Professional Documents

Culture Documents

Birla Real Estate Investor Presentation

Birla Real Estate Investor Presentation

Uploaded by

akumar4uCopyright:

Available Formats

You might also like

- Solving Typical FE ProblemsDocument30 pagesSolving Typical FE ProblemsCarlo Mabini Bayo50% (2)

- ProblemDocument26 pagesProblemMengyao LiNo ratings yet

- Know Your Customer Form (Kyc)Document2 pagesKnow Your Customer Form (Kyc)Shivanand ShirolNo ratings yet

- Delta Corp Annual Report FY 2021-22Document241 pagesDelta Corp Annual Report FY 2021-22akumar4uNo ratings yet

- Top 100 RE ManagementDocument4 pagesTop 100 RE ManagementCosimoNo ratings yet

- Industry Analysis Strategy Real Estate 1Document10 pagesIndustry Analysis Strategy Real Estate 1jagdip_barik100% (1)

- FL CCIM - Retail Feasibility Analysis PDFDocument111 pagesFL CCIM - Retail Feasibility Analysis PDFsaundersrealestateNo ratings yet

- PWC Real Estate Monetization StrategiesDocument28 pagesPWC Real Estate Monetization StrategiesAbdulkareem Tawili100% (1)

- Cheru Bekele End Research 2018Document44 pagesCheru Bekele End Research 2018samuel kebedeNo ratings yet

- 19 - Real Estate Thesis PDFDocument206 pages19 - Real Estate Thesis PDFPriyanka MNo ratings yet

- Venture Investing - Rules of SuccessDocument100 pagesVenture Investing - Rules of SuccessSrikrishna Sharma KashyapNo ratings yet

- Review of Commercial Real Estate in The 21st CenturyDocument21 pagesReview of Commercial Real Estate in The 21st CenturyColdwell Banker CommercialNo ratings yet

- Real Estate Market Research, Analysis and Sales of OmaxeDocument100 pagesReal Estate Market Research, Analysis and Sales of OmaxeGarima GargNo ratings yet

- Real Estate Cashflow and Financial Modelling PDFDocument6 pagesReal Estate Cashflow and Financial Modelling PDFadonisghlNo ratings yet

- Real EstateDocument103 pagesReal EstateAkshi Agrawal100% (1)

- Insurance Sales Agents Handbook - FinalDocument76 pagesInsurance Sales Agents Handbook - FinalNedy OtukiNo ratings yet

- 2023 Commercial Real Estate Magazine Media KitDocument19 pages2023 Commercial Real Estate Magazine Media KitعبدالعزيزNo ratings yet

- Commercial Real Estate OutlookDocument36 pagesCommercial Real Estate OutlookRipan SarkarNo ratings yet

- Real Estate Investment Business Plan1 PDFDocument43 pagesReal Estate Investment Business Plan1 PDFLorettaSmithNo ratings yet

- Development of A Real Estate Agency ManaDocument68 pagesDevelopment of A Real Estate Agency ManaAfaq AhmadNo ratings yet

- I See, There's Some Gap in Your Work History. Why?Document8 pagesI See, There's Some Gap in Your Work History. Why?Minhaj AliNo ratings yet

- Real Estate Merger Motives PDFDocument13 pagesReal Estate Merger Motives PDFadonisghlNo ratings yet

- Essentials of Real Estate FinanceDocument46 pagesEssentials of Real Estate FinanceJune AlapaNo ratings yet

- Guidelines For Real Estate Research and Case Study Analysis: January 2016Document129 pagesGuidelines For Real Estate Research and Case Study Analysis: January 2016dzun nurwinasNo ratings yet

- CBRE Multifamily Client Call - 112718Document29 pagesCBRE Multifamily Client Call - 112718SukkMidickNo ratings yet

- AHS Home Warranty Summary - AcceptDecline - 2014Document2 pagesAHS Home Warranty Summary - AcceptDecline - 2014Phillip KingNo ratings yet

- Crowd Real Estate Site TrackingDocument56 pagesCrowd Real Estate Site TrackingahgonzalezpNo ratings yet

- Real Estate FinanceDocument33 pagesReal Estate FinanceAVICK BISWASNo ratings yet

- Real Estate Processes Management Case StudyDocument2 pagesReal Estate Processes Management Case Studysaadi777No ratings yet

- Developing For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITDocument73 pagesDeveloping For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITmarks2muchNo ratings yet

- Business Presentation / PitchDocument21 pagesBusiness Presentation / PitchDebbie HauserNo ratings yet

- Sample Real Estate Joint Venture Waterfall StructureDocument6 pagesSample Real Estate Joint Venture Waterfall StructurehogantecNo ratings yet

- Best Real Estate Lead GenerationDocument10 pagesBest Real Estate Lead GenerationDale Randolph SasNo ratings yet

- Real Estate Debt Due Diligence 2016Document17 pagesReal Estate Debt Due Diligence 2016Shahrani KassimNo ratings yet

- Amanahray ReitDocument123 pagesAmanahray ReitFrank KeeNo ratings yet

- SCG - Example - Offering MemorandumDocument18 pagesSCG - Example - Offering MemorandumHammad KhanNo ratings yet

