Professional Documents

Culture Documents

Workbook Investment Final 4

Workbook Investment Final 4

Uploaded by

aditiguptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workbook Investment Final 4

Workbook Investment Final 4

Uploaded by

aditiguptaCopyright:

Available Formats

INVESTMENT

PLANNING

Module 4 : Workbook

The Indian Institute of Financial Planning

Contents

Copyright: IIFP

1st Edition : September 2008

The course material is exclusively designed and published for the use of the Students of the IIFP. It is

not a priced publication. No part of this publication may be reproduced or copied or sold/ distributed in

any form or any means, electronic, mechanical, photocopying, and recording or stored in a data base

or retrievable system without the explicit permission of the institute.

Price: Not for Sale

Printed in INDIA

Publication: September 2008

The Indian Institute of Financial Planning

Contents

FOREWORD

Welcome to IIFP-

Power Your Growth…..

We thank you for choosing the IIFP as your preferred education provider for CFP

certification program. We are one of the leading education providers for CFP

certification program and we are basically a No Frills-Pure Education institute

imparting high quality financial planning education in India.

IIFP has been promoted by Kush Education Society which has been formed and

backed by eminent industrialists and educationists of India. Kush Education Society

was formed in the year 2001 and it also runs the prestigious Delhi Public School

(DPS), Varanasi.

We are constantly engaged in research and development of new study tools which

can help our students to crack this highly professional CFP certification program in

the first attempt itself and in light of this we feel pleasure in presenting before you

first edition of our Work book, Module 4 (Investment Planning).

We hope that this tool will help you in your studies and we assure you that we will

always be there to help and guide you.

Wishing you Good Luck….

Faculty and Content Team, IIFP

The Indian Institute of Financial Planning

Contents

Index

Page No.

1. List of Important Formulas 1 - 10

2. Types of Risk and General Economics 11 - 16

3. Measuring Risk 17 - 38

4. Measuring Return 39 - 56

5. CAPM 57 - 62

6. Risk Adjusted Return 63 - 68

7. Fixed Income Securities 69 - 82

8. Equity Valuation 83 - 98

9. Forward and Futures 99 - 106

10. Options 107 - 132

11. Real Estate and Other Investments 133 - 138

12. Mutual Funds 139 - 142

13. Other Fixed Income Instruments and SSI 143 - 146

14. Asset Allocation Strategies 147 - 152

15. Financial Statement Analysis 153 - 172

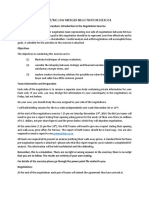

16. Regulations 173 - 177

The Indian Institute of Financial Planning

Chapter 1

List of Important Formulas

Chapter 1 : List of Important Formulas

Chapter 1

List of Important Formulas

Measuring Risk

1. Range = Highest Value – Lowest Value

2. Variance= P1[r1-E(r)]2+ P2[r2-E(r)]2+ P3[r3-E(r)]2 + ... +Pn(rn–E(r)]2

where,

r1,r2,r3,...,rn = Observed Returns

E(r) = Expected return

P1,P2,P3,......, Pn = Probability

3. Standard Deviation = Variance

Standard Deviation

4. Coefficient of variation = X 100

Mean

C o v im

5. B e ta (β i m ) =

σ2m

Where,

Covim = Co-variance between market return and security ‘i’ return

σ 2m = Variance of market return

6. Covariance of two securities

n

∑

i =1

(xi - x ) (yi - y )

n-1

Where,

xi = Return on Security ‘i’

yi = Return on security ‘i’

x = Mean of return on Security ‘x’

y = Mean of return on Security ‘y’

n = Number of observations

7. Cov12 = r12 * σ 1 * σ 2

Where,

Cov12 = Co – variance between return on asset ‘1’ & asset ‘2’

r12 = Coefficient of correlation between two securities

σ1 = Standard Deviation of asset ‘1’ return

σ2 = Standard Deviation of asset ’2’ return

The Indian Institute of Financial Planning 1

Investment Planning (Workbook)

8. Co-efficient of correlation of security ‘i’ return with security k return

Covik

r =

σi * σ k

Where,

Covik = Co – variance Between asset ‘i’ & asset ‘k’

