Professional Documents

Culture Documents

Macay Holdings Inc. in Absolute Figures

Macay Holdings Inc. in Absolute Figures

Uploaded by

Myka BibalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macay Holdings Inc. in Absolute Figures

Macay Holdings Inc. in Absolute Figures

Uploaded by

Myka BibalCopyright:

Available Formats

MACAY HOLDINGS INC.

Cash Flow Analysis

In Absolute Figures

Ratios 2016

Operating Cash Flow Ratio 0.21

Cash Flow from Operations 2,438,316,836

Sales 11,378,313,250

Interpretation

Asset Efficiency Ratio 0.29

Cash Flow from Operations 2,438,316,836

Total Assets 8,391,369,065

Interpretation

Current Liability Coverage Ratio 0.95

Cash Flow from Operations 2,438,316,836

Current Liabilities 2,575,460,666

Interpretation

Current Liability Coverage Ratio 0.90

Cash Flow from Operations 2,438,316,836

Dividends Paid 126,583,212

Current Liabilities 2,575,460,666

Interpretation

Long Term Debt Coverage Ratio 0.95

Cash Flow from Operations 2,438,316,836

Long Term Debt 2,577,512,419

Interpretation

Long Term Debt Coverage Ratio 0.90

Cash Flow from Operations 2,438,316,836

Dividends Paid 126,583,212

Long Term Debt 2,577,512,419

Interpretation

Interest Coverage Ratio 534.83

Cash Flow from Operations 2,438,316,836

Interest Paid 5,908,056

Taxes Paid 715,572,637

Interest Paid 5,908,056

Interpretation

Cash Generating Power Ratio 2.94

Cash Flow from Operations 2,438,316,836

Cash Flow from Operations 2,438,316,836

Cash Investing Inflow -1,031,614,306

Cash Financing Inflow -576,583,212

Interpretation

External Financing Index Ratio -0.24

Cash from Financing -576,583,212

Cash Flow from Operations 2,438,316,836

Interpretation

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Management Accounts For The Year 2022Document6 pagesManagement Accounts For The Year 2022Clyton MusipaNo ratings yet

- Company Info - Print Financials VIDocument2 pagesCompany Info - Print Financials VIMayank BhardwajNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFutkarsh varshneyNo ratings yet

- PVR Inox - Accounts 1Document13 pagesPVR Inox - Accounts 1Prithwish RoyNo ratings yet

- Fund FlowDocument15 pagesFund FlowArunRamachandranNo ratings yet

- WEOPI FS Highlights Dec 2023Document5 pagesWEOPI FS Highlights Dec 2023Amino BenitoNo ratings yet

- Safaricom Cash Flow Analysis RatiosDocument2 pagesSafaricom Cash Flow Analysis RatioswarrenmachiniNo ratings yet

- Project Final 2Document8 pagesProject Final 2Nirob AhmedNo ratings yet

- Mahinda Last Five Years Balance SheetDocument2 pagesMahinda Last Five Years Balance SheetSuman Sarkar100% (1)

- Vodafone Idea Limited: PrintDocument2 pagesVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Consolidated ReportsDocument32 pagesConsolidated ReportsSalman JahangirNo ratings yet

- Money ControlDocument2 pagesMoney ControljigarNo ratings yet

- Salman Traders 2022 3 YearsDocument14 pagesSalman Traders 2022 3 Yearsvayave5454No ratings yet

- Balance Sheet of Tata Communications: - in Rs. Cr.Document24 pagesBalance Sheet of Tata Communications: - in Rs. Cr.ankush birlaNo ratings yet

- Target Final AnalysisDocument5 pagesTarget Final AnalysisSatyam1771No ratings yet

- Spring 2023 - ACC501 - 1Document3 pagesSpring 2023 - ACC501 - 1Ghazanfar AliNo ratings yet

- AHTM 2003 - OpenDoors - PKDocument11 pagesAHTM 2003 - OpenDoors - PKWaleed KhalidNo ratings yet

- Phoenix Insurance Company Annual Report 2022 197 236Document40 pagesPhoenix Insurance Company Annual Report 2022 197 236ahsanuladib018No ratings yet

- Financial Analysis of Astrazeneca (2014-2015)Document12 pagesFinancial Analysis of Astrazeneca (2014-2015)Hyceinth KumNo ratings yet

