Professional Documents

Culture Documents

Dallas County Property Tax Reform Letter 7.13.17

Dallas County Property Tax Reform Letter 7.13.17

Uploaded by

Naomi MartinCopyright:

Available Formats

You might also like

- Eric Jamal Johnson Arrest Warrant AffidavitDocument4 pagesEric Jamal Johnson Arrest Warrant AffidavitNaomi MartinNo ratings yet

- The Texas Economy and School ChoiceDocument48 pagesThe Texas Economy and School ChoiceTPPFNo ratings yet

- Dallas County v. Opioid Drug Makers LawsuitDocument119 pagesDallas County v. Opioid Drug Makers LawsuitNaomi Martin100% (2)

- Dallas County Juvenile Medlock Sexual Incidents Independent Ombudsman Report 9.20.17Document8 pagesDallas County Juvenile Medlock Sexual Incidents Independent Ombudsman Report 9.20.17Naomi MartinNo ratings yet

- Parkland Strategic Plan 2017-2020Document28 pagesParkland Strategic Plan 2017-2020Naomi Martin100% (1)

- Glidewell PetitionDocument8 pagesGlidewell PetitionNaomi MartinNo ratings yet

- Local Property Tax ReformDocument2 pagesLocal Property Tax ReformTPPFNo ratings yet

- 2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnDocument2 pages2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnTPPFNo ratings yet

- 2018 06 RR Robin Hood School Property Tax BelewSassPeacockDocument12 pages2018 06 RR Robin Hood School Property Tax BelewSassPeacockTPPF100% (1)

- Governors Budget FY 2020 2021 PDFDocument22 pagesGovernors Budget FY 2020 2021 PDFrangerNo ratings yet

- A Roadmap To BetterDocument16 pagesA Roadmap To BetterTexas Comptroller of Public AccountsNo ratings yet

- Public Education 2015Document6 pagesPublic Education 2015Christopher KindredNo ratings yet

- HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaDocument6 pagesHB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaOctorara_ReportNo ratings yet

- Putting Texas FirstDocument113 pagesPutting Texas FirstProgressTXNo ratings yet

- Texas Taxpayer Student Fairness Coalition FilingDocument17 pagesTexas Taxpayer Student Fairness Coalition FilingPaul MastersNo ratings yet

- Fall 2014 Legislative ReportDocument4 pagesFall 2014 Legislative ReportSenator Brandon CreightonNo ratings yet

- Abbott's Latest "Working Document" On School FinanceDocument44 pagesAbbott's Latest "Working Document" On School FinancedmnpoliticsNo ratings yet

- GOP State of The State 2018Document3 pagesGOP State of The State 2018Anonymous 3cOviHTinNo ratings yet

- HB 1759 Press ReleaseDocument1 pageHB 1759 Press ReleasePatrick PerryNo ratings yet

- Texas Commission ON Human Rights: Strategic Plan For The 2003 - 2007 PeriodDocument70 pagesTexas Commission ON Human Rights: Strategic Plan For The 2003 - 2007 Periodmemelo2No ratings yet

- 2014 Roadmap To RenewalDocument22 pages2014 Roadmap To RenewalsuzanneyankeeNo ratings yet

- Testimony Before NYS Legislative Fiscal CommitteeDocument3 pagesTestimony Before NYS Legislative Fiscal CommitteemaryrozakNo ratings yet

- San Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Document102 pagesSan Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Scribd Government DocsNo ratings yet

- 2017 07 SpecialSessionInvestment CEF PeacockQuinteroGinn TribTalkDocument1 page2017 07 SpecialSessionInvestment CEF PeacockQuinteroGinn TribTalkTPPFNo ratings yet

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorNo ratings yet

- Financing Educational SystemsDocument2 pagesFinancing Educational SystemsRochelle EstebanNo ratings yet

- How School Funding WorksDocument20 pagesHow School Funding WorksCarolyn UptonNo ratings yet

- Fact Sheet Huntsville Property Tax RenewalDocument2 pagesFact Sheet Huntsville Property Tax RenewalChamber of Commerce of Huntsville/Madison CountyNo ratings yet

- CWG - The Texas ModelDocument2 pagesCWG - The Texas ModelTPPFNo ratings yet

- Ohn - Aylor: Dear Neighbor: Governor Proposes $1.2 Billion State BudgetDocument4 pagesOhn - Aylor: Dear Neighbor: Governor Proposes $1.2 Billion State BudgetPAHouseGOPNo ratings yet

- State of The State 2013Document16 pagesState of The State 2013dhmontgomeryNo ratings yet

