Professional Documents

Culture Documents

11 - 22 - 4850 - 15 - 56 - 2573 - Potato Market Bulletin

11 - 22 - 4850 - 15 - 56 - 2573 - Potato Market Bulletin

Uploaded by

ELVISOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 - 22 - 4850 - 15 - 56 - 2573 - Potato Market Bulletin

11 - 22 - 4850 - 15 - 56 - 2573 - Potato Market Bulletin

Uploaded by

ELVISCopyright:

Available Formats

Market Survey #2: Potato Production in Zimbabwe

INTRODUCTION

Potatoes are a starchy, tuberous crop from the

nightshade family (Solanaceous), Solanum Tuberosom.

They are one of the worlds most important non-cereal

crops and have gained popularity as a staple food in the

Zimbabwean diet. Potatoes have a high carbohydrate

content and contain many different proteins, minerals

(particularly calcium and potassium), and vitamins

(particularly Vitamin C).

PRODUCTION

Traditionally, potatoes have been grown by large

commercial farmers in Zimbabwe, but more and more

smallholders are growing the crop. Currently, communal

areas around Nyanga, Mutasa, Domboshawa,

Chiweshe, Wedza, Goromonzi and Mhondoro are

Washed (above) and

producing significant quantities of table potatoes.

However, there is a lack of statistical data available, and unwashed (left)

it is very difficult to estimate national potato production potatoes are packed

or what percentage of the potato crop is produced by in net pockets ready

smallholder farmers. From figures on sales of seed for sale.

potato sold in 2010 (Seed Potato Co-op), it is estimated

that approximately 900-1000 hectares are under

production for potatoes in Zimbabwe per year. This

figure may be much higher since many growers dont Potatoes grown in

buy their seed from Seed Potato Co-op, but rather trade clay (left) have a

with one another through informal arrangements. longer shelf life and

Nyanga is the main area where seed potatoes are are worth more than

grown as it is too cold for insect vectors to survive, so

those grown in

the crops remain virus free.

lighter, sandy soils.

MARKETS Photos by Fintrac Inc.

Zimbabwes potato market can be divided into formal and informal markets. The formal

market is made up of traders such as FAVCO, Harare Produce Sales and Sunspun, which have high overheads and

large distribution channels. The informal markets like Mbare, Chikwana and Machipisa sell the bulk of their potatoes

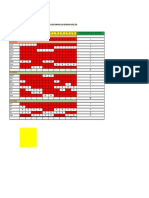

out of stalls to street vendors but often have buyers from formal markets as well. The following table lists the main

formal and informal markets for potatoes.

Company Function

Production Wholesaler Retailer Processor Transporter

Interfresh X X X

TM X

Cairns X X

Inscor X

Sunspun X X X

Harare Produce Sales X X X

Freshpro X X

Muchero Africa X X

FAVCO X X

Valley Fresh X X X

SPAR X

stamp@fintrac.com www.Zim-STAMP.org www.fintrac.com Issue #02 February 2011 1

Company Function

Production Wholesaler Retailer Processor Transporter

OK Zimbabwe X

Fruit and Veg City X

Honey dew X X X

Mbare * X X X X

Interfresh X X

Willsgroove X X X X

D G Patel X X

M S Patel X X

DMM X X

Lippar X X

Valley Foods X X

Interfresh X X

Manica Produce X X X

Sakubva * X X X X

*Informal markets

Mbare is Harares largest market for potatoes, accounting for 33 percent of the 350-400 tons traded per week. The

Mbare market pays cash on delivery, while the formal market may take up to a month to pay farmers who are reluctant

to participate in these formal channels even when the offering price is 20 percent higher.

Potatoes grown in heavy clay soils are the most popular as they tend to have a longer shelf life and fetch higher

prices. As of January 2011, farmers growing in sandy

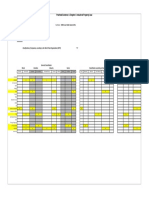

soils earned US$0.67/kg for large potatoes, while Figure 1: Harare Market Sales

those growing in clay soils earned US$0.80/kg a 19

MUCHERO FAVCO INTERFRESH

percent increase. The bulk of potatoes are sold AFRICA 2%

2%

unwashed in 15 kg pockets, but a market has emerged 6% FRESHPRO

2%

for washed potatoes since the dollarization of

economy. Eighty percent of all unwashed potatoes are

SELBY

bought by hotels, restaurants, and processors. 8% HPS

Washed potatoes are only available in supermarkets in 20%

smaller pack sizes, catering to higher-income

customers who pay a 15 percent premium. Two

companies, Selby and Interfresh, have already

invested in potato washing machines.

