Professional Documents

Culture Documents

The Policy Coordination Instrument: Communications Department

The Policy Coordination Instrument: Communications Department

Uploaded by

The Independent MagazineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Policy Coordination Instrument: Communications Department

The Policy Coordination Instrument: Communications Department

Uploaded by

The Independent MagazineCopyright:

Available Formats

The Policy Coordination Instrument

The Policy Coordination Instrument (PCI) is a non-financing tool open to all members of

the International Monetary Fund (IMF). It enables them to signal commitment to reforms

and catalyze financing from other sources. The establishment of the PCI is part of the

Funds broader effort to strengthen the global financial safety neta network of

insurance and loan instruments that countries can draw on if confronted with a crisis.

Strengthening the global financial safety net

The PCI is available to all IMF members that do not need Fund financial resources at the

time of approval. It is designed for countries seeking to demonstrate commitment to a reform

agenda or to unlock and coordinate financing from other official creditors or private investors.

The PCI aims to help countries better coordinate their access to multiple layers of the global

financial safety net, particularly regional financing arrangements.

Maintaining a high standard for policies

The PCI enables a close policy dialogue between the IMF and a member country, regular

monitoring of economic developments and policies, and the endorsement of those policies by

the IMFs Executive Board. The PCI aims to help countries formulate and implement a

macroeconomic policy agenda to:

i) prevent crises and build buffers against external shocks;

ii) enhance macroeconomic stability; and

iii) address macroeconomic imbalances.

Although the PCI involves no use of Fund resources, policies supported under the instrument

would be required to meet the same standard as those required under a standard IMF loan.

Key features

Eligibility. The PCI is available for all IMF members that do not require Fund financing at the

time of PCI approval and do not have overdue financial obligations to the IMF.

Duration and repeated use. The PCI is generally meant to have a duration of two to three

years, but could be approved for a minimum of six months and up to four years. This ensures

sufficient flexibility to meet the varying needs of countries reform agendas. There is no limit

on the number of successor PCIs.

Program reviews. Reviews occur on a fixed schedule, normally every six months, to provide

regular feedback on program performance. Delays in the completion of reviews under the

PCI are possible for a three-month buffer period to allow the authorities to implement

overdue policies, take corrective actions, or mobilize necessary financing to close the

financing gap. If a review is delayed beyond the three-month buffer period, it can no longer

be completed by the Executive Board, and Fund staff would provide an interim performance

update to the Board for information. Non-completion of a review for a twelve-month period

would result in an automatic termination of the PCI. In addition, the PCI has a review-based

THIS INFORMATION IS CURRENT AS OF JULY 2017

Communications Department Washington, D.C. 20431 Telephone 202-623-7300 Fax 202-623-6278

Factsheet URL: http://www.imf.org/external/np/exr/facts/psi.htm

-2-

approach to monitoring program targets, which eliminates the need to request waivers for

missed targets.

Use with financial instruments. An on-track PCI could facilitate access to Fund resources

should the member experience a balance of payments need.

Charging. The PCI is a form of technical assistance and as such its costs are aligned with

Fund TA policy, which currently requires only advanced economies to pay for the associated

administrative costs.

THIS INFORMATION IS CURRENT AS OF JULY 2017

You might also like

- Larry Allen - Global Financial System 1750-2000 (258s) PDFDocument258 pagesLarry Allen - Global Financial System 1750-2000 (258s) PDFdomeec100% (1)

- Security Guard Assessment and Validation Form - Rev 0Document2 pagesSecurity Guard Assessment and Validation Form - Rev 0kartikeya RanjanNo ratings yet

- Mussa and SavastanoDocument44 pagesMussa and SavastanoaamirNo ratings yet

- Business Feasibility StudyDocument54 pagesBusiness Feasibility StudyNabazNo ratings yet

- Guidance On Micro-Capital GrantsDocument3 pagesGuidance On Micro-Capital GrantsAmi KarNo ratings yet

- Q&a On ImfDocument15 pagesQ&a On ImfFuaad DodooNo ratings yet

- 1SUREA2023003Document129 pages1SUREA2023003ngonimaposssNo ratings yet

- Hact Challenges and ResponsesDocument6 pagesHact Challenges and ResponsesChandan DeoNo ratings yet

