Professional Documents

Culture Documents

What Title Insurance Covers

What Title Insurance Covers

Uploaded by

David M. Evans0 ratings0% found this document useful (0 votes)

12 views1 pageHow to know what your title policy covers

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHow to know what your title policy covers

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views1 pageWhat Title Insurance Covers

What Title Insurance Covers

Uploaded by

David M. EvansHow to know what your title policy covers

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Title Protection

Are You Really Covered?

he advantages of holding property in a trust are If you answered yes to either of the first two

well known. However, before transferring questions and no to the last one, then it is time to

property to a trust, consider how the transfer will review your title insurance policy. In many cases,

effect the propertys current title insurance coverage. successor trustees do not obtain the benefit of the

At the time the property is placed in a trust, either existing title insurance policy when the property

confirm that the existing title insurance coverage passes to a trust established after policy date.

will be continued or obtain an endorsement to the

existing policy naming the trust as an additional However, the owner can prevent this by adding an

insured on the policy. Only the ALTA Homeowners endorsement that states the title insurance will be

Policy of Title Insurance for one-to-four family retained when the property passes to the trustee.

residences, adopted October 17, 1998, provides for

automatic coverage when title is transferred from Why is it important to retain the title insurance?

the named insured to a trust. No title insurance Since title insurance is your best protection against

policies issued prior to that date provided for a claims on your interest in real property, maintaining

continuation of coverage for a transfer to a trust that protection is paramount. Should your existing

after the policy date. Consider obtaining an policy not transfer to a trust or you are unable to

endorsement naming the trust as an additional add an endorsement to the policy, the trust may

insured for any policy without coverage for a later need to purchase a new title policy. The cost of a

transfer to a trust. new policy would be based on the value of the

property today and that could be a significant

ASK YOURSELF THESE THREE QUESTIONS: increase in cost as well as equity.

DID YOU BUY THE PROPERTY BEFORE 1998?

Of course you should consult

IF YOU PURCHASED THE PROPERTY AFTER 1998, your legal, real estate or title

DID YOU OBTAIN A POLICY OTHER THAN THE insurance professional to discuss

ALTA HOMEOWNERS POLICY OF INSURANCE? your specific situation. If you

want to know more about how

HAVE YOU ADDED AN ENDORSEMENT OR

to protect your property call us

OBTAINED THE ALTA HOMEOWNERS POLICY today or visit us on the web at

AFTER PURCHASING THE PROPERTY? www.ChicagoTitle.com

Chicago Title

w w w. C h i c a g o T i t l e . c o m

Chicago Title protecting your future today.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- NR EditedDocument46 pagesNR Editedirish59% (22)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

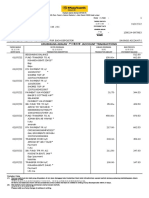

- Your Automatic Payments Schedule: PO Box 3199 Winston Salem, NC 27102-3199Document4 pagesYour Automatic Payments Schedule: PO Box 3199 Winston Salem, NC 27102-3199Yenny VidalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PDFDocument2 pagesPDFLIMNo ratings yet

- Fraud in Banking SectorDocument30 pagesFraud in Banking SectorRavleen Kaur100% (1)

- RocketpreepayDocument5 pagesRocketpreepayMizanur RahmanNo ratings yet

- Dr. Marasigan Journal EntriesDocument1 pageDr. Marasigan Journal EntriesNeilan Jay FloresNo ratings yet

- ch2 All HW-PS2Document89 pagesch2 All HW-PS2yu zhangNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Ch01-The Investment SettingDocument27 pagesCh01-The Investment Settingmc limNo ratings yet

- Chapter 1-Financial MarketsDocument18 pagesChapter 1-Financial Marketskim che100% (1)

- 179-Article Text-1014-1-10-20210725Document15 pages179-Article Text-1014-1-10-20210725Eka TriwulandariNo ratings yet

- Ax Ujjivn1707300775682Document38 pagesAx Ujjivn1707300775682salomiv98No ratings yet

- Health Insurance Policy Certificate Section80DDocument1 pageHealth Insurance Policy Certificate Section80DDebosmita DasNo ratings yet

- Example Paper CF Exam 2Document6 pagesExample Paper CF Exam 2Ashton Kyle ClarkeNo ratings yet

- Page 226 236 - Lyka Mae AdluzDocument9 pagesPage 226 236 - Lyka Mae AdluzWendell Maverick MasuhayNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- The Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceDocument18 pagesThe Determinants of Intermediation Margins in Islamic and Conventional Banksmanagerial FinanceHeriyanto UIRNo ratings yet

- MedPlus Health Services Limited Anchor Intimation To Stock ExchangeDocument3 pagesMedPlus Health Services Limited Anchor Intimation To Stock ExchangeRubiks TejNo ratings yet

- ApplicationDocument5 pagesApplicationAkula Gopi KrishnaNo ratings yet

- Balance Sheet - WikipediaDocument32 pagesBalance Sheet - WikipediaIrshad ShaikhNo ratings yet

- Risk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha KathiraveluDocument26 pagesRisk Sharing: Sylvain Botteron, Luca Gallo, Céline Gonçalves Madeira, Shthursha Kathiraveludavid AbotsitseNo ratings yet

- The Accounting Process-A ReviewDocument11 pagesThe Accounting Process-A ReviewLeoreyn Faye MedinaNo ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- CH4 - FM - For StudentsDocument45 pagesCH4 - FM - For Studentsjajo200110No ratings yet

- Minggu 2 - Chapter 03 Interest and EquivalenceDocument38 pagesMinggu 2 - Chapter 03 Interest and EquivalenceAchmad Nabhan YamanNo ratings yet

- Mitesh Prajapati MB20023 (Project Report)Document66 pagesMitesh Prajapati MB20023 (Project Report)Mitesh prajapatiNo ratings yet

- Regulation of Cryptocurrency in Key JurisdictionsDocument11 pagesRegulation of Cryptocurrency in Key Jurisdictionscryptic kenyaNo ratings yet

- FAP Midterm (A)Document3 pagesFAP Midterm (A)musharraf anjumNo ratings yet

- CHAPTER 6 10.docx-1Document39 pagesCHAPTER 6 10.docx-1Tristan demesaNo ratings yet

- HLB Receipt-2023-03-08Document2 pagesHLB Receipt-2023-03-08zu hairyNo ratings yet