- Jobs, Jobs, Jobs: Follow What's Happening OnDocument4 pagesJobs, Jobs, Jobs: Follow What's Happening OnPAHouseGOPNo ratings yet

- Ten ReasonsDocument3 pagesTen ReasonsOctorara_ReportNo ratings yet

- Margin TaxDocument20 pagesMargin TaxLatinos Ready To VoteNo ratings yet

- An Open Letter To Antietam School District ResidentsDocument5 pagesAn Open Letter To Antietam School District ResidentsReading_EagleNo ratings yet

- The Message: A Time for Repair and Reward in Texas CommunitiesFrom EverandThe Message: A Time for Repair and Reward in Texas CommunitiesNo ratings yet

- Texas Impact Legislative AgendaDocument5 pagesTexas Impact Legislative Agendabee5834No ratings yet

- BP65 2010 Burdens ReportDocument12 pagesBP65 2010 Burdens ReportjspectorNo ratings yet

- Budget Background Taxes 2011 - FINAL PDFDocument2 pagesBudget Background Taxes 2011 - FINAL PDFAndi ParkinsonNo ratings yet

- White House Middle Class Reports MassachusettsDocument6 pagesWhite House Middle Class Reports MassachusettsMassLiveNo ratings yet

- 2015 Progress Texas Constitutional Amendment Ballot GuideDocument4 pages2015 Progress Texas Constitutional Amendment Ballot GuideProgressTX100% (1)

- New Budget Cuts Threaten SCH FNDG Settlemts-Stateline TOP STORYDocument4 pagesNew Budget Cuts Threaten SCH FNDG Settlemts-Stateline TOP STORYEducation JusticeNo ratings yet

- Delivering Efficient State and Local Government Services and Providing For Their Long-Term Fiscal SustainabilityDocument6 pagesDelivering Efficient State and Local Government Services and Providing For Their Long-Term Fiscal SustainabilitykreiaNo ratings yet

- A Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights ReservedDocument5 pagesA Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights Reservedapi-251198534No ratings yet

- Texas Higher Education Coordinating Board Releases 2011 Texas Public Higher Education AlmanacDocument12 pagesTexas Higher Education Coordinating Board Releases 2011 Texas Public Higher Education AlmanacczcardonaNo ratings yet

- Christina Mazuca March 16, 2011 The State of Texas' Education BudgetDocument4 pagesChristina Mazuca March 16, 2011 The State of Texas' Education Budgetapi-47035565No ratings yet

- Tax Cap Brochure 10-14-11Document6 pagesTax Cap Brochure 10-14-11hhhtaNo ratings yet

- Pennsylvania State Spending: by Nathan Benefield Commonwealth FoundationDocument25 pagesPennsylvania State Spending: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- 10 Lege Guide SS17 Paycheck ProtectionDocument1 page10 Lege Guide SS17 Paycheck ProtectionTPPFNo ratings yet

- Michigan's Middle Class PlanDocument11 pagesMichigan's Middle Class PlanhousedemsMINo ratings yet

- Reichley Report Summer 2011Document4 pagesReichley Report Summer 2011PAHouseGOPNo ratings yet

- Newsletter 337Document11 pagesNewsletter 337Henry CitizenNo ratings yet

- Laubenberg Letter 4-17-2011Document1 pageLaubenberg Letter 4-17-2011TEA_Party_RockwallNo ratings yet

- TPCAC 83rd Legislative PrioritiesDocument18 pagesTPCAC 83rd Legislative PrioritiesKonni BurtonNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- Equitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una JakupovicDocument5 pagesEquitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una Jakupovicapi-523746438No ratings yet

- 85th Legislature Special Session AgendaDocument1 page85th Legislature Special Session AgendaTPPFNo ratings yet

- The Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)Document35 pagesThe Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)National Education Policy CenterNo ratings yet

- Immigration: Securing The Border and Texas' Economic FutureDocument4 pagesImmigration: Securing The Border and Texas' Economic FutureLVPPressNo ratings yet

- Massachusetts&New York MauroDocument3 pagesMassachusetts&New York Maurofmauro7531No ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Federalist Papers Renewed: Hamilton's Blueprint for Restoring the American DreamFrom EverandFederalist Papers Renewed: Hamilton's Blueprint for Restoring the American DreamNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Minimum Competency: A Novel About Education, Testing, Life, and Death in Upstate New YorkFrom EverandMinimum Competency: A Novel About Education, Testing, Life, and Death in Upstate New YorkNo ratings yet