SUNSPAN

MBARE 13%

In December of last year, the Agricultural Marketing 33%

Authority (AMA) imposed a ban on the import of

potatoes from South Africa. The ban was a result of

INNSCOR

lobbying by Zimbabwean potato producers who were 13%

unable to compete with the price of South African

potatoes, but large volumes are still entering the CAIRNS

1%

country, with the majority being sold in Bulawayo,

Zimbabwes second largest city (see Figure 2). Stricter

measures to enforce the ban would result in serious Figure 2: Bulawayo Potato Sales

potato shortages, as local producers cannot yet meet

national demand. According to industry sources, 300 Imports Local

tons per week of potatoes are required by Bulawayo,

Hwange and Victoria Falls markets. Mutare has a

much lower demand, requiring an average of 23 tons 40%

per week. Again, the bulk of the potatoes are sold on

60%

the informal market in Sakubva, located on the

outskirts of Mutare, and the remainder through the two

main wholesalers supplying the supermarkets (Manica

Produce and Interfresh).

stamp@fintrac.com www.Zim-STAMP.org www.fintrac.com Issue #02 February 2011 2

PRICING

Figure 4: Potato prices 2010

During 2010, potato prices were fairly stable and

fluctuated with supply. Higher prices in November and 1.6

December have been attributed to greater demand 1.4

during the holiday season. Figure 4 shows the prices of 1.2

large, medium and small potatoes for the formal market

1

US$/Kg

released by Interfresh in 2010 for the Harare market.

0.8 Large

TRENDS 0.6 Medium

In most supermarkets, potatoes are pre-packed into 0.4

0.2 Small

1kg, 2kg, 4kg, 5kg, 10kg and 15kg bags. Large and

medium potatoes tend to move faster than small 0

potatoes as takeaways, hotels and caterers prefer large Jan Mar May Jul Sep Nov

potatoes to make chips while housewives prefer

medium potatoes for household consumption. Small Months

potatoes are mainly bought by street vendors through Source: Interfresh Market Survey

informal channels who seek to maximize on the number

of potatoes in each bag without regard for the size.

OUTLOOK

It is estimated that the local market is operating at 50 percent of capacity, but it is difficult for new farmers to penetrate

the potato market as the cost to produce 1 hectare of potatoes ranges from $4,500 to $6,500, which is too much for

many smallholder farmers. Procurement of high quality seed is also a challenge as supplies are limited and normally

sold on a relationship basis. The main suppliers of seed are the Seed Potato Co-op, Kutsaga and Prime Seed. Seed

Potato Co-op and Kutsaga produce potato tubers whilst Prime Seed sells true potato seed (TPS). With the

implementation of legislation banning the import of seed and table potatoes into Zimbabwe, smallholder farmers with

access to credit have a huge opportunity to step up and take advantage of demand.

stamp@fintrac.com www.Zim-STAMP.org www.fintrac.com Issue #02 February 2011 3

You might also like

- Money Secrets PDFDocument108 pagesMoney Secrets PDFELVIS100% (6)

- Three Dual Polarized 2.4GHz Microstrip Patch Antennas For Active Antenna and In-Band Full Duplex ApplicationsDocument4 pagesThree Dual Polarized 2.4GHz Microstrip Patch Antennas For Active Antenna and In-Band Full Duplex Applicationssanthosh kNo ratings yet

- Bagging Controller Panther 2000 c750Document6 pagesBagging Controller Panther 2000 c750ELVIS100% (1)

- IATA EASA Cross-Reference List User Manual Ed 1Document37 pagesIATA EASA Cross-Reference List User Manual Ed 1Андрей Лубяницкий50% (2)

- Justification of Producing CropsDocument4 pagesJustification of Producing Cropsalfred racumaNo ratings yet

- HOT 121-Introduction To PomologyDocument5 pagesHOT 121-Introduction To PomologyRtr Ahmed Abidemi CertifiedNo ratings yet

- TreinamentosDocument1 pageTreinamentosWilson da SilvaNo ratings yet

- VCA4D 16 - Sierra Leone CashewDocument6 pagesVCA4D 16 - Sierra Leone Cashewkarantina tumbuhan makassarNo ratings yet

- Oil&gas Industry End Users LatamDocument3 pagesOil&gas Industry End Users LatamvatolocogrNo ratings yet

- Modified Companion PlantingDocument19 pagesModified Companion PlantingInternational Movement for World Without CancerNo ratings yet

- Example Worksheet # 16 - Planting and Harvesting Schedule: CropDocument4 pagesExample Worksheet # 16 - Planting and Harvesting Schedule: Cropmarlynrich3652No ratings yet

