Professional Documents

Culture Documents

Weekly 12082017

Weekly 12082017

Uploaded by

Thiyaga RajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly 12082017

Weekly 12082017

Uploaded by

Thiyaga RajanCopyright:

Available Formats

August 12, 2017

For Private Circulation Only 5

Technical Picks | August 12, 2017

Market in early stages of correction, stay light

Sensex (31214) / Nifty (9711)

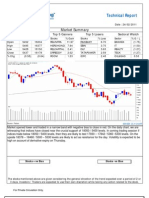

Exhibit 1: Nifty Weekly chart

Trading for the week began with a narrow range candle on

Monday. However, the index started correcting on Tuesday

to sneak below the 10000 mark. As the week progressed,

the selling pressure intensified as the broader markets

witnessed massive destruction. Amidst gap down openings

on Thursday and Friday, the index crept lower and ended

the week tad above the 9700 mark, registering a loss of

3.53 percent over its previous week's close.

Key Moving Averages:

The 89-day EMA and the 89-week EMA for the

Sensex/Nifty are placed at 30987 / 9593 and 28382 /

8734 levels, respectively.

The 20-day EMA and the 20-week EMA for the Source: Company, Angel Research

Sensex/Nifty are placed at 32025 / 9917 and 30876 /

9549 levels, respectively. Exhibit 2: Nifty Daily chart

Future outlook

In the week gone by, our market has posted a biggest

weekly fall in this calendar year. Everyone was so exuberant

a week ago celebrating the five digit milestone for the Nifty;

but, finally the market has surprised and before anyone

could realize it, we are back to 9700. The entire rally in

previous three weeks has now been completely snapped in

merely four trading sessions.

In the recent rally, we have been quite vocal about the

ongoing extreme nature of the market and have been

advocating using this rally to book profits in order to avoid

surprises. The kind of massive sell off we have witnessed in Source: Company, Angel Research

the broader market is certainly a part of this surprise. Yes,

one would say, it has come on the back of geopolitical Now, we can say that our persistent cautious stance on the

concerns between the US and the North Korea. But, market has worked well for us. On the weekly chart, the

historically speaking, the market would always find its own RSI-Smoothened has confirmed a negative crossover along

reason to correct and this is what we witnessed during the with the big bearish candle. This certainly calls for an

week. In our previous article, we mentioned few observations extended correction in the market. For the coming week,

that are, 10060 to act as a strong resistance of Upward 9600 9580 levels are likely to be tested and since, its a

Sloping Trend Line on monthly chart, which coincides with major support zone in the near term, the market may

the 100% Price Extension of the previous up move from respect it for a while. But in case of a bounce back, 9770

7893.80. 9852 are likely to act a strong resistance for the index.

Traders are repeatedly advised to stay light and avoid taking

undue risks as market seems to have entered a corrective

phase. Hence, the possibility of breaking this mentioned

support zone is quite high now.