- Texas A&M University Sexual Assault Survey 2015Document261 pagesTexas A&M University Sexual Assault Survey 2015Naomi MartinNo ratings yet

- Emails On Director Search CommitteeDocument2 pagesEmails On Director Search CommitteeNaomi MartinNo ratings yet

- JWP Letter To Jenkins Re Juvenile BoardDocument1 pageJWP Letter To Jenkins Re Juvenile BoardNaomi MartinNo ratings yet

- Secretary of State Letter To AG Regarding Dallas County Commissioner's RaceDocument1 pageSecretary of State Letter To AG Regarding Dallas County Commissioner's RaceNaomi MartinNo ratings yet

- John Wiley Price vs. Terry Smith LettersDocument3 pagesJohn Wiley Price vs. Terry Smith LettersNaomi MartinNo ratings yet

- PCT 1 Constable Compliance Report FY14-16Document24 pagesPCT 1 Constable Compliance Report FY14-16Naomi MartinNo ratings yet

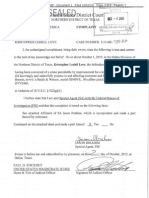

- Kristopher Ledell Love ComplaintDocument8 pagesKristopher Ledell Love ComplaintNaomi MartinNo ratings yet

- Michael Phillips PetitionDocument5 pagesMichael Phillips PetitionNaomi MartinNo ratings yet

- Petition To Remove Dallas County Elections Administrator Toni Pippins-Poole From OfficeDocument5 pagesPetition To Remove Dallas County Elections Administrator Toni Pippins-Poole From OfficeNaomi MartinNo ratings yet

- Dallas County Mental Health PlanDocument11 pagesDallas County Mental Health PlanNaomi MartinNo ratings yet

- Eric Johnson Jail Letter 2/2/16Document8 pagesEric Johnson Jail Letter 2/2/16Naomi MartinNo ratings yet

- Parkland Current Disclosure PolicyDocument7 pagesParkland Current Disclosure PolicyNaomi MartinNo ratings yet

- Records BLDG - Historical Evaluation Presentation - 042616Document27 pagesRecords BLDG - Historical Evaluation Presentation - 042616Naomi MartinNo ratings yet

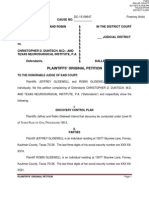

- Christopher Duntsch Request For Bond ReductionDocument53 pagesChristopher Duntsch Request For Bond ReductionNaomi MartinNo ratings yet

- Xadrian Davis Arrest WarrantDocument4 pagesXadrian Davis Arrest WarrantNaomi MartinNo ratings yet

- Butt Injections Murder WarrantDocument4 pagesButt Injections Murder WarrantNaomi MartinNo ratings yet

- Arrest Warrant Affidavit For Vikram VirkDocument3 pagesArrest Warrant Affidavit For Vikram VirkNaomi MartinNo ratings yet

- FBI Director Comey On Garland Terror Suspect BulletinDocument2 pagesFBI Director Comey On Garland Terror Suspect BulletinNaomi MartinNo ratings yet

- Arrest AffidavitDocument8 pagesArrest AffidavitDallas PoliceNo ratings yet

- Roxanna Mayo LawsuitDocument20 pagesRoxanna Mayo LawsuitNaomi MartinNo ratings yet

- National Moot Court ProblemDocument3 pagesNational Moot Court ProblemAnurag FarkyaNo ratings yet

- Corruption in Public LifeDocument3 pagesCorruption in Public LifedaspavelNo ratings yet

- Article 13Document3 pagesArticle 13Jessica JoyceNo ratings yet

- Criminology - Sociological Theories - BritannicaDocument7 pagesCriminology - Sociological Theories - BritannicaShafah MariyamNo ratings yet

- Article 2 Declaration of Principles and State PoliciesDocument3 pagesArticle 2 Declaration of Principles and State PoliciesKris Borlongan100% (1)

- Lafd PSD ManualDocument218 pagesLafd PSD Manualя долбаёбNo ratings yet

- 14-Bangayan v. Bangayan G.R. No. 201061 July 3, 2013Document4 pages14-Bangayan v. Bangayan G.R. No. 201061 July 3, 2013ShaneBeriñaImperialNo ratings yet

- PLEB PrimerDocument2 pagesPLEB PrimerAnonymous b4ycWuoIcNo ratings yet

- Eng 318 Lecture Slides 2024Document31 pagesEng 318 Lecture Slides 2024tirnomdzNo ratings yet

