Professional Documents

Culture Documents

London Market Closing Update 17 July 2017

London Market Closing Update 17 July 2017

Uploaded by

ChrisTheodorouOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

London Market Closing Update 17 July 2017

London Market Closing Update 17 July 2017

Uploaded by

ChrisTheodorouCopyright:

Available Formats

LONDON MARKET Closing Update 17 July 2017

Market Commentary

CEO Carolyn McCalls departure from Easyjet came as a surprise, she is moving over to become CEO

of ITV. Easyjet shares jumped on speculation a new CEO will address the contentious policy of

Easyjets rapid fleet growth, which has hit seat pricing. Other executive news, Dixons Carphone

chairman Ian Livingstone acquired 50k worth of Dixons shares helping them recover from year

lows.

Go-Ahead Group rallied on news of an extension to its lucrative London Midland franchise.

UK blue chips equities rose 0.45% helped by gains in oil & gas, mining and banking stocks.

Ravi Lockyer MSc Llb ACSI Senior Analyst

Today's Closing Update

U.S. shares were little changed at the start of the week as investors largely brushed off a steep

decline in Chinese equities.

European and U.K. shares showed mixed trade as investors digested positive Chinese data

and kept an eye on earnings, all while the second round of Brexit talks started up.

Compass Group said it has paid the 1bn special dividend to shareholders that was announced

in May. The catering and support services firm proposed the special dividend, equal to 61p per

share, on 10th May, after it said it enjoyed a solid first half that saw free cashflow generation rise

27% year-on-year. Compass said the special dividend has been paid. When the special dividend

was declared, Compass reported that for the six months to 31st March it made a pretax profit of

831m, up from 666m in the same period the prior year. Revenue rose to 11.47bn from

9.54bn year-on-year. The company noted revenue benefited by over 15% from the translational

effects of weaker sterling.

Centrica has agreed with Bayerngas Norge to merge the companies' North Sea assets, creating

the region's largest non-major oil and gas producer and allowing Centrica access to younger

fields and to lower its decommissioning liabilities. The joint venture, to be led by Centrica's head

of exploration and production, will produce 50-55m barrels this year and have access to 625m

barrels of proved and probable oil and gas reserves. Centrica will own 69% of the new entity and

raise its interests in younger fields, including the Cygnus gas field which started producing in

December, as well as dilute its decommissioning costs and reduce its capital expenditure needs.

The UK Financial Conduct Authority set out the scope of its investigation into investment

platforms, that will explore if there is effective competition in the sector. The regulator said

investment platforms are increasingly used by consumers and financial advisers to access retail

investment products and to manage investments, and said the total amount of assets under

administration for both adviser and direct platforms jumped to 500bn in 2016 from just 108bn

in 2008. "Many platforms offer investors and their advisers a range of information and tools to

help them make investment decisions and some also offer their own investment products. As

part of the study, the FCA will explore whether platforms help investors make good investment

decisions and whether their investment solutions offer investors value for money," said the FCA.

One of America's best-known fashion retailers is vying with investors from the UK and China to

seal an 800m takeover of Jimmy Choo, the upmarket shoe designer. It has been reported that

Michael Kors, the New York-listed chain, has indicated that it will table an indicative bid for

Jimmy Choo, which was founded by the businesswoman and socialite Tamara Mellon, ahead

Formula One motor racing.

Touchstone Exploration said it saw an increase in average daily oil production for the second

quarter of the year, but a reduction in average prices. Average daily oil production for the three

months ended 30th June was 1,335 barrels per day, up by 4% from 1,280 barrels produced in

the last quarter, however realized pricing was $45.51 per barrel, down by 6% from $48.20 per

barrels in the first quarter of 2017. The reason for the decrease in pricing was due to an 8%

decrease in the Brent reference price over the period, and a reduction in the realized Brent

reference differential from 10% to 8%.

Go-Ahead Group said its joint venture Govia has been awarded an eight-week extension to the

London Midland rail franchise that it currently operates, and said a further extension could be

awarded. The transport firm owns 65% of Govia alongside partner Keolis, which owns the other

35%. Govia has operated the London Midland franchise since 2007. The Department for

Transport has awarded an eight-week extension to the current franchise until 10 December,

under the existing franchise terms. A further eight-week extension may be awarded to Govia if

the Department for Transport exercises an option to do so by 18th August.