- AGRIBUSINESSDocument10 pagesAGRIBUSINESSTWINKLE MAE EGAYNo ratings yet

- ZA2010 SorgoGranifUF CULTIVARESDocument3 pagesZA2010 SorgoGranifUF CULTIVARESHugo BandeiraNo ratings yet

- Tarea de Colcabamba Del Trabajo 2021Document2 pagesTarea de Colcabamba Del Trabajo 2021Michel Florencio Saavedra BalmacedaNo ratings yet

- ECO2011 Basic Microeconomics - Lecture 4Document23 pagesECO2011 Basic Microeconomics - Lecture 41194390705No ratings yet

- Harbest Agribusiness Corporation Palo Leyte Branch Marketing Plan For The Year 2019Document5 pagesHarbest Agribusiness Corporation Palo Leyte Branch Marketing Plan For The Year 2019Jay Vien Mark DulosaNo ratings yet

- Why ERP?: I. The Main Characteristics of ERPDocument5 pagesWhy ERP?: I. The Main Characteristics of ERPayaNo ratings yet

- Indonesia Country Profile Access To Seeds Index 2019Document1 pageIndonesia Country Profile Access To Seeds Index 2019tediNo ratings yet

- Lista de Chequeo Carpetas ProveedoresDocument1 pageLista de Chequeo Carpetas ProveedoresAure CruzNo ratings yet

- Company Profile: Company Name: Company S.R.LDocument2 pagesCompany Profile: Company Name: Company S.R.LКристина ПарфениNo ratings yet

- Jaga NovemberDocument55 pagesJaga NovemberandhikaNo ratings yet

- Win Loss Trade CalculatorDocument1 pageWin Loss Trade CalculatorArsheed BhatNo ratings yet

- Dengue Vaccine Recipient Monitoring FormDocument5 pagesDengue Vaccine Recipient Monitoring FormNorelyn CN TrinidadNo ratings yet

- Perimeter Protection FunctionalitiesDocument1 pagePerimeter Protection FunctionalitiesRomiNo ratings yet

- Natural Rubber An Opportunity in BrazilDocument18 pagesNatural Rubber An Opportunity in Brazilowl meadowNo ratings yet

- 10.1007s12571 016 0562 1Document16 pages10.1007s12571 016 0562 1bibrevNo ratings yet

- STASE 16 JANUARIrevDocument1 pageSTASE 16 JANUARIrevLeksmanaHidayatullahNo ratings yet

- Pet Tao Food ChartDocument1 pagePet Tao Food ChartdrteresagattNo ratings yet

- PPE Matrix 1Document1 pagePPE Matrix 1Mohamad azri azizi ZamrosNo ratings yet

- Autorizações Atendimentos PSDocument2 pagesAutorizações Atendimentos PSthaysts2303No ratings yet

- Prescription Tillage Technology LLC Catalog 2016Document21 pagesPrescription Tillage Technology LLC Catalog 2016RyanNo ratings yet

- Performance of Verdant Select, Verdant V-80 and F1 HybridDocument20 pagesPerformance of Verdant Select, Verdant V-80 and F1 Hybrideka pramudyaNo ratings yet

- Semanatoare MFDocument28 pagesSemanatoare MFPaul Cosmin Saracin100% (1)

- Quality DCLDocument11 pagesQuality DCLJoy DeyNo ratings yet

- Analisis Butir Soal SMTR 1 2022-2023Document6 pagesAnalisis Butir Soal SMTR 1 2022-2023nurpujiastuti07No ratings yet

- ISABGOLDocument28 pagesISABGOLNaveen.M.NNo ratings yet

- Tipo de Receptores X CanalDocument4 pagesTipo de Receptores X CanalAngie BecerraNo ratings yet

- Wina Padang l1 080715Document1 pageWina Padang l1 080715yourbrodie brosNo ratings yet

- 50 CultivosDocument1 page50 CultivosGONZALES CALERO ,Miguel AngelNo ratings yet

- Todos Los Tipos de Suspension HDocument8 pagesTodos Los Tipos de Suspension HJorge MarquezNo ratings yet

- Interdependence of TradeDocument34 pagesInterdependence of Tradesadiq farhanNo ratings yet

- Cross Border Issues: Nguyễn Hồng Thắng, UEHDocument67 pagesCross Border Issues: Nguyễn Hồng Thắng, UEHDUNG NGUYỄN THỊ TRUNGNo ratings yet