- Katarungang Pambarangay Sections 399 To 422 of The Local Government CodeDocument8 pagesKatarungang Pambarangay Sections 399 To 422 of The Local Government Codemhilet_chi100% (1)

- Liaison Officer Chapter-15Document15 pagesLiaison Officer Chapter-15Amrutha Rao MangamNo ratings yet

- The Sociology of ElitesDocument20 pagesThe Sociology of ElitesKevin Ashneil PrasadNo ratings yet

- The Impact of Indonesia's Information and Electronic Transaction Law (UU ITE)Document9 pagesThe Impact of Indonesia's Information and Electronic Transaction Law (UU ITE)Rifqi SatriaNo ratings yet

- United States Court of Appeals Third CircuitDocument8 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Constitution With Suggestions From ROSDocument14 pagesConstitution With Suggestions From ROSadrianongliangkiatNo ratings yet

- TIGNAYDocument12 pagesTIGNAYAlexa M. YadaoNo ratings yet

- Collado V CaDocument5 pagesCollado V CaJucca Noreen SalesNo ratings yet

- THE ORA: Black Sea ... Black Hole?Document16 pagesTHE ORA: Black Sea ... Black Hole?Ana MerluscaNo ratings yet

- Tax Exemptions On Retirement PlansDocument3 pagesTax Exemptions On Retirement PlansVola AriNo ratings yet

- SRCEDocument3 pagesSRCEJay DuhaylongsodNo ratings yet

- Visa Information System (Vis) : What Is The Vis?Document2 pagesVisa Information System (Vis) : What Is The Vis?a_one08No ratings yet

- Information On Homicide With RobberyDocument2 pagesInformation On Homicide With RobberyGrace AvellanoNo ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner of Internal Revenue, Petitioner, vs. Aichi Forging Company of Asia, Inc., Respondent. FactsDocument11 pagesG.R. No. 184823 October 6, 2010 Commissioner of Internal Revenue, Petitioner, vs. Aichi Forging Company of Asia, Inc., Respondent. FactsAlyza Montilla BurdeosNo ratings yet

- WAR On Terrorism: Impact On Pakistan's Economy Rehana Saeed HashmiDocument15 pagesWAR On Terrorism: Impact On Pakistan's Economy Rehana Saeed HashmiEjaz KazmiNo ratings yet

- Thomas Shea v. James Gabriel, United States Attorney, 520 F.2d 879, 1st Cir. (1975)Document6 pagesThomas Shea v. James Gabriel, United States Attorney, 520 F.2d 879, 1st Cir. (1975)Scribd Government DocsNo ratings yet

- Renewal Regular Passport Application Form (Minor)Document2 pagesRenewal Regular Passport Application Form (Minor)Alfred LopezNo ratings yet

- Do We Live in A MeritocracyDocument2 pagesDo We Live in A MeritocracymimirosellNo ratings yet

- In Re JuradoDocument17 pagesIn Re JuradoRaeNo ratings yet

- Konstitusi Amerika Serikat Dan TerjemahanDocument31 pagesKonstitusi Amerika Serikat Dan TerjemahanAnggieAnggrainiNo ratings yet

- Rise of Napoleon and Domestic Reform PDFDocument12 pagesRise of Napoleon and Domestic Reform PDFAdilNo ratings yet

Dallas County Property Tax Reform Letter 7.13.17

Dallas County Property Tax Reform Letter 7.13.17

Uploaded by

Naomi MartinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dallas County Property Tax Reform Letter 7.13.17

Dallas County Property Tax Reform Letter 7.13.17

Uploaded by

Naomi MartinCopyright:

Available Formats

Dallas County

Commissioners Court Administration

Property Tax Reform and Dallas County

The Dallas County Commissioners Court consistently provides State mandated services while

maintaining one of the lowest tax rates, tax burdens, and the lowest debt-per-capita in the State of Texas.

This has been accomplished through a combination of management, responding to constituents needs, and

statesmanship. Because of this, we feel we are uniquely qualified to make recommendations to the

Legislature on how to lower the property tax burden in Dallas County and in the State of Texas. Below

are the best actions the State should take to address rising property taxes.

1. The State of Texas should reform school finance. School districts make up at least half of a

homeowners property tax bill. The States continued reliance on school property taxes to fund

schools instead of appropriating State revenues has systematically created the property tax

problem. This is most evident in the State budget for the 85th Legislative Session which will

increase local school property taxes by nearly 14%. Page III-5 of the State budget reads,

Property values, and the estimates of local tax collections on which they are based, shall be

increased by 7.04 percent for tax year 2017 and 6.77 percent for tax year 2018. The average

homeowner in the DISD will see a property tax increase over the next two years of $280.