σ i = Standard Deviation of asset ‘i’ return

σ m = Standard Deviation of asset ’k’ return

Return

1. Cumulative Wealth Index (CWIn) = WI0 (1+R1) (1+R2) ........ (1+Rn)

CWIn = Cumulative wealth index at the end of n years

WI0 = The begning index value which is typically one rupee

Ri = Total return for year i (i = 1, .......n)

2. Arithmetic Return = R1 + R2 + R3 + ........... + Rn

n

n

= ∑R

i =1

i

n

Where,

R1, R2, R3, ..... R4 = Returns for the different periods

n = Number of periods

n

∑R

i =1

i = Summation of the returns for the period

3. Holding Period Return = [(Ending Price – Beginning Price + Cash Dividend) /Beginning Price] x 100.

4. Geometic Mean (G.M.) = { ( 1+ TR1) ( 1+ TR2)….(1+ TRn)]1/n -1} x 100

TRi = Total return for period i, where i = (1, 2, 3...... n)

n = Total holding period

5. CAGR (Compounded Annual Growth Rate)

{[ BeginningV

EndingV alue

alue

] 1/n

-1 } x100

6. Real rate of Return = { [ 11 ++ ei ] - 1 } x 1 0 0

i = Interest Rate

e = Inflation Rate

2 The Indian Institute of Financial Planning

Chapter 1 : List of Important Formulas

7. Post Tax Return = Return * (1 – Tax Rate)

8. Expected return : E(R) = ∑R P

i=1

i i

Where,

E(R) = Expected return from the stock

Ri = Return form the stock

Pi = Probability associated with the possible outcome

n = Number of possible states of the world

9. Treynor Measure = (Return on portfolio - risk free return) / beta of portfolio

r p – rf

Ti =

ß

Where,

Ti =

Treynor Index

rp = Return on Portfolio Risk

rf = Risk Free Return

ß = Beta of Portfolio

10. Sharpe Measure = (Return on portfolio - risk free return)/ standard deviation of portfolio

rp – rf

Si =

σp

Where,

si = Sharpe Performance Index

rp = Return on Portfolio

rf = Risk Free Return

s p= Standard Deviation of Portfolio

11. Jensen Measure (ALPHA) = Portfolio return – [Risk free rate + (market return- risk free rate) *

portfolio beta]

Jensen Measure = Rp – [Rf + (Rm – R f)* ß p ]

Where,

Rp = Portfolio Return

Rf = Risk free rate

R = Market Return

ßp = Portfolio Beta

The Indian Institute of Financial Planning 3

Investment Planning (Workbook)

Portfolio Investment

1. Portfolio variance: = [Standard Deviation of Portfolio]2

2. For a two asset portfolio:

Portfolio return:

E ( R p ) = w A E ( R A ) + (1 − w A )E ( RB ) = w A E ( R A ) + wB E ( R B )

Where,

E(RP) = Expected return of the portfolio

wA = Weight of security A

wB = Weight of security B

E(RA) = Expected return of the security A

E(RB) = Expected return of the security B

3. Variance of Portfolio Returns= W12s12 + W22s22 + 2 W 1W2 Cov12

Where co – variance is given

W1 = Weight of security 1

W2 = Weight of security 2

s1 = Standard deviation of security 1

s2 = Standard deviation of security 2

Cov12 = Covariance between return on security 1 & 2

4. Variance of Portfolio Returns = W12 s12 + W22s22 + 2 W1W2 r12 s1 s 2

Where correlation is given

r12 = coefficient of correlation between security 1 & 2

5. For a three asset portfolio, the variance is:

w2Aσ2A +w2Bσ2B + w2CσC2 + 2wAwBrABσAσB +2wAwCrACσAσC +2wBwCrBCσBσC

Where,

rAB = Coefficient of correlation between security A and B

rBC = Coefficient of correlation between security B and C

rAC = Coefficient of correlation between security A and C

wA = Weight of security A

wB = Weight of security B

wC = Weight of security C

σA = Standard deviation of security A

σB = Standard deviation of security B

σC = Standard deviation of security C

4 The Indian Institute of Financial Planning

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Stock Market NumerologyDocument2 pagesStock Market NumerologyPratiiek Mor80% (5)

- ACCTG 002 HandoutDocument5 pagesACCTG 002 HandoutMelana Muli100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporation Test BankDocument8 pagesCorporation Test BankAJ Gaspar67% (9)