- 2017 Profile of Real Estate Firms 08-21-2017Document75 pages2017 Profile of Real Estate Firms 08-21-2017National Association of REALTORS®100% (3)

- Hotel Chancery Is A Luxurious 3Document17 pagesHotel Chancery Is A Luxurious 3Vijay Singh AdhikariNo ratings yet

- Home Seller's Guide PDFDocument26 pagesHome Seller's Guide PDFPaul BernardiNo ratings yet

- CBRE Real Estate Consulting ReportDocument37 pagesCBRE Real Estate Consulting Reportalim shaikhNo ratings yet

- 2022 Realtor Business Plan Free Template - RealOffice360 Real Estate CRMDocument21 pages2022 Realtor Business Plan Free Template - RealOffice360 Real Estate CRMChrstina GirmaNo ratings yet

- Cannabis Real Estate Investment Trust Article (00984639xC689E)Document4 pagesCannabis Real Estate Investment Trust Article (00984639xC689E)Kevin ParkerNo ratings yet

- Property Management Flyer1Document1 pageProperty Management Flyer1Chris FanaraNo ratings yet

- Calgary Listing PresentationDocument32 pagesCalgary Listing PresentationRyanDeLucaNo ratings yet

- Factors Affecting Capitalization Rate of US Real EstateDocument36 pagesFactors Affecting Capitalization Rate of US Real Estatevharish88No ratings yet

- Real-Estate To Pass A REIQ CourseDocument9 pagesReal-Estate To Pass A REIQ Coursemy AccountNo ratings yet

- PB Asia 30 Equity Fund Prospectus SCDocument43 pagesPB Asia 30 Equity Fund Prospectus SCyanohuNo ratings yet

- Aztala Corporation Is The Real Estate Developer of BluHomesDocument46 pagesAztala Corporation Is The Real Estate Developer of BluHomesPaolo BellosilloNo ratings yet

- Commercial Real Estate Valuation ModelDocument6 pagesCommercial Real Estate Valuation Modelkaran yadavNo ratings yet

- Commercial Real EstateDocument32 pagesCommercial Real Estatehb_scribNo ratings yet

- Real Estate Investment TrustsDocument17 pagesReal Estate Investment TrustsShubham PhophaliaNo ratings yet

- Business Plan: Creating Solid Investments Through Refurbishing ApartmentsDocument56 pagesBusiness Plan: Creating Solid Investments Through Refurbishing ApartmentsJay LewisNo ratings yet

- BR Development - Hidden Vine ApartmentsDocument35 pagesBR Development - Hidden Vine ApartmentsSamuel SNo ratings yet

- Equity Valuation Short NotesDocument8 pagesEquity Valuation Short NotesImran AnsariNo ratings yet

- Marketing PresentationDocument20 pagesMarketing Presentationapi-277609984No ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- Real Estate Agent Profiles 2013Document23 pagesReal Estate Agent Profiles 2013timesnewspapersNo ratings yet

- RE 01 12 Simple Multifamily Acquisition SolutionsDocument3 pagesRE 01 12 Simple Multifamily Acquisition SolutionsAnonymous bf1cFDuepPNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- Private Real Estate Financing OverviewDocument13 pagesPrivate Real Estate Financing OverviewJoseph McDonald100% (1)

- Guide To Purchase Your HomeDocument28 pagesGuide To Purchase Your HomeDavid WangNo ratings yet

- Sample Business ProposalDocument11 pagesSample Business ProposalWilliam TorradoNo ratings yet

- Quarter December 2017 2018Document9 pagesQuarter December 2017 2018akumar4uNo ratings yet

- Annual Report 2017 2018Document220 pagesAnnual Report 2017 2018akumar4uNo ratings yet

- Notice of 27th AgmDocument14 pagesNotice of 27th Agmakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-18-2019)Document164 pagesZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNo ratings yet

- Design Thinking EbookDocument850 pagesDesign Thinking Ebookakumar4uNo ratings yet

- The Startup's Guide To Google CloudDocument18 pagesThe Startup's Guide To Google Cloudakumar4uNo ratings yet

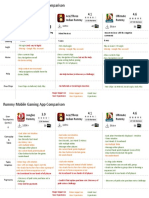

- Rummy Mobile Gaming ComparisonDocument2 pagesRummy Mobile Gaming Comparisonakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-17-2020)Document186 pagesZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDocument38 pagesKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- Healthcare: Ind AS 116: Impact Analysis On Healthcare CompaniesDocument7 pagesHealthcare: Ind AS 116: Impact Analysis On Healthcare Companiesakumar4uNo ratings yet

- Indian HospitalsDocument8 pagesIndian Hospitalsakumar4uNo ratings yet

- India - Healthcare: NCR Healthcare Visit: Tales From DelhiDocument5 pagesIndia - Healthcare: NCR Healthcare Visit: Tales From Delhiakumar4uNo ratings yet

- Healthcare: Resilient Growth in A Seasonally Weak QuarterDocument9 pagesHealthcare: Resilient Growth in A Seasonally Weak Quarterakumar4uNo ratings yet