2. The State of Texas should stop raising school property taxes. Over the last ten years, the State

of Texas has increased school property taxes by 44%, or $684 per year for average homeowners

in Dallas Independent School District. This has been achieved by systematically shifting public

school funding away from State aid and to local property taxes. In 2008, Texas schools were

funded 44.8% through local property taxes, 44.9% through State aid, and 10.3% through federal

aid. In 2017, Texas schools are funded 51.5% through local property taxes, 38.4% State aid, and

10% through federal aid. To put that into perspective, the State of Texas has raised school

property taxes from $18.2 billion to $26.2 billion in ten years.

3. The State of Texas should stop shifting costs to local governments. If the State of Texas

simply paid its own bills, Dallas County homeowners would save 17% or $103 per year in

lowered property taxes. In Dallas County alone, we spend $145 million per year on services the

State is supposed to provide such as criminal indigent defense, state prisoners in our jail, and

appointment of counsel in CPS cases. These are all state responsibilities that counties are

mandated to pay for without adequate or any reimbursement.

4. The State of Texas should leave the decision point of taxation at the local level and out of

Austin. Taxpayers have decided, and should continue to decide, what level of taxation is best

through the election of our local officials. There is no need to move away from the traditional and

conservative Texas model of governance, which empowers local officials, to a state centralized

model, like California, where Austin decides how local jurisdictions raise and lower taxes.

charles.reed@dallascounty.org - (214) 653 - 6655

411 Elm Street - 3rd Floor - Dallas, Texas 75202-3340

You might also like

- Eric Jamal Johnson Arrest Warrant AffidavitDocument4 pagesEric Jamal Johnson Arrest Warrant AffidavitNaomi MartinNo ratings yet

- The Texas Economy and School ChoiceDocument48 pagesThe Texas Economy and School ChoiceTPPFNo ratings yet

- Dallas County v. Opioid Drug Makers LawsuitDocument119 pagesDallas County v. Opioid Drug Makers LawsuitNaomi Martin100% (2)

- Dallas County Juvenile Medlock Sexual Incidents Independent Ombudsman Report 9.20.17Document8 pagesDallas County Juvenile Medlock Sexual Incidents Independent Ombudsman Report 9.20.17Naomi MartinNo ratings yet

- Parkland Strategic Plan 2017-2020Document28 pagesParkland Strategic Plan 2017-2020Naomi Martin100% (1)

- Glidewell PetitionDocument8 pagesGlidewell PetitionNaomi MartinNo ratings yet

- Local Property Tax ReformDocument2 pagesLocal Property Tax ReformTPPFNo ratings yet

- 2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnDocument2 pages2017 08 02 Testimony Eliminating Rising Property Tax Burden HB285 CFP VanceGinnTPPFNo ratings yet

- 2018 06 RR Robin Hood School Property Tax BelewSassPeacockDocument12 pages2018 06 RR Robin Hood School Property Tax BelewSassPeacockTPPF100% (1)

- Governors Budget FY 2020 2021 PDFDocument22 pagesGovernors Budget FY 2020 2021 PDFrangerNo ratings yet

- A Roadmap To BetterDocument16 pagesA Roadmap To BetterTexas Comptroller of Public AccountsNo ratings yet

- Public Education 2015Document6 pagesPublic Education 2015Christopher KindredNo ratings yet

- HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaDocument6 pagesHB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaOctorara_ReportNo ratings yet

- Putting Texas FirstDocument113 pagesPutting Texas FirstProgressTXNo ratings yet

- Texas Taxpayer Student Fairness Coalition FilingDocument17 pagesTexas Taxpayer Student Fairness Coalition FilingPaul MastersNo ratings yet

- Fall 2014 Legislative ReportDocument4 pagesFall 2014 Legislative ReportSenator Brandon CreightonNo ratings yet

- Abbott's Latest "Working Document" On School FinanceDocument44 pagesAbbott's Latest "Working Document" On School FinancedmnpoliticsNo ratings yet

- GOP State of The State 2018Document3 pagesGOP State of The State 2018Anonymous 3cOviHTinNo ratings yet

- HB 1759 Press ReleaseDocument1 pageHB 1759 Press ReleasePatrick PerryNo ratings yet

- Texas Commission ON Human Rights: Strategic Plan For The 2003 - 2007 PeriodDocument70 pagesTexas Commission ON Human Rights: Strategic Plan For The 2003 - 2007 Periodmemelo2No ratings yet