- Imf Policy PaperDocument10 pagesImf Policy PaperIsabela SilvaNo ratings yet

- Ppea 2019012Document172 pagesPpea 2019012Nguyễn Chí DũngNo ratings yet

- Fiduciary Arrangements For Grant Recipients - Assessment of Principal RecipientsDocument10 pagesFiduciary Arrangements For Grant Recipients - Assessment of Principal RecipientsKataisee RichardsonNo ratings yet

- Addressing Financial Risks From Climate Change 1689415144Document40 pagesAddressing Financial Risks From Climate Change 1689415144yvfrdn5mv9No ratings yet

- Reform of The Policy On Public Debt Limits in Fund-Supported ProgramsDocument45 pagesReform of The Policy On Public Debt Limits in Fund-Supported ProgramsLiliya RepaNo ratings yet

- T Proc Notices Notices 090 K Notice Doc 86045 933083426Document6 pagesT Proc Notices Notices 090 K Notice Doc 86045 933083426Yemi FajingbesiNo ratings yet

- International Monetary Fund: Sarath.K.S & Aneesh PDocument38 pagesInternational Monetary Fund: Sarath.K.S & Aneesh PSarath Sadasivan K SNo ratings yet

- IMF Lending: When Can A Country Borrow From The IMF?Document5 pagesIMF Lending: When Can A Country Borrow From The IMF?Ram KumarNo ratings yet

- 1FJIEA2023001Document69 pages1FJIEA2023001dbigfatNo ratings yet

- 1KENEA2023001Document190 pages1KENEA2023001Alexander OkelloNo ratings yet

- Perfo - Medium/High Rise Condominiumrmance PerformanceBasedFunding Brochure enDocument6 pagesPerfo - Medium/High Rise Condominiumrmance PerformanceBasedFunding Brochure enRebecca SmithNo ratings yet

- Me Strategy 031020Document27 pagesMe Strategy 031020Saif Ullah ZehriNo ratings yet

- 1PRYEA2024001Document115 pages1PRYEA2024001Donya RabieiNo ratings yet

- COVID-19 Pandemic: Financial Stability Impact and Policy ResponsesDocument20 pagesCOVID-19 Pandemic: Financial Stability Impact and Policy ResponsesThabiso MtimkuluNo ratings yet

- Review of CD PolicyDocument43 pagesReview of CD Policymeimeiwang204No ratings yet

- Skyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Document8 pagesSkyline Business School Assignment of Role of International Financial Institutions Faculty Mrs Rajni Gupta Subject Code BB0030Rajat SuriNo ratings yet

- Correction ProDocument42 pagesCorrection ProJyothi RameshNo ratings yet

- Strategic Objectives: Group 3: Shivani Singh Vatsal Upadhyay Shreya Maheshwari Pujabhat Shaji Namrata HarshDocument18 pagesStrategic Objectives: Group 3: Shivani Singh Vatsal Upadhyay Shreya Maheshwari Pujabhat Shaji Namrata Harshpuja bhatNo ratings yet

- FSSP: Financial Sector Support ProjectDocument6 pagesFSSP: Financial Sector Support ProjectRaihanul KabirNo ratings yet

- Treasury Management Practices 2022/23: Appendix 2Document45 pagesTreasury Management Practices 2022/23: Appendix 2markngare investmentdataNo ratings yet

- Imf and Covid-19Document10 pagesImf and Covid-19Andrea LattanzioNo ratings yet

- CONCEPTUAL FRAMEWORK PROGRAMME - VIII - (B)Document8 pagesCONCEPTUAL FRAMEWORK PROGRAMME - VIII - (B)najiath mzeeNo ratings yet

- Inrernationa Monetary FundDocument25 pagesInrernationa Monetary FundAjit Singh SainiNo ratings yet

- ADP Monitoring DashboardDocument21 pagesADP Monitoring DashboardRana SarkarNo ratings yet

- Brics Joint Finance Ministers and Central Bank Governors StatementDocument5 pagesBrics Joint Finance Ministers and Central Bank Governors StatementAmr M. AminNo ratings yet

- 1 CH Nea 2024001Document137 pages1 CH Nea 2024001acesaingNo ratings yet

- Condition Ali Ties by International Monetary FundDocument4 pagesCondition Ali Ties by International Monetary FundTooba MubarakNo ratings yet

- International Monetary FundDocument5 pagesInternational Monetary FundAastha sharmaNo ratings yet