- TradecraftDocument450 pagesTradecraftSonu KumarNo ratings yet

- PPE MatrixDocument1 pagePPE MatrixMohamad azri azizi ZamrosNo ratings yet

- Absensi Petugas Kelurahan Siaga Puskesmas Gayungan Bulan April 2016Document4 pagesAbsensi Petugas Kelurahan Siaga Puskesmas Gayungan Bulan April 2016binasaNo ratings yet

- Final Saffron BrochureDocument2 pagesFinal Saffron BrochureArif100% (1)

- SurveyDocument1 pageSurveyapi-355095313No ratings yet

- BOVA Footwear Catalogue .CompressedDocument64 pagesBOVA Footwear Catalogue .CompressedJaney-Dell NelNo ratings yet

- Bahan Ajar Pertemuan 1bDocument16 pagesBahan Ajar Pertemuan 1bFarhan ZeldyNo ratings yet

- The Effectiveness of Using Biochar Derivatives On The Establishment of Oil Palm Plantations in The Osa Peninsula in Costa Rica, Central AmericaDocument28 pagesThe Effectiveness of Using Biochar Derivatives On The Establishment of Oil Palm Plantations in The Osa Peninsula in Costa Rica, Central AmericaFrancisco GarroNo ratings yet

- Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers StateDocument8 pagesProfitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Production Systems: Ecological ZonesDocument13 pagesProduction Systems: Ecological ZonesMakhou LadoumNo ratings yet

- Rafiki Mtoto Simba Young Simba Mufasa Scar Nala Young Nala Timon Pumba Zazu Sarabi BanzaiDocument2 pagesRafiki Mtoto Simba Young Simba Mufasa Scar Nala Young Nala Timon Pumba Zazu Sarabi Banzaipianoplayaa98No ratings yet

- Schedule Preventive Maintenance PT. SSDP 2021Document4 pagesSchedule Preventive Maintenance PT. SSDP 2021slamet supriyadiNo ratings yet

- Raspberries IowastateunivDocument4 pagesRaspberries IowastateunivFernando Ramonet MarquésNo ratings yet

- Articol Stiinfitic 16 - Apple Varieties in AlabamaDocument8 pagesArticol Stiinfitic 16 - Apple Varieties in AlabamaOlgaNo ratings yet

- PLANING SCADULE 9 April 2020 16 - 25-1Document1 pagePLANING SCADULE 9 April 2020 16 - 25-1NsgrhapNo ratings yet

- Interdependence and The Gains From TradeDocument45 pagesInterdependence and The Gains From TradeIntira ItsarajirasetNo ratings yet

- Unlimited Ways To Modern FarmingDocument19 pagesUnlimited Ways To Modern FarmingmohammadNo ratings yet

- Practical Evidence 1 Chapter 1 Industrial Property LawDocument1 pagePractical Evidence 1 Chapter 1 Industrial Property LawrecepcionNo ratings yet

- Responsabilidad Social DawnDocument4 pagesResponsabilidad Social Dawnangie pimientaNo ratings yet

- Autocontrol 1 Consonantes 3cDocument2 pagesAutocontrol 1 Consonantes 3cKarina RiveroNo ratings yet

- Knave Character Sheet HSDocument2 pagesKnave Character Sheet HScla claNo ratings yet

- The Rise of the African Multinational Enterprise (AMNE): The Lions Accelerating the Development of AfricaFrom EverandThe Rise of the African Multinational Enterprise (AMNE): The Lions Accelerating the Development of AfricaNo ratings yet

- Dictionnaire Francais Dictionary PDFDocument34 pagesDictionnaire Francais Dictionary PDFELVISNo ratings yet

- An Intro To JournalismDocument14 pagesAn Intro To JournalismELVISNo ratings yet

- 2016: Living From Your Center: Sanaya and Duane MessageDocument24 pages2016: Living From Your Center: Sanaya and Duane MessageELVIS100% (1)

- Real Spy v1Document18 pagesReal Spy v1ELVIS100% (2)

- Exercises - The French Tutorial-HtmDocument1 pageExercises - The French Tutorial-HtmELVISNo ratings yet

- Programmers GuideDocument372 pagesProgrammers GuideELVIS100% (2)

- Sri Yantra: Menumenu Kundalini Chakras Nadis Yantras Sri Yantra LinksDocument1 pageSri Yantra: Menumenu Kundalini Chakras Nadis Yantras Sri Yantra LinksELVISNo ratings yet

- MALAWI - Learn Chichewa-HtmDocument5 pagesMALAWI - Learn Chichewa-HtmELVISNo ratings yet

- From 10 To 19 - The French Tutorial-Htm PDFDocument1 pageFrom 10 To 19 - The French Tutorial-Htm PDFELVISNo ratings yet