- 2014 Roadmap To RenewalDocument22 pages2014 Roadmap To RenewalsuzanneyankeeNo ratings yet

- Testimony Before NYS Legislative Fiscal CommitteeDocument3 pagesTestimony Before NYS Legislative Fiscal CommitteemaryrozakNo ratings yet

- San Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Document102 pagesSan Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Scribd Government DocsNo ratings yet

- 2017 07 SpecialSessionInvestment CEF PeacockQuinteroGinn TribTalkDocument1 page2017 07 SpecialSessionInvestment CEF PeacockQuinteroGinn TribTalkTPPFNo ratings yet

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorNo ratings yet

- Financing Educational SystemsDocument2 pagesFinancing Educational SystemsRochelle EstebanNo ratings yet

- How School Funding WorksDocument20 pagesHow School Funding WorksCarolyn UptonNo ratings yet

- Fact Sheet Huntsville Property Tax RenewalDocument2 pagesFact Sheet Huntsville Property Tax RenewalChamber of Commerce of Huntsville/Madison CountyNo ratings yet

- CWG - The Texas ModelDocument2 pagesCWG - The Texas ModelTPPFNo ratings yet

- Ohn - Aylor: Dear Neighbor: Governor Proposes $1.2 Billion State BudgetDocument4 pagesOhn - Aylor: Dear Neighbor: Governor Proposes $1.2 Billion State BudgetPAHouseGOPNo ratings yet

- State of The State 2013Document16 pagesState of The State 2013dhmontgomeryNo ratings yet

- Jobs, Jobs, Jobs: Follow What's Happening OnDocument4 pagesJobs, Jobs, Jobs: Follow What's Happening OnPAHouseGOPNo ratings yet

- Ten ReasonsDocument3 pagesTen ReasonsOctorara_ReportNo ratings yet

- Margin TaxDocument20 pagesMargin TaxLatinos Ready To VoteNo ratings yet

- An Open Letter To Antietam School District ResidentsDocument5 pagesAn Open Letter To Antietam School District ResidentsReading_EagleNo ratings yet

- The Message: A Time for Repair and Reward in Texas CommunitiesFrom EverandThe Message: A Time for Repair and Reward in Texas CommunitiesNo ratings yet

- Texas Impact Legislative AgendaDocument5 pagesTexas Impact Legislative Agendabee5834No ratings yet

- BP65 2010 Burdens ReportDocument12 pagesBP65 2010 Burdens ReportjspectorNo ratings yet

- Budget Background Taxes 2011 - FINAL PDFDocument2 pagesBudget Background Taxes 2011 - FINAL PDFAndi ParkinsonNo ratings yet

- White House Middle Class Reports MassachusettsDocument6 pagesWhite House Middle Class Reports MassachusettsMassLiveNo ratings yet

- 2015 Progress Texas Constitutional Amendment Ballot GuideDocument4 pages2015 Progress Texas Constitutional Amendment Ballot GuideProgressTX100% (1)

- New Budget Cuts Threaten SCH FNDG Settlemts-Stateline TOP STORYDocument4 pagesNew Budget Cuts Threaten SCH FNDG Settlemts-Stateline TOP STORYEducation JusticeNo ratings yet

- Delivering Efficient State and Local Government Services and Providing For Their Long-Term Fiscal SustainabilityDocument6 pagesDelivering Efficient State and Local Government Services and Providing For Their Long-Term Fiscal SustainabilitykreiaNo ratings yet

- A Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights ReservedDocument5 pagesA Reprint From Tierra Grande Magazine © 2014. Real Estate Center. All Rights Reservedapi-251198534No ratings yet

- Texas Higher Education Coordinating Board Releases 2011 Texas Public Higher Education AlmanacDocument12 pagesTexas Higher Education Coordinating Board Releases 2011 Texas Public Higher Education AlmanacczcardonaNo ratings yet

- Christina Mazuca March 16, 2011 The State of Texas' Education BudgetDocument4 pagesChristina Mazuca March 16, 2011 The State of Texas' Education Budgetapi-47035565No ratings yet

- Tax Cap Brochure 10-14-11Document6 pagesTax Cap Brochure 10-14-11hhhtaNo ratings yet

- Pennsylvania State Spending: by Nathan Benefield Commonwealth FoundationDocument25 pagesPennsylvania State Spending: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- 10 Lege Guide SS17 Paycheck ProtectionDocument1 page10 Lege Guide SS17 Paycheck ProtectionTPPFNo ratings yet