For Private Circulation Only 1

Technical Picks | August 12, 2017

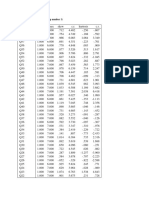

Weekly Pivot Levels For Nifty Constituents

SCRIPS S2 S1 PIVOT R1 R2

SENSEX 30,311 30,762 31,579 32,030 32,847

NIFTY 9,426 9,568 9,828 9,971 10,231

NIFTY BANK 23,105 23,546 24,262 24,703 25,420

ACC 1,692 1,727 1,782 1,816 1,872

ADANIPORTS 352 367 394 410 437

AMBUJACEM 250 257 269 276 288

ASIANPAINT 1,102 1,123 1,142 1,163 1,182

AUROPHARMA 628 666 704 742 779

AXISBANK 462 476 494 508 526

BAJAJ-AUTO 2,609 2,698 2,840 2,929 3,071

BANKBARODA 128 135 148 155 168

BPCL 438 461 495 518 552

BHARTIARTL 402 408 417 423 432

INFRATEL 357 369 389 402 421

BOSCHLTD 20,765 21,694 23,189 24,118 25,613

CIPLA 494 518 549 573 605

COALINDIA 221 229 241 248 260

DRREDDY 1,701 1,856 2,056 2,212 2,412

EICHERMOT 27,090 28,359 30,404 31,673 33,718

GAIL 338 353 371 387 405

HCLTECH 847 860 877 890 907

HDFCBANK 1,693 1,721 1,759 1,787 1,825

HDFC 1,638 1,667 1,710 1,738 1,782

HEROMOTOCO 3,663 3,752 3,886 3,974 4,108

HINDALCO 201 211 228 238 255

HINDUNILVR 1,103 1,128 1,168 1,193 1,234

IBULHSGFIN 981 1,065 1,141 1,226 1,301

ICICIBANK 242 265 284 306 325

IOC 386 399 416 429 446

INDUSINDBK 1,557 1,591 1,633 1,667 1,709

INFY 938 963 980 1,005 1,022

ITC 262 267 275 280 288

KOTAKBANK 960 976 989 1,005 1,018

LT 1,097 1,114 1,143 1,161 1,189

LUPIN 868 904 954 991 1,041

M&M 1,283 1,315 1,373 1,405 1,463

MARUTI 7,064 7,261 7,577 7,773 8,089

NTPC 160 164 172 176 184

ONGC 153 156 162 165 170

POWERGRID 205 212 219 226 234

RELIANCE 1,472 1,509 1,570 1,608 1,669

SBIN 255 268 290 302 324

SUNPHARMA 401 425 469 494 538

TCS 2,450 2,473 2,504 2,527 2,558

TATAMTRDVR 187 205 231 249 275

TATAMOTORS 310 342 391 423 472

TATAPOWER 74 75 77 79 81

TATASTEEL 561 579 602 620 644

TECHM 381 392 404 414 426

ULTRACEMCO 3,687 3,805 3,960 4,077 4,232

VEDANTA 257 268 287 298 318

WIPRO 280 285 290 295 299

YESBANK 1,638 1,689 1,753 1,804 1,868

ZEEL 474 490 517 533 561

Technical Research Team

For Private Circulation Only 2

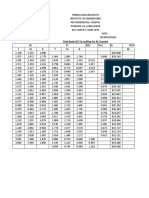

Derivatives Review | August 12, 2017

FIIs index future Long Short Ratio lowest in 2017

Nifty spot closed at 9710.80 this week, against a close of 10066.40 last week. The Put-Call Ratio has decreased from 1.27 to 1.06

levels and the annualized Cost of Carry is positive at 5.69%. The Open Interest of Nifty Futures increased by 9.20%.

Derivatives View Weekly OI gainers

OI OI Price

Nifty current month future closed with a premium of 30.25 Scrip Price

Futures Chg (%) Chg (%)

points against a premium of 42.15 points to its spot. Next REPCOHOME 672000 76.15 637.70 (17.22)

month future is trading with a premium of 61.25 points.

BRITANNIA 424600 31.37 4113.45 4.74

PCR-OI has decreased from 1.27 to 1.06 levels on W-o-W

CADILAHC 2691200 22.68 483.30 (9.56)

basis. Being a volatile week, the overall build-up in options

are quite scattered. In call option, 9800-10200 strikes were PVR 642800 22.02 1291.20 (8.10)

active and they also added huge positions. On the flip side, TVSMOTOR 5570000 20.72 530.35 (11.92)

out the money strikes of 9000, 9200 and 9400-9600 put

SBIN 75375000 19.73 281.25 (8.39)

options added decent positions; followed by significant

unwinding in 9900-10100 put options. Highest open interest UBL 1246000 19.54 788.20 (3.79)

in August series has now been shifted to 10000 call and 9500 INFRATEL 11102700 17.57 384.30 (5.74)

put option.

Stock that added longs last week are BRITANNIA and

JUBLFOOD. While, fresh shorts were visible in REPCOHOME, Weekly OI losers

GODREJIND, TVSMOTOR, SUNTV and CADILAHC. Liquid OI OI Price

Scrip Price

counters with higher CoC are CIPLA, INFIBEAM, JSWENERGY, Futures Chg (%) Chg (%)

SREINFRA and RCOM. Stocks with negative CoC are PCJEWELLER 3957000 (34.31) 297.40 13.97

CHENNPETRO, INDIGO, GSFC, MCX and RBLBANK. HEXAWARE 1794000 (31.74) 254.85 1.45

Last week, the benchmark index plunged 3.64% with decent

CHOLAFIN 285500 (29.42) 1144.50 (3.43)

rise in open interest, hinting short formation in this fall. FIIs too

actively participated by doubling their shorts in index futures INDIGO 1635600 (26.38) 1215.15 (2.57)

segment. As a result, their Long Short Ratio declined from RAMCOCEM 520800 (25.00) 662.50 (4.03)

65% to 58%. In addition, they bought significant amount of

MGL 901200 (23.05) 989.90 (4.16)

index put options along with writing in call options, indicating

market to remain under pressure going ahead. Maximum BATAINDIA 2857800 (22.91) 637.05 0.56

concentration of put options has shifted lower indicating scope NHPC 21654000 (22.81) 30.25 0.00

for correction towards 9500-9550.