- A Study of India's Healthcare Sector Including Union Budget 2020Document15 pagesA Study of India's Healthcare Sector Including Union Budget 2020akumar4uNo ratings yet

- Physica A: Xiao-Tian Wang, Zhong-Feng Zhao, Xiao-Fen FangDocument13 pagesPhysica A: Xiao-Tian Wang, Zhong-Feng Zhao, Xiao-Fen FangAirlangga TantraNo ratings yet

- Credit Transaction CasesDocument10 pagesCredit Transaction CasesLianne Carmeli B. FronterasNo ratings yet

- Home First Finance Company India Limited: Issue HighlightsDocument16 pagesHome First Finance Company India Limited: Issue HighlightstempvjNo ratings yet

- 1st Prelim Reviewer in FinanceDocument7 pages1st Prelim Reviewer in FinancemarieNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyAbasi masoudNo ratings yet

- Far110 - Financial StatementDocument2 pagesFar110 - Financial StatementSyaza AisyahNo ratings yet

- Jeevan Anand: G. Sudhakar Dev - OfficerDocument4 pagesJeevan Anand: G. Sudhakar Dev - OfficerYugendra Babu KNo ratings yet

- Module 7 - Dealing With UncertaintyDocument5 pagesModule 7 - Dealing With UncertaintyHazel NantesNo ratings yet

- FMI 2016-2017 Course ManualDocument8 pagesFMI 2016-2017 Course ManualThomas KenbeekNo ratings yet

- Questions BookDocument437 pagesQuestions BookShairish Ajmeri100% (1)

- Aqua Gear in Business Since 2008 Makes Swimwear For ProfessionDocument1 pageAqua Gear in Business Since 2008 Makes Swimwear For ProfessionAmit PandeyNo ratings yet

- Acc 103 - Module 5aDocument14 pagesAcc 103 - Module 5aPrincess Darlyn AlimagnoNo ratings yet

- The Future of PaymentsDocument6 pagesThe Future of Paymentszing65No ratings yet

- 17MB215 International Financial Management: Skill DevelopmentDocument2 pages17MB215 International Financial Management: Skill DevelopmentRamkumarNo ratings yet

- Ifrs 15Document58 pagesIfrs 15furqanNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRifat HelalNo ratings yet

- Banking Mangement SystemDocument10 pagesBanking Mangement SystemFirew KifleNo ratings yet

- Depreciation DBM DDBM SYDDocument16 pagesDepreciation DBM DDBM SYDTayam Prince RussellNo ratings yet

- Bank StatementDocument5 pagesBank Statementshahbaz alamNo ratings yet

- Cryptocurrency From Shari'ah PerspectiveDocument18 pagesCryptocurrency From Shari'ah PerspectiveAna FienaNo ratings yet

- Dissertation Financial MarketsDocument4 pagesDissertation Financial MarketsWriteMyPaperApaFormatToledo100% (1)

- Bali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock ReturnsDocument51 pagesBali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock Returnsroblee1No ratings yet

- Economics Exam QuestionsDocument11 pagesEconomics Exam Questionsmastersaphr1898No ratings yet

- Bisek 1Document17 pagesBisek 1heda kaleniaNo ratings yet

- Simple Interest ActivityDocument2 pagesSimple Interest ActivityDhet Pas-Men100% (1)

- Security Analysis: Analysis of The Income Account. The Earnings Factor in Common Stock ValuationDocument17 pagesSecurity Analysis: Analysis of The Income Account. The Earnings Factor in Common Stock ValuationJessica RamirezNo ratings yet

Birla Real Estate Investor Presentation

Birla Real Estate Investor Presentation

Uploaded by

akumar4uOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Birla Real Estate Investor Presentation

Birla Real Estate Investor Presentation

Uploaded by

akumar4uCopyright:

Available Formats

Real(i)ty - Indian Real Estate, back on track

Birla Sun Life Asset Management Company Ltd.

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Real Estate – Emerging steadily from the slump

The REAL ESTATE journey

Glory Despair Recovery

2006-07 2007 -08 2008 -09 2009 -10

High liquidity at Rise in Depressed

low rates mortgage rates demand, low

sales

Highest levels Rise in prices Enough signs of easing

of land buying due to over Lack of trust

liquidity

recorded supply about pricing

and delivery of Increase in off take with

projects stability appearing in prices

After a course correction, Back on track

Birla Sun Life Asset Management Company Ltd. 2

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Real estate growth –

expected at a CAGR of 26% till 2014

Estimated Real estate market size – 2009-2014 Sector wise demand projections – 2009-2013

6,90,000 room nights

Hospitality 10 20 20 26 24

7.5 million units

Residential 17 18 20 23 22

>43 million sq. feet

Retail 15 17 19 26 23

> 196 million sq. feet

Office 15 10 25 25 25

0% 20% 40% 60% 80% 100%

2009 2010 2011 2012 2013

Research and markets Cushman and Weikfeild 2009 report

Current property prices present a great opportunity to investors. A peak is expected in the next 3~5

years making real estate an attractive investment option.