- мвфDocument167 pagesмвфasdfasdfasdfsdaNo ratings yet

- 1 HN Dea 2023001Document142 pages1 HN Dea 2023001fernando boeschNo ratings yet

- Promoting Global Financial Stability: 2021 FSB Annual ReportDocument37 pagesPromoting Global Financial Stability: 2021 FSB Annual ReportTom BaetensNo ratings yet

- Guidelines For United Nations Peace and Development Trust Fund-2nd-EditionDocument53 pagesGuidelines For United Nations Peace and Development Trust Fund-2nd-Editionalok bhowmickNo ratings yet

- World Bank Myanmar ISN Summary 08102012Document2 pagesWorld Bank Myanmar ISN Summary 08102012vansorat6715No ratings yet

- Chapter III International Public Sector Accounting Stanadards IPSASDocument26 pagesChapter III International Public Sector Accounting Stanadards IPSASnatnaelsleshi3No ratings yet

- Recent Public Financial Management Publications and Other ResourcesDocument16 pagesRecent Public Financial Management Publications and Other ResourcesInternational Consortium on Governmental Financial ManagementNo ratings yet

- Revised SFMP - Final VersionDocument33 pagesRevised SFMP - Final VersionGile ŠampionNo ratings yet

- Foster Fozzard 2000Document86 pagesFoster Fozzard 2000María MaNo ratings yet

- Bali Fintech AgendaDocument43 pagesBali Fintech AgendaJeyjo d'BestNo ratings yet

- Revised SFMP - Final VersionDocument33 pagesRevised SFMP - Final VersionGile ŠampionNo ratings yet

- C2 Objective of Financial ReportingDocument5 pagesC2 Objective of Financial ReportingAllaine ElfaNo ratings yet

- Agricultural FinanceDocument43 pagesAgricultural FinancegildesenganioNo ratings yet

- Sri Lanka: IMF Country Report No. 19/135Document124 pagesSri Lanka: IMF Country Report No. 19/135Aman GuptaNo ratings yet

- 01-G20 Joint Action Plan On SME FinancingDocument14 pages01-G20 Joint Action Plan On SME FinancingOumema AL AZHARNo ratings yet

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARRONo ratings yet

- GEF-8 First CFP - FINALDocument11 pagesGEF-8 First CFP - FINALSitwell Chichitike BandaNo ratings yet

- MDTFs PDFDocument3 pagesMDTFs PDFbercheheleneNo ratings yet

- Capital Budgeting: Chapter SevenDocument11 pagesCapital Budgeting: Chapter SevenWendosen H FitabasaNo ratings yet

- 14th-Strenthening Financial MGTDocument27 pages14th-Strenthening Financial MGTgopichand456No ratings yet

- Issues Briefing Number 3: Decision Point of New Funding Model (NFM) For 28th Global Fund Board MeetingDocument6 pagesIssues Briefing Number 3: Decision Point of New Funding Model (NFM) For 28th Global Fund Board MeetingKataisee RichardsonNo ratings yet

- Woods PaperDocument9 pagesWoods PaperGokul ChandraNo ratings yet

- Joint CSO Letter On Private Finance Related Issues: 23 March 2020Document5 pagesJoint CSO Letter On Private Finance Related Issues: 23 March 2020Camilo MolinaNo ratings yet

- Salution of Economics - Short Not Dec-15Document10 pagesSalution of Economics - Short Not Dec-15Nazneen SabinaNo ratings yet

- Public Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveNo ratings yet

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- Statement by The Minister of Internal Affairs On The Matter of Alleged Kidnaps On 4th February 2021Document5 pagesStatement by The Minister of Internal Affairs On The Matter of Alleged Kidnaps On 4th February 2021The Independent MagazineNo ratings yet

- Janet Museveni School Reopening StatementDocument21 pagesJanet Museveni School Reopening StatementThe Independent MagazineNo ratings yet

- NRM Campaign Facilitation For Flag Bearers 2021Document6 pagesNRM Campaign Facilitation For Flag Bearers 2021The Independent MagazineNo ratings yet

- Uganda Elections Petition NUP 2021Document20 pagesUganda Elections Petition NUP 2021The Independent Magazine100% (1)

- Eu Statement On Uganda 2021 Ta-9-2021-0057 - enDocument7 pagesEu Statement On Uganda 2021 Ta-9-2021-0057 - enThe Independent MagazineNo ratings yet

- KeepItOn Open Letter Uganda ElectionDocument7 pagesKeepItOn Open Letter Uganda ElectionThe Independent MagazineNo ratings yet