- Michigan's Middle Class PlanDocument11 pagesMichigan's Middle Class PlanhousedemsMINo ratings yet

- Reichley Report Summer 2011Document4 pagesReichley Report Summer 2011PAHouseGOPNo ratings yet

- Newsletter 337Document11 pagesNewsletter 337Henry CitizenNo ratings yet

- Laubenberg Letter 4-17-2011Document1 pageLaubenberg Letter 4-17-2011TEA_Party_RockwallNo ratings yet

- TPCAC 83rd Legislative PrioritiesDocument18 pagesTPCAC 83rd Legislative PrioritiesKonni BurtonNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- Equitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una JakupovicDocument5 pagesEquitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una Jakupovicapi-523746438No ratings yet

- 85th Legislature Special Session AgendaDocument1 page85th Legislature Special Session AgendaTPPFNo ratings yet

- The Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)Document35 pagesThe Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)National Education Policy CenterNo ratings yet

- Immigration: Securing The Border and Texas' Economic FutureDocument4 pagesImmigration: Securing The Border and Texas' Economic FutureLVPPressNo ratings yet

- Massachusetts&New York MauroDocument3 pagesMassachusetts&New York Maurofmauro7531No ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- Federalist Papers Renewed: Hamilton's Blueprint for Restoring the American DreamFrom EverandFederalist Papers Renewed: Hamilton's Blueprint for Restoring the American DreamNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Minimum Competency: A Novel About Education, Testing, Life, and Death in Upstate New YorkFrom EverandMinimum Competency: A Novel About Education, Testing, Life, and Death in Upstate New YorkNo ratings yet

- Texas A&M University Sexual Assault Survey 2015Document261 pagesTexas A&M University Sexual Assault Survey 2015Naomi MartinNo ratings yet

- Emails On Director Search CommitteeDocument2 pagesEmails On Director Search CommitteeNaomi MartinNo ratings yet

- JWP Letter To Jenkins Re Juvenile BoardDocument1 pageJWP Letter To Jenkins Re Juvenile BoardNaomi MartinNo ratings yet

- Secretary of State Letter To AG Regarding Dallas County Commissioner's RaceDocument1 pageSecretary of State Letter To AG Regarding Dallas County Commissioner's RaceNaomi MartinNo ratings yet

- John Wiley Price vs. Terry Smith LettersDocument3 pagesJohn Wiley Price vs. Terry Smith LettersNaomi MartinNo ratings yet

- PCT 1 Constable Compliance Report FY14-16Document24 pagesPCT 1 Constable Compliance Report FY14-16Naomi MartinNo ratings yet

- Kristopher Ledell Love ComplaintDocument8 pagesKristopher Ledell Love ComplaintNaomi MartinNo ratings yet

- Michael Phillips PetitionDocument5 pagesMichael Phillips PetitionNaomi MartinNo ratings yet

- Petition To Remove Dallas County Elections Administrator Toni Pippins-Poole From OfficeDocument5 pagesPetition To Remove Dallas County Elections Administrator Toni Pippins-Poole From OfficeNaomi MartinNo ratings yet

- Dallas County Mental Health PlanDocument11 pagesDallas County Mental Health PlanNaomi MartinNo ratings yet

- Eric Johnson Jail Letter 2/2/16Document8 pagesEric Johnson Jail Letter 2/2/16Naomi MartinNo ratings yet

- Parkland Current Disclosure PolicyDocument7 pagesParkland Current Disclosure PolicyNaomi MartinNo ratings yet

- Records BLDG - Historical Evaluation Presentation - 042616Document27 pagesRecords BLDG - Historical Evaluation Presentation - 042616Naomi MartinNo ratings yet

- Christopher Duntsch Request For Bond ReductionDocument53 pagesChristopher Duntsch Request For Bond ReductionNaomi MartinNo ratings yet

- Xadrian Davis Arrest WarrantDocument4 pagesXadrian Davis Arrest WarrantNaomi MartinNo ratings yet

- Butt Injections Murder WarrantDocument4 pagesButt Injections Murder WarrantNaomi MartinNo ratings yet

- Arrest Warrant Affidavit For Vikram VirkDocument3 pagesArrest Warrant Affidavit For Vikram VirkNaomi MartinNo ratings yet

- FBI Director Comey On Garland Terror Suspect BulletinDocument2 pagesFBI Director Comey On Garland Terror Suspect BulletinNaomi MartinNo ratings yet

- Arrest AffidavitDocument8 pagesArrest AffidavitDallas PoliceNo ratings yet

- Roxanna Mayo LawsuitDocument20 pagesRoxanna Mayo LawsuitNaomi MartinNo ratings yet