The residential segment will lead the sector’s recovery:

New players are expected to enter the market with properties designed keeping in mind

current economic conditions and consumer preferences

Focus of real estate developers is the affordable housing segment which makes up 50% of

the total market currently.

Business Standard

Birla Sun Life Asset Management Company Ltd. 3

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

The best time to invest in this asset class

Indian Real Estate Index – 2009

• Evident signs of increasing investment activity in

the real estate sector

• USD 15 billion, the sum raised by real estate firms

in the past six months through QIP’s.

• 20 -25, the expected number of IPO’s from real

estate firms in the forthcoming six months.

• Emmar, Godrej properties, DB realty together plan

to raise USD 1.8 billion through IPO’s.

• Unitech and DLF, the top two of the ten firms

receiving maximum FII in the Q2 2009.

Source: BSE India Website

FDI Inflow Cumulative

2006-07 2007-08 2008-09 2009 -10 (E)

(USD million) (2006 – 2009)

Housing and real estate 467 2179 2801 1181 6628

Source: Cushman and Wakefield 2009 report

India tops the BRIC nations Real Estate Transparency Index says Jones Lang LaSalle as per

their 2008 report. Investors looking at India as a long term investment destination can be confident

Birla Sun Life Asset Management Company Ltd. 4

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Residential realty – The juicy bit

Birla Sun Life Asset Management Company Ltd.

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Residential realty demand pegged at

7.5 million homes by 2013

• Demand for residential realty to reach 7.5 Residential Real Estate Demand - in units

million units by 2013*. (2009-13)

• Highest cumulative demand will be seen by

Mumbai (1.6 million units). Bangalore and

Hyderabad to witness highest CAGR at 14%.

• Urbanization, development of city suburbs,

increasing nuclear families and rising income

levels to be the key demand drivers

• Prize rationalization, reduced costs of

borrowing, government sops etc. and,

increasing focus on affordable housing all

contributing to renewed demand. Most

developers are increasing their portfolio to

include affordable housing

Source: Cushman and Wakefield, September 2009

* September 2009 report

Birla Sun Life Asset Management Company Ltd. 6

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Your best bet to Gain – The ADITYA BIRLA group

Birla Sun Life Asset Management Company Ltd.

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Your Partner in Value Creation –

The Aditya Birla Group

One of India’s Employs More

Global Turnover of Fortune 500 Presence in 25

Oldest Business Than 100,000

USD 28 billion Company Countries

Houses People

Has a Dedicated Presence in

Leadership across Joint Venture with Awarded India’s

Financial Services Insurance, Asset

businesses Sun Life Best Employer

Group Mgt., MFs

Birla Sun Life Asset Management Company Ltd.

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Birla Sun Life Asset Management Co.

A JV between two stalwarts

Birla Sun

Life Asset

Management

Company

A Joint Venture between the Investment manager of one An amalgam of Aditya Birla

Aditya Birla Group and of the India's leading Group’s strengths in

Sun Life Financial Mutual Funds - Birla Sun the Indian Market and, Sun

Services Inc. of Canada Life Mutual Fund Life's global experience

Birla Sun Life Asset Management Company Ltd. 9

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

One of the best teams in the industry (1/2)

Shashi Kumar,

Head Real Estate

Alumnus of one of India’s leading B-schools

Experience of 18 years in Business; 10 years in

Indian Realty and related businesses

Founder member of India REIT as Chief

Investment Officer (Ajay Piramal group RE Fund)

Has successfully completed an investment cycle –

Fund raising – Deployment – Exit

Managed funds – Domestic: INR 10 billion;

Offshore: INR 25 billion

Headed Real Estate expansion at Shoppers Stop

and related business at Landmark, India REIT and

now, Birla Sun Life AMC

Birla Sun Life Asset Management Company Ltd. 10

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

One of the best teams in the industry (2/2)

Shekhar Rangaraj, Head

Jagannath Shetty, CFO

Business Development

Chartered Accountant with 20 years More than 20 years of experience in

experience Business Development and Channel

Management

15 years in Lupin Group in Corporate

Finance, Projects, Mergers and 10 years of international exposure of

Acquisitions with global exposure, dealing with luxury brands

reporting to Head Finance

Instrumental in launching the Indian

Deputed to group’s Real Estate sojourn of renowned luxury brands

business for 6 years, heading Finance and enlightening them on the Indian

and Legal functions with exposure to consumer psyche

evaluation and negotiation

Well exposed to dealing with HNI’s

Wide experience in deal structuring,

due diligence, closing and post

closing compliance and integration

Birla Sun Life Asset Management Company Ltd. 11

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Primary focus: Mitigating risk exposure and…

Principles for Investments

To maximise value for

Investment focus on Invest in mid-tier

investors, investments to

residential realty, the developers’ top-grade

be milestone/target

most attractive segment projects

oriented

Caps on Exposure to Limit Risks:

Single Project: 15%

Overall exposure in a single group: 30%

Guidelines for Single City (Metros): 50%

Investments Non metros: 30%

Yield based investments: 15%

Above caps to be reviewed periodically by Investment Committee

Birla Sun Life Asset Management Company Ltd. 12

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

…spreading our investments evenly.

