Professional Documents

Culture Documents

FAR3

FAR3

Uploaded by

Hermie TimarioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR3

FAR3

Uploaded by

Hermie TimarioCopyright:

Available Formats

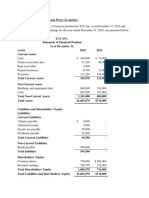

FRIENDSHIPS CO.

Statement of Financial Position

As of December 31, 20x1

(amounts in Philippine Pesos)

Notes 20x1

ASSETS

Current assets

Cash and Cash Equivalent 4 4,240,975

Trade and other receivables 5 9,033,111

Inventories 6 22,117,615

Prepaid Supplies 890,239

Prepaid Income Tax 234,125

Held for Trading Securities 2,834,079

Total current assets 39,350,144

Non-current assets

Investment in equity instruments 987,234

Investment in associate 1,290,347

Property, plant and equipment 12,370,960

Deferred tax 1,092,387

Loans receivable 9,827,341

Unearned interest income -1,234,819

Total non-current assets 24,333,450

Total assets 63,683,594

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 10,302,733

Provision for warranty obligations 432,187

Loan payable 7,253,748

Income tax payable 721,346

Total current liabilities 8,407,281

Non-current liabilities

Deferred credits 712,788

Deferred tax 918,732

Total non-current liabilities 1,631,520

Total liabilities 20,341,534

Equity

Share capital 26,000,000

Retained earnings 17,342,060

Other components of equity

Total equity 43,342,060

Total liabilities and equity 63,683,594

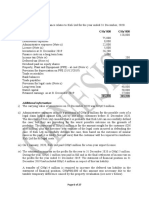

BEST FRIENDS CO.

Statement of Profit or Loss and Other Comprehensive Income

For the year ended December 31, 20x1

(amounts in Philippine Pesos)

Notes 20x1

Sales 22,800,000

Cost of sales 100,000

Gross profit 22,900,000.00

Other income

Distribution costs

Selling expense 800,000

Administrative expenses 100,000

Impairment of property, plant and equipment 720,000

Other expenses

Finance costs 560,000

Share of profit of associates

Profit before tax

Income tax expense

Profit for the year from continuing operations

Loss for the year from discontinued operations

PROFIT FOR THE YEAR

Other comprehensive income, after tax:

Items that will not be reclassified subsequently to profit or loss:

Gains on property revaluation

Share of other comprehensive income of associates

Remeasurements of defined benefit pension plans

Investments in equity instruments

Items that will be reclassified subsequently to profit or loss:

Exchange differences on translating foreign operations

Cash flow hedges

Other comprehensive income for the year, net of tax

TOTAL COMPREHENSIVE INCOME FOR THE YEAR

December 31, 20x1

December 31, 20x1 Cost of Sales 100,000

Inventory 100,000

To write down inventories at net realizable value

December 31, 20x1 Bad debts expense 50,000

Allowance for doubtful account 50,000

To record bad debt expense

December 31, 20x1 Loss on reclassification 200,000

Held for trading securities 200,000

To record the loss on reclassification

December 31, 20x1 Held for trading securities 180,000

Unrealized gain - P/L 180,000

To record the fair value changes

Cash flow hedges

Other comprehensive income for the year, after tax

TOTAL COMPREHENSIVE INFOME FOR THE YEAR

Total comprehensive income attributable to:

Owners of the parent

No-controlling interests

BUDDIES CO.

Statement of Profit or Loss and Other Comprehensive Income

For the year ended December 31, 20x1

(amounts in Philippine Pesos)

Notes

Revenue

Other income

Change in inventory

Net purchases

Employee benefits expense

Depreciation and amortization expense

Impairment of property, plant and equipment

Other expenses

Finance costs

Share of profit of associates

Profit before tax

Income tax expense

Profit for the year from continuing operations

Loss for the year from discontinued operations

PROFIT FOR THE YEAR

Profit attributable to:

Owners of the parent

Non-controlling interests

Other comprehensive income, after tax

Items that will not be reclassified subsequently to profit or loss:

Gains on property revaluation

Share of other comprehensive income of associates - revaluation gain

Remeasurements of defined pension plans

Investment in equity instruments

Items that will be reclassified subsequently to profit or loss:

Exchange differences on translating foreign operations

Date Accounts

e December 31,20x1 Investment in amortized cost

Gain on sale

To record the gain on sale of investment

December 31,20x1 Loss from change in FVLCS

20x1 Biological Assets

To record the change in FVLCS

December 31,20x1 Investment in associate

Share in Profit of Associate

To record the share in profit of associate

December 31,20x1 Dividend income

Investment in associate

To correct the entry on dividend income

December 31,20x1 Investment in Associate

Share in OCI of Associate - revaluation surplus

To record the share in associate's other comprehensive incom

Dr. Cr.

