Answer KeyDocument10 pagesABC Practice Problems Answer KeyKemberly AribanNo ratings yet

- Chapter 2 and 3 AssignmentDocument12 pagesChapter 2 and 3 AssignmentBien Carlo BuenaventuraNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Formative Assessment On Relative CostDocument8 pagesFormative Assessment On Relative CostChai MarapaoNo ratings yet

- Problem 5-51 BlocherDocument2 pagesProblem 5-51 BlocherAlif ArmadanaNo ratings yet

- TJB CaseDocument14 pagesTJB Casesupeach.kNo ratings yet

- Sample Dupa20Document1 pageSample Dupa20Jetro SarajenaNo ratings yet

- Exam 2 ReviewDocument18 pagesExam 2 ReviewBrad MellerNo ratings yet

- ACN 202 Final ReportDocument10 pagesACN 202 Final ReportMohammed Nahiyan MollahNo ratings yet

- Chapter 3-Test Material 1Document6 pagesChapter 3-Test Material 1Marcus MonocayNo ratings yet

- Answers To 11 - 16 Assignment in ABC PDFDocument3 pagesAnswers To 11 - 16 Assignment in ABC PDFMubarrach MatabalaoNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- Solution To Quiz 2Document4 pagesSolution To Quiz 2GianJoshuaDayritNo ratings yet

- Theories ProblemsDocument6 pagesTheories ProblemsFernando III PerezNo ratings yet

- Product Cost From TraditionalDocument5 pagesProduct Cost From TraditionalPrijulNo ratings yet

- Maceda Glass and Aluminum Supply Job Order Cost SheetDocument8 pagesMaceda Glass and Aluminum Supply Job Order Cost SheetWarren CabunyagNo ratings yet

- PK VCDocument16 pagesPK VClidiawuNo ratings yet

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- Destin Brass 2019 (SV)Document11 pagesDestin Brass 2019 (SV)PRITEENo ratings yet

- Alaire CorporationDocument2 pagesAlaire CorporationChleo EsperaNo ratings yet

- F5 Section CDocument72 pagesF5 Section CRassie AshNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- Brocher Solution Problem 5-51Document5 pagesBrocher Solution Problem 5-51Alif ArmadanaNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Process Costing Excel ExampleDocument3 pagesProcess Costing Excel Examplehub sportxNo ratings yet

- LVC Session - 3 (Illustrations)Document6 pagesLVC Session - 3 (Illustrations)Srinivasan NarasimmanNo ratings yet

- Total Machine Hours:: Suggested Solution Maf451 (June 2016) QUESTION 1: AnswerDocument8 pagesTotal Machine Hours:: Suggested Solution Maf451 (June 2016) QUESTION 1: Answeranis izzatiNo ratings yet

- Ch2 - Cost Accounting - Horngren'sDocument16 pagesCh2 - Cost Accounting - Horngren'svipinkala1No ratings yet

- Documents - MX - Destin Brass Products Co 55f065486abf6 PDFDocument9 pagesDocuments - MX - Destin Brass Products Co 55f065486abf6 PDFNikhil WadhwaniNo ratings yet

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Quantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Document7 pagesQuantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Anne MendozaNo ratings yet

- Wilkerson ABC at CapacityDocument1 pageWilkerson ABC at CapacityTushar DuaNo ratings yet

- Classic Pen Company: Syndicate 101Document4 pagesClassic Pen Company: Syndicate 101Silvia WongNo ratings yet

- Tugas Activity Based Costing - Kel 5 - Akuntansi ManajemenDocument8 pagesTugas Activity Based Costing - Kel 5 - Akuntansi Manajemenyslin mrgthNo ratings yet

- Quantity Schdule: Average MethodDocument4 pagesQuantity Schdule: Average MethodAnne MendozaNo ratings yet

- Term Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisDocument10 pagesTerm Report On Case Study: Farr Ceramics Production Division: A Budgetary AnalysisImranul GaniNo ratings yet

- Revenue Models REPTILEDocument6 pagesRevenue Models REPTILEAl-faizal A. OntongNo ratings yet

- Solution JUN 2018Document7 pagesSolution JUN 2018anis izzatiNo ratings yet

- City Buildings Business PowerPoint TemplateDocument15 pagesCity Buildings Business PowerPoint TemplateSalman SajidNo ratings yet

- Classic Pen CompanyDocument6 pagesClassic Pen CompanySangtani PareshNo ratings yet

- Sanitary Land Fill Components 2000sq.m, at Brgy. PanansanganDocument5 pagesSanitary Land Fill Components 2000sq.m, at Brgy. PanansanganGayeGabrielNo ratings yet