- Uganda Voter Education Handbook 2020Document72 pagesUganda Voter Education Handbook 2020The Independent MagazineNo ratings yet

- Report On The Supplementary Expenditure Schedule 3 and Addendum 1 2 To Schedule 3 For FY 2020'21Document19 pagesReport On The Supplementary Expenditure Schedule 3 and Addendum 1 2 To Schedule 3 For FY 2020'21The Independent MagazineNo ratings yet

- Circular To NRM Chairpersons - Campaign Facilitation For NRM Flag BearersDocument7 pagesCircular To NRM Chairpersons - Campaign Facilitation For NRM Flag BearersThe Independent MagazineNo ratings yet

- NEW UGANDA School-CalendarDocument6 pagesNEW UGANDA School-CalendarThe Independent Magazine0% (1)

- UGANDA Health Sector Annual Budget Monitoring Report FY2019 - 2020Document150 pagesUGANDA Health Sector Annual Budget Monitoring Report FY2019 - 2020The Independent MagazineNo ratings yet

- UGANDA Voter Count by District 2021Document4 pagesUGANDA Voter Count by District 2021The Independent MagazineNo ratings yet

- Uganda Presidential Campaign Programme As at 26.12.2020Document9 pagesUganda Presidential Campaign Programme As at 26.12.2020The Independent MagazineNo ratings yet

- Presidential Campaign Guidelines 2020Document7 pagesPresidential Campaign Guidelines 2020The Independent MagazineNo ratings yet

- NEC-1-20-Proposal by Government To Borrow Up To UGX 4,307,3 Billion Through Domestic Borrowing To Finance Budget Deficit For The FY 2020 210001Document19 pagesNEC-1-20-Proposal by Government To Borrow Up To UGX 4,307,3 Billion Through Domestic Borrowing To Finance Budget Deficit For The FY 2020 210001Okema LennyNo ratings yet

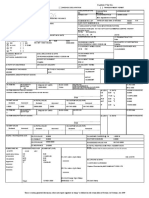

- MV Validation and TransferDocument4 pagesMV Validation and TransferIsaac DanNo ratings yet

- UGANDA Final Guidelines For Implementation of Covid-19 Sops in Education Instions-1Document10 pagesUGANDA Final Guidelines For Implementation of Covid-19 Sops in Education Instions-1The Independent MagazineNo ratings yet

- Basic Information For Covid 19 Patients Undergoing Home Based Isolation and CareDocument14 pagesBasic Information For Covid 19 Patients Undergoing Home Based Isolation and CareThe Independent MagazineNo ratings yet

- Constitutional Court Uganda 2019-11-0 JUSTICE MUSOTADocument12 pagesConstitutional Court Uganda 2019-11-0 JUSTICE MUSOTAThe Independent MagazineNo ratings yet

- NEC-1-20-Proposal by Government To Borrow Up To USD 600 Million From The IMF To Finance The Budget Deficit For The FY 2020 2100010001Document19 pagesNEC-1-20-Proposal by Government To Borrow Up To USD 600 Million From The IMF To Finance The Budget Deficit For The FY 2020 2100010001Okema LennyNo ratings yet

- REVISED Presidential Campaign Programme 21.11.2020Document18 pagesREVISED Presidential Campaign Programme 21.11.2020The Independent Magazine100% (1)

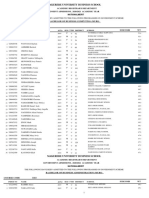

- MUBS Government Sponsorship Admission List 2020 2021Document7 pagesMUBS Government Sponsorship Admission List 2020 2021The Independent Magazine0% (2)

- Bou Statement On Financial Institutions Business Regulated by Bou Under The Fiaa2016Document4 pagesBou Statement On Financial Institutions Business Regulated by Bou Under The Fiaa2016The Independent MagazineNo ratings yet

- Makerere University Private Sponsorship Admission List 2020 2021Document192 pagesMakerere University Private Sponsorship Admission List 2020 2021The Campus Times100% (3)

- Uganda's National 4IR StrategyDocument15 pagesUganda's National 4IR StrategyThe Independent Magazine100% (1)

- Museveni Response SEPTEMBER 3 2020Document24 pagesMuseveni Response SEPTEMBER 3 2020The Independent MagazineNo ratings yet

- UGANDA Guidelines For Reopening Schs-2020Document6 pagesUGANDA Guidelines For Reopening Schs-2020The Independent MagazineNo ratings yet

