Professional Documents

Culture Documents

New Features - Previous Releases: Major Changes

New Features - Previous Releases: Major Changes

Uploaded by

Anonymous atsRZVKHxCopyright:

Available Formats

You might also like

- Letter of Intent To Buy Real PropertyDocument2 pagesLetter of Intent To Buy Real PropertyAnonymous 2FpdQGKE93% (15)

- Tax Presentation-29.01.2023Document25 pagesTax Presentation-29.01.2023Abhinav Parhi100% (2)

- Metro Pcs Bill 9.27Document3 pagesMetro Pcs Bill 9.27Jay L0% (1)

- YES BANK Jun 001Document9 pagesYES BANK Jun 001Sahel BaidyaNo ratings yet

- Scope of White Label ATMs Business in PakistanDocument15 pagesScope of White Label ATMs Business in PakistanSay Pakistan100% (1)

- New Tax RatesDocument2 pagesNew Tax RatesSIVAKUMARNo ratings yet

- Direct Tax AmendmentDocument1 pageDirect Tax AmendmentDevarajan VeeraraghavanNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Tax Updates For June 2015 Examination - 20!03!15Document37 pagesTax Updates For June 2015 Examination - 20!03!15kumar_anil666No ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Opportunities Cost AccountantsDocument37 pagesOpportunities Cost AccountantswindislifeNo ratings yet

- Amendments in Income Tax Act: Submitted To-Prof. Atul KochharDocument11 pagesAmendments in Income Tax Act: Submitted To-Prof. Atul KochharKUNAL GUPTANo ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- Minimum Alternate TaxDocument8 pagesMinimum Alternate Taxjainrahul234No ratings yet

- RSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Document17 pagesRSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Rohan JainNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation RulesDocument19 pagesCBDT - E-Filing - ITR 4 - Validation RulesAshish GuliaNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Presumptive Income - Updated! (Section 44AD, 44ADA, 44AEDocument4 pagesPresumptive Income - Updated! (Section 44AD, 44ADA, 44AEHema joshiNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- Income Tax Amendments & Transition Notes For CA Inter May 24 byDocument63 pagesIncome Tax Amendments & Transition Notes For CA Inter May 24 byRutika ShindeNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Introduction to the Australian Taxation System and Calculation of Income TaxDocument63 pagesIntroduction to the Australian Taxation System and Calculation of Income TaxNicsNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- Minimum Alternate TaxDocument20 pagesMinimum Alternate Taxapi-3832224100% (2)

- 16 Total IncomeDocument7 pages16 Total IncomeHritik HarlalkaNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamsshrutishindeNo ratings yet

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Know About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Document5 pagesKnow About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Suman AgarwalNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

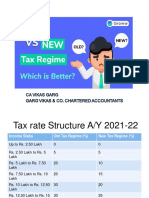

- Old Vs New Tax RegimeDocument9 pagesOld Vs New Tax Regimescintillating26No ratings yet

- Tax Updates For June 2012 ExamsDocument37 pagesTax Updates For June 2012 ExamsShanky MalhotraNo ratings yet

- Changes Affecting Corporates and BusinesDocument3 pagesChanges Affecting Corporates and BusinesSURYA SNo ratings yet

- Affecting Corporates - ChangesDocument3 pagesAffecting Corporates - ChangesSURYA SNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Old Vs New Personal Tax Regime 010323Document20 pagesOld Vs New Personal Tax Regime 010323Sreehari RaoNo ratings yet

- When Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Document6 pagesWhen Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Biswabandhu PalNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22Document15 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22MOHAMMED LayeeqNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Corporate TaxationDocument6 pagesCorporate TaxationSachin NairNo ratings yet

- Tax UpdateDocument149 pagesTax UpdateJamz LopezNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- How To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABDocument12 pagesHow To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABPradeep PandeyNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- How To Complete Mira 601 PDFDocument10 pagesHow To Complete Mira 601 PDFSODDEYNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Assessment of CompaniesxDocument40 pagesAssessment of CompaniesxMayur RathodNo ratings yet

- Sens Ys Compliance HandbookDocument32 pagesSens Ys Compliance HandbookPraful Anil UberoiNo ratings yet

- IND As Note Implications For Companies in India FinalDocument6 pagesIND As Note Implications For Companies in India FinalRavNeet KaUrNo ratings yet

- Minimum Alternate TaxDocument20 pagesMinimum Alternate Taxmuskan khatriNo ratings yet

- Budget 14 AnalysisDocument19 pagesBudget 14 AnalysisSaurav BharadwajNo ratings yet

- L10 - Revenue RecognitionDocument8 pagesL10 - Revenue RecognitionAhmed HussainNo ratings yet

- J.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Credit Card ActvitiesDocument9 pagesCredit Card ActvitiesNickNo ratings yet