150,000

150,000

300,000

300,000

300,000

300,000

90,000

90,000

36,000

36,000

rehensive incom

You might also like

- Ind As Summary Charts PDFDocument47 pagesInd As Summary Charts PDFVinayak67% (3)

- Sample Problem IncomeDocument4 pagesSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- GZU Fin Reporting Masters Question BankDocument31 pagesGZU Fin Reporting Masters Question BankTawanda Tatenda Herbert100% (2)

- CHAPTER 7 AnswerDocument7 pagesCHAPTER 7 AnswerKenncy100% (5)

- Solution To AP05 - InvestmentsDocument17 pagesSolution To AP05 - InvestmentsmarkNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Income StatementDocument6 pagesIncome Statementabernardino.forschoolNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Practice For Test 3 - Copy (1) EbiDocument9 pagesPractice For Test 3 - Copy (1) EbireynaldohizkiaNo ratings yet

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- Problem 6 (Free Cash Flow) Statement of Financial Position Assets 20X3 20X4Document5 pagesProblem 6 (Free Cash Flow) Statement of Financial Position Assets 20X3 20X4Jule Adlawan100% (1)

- Eflatoun Company: Financial Statements For The Year Ended 31 December 2009Document10 pagesEflatoun Company: Financial Statements For The Year Ended 31 December 2009shazNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Week 4 NotesDocument4 pagesWeek 4 NotescalebNo ratings yet

- E5-1B (Similar To E5-6) (LO 3) Preparing and Interpreting A Classified Balance Sheet With Discussion of Terminology (Challenging)Document4 pagesE5-1B (Similar To E5-6) (LO 3) Preparing and Interpreting A Classified Balance Sheet With Discussion of Terminology (Challenging)Muostapha FikryNo ratings yet

- Statement of Cash FlowDocument7 pagesStatement of Cash Flowvdj kumarNo ratings yet

- Tugas Personal 1Document6 pagesTugas Personal 1kopi klasikNo ratings yet

- Ass For BMDocument6 pagesAss For BMMeron TemisNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Cash Flow SolutionsDocument6 pagesCash Flow SolutionszoeyNo ratings yet

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- CH 12 Wiley Plus Kimmel Quiz & HWDocument9 pagesCH 12 Wiley Plus Kimmel Quiz & HWmkiNo ratings yet

- Chapter 8 - Financial AnalysisDocument4 pagesChapter 8 - Financial AnalysisLưu Ngọc Tường ViNo ratings yet

- Vuico Printing ServicesDocument18 pagesVuico Printing ServicesRoseinthedark TiuNo ratings yet

- Superhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009Document9 pagesSuperhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009shazNo ratings yet

- Financial Ratio Analysis Case StudyDocument10 pagesFinancial Ratio Analysis Case StudyGracel Joy VicenteNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Income StatementDocument7 pagesIncome StatementVALENCIA TORENTHANo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- Cash Flow Statement Illustration (IAS 7)Document2 pagesCash Flow Statement Illustration (IAS 7)amahaktNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- Week 2 RequirementsDocument18 pagesWeek 2 RequirementsCarlo B CagampangNo ratings yet

- Extra Ex QTTC28129Document4 pagesExtra Ex QTTC28129Quang TiếnNo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- Activity 1.4.A Preparation of Financial ReportsDocument1 pageActivity 1.4.A Preparation of Financial ReportsheyheyNo ratings yet

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument26 pagesIas 1 Presentation of Financial Statementsdatgooner97No ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Problem 3Document2 pagesProblem 3Vicente, Liza Mae C.No ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- Illustrative Problem 4.1 PDFDocument1 pageIllustrative Problem 4.1 PDFChincel G. ANINo ratings yet

- Financial Statements - AISDocument19 pagesFinancial Statements - AISRegine Alesna AlcoberNo ratings yet

- Camille ManufacturingDocument4 pagesCamille ManufacturingChristina StephensonNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Advanced Corp AccountingDocument10 pagesAdvanced Corp AccountingTejas GNo ratings yet

- Topic 3 Computation of Taxable Profit or LossDocument25 pagesTopic 3 Computation of Taxable Profit or LossitulejamesNo ratings yet

- Tarea - 3 Bis - Caso Dyaton Products - Formato ADocument8 pagesTarea - 3 Bis - Caso Dyaton Products - Formato AMiguel VázquezNo ratings yet

- Devie Helen S1 Akuntansi T12 C PADocument5 pagesDevie Helen S1 Akuntansi T12 C PAShigit PebriantoNo ratings yet

- 137 - Tugas TerstreukturDocument1 page137 - Tugas TerstreukturFransiska JessicaNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Ninth EditionDocument70 pagesFinancial Accounting: Tools For Business Decision Making: Ninth EditionJesussNo ratings yet