Blue Apron shares dropped sharply, accelerating the slide since their debut amid fresh signs of

competition from Amazon. The internet giant has registered a trademark in the U.S. for a service

described as: "We do the prep. You be the chef," according to a filing. Blue Apron shares hit an

all-time intraday low of $6.51 a share, according to FactSet, and the stock was last down more

than 9%. Blue Apron, a meal-kit delivery service backed by major investors including Fidelity,

Bessemer Venture Partners and First Round Capital, has seen shares fall after hitting the public

market in late June. The stock has shed nearly 30% month to date.

Oil prices advanced in volatile trade, amid ongoing concerns that stockpiles will prove resilient to

production cuts led by the global oil cartel.

Gold climbed and was likely to see further gains after the dollar slumped to multi-month lows on

the back of data that pointed to weak U.S. inflation and dampened prospects for rate hikes.

Market Close - 4:35pm

Market Index Change % Change

UK 100 7404.1 +25.7 +0.4%

UK 250 19,520.6 +112.2 +0.6%

GER 30 12,587.2 -44.6 -0.4%

FRA 40 5,230.2 -5.1 -0.1%

U.S. 30 21,637.02 -0.72 -0.0%

U.S. 500 2,460.0 +0.8 +0.0%

OIL (BRENT) 48.95 +0.04 +0.1%

GOLD 1,234.33 +5.63 +0.5%

UK Major Risers & Fallers - 4:35pm

Company Price Change % Change

Carillion 67.3 +10.75 +19.1%

Ashtead 1635 +54 +3.4%

Micro Focus 2158 +69 +3.3%

Imperial Brands 3442.5 -57 -1.6%

Experian 1564 -24 -1.5%

Barr AG 580.25 -24 -4.0%

Reported Economic Data

Time/Date Previous Forecast Outcome

10:00am: European Final CPI y/y 1.3% 1.3% 1.3%

10:00am: European Final Core CPI y/y 1.1% 1.1% 1.1%

1:30pm: U.S. Empire State Manufacturing 19.8 15.2 9.8

Index

Interbank Spot FX Rates - 4:35pm

Pairing Rate % Change

GBP/USD 1.3055 -0.33%

EUR/USD 1.1467 -0.03%

GBP/EUR 1.1386 -0.33%

USD/JPY 112.7500 +0.20%

USD/CHF 0.9632 -0.03%

GBP/JPY 147.2390 -0.10%

You might also like

- Cred ReportDocument103 pagesCred ReportJamie CrawleyNo ratings yet

- The Signs Were There: The clues for investors that a company is heading for a fallFrom EverandThe Signs Were There: The clues for investors that a company is heading for a fallRating: 4.5 out of 5 stars4.5/5 (2)

- 100 QuestionsDocument31 pages100 QuestionsmarubadiNo ratings yet

- London Market Closing Update 14 July 2017Document3 pagesLondon Market Closing Update 14 July 2017ChrisTheodorouNo ratings yet

- Closing Update 24th October 2016Document2 pagesClosing Update 24th October 2016ChrisTheodorouNo ratings yet

- London Market Closing Update 26 July 2017Document3 pagesLondon Market Closing Update 26 July 2017ChrisTheodorouNo ratings yet

- London Market Closing Update 13 July 2017Document3 pagesLondon Market Closing Update 13 July 2017ChrisTheodorouNo ratings yet

- London Market Closing Update 18 July 2017Document3 pagesLondon Market Closing Update 18 July 2017ChrisTheodorouNo ratings yet

- London Market Pre-Open 24 July 2017Document5 pagesLondon Market Pre-Open 24 July 2017ChrisTheodorouNo ratings yet

- Daily Report 20150106Document3 pagesDaily Report 20150106Joseph DavidsonNo ratings yet

- RBS Round Up: 01 September 2010Document11 pagesRBS Round Up: 01 September 2010egolistocksNo ratings yet

- Aily Arket Pdate: BCD C M I - VMI 'Ejummo W HQN RU UMM NNNN ) K K KDocument3 pagesAily Arket Pdate: BCD C M I - VMI 'Ejummo W HQN RU UMM NNNN ) K K Kapi-25889552No ratings yet