Location Focus on the highest potential geographies

High potential cities such Secondary focus will be on

Primary Secondary

as Mumbai Bangalore, cities such as NCR region

Focus Focus

Chennai, Hyderabad and and Kolkata

Pune

Investment Strategy: Focus on Residential Realty

Has long-term demand potential as evidenced earlier

Is the safest investment domain in the realty

Demand is picking up steadily and, consolidating Developers are looking

Government support for the sector is most evident in for alternative sources

of funds, as funds from

Residential public sector banks leading with low cost of housing banks have dried up,

Realty finance in addition to a slew of other measures leading to an increase

Has shorter cycle time and hence quicker completion in opportunity

of projects

Early returns on investments a distinct possibility

Birla Sun Life Asset Management Company Ltd. 13

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

…and creating value for our customers…

Delivering significant Value

The Investments will be made after conducting an

exhaustive assessment/evaluation of all critical criteria

The appraisal and decision making processes of the

team will not only be prompt but also clearly

communicated

Once a decision to invest is reached, it will be

followed by putting forward clear terms, including

approval on key decisions

Advantages of Associating with us

Benefit of the Assurance of A hurdle of 10%

values and expertise from a Profit sharing of

commitment of team having a 80:20

India’s leading successful track An expected IRR

conglomerate record in this of 20%

sector

Birla Sun Life Asset Management Company Ltd. 14

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

...through a strong process driven approach to

investments

Sector evaluation

Step 1: Filtration

Pre-feasibility studies

Step 2: Due Diligence and Engaging 3rd party experts

Valuation Conducting due-diligence

Low cash out

Downward protection

Step 3: Entry strategy ‘Early stage’ entry

Well-defined exits

Clear land title

Established sanction feasibility

Step 4: Validation and Legal

Multi-tier Investment Committee approval

Compliance

Definitive agreements with in-built veto & monitoring rights

Tax-efficient structuring

Step 5: Financial Close Optimal debt planning

Value-addition in planning, construction, marketing

Step 6: Project Execution Periodic monitoring and reporting mechanisms

Milestone driven disbursements

Tracking of market conditions

Step 7: Exit Strategic equity sale

IPOs /REITs/REMFs

Self-liquidating SPVs/Pre-sales

Birla Sun Life Asset Management Company Ltd. 15

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Now, The Product

Summary of Key Terms

Fund Name Aditya Birla Real Estate Fund

Fund Size INR. 750 crores with a green shoe option of INR 250 crores

Fund Tenure 6 years with two 1 year extensions

Minimum Commitment Individual Investor – INR 2,500,000; Institutional Investor – INR 100,000,000

Initial Draw-down Amount 20% of the total commitment

Draw-down Notice Period 15 business days

Initial Closing Minimum corpus of INR 500 crores

Investment Term 3 years from date of Initial Closing

Hurdle 10% p.a. calculated in INR

Carry 80:20 [80% to investor] with catch-up

2% p.a. of the total commitment amount during investment period and 2% p.a. of

Management Fees the residual capital commitment thereafter (Total draw downs less cost of

investments sold) . One time set up fee of 3% of capital commitment

Auditor/Custodian Deutsche Bank/Ernst & Young

Counsel Nishith Desai Associates

Birla Sun Life Asset Management Company Ltd. 16

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Distribution of Proceeds - Details

Disbursement Schedule - Details of payout

First Payout 100% of Paid-up Capital Commitment

Second Payout 100% of Hurdle @ 10%

Third Payout Catch up to Investment Manager

Final Payout Balance Distribution:

80% to Investor

20% to Investment Manager

For better understanding of the above, illustration is given below (for a one year horizon)

Capital Commitment 100

Fund Realization 200

Disbursement Schedule

First Payout 100% of Paid-up Capital Commitment 100

Second Payout 100% of Hurdle @ 10% 10

Third Payout Catch up to Investment Manager 2.5

Final Payout Balance Distribution:

80% to Investor 70

20% to Investment Manager 17.5

Birla Sun Life Asset Management Company Ltd. 17

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

What makes us and our product unique?

REAL ESTATE - A sector poised to take a huge step forward,

an opportunity in waiting

THE BRAND - Aditya Birla Group, one of the must trusted names in India

THE TEAM – Has extensive real estate experience and a proven track

record

The PRODUCT – Focussed on the most attractive, potential segment,

RESIDENTIAL realty

Product Highlight - Designed for maximum downside protection, flexibility

and easy exits

Birla Sun Life Asset Management Company Ltd. 18

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

Disclaimer

This document is being furnished to you by BIRLA SUNLIFE Asset Management Co. on behalf of Aditya Birla Real

Estate Fund strictly on a confidential basis. This document is for informational purposes only and does not

constitute an offer for participating in the proposed Fund. This information profile has been provided to its recipient

upon the express understanding that the information contained herein, or made available in connection with any

further investigation, is strictly confidential and is intended for the exclusive use of its recipient. It shall not be

photocopied, reproduced or distributed to others at any time without prior written consent. This document is neither

a prospectus nor an invitation to subscribe to units. Prospective Contributors and/or investors should carefully

review the underlying Constituent documents of the Fund before making a decision to invest. In general, investment

in the shares of the Fund will involve significant risks. Nothing in this document is intended to constitute legal, tax,

securities or investment advice, or opinion regarding the appropriateness of any investment, or a solicitation for any

product or service. The use of any information set out in this document is entirely at the recipient’s own risk.