Weekly change in OI

40,000

Call Put

30,000

20,000

10,000

(10,000)

(20,000)

(30,000)

(40,000)

For Private Circulation Only 3

Research Team Tel: 022 39357800 Website: www.angelbroking.com

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as Angel) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

For Private Circulation Only 4

You might also like

- Mil DTL 27426 2a BaseDocument4 pagesMil DTL 27426 2a BaseRobyn NashNo ratings yet

- Session 3 - Valuation Model - AirportsDocument105 pagesSession 3 - Valuation Model - AirportsPrathamesh GoreNo ratings yet

- Research Project 2 On Indigo AirlinesDocument13 pagesResearch Project 2 On Indigo AirlinesNaresh Reddy100% (3)

- Marriott Rooms Forecasting - UnsolvedDocument23 pagesMarriott Rooms Forecasting - UnsolvedmishikaNo ratings yet

- Market Roundup 22042024Document5 pagesMarket Roundup 22042024Tamanna AggarwalNo ratings yet

- Equity Report 6 To 10 NovDocument6 pagesEquity Report 6 To 10 NovzoidresearchNo ratings yet

- Tech Report 05.01Document3 pagesTech Report 05.01Swayam MangwaniNo ratings yet

- Daily Market Update OF 25 APRIL 2023-202304251728143358428Document4 pagesDaily Market Update OF 25 APRIL 2023-202304251728143358428Pratik ShingareNo ratings yet

- Tech Report 08.12Document3 pagesTech Report 08.12bnr534No ratings yet

- Equity Report 26 June To 30 JuneDocument6 pagesEquity Report 26 June To 30 JunezoidresearchNo ratings yet

- Equity Report 10 July To 14 JulyDocument6 pagesEquity Report 10 July To 14 JulyzoidresearchNo ratings yet

- Tech Report 24 (1) .02.2011Document3 pagesTech Report 24 (1) .02.2011Arijit TagoreNo ratings yet

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Document5 pagesStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhNo ratings yet

- Equity Weekly Report 8 May To 12 MayDocument6 pagesEquity Weekly Report 8 May To 12 MayzoidresearchNo ratings yet

- Equity Outlook 13 Feb To 17 FebDocument6 pagesEquity Outlook 13 Feb To 17 FebzoidresearchNo ratings yet

- Family Mart Annual Report1Document39 pagesFamily Mart Annual Report1태하No ratings yet

- Daily Market Update 3 January 2023 File-202301031742097186877 PDFDocument5 pagesDaily Market Update 3 January 2023 File-202301031742097186877 PDFChandan BaggaNo ratings yet

- Equity Report 16 - 20 OctDocument6 pagesEquity Report 16 - 20 OctzoidresearchNo ratings yet

- WAR of GLORY 2020 - V.04Document174 pagesWAR of GLORY 2020 - V.04anom budiNo ratings yet

- Technical Morning - Call - 200921Document5 pagesTechnical Morning - Call - 200921Equity NestNo ratings yet

- Equity Report 21 Aug To 25 AugDocument6 pagesEquity Report 21 Aug To 25 AugzoidresearchNo ratings yet

- Equity Report 19 June To 23 JuneDocument6 pagesEquity Report 19 June To 23 JunezoidresearchNo ratings yet

- 05 03 2019anDocument120 pages05 03 2019anNarnolia'sNo ratings yet

- Equity Weekly ReportDocument6 pagesEquity Weekly ReportzoidresearchNo ratings yet

- Price List TVS Adira Per 1 April 2022Document1 pagePrice List TVS Adira Per 1 April 2022mulyono73No ratings yet

- Equity Technical Weekly ReportDocument6 pagesEquity Technical Weekly ReportzoidresearchNo ratings yet