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25889552No ratings yet

- Efg Financial Products LTD Brandschenkestrasse 90, Ch-8002Document3 pagesEfg Financial Products LTD Brandschenkestrasse 90, Ch-8002api-25889552No ratings yet

- Caught Between Armageddon and Irrational Exuberance: Stop Press ....Document4 pagesCaught Between Armageddon and Irrational Exuberance: Stop Press ....FirstEquityLtdNo ratings yet

- Can You Trust ForcastsDocument14 pagesCan You Trust ForcastsWuU2345No ratings yet

- Home Mail News Finance Sports Entertainment Life Yahoo Plus MORE... Yahoo FinanceDocument49 pagesHome Mail News Finance Sports Entertainment Life Yahoo Plus MORE... Yahoo FinanceCasual ThingNo ratings yet

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25889552No ratings yet

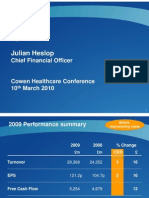

- Cowen Healthcare 10 March 2010Document18 pagesCowen Healthcare 10 March 2010jamiepwoodNo ratings yet

- Daily Market Report: Corporate & Investment Banking Currency Risk ManagementDocument1 pageDaily Market Report: Corporate & Investment Banking Currency Risk ManagementInternational Business TimesNo ratings yet

- Weekly Market Research Oct 27-Oct 31Document2 pagesWeekly Market Research Oct 27-Oct 31FEPFinanceClubNo ratings yet

- RBS - Round Up - 180510Document10 pagesRBS - Round Up - 180510egolistocksNo ratings yet

- Stock Market Trading Analysis by Mansukh Investment and Trading Solutions 3/4/2010Document5 pagesStock Market Trading Analysis by Mansukh Investment and Trading Solutions 3/4/2010MansukhNo ratings yet

- Weekly Market Update June 2 2023Document11 pagesWeekly Market Update June 2 2023dwikazanzaNo ratings yet

- Mergers and Acquisitions: Good But For Who?Document42 pagesMergers and Acquisitions: Good But For Who?aparnah_83No ratings yet

- 23 June ReportDocument7 pages23 June ReportPriya RathoreNo ratings yet

- Morning Meeting 20090121Document8 pagesMorning Meeting 20090121fred607No ratings yet

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25889552No ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 28/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 28/06/2010MansukhNo ratings yet

- 3Document8 pages3YogeshPrakashNo ratings yet

- The Round Up: 7 September 2009Document8 pagesThe Round Up: 7 September 2009egolistocksNo ratings yet

- Ejemplo Caso Financiera InglesDocument20 pagesEjemplo Caso Financiera Ingleselena wuNo ratings yet

- On Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Document5 pagesOn Portugal: .DJI 12,170.56 (+84.54) .SPX 1,309.66 (+12.12) .IXIC 2,736.42 (+38.12)Andre SetiawanNo ratings yet

- Yell PresentationDocument27 pagesYell PresentationSounak DuttaNo ratings yet

- RBS - Round Up - 081009Document8 pagesRBS - Round Up - 081009egolistocksNo ratings yet

- Phps AYL3 ADocument5 pagesPhps AYL3 Afred607No ratings yet

- RBS - Round Up - 111209Document8 pagesRBS - Round Up - 111209egolistocksNo ratings yet

- Economics UKDocument8 pagesEconomics UKnishantashahiNo ratings yet

- Macro Report October'23 Week1Document14 pagesMacro Report October'23 Week19n7k2c6ggqNo ratings yet

- RBS - Round Up - 010210Document9 pagesRBS - Round Up - 010210egolistocksNo ratings yet

- TheoilsectorDocument24 pagesTheoilsectorjamilkhannNo ratings yet

- Morning Notes 09 July 2010: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 09 July 2010: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Daily 30.06.2014Document1 pageDaily 30.06.2014FEPFinanceClubNo ratings yet

- U.S. Stocks Fall As Economic Reports, Europe Overshadow EarningsDocument5 pagesU.S. Stocks Fall As Economic Reports, Europe Overshadow EarningsmichaelbaxterxedeNo ratings yet

- RBS - Round Up - 040610Document9 pagesRBS - Round Up - 040610egolistocksNo ratings yet

- Aily Arket Pdate: QuitiesDocument3 pagesAily Arket Pdate: Quitiesapi-25890856No ratings yet