- National Moot Court ProblemDocument3 pagesNational Moot Court ProblemAnurag FarkyaNo ratings yet

- Corruption in Public LifeDocument3 pagesCorruption in Public LifedaspavelNo ratings yet

- Article 13Document3 pagesArticle 13Jessica JoyceNo ratings yet

- Criminology - Sociological Theories - BritannicaDocument7 pagesCriminology - Sociological Theories - BritannicaShafah MariyamNo ratings yet

- Article 2 Declaration of Principles and State PoliciesDocument3 pagesArticle 2 Declaration of Principles and State PoliciesKris Borlongan100% (1)

- Lafd PSD ManualDocument218 pagesLafd PSD Manualя долбаёбNo ratings yet

- 14-Bangayan v. Bangayan G.R. No. 201061 July 3, 2013Document4 pages14-Bangayan v. Bangayan G.R. No. 201061 July 3, 2013ShaneBeriñaImperialNo ratings yet

- PLEB PrimerDocument2 pagesPLEB PrimerAnonymous b4ycWuoIcNo ratings yet

- Eng 318 Lecture Slides 2024Document31 pagesEng 318 Lecture Slides 2024tirnomdzNo ratings yet

- Katarungang Pambarangay Sections 399 To 422 of The Local Government CodeDocument8 pagesKatarungang Pambarangay Sections 399 To 422 of The Local Government Codemhilet_chi100% (1)

- Liaison Officer Chapter-15Document15 pagesLiaison Officer Chapter-15Amrutha Rao MangamNo ratings yet

- The Sociology of ElitesDocument20 pagesThe Sociology of ElitesKevin Ashneil PrasadNo ratings yet

- The Impact of Indonesia's Information and Electronic Transaction Law (UU ITE)Document9 pagesThe Impact of Indonesia's Information and Electronic Transaction Law (UU ITE)Rifqi SatriaNo ratings yet

- United States Court of Appeals Third CircuitDocument8 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Constitution With Suggestions From ROSDocument14 pagesConstitution With Suggestions From ROSadrianongliangkiatNo ratings yet

- TIGNAYDocument12 pagesTIGNAYAlexa M. YadaoNo ratings yet

- Collado V CaDocument5 pagesCollado V CaJucca Noreen SalesNo ratings yet

- THE ORA: Black Sea ... Black Hole?Document16 pagesTHE ORA: Black Sea ... Black Hole?Ana MerluscaNo ratings yet

- Tax Exemptions On Retirement PlansDocument3 pagesTax Exemptions On Retirement PlansVola AriNo ratings yet

- SRCEDocument3 pagesSRCEJay DuhaylongsodNo ratings yet

- Visa Information System (Vis) : What Is The Vis?Document2 pagesVisa Information System (Vis) : What Is The Vis?a_one08No ratings yet

- Information On Homicide With RobberyDocument2 pagesInformation On Homicide With RobberyGrace AvellanoNo ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner of Internal Revenue, Petitioner, vs. Aichi Forging Company of Asia, Inc., Respondent. FactsDocument11 pagesG.R. No. 184823 October 6, 2010 Commissioner of Internal Revenue, Petitioner, vs. Aichi Forging Company of Asia, Inc., Respondent. FactsAlyza Montilla BurdeosNo ratings yet

- WAR On Terrorism: Impact On Pakistan's Economy Rehana Saeed HashmiDocument15 pagesWAR On Terrorism: Impact On Pakistan's Economy Rehana Saeed HashmiEjaz KazmiNo ratings yet

- Thomas Shea v. James Gabriel, United States Attorney, 520 F.2d 879, 1st Cir. (1975)Document6 pagesThomas Shea v. James Gabriel, United States Attorney, 520 F.2d 879, 1st Cir. (1975)Scribd Government DocsNo ratings yet

- Renewal Regular Passport Application Form (Minor)Document2 pagesRenewal Regular Passport Application Form (Minor)Alfred LopezNo ratings yet

- Do We Live in A MeritocracyDocument2 pagesDo We Live in A MeritocracymimirosellNo ratings yet

- In Re JuradoDocument17 pagesIn Re JuradoRaeNo ratings yet

- Konstitusi Amerika Serikat Dan TerjemahanDocument31 pagesKonstitusi Amerika Serikat Dan TerjemahanAnggieAnggrainiNo ratings yet

- Rise of Napoleon and Domestic Reform PDFDocument12 pagesRise of Napoleon and Domestic Reform PDFAdilNo ratings yet