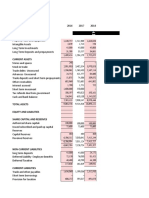

- Financial AnalysisDocument14 pagesFinancial AnalysisNavneet MayankNo ratings yet

- Ilovepdf MergedDocument11 pagesIlovepdf MergedNasri BalecheNo ratings yet

- Adani Green Balance SheetDocument2 pagesAdani Green Balance SheetTaksh DhamiNo ratings yet

- RFL 3rd Quarter 2017 FinalDocument4 pagesRFL 3rd Quarter 2017 Finalanup dasNo ratings yet

- Financial Plan: Company NameDocument5 pagesFinancial Plan: Company NameJasmine Esguerra IgnacioNo ratings yet

- Bano of India Bs 1Document1 pageBano of India Bs 1God PlanNo ratings yet

- Balance Sheet of Life Insurance Corporation of IndiaDocument5 pagesBalance Sheet of Life Insurance Corporation of IndiaPuru JainNo ratings yet

- Ratio Analysis NBPDocument16 pagesRatio Analysis NBPArshad M Yar100% (1)

- Statement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Document6 pagesStatement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Rica CatanguiNo ratings yet

- Financial Performance and ReviewDocument2 pagesFinancial Performance and Reviewsunaina jojoNo ratings yet

- Análise HCB 260323Document4 pagesAnálise HCB 260323IlidiomozNo ratings yet

- Financial Plan - Cakes InsideDocument9 pagesFinancial Plan - Cakes InsideDenimNo ratings yet

- Pert. Ke 3. Analisa Kinerja KeuanganDocument25 pagesPert. Ke 3. Analisa Kinerja KeuanganYULIANTONo ratings yet

- SBI Life Insurance B - L Sheet 2023Document2 pagesSBI Life Insurance B - L Sheet 2023Kiran MengalNo ratings yet

- Balance SheetDocument2 pagesBalance SheetSachin SinghNo ratings yet

- CA2Document22 pagesCA2aryanvaish64No ratings yet

- Reshma Deep Boaring 767Document7 pagesReshma Deep Boaring 767Abishek AdhikariNo ratings yet

- HTMLReports 12Document1 pageHTMLReports 12Umesh SainiNo ratings yet

- Cakes Inside: Biratnagar, NepalDocument23 pagesCakes Inside: Biratnagar, NepalDenimNo ratings yet

- Trent Westside DeepakDocument8 pagesTrent Westside DeepakDeepakNo ratings yet

- Income Statement PSODocument4 pagesIncome Statement PSOMaaz HanifNo ratings yet

- PFM Report FinalDocument20 pagesPFM Report FinalSHARSINIGA A/P ANASELVENNo ratings yet

- Quarterly Report As at 31 March 2022Document11 pagesQuarterly Report As at 31 March 2022Tutii FarutiNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisEashaa SaraogiNo ratings yet

- NBL Annual Report 2017Document282 pagesNBL Annual Report 2017Rumana ShornaNo ratings yet

- School of Business, Management and Accountancy: Aldersgate College, Inc. Solano, Nueva VizcayaDocument8 pagesSchool of Business, Management and Accountancy: Aldersgate College, Inc. Solano, Nueva Vizcayalorren ramiroNo ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Project ReportDocument15 pagesProject ReportMichael AdonikarNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsjohnNo ratings yet

- Balance Sheet of NLC IndiaDocument8 pagesBalance Sheet of NLC IndiaSweety RoyNo ratings yet

- Financial SilverstoneDocument16 pagesFinancial SilverstoneismaelafzalNo ratings yet

- Annual-Accounts-2021 (2) - Pages-DeletedDocument6 pagesAnnual-Accounts-2021 (2) - Pages-DeletedShehzad QureshiNo ratings yet

- Acct 401 Tutorial Set FiveDocument13 pagesAcct 401 Tutorial Set FiveStudy GirlNo ratings yet

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- The Coca-Cola Company (KO) Balance Sheet - Yahoo FinanceDocument3 pagesThe Coca-Cola Company (KO) Balance Sheet - Yahoo FinanceTAN CHUN LIN BOBBY DOWNo ratings yet

- Taliworks Q4FY19Document28 pagesTaliworks Q4FY19Gan ZhiHanNo ratings yet

- Condensed Interim Financial Information For The Three Months Ended March 31Document15 pagesCondensed Interim Financial Information For The Three Months Ended March 31AJWAD AIRFNo ratings yet