- Cost Accounting CH 1 and 5 AnswersDocument16 pagesCost Accounting CH 1 and 5 AnswersChristian Mark PalayNo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- Lurisa Cip SupplementalDocument10 pagesLurisa Cip SupplementalMAQ ConstructionNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsDocument25 pagesSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockNo ratings yet

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Document36 pagesChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document23 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Document32 pagesChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Document18 pagesChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- CH23 PDFDocument5 pagesCH23 PDFJay BrockNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Measuring and Improving Internal Business Processes Answer To End of Chapter ExercisesDocument7 pagesMeasuring and Improving Internal Business Processes Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesDocument6 pagesPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDDocument7 pagesIdentifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDJay BrockNo ratings yet

- Strategy and Control System Design Answer To End of Chapter ExercisesDocument5 pagesStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesDocument6 pagesAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Further Decision-Making Problems Answers To End of Chapter ExercisesDocument6 pagesFurther Decision-Making Problems Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesDocument2 pagesBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesDocument5 pagesInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Manufacturing Methods Answer To End of Chapter ExercisesDocument5 pagesStandard Costing and Manufacturing Methods Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control Systems Answer To End of Chapter ExercisesDocument3 pagesBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Control in Divisionalized Organizations Answer To End of Chapter ExercisesDocument6 pagesControl in Divisionalized Organizations Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Pricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesDocument2 pagesPricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesJay BrockNo ratings yet

- 4 - Retail-Strategic Planning NDocument25 pages4 - Retail-Strategic Planning NSaurabh RathoreNo ratings yet

- A Comparative Study On Performance of ITC Hotels and Taj Hotels LTD From 2013-2017 Using Leverage and TrendDocument5 pagesA Comparative Study On Performance of ITC Hotels and Taj Hotels LTD From 2013-2017 Using Leverage and TrendPragya Singh BaghelNo ratings yet

- ch22 Beams12ge SMDocument14 pagesch22 Beams12ge SMJosua PranataNo ratings yet

- Elementary Sample Readings (Business English) PDFDocument9 pagesElementary Sample Readings (Business English) PDFChristhian Cabrera Briones100% (1)

- Chapter 7 - Test BankDocument94 pagesChapter 7 - Test Bankbekbek12100% (2)

- SOI MOS Device Modelling EE5341 Part1Document36 pagesSOI MOS Device Modelling EE5341 Part1devi1992No ratings yet

- Accounting Is ArtDocument20 pagesAccounting Is ArtphaibaNo ratings yet

- Director Marketing Corporate Branding in USA Virtual Resume Lisa KatzeDocument2 pagesDirector Marketing Corporate Branding in USA Virtual Resume Lisa KatzeLisaKatzeNo ratings yet

- Financial Management - Meaning, Objectives and FunctionsDocument5 pagesFinancial Management - Meaning, Objectives and FunctionsRuchi ChhabraNo ratings yet

- Young, Tú Te Lo Has BuscadoDocument298 pagesYoung, Tú Te Lo Has BuscadoPaola Nicolasa SchiedaNo ratings yet

- Vinegar BusinessDocument2 pagesVinegar BusinessLauriz Dillumas Machon100% (1)

- TBWA CredentialsDocument29 pagesTBWA Credentialsvoodooch1ld20% (1)

- Janome DC 3050 ManualkDocument42 pagesJanome DC 3050 ManualkluckypurrNo ratings yet

- Chapter 12 Assigned Question SOLUTIONSDocument61 pagesChapter 12 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- LambersCPAReviewAUDIT PDFDocument589 pagesLambersCPAReviewAUDIT PDFjulie anne mae mendozaNo ratings yet

- DBR Assignment 1 - 2015Document11 pagesDBR Assignment 1 - 2015Yoga ChanNo ratings yet

- Intro GonegosyoDocument19 pagesIntro GonegosyoRod Jr LicayanNo ratings yet

- Annual Report 2008Document60 pagesAnnual Report 2008webmaster@sltda100% (1)

- M&A Predictor: 2018 Annual ReportDocument48 pagesM&A Predictor: 2018 Annual ReportdsdsNo ratings yet

- Problems With Solution On Deferred TaxDocument2 pagesProblems With Solution On Deferred TaxMansiShahNo ratings yet

- Physical FacilitiesDocument18 pagesPhysical FacilitiesChristine Apolo100% (2)

- Uber Statistics ReportDocument17 pagesUber Statistics ReportBakayoko VaflalyNo ratings yet

- AerotropolisDocument10 pagesAerotropolisCharlot Boongaling100% (1)

- VAT Change-In FA 2012Document3 pagesVAT Change-In FA 2012rajeshaisdu009No ratings yet