Contributors are advised to seek independent professional advice to understand all attendant risks attached to

investments in the Fund. Also, Contributors should have the financial ability and willingness to accept the risks and

lack of liquidity, which are characteristics of the investments described herein. In making an investment decision,

investors must rely on their own examination of the documents and the terms of the Offering to be set out in detail in

a separate document, including the merits and risks involved.

While reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at

the time of publication, BIRLA SUNLIFE Asset Management Co. makes no representation as to its accuracy or

completeness. The information herein is subject to change without notice. Neither BIRLA SUNLIFE Asset

Management Co. nor any of its officers or employees accept any liability whatsoever for any direct or consequential

loss arising from any use of this publication or its contents.

The facts and figures used in this presentation reflect the latest available information and have been sourced from

various reports in leading newspapers, IBEF, Reserve Bank of India, Deutsche Bank Research, Report on Indian Real

estate and, BIRLA SUNLIFE research and other sources that are in public domain.

Birla Sun Life Asset Management Company Ltd. 19

Copyright: Birla Sun Life Asset Management Company Ltd. 2009

You might also like

- Solving Typical FE ProblemsDocument30 pagesSolving Typical FE ProblemsCarlo Mabini Bayo50% (2)

- ProblemDocument26 pagesProblemMengyao LiNo ratings yet

- Know Your Customer Form (Kyc)Document2 pagesKnow Your Customer Form (Kyc)Shivanand ShirolNo ratings yet

- Delta Corp Annual Report FY 2021-22Document241 pagesDelta Corp Annual Report FY 2021-22akumar4uNo ratings yet

- Top 100 RE ManagementDocument4 pagesTop 100 RE ManagementCosimoNo ratings yet

- Industry Analysis Strategy Real Estate 1Document10 pagesIndustry Analysis Strategy Real Estate 1jagdip_barik100% (1)

- FL CCIM - Retail Feasibility Analysis PDFDocument111 pagesFL CCIM - Retail Feasibility Analysis PDFsaundersrealestateNo ratings yet

- PWC Real Estate Monetization StrategiesDocument28 pagesPWC Real Estate Monetization StrategiesAbdulkareem Tawili100% (1)

- Cheru Bekele End Research 2018Document44 pagesCheru Bekele End Research 2018samuel kebedeNo ratings yet

- 19 - Real Estate Thesis PDFDocument206 pages19 - Real Estate Thesis PDFPriyanka MNo ratings yet

- Venture Investing - Rules of SuccessDocument100 pagesVenture Investing - Rules of SuccessSrikrishna Sharma KashyapNo ratings yet

- Review of Commercial Real Estate in The 21st CenturyDocument21 pagesReview of Commercial Real Estate in The 21st CenturyColdwell Banker CommercialNo ratings yet

- Real Estate Market Research, Analysis and Sales of OmaxeDocument100 pagesReal Estate Market Research, Analysis and Sales of OmaxeGarima GargNo ratings yet

- Real Estate Cashflow and Financial Modelling PDFDocument6 pagesReal Estate Cashflow and Financial Modelling PDFadonisghlNo ratings yet

- Real EstateDocument103 pagesReal EstateAkshi Agrawal100% (1)

- Insurance Sales Agents Handbook - FinalDocument76 pagesInsurance Sales Agents Handbook - FinalNedy OtukiNo ratings yet

- 2023 Commercial Real Estate Magazine Media KitDocument19 pages2023 Commercial Real Estate Magazine Media KitعبدالعزيزNo ratings yet

- Commercial Real Estate OutlookDocument36 pagesCommercial Real Estate OutlookRipan SarkarNo ratings yet

- Real Estate Investment Business Plan1 PDFDocument43 pagesReal Estate Investment Business Plan1 PDFLorettaSmithNo ratings yet

- Development of A Real Estate Agency ManaDocument68 pagesDevelopment of A Real Estate Agency ManaAfaq AhmadNo ratings yet

- I See, There's Some Gap in Your Work History. Why?Document8 pagesI See, There's Some Gap in Your Work History. Why?Minhaj AliNo ratings yet

- Real Estate Merger Motives PDFDocument13 pagesReal Estate Merger Motives PDFadonisghlNo ratings yet

- Essentials of Real Estate FinanceDocument46 pagesEssentials of Real Estate FinanceJune AlapaNo ratings yet

- Guidelines For Real Estate Research and Case Study Analysis: January 2016Document129 pagesGuidelines For Real Estate Research and Case Study Analysis: January 2016dzun nurwinasNo ratings yet

- CBRE Multifamily Client Call - 112718Document29 pagesCBRE Multifamily Client Call - 112718SukkMidickNo ratings yet