- Opening STOCK Sales 17-18 673 844 802 598 817 781Document10 pagesOpening STOCK Sales 17-18 673 844 802 598 817 781Anurag SugandhiNo ratings yet

- Equity Report 22 May To 26 MayDocument6 pagesEquity Report 22 May To 26 MayzoidresearchNo ratings yet

- ID Year Cash and Cash Equivalent ReceivablesDocument12 pagesID Year Cash and Cash Equivalent ReceivablesHuma HussainNo ratings yet

- Final Project BSAF ADocument7 pagesFinal Project BSAF Aعصام المحمودNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNo ratings yet

- Updated Fcss Receipts & PaymentsDocument6 pagesUpdated Fcss Receipts & PaymentsMubasar khanNo ratings yet

- Feeder Service Area 27 03 2024 03 31Document6 pagesFeeder Service Area 27 03 2024 03 31jaydevNo ratings yet

- Monitoring Piutang: COA Saldo TB Agustus Tambah Ar Update SeptemberDocument7 pagesMonitoring Piutang: COA Saldo TB Agustus Tambah Ar Update Septemberarkee78No ratings yet

- Technical Morning - Call - 120922 PDFDocument5 pagesTechnical Morning - Call - 120922 PDFSomeone 4780No ratings yet

- Equity Report 15 May To 19 MayDocument6 pagesEquity Report 15 May To 19 MayzoidresearchNo ratings yet

- JGPKJG (KLDocument14 pagesJGPKJG (KLjdgregorioNo ratings yet

- Technical Morning - Call - 270721Document5 pagesTechnical Morning - Call - 270721Ram hedaNo ratings yet

- Nas 1581Document1 pageNas 1581tangyuNo ratings yet

- Assessment of NormalityDocument1,553 pagesAssessment of NormalityNMNGNo ratings yet

- To Find The Profitability of Charlie Lyons Identify Functional Cost Centre Order Getting Cost Order Filling CostDocument8 pagesTo Find The Profitability of Charlie Lyons Identify Functional Cost Centre Order Getting Cost Order Filling CostmohindroosahilNo ratings yet

- Field Book of F Ly Levlling For RL TransferDocument2 pagesField Book of F Ly Levlling For RL TransferNaresh JirelNo ratings yet

- Angel SuggestedDocument4 pagesAngel Suggestedmangalraj900No ratings yet

- Nas 1202 Thrunas 1210Document2 pagesNas 1202 Thrunas 1210tangyuNo ratings yet

- Monitoring PSM Week 1 (1-2 AGUSTUS 2023)Document288 pagesMonitoring PSM Week 1 (1-2 AGUSTUS 2023)Rizky Tegar Agus PrasetyoNo ratings yet

- Exportadores Periodo 2012 1 2013 2 2014 3 2015 4 2016 5: Demanda en El MundoDocument6 pagesExportadores Periodo 2012 1 2013 2 2014 3 2015 4 2016 5: Demanda en El MundoJenryAvalosNo ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- 2015 Census-Based Population ProjectionsDocument685 pages2015 Census-Based Population ProjectionsChris-Goldie Lorezo100% (1)

- MOSt Market RoundupDocument5 pagesMOSt Market RoundupBalaji KannanNo ratings yet

- Data SheetDocument2 pagesData SheetArielNo ratings yet

- Linear Regression OcanaDocument5 pagesLinear Regression OcanaAlejandro OcañaNo ratings yet

- Australian Accommodation Monitor - Summary: Date Created: September 23, 2020Document9 pagesAustralian Accommodation Monitor - Summary: Date Created: September 23, 2020Pi SàNo ratings yet

- Analysis of Financial Statement: Khurram Mansoor Muhammad Noman Shaf Mubasher RehmanDocument31 pagesAnalysis of Financial Statement: Khurram Mansoor Muhammad Noman Shaf Mubasher RehmanNandakumarDuraisamyNo ratings yet

- Factor Analysis: KMO and Bartlett's TestDocument16 pagesFactor Analysis: KMO and Bartlett's TestThiên Phúc Võ NguyễnNo ratings yet

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceDocument23 pagesCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaNo ratings yet

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDocument12 pagesSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliNo ratings yet

- Final PPC Module Ahmed Stone CrushingDocument26 pagesFinal PPC Module Ahmed Stone Crushingzain10684No ratings yet

- Gaji Induk PNS Mei 2022 InhilDocument102 pagesGaji Induk PNS Mei 2022 Inhilfajri sabtiNo ratings yet