- URC FinancialsDocument7 pagesURC FinancialsCGNo ratings yet

- RequestFREE (Elf)Document10 pagesRequestFREE (Elf)EdsonnSPBrNo ratings yet

- Marcellus Consistent-Compounders Nov-2019 PMSDocument15 pagesMarcellus Consistent-Compounders Nov-2019 PMSRBNo ratings yet

- Incredible Story of Transaction Cost MeasurementDocument7 pagesIncredible Story of Transaction Cost MeasurementWayne H WagnerNo ratings yet

- O2 Gen Company ProfileDocument17 pagesO2 Gen Company ProfileaditiguptaNo ratings yet

- AFP Pracrice Book Part 2 Case Studies 1Document26 pagesAFP Pracrice Book Part 2 Case Studies 1aditiguptaNo ratings yet

- Cams Pos For Kyd 070910Document1 pageCams Pos For Kyd 070910aditiguptaNo ratings yet

- AMFI Mutual Fund Practice Book SampleDocument30 pagesAMFI Mutual Fund Practice Book SampleaditiguptaNo ratings yet

- Schedule Gender Respondent: 1. No of Males and Females Respondent in SurveyDocument11 pagesSchedule Gender Respondent: 1. No of Males and Females Respondent in SurveyImtiaz Ali ShaikhNo ratings yet

- Financial Shock: by Mark Zandi, FT Press, 2009Document6 pagesFinancial Shock: by Mark Zandi, FT Press, 2009amitprakash1985No ratings yet

- Chen Et Al-2019-Accounting & FinanceDocument41 pagesChen Et Al-2019-Accounting & FinanceEhssan SamaraNo ratings yet

- Correct Answers Are Shown in GreenDocument14 pagesCorrect Answers Are Shown in Greenmalalav0% (1)

- s12 Cost of Capital PDFDocument22 pagess12 Cost of Capital PDFJasonSpringNo ratings yet

- Mybestfunds Newsletter 06-08-13Document40 pagesMybestfunds Newsletter 06-08-13Aliya JamesNo ratings yet

- AT&T MCCAW Instructions 1Document2 pagesAT&T MCCAW Instructions 1NishantShahNo ratings yet

- Accounting Principles MCQDocument8 pagesAccounting Principles MCQSmile AliNo ratings yet

- Kushal Yadav ProjectDocument65 pagesKushal Yadav Projectarjunmba119624No ratings yet

- Trend Blaster Trading System For Amibroker GuideDocument12 pagesTrend Blaster Trading System For Amibroker GuidexytiseNo ratings yet

- The Role of Nigerian Stock Exchange in Capital Formation in Nigeria (Chapters 4 and 5Document14 pagesThe Role of Nigerian Stock Exchange in Capital Formation in Nigeria (Chapters 4 and 5Newman EnyiokoNo ratings yet

- E120 Fall14 HW6Document2 pagesE120 Fall14 HW6kimball_536238392No ratings yet

- Chapter 9 Cost of CapitalDocument52 pagesChapter 9 Cost of CapitalksachchuNo ratings yet

- CFAS Chapter 5-8 PDFDocument25 pagesCFAS Chapter 5-8 PDFKenneth PimentelNo ratings yet

- Sem5 MCQ MangACCDocument8 pagesSem5 MCQ MangACCShirowa ManishNo ratings yet

- Understanding Financial HealthDocument4 pagesUnderstanding Financial Healtharthuromolo6530No ratings yet

- Technical AnalysisDocument64 pagesTechnical AnalysisDharam VeerNo ratings yet

- Chapter 02 - Stock Investment - Investor Accounting and ReportingDocument26 pagesChapter 02 - Stock Investment - Investor Accounting and ReportingTina Lundstrom100% (3)

- 1st Year, FINACC (SQE) 2011,2007, 2012Document21 pages1st Year, FINACC (SQE) 2011,2007, 2012Kristine SanchezNo ratings yet

- Chasing Goldman Sachs by Suzanne McGee - ExcerptDocument66 pagesChasing Goldman Sachs by Suzanne McGee - ExcerptCrown Publishing Group42% (31)

- Ricy Annual Report 2014Document118 pagesRicy Annual Report 2014Farida SetiawatiNo ratings yet

- Project Report On SharekhanDocument59 pagesProject Report On Sharekhankumar shashank keshriNo ratings yet

- Sohail Copied Black Book ProjectDocument84 pagesSohail Copied Black Book ProjectMayuriUmaleNo ratings yet