- AHS Home Warranty Summary - AcceptDecline - 2014Document2 pagesAHS Home Warranty Summary - AcceptDecline - 2014Phillip KingNo ratings yet

- Crowd Real Estate Site TrackingDocument56 pagesCrowd Real Estate Site TrackingahgonzalezpNo ratings yet

- Real Estate FinanceDocument33 pagesReal Estate FinanceAVICK BISWASNo ratings yet

- Real Estate Processes Management Case StudyDocument2 pagesReal Estate Processes Management Case Studysaadi777No ratings yet

- Developing For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITDocument73 pagesDeveloping For Demand - An Analysis of Demand Segmentation Methods and Real Estate Development - MITmarks2muchNo ratings yet

- Business Presentation / PitchDocument21 pagesBusiness Presentation / PitchDebbie HauserNo ratings yet

- Sample Real Estate Joint Venture Waterfall StructureDocument6 pagesSample Real Estate Joint Venture Waterfall StructurehogantecNo ratings yet

- Best Real Estate Lead GenerationDocument10 pagesBest Real Estate Lead GenerationDale Randolph SasNo ratings yet

- Real Estate Debt Due Diligence 2016Document17 pagesReal Estate Debt Due Diligence 2016Shahrani KassimNo ratings yet

- Amanahray ReitDocument123 pagesAmanahray ReitFrank KeeNo ratings yet

- SCG - Example - Offering MemorandumDocument18 pagesSCG - Example - Offering MemorandumHammad KhanNo ratings yet

- 2017 Profile of Real Estate Firms 08-21-2017Document75 pages2017 Profile of Real Estate Firms 08-21-2017National Association of REALTORS®100% (3)

- Hotel Chancery Is A Luxurious 3Document17 pagesHotel Chancery Is A Luxurious 3Vijay Singh AdhikariNo ratings yet

- Home Seller's Guide PDFDocument26 pagesHome Seller's Guide PDFPaul BernardiNo ratings yet

- CBRE Real Estate Consulting ReportDocument37 pagesCBRE Real Estate Consulting Reportalim shaikhNo ratings yet

- 2022 Realtor Business Plan Free Template - RealOffice360 Real Estate CRMDocument21 pages2022 Realtor Business Plan Free Template - RealOffice360 Real Estate CRMChrstina GirmaNo ratings yet

- Cannabis Real Estate Investment Trust Article (00984639xC689E)Document4 pagesCannabis Real Estate Investment Trust Article (00984639xC689E)Kevin ParkerNo ratings yet

- Property Management Flyer1Document1 pageProperty Management Flyer1Chris FanaraNo ratings yet

- Calgary Listing PresentationDocument32 pagesCalgary Listing PresentationRyanDeLucaNo ratings yet

- Factors Affecting Capitalization Rate of US Real EstateDocument36 pagesFactors Affecting Capitalization Rate of US Real Estatevharish88No ratings yet

- Real-Estate To Pass A REIQ CourseDocument9 pagesReal-Estate To Pass A REIQ Coursemy AccountNo ratings yet

- PB Asia 30 Equity Fund Prospectus SCDocument43 pagesPB Asia 30 Equity Fund Prospectus SCyanohuNo ratings yet

- Aztala Corporation Is The Real Estate Developer of BluHomesDocument46 pagesAztala Corporation Is The Real Estate Developer of BluHomesPaolo BellosilloNo ratings yet

- Commercial Real Estate Valuation ModelDocument6 pagesCommercial Real Estate Valuation Modelkaran yadavNo ratings yet

- Commercial Real EstateDocument32 pagesCommercial Real Estatehb_scribNo ratings yet

- Real Estate Investment TrustsDocument17 pagesReal Estate Investment TrustsShubham PhophaliaNo ratings yet

- Business Plan: Creating Solid Investments Through Refurbishing ApartmentsDocument56 pagesBusiness Plan: Creating Solid Investments Through Refurbishing ApartmentsJay LewisNo ratings yet

- BR Development - Hidden Vine ApartmentsDocument35 pagesBR Development - Hidden Vine ApartmentsSamuel SNo ratings yet

- Equity Valuation Short NotesDocument8 pagesEquity Valuation Short NotesImran AnsariNo ratings yet

- Marketing PresentationDocument20 pagesMarketing Presentationapi-277609984No ratings yet

- Real Estate FinancingDocument29 pagesReal Estate FinancingRaymon Prakash100% (1)

- Real Estate Agent Profiles 2013Document23 pagesReal Estate Agent Profiles 2013timesnewspapersNo ratings yet

- RE 01 12 Simple Multifamily Acquisition SolutionsDocument3 pagesRE 01 12 Simple Multifamily Acquisition SolutionsAnonymous bf1cFDuepPNo ratings yet

- Chapter 18. Lease Analysis (Ch18boc-ModelDocument16 pagesChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainNo ratings yet

- Private Real Estate Financing OverviewDocument13 pagesPrivate Real Estate Financing OverviewJoseph McDonald100% (1)

- Guide To Purchase Your HomeDocument28 pagesGuide To Purchase Your HomeDavid WangNo ratings yet