- X X Edition: International: Business Business HomeDocument7 pagesX X Edition: International: Business Business HomeWORKNo ratings yet

- RBS - Round Up 300610Document9 pagesRBS - Round Up 300610egolistocksNo ratings yet

- Daily Trade Journal - 24.12.2013Document6 pagesDaily Trade Journal - 24.12.2013Randora LkNo ratings yet

- Index Reversed But On A Slow Note : Wednesday, July 10, 2013Document7 pagesIndex Reversed But On A Slow Note : Wednesday, July 10, 2013Randora LkNo ratings yet

- MNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFDocument8 pagesMNCL-DailyCom-16 Dec 2020 - 120203 - E7d49 PDFANIL PARIDANo ratings yet

- Hiscox Interim Statement 2005Document12 pagesHiscox Interim Statement 2005saxobobNo ratings yet

- Equity Reports For The Week (25th - 29th April '11)Document6 pagesEquity Reports For The Week (25th - 29th April '11)Dasher_No_1No ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 29/06/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 29/06/2010MansukhNo ratings yet

- IMT Covid19Document8 pagesIMT Covid19Anonymous 1997No ratings yet

- Daily Report 20141105Document3 pagesDaily Report 20141105Joseph DavidsonNo ratings yet

- RBS - Round Up - 021009Document8 pagesRBS - Round Up - 021009egolistocksNo ratings yet

- Daily. 11.06.2013Document1 pageDaily. 11.06.2013Paulo Samuel Rodrigues NunesNo ratings yet

- Daily Report 20141006Document3 pagesDaily Report 20141006Joseph DavidsonNo ratings yet

- Daily 11.06.2013Document1 pageDaily 11.06.2013Paulo Samuel Rodrigues NunesNo ratings yet

- Daily Trade Journal - 29.04.2014Document6 pagesDaily Trade Journal - 29.04.2014Randora LkNo ratings yet

- Daily Trade Journal - 25.07.2013Document6 pagesDaily Trade Journal - 25.07.2013Randora LkNo ratings yet

- What Is The Magic Formula GreenblattDocument14 pagesWhat Is The Magic Formula GreenblattChrisTheodorouNo ratings yet

- Aim-Ing For Growth in 2019: Harriet ClarfeltDocument11 pagesAim-Ing For Growth in 2019: Harriet ClarfeltChrisTheodorouNo ratings yet

- London Market Closing Update 26 July 2017Document3 pagesLondon Market Closing Update 26 July 2017ChrisTheodorouNo ratings yet

- Economic Calendar 24th July 2017: Key Data ReleasesDocument2 pagesEconomic Calendar 24th July 2017: Key Data ReleasesChrisTheodorouNo ratings yet

- Dell™ Dimension™ E520 Service Manual: Notes, Notices, and CautionsDocument79 pagesDell™ Dimension™ E520 Service Manual: Notes, Notices, and CautionsChrisTheodorouNo ratings yet

- Crest Transfer FormDocument2 pagesCrest Transfer FormChrisTheodorouNo ratings yet

- 6 Month Performance SummaryDocument1 page6 Month Performance SummaryChrisTheodorouNo ratings yet

- Guardian CFD BrochureDocument12 pagesGuardian CFD BrochureChrisTheodorouNo ratings yet

- London Market Pre-Open 24 July 2017Document5 pagesLondon Market Pre-Open 24 July 2017ChrisTheodorouNo ratings yet

- Guardian CFD BrochureDocument12 pagesGuardian CFD BrochureChrisTheodorouNo ratings yet

- Economic Calendar 19th July 2017: Key Data ReleasesDocument1 pageEconomic Calendar 19th July 2017: Key Data ReleasesChrisTheodorouNo ratings yet

- Economic Calendar 20th July 2017: Key Data ReleasesDocument1 pageEconomic Calendar 20th July 2017: Key Data ReleasesChrisTheodorouNo ratings yet

- London Market Closing Update 13 July 2017Document3 pagesLondon Market Closing Update 13 July 2017ChrisTheodorouNo ratings yet

- Sharesmagazine 2004-06-17Document68 pagesSharesmagazine 2004-06-17ChrisTheodorouNo ratings yet

- Investment StrategiesDocument20 pagesInvestment StrategiesChrisTheodorouNo ratings yet