- Makerere University MATURE AGE Private Sponsorship Admission Lists 2020-2021Document7 pagesMakerere University MATURE AGE Private Sponsorship Admission Lists 2020-2021The Campus Times100% (1)

- Mak Internationals Admission Lists For AY 2020 2021Document7 pagesMak Internationals Admission Lists For AY 2020 2021Tumuheire AgnesNo ratings yet

- Mak Government Sponsorship Admission List 2020 2021Document35 pagesMak Government Sponsorship Admission List 2020 2021The Independent Magazine100% (2)

- Romanticismo Generale + FrankensteinDocument3 pagesRomanticismo Generale + FrankensteinVirginia LongoNo ratings yet

- Open TenderDocument4 pagesOpen TenderHarris Anuar HNo ratings yet

- Adjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Document3 pagesAdjei v. Grumah: (1982-83) GLR 985. Court of Appeal, Accra 14 December 1982Naa Odoley OddoyeNo ratings yet

- Internal Control System in BanksDocument56 pagesInternal Control System in BankscelesteNo ratings yet

- United States v. Saccoccio, 1st Cir. (1995)Document170 pagesUnited States v. Saccoccio, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- Samco Individual Trading PDFDocument14 pagesSamco Individual Trading PDFLaxmi Narayan SharmaNo ratings yet

- Topic 1 - Lesson 3 Reading-Google-LecturaDocument3 pagesTopic 1 - Lesson 3 Reading-Google-LecturaDanitzaParejATorresNo ratings yet

- Practicum ZhamDocument6 pagesPracticum ZhamElmar PurciaNo ratings yet

- Spill and Pride March Program FlowDocument1 pageSpill and Pride March Program FlowCharys KasanNo ratings yet

- BDO V EquitableDocument13 pagesBDO V EquitableMp CasNo ratings yet

- 1 4a-BDocument4 pages1 4a-Bapi-237266847No ratings yet

- Heat and Mass Transfer PDFDocument267 pagesHeat and Mass Transfer PDFAngel RoyNo ratings yet

- Law Society CONVEYANCING PRACTICE SOLICITORS UNDERTAKINGDocument1 pageLaw Society CONVEYANCING PRACTICE SOLICITORS UNDERTAKINGRian TamNo ratings yet

- Badminton Memorandum For Refresher Course For Technical OfficialsDocument5 pagesBadminton Memorandum For Refresher Course For Technical OfficialsMabellee CabreraNo ratings yet

- IEUsersGuide PDFDocument549 pagesIEUsersGuide PDFEddison GolindanoNo ratings yet

- Kape-Hc-219904-07-06-2022 TMTDDocument1 pageKape-Hc-219904-07-06-2022 TMTD0911khanNo ratings yet

- Role of UlumaDocument19 pagesRole of UlumaMariyam MurtazaNo ratings yet

- Case #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsDocument1 pageCase #5 Republic vs. Quinonez G.R. No. 237412, January 6, 2020 FactsJoan Pauline PimentelNo ratings yet

- Name Vocabulary: Unit 4 - Grammar and VocabularyDocument4 pagesName Vocabulary: Unit 4 - Grammar and VocabularyCarolina Cachaldora RodriguezNo ratings yet

- Windows 7 Privacy Statement enDocument61 pagesWindows 7 Privacy Statement enROCKNo ratings yet

- Notes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The NotesDocument5 pagesNotes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The Notesjake doinogNo ratings yet

- People v. Aquino G.R. No. 203435Document8 pagesPeople v. Aquino G.R. No. 203435salemNo ratings yet

- Member Sabbatical Leave - Employer Verification: Part B Part ADocument1 pageMember Sabbatical Leave - Employer Verification: Part B Part AdanehalNo ratings yet

- Investec Bank (Mauritius) Limited - FactsheetDocument4 pagesInvestec Bank (Mauritius) Limited - FactsheetTariro MudzudzuNo ratings yet

- Parliamentary ProcedureDocument99 pagesParliamentary ProcedureNoel Jr SiosanNo ratings yet

- Quick Reference Guide AbacusDocument5 pagesQuick Reference Guide AbacuscoolnzadNo ratings yet

- Week 1 Slides (Upsa)Document28 pagesWeek 1 Slides (Upsa)Orleans JayNo ratings yet

- Emailing Company Law Additional Question BankDocument223 pagesEmailing Company Law Additional Question Bankpavan lodukNo ratings yet