- IHC - Internal Payments - Receipts Among SubsidiariesDocument19 pagesIHC - Internal Payments - Receipts Among SubsidiariesSrinuNo ratings yet

- Finacle 19A - Cbs Menu - UpgbDocument27 pagesFinacle 19A - Cbs Menu - UpgbyezdiarwNo ratings yet

- Invoice 4Document1 pageInvoice 4Ankur GuptaNo ratings yet

- RMC 1-2019 PDFDocument1 pageRMC 1-2019 PDFJhenny Ann P. SalemNo ratings yet

- Account Statement 29-12-2019T11 52 22 PDFDocument2 pagesAccount Statement 29-12-2019T11 52 22 PDFMuhammad RashidNo ratings yet

- Personal CheckDocument3 pagesPersonal CheckXjlan AhmedNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFAbhishek AgrawalNo ratings yet

- Mr. RechDocument2 pagesMr. RechnellyNo ratings yet

- Statement of Account: Switch To E-Billing and Go Green Today!Document11 pagesStatement of Account: Switch To E-Billing and Go Green Today!ChewKietEieNo ratings yet

- LG 20 L Solo Microwave Oven: MCXB009NMCC0300Document1 pageLG 20 L Solo Microwave Oven: MCXB009NMCC0300Chandan Singha0% (1)

- Shree2 PDFDocument1 pageShree2 PDFHolvin FoodsNo ratings yet

- Greenville County Tax SaleDocument6 pagesGreenville County Tax SaleGreenville NewsNo ratings yet

- Accounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFDocument8 pagesAccounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFCHANDRASHEKAR SHAMANNANo ratings yet

- PWC NotesDocument2 pagesPWC NotesDave Mar IdnayNo ratings yet

- 210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguDocument8 pages210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguSulis SetioriniNo ratings yet

- Chapter 05 Estate TaxDocument14 pagesChapter 05 Estate TaxNikki BucatcatNo ratings yet

- Vaccum Cleaner Bill 2019Document2 pagesVaccum Cleaner Bill 2019KrishnaKumar MNo ratings yet

- Yi CFHJ Oiq 2 DCSC ZRDocument4 pagesYi CFHJ Oiq 2 DCSC ZRNishant Sagar DewanganNo ratings yet

- Ethiopia Digital Payments AssessmentDocument30 pagesEthiopia Digital Payments AssessmentTEMESGEN TEFERINo ratings yet

- Boxplot y Cuartiles, Asimetria, CurtosisDocument21 pagesBoxplot y Cuartiles, Asimetria, Curtosishernan salgueroNo ratings yet

- formFeeRecieptPrintReport Duplicate RC Book PDFDocument1 pageformFeeRecieptPrintReport Duplicate RC Book PDFsnaehalNo ratings yet

- Financial Management - Exercise 2Document5 pagesFinancial Management - Exercise 2jhun ecleoNo ratings yet

- Eng1 PDFDocument1 pageEng1 PDFPabean AmbonNo ratings yet

- Differences Between Private Income and Personal Income Are As FollowsDocument2 pagesDifferences Between Private Income and Personal Income Are As Followsveronica_rachnaNo ratings yet

New Features - Previous Releases: Major Changes

New Features - Previous Releases: Major Changes

Uploaded by

Anonymous atsRZVKHxOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Features - Previous Releases: Major Changes

New Features - Previous Releases: Major Changes

Uploaded by

Anonymous atsRZVKHxCopyright:

Available Formats

New Features - Previous Releases

AY 2017-18 computation

AY 2017-18 is now released and software is updated with the relevant changes as per Finance Act 2016.

Major Changes:

Surcharge Rate increased from 12% to 15% for Individual, HUF, AOP, BOI & AJP

Rebate u/s 87A Rebate limit increased from Rs.2,000 to Rs.5,000

Domestic Co.

Concessional Tax rates

Tax rate of 29% is applicable, if the Total Turnover/Gross Receipts during the

FY 2014-15 <= Rs.5 crore.

Tax rate of 25% is applicable, if conditions prescribed u/s 115BA are satisfied.

Option is given to select the applicable rate against the new row Tax rate

which is given above Tax on total income in Computation window.

Presumptive profits u/s

44AD

Turnover limit enhanced from Rs.1 crore to Rs.2 crore

Presumptive profits u/s

44ADA

New sub-table Profession: u/s 44ADA - Presumptive profits is provided under

Profits and gains of Business or Profession

Additional depreciation Additions used for less than 180 days during AY 16-17 are eligible for 50% of

the additional depreciation in AY 17-18. Necessary changes are made in

Depreciation as per IT Act table.

Capital Gains In case of unlisted shares, period of holding is 24 months for treating as longterm

capital asset. Necessary changes are updated.