- Sharesmagazine 2004-06-24Document74 pagesSharesmagazine 2004-06-24ChrisTheodorouNo ratings yet

- Royal Mail Group (RMG) : Trade 1Document10 pagesRoyal Mail Group (RMG) : Trade 1ChrisTheodorouNo ratings yet

- Balanced Growth (BG)Document12 pagesBalanced Growth (BG)ChrisTheodorouNo ratings yet

- 1 .4 Limitations of The StudyDocument10 pages1 .4 Limitations of The Studychinmay ajgaonkarNo ratings yet

- Skookum Minutes 2018-08-08 DraftDocument1 pageSkookum Minutes 2018-08-08 DraftSteveNo ratings yet

- Act 701 Assignment 2Document3 pagesAct 701 Assignment 2Nahid HawkNo ratings yet

- Executive Summary of The Honolulu Rapid Transit ProjectDocument10 pagesExecutive Summary of The Honolulu Rapid Transit ProjectHonolulu Star-AdvertiserNo ratings yet

- ICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Document4 pagesICSB Mexico MSMEs Outlook Ricardo D. Alvarez v.2.Ricardo ALvarezNo ratings yet

- Chapter 15 Business Combinations - Part 2Document10 pagesChapter 15 Business Combinations - Part 2Erwin Labayog Medina100% (2)

- Beal Companies LNV MGC Key PeopleDocument8 pagesBeal Companies LNV MGC Key PeopleDenise Subramaniam100% (1)

- Hero Moto Corp Financial Analysis 2012Document10 pagesHero Moto Corp Financial Analysis 2012Amar NegiNo ratings yet

- 99333Document26 pages99333Amira TakiNo ratings yet

- Sip Proposal ReportDocument1 pageSip Proposal ReportRitika PaulNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Chapter 9 Net Present Value and Other Investment Criteria: Use The Following Information To Answer Questions 1 Through 5Document12 pagesChapter 9 Net Present Value and Other Investment Criteria: Use The Following Information To Answer Questions 1 Through 5Tuấn HoàngNo ratings yet

- 1 Can Islamic Banking Ever Become IslamicDocument20 pages1 Can Islamic Banking Ever Become IslamicPT DNo ratings yet

- Accounting Journal EntryDocument3 pagesAccounting Journal EntryPrinceSingh198No ratings yet

- Chapter 14: Working Capital ManagementDocument19 pagesChapter 14: Working Capital Management2221624No ratings yet

- WBAF Congress 2018 BookletDocument180 pagesWBAF Congress 2018 BookletObserver123No ratings yet

- CB Insights Fintech Trends 2018Document118 pagesCB Insights Fintech Trends 2018DIana100% (1)

- Presentation File 50f7f380 Ebac 4ef9 A95f 0502ac10168aDocument5 pagesPresentation File 50f7f380 Ebac 4ef9 A95f 0502ac10168aInnoVentureCommunityNo ratings yet

- NEW Ten Years of MA Transactions in Brazil 2013 2023Document56 pagesNEW Ten Years of MA Transactions in Brazil 2013 2023Jeferson GimenezNo ratings yet

- Bank Regulation: Financial Markets and Institutions, 7e, Jeff MaduraDocument45 pagesBank Regulation: Financial Markets and Institutions, 7e, Jeff MaduraWahyu MmuuzzammilNo ratings yet

- Employment LawsDocument23 pagesEmployment Lawsapi-308726577No ratings yet

- Cooper Industry Diversification StrategyDocument16 pagesCooper Industry Diversification StrategyOnkar PatilNo ratings yet

- Analysis of Audited Financial Statements of San Miguel Corporation 2021Document28 pagesAnalysis of Audited Financial Statements of San Miguel Corporation 2021Marquez, Jazzmine K.No ratings yet

- L9 Mmi 09 Bma 17 Debt PolicyDocument27 pagesL9 Mmi 09 Bma 17 Debt PolicychooisinNo ratings yet

- Tax Problem SolutionDocument5 pagesTax Problem SolutionSyed Ashraful Alam RubelNo ratings yet

- It MCQDocument4 pagesIt MCQPretty PraveenNo ratings yet

- Framing The DebateDocument11 pagesFraming The DebateAndré GrandaNo ratings yet