- Growing A Healthy Lawn: FREE! Take One!Document2 pagesGrowing A Healthy Lawn: FREE! Take One!ELVISNo ratings yet

- Research Compilation FinalDocument23 pagesResearch Compilation FinalJessa Mae LoredoNo ratings yet

- Taylor & Francis Journals Standard Reference Style Guide: American Psychological Association, Seventh Edition (APA-7)Document36 pagesTaylor & Francis Journals Standard Reference Style Guide: American Psychological Association, Seventh Edition (APA-7)Yago PessoaNo ratings yet

- 211-Article Text-399-1-10-20180522 PDFDocument42 pages211-Article Text-399-1-10-20180522 PDFAlex KanathNo ratings yet

- Anil Laul BharaniDocument30 pagesAnil Laul BharaniBharani MadamanchiNo ratings yet

- Cleopatra Wall Tiles CatalogueDocument151 pagesCleopatra Wall Tiles CatalogueHussain ElarabiNo ratings yet

- HashingDocument1,668 pagesHashingDinesh Reddy KommeraNo ratings yet

- Popular Music Dance Music: Disco, Beat-Driven Style ofDocument2 pagesPopular Music Dance Music: Disco, Beat-Driven Style ofRengeline LucasNo ratings yet

- Jurnal SdaDocument7 pagesJurnal SdaPeten AmtiranNo ratings yet

- Analgesics in ObstetricsDocument33 pagesAnalgesics in ObstetricsVeena KaNo ratings yet

- Pioneer Plasma TV - ScanBoard & ICs Removal Re Installation GuideDocument12 pagesPioneer Plasma TV - ScanBoard & ICs Removal Re Installation GuideRagnar7052No ratings yet

- Form 5 ElectrolysisDocument2 pagesForm 5 ElectrolysisgrimyNo ratings yet

- Jeppview For Windows: General Information Communication Information General InformationDocument34 pagesJeppview For Windows: General Information Communication Information General InformationAviation WithvoiceNo ratings yet

- Inno Apps Company ProfileDocument29 pagesInno Apps Company ProfileAru KNo ratings yet

- All India Companies Directory - Database - List (.XLSX Excel Format) 11th EditionDocument2 pagesAll India Companies Directory - Database - List (.XLSX Excel Format) 11th EditionAVNo ratings yet

- Historical Change and Ceramic Tradition: The Case of Macedonia - Zoi KotitsaDocument15 pagesHistorical Change and Ceramic Tradition: The Case of Macedonia - Zoi KotitsaSonjce Marceva100% (2)

- Emma's Daily Routine - ReadingDocument2 pagesEmma's Daily Routine - ReadingEl Brayan'TVNo ratings yet

- Universidad Emiliano Zapata Período Enero-Abril 2022 English IiDocument3 pagesUniversidad Emiliano Zapata Período Enero-Abril 2022 English IiJorge Alberto Salas MuñozNo ratings yet

- JM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270Document1 pageJM Mechanically Fastened and Adhered Details UltraGard TPO Roof Drain New Construction Detail Drawing B18270michael jan tubongbanuaNo ratings yet

- Safety Data Sheet: 1. IdentificationDocument15 pagesSafety Data Sheet: 1. IdentificationFelix Vejar ZepedaNo ratings yet

- Ques Risk and Return & CAPM (S-17Revised)Document6 pagesQues Risk and Return & CAPM (S-17Revised)Najia SiddiquiNo ratings yet

- Dow Integraflux™ Ultrafiltration Modules: Product Data SheetDocument3 pagesDow Integraflux™ Ultrafiltration Modules: Product Data SheetArunkumar ChandaranNo ratings yet

- Multimode Relay MT: 2 / 3 Pole 10 A, DC-or AC-coilDocument4 pagesMultimode Relay MT: 2 / 3 Pole 10 A, DC-or AC-coilgoo gleNo ratings yet

- UntitledDocument58 pagesUntitledArun KumarNo ratings yet

- People vs. JaysonDocument5 pagesPeople vs. JaysonnathNo ratings yet

- Cost Audit RepairDocument7 pagesCost Audit RepairkayseNo ratings yet

- Gas Properties, Flowrate and Conditions: Reciprocating Compressor Calculation SheetDocument5 pagesGas Properties, Flowrate and Conditions: Reciprocating Compressor Calculation SheetNaqqash Sajid0% (2)

- VR8304 Intermittent Pilot Combination Gas Control: ApplicationDocument8 pagesVR8304 Intermittent Pilot Combination Gas Control: ApplicationGregorio Mata MartínezNo ratings yet

- Hero Rubric 2Document3 pagesHero Rubric 2api-293865917No ratings yet