- FunctionsDocument15 pagesFunctionsHermie TimarioNo ratings yet

- NFJPIA1718 - Resume Pro FromaDocument2 pagesNFJPIA1718 - Resume Pro FromaHermie TimarioNo ratings yet

- English Thesis - PreliminariesDocument7 pagesEnglish Thesis - PreliminariesHermie TimarioNo ratings yet

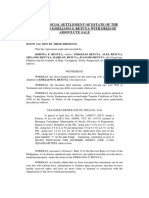

- Extra-Judicial Settlement of Estate of The Deceased Emeliano S. Retuya With Deed of Absoulute SaleDocument2 pagesExtra-Judicial Settlement of Estate of The Deceased Emeliano S. Retuya With Deed of Absoulute SaleHermie TimarioNo ratings yet

- Investments in Financial Instruments: Problem 1Document10 pagesInvestments in Financial Instruments: Problem 1Johanna Vidad100% (1)

- DITO CME 17A 2020 With Sustainability ReportDocument128 pagesDITO CME 17A 2020 With Sustainability Reportangelo santosNo ratings yet

- Lesson 3A. Investment On Securities - Please PrintDocument13 pagesLesson 3A. Investment On Securities - Please PrintHail DeityNo ratings yet

- The Philippine Financial Reporting Standards: PFRS Updates TrainingDocument74 pagesThe Philippine Financial Reporting Standards: PFRS Updates TrainingMara Shaira Siega100% (1)

- Norco Annual Report 2017Document107 pagesNorco Annual Report 2017Jigar Rameshbhai PatelNo ratings yet

- WRK IFRS SMEsDocument109 pagesWRK IFRS SMEsMazhar Ali JoyoNo ratings yet

- Investments 1 PDFDocument98 pagesInvestments 1 PDFAbby NavarroNo ratings yet

- Chapter 14 Investments in AssociatesDocument17 pagesChapter 14 Investments in AssociatesElla GraceNo ratings yet

- Philippine Accounting Standards 1 - Presentation of Financial StatementsDocument10 pagesPhilippine Accounting Standards 1 - Presentation of Financial StatementsJohn Rafael Reyes PeloNo ratings yet

- Theory of Accounts: Module 2 Financial Statement PresentationDocument33 pagesTheory of Accounts: Module 2 Financial Statement PresentationRHEA CYBELE OSARIONo ratings yet

- SNLK - Laporan Keuangan Per 31 Dec 2020Document67 pagesSNLK - Laporan Keuangan Per 31 Dec 2020yohanes andryanjayaNo ratings yet

- This Study Resource Was: ReferencesDocument4 pagesThis Study Resource Was: ReferencesEngel QuimsonNo ratings yet

- Intermediate Accounting: Chapter 16 Appendix ADocument24 pagesIntermediate Accounting: Chapter 16 Appendix AShuo LuNo ratings yet

- Imperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020Document26 pagesImperial Pacific International Holdings Limited: Interim Results For The Six Months Ended 30 June 2020in resNo ratings yet

- Notes On Pfrs For SmesDocument8 pagesNotes On Pfrs For SmesbiadnescydcharyNo ratings yet

- Intermediate 3 Blend. (AutoRecovered)Document72 pagesIntermediate 3 Blend. (AutoRecovered)Cherwin bentulanNo ratings yet

- US GAAP X IFRSDocument220 pagesUS GAAP X IFRSTharsis BaldinottiNo ratings yet

- Ch13 4es - InvestmentDocument27 pagesCh13 4es - InvestmentK59 Nguyen Dang Vy KhanhNo ratings yet

- Chapter 6: Conceptual Framework Recognition and MeasurementDocument15 pagesChapter 6: Conceptual Framework Recognition and MeasurementJan DecemberNo ratings yet

- Ratio Analysis of Maruti Suzuki and M&MDocument5 pagesRatio Analysis of Maruti Suzuki and M&MkritiNo ratings yet

- QuizDocument6 pagesQuizKathrine YapNo ratings yet

- CS 280323 Prog Bil 2022 KME EnglDocument14 pagesCS 280323 Prog Bil 2022 KME EnglChipasha MwelwaNo ratings yet

- BCTC UnileverDocument6 pagesBCTC Unilever04 - Bùi Thị Thanh Mai - DHTM14A4HNNo ratings yet

- Accounting: All-In-1Document478 pagesAccounting: All-In-1Ntsikelelo MosikareNo ratings yet

- Investment in Equity SecuritiesDocument11 pagesInvestment in Equity SecuritiesnikNo ratings yet

- Preparation and Presentation of Financial StatementsDocument56 pagesPreparation and Presentation of Financial StatementsKogularamanan NithiananthanNo ratings yet

- Group Accounting - IIDocument21 pagesGroup Accounting - IISajid IqbalNo ratings yet