New items are provided in LTCG and STCG Asset list

In LTCG table new list item 54EE: Investment in units of specified fund is

provided under Exemptions

Section 115BBDA Dividends in excess of Rs. 10 lakh is taxable u/s 115BBDA @10% in case of

Resident-Individual/HUF/Firm/LLP. Required changes are made in Dividends

sub-table under Income from other sources

MAT table New items are added under Additions and Deletions list

Option to calculate MAT @ 9% in case of units located in International

Financial Services Center

Chapter VI-A Deductions 80GG Deduction limit increased from Rs.24,000 to Rs.60,000

New items, viz., 80-IAC: Eligible start-ups and 80-IBA: Housing

projects and 80EE: Interest on Housing Loan are provided

Interest u/s 234C 15th June installment is made applicable for all status.

In respect of eligible business u/s 44AD, only 15th March installment is

applicable.

Necessary changes are made in calculation of Interest u/s 234C

Other Changes New item Payment to Indian Railways given in 43B disallowance

sub-table

New list item 35ABA: Telecommunication Spectrum fees given in '35

to 35E, 32AC, 32AD, 33AB, 33ABA deductions' sub-table.

New list item 115BBF: Royalty income from patent given in 'Income

taxable at special rates' sub-table

Section 25A, 25AA, 25B related changes are made in Arrears /

Unrealised rent received sub-table under Income from House Property

And many other improvements

You might also like

- Letter of Intent To Buy Real PropertyDocument2 pagesLetter of Intent To Buy Real PropertyAnonymous 2FpdQGKE93% (15)

- Tax Presentation-29.01.2023Document25 pagesTax Presentation-29.01.2023Abhinav Parhi100% (2)

- Metro Pcs Bill 9.27Document3 pagesMetro Pcs Bill 9.27Jay L0% (1)

- YES BANK Jun 001Document9 pagesYES BANK Jun 001Sahel BaidyaNo ratings yet

- Scope of White Label ATMs Business in PakistanDocument15 pagesScope of White Label ATMs Business in PakistanSay Pakistan100% (1)

- New Tax RatesDocument2 pagesNew Tax RatesSIVAKUMARNo ratings yet

- Direct Tax AmendmentDocument1 pageDirect Tax AmendmentDevarajan VeeraraghavanNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Tax Updates For June 2015 Examination - 20!03!15Document37 pagesTax Updates For June 2015 Examination - 20!03!15kumar_anil666No ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Opportunities Cost AccountantsDocument37 pagesOpportunities Cost AccountantswindislifeNo ratings yet

- Amendments in Income Tax Act: Submitted To-Prof. Atul KochharDocument11 pagesAmendments in Income Tax Act: Submitted To-Prof. Atul KochharKUNAL GUPTANo ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- Minimum Alternate TaxDocument8 pagesMinimum Alternate Taxjainrahul234No ratings yet

- RSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Document17 pagesRSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Rohan JainNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation RulesDocument19 pagesCBDT - E-Filing - ITR 4 - Validation RulesAshish GuliaNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Presumptive Income - Updated! (Section 44AD, 44ADA, 44AEDocument4 pagesPresumptive Income - Updated! (Section 44AD, 44ADA, 44AEHema joshiNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- Income Tax Amendments & Transition Notes For CA Inter May 24 byDocument63 pagesIncome Tax Amendments & Transition Notes For CA Inter May 24 byRutika ShindeNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Introduction to the Australian Taxation System and Calculation of Income TaxDocument63 pagesIntroduction to the Australian Taxation System and Calculation of Income TaxNicsNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiNo ratings yet

- Minimum Alternate TaxDocument20 pagesMinimum Alternate Taxapi-3832224100% (2)

- 16 Total IncomeDocument7 pages16 Total IncomeHritik HarlalkaNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamsshrutishindeNo ratings yet

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- Know About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Document5 pagesKnow About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Suman AgarwalNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Old Vs New Tax RegimeDocument9 pagesOld Vs New Tax Regimescintillating26No ratings yet

- Tax Updates For June 2012 ExamsDocument37 pagesTax Updates For June 2012 ExamsShanky MalhotraNo ratings yet

- Changes Affecting Corporates and BusinesDocument3 pagesChanges Affecting Corporates and BusinesSURYA SNo ratings yet

- Affecting Corporates - ChangesDocument3 pagesAffecting Corporates - ChangesSURYA SNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Old Vs New Personal Tax Regime 010323Document20 pagesOld Vs New Personal Tax Regime 010323Sreehari RaoNo ratings yet

- When Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Document6 pagesWhen Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Biswabandhu PalNo ratings yet

- Central Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22Document15 pagesCentral Board of Direct Taxes, E-Filing Project: ITR 1 - Validation Rules For AY 2021-22MOHAMMED LayeeqNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Corporate TaxationDocument6 pagesCorporate TaxationSachin NairNo ratings yet