- Jet AirwaysDocument4 pagesJet Airwayssmith dabreoNo ratings yet

- BLR Factsheet - June 2010Document4 pagesBLR Factsheet - June 2010MahaplagNewsNo ratings yet

- SMS Internet Banking FormDocument4 pagesSMS Internet Banking FormSayed InsanNo ratings yet

- BCG MatrixDocument14 pagesBCG MatrixBeatrice Musiimenta Wa MpireNo ratings yet

- Beams11 ppt05Document39 pagesBeams11 ppt05Christian TambunanNo ratings yet

- Milena Resume 2010Document1 pageMilena Resume 2010milena_francoNo ratings yet

- Customer Segmentation E-CommerceDocument22 pagesCustomer Segmentation E-CommerceNora HabrichNo ratings yet

- ARIA Fiber Optic Product CatalogDocument188 pagesARIA Fiber Optic Product CatalogTri Wulandari RamidiNo ratings yet

- Triumph Handbook July 2013Document43 pagesTriumph Handbook July 2013JovanNo ratings yet

- Model Recruitment Contract Annex C V Aug14Document4 pagesModel Recruitment Contract Annex C V Aug14George HabaconNo ratings yet

- IMAS - Annual Report - 2017 PDFDocument350 pagesIMAS - Annual Report - 2017 PDFRahmani MuharimNo ratings yet

- Sap MM Im Me2o SC Stock Monitoring For VendorDocument7 pagesSap MM Im Me2o SC Stock Monitoring For VendorSunil GNo ratings yet

- Fujitsu M10-1 Server: OracleDocument4 pagesFujitsu M10-1 Server: OracleMedMhamdiNo ratings yet

- Ford Motor CompanyDocument2 pagesFord Motor CompanyPrakash WaliNo ratings yet

- Kandidat SalesDocument20 pagesKandidat SalesDitha MardianiNo ratings yet

- Reinsurance ExplainedDocument55 pagesReinsurance ExplainedChandrima DasNo ratings yet

- Financial Institutions Instruments and Markets 8th Edition Viney Test BankDocument35 pagesFinancial Institutions Instruments and Markets 8th Edition Viney Test Bankchicanerdarterfeyq100% (30)

- Study Guide Module 4Document20 pagesStudy Guide Module 4sweta_bajracharyaNo ratings yet

- APEC Members Begin Talks On Connectivity and Infrastructure - 6 July 2013 - The Jakarta PostDocument2 pagesAPEC Members Begin Talks On Connectivity and Infrastructure - 6 July 2013 - The Jakarta PostTeddy HarmonoNo ratings yet

- Out-Of-Classification Assignment: Pay or ExperienceDocument14 pagesOut-Of-Classification Assignment: Pay or ExperienceNagib Farhad SpainNo ratings yet

- BS en 335 2013Document18 pagesBS en 335 2013Carlos BrachoNo ratings yet

- Marketing Communication Paper 01 PDFDocument7 pagesMarketing Communication Paper 01 PDFraghunathaneceNo ratings yet

- Pulic Procurement ExamDocument4 pagesPulic Procurement Exambookabdi1100% (1)

- Gucci Group AssgnmentDocument33 pagesGucci Group AssgnmentAbhishek Kumar Shing100% (1)

- SOP For Sweden MGKDocument3 pagesSOP For Sweden MGKMahim100% (1)

- CH 14Document11 pagesCH 14Salman ZafarNo ratings yet

- CAF Gasket Removal ManualDocument3 pagesCAF Gasket Removal Manualgirish_motiyaniNo ratings yet

- 15 1312MH CH09 PDFDocument17 pages15 1312MH CH09 PDFAntora HoqueNo ratings yet

- IBP (Orgsetup& Natofficers)Document3 pagesIBP (Orgsetup& Natofficers)Honorio Bartholomew ChanNo ratings yet

- Bureau of Customs Memo-2018-04-002 Submission and Counter Checking of List of ImportablesDocument1 pageBureau of Customs Memo-2018-04-002 Submission and Counter Checking of List of ImportablesPortCalls100% (1)

- Trial Balance PD Mitra Des 16 Rev 2018 13 PeriodeDocument1 pageTrial Balance PD Mitra Des 16 Rev 2018 13 PeriodeFaie RifaiNo ratings yet