- Sample Business ProposalDocument11 pagesSample Business ProposalWilliam TorradoNo ratings yet

- Quarter December 2017 2018Document9 pagesQuarter December 2017 2018akumar4uNo ratings yet

- Annual Report 2017 2018Document220 pagesAnnual Report 2017 2018akumar4uNo ratings yet

- Notice of 27th AgmDocument14 pagesNotice of 27th Agmakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-18-2019)Document164 pagesZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNo ratings yet

- Design Thinking EbookDocument850 pagesDesign Thinking Ebookakumar4uNo ratings yet

- The Startup's Guide To Google CloudDocument18 pagesThe Startup's Guide To Google Cloudakumar4uNo ratings yet

- Rummy Mobile Gaming ComparisonDocument2 pagesRummy Mobile Gaming Comparisonakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-17-2020)Document186 pagesZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDocument38 pagesKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDocument13 pagesExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNo ratings yet

- Healthcare: Ind AS 116: Impact Analysis On Healthcare CompaniesDocument7 pagesHealthcare: Ind AS 116: Impact Analysis On Healthcare Companiesakumar4uNo ratings yet

- Indian HospitalsDocument8 pagesIndian Hospitalsakumar4uNo ratings yet

- India - Healthcare: NCR Healthcare Visit: Tales From DelhiDocument5 pagesIndia - Healthcare: NCR Healthcare Visit: Tales From Delhiakumar4uNo ratings yet

- Healthcare: Resilient Growth in A Seasonally Weak QuarterDocument9 pagesHealthcare: Resilient Growth in A Seasonally Weak Quarterakumar4uNo ratings yet

- A Study of India's Healthcare Sector Including Union Budget 2020Document15 pagesA Study of India's Healthcare Sector Including Union Budget 2020akumar4uNo ratings yet

- Physica A: Xiao-Tian Wang, Zhong-Feng Zhao, Xiao-Fen FangDocument13 pagesPhysica A: Xiao-Tian Wang, Zhong-Feng Zhao, Xiao-Fen FangAirlangga TantraNo ratings yet

- Credit Transaction CasesDocument10 pagesCredit Transaction CasesLianne Carmeli B. FronterasNo ratings yet

- Home First Finance Company India Limited: Issue HighlightsDocument16 pagesHome First Finance Company India Limited: Issue HighlightstempvjNo ratings yet

- 1st Prelim Reviewer in FinanceDocument7 pages1st Prelim Reviewer in FinancemarieNo ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyAbasi masoudNo ratings yet

- Far110 - Financial StatementDocument2 pagesFar110 - Financial StatementSyaza AisyahNo ratings yet

- Jeevan Anand: G. Sudhakar Dev - OfficerDocument4 pagesJeevan Anand: G. Sudhakar Dev - OfficerYugendra Babu KNo ratings yet

- Module 7 - Dealing With UncertaintyDocument5 pagesModule 7 - Dealing With UncertaintyHazel NantesNo ratings yet

- FMI 2016-2017 Course ManualDocument8 pagesFMI 2016-2017 Course ManualThomas KenbeekNo ratings yet

- Questions BookDocument437 pagesQuestions BookShairish Ajmeri100% (1)

- Aqua Gear in Business Since 2008 Makes Swimwear For ProfessionDocument1 pageAqua Gear in Business Since 2008 Makes Swimwear For ProfessionAmit PandeyNo ratings yet

- Acc 103 - Module 5aDocument14 pagesAcc 103 - Module 5aPrincess Darlyn AlimagnoNo ratings yet

- The Future of PaymentsDocument6 pagesThe Future of Paymentszing65No ratings yet

- 17MB215 International Financial Management: Skill DevelopmentDocument2 pages17MB215 International Financial Management: Skill DevelopmentRamkumarNo ratings yet

- Ifrs 15Document58 pagesIfrs 15furqanNo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRifat HelalNo ratings yet

- Banking Mangement SystemDocument10 pagesBanking Mangement SystemFirew KifleNo ratings yet

- Depreciation DBM DDBM SYDDocument16 pagesDepreciation DBM DDBM SYDTayam Prince RussellNo ratings yet

- Bank StatementDocument5 pagesBank Statementshahbaz alamNo ratings yet

- Cryptocurrency From Shari'ah PerspectiveDocument18 pagesCryptocurrency From Shari'ah PerspectiveAna FienaNo ratings yet

- Dissertation Financial MarketsDocument4 pagesDissertation Financial MarketsWriteMyPaperApaFormatToledo100% (1)

- Bali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock ReturnsDocument51 pagesBali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock Returnsroblee1No ratings yet

- Economics Exam QuestionsDocument11 pagesEconomics Exam Questionsmastersaphr1898No ratings yet

- Bisek 1Document17 pagesBisek 1heda kaleniaNo ratings yet

- Simple Interest ActivityDocument2 pagesSimple Interest ActivityDhet Pas-Men100% (1)

- Security Analysis: Analysis of The Income Account. The Earnings Factor in Common Stock ValuationDocument17 pagesSecurity Analysis: Analysis of The Income Account. The Earnings Factor in Common Stock ValuationJessica RamirezNo ratings yet