- Tax UpdateDocument149 pagesTax UpdateJamz LopezNo ratings yet

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Document6 pagesLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- How To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABDocument12 pagesHow To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABPradeep PandeyNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- How To Complete Mira 601 PDFDocument10 pagesHow To Complete Mira 601 PDFSODDEYNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Assessment of CompaniesxDocument40 pagesAssessment of CompaniesxMayur RathodNo ratings yet

- Sens Ys Compliance HandbookDocument32 pagesSens Ys Compliance HandbookPraful Anil UberoiNo ratings yet

- IND As Note Implications For Companies in India FinalDocument6 pagesIND As Note Implications For Companies in India FinalRavNeet KaUrNo ratings yet

- Minimum Alternate TaxDocument20 pagesMinimum Alternate Taxmuskan khatriNo ratings yet

- Budget 14 AnalysisDocument19 pagesBudget 14 AnalysisSaurav BharadwajNo ratings yet

- L10 - Revenue RecognitionDocument8 pagesL10 - Revenue RecognitionAhmed HussainNo ratings yet

- J.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2024: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Credit Card ActvitiesDocument9 pagesCredit Card ActvitiesNickNo ratings yet

- IHC - Internal Payments - Receipts Among SubsidiariesDocument19 pagesIHC - Internal Payments - Receipts Among SubsidiariesSrinuNo ratings yet

- Finacle 19A - Cbs Menu - UpgbDocument27 pagesFinacle 19A - Cbs Menu - UpgbyezdiarwNo ratings yet

- Invoice 4Document1 pageInvoice 4Ankur GuptaNo ratings yet

- RMC 1-2019 PDFDocument1 pageRMC 1-2019 PDFJhenny Ann P. SalemNo ratings yet

- Account Statement 29-12-2019T11 52 22 PDFDocument2 pagesAccount Statement 29-12-2019T11 52 22 PDFMuhammad RashidNo ratings yet

- Personal CheckDocument3 pagesPersonal CheckXjlan AhmedNo ratings yet

- Cashless Society: Presented By: Arsalan ArifDocument24 pagesCashless Society: Presented By: Arsalan ArifArsalan ArifNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFAbhishek AgrawalNo ratings yet

- Mr. RechDocument2 pagesMr. RechnellyNo ratings yet

- Statement of Account: Switch To E-Billing and Go Green Today!Document11 pagesStatement of Account: Switch To E-Billing and Go Green Today!ChewKietEieNo ratings yet

- LG 20 L Solo Microwave Oven: MCXB009NMCC0300Document1 pageLG 20 L Solo Microwave Oven: MCXB009NMCC0300Chandan Singha0% (1)

- Shree2 PDFDocument1 pageShree2 PDFHolvin FoodsNo ratings yet

- Greenville County Tax SaleDocument6 pagesGreenville County Tax SaleGreenville NewsNo ratings yet

- Accounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFDocument8 pagesAccounting Journal Entries For Taxation Excise Service Tax Tds Accounts Knowledge Hub PDFCHANDRASHEKAR SHAMANNANo ratings yet

- PWC NotesDocument2 pagesPWC NotesDave Mar IdnayNo ratings yet

- 210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguDocument8 pages210 - RFP - Sewa Ruangan, Internet, Listrik & Over Time SguSulis SetioriniNo ratings yet

- Chapter 05 Estate TaxDocument14 pagesChapter 05 Estate TaxNikki BucatcatNo ratings yet

- Vaccum Cleaner Bill 2019Document2 pagesVaccum Cleaner Bill 2019KrishnaKumar MNo ratings yet

- Yi CFHJ Oiq 2 DCSC ZRDocument4 pagesYi CFHJ Oiq 2 DCSC ZRNishant Sagar DewanganNo ratings yet

- Ethiopia Digital Payments AssessmentDocument30 pagesEthiopia Digital Payments AssessmentTEMESGEN TEFERINo ratings yet

- Boxplot y Cuartiles, Asimetria, CurtosisDocument21 pagesBoxplot y Cuartiles, Asimetria, Curtosishernan salgueroNo ratings yet

- formFeeRecieptPrintReport Duplicate RC Book PDFDocument1 pageformFeeRecieptPrintReport Duplicate RC Book PDFsnaehalNo ratings yet

- Financial Management - Exercise 2Document5 pagesFinancial Management - Exercise 2jhun ecleoNo ratings yet

- Eng1 PDFDocument1 pageEng1 PDFPabean AmbonNo ratings yet

- Differences Between Private Income and Personal Income Are As FollowsDocument2 pagesDifferences Between Private Income and Personal Income Are As Followsveronica_